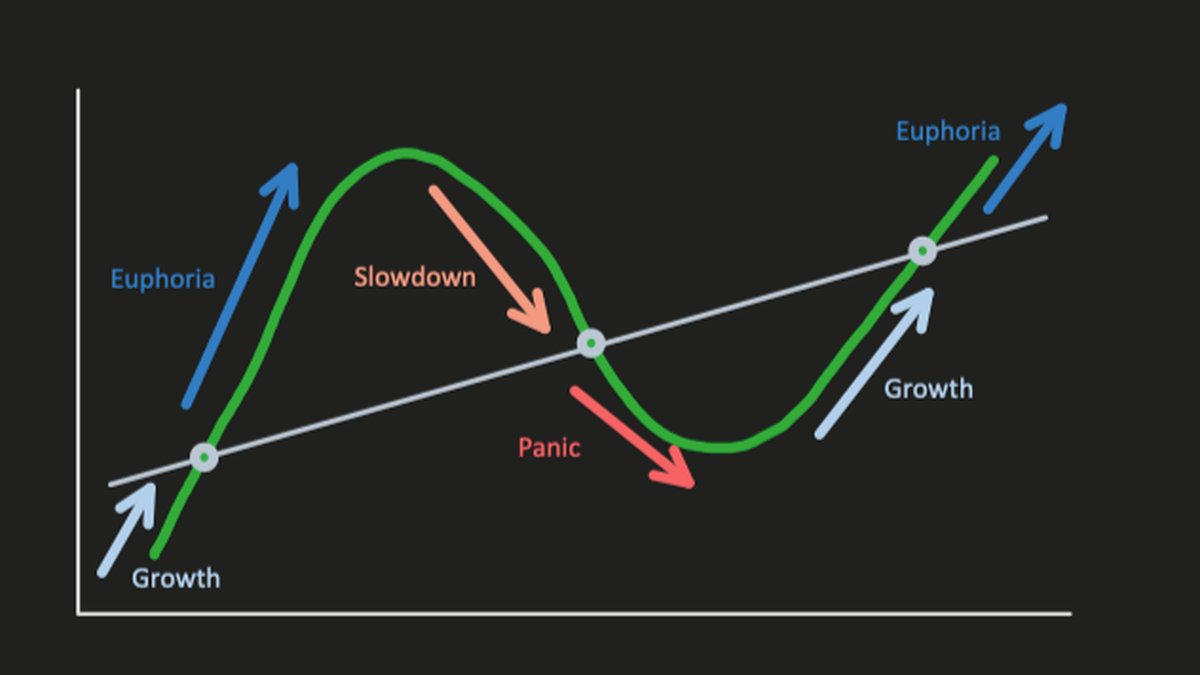

Why Downtrends Are the Most Important Phase of Investing

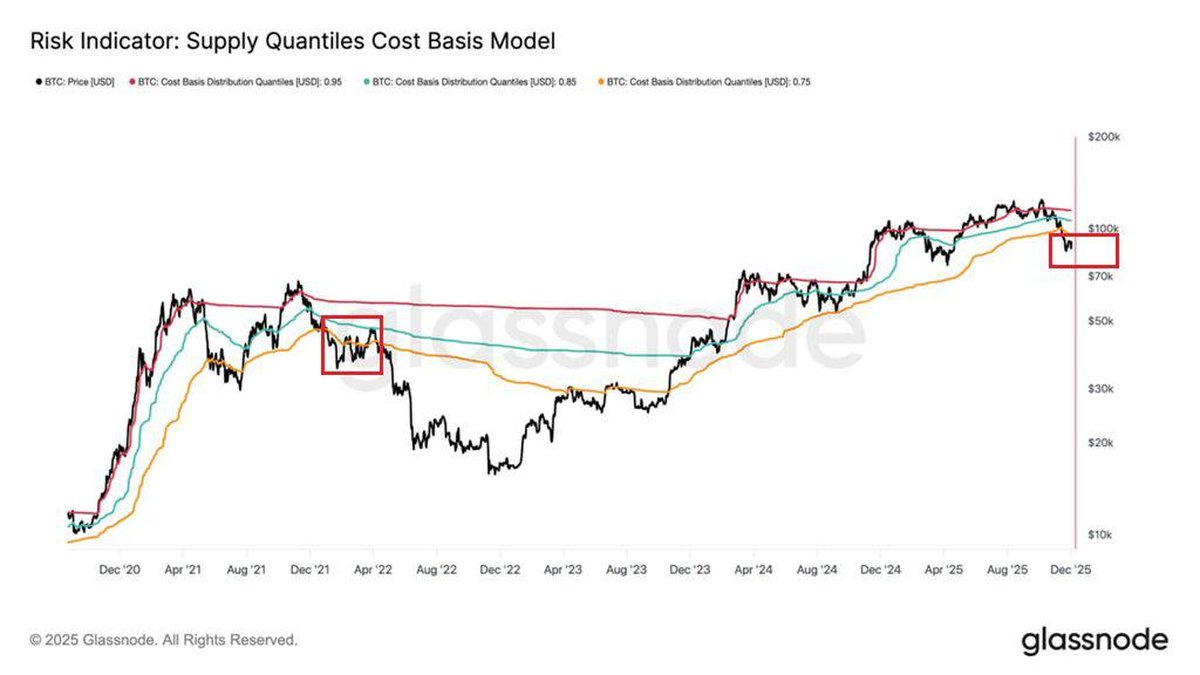

Downtrends feel like the worst possible time to be in the market, but for patient, long-horizon investors they are often the most important phase of the entire cycle: this is when risk is repriced, strong hands accumulate, and the foundations of the next upswing are quietly built.

Read more →