Why the 2028–2029 Bitcoin Cycle Could Be Longer, Stronger and Very Different From 2024

A growing number of macro and on-chain analysts describe 2024 as a kind of mini bull market rather than the main event. Prices recovered dramatically from the 2022 lows, exchange-traded products (ETPs and ETFs) drew historic inflows, and Bitcoin claimed a lasting seat in institutional portfolios. Yet the move lacked some of the classic features of past euphoric cycles: global liquidity was still tight, interest rates remained high by post-2008 standards, and retail participation was muted compared with 2017 or 2021.

Looking ahead, the 2028–2029 window stands out as a very different macro and structural environment. If current trajectories hold, it will bring together four powerful pillars: a shift toward easier monetary policy, sharply reduced new Bitcoin issuance, much broader real-world adoption and a more mature, multi-layer crypto technology stack. Instead of a short, vertical spike followed by a deep hangover, the next full cycle could look more like a multi-year expansion where Bitcoin and related assets become deeply embedded in the global financial system.

This article does not attempt to predict exact prices. Instead, it lays out an educational, scenario-based framework for why the 2028–2029 cycle could be both longer and less fragile than the 2024 recovery, while also highlighting key risks that could invalidate the thesis.

1. 2024 as a recovery phase, not a finished supercycle

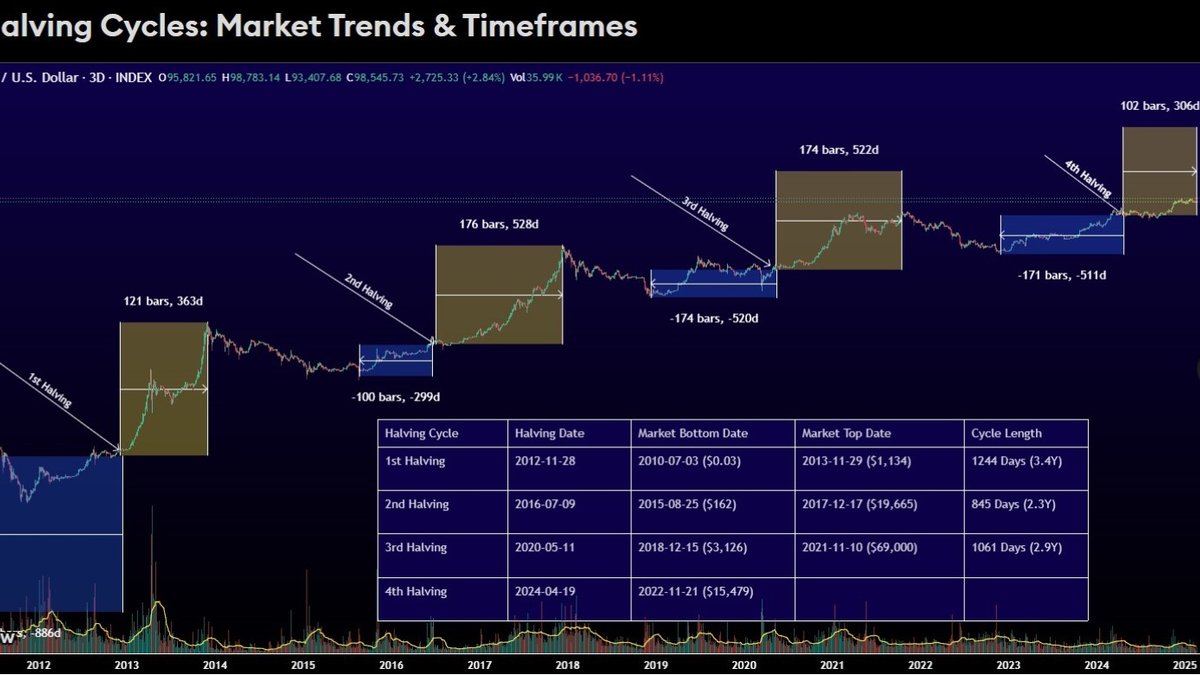

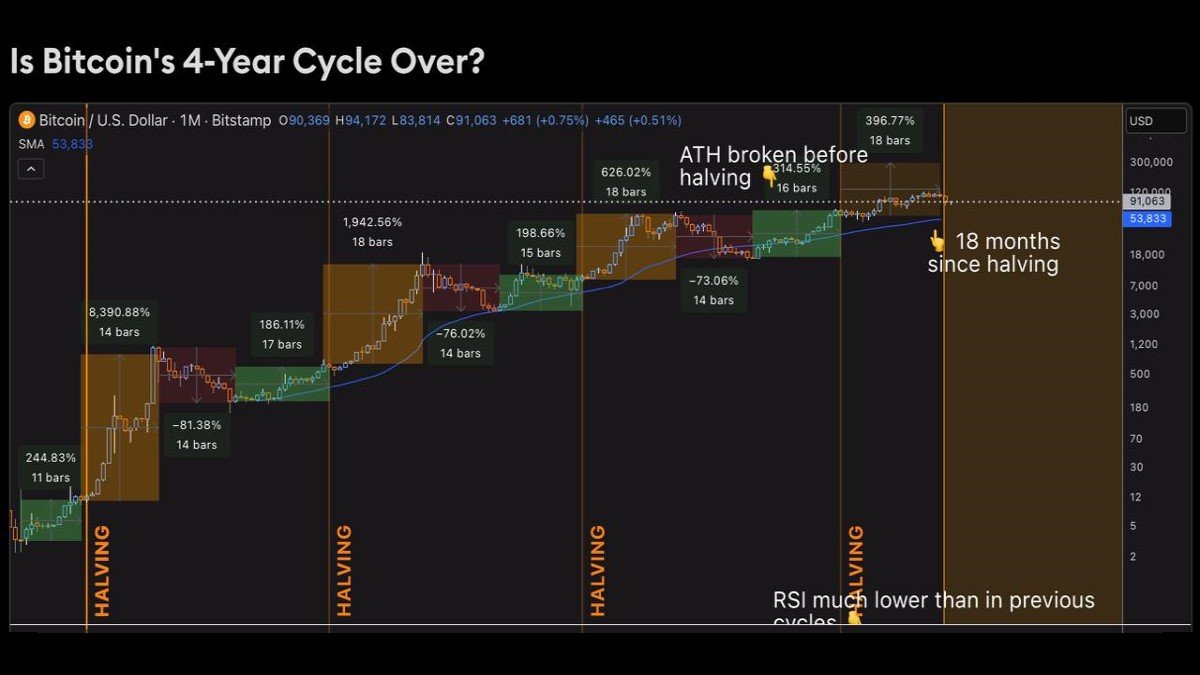

To understand why the next cycle may be different, it helps to define what 2024 actually was. In price terms, Bitcoin delivered an impressive rebound: from roughly fifteen thousand dollars at the 2022 low to new highs two years later. But the drivers of that move show why it was still a transitional phase.

1.1. A cycle born in a tight monetary regime

The 2024 upswing unfolded while the Federal Reserve was still near the end of its most aggressive tightening path in four decades. Policy rates remained well above the levels that had prevailed for most of the 2010s, real yields were positive, and major central banks were withdrawing liquidity through quantitative tightening. Historically, the biggest and longest-lasting bull markets in risk assets tend to occur not during late-cycle tightening, but during periods of sustained easing.

In this environment, large allocators could justify modest exposure to Bitcoin and other digital assets, but only as part of a diversified portfolio. There was little incentive for them to move aggressively out the risk curve when high-grade bonds and cash already provided attractive yields. In other words, Bitcoin was allowed back into the room, but it did not yet become the centrepiece of the macro conversation.

1.2. ETF inflows as a first doorway, not a final destination

Spot Bitcoin ETFs were the defining catalyst of the 2024 mini bull. They created a simple, regulated wrapper for investors who either could not or did not want to hold Bitcoin directly. This mattered greatly for pensions, advisers and conservative institutions. However, the flows we saw in 2024 should be viewed as Phase One of a much longer process.

Large institutions typically build positions over five- to ten-year horizons. Many committees were still updating mandates, custody policies and risk models in 2024. For a sizeable group, the logical first step was a small allocation that could be increased gradually if the product behaved as expected. That dynamic alone suggests that the most significant impact of ETFs may arrive with a delay, as allocations are scaled up over multiple years rather than in a single season.

1.3. Retail on the sidelines and a narrow leadership structure

Search trends, app-download statistics and exchange-signup data all pointed to a subdued retail presence in 2024 compared with 2017 or 2021. Many individual participants were still recovering from prior drawdowns, or had shifted attention toward artificial-intelligence equities and other themes. Outside a handful of large-capitalisation names, much of the digital-asset universe underperformed, indicating that speculative enthusiasm was limited.

Taken together, these elements paint 2024 as a necessary healing and repricing phase, but not as the end point of Bitcoin’s structural story. For that, we likely need a combination of easier global liquidity, deeper institutional integration and a fully re-engaged retail base. That combination is more plausibly aligned with the 2028–2029 horizon.

2. A very different macro backdrop in 2028–2029

The first pillar of the supercycle thesis is that the global monetary environment in 2028–2029 will look very different from the late-tightening regime of 2024.

2.1. From peak tightening to structural easing

The Fed’s recent cycle has already delivered the fastest rate increases since the early 1980s. Maintaining policy at such restrictive levels indefinitely would be difficult. Ageing populations, high debt loads and political pressure for growth all push in the opposite direction. While the exact path is uncertain, it is reasonable to expect that by the late 2020s, policy rates in major economies will have moved back toward more neutral or even accommodative ranges.

In practical terms, this means lower real yields, a flatter cost of capital and a renewed search for assets with asymmetric upside. Historically, these are the conditions under which longer-dated growth equities, emerging-market assets and, increasingly, digital assets tend to outperform. If the 2024 mini bull was forced to climb a wall of high rates and quantitative tightening, the next cycle may benefit from a monetary tide that is rising rather than falling.

2.2. Global rather than local liquidity

Another key difference is the likely broadening of the easing cycle beyond the US. The European Central Bank, Bank of England and Bank of Japan all face their own growth and debt challenges. As inflation pressures stabilise, the political cost of keeping rates high will increase. When several major central banks ease concurrently, liquidity effects are not just additive; they can reinforce each other across foreign-exchange and cross-border capital flows.

Bitcoin, as a globally traded asset with 24/7 markets and deep derivatives liquidity, is especially sensitive to these cross-border impulses. A world in which real yields compress in the US, Europe and parts of Asia at the same time is one in which the global pool of risk-seeking capital could be substantially larger than in 2024.

3. Adoption: from speculative theme to embedded infrastructure

The second pillar of the 2028–2029 supercycle thesis is adoption. Previous cycles were dominated by one or two narratives – initial coin offerings, decentralised finance, non-fungible tokens. These brought users and innovation, but often remained siloed communities.

By the late 2020s, the adoption story is likely to be broader and more grounded in day-to-day infrastructure.

3.1. Nation-state reserves and corporate treasuries

We already see early signs of sovereign experiments with Bitcoin and other digital assets, from small allocations in national funds to pilots involving tokenised government debt. As macro uncertainty persists, some countries may view a limited allocation to Bitcoin as a way to diversify reserves or signal openness to innovation. Even small percentage allocations at the sovereign level can be meaningful in absolute terms.

On the corporate side, treasury strategies are evolving. A number of listed firms now treat Bitcoin as a strategic reserve asset, complementing cash, short-term bonds and commodities. If accounting standards and regulatory guidelines become clearer, more boards may consider similar approaches, especially in sectors where digital-asset literacy is already high. The 2024 ETFs helped normalise Bitcoin as an investable asset; the next step is for it to become a common line item in institutional portfolios.

3.2. Stablecoins and tokenisation as everyday rails

Perhaps the most under-appreciated adoption vector is the expansion of stablecoins and tokenised assets into mainstream payments, trade finance and capital markets. As banks, fintech platforms and even central-bank pilot projects integrate blockchain-based settlement, millions of users could interact with digital-asset rails without consciously entering the “crypto market” at all.

By 2028–2029, it is plausible that stablecoins will be deeply embedded in cross-border commerce, remittances and on-chain representations of traditional securities. In such a world, Bitcoin no longer sits as an isolated speculative asset; it shares an ecosystem with instruments that move large volumes of real-economy value each day. This integration can both attract new classes of investors and provide more robust liquidity conditions.

3.3. Blockchain as a financial and AI coordination layer

The late 2020s are also expected to be a period of rapid progress for artificial intelligence, robotics and high-performance computing. These sectors require new forms of coordination: data marketplaces, compute-sharing networks, long-term incentive structures for open-source contributors. Many of these problems are well-suited to blockchain-based solutions.

If decentralised infrastructure becomes a standard component of AI and data-economy workflows, demand for native digital assets – including Bitcoin as a reserve and collateral asset – could grow structurally. This is different from prior cycles, where usage often lagged behind price. In the 2028–2029 scenario, real usage could be an engine that supports valuation rather than just a justification after the fact.

4. Supply dynamics: the 2028 halving and institutional accumulation

The third pillar of the supercycle thesis is simple but powerful: supply. Bitcoin’s halving schedule reduces the block subsidy roughly every four years. By the time of the 2028 event, new issuance will have fallen to a level where less than one Bitcoin is created per block on average. Daily new supply will be a fraction of what it was in earlier decades.

In earlier eras, miners were a dominant source of sell pressure, as they routinely converted a portion of block rewards into fiat to cover operating expenses. As the subsidy shrinks and transaction-fee markets mature, miners’ relative impact on net supply may fall. More importantly, this dwindling issuance will occur at the same time that structurally patient investors – ETFs, corporations, long-horizon funds – continue to accumulate.

These entities differ from short-term traders in one key respect: they tend to adjust positions slowly and rarely divest entirely. A pension fund that sets a strategic Bitcoin allocation is unlikely to liquidate it within a single quarter; instead, it may rebalance around a long-term target. Similarly, a corporate treasury that presents a digital-asset strategy to shareholders has reputational and governance reasons to treat that allocation as a multi-year commitment.

Combine this behaviour with the 2028 halving, and the supply–demand balance looks very different from 2024. If net new issuance falls toward a level that is small relative to even modest ETF inflows, the market can reach a point where the free float effectively tightens over time. Under those conditions, price expansions are less likely to be one-off spikes and more likely to take the shape of stair-step advances as each wave of demand competes for a shrinking pool of available coins.

5. The delayed return of retail and the psychology of extended cycles

The fourth pillar is human behaviour. Retail investors were the defining fuel of the 2017 and 2021 cycles. In 2024, by contrast, their presence has been subdued. Many households are more cautious after prior drawdowns, and competing narratives such as AI equities have captured imagination.

History suggests that broad public participation tends to arrive after assets have already posted strong multi-year gains and mainstream media coverage has shifted from scepticism to curiosity. If the institutional- and infrastructure-driven forces described above push Bitcoin to new and more stable highs in the mid-to-late 2020s, that could be the trigger for a renewed retail wave sometime in the 2027–2029 window.

When that wave arrives, it is unlikely to be a short burst. Past cycles show that once friends, colleagues and social networks begin discussing an asset class in everyday conversation, enthusiasm can persist for 18–30 months. During that period, new participants often rotate from the most established assets into more experimental ones, extending the overall cycle even after the initial leaders pause.

If we overlay this behavioural pattern onto the expected macro easing and structural supply constraints of the late 2020s, we end up with a plausible roadmap for a cycle that does not peak immediately after the 2028 halving, but continues building momentum through 2029 and potentially into the early 2030s.

6. The technology supercycle: crypto as the native asset of a digital economy

Zooming out, the period from roughly 2026 to 2032 could resemble the late 1990s in one important sense: multiple transformative technologies are maturing at the same time. Artificial intelligence, robotics, high-performance computing, new energy systems and advanced communications infrastructure all require massive investment. Historically, such periods of intense technological change have been associated with extended expansions in equity and venture markets.

Crypto sits at an unusual intersection in this landscape. It is both a technology stack and a set of financial assets. Tokenisation can give traditional securities new characteristics; blockchain rails can support micropayments, machine-to-machine commerce and novel forms of digital rights management. Bitcoin, meanwhile, acts as a neutral collateral asset that exists outside any single jurisdiction but can be integrated into settlement and lending systems worldwide.

In a technology supercycle, investors often look for assets that are most sensitive to innovation and liquidity. Digital assets, with their 24/7 markets and high elasticity of demand, naturally fit that profile. If they are supported by deeper adoption and a more robust regulatory framework than in prior cycles, they could become central beneficiaries rather than peripheral themes.

7. Risks and alternative paths

A supercycle is not guaranteed. Several risks could derail or delay the 2028–2029 thesis:

• Macroeconomic shocks. A severe and prolonged recession, unexpected inflation surge or sovereign-debt crisis could force central banks into difficult trade-offs that suppress liquidity rather than expand it.

• Regulatory reversals. While the trend has been toward clearer frameworks, adverse policy decisions in major jurisdictions could limit access to digital-asset products, especially for institutions.

• Technological or governance failures. Large-scale security incidents, governance breakdowns in key protocols or major operational failures at core infrastructure providers could damage confidence and slow adoption.

• Over-financialisation. If leverage and complex derivatives grow faster than underlying adoption, cycles could still end in sharp, destabilising corrections even in a structurally bullish environment.

Recognising these risks is essential. A longer and stronger cycle does not mean a smooth or guaranteed path upward. Even within a supercycle, drawdowns of 40–60 percent have historically been possible. The key distinction is that in a genuine supercycle, those drawdowns occur within a broader multi-year expansion rather than marking the end of the entire trend.

8. Conclusion: 2024 as the warm-up, 2028–2029 as the main event

The simplest way to summarise the argument is this: 2024 looks like a rehearsal, not the finale. It re-introduced Bitcoin to institutional portfolios, demonstrated that spot ETFs can function at scale, and proved that the asset can recover from severe drawdowns. But it did so in a world of high interest rates, cautious households and still-developing infrastructure.

By contrast, the 2028–2029 window lines up with a potential convergence of macro easing, structural supply constraints, deep real-world integration and delayed retail enthusiasm. In that environment, Bitcoin is less a speculative outlier and more an anchor asset of a broader digital-value ecosystem. The result is likely to be a cycle that unfolds over many years, with multiple phases and pauses, rather than a single speculative spike followed by a long winter.

For observers and participants, the key takeaway is not a price target, but a mindset shift. If the supercycle thesis is broadly correct, the most important decisions may revolve around risk management, time horizon and diversification rather than short-term market timing. 2024 may have reminded the world that Bitcoin is still alive. The late 2020s could be the period when it finally grows into the role that early advocates imagined: a scarce, globally recognised digital asset at the centre of an increasingly tokenised financial system.