Perp DEX 2026: The Quiet Flip from Exchanges to Embedded Trading

Perp DEXs didn’t just “grow” in 2025—they changed where trading lives. In 2026, the winning battlefield won’t be UI. It will be distribution, risk, and liquidity.

Read more →

Perp DEXs didn’t just “grow” in 2025—they changed where trading lives. In 2026, the winning battlefield won’t be UI. It will be distribution, risk, and liquidity.

Read more →

Coinbase is pausing peso-based rails in Argentina while keeping crypto-to-crypto services live. The headline sounds operational—but the deeper story is about where exchanges actually take risk: not on-chain, but in the messy middle layer between banks, rules, and settlement.

Read more →

By acquiring The Clearing Company, Coinbase is not just adding another product line. It is positioning itself at the center of a new market where opinions about future events trade as liquid contracts, and where compliance and infrastructure matter as much as user interface. The move shows how prediction markets are maturing from a niche experiment into a strategic pillar of the 'Everything Exchange' vision.

Read more →

After leaving the UK in 2023 when new financial promotion rules landed, Bybit has quietly returned with a spot-only offering approved through licensed exchange Archax. This article explains how the structure works, why the UK’s approach to crypto marketing matters so much, and what Bybit’s comeback reveals about the future of regulated digital-asset platforms in London.

Read more →

Perpetual futures exchanges built on public blockchains are starting to resemble a fully fledged Wall Street stack: exchange, clearing house, prime broker and lending desk compressed into smart contracts. By comparing their cost structure with traditional finance and looking at how liquidity, leverage and stablecoins interact, we can see why Perp DEXs are turning into the core infrastructure layer for on-chain markets — and why risk management and regulation still matter just as much as innovation.

Read more →

PancakeSwap and YZI Labs are incubating Probable, a new prediction-market protocol on BNB Chain that lets users express views on sports, politics, digital assets and major events by trading outcome tokens collateralised in USDT. We examine how the design works, why stablecoins and oracles such as UMA sit at the core of the system, and what this says about the next phase of on-chain market infrastructure.

Read more →

dYdX has launched its first spot trading product on Solana and, for the first time, opened access to U.S. users. Behind what looks like a simple product release is a much bigger story: a derivatives-native DeFi venue repositioning itself as a multi-product, multi-chain platform that tries to align performance, transparency and regulatory realities.

Read more →

Gemini’s Gemini Titan platform has secured a U.S. CFTC Designated Contract Market license to list yes/no event contracts, opening a new chapter where prediction markets, crypto infrastructure and regulated derivatives begin to intersect.

Read more →

For the first time, the Commodity Futures Trading Commission will allow spot cryptocurrency products to trade on federally regulated US exchanges. Behind the bureaucracy is a simple idea: bring Bitcoin, Ethereum and other major assets onto the same platforms that already clear trillions in futures and options. This article unpacks what the decision actually does, how it differs from the ETF wave, and why it could quietly rewire the balance of power between Wall Street and the global crypto industry.

Read more →

Coinbase is no longer content with being the blue-chip crypto on-ramp. With US-listed perpetual futures up to 10x leverage, the acquisition of Deribit, plans to add stocks and commodities, a regulatory green light for stablecoins under the Genius Act, and a push into SME banking, the company is trying to become an everything exchange. The upside is a dominant position at the intersection of markets and money. The downside is that it starts to look a lot like a systemically important financial institution in regulators’ crosshairs.

Read more →

A deep, practical evaluation of NeuroDex after its AI-heavy upgrade: what the new features actually do, how they change user workflows, the tradeoffs versus high-volume DEXs like HyperLiquid, and a realistic checklist to test whether AI agents improve outcomes for retail traders hunting low-cap opportunities.

Read more →

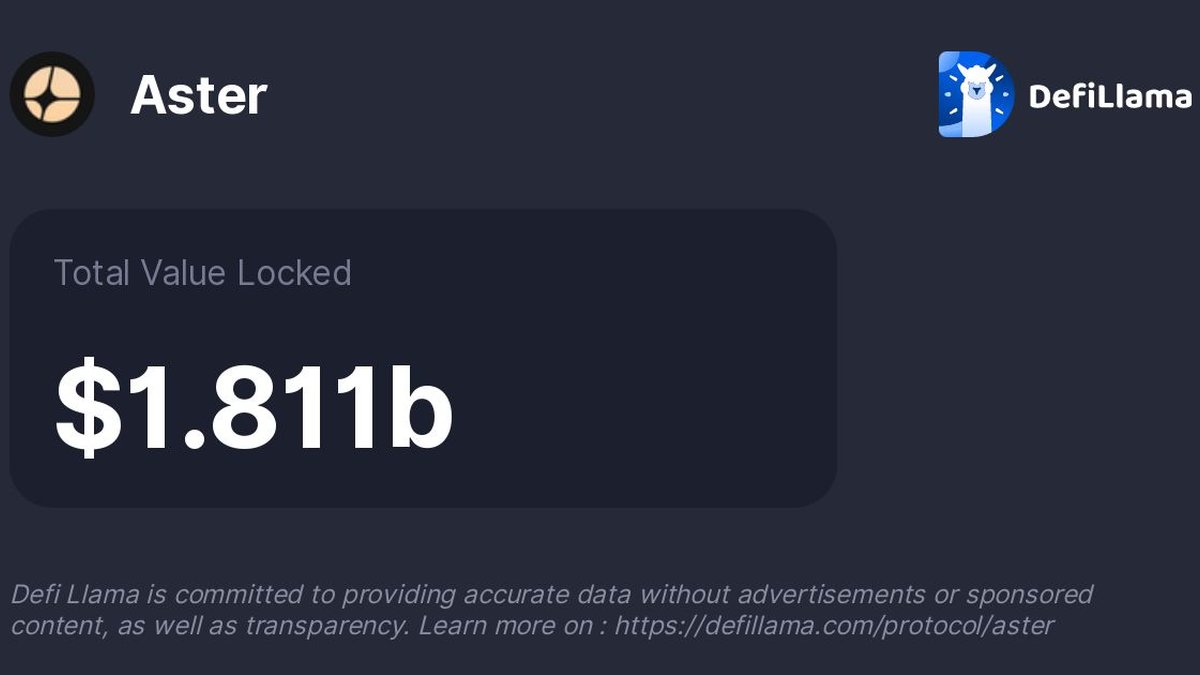

After a brief delisting over data-integrity concerns, DefiLlama has quietly reinstated Aster’s perpetuals data—with caveats. Here’s the timeline, why the dispute happened, what the relisting actually signals (and doesn’t), and a practical checklist for evaluating whether Aster’s eye-popping volumes reflect real risk transfer.

Read more →

A plain-English intro to Hyperliquid — a next-gen decentralized perps exchange built on its own Layer-1. Learn what it is, why it’s fast (and gasless to trade), how it differs from AMM DEXs, how to start in 3 steps, and key risks to know.

Read more →

Our 2025 DEX power ranking for individual crypto investors: Hyperliquid takes the derivatives crown thanks to speed and transparency; Uniswap remains the spot-liquidity core with V4; NEURODEX brings an AI-native, chat-first trading terminal; Aster is a fast-rising challenger in on-chain perps; Curve continues to dominate stablecoin swaps with low slippage and cost.

Read more →

After the historic Oct. 10 liquidation cascade, a #DeleteBinance backlash surged as users alleged depeg-driven forced liquidations and inadequate credits. Binance outlined a compensation formula for USDE, BNSOL, and wBETH collateral and says hundreds of millions have been paid. Data providers flagged large post-crash outflows, while Binance executives pushed back. Here’s the signal amid the noise—and what to watch next.

Read more →

Gemini’s first month as a public company draws 11 Wall Street initiations, a Buy/Neutral split tilted positive, and price targets implying ~25% upside—amid profitability questions and an intensifying race with Coinbase and Robinhood.

Read more →

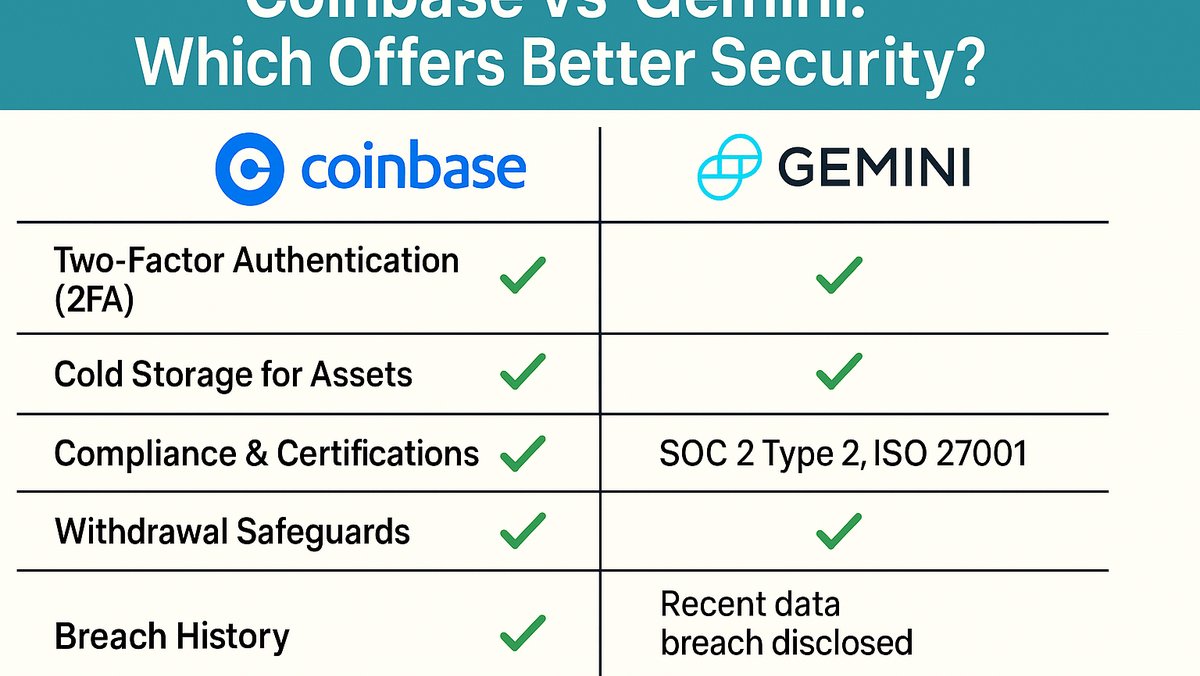

Introduction: Security is a paramount concern for anyone investing in cryptocurrencies.

Read more →

Detailed analysis of Fidelity Crypto including fees, supported assets, and how it compares with other exchanges.

Read more →

An in-depth review of Fidelity Crypto focusing on fees, security measures and trading features.

Read more →

A detailed guide to purchasing Bitcoin on Fidelity’s crypto platform, tailored for newcomers.

Read more →

Fidelity deepens its crypto strategy with new ETFs designed for institutional investors.

Read more →

A look at Fidelity's upcoming crypto trading platform tailored to institutional and retail investors.

Read more →

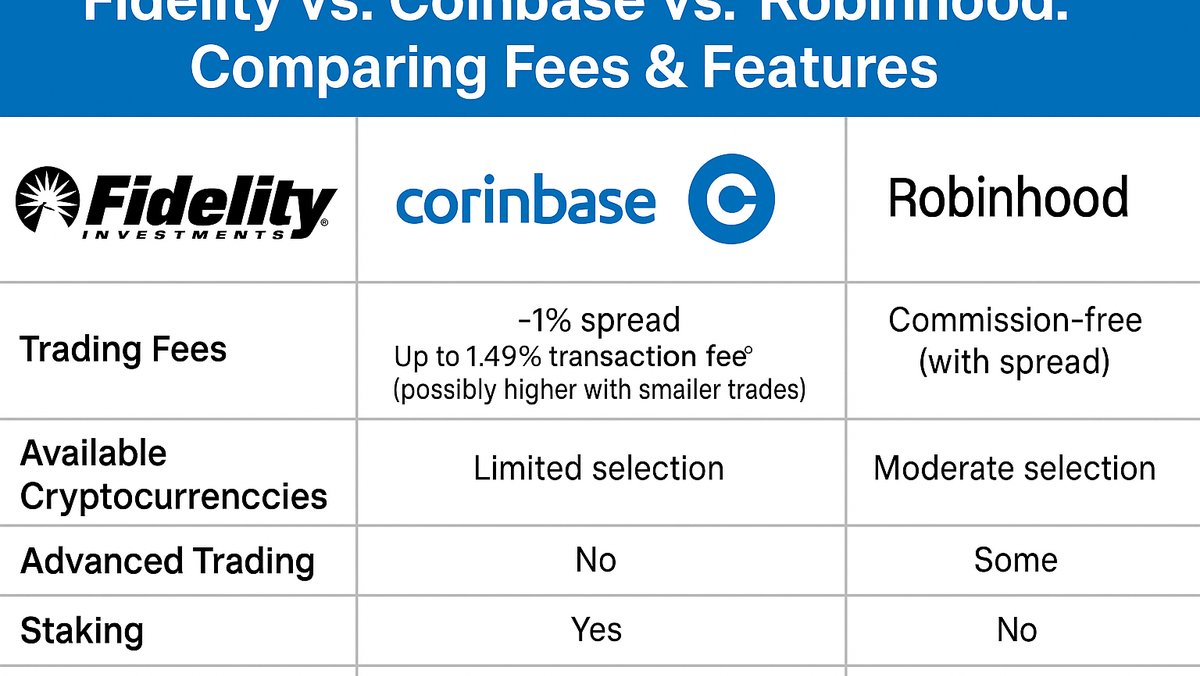

An in-depth comparison of three major platforms for buying and holding cryptocurrency.

Read more →

A balanced look at the potential upside and risks of using Fidelity’s crypto services.

Read more →

Step-by-step instructions for opening and maintaining a crypto account with Fidelity.

Read more →

We assess the features and security of Fidelity’s new crypto wallet offering.

Read more →

A head-to-head look at Fidelity Crypto versus Robinhood across fees, security and usability.

Read more →

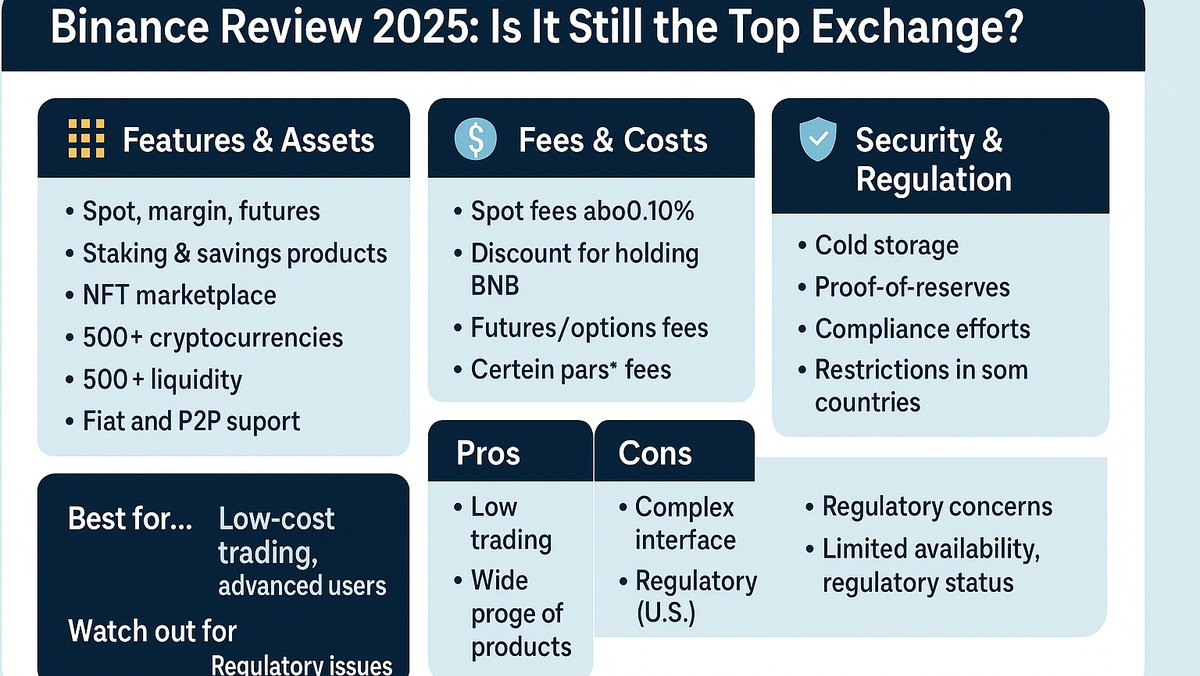

Hands-on checklist, current fees, depth, regional limits, security posture, and head-to-head comparisons with Coinbase, Kraken, and Bybit.

Read more →

Coinbase vs Gemini: Which Offers Better Security?

Read more →

How to Transfer Crypto Between Exchanges Safely

Read more →