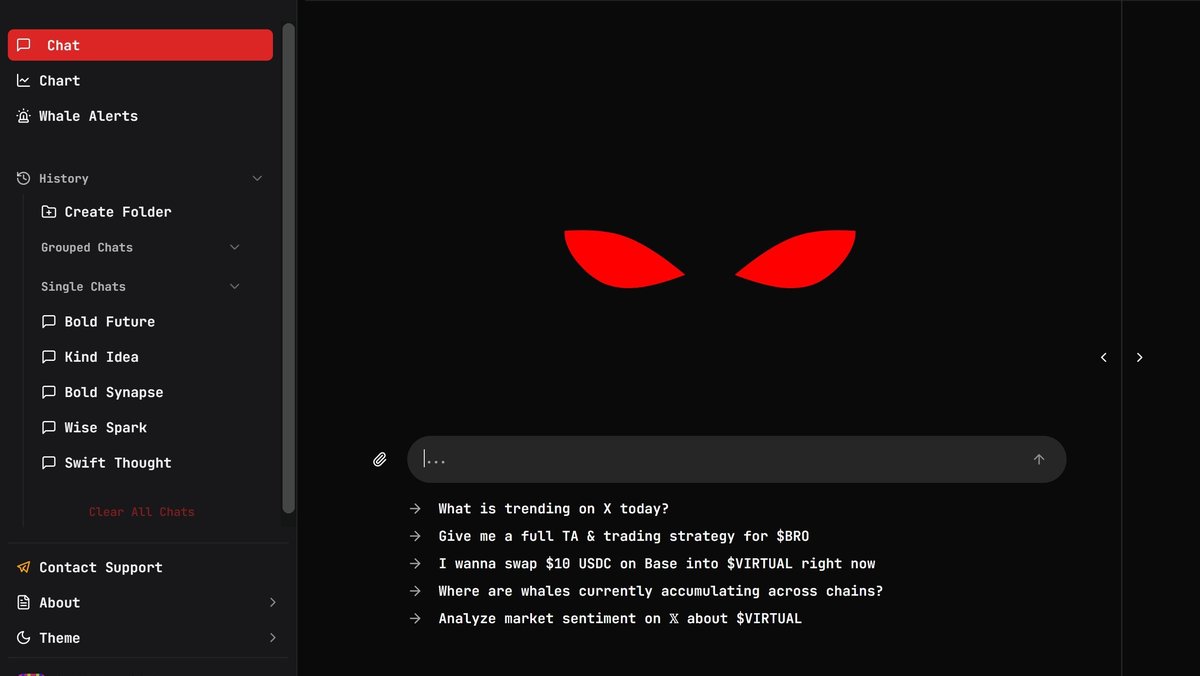

NeuroDex’s Big Upgrade: Can an AI–First DEX Out-Innovate Centralized Exchanges?

If you dislike centralized exchanges and their custody, listing, or withdrawal policies, an AI-first decentralized exchange sounds like the antidote. NeuroDex’s new release is its boldest swing yet: an integrated suite of AI modules that promise to summarize coin-specific news on demand , run chart analysis with classic indicators (support, resistance, Fibonacci levels, Bollinger Bands), suggest entries/exits and risk limits , and monitor whale wallets and fund flows across chains. The team frames this as more than a feature drop. Their thesis: traders do not need yet another charting tab; they need a decision assistant that compresses the research loop from hours to minutes. They also claim NeuroDex is the first DEX to integrate a fleet of up to

80 AI agents that divide and conquer research tasks. Add newly expanded cross-chain swaps that aim to make moving inventory free and simple, and you have a platform staking its brand on AI-driven, retail-friendly discovery rather than whale-only depth.

This analysis is written for readers who want more than headlines. We will break down what the upgrade plausibly does under the hood, show how the pieces may work together in real trading workflows, compare NeuroDex with high-volume competitors like HyperLiquid (often preferred by whales for deep books on majors), and lay out a hands-on validation plan to see whether these AI tools actually change outcomes. We will also highlight risks: model hallucination, front-running, bridge exposure, and governance concerns that a polished UI can hide.

Executive Summary: What Changed, Why It Matters

• News-on-demand per asset: Ask for a coin and the system compiles salient developments. The value is not only recall, but relevance ranking around catalysts that move order flow.

• Built-in technical analysis: Automatic mapping of support/resistance zones, Fibonacci retracements, and Bollinger Bands. Think of it as pre-annotated charts to speed scenario planning.

• Trading suggestions via AI: Earlier versions already offered suggested entries, take-profit targets, and stop-loss bands. The upgrade appears to connect these suggestions to the news and flow modules to add context-aware positioning.

• Whale and flow intelligence: A pipeline for tracking “smart money” wallets and money movements. For low-cap hunters, this can be the difference between joining early and becoming exit liquidity.

• Agentic architecture: NeuroDex positions itself as the first DEX to integrate roughly 80 AI agents. Specialization matters because a single generalist model tends to blur tasks; agents can be optimized for news ranking, on-chain clustering, chart pattern detection, or risk control.

• Cross-chain swaps now broader and simpler: The platform advertises frictionless token swaps across multiple chains, aiming for fee-free routing at the user level. The implication: more shots on goal without bridge overhead.

NeuroDex’s speculative position is clear: if HyperLiquid is the DEX whales open when they want depth on majors, NeuroDex wants to be the DEX retail opens when they want answers and a credible way to chase (or avoid) small-cap volatility with discipline.

How the AI Stack Could Be Wired (and Why It Helps)

It is tempting to treat “80 AI agents” as marketing. But breaking the problem down explains why agentic design is useful:

1. Ingestion agents pull structured and unstructured data: price/volume, order book snapshots (where available), on-chain transfers, GitHub commits, governance proposals, headlines, and social signals.

2. Filtering and clustering agents separate noise from signal: they can de-duplicate stories, group related wallets into likely entities, and isolate unusual bursts in stablecoin inflows to particular ecosystems.

3. Indicator agents compute levels and regimes: support/resistance from market profile or swing highs/lows, Fibonacci retracements on multi-timeframe anchors, Bollinger Bands and band-width squeezes, RSI/MFI divergences, and volatility shifts.

4. Reasoning agents assemble a narrative: “Level X held five times on rising volume; a large address accumulated on two chains; a catalyst vote closes tomorrow; implied vol is rising.”

5. Policy agents translate narrative into guardrails: a min/max position size, staged entries, stop placement below invalidation (not just a round number), and laddered take-profit targets tied to prior supply zones.

In traditional research, one person or team does each step manually. The agentic approach compresses this workflow so that a typical retail user can see a curated plan instead of 20 tabs and a blinking cursor. The risk is that speed invites overconfidence. The value is that speed reduces fatigue and missed setups—if the recommendations are auditable and not black box.

Feature Deep-Dive

1) Per-Asset News Synthesis

NeuroDex’s on-demand news summary aims to solve a very specific problem: traders chase headlines, but most headlines are irrelevant to near-term order flow. A competent system should rank developments by probable price impact and timeframe. For example: a mainnet upgrade scheduled in three weeks may matter less to a low-float token whose treasury just unlocked tomorrow. The win condition is not “more news.” It is hierarchy of news plus clean provenance (where the item came from) and explicit uncertainty tags (rumor, confirmed, proposal stage).

How to use it: pair the feed with the flow module. If the news says a grant program for a small L2 project just passed and flow intelligence shows two known bottom-fish wallets accumulated before the vote, the combination has more weight than either signal alone.

2) Auto-Charting with Classic Indicators

Support and resistance are psychology drawn on price. It is helpful when an algorithm avoids naive levels (e.g., “every round number is resistance”) and instead detects where trades actually exchanged risk. A credible routine would incorporate local liquidity nodes and confluence: “daily VWAP intersects weekly 0.618 retracement within two percent.” Bollinger Bands are often misused as “buy the band, sell the band.” What you want is band-width regime shifts and squeeze breaks with confirmation.

How to use it: do not accept one set of lines. Ask the system to show two timeframes, then stress the plan: where is your invalidation if news is stale, or if a whale dump erases the last leg? An AI that can surface historical analogs (“this structure last appeared on this asset in month X; outcome distribution looked like Y”) adds more than static lines ever could.

3) Entries, Take-Profits, and Stops — Now Context-Aware

Early NeuroDex releases suggested entries and exits using basic pattern recognition. The upgrade’s promise is to condition those suggestions on news and flow. In practice, that could mean reducing position size when a catalyst is unverified, moving stop placement to the other side of a real supply zone instead of a round number, or laddering take profits into zones where prior rally attempts died. Done right, this looks like a junior assistant who points out risks you forgot while you were tunnel-visioning a setup.

4) Whale Wallet & Flow Monitoring

Retail traders care about whales for two reasons. First, their trades move illiquid books. Second, whales often sit close to primary information channels or protocol treasuries. A sensible module will track (a) accumulation or distribution patterns in tagged wallets, (b) fresh wallets sourced from funding patterns, (c) cross-chain behavior (e.g., bridge to a specific L2 right before listings or incentive announcements), and (d) speed of rotation. Flow without speed is just a chart overlay; flow with speed tells you whether you are already late.

How to use it: combine flow alerts with the auto-chart module to decide whether to wait for a pullback or accept momentum. If a whale bid steps up a level into the band squeeze breakout, your fill philosophy changes. If the same wallet unloads into strength, you scale down or avoid chasing.

5) Cross-Chain Swaps, Now ‘Free’ and Simplified

“Free” is a loaded word in crypto. Usually it means someone is paying: the protocol, a partner, or your execution via slightly wider routes subsidized elsewhere. NeuroDex’s proposition is that moving inventory across multiple chains should neither require a graduate seminar in bridge risk nor a week’s worth of gas fees. The right way to evaluate this is not the marketing page; it is your own daily P&L friction. If you can re-allocate collateral across chains with minimal slippage, predictable speed, and verifiable settlement, you unlock strategies (e.g., capture early catalysts where the token is native) that centralized exchanges cannot offer until they list the asset—often too late.

Who Is NeuroDex For?

The platform’s positioning is explicit. If HyperLiquid is the DEX whales visit for deep perps exposure on large caps with superb latency and serious liquidity, then NeuroDex wants to be the research-driven DEX for retail and semi-pro users who want a decision assistant to detect, qualify, and attack low-cap opportunities across chains. This is not an indictment of either strategy; it is a split. One optimizes for throughput and tightness on majors, the other for edge in discovery through assistants. Plenty of users will do both: build core exposure where depth is king, and run a satellite book where asymmetric small-cap speculative positions live.

NeuroDex vs HyperLiquid: A Quick Comparison

| Dimension | NeuroDex (AI–First DEX) | HyperLiquid (High-Volume DEX) |

|---|---|---|

| Primary Edge | AI research agents, per-asset news synthesis, whale/flow analytics, auto-TA | Deep liquidity and speed on majors, stable perps infra, whale-friendly execution |

| Target User | Retail & semi-pro hunting low/mid caps across chains | Whales, latency-sensitive traders, high notional perps users |

| Cross-Chain | Expanded, simple swaps; aims for fee-free user experience | Focus on core markets where depth matters most |

| Decision Support | Entry/TP/SL suggestions with context from news and flow | Rich order types and risk controls; users bring their own research |

| Learning Curve | Lower for research; higher if users over-trust recommendations | Lower for execution; research remains user-led |

There is no ‘better’ universally. There is only ‘better for this job today.’ NeuroDex’s claim is that jobs involving finding and qualifying new names are simply faster with an assistant at your elbow.

Will AI Agents Actually Improve Outcomes? A Practical Test Plan

Do not take the marketing at face value. Run controlled experiments for two weeks:

1. Define your basket: choose eight assets (four mid caps, four low caps) across at least three chains.

2. Baseline period: trade for three days using your normal process without AI assistance. Log every decision: entry time, reason, stop, target, news that influenced you.

3. Assisted period: trade the next three days using NeuroDex’s full suite: news synthesis, flow alerts, auto-TA, and AI suggestions. Again log decisions, but also log which agent signal changed your mind.

4. Metrics to compare: (a) average time from idea to order; (b) average risk per trade; (c) hit rate; (d) average R multiple on winners/losers; (e) slippage relative to intended fills; (f) drawdown volatility.

5. Qualitative audit: were the suggested stops placed at real invalidation points or generic percentages? Did news ranking help you avoid traps or just confirm bias? Did flow alerts correlate with subsequent book pressure?

If your hit rate stays flat but your time to decision drops 40% while slippage and drawdowns improve, that is a real productivity gain, even if outcome variance remains. If the system routinely suggests stops that are too tight (death by a thousand cuts) or targets that are fantasy, you will see it quickly in the logs.

Risk Section — The Uncomfortable Stuff

• Model hallucination: AI can produce confident, wrong summaries. Demand sources and confidence scores. If an agent cannot show provenance, treat it as a rumor.

• Data freshness and replay attacks: Real-time feeds stale by minutes can be lethal in micro-cap books. Also probe how the system defends against spoofed on-chain activity designed to trigger ‘whale’ alerts.

• Front-running and MEV: Cross-chain swaps and DEX routing can expose you to sandwich attacks or arb bots. NeuroDex should document protections (private mempools, batching, or route randomization) and show slippage distributions.

• Bridge and relay risk: ‘Free’ swaps often stand on partners and bridges. Study their audits, failure modes, and how redemptions are handled in partial outages.

• Overfitting to hindsight: Some indicator logic looks great on past data. True testing requires walk-forward analysis and explicit out-of-sample checks.

• Adverse selection via social signals: The easiest wallets to track may be the noisiest. Build your own whitelist of addresses whose forward returns actually justify the copycat risk.

• Compliance and geo-fencing: A DEX with AI is still a DEX. Users remain responsible for local rules, reporting, and eligibility.

Governance, Transparency, and What We Would Like to See Next

1. Explainability panels: When an agent suggests a plan, include a one-click panel that shows the inputs and weights that drove the suggestion. Even a simple “70% signal weight from flow; 20% from TA; 10% from news” helps.

2. Replayable backtests: Let users run the same agent logic on prior weeks to understand tendencies (e.g., too aggressive in chop, too timid in trends).

3. User-tunable risk templates: Not all traders want the same stop philosophy. Offer presets (conservative/moderate/aggressive) with clear statistical expectations.

4. Public method cards for each agent: Short documentation stating inputs, update frequency, and failure modes for every notable agent. This prevents cargo-cult usage.

5. Independent evaluation sets: Periodic third-party report cards on signal utility, akin to an index of agent performance across markets.

Three Realistic Workflows NeuroDex Now Enables

Workflow A: The 20-Minute Daily Scan

Ask the news agent for top five catalysts in the next 72 hours across your watchlist. Pull flow alerts tied to those names, then open the auto-TA panel for two timeframes. If news is fresh and flow is leaning in the same direction, queue a staged order with a stop under the most recent invalidation and partial profit at the first supply shelf. Total time: 20 minutes. Your goal is fewer, better trades, not more clicks.

Workflow B: Low-Cap Discovery with Guardrails

Start from the whale agent’s ‘new wallets’ feed in a target ecosystem. When two unrelated wallets accumulate the same unheard-of token, request a news synthesis for that token only. If the output is thin or speculative, cut size and demand tighter invalidation. If there is a confirmed grant, roadmap milestone, or mainnet date, increase size within your max risk.

Workflow C: Cross-Chain Rebalancing for Event Windows

When a catalyst is native to a different chain, use the cross-chain swap module and inspect the route details before execution. Immediately check realized slippage and any hidden fees. Record time-to-finality. Over a week, you will learn how much friction the system actually removed compared with your prior bridge routine.

Metrics That Matter (For Users and for the Team)

- Assisted Trade Share: percent of trades placed with at least one agent input; track win/loss skew versus unassisted trades.

- Decision Time Delta: average minutes from idea to placed order with and without AI.

- Risk Utilization: average realized drawdown per trade compared with planned risk; if stops hit earlier than planned, agent sizing is off.

- Cross-Chain Friction Index: composite of slippage, latency, and failed swap rate across routes.

- Signal Drift: how often a news or flow signal “changes its mind” within a short window; high drift can indicate poor filters.

Bottom Line

NeuroDex’s upgrade is not just another tab. It is an attempt to embed a research desk into a DEX interface. If the agents reduce decision time, prevent avoidable errors, and surface better risk placements, retail traders will feel the difference quickly. If the agents parrot headlines, draw decorative lines, or overfit to yesterday’s tape, users will revert to old habits just as quickly. The test is empirical: logs, fills, and outcomes over weeks, not weeks of marketing.

In a market where centralized exchanges still dominate liquidity and a handful of high-performance DEXs win execution on majors, NeuroDex’s AI-first positioning is coherent: win the discovery and decision layer, then let cross-chain plumbing remove logistics tax. For small accounts, this is the only path that makes sense—depth alone does not create edge; finding and qualifying opportunities does.

Disclaimer

This report is independent analysis for educational purposes and does not constitute investment advice. Digital assets are volatile and involve risk, including total loss. Always verify claims about features, fees, bridges, and agent behavior directly in-product before committing capital, and comply with local laws and reporting obligations.