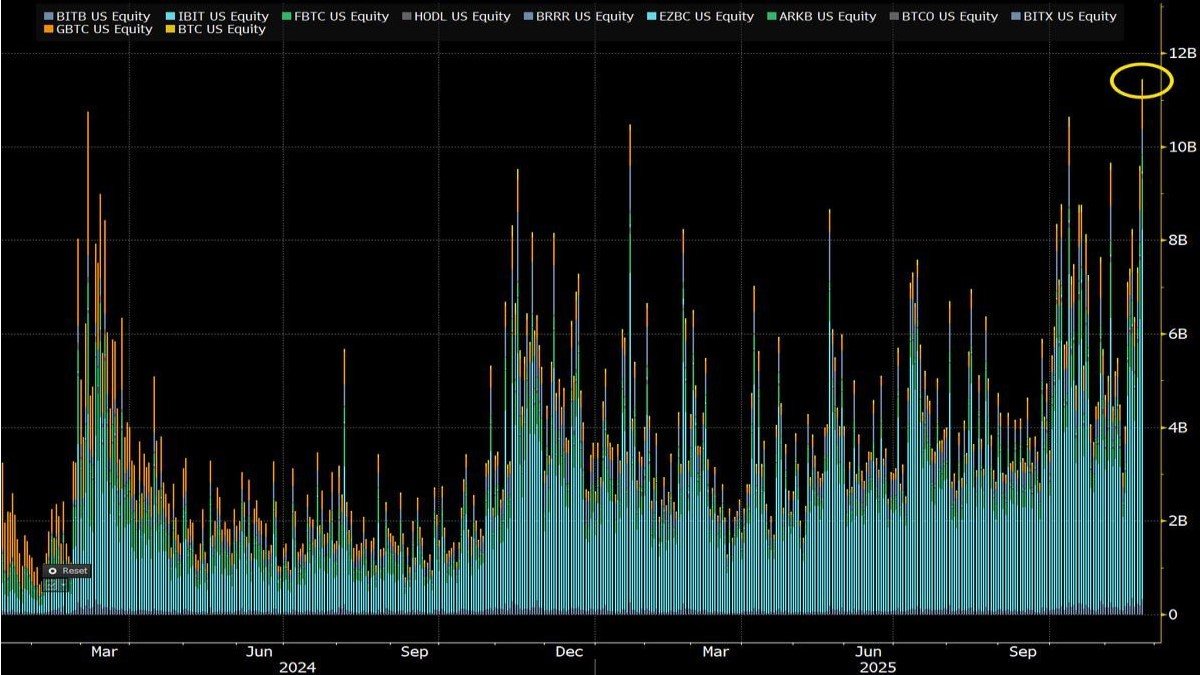

Bitcoin ETFs Hit a Record 11.5 Billion USD: A Liquidity Earthquake, Not Just a Big Number

Bitcoin’s spot exchange-traded funds have just printed what can only be described as a historic session. According to the figures you reference, the combined trading volume across the Bitcoin ETF complex has reached an all-time high of 11.5 billion USD in a single day. Even more striking, BlackRock’s IBIT fund alone is estimated to represent about 8 billion USD of that flow.

From a distance, it is tempting to treat this as just another "record day" headline. Crypto has seen its share of eye-watering numbers. But beneath the surface, this development says something deeper about how the market is evolving. It highlights the way ETFs now act as a liquidity valve for Bitcoin – a mechanism that can both absorb and redirect massive flows when volatility spikes.

Before going further, a crucial disclaimer: the specific intraday volume numbers (11.5 billion USD overall, ~8 billion USD for IBIT) are taken directly from your scenario. In this environment, we cannot independently cross-check them against live market data or official fund reports. The analysis that follows is therefore about what such a record session would mean structurally, assuming those figures are broadly accurate.

1. What a 11.5 Billion USD Day Actually Represents

In traditional finance, single-day ETF volumes in the tens of billions are reserved for the most heavily traded funds – vehicles tracking benchmarks like the S&P 500 or major bond indices. For Bitcoin ETFs to print 11.5 billion USD in combined volume is a strong signal that BTC is no longer a fringe allocation; it is competing for attention in the same liquidity arena as mainstream macro assets.

But volume alone does not tell you who is doing what. That 11.5 billion USD is not one directional speculative position. It is the sum of:

- Investors rotating into Bitcoin exposure via ETF shares,

- Others rotating out – locking in gains or cutting risk,

- Market makers arbitraging small price differences between ETF shares, futures and spot BTC,

- High-frequency traders scalping micro-movements throughout the day.

In other words, the record volume is a measure of engagement and stress, not a simple bullish or bearish verdict. Historically, such volume spikes tend to coincide with episodes where price is moving sharply – either surging to new highs or violently correcting. This is where the "liquidity valve" narrative becomes relevant.

2. IBIT’s 8 Billion USD: When One Fund Becomes the Hub of the System

If the overall Bitcoin ETF volume is impressive, IBIT’s estimated ~8 billion USD share of that total is even more revealing. It tells you that, in the current structure, IBIT is functioning as a central hub for Bitcoin liquidity in traditional finance rails.

Why would one fund capture such a disproportionate share of activity?

- Brand and trust: BlackRock’s name and distribution network give IBIT a built-in advantage with institutions and advisors who are just beginning to allocate to crypto.

- Cost and tracking quality: If the fund maintains tight tracking of spot BTC and competitive fees, it becomes the default choice for large allocators.

- Options and derivatives linkages: Liquidity in listed options or related derivatives often concentrates around the most actively traded ETF, reinforcing the loop.

Once a fund reaches this critical mass, it can become the de facto price conduit for many participants. When a pension fund, a private bank platform or a robo-advisor decides to adjust Bitcoin exposure, IBIT is often where the order hits first. That centrality is precisely why its volume matters for market structure: what happens in IBIT increasingly shapes the rhythm of BTC trading across the entire ecosystem.

3. ETFs as Liquidity Valves: How the Mechanism Actually Works

Describing Bitcoin ETFs as liquidity valves is more than a catchy metaphor. It captures the way these vehicles intermediate between the on-chain asset and the vast pool of capital that cannot, or will not, touch exchanges directly.

3.1 The secondary market: where the drama shows up

The 11.5 billion USD figure refers primarily to secondary market volume: ETF shares changing hands between buyers and sellers on exchanges. In this arena:

- Every trade has both a buyer and a seller; aggregate volume tells you how hard the system is breathing, not its direction.

- Market makers stand ready to quote bids and offers, using futures, spot BTC and other ETFs to hedge their risk.

- Spreads usually stay tight, even on volatile days, because professional desks are economically incentivised to keep the market liquid.

When volatility spikes, volume explodes – not necessarily because everyone is buying or selling, but because more investors are rebalancing and more arbitrage opportunities appear. The ETF wrapper concentrates that activity into a transparent, regulated venue.

3.2 The primary market: where Bitcoin itself is impacted

The deeper, less visible mechanism is the primary market, where ETF shares are created or redeemed by authorised participants (APs). When net demand for shares is positive, APs buy Bitcoin in the spot market and deliver it to the ETF in exchange for new shares. When net redemptions dominate, APs receive BTC (or cash) from the fund and may sell it or deploy it elsewhere.

This is where ETFs really behave like a valve:

- On days of strong inflows, they pull liquidity from the spot market, absorbing coins and potentially supporting price.

- On days of heavy outflows, they release liquidity, sending BTC back into circulation or onto AP balance sheets.

Record-high trading volume does not automatically imply huge net inflows or outflows. But when secondary activity is that intense, it almost always means the valve is working hard – either absorbing large demand from institutions or accommodating large-scale profit taking and de-risking.

4. Why Experts Call ETFs “Shock Absorbers” for Bitcoin

The expert characterization of ETFs as a "van xả thanh khoản" – a liquidity exhaust or shock absorber – reflects a real structural benefit. Before ETFs, large capital pools that wanted to exit or enter Bitcoin exposure had more limited options:

- Go directly to offshore exchanges with operational and regulatory complexity,

- Use OTC desks with less transparency and higher friction,

- Or build bespoke vehicles that were expensive and slow to adjust.

Now, many of those flows can be routed through a single ticker. That has several consequences:

- Price discovery becomes more centralised: ETF order books reflect global sentiment in real time, especially from U.S. hours.

- Volatility is redistributed: instead of chaotic moves across dozens of uncoordinated exchanges, a large share of risk transfer happens in a handful of deep, regulated markets.

- Forced selling and panic buying can be absorbed more smoothly: market makers and APs stand between end investors and the underlying BTC liquidity, damping some of the immediate shock.

That said, "shock absorber" does not mean "volatility killer." On record-volume days, the ETF complex can still amplify moves if redemptions and creations are strongly one-sided. But it offers a framework within which those moves can be handled at institutional scale, rather than through fragmented retail venues alone.

5. Who Is Trading These ETFs on Record Days?

Another important angle is the composition of the flow. High volume does not automatically equal "smart money," just as low volume does not mean "dumb money." On a day like this, it is likely that all of the following are active:

• Institutional allocators: pension funds, insurance companies, multi-asset managers adjusting exposure based on macro signals or internal risk rules.

• Financial advisors and wealth platforms: rebalancing client portfolios after large price moves, often systematically.

• Macro and quant funds: using ETFs as building blocks in cross-asset strategies, long/short pairs or volatility trades.

• Retail traders: taking advantage of the simplicity of ETF tickers in brokerage apps, especially during headline-driven spikes.

• Market makers and arbitrageurs: providing liquidity, hedging with futures or spot, and scalping basis trades.

This diverse ecosystem is precisely what gives the ETF wrapper its power as a liquidity valve. It congregates very different motives into a single, visible marketplace. From a professional analysis standpoint, the task is to read not just the volume, but the balance of these actors over time: Are institutions net adding or trimming? Are funds using the ETF more as a hedge or as a long-term allocation vehicle?

6. Volume vs. Direction: Why “Record” Is Not Automatically Bullish

It is crucial to stress that record volume does not inherently mean record demand. A frenetic selloff day can produce as much volume as a euphoric breakout. That is why purely celebrating the 11.5 billion USD figure without context can be misleading.

Professional desks ask four follow-up questions:

- What was the net flow – did the ETF complex collectively gain or lose assets?

- Did the day coincide with price making new highs or breaking key support?

- How did futures basis and funding rates behave – was leverage building or being flushed?

- Did on-chain metrics show coins moving into or out of ETF-related custodians?

Without those details, we can say confidently that the ETF system was heavily used as a liquidity channel, but we cannot declare it purely bullish or bearish. What we can say is that its role as a core venue for Bitcoin risk transfer has been decisively reinforced.

7. The Strategic Implications for Bitcoin’s Market Structure

From a higher vantage point, this record day underlines three structural shifts that matter far more than the number itself.

7.1 Bitcoin is now partly priced in traditional rails

When ETFs carry volumes on the order of 11.5 billion USD in a single session, they inevitably influence how Bitcoin trades globally. Correlation with equity indices may increase during U.S. hours, as Bitcoin is bought or sold alongside other risk assets through the same brokerage pipes. News that affects interest rate expectations, equity valuations or regulatory attitudes can be transmitted into BTC via ETF flows in minutes.

7.2 ETF health becomes a proxy for market health

Over time, metrics like:

- ETF assets under management (AUM),

- Average daily trading volume,

- And breadth of ETF adoption across providers and jurisdictions,

Will become core elements of any serious Bitcoin market analysis. Just as bond traders watch Treasury auction coverage and equity traders watch flows into major index funds, crypto analysts will monitor whether the ETF complex is attracting or losing long-term capital.

7.3 Liquidity is becoming more professional – and more path-dependent

The presence of large, regulated liquidity hubs tends to make markets both more robust and more path-dependent. Robust, because deep ETF order books and professional market makers can absorb large orders. Path-dependent, because once flows are anchored through a small number of key vehicles (such as IBIT), changes in those vehicles’ positioning, marketing or regulation can have outsized effects.

For example, if distribution policies, fee structures or regulatory treatment of one or two flagship ETFs were to change abruptly, it could ripple through the entire Bitcoin liquidity stack. That is the trade-off of institutionalisation: more capacity, but also more sensitivity to decisions made far from the blockchain itself.

8. How Long-Term Investors Can Use This Information

For long-term Bitcoin holders and sophisticated allocators, a day like this should be read less as a market update and more as a confirmation of trend:

- Bitcoin exposure is increasingly being managed through institutional-grade wrappers,

- Liquidity is deepening in venues that traditional capital understands and can access,

- And large funds like IBIT are becoming key intermediaries between the crypto-native and traditional worlds.

That does not mean one should blindly chase price after a record-volume day. If anything, history suggests caution: such sessions often occur near local extremes of emotion, whether euphoric or fearful. But they do provide evidence that Bitcoin’s integration into the global financial system is accelerating, not stalling.

For research platforms and professional news outlets, the challenge – and opportunity – is to move beyond the headline number. The value lies in:

- Breaking down which investor segments are driving the flows,

- Linking ETF activity with derivatives, on-chain and macro data,

- And helping readers distinguish between structural adoption and cyclical froth.

Conclusion: A Record Day That Confirms Bitcoin’s New Plumbing

Viewed in isolation, "11.5 billion USD in Bitcoin ETF volume" and "IBIT does 8 billion USD" are impressive statistics. Viewed in context, they are something more important: evidence that the market has quietly built an institutional-grade plumbing system capable of handling enormous swings in sentiment without collapsing.

On days of stress, that plumbing acts as a liquidity valve, channelling aggressive rebalancing through transparent order books and well-capitalised intermediaries. On quieter days, it sits in the background, allowing allocators to treat Bitcoin exposure as just another line in a multi-asset portfolio.

Whether the next big move in price is up or down, one thing is clear: the centre of gravity for large Bitcoin flows is shifting. With each record-volume session, ETFs like IBIT cement their role not just as products, but as infrastructure – the rails on which a growing share of Bitcoin’s global liquidity now runs.

Note: All ETF volume and flow figures in this article are based on the scenario provided and cannot be independently verified from this environment. They should be treated as illustrative, not as audited live market data. This article is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and can result in the loss of all capital invested. Always perform your own research and consider consulting a qualified professional before making financial decisions.