Aave App Wants to Be Your Next Savings Account – And a Trojan Horse for On-Chain Finance

For years, DeFi users have juggled seed phrases, browser wallets and intimidating dashboards while friends and family stuck with savings accounts paying fractions of a percent. Aave Labs now wants to collapse that divide into a single icon on your phone. Aave App, its new consumer savings product, does something deceptively simple: it packages on-chain yield into an experience that looks and feels like a familiar banking app.

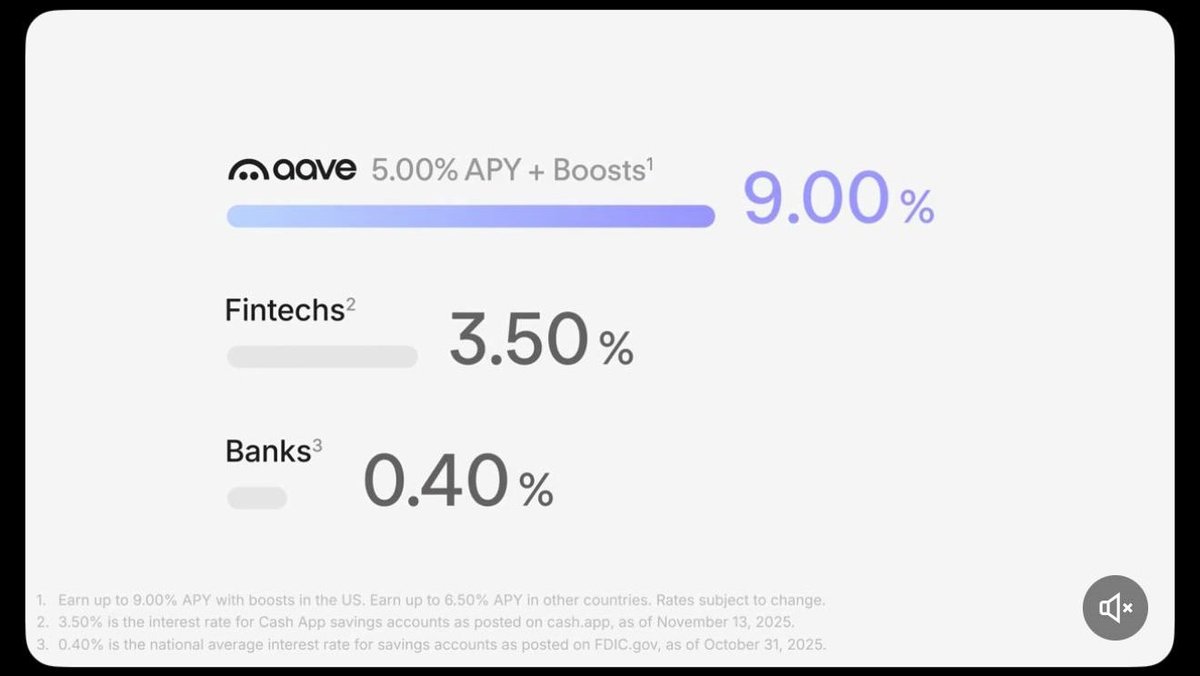

Under the hood, it is still powered by the same Aave lending markets that have become a backbone of Ethereum DeFi. On the surface, it behaves like a high-yield savings account: a base rate around 5% APY, the possibility to boost returns toward 9% through referrals and automatic deposits, interest that compounds every second, and balance protection up to one million dollars. Deposits can flow in from bank accounts, debit cards or stablecoins; withdrawals are on demand, with no fixed lockups or notice periods.

For casual users, that may just sound like a better place to park cash. For the industry, it is something more important: a test of whether DeFi can finally move beyond products for insiders and become an invisible layer beneath everyday finance.

1. What exactly is Aave App?

Aave App is a retail savings application built by Aave Labs, initially rolling out on Apple's App Store with Android in the pipeline. Its core promise is straightforward: offer yields significantly higher than typical bank savings rates, while abstracting away the complexity of wallets, gas fees and protocol interactions.

According to Aave's own launch materials, the app currently targets:

- A base annual yield in the region of 5% on supported deposits.

- Additional rate boosts that can lift the effective APY toward a ceiling around 9%, earned by actions such as enabling automated deposits, completing identity verification and inviting new users.

- Continuous interest accrual, with returns compounding every second and visible in real time inside the app.

- Balance protection up to one million dollars per eligible user account, backed by an insurance structure rather than a traditional deposit guarantee scheme.

Unlike most DeFi frontends, Aave App does not ask mainstream savers to think in terms of Web3 primitives. Users link a bank account or debit card from a list of more than twelve thousand supported institutions, or transfer stablecoins from an existing wallet. From that point on, the interface behaves like any other fintech savings app: dashboards for projected earnings, sliders for contribution amounts, an Auto Saver for recurring transfers and a simple withdraw button when cash is needed.

Crucially, however, the yield does not come from an opaque corporate balance sheet or a black-box trading strategy. It comes from providing liquidity to the Aave protocol, which matches depositors with over-collateralised borrowers and dynamically adjusts interest rates based on supply and demand.

2. The DeFi engine under the glossy interface

To understand what makes Aave App more than yet another neo-bank, it is worth unpacking the machinery beneath it. The Aave protocol is a non-custodial lending system deployed across multiple chains, where users supply assets to shared liquidity pools and other participants borrow those assets against posted collateral.

Several features of this design matter for savers:

• Over-collateralisation. Borrowers generally must post collateral worth more than the value of the assets they borrow. If their collateral ratio falls too low, the protocol liquidates positions automatically. This attempts to keep the system solvent and helps Aave market itself as 'money markets backed by more than one hundred percent of their value' rather than unsecured lending.

• Dynamic interest curves. Interest rates on stablecoins within Aave's lending pools move with utilisation. When borrowing demand for a particular asset spikes, the rate paid to depositors rises. When demand drops, yields compress. The consumer-facing Aave App smooths some of this variability through its base-plus-boost model, but ultimately the engine is still a decentralised interest rate curve.

• Transparent accounting. All positions, loans, liquidations and rate changes are visible on-chain. While most retail users will never inspect these directly, institutions and risk analysts can, which is a stark contrast to the opacity of many failed centralised lenders from the last cycle.

Scale also matters. Aave has grown into one of DeFi's largest lending protocols, with total value locked and active deposits measured in the tens of billions of dollars. Recent reports place its liquidity north of thirty billion dollars, and some on-chain aggregators have recorded peaks closer to forty or even seventy billion depending on the timeframe and networks considered. That is not on the scale of global banks, but it does give Aave an institutional weight that most DeFi experiments lack.

Aave App is essentially a carefully controlled front door into this machinery. Consumer deposits are channelled into stablecoin lending strategies on Aave, with Aave Labs capturing a spread between the protocol's raw yield and the rate promised to retail savers. In other words, for end users the app behaves like a simple savings product; for Aave Labs, it is a structured way to monetise and deepen the protocol's liquidity base.

3. Hybrid finance: where bank rails meet smart contracts

One of the most striking aspects of Aave App is how aggressively it leans into traditional rails instead of ignoring them. Rather than forcing newcomers to convert fiat through exchanges or stablecoin on-ramps, the app integrates directly with a broad network of banks and debit card providers. Users can connect existing accounts in minutes and schedule recurring transfers, all without leaving the familiar fintech context.

This hybrid architecture has several implications:

• Lower onboarding friction. The biggest barrier for DeFi adoption has never been yield; it has been the user journey. Aave App compresses the multi-step process of buying stablecoins, moving them to a self-custodial wallet and interacting with a lending protocol into a one-stop interface. That alone could expand the reachable market far beyond crypto natives.

• Regulatory entanglement. By integrating with banking rails and offering identity-based boosts, Aave Labs is implicitly embracing a compliance-heavy model. Know-your-customer checks, sanctions screening and jurisdiction-specific consumer protections all become part of the operational stack. This is both a moat and a constraint compared with purely permissionless DeFi.

• New risk expectations. Marketing an app with balance protection up to one million dollars sets a very different expectation than telling users that in DeFi, contracts are used at their own risk. While the protection is insurance-backed rather than a sovereign guarantee, many consumers will intuitively compare it to deposit insurance. That raises the bar for incident response and communication during market stress.

From a strategic angle, this hybrid model is the point, not a side effect. Aave Labs is explicitly positioning itself as a bridge between on-chain yield and off-chain savers who neither know nor care what a liquidity pool is. If the app succeeds, many of its users may never realise they are using a DeFi protocol at all; they will simply see an account with a higher rate and a smooth mobile experience.

4. How does Aave App stack up against banks and fintechs?

On the surface, Aave App is another player in a crowded contest: the race to offer a more attractive home for idle cash. High-yield savings accounts, money market funds, fintech apps that sweep balances into Treasuries and cash-like ETFs all compete based on a similar pitch. The distinction lies in where returns come from and how risk is shared.

Traditional banks typically pay a fraction of prevailing risk-free rates on savings accounts and make their margin by lending at higher rates or investing in assets like government bonds and mortgages. High-yield fintechs often route funds into short-term Treasuries or wholesale cash markets, passing a larger slice of the yield to users while keeping some spread and embedding more explicit risk disclosures.

Aave App, by contrast, routes deposits to borrowers on a decentralised protocol. The spread it earns depends on stablecoin lending conditions, crypto market structure and the health of Aave's risk management. That can produce yields above what many banks pay, especially if policy rates fall faster than DeFi borrowing demand. It can also move in directions that have little to do with central bank decisions, particularly during periods of crypto-specific stress.

From a user perspective, the main differentiators are:

• Yield level and variability. A base rate near 5% with clear, gamified boosts up to 9% is materially higher than the averages quoted for many savings products. However, those yields are ultimately anchored to lending markets that can change quickly. The app abstracts that volatility, but it cannot make it disappear forever.

• Protection structure. Balance protection up to one million dollars via insurance is meaningful, but it differs from government deposit schemes that cover a much bigger banking ecosystem and are backed by central banks and fiscal authorities. Users need to understand that protection applies to specific categories of risk and may not cover every adverse outcome.

• Asset exposure. Deposits are either converted into or already denominated in stablecoins. That creates an additional layer of risk tied to stablecoin issuers, backing reserves and regulatory regimes that does not exist in a simple cash savings account.

In short, Aave App is not simply a higher-yield bank account; it is an on-chain yield product heavily wrapped in bank-like clothing. For some users that will be an acceptable trade-off. For others, especially those with low risk tolerance or limited understanding of DeFi, the mismatch between branding and underlying mechanics will require careful education.

5. Risk, transparency and the meaning of a million-dollar guarantee

The most eye-catching number in Aave App's marketing is not 9% APY; it is one million. That is the stated maximum balance protection per customer, an order of magnitude higher than the coverage ceilings in many deposit insurance frameworks. It is also a number that invites scrutiny.

Based on Aave's public materials and third-party reporting, the protection is structured as an insurance-backed coverage against specified categories of loss, such as security breaches or technology failures affecting user balances. It does not magically immunise users from market moves, smart contract security vulnerabilities beyond the policy scope or stablecoin depegs. In other words, it is closer to a specialised insurance policy layered on top of a DeFi stack than to a state guarantee on bank liabilities.

For sophisticated investors, this distinction is obvious. For many households, it will not be. If Aave App experiences a stress event, the way it handles claims, communication and restoration of confidence will matter as much as the legal fine print. The promise of coverage is only as strong as the insurer's solvency, the clarity of terms and the operational ability to process payouts quickly.

Beyond insurance, standard DeFi risks still apply. Although Aave has built a reputation as one of the more conservative and battle-tested protocols, it has not been entirely free of security scares and parameter misconfigurations. On-chain lending is exposed to risks such as oracle manipulation, liquidation cascades during sharp market moves and governance attacks. Aave's extensive audits, bug bounties and risk frameworks reduce but do not eliminate these hazards.

That said, one advantage of the Aave model compared with opaque yield platforms from previous cycles is transparency. Analysts can track aggregate collateral, utilisation, liquidations and reserves on-chain. Independent risk teams can stress-test protocol behaviour under historical shocks. This does not guarantee safety, but it gives both institutions and regulators tools to monitor systemic build-ups in a way that is impossible with black-box balance sheets.

6. Why this launch matters for DeFi’s evolution

In isolation, a new savings app is just another product announcement. In the context of DeFi's trajectory since 2020, Aave App looks more like a strategic pivot for the sector.

Early DeFi was driven by yield farming, governance token incentives and speculative leverage loops. Returns in double or triple digits were common but obviously unsustainable. When those incentives dried up and several centralised lenders collapsed in 2022, demand shifted toward safer, more transparent yield sources. Stablecoin lending on major protocols, liquid staking and real-world asset strategies took centre stage.

Aave App fits into this second phase. It does not promise lottery-ticket APYs; it offers single-digit yields framed as sustainable, with explicit risk mitigation and insurance. It targets not traders chasing the next farm, but savers willing to move from 0.5% in a bank to 5–7% in a hybrid on-chain product if the experience feels trustworthy.

If this model succeeds, it sets a template for other protocols: build institutional-grade risk management, partner with insurers and regulated on-ramps, then hide the blockchain under a conventional interface. In that world, DeFi does not replace banks directly; it becomes the infrastructure they quietly rely on for yield and settlement.

7. Implications for Aave, stablecoins and on-chain liquidity

For Aave itself, the app is more than a branding exercise. It potentially reshapes the protocol's liquidity profile. Retail deposits flowing through Aave App are likely to be sticky, recurring and denominated primarily in major stablecoins. That kind of capital is attractive: it deepens pools, stabilises interest rate curves and reinforces Aave's position as a reference venue for stablecoin borrowing.

For stablecoin issuers, the app is also notable. It creates yet another large, user-friendly sink for assets such as USDC, USDT and possibly others over time. At a macro level, every successful consumer app that funnels savings into on-chain stablecoin strategies strengthens the argument that dollar-linked tokens are becoming a parallel cash system.

For competitors in both DeFi and fintech, Aave App raises the bar. Other protocols now have a concrete example of what a consumer-grade, insured, hybrid savings bridge looks like. Banks and neo-banks, meanwhile, face a new entrant that is not content to remain in the crypto niche but is explicitly competing for deposits on the basis of rate, transparency and always-on compounding.

8. How a professional should look at Aave App

For analysts and allocators, the right response to Aave App is neither blind enthusiasm nor blanket scepticism. Instead, it is to treat the app as a case study in how on-chain finance can be packaged for retail, and then ask a few disciplined questions.

- Is the yield stack transparent, and can it be monitored independently on-chain?

- Are the insurance arrangements clearly disclosed, with realistic limits and exclusions?

- How does the product behave under stress, for example during sharp stablecoin depegs or spikes in DeFi borrowing demand?

- What regulatory perimeter does the app fall under in its launch jurisdictions, and how might that evolve?

- Does the inflow of retail deposits materially change the risk profile of the underlying protocol or the stablecoins it uses?

Answering these questions does not require dismissing the app's ambitions. It simply means recognising that every attempt to merge DeFi yield with bank-like assurances carries both opportunity and responsibility. If Aave App can consistently deliver on its promises without hidden leverage or opaque risk transformation, it will deserve the attention it is already receiving. If not, it will become another exhibit in the long history of financial products that promised more yield with no extra risk and discovered, too late, that such alchemy does not exist.

Conclusion: an experiment worth watching, and understanding

Aave App arrives at a moment when both savers and regulators are re-evaluating what they want from digital finance. Households are tired of near-zero yields in a world of persistent inflation. Policymakers are wary of fragile structures that promise the moon and deliver collapse. DeFi protocols, after surviving a brutal shake-out, are searching for sustainable paths to growth.

In that landscape, a consumer savings app that offers bank-like simplicity, on-chain transparency and insured balances up to one million dollars is more than a marketing stunt. It is a live experiment in whether on-chain finance can integrate into everyday life without repeating the excesses of the last cycle.

For now, the verdict is open. What is clear is that serious analysis of Aave App should look past the headline APY and focus on structure: where returns come from, how risk is managed and who ultimately stands behind the promises on the splash screen. That, more than any single rate number, will determine whether this is just another fintech logo or a genuine step toward making on-chain finance an invisible part of global savings.

This article is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets and DeFi products are highly volatile and may be unsuitable for many investors. Always conduct your own research and consider consulting a qualified professional before making financial decisions.