Bitcoin Below 80K: Panic on the Surface, Rotation Underneath

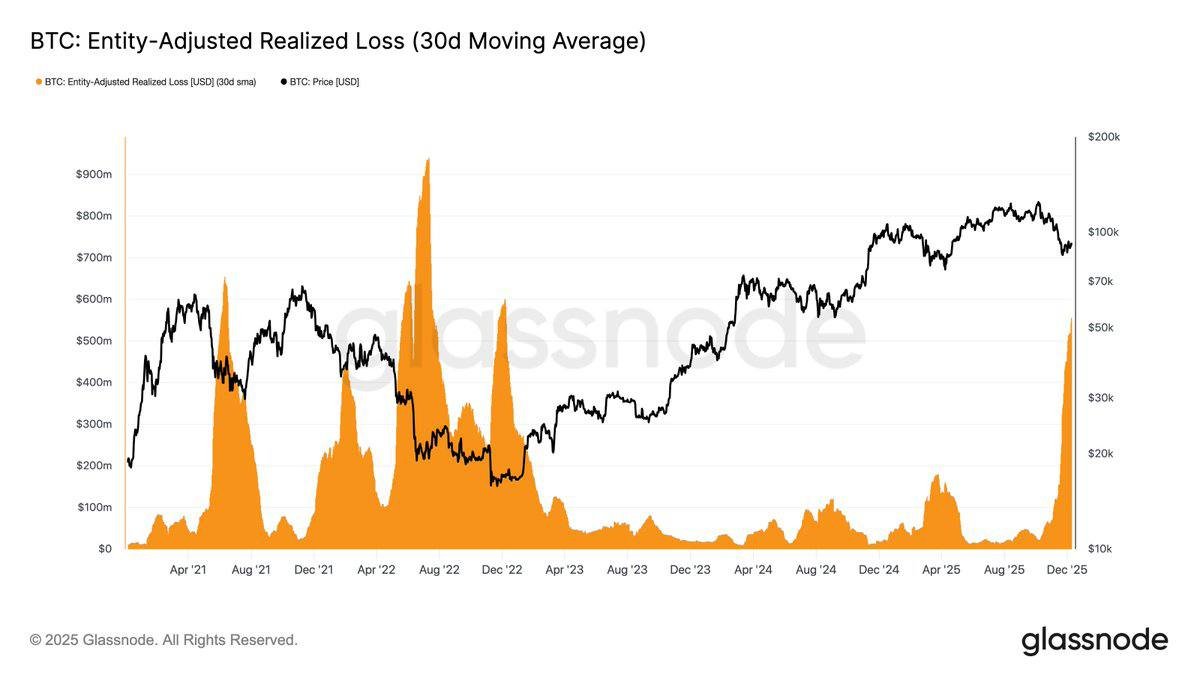

The crypto market has entered one of its most uncomfortable phases of this cycle. Bitcoin has broken below the psychologically charged 80,000 USD mark after weeks of grinding losses. Liquidations have piled up across futures venues, and major altcoins from Ethereum to Solana and DOGE have followed BTC lower. Headlines focus on fear: multi-billion dollar outflows from spot Bitcoin and Ethereum ETFs, a wave of forced selling, and a sense that the long-awaited bear market might finally have arrived.

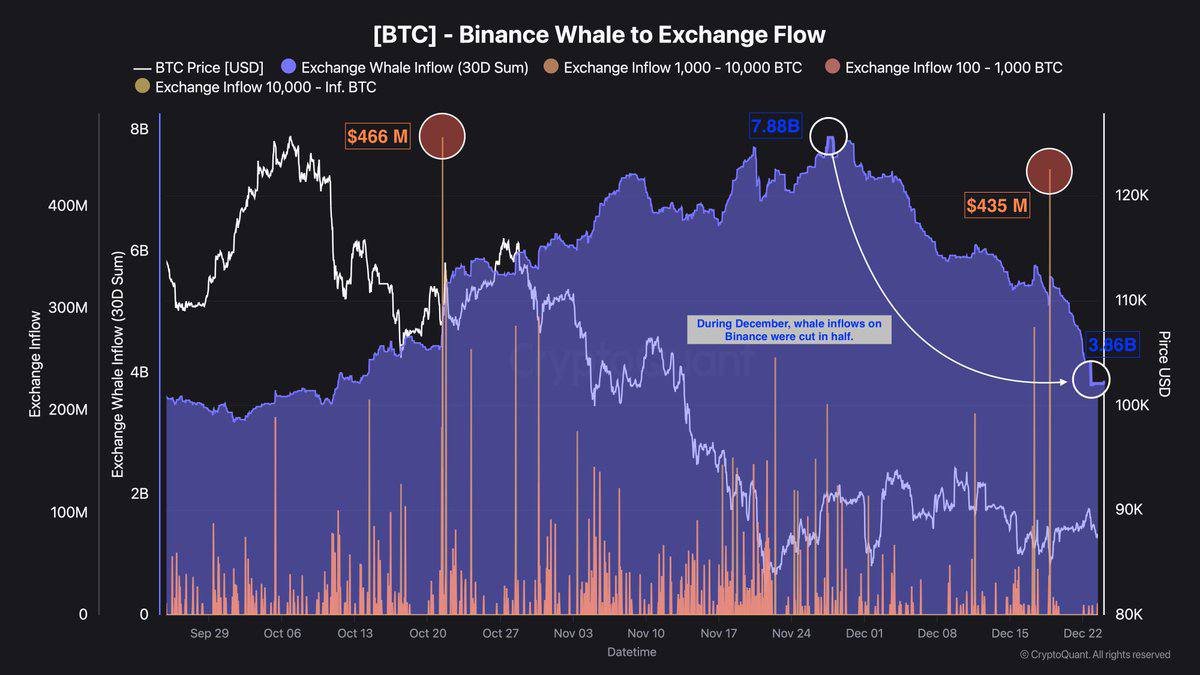

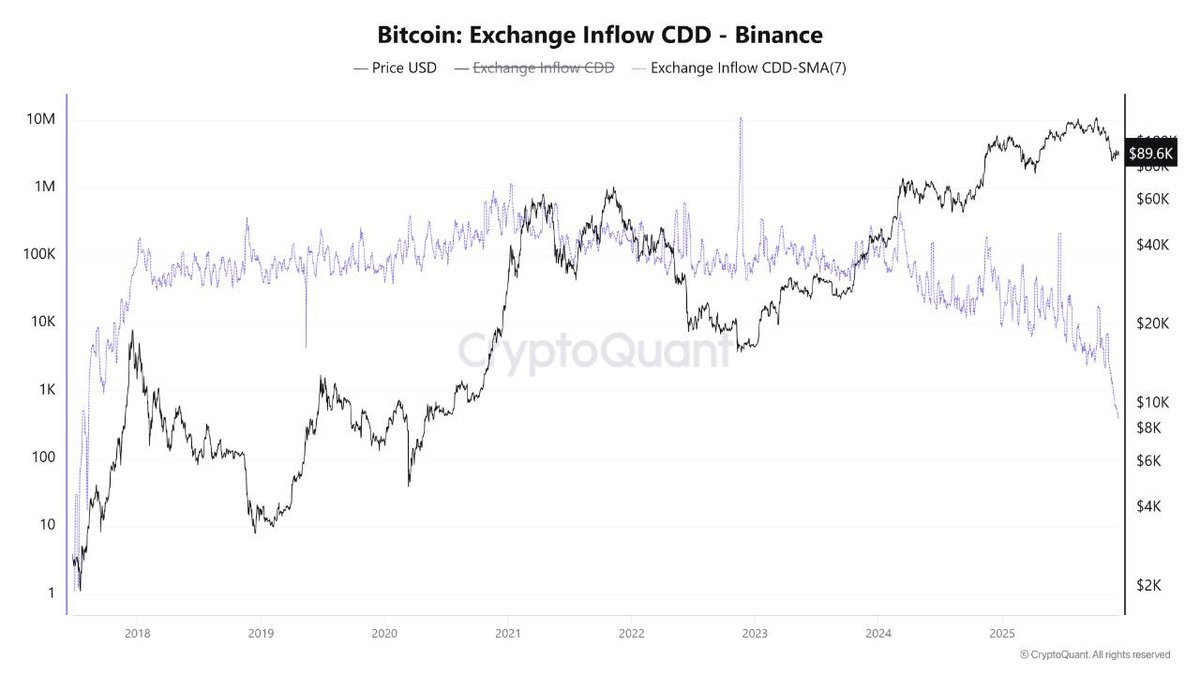

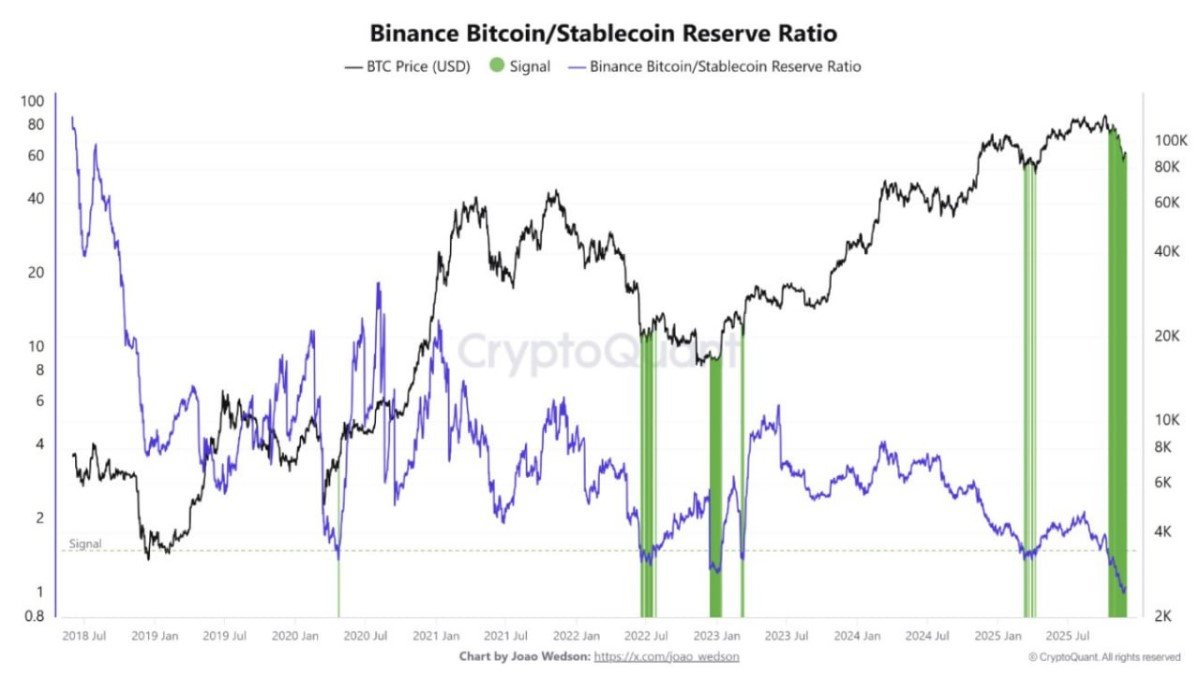

Yet if we look past the top-line carnage, the data you highlight tell a more nuanced story. Even as so-called smart money is redeeming Bitcoin and Ether exposure, the same institutional channel is funneling fresh capital into a different pair of assets. ETFs tracking Solana and XRP are attracting substantial inflows, with combined new capital in the hundreds of millions of dollars and day-one demand for the new XRP product far exceeding expectations. In other words: whales are not leaving the high-risk gaming venue; they are changing tables.

Because this analysis is based on the figures and events you supplied, and cannot be cross-checked against live markets from within this environment, we treat them as scenario inputs rather than verified real-time data. The goal here is not to confirm exact numbers, but to understand what such a configuration of flows and prices would mean for market structure and for investors trying to navigate it.

1. The Selloff: Bitcoin Loses 80K and ETFs Bleed

The first part of the story is straightforward and painful. A combination of macro uncertainty, fading enthusiasm over monetary easing, and a string of security incidents and legal disputes has turned what once looked like a steady bull market into a cascade of risk-off behavior. As Bitcoin slipped from the six-figure zone toward 90,000 USD, many traders told themselves it was a healthy correction. The break toward 80,000 USD shattered that comfort. At these levels, not only leveraged participants but also spot buyers from earlier in the year are deeply underwater.

ETF flow data amplify that picture. Spot Bitcoin products, once the symbol of institutional endorsement, are now the main channel through which capital is leaving the asset. The numbers you mention – almost one billion dollars in net outflows in a short window, and several billion from BlackRock’s flagship fund over the month – imply that large portfolios are not merely trimming; they are actively de-risking. Ethereum funds are seeing similar patterns. For allocators whose investment committees only recently got comfortable with crypto, the combination of volatility, regulatory ambiguity and macro noise has proven too much.

In technical terms, the charts confirm the stress. Moving averages on Bitcoin have rolled over, and the classic “death cross” – where shorter-term averages drop below longer-term ones – is appearing on widely watched timeframes. Whether one believes in the predictive power of such patterns or not, they matter because so many participants trade based on them. Once a death cross is widely discussed, systematic strategies and risk managers often cut exposure automatically, adding mechanical sell pressure to an already fragile tape.

2. Why Are ETFs Bleeding? Understanding the Institutional Mindset

From the outside it is tempting to call institutional sellers “weak hands”, but that misses the constraints under which they operate. Many pension funds, endowments and large asset managers have strict volatility, drawdown and correlation limits. Crypto allocations, especially in the form of public ETFs, sit inside broader portfolios that must answer to boards and regulators.

When macro uncertainty spikes – the Federal Reserve lacks clean inflation data, the odds of rate cuts swing violently, and the equity market sheds a trillion dollars of value in a day – risk managers often make coarse decisions: cut exposure to whatever is hardest to model. Crypto fits that description perfectly. In such an environment, it is rational for them to redeem Bitcoin and Ethereum ETF shares even if they still believe in the long-term thesis. Survival of the fund comes before conviction in any single asset.

There is also the issue of crowding. Bitcoin ETFs have become the first stop for almost every institution wanting crypto exposure. That success has a downside: when risk-off hits, everyone tries to squeeze through the same small exit at the same time. The result is exactly what we are seeing: record redemptions and a sharp repricing lower, even though crypto’s underlying technological story has not changed overnight.

3. The Rotation: Why Solana and XRP ETFs Are Seeing Inflows

Against this backdrop, the inflows into Solana and XRP ETFs are striking. If the only story were “institutions hate crypto again”, we would expect outflows across the board. Instead, the flows are selective. New Solana funds are attracting tens of millions of dollars in a single session; the freshly launched XRP ETF from Bitwise reportedly pulled in over 100 million USD on day one. The New York Stock Exchange has green-lit XRP and DOGECOIN ETF listings from Grayscale, expanding the menu of regulated altcoin exposure for U.S. investors.

What explains this apparent contradiction? Several factors may be at work:

• Search for differentiated beta. Some portfolios are not abandoning crypto; they are rebalancing within it. After a long stretch in which Bitcoin dominated flows, allocators are now looking for assets that might outperform in the next phase of the cycle, especially those tied to high-throughput chains or payment narratives.

• Regulatory signaling. The very fact that regulators are comfortable approving Solana and XRP ETFs sends a strong signal to conservative institutions. For XRP, the partial courtroom clarity around its legal status gives some investors a sense – justified or not – that regulatory tail risk is lower than for certain other tokens.

• Perceived asymmetry. With Bitcoin still trading at a large multiple of its pre-ETF levels, some investors see more room for percentage gains in altcoin blue chips whose adoption curves they believe are only beginning.

From the perspective of whale behavior, ETF inflows are only part of the picture. On-chain data in comparable past episodes have often shown large non-exchange wallets accumulating when retail is panicking. If that pattern is repeating here, it would suggest that whales are using ETF products as the public, regulated face of a broader accumulation strategy in Solana and XRP. The message is not “crypto is dead,” but rather “the leadership within crypto is changing.”

4. Solana and XRP: What Exactly Are Whales Buying?

To understand why big players might favour Solana and XRP at this juncture, it is worth revisiting what these networks represent in the current ecosystem.

Solana has positioned itself as a high-throughput, low-latency chain optimised for trading, DeFi and consumer use cases. Its ecosystem has hosted some of the largest memecoin waves, NFT activity and on-chain order-book experiments of this cycle. For whales who believe that a significant portion of crypto’s future volume will occur on high-performance chains rather than on the Ethereum base layer, Solana exposure is a levered speculative position on that thesis. Buying Solana via an ETF gives them a compliant, simple way to express that view without managing private keys or navigating DeFi risk directly.

XRP, by contrast, is tied to a much older narrative: cross-border payments and banking rails. Despite years of controversy, the asset still enjoys deep liquidity, a global holder base and increasing institutional acceptance after partial legal wins in U.S. courts. For some investors, XRP is a way to speculative position on tokenised payments and banking integration rather than on DeFi or memecoins. The launch of a well-structured ETF turns that story into a familiar ticker inside brokerage accounts, something pension committees know how to approve.

Viewed through that lens, whales rotating from BTC and ETH into SOL and XRP are not just chasing momentum; they are diversifying across narratives – store of value, smart-contract platform, high-speed execution layer and cross-border settlement asset. A professional allocation to crypto in 2025 can look much more like a sector portfolio than a binary speculative position on Bitcoin alone.

5. Risks: When Rotation Happens During a Macro Storm

None of this should be read as a guarantee that Solana or XRP are safe havens. Rotation inside a downtrend does not magically cancel systemic risk. In fact, there are at least three layers of danger that sophisticated investors are very aware of:

• Correlation risk. During severe risk-off episodes, correlations across crypto assets tend to converge toward one. In practice, that means if Bitcoin experiences another leg lower due to ETF redemptions or macro shocks, Solana and XRP are unlikely to be completely insulated, even if they are seeing inflows today.

• Regulatory overhang. The same regulators approving new ETFs can also tighten rules tomorrow. SEC roundtables scheduled for December, along with ongoing enforcement actions and policy debates, can still reshape how these products operate or which tokens remain welcome in public markets.

• Liquidity trap. Heavy ETF inflows into relatively smaller-cap assets can create crowded trades. If sentiment flips, the exit door may again prove narrow, leading to exaggerated downside moves.

There is also the broader macro question. As long as the Federal Reserve remains data-dependent while lacking clean inflation numbers, and as long as expectations around rate cuts swing from optimism to pessimism week by week, crypto will remain a high-beta expression of global risk appetite. Even if whales are building positions in SOL and XRP, they cannot control the tidal wave of macro liquidity that ultimately decides how much capital is available for speculative assets.

6. How a Professional Desk Interprets This Environment

For a professional research and trading desk, the correct response to a tape like this is not panic and not blind dip-buying, but a disciplined reassessment of market structure.

On the one hand, record ETF outflows, a break of key Bitcoin levels and the emergence of classical bear-market chart patterns all argue for caution. Funding conditions, basis, and order-book depth need to be monitored continuously. Risk systems should assume that volatility can spike further and that weekend liquidity gaps may amplify moves.

On the other hand, selective institutional inflows into Solana and XRP, continued accumulation of crypto-related equities by large funds and pensions, and the rollout of new ETF products on major venues like the NYSE show that the structural integration of crypto into traditional finance is still advancing. Capital is not abandoning the asset class; it is negotiating which parts deserve long-term exposure.

In practice, this may translate into strategies such as:

- Maintaining hedged or reduced Bitcoin exposure while building small, staggered positions in assets showing relative strength and robust inflows, such as SOL and XRP ETFs.

- Focusing on liquidity metrics – depth of books, slippage on large orders, ETF primary market activity – rather than price alone when assessing risk.

- Preparing for both outcomes of upcoming policy events, including SEC roundtables and central-bank meetings, by stress-testing portfolios under scenarios of both renewed easing and prolonged tightness.

7. What Individual Investors Can Learn From Whale Behaviour

For non-institutional participants, the most valuable takeaway from this period is not which specific coin is being accumulated, but how large players think about risk and rotation. When volatility surges, they do not usually flip from all-in to all-out overnight. Instead, they reshuffle within their opportunity set, favouring assets with clearer narratives, stronger liquidity and new structural demand drivers.

Watching whales and ETF flows can help retail investors avoid some common mistakes:

- Assuming that a drop in Bitcoin automatically means the end of the crypto story.

- Chasing whatever has already pumped the most in the previous weeks rather than noticing where fresh capital is quietly entering.

- Ignoring macro and regulatory calendars, which often explain sudden shifts in flows better than any chart pattern.

None of this means copying institutional positioning blindly is a good idea. Big players have time horizons, risk tools and access to liquidity that most individuals do not. But understanding that the current selloff is not simply “crypto dying” – rather, a contested re-pricing in which some assets are being abandoned while others are funded – can help investors maintain a more rational perspective.

Conclusion: From Monolith to Mosaic

Bitcoin’s break below 80,000 USD, combined with heavy ETF redemptions and the sight of BlackRock itself reporting substantial outflows, makes for frightening headlines. Many participants will remember only the blood on the screen and the charts screaming death cross. Yet underneath that surface narrative, a quieter transformation is taking place. Capital is rotating, not disappearing. Solana and XRP ETFs are attracting hundreds of millions of dollars; large investors continue to buy crypto-linked equities; new products are being approved on the world’s largest stock exchange.

This does not guarantee that the current correction has ended, nor that Solana and XRP will be immune to further shocks. The macro environment remains unstable, regulatory risk is ever-present, and technical damage on Bitcoin’s chart is real. But from the vantage point of a professional analysis outlet, the key message is that we are moving from a monolithic, Bitcoin-only narrative toward a mosaic of differentiated crypto exposures. Whales are voting with their capital: not for or against crypto as a whole, but for specific segments they believe will matter most in the next phase of the digital asset experiment.

Important note: All numerical values and events described in this article are based on the scenario you provided and cannot be independently verified from within this environment. They should be treated as illustrative rather than as audited live data. This text is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and can result in the loss of all capital invested. Always perform your own research and consider consulting a qualified professional before making financial decisions.