The 4-Year Halving Cycle Is Over: Bitcoin Has Graduated to the Macro League

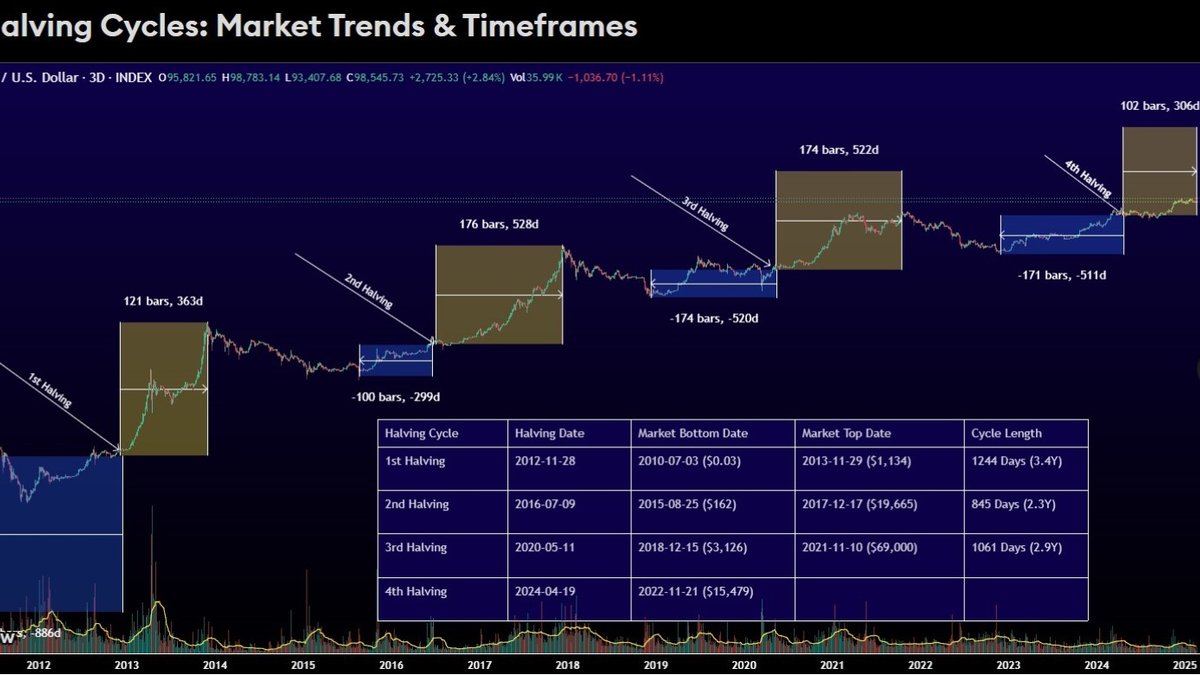

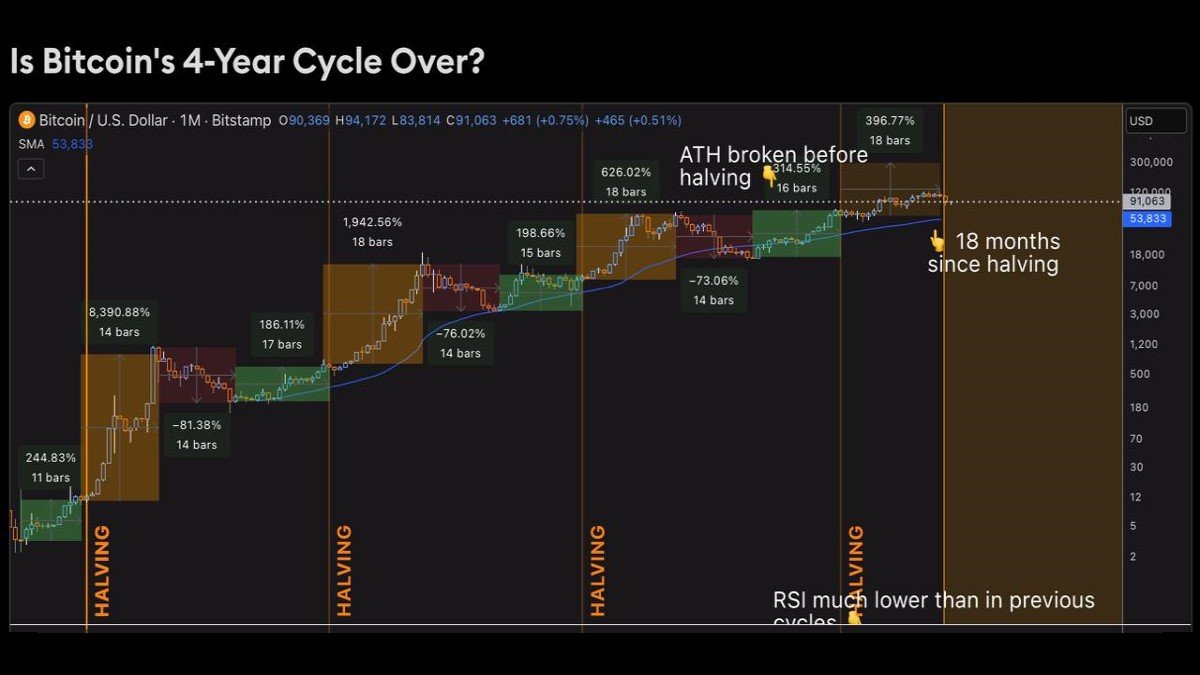

For most of Bitcoin’s history, there was a simple story that everyone from YouTube influencers to hedge funds repeated: every four years, the block reward halves, miners sell fewer coins, supply shocks the market, and price goes vertical. In that world, you didn’t need to understand the Federal Reserve, global liquidity, or ETF flows. You just circled the next halving date on your calendar and waited for fireworks.

That world is gone.

Bitcoin has now issued about 95% of its eventual 21 million supply, with roughly 19.95 million BTC mined and just over 1 million left to come in over a century. At the same time, U.S. spot Bitcoin ETFs alone custodian around 1.3 million BTC, with global products pushing that total higher, and institutions, governments and corporates together controlling an estimated mid-teens percentage of all coins in existence. In other words, the small pond has become an ocean – and it’s crowded not with hobbyist miners, but with aircraft carriers.

Halvings still matter. But they no longer dominate price action the way they once did. If you trade Bitcoin in 2025 as if it were still 2013, you’re not early – you’re playing an old game that the market has already moved past.

1. Why the 4-year pattern ever worked in the first place

To see why the “post-halving pump” made sense in early cycles, it helps to remember how small the ecosystem actually was. Think of the pre-2017 Bitcoin market as a quiet fishing pond:

- Daily spot volume was modest, dominated by a handful of exchanges and retail traders.

- Miners were large fish in a small body of water; their constant selling to pay electricity bills materially affected net supply.

- Most participants didn’t run complex macro models – they responded to narratives and visible supply shifts.

In that environment, cutting block rewards from 50 to 25, then to 12.5 BTC per block had real bite. Issuance dropped sharply relative to the size of the market. If demand was even mildly rising, miner selling pressure fell faster than new buyers arrived, and the only way to clear the order book was for price to grind – then spike – higher. The familiar pattern emerged: a quiet accumulation phase, halving, lag, then a parabolic advance.

Crucially, those cycles were not “magic coded into the protocol.” They were the product of a small system where a single variable – miner issuance – was a major share of net flows. That is no longer the world we live in.

2. From pond to ocean: ETFs and institutions dwarf miner supply

Fast-forward to late 2025. Bitcoin now behaves less like a niche tech experiment and more like a global macro asset. Several structural shifts underlie this change:

• Supply mostly issued. With roughly 19.95 million BTC already mined, daily issuance after the April 2024 halving is around 400–450 BTC – less than 0.5% annual supply growth.

• ETFs as giant vacuum cleaners. Spot Bitcoin ETFs in the U.S. alone hold over 1.3 million BTC, representing more than 6% of total supply. When flows are positive, those vehicles can absorb months of miner output in a matter of days.

• Institutional anchoring. Research estimates that roughly 16% of all Bitcoin is now in the hands of corporates, governments and ETF structures combined. That figure has been rising year by year as more balance sheets and funds allocate.

Compare the scales. Miners collectively bring about 400 new BTC to market each day. A single strong ETF inflow day can require issuers to buy several thousand BTC. A week of net ETF redemptions can dump the equivalent of months of miner issuance back into the market. The “fish” that used to dominate the pond is now a footnote in an ocean of institutional flows.

Once you see those numbers next to each other, the conclusion is hard to avoid: the halving still tightens supply, but in flow terms it is now a secondary force. The primary driver is the behaviour of large, price-insensitive holders and the macro liquidity regimes that govern their risk appetite.

3. The halving as a ritual, not a switch

This doesn’t mean the halving is meaningless. It still matters in three ways – just not in the simple “number go up right after” way that early cycles taught people to expect.

- It anchors long-term scarcity. Every halving mechanically reduces future issuance and reinforces the narrative that Bitcoin is getting harder to obtain at the margin. That supports the idea of Bitcoin as digital hard money.

- It shapes expectations. Traders, miners and businesses plan around halving dates. Those expectations influence investment in mining infrastructure, risk models and Treasury strategies.

- It supplies a marketing moment. Halving years attract new retail interest, media coverage and product launches. That can add temporary demand on the edges.

What the halving no longer does, by itself, is guarantee a reflexive bubble. In a market where daily ETF flows and macro headlines can move billions of dollars in or out in a week, the reduction of a few hundred coins a day is not a switch that flips the cycle. It is background radiation – important over decades, subtle over months.

In that sense, the halving has gone from being the engine of the market to something closer to a protocol holiday: still meaningful, still celebrated, but no longer the only thing that matters.

4. Bitcoin now dances to macro music

If the halving has been demoted, what has taken its place? The short answer: macro and liquidity.

Bitcoin today is deeply entangled with the broader financial system. When rate-cut expectations rise, dollar liquidity improves and risk assets rally, Bitcoin tends to benefit. When bond yields spike, central banks talk tough and ETFs bleed capital, Bitcoin is treated – at least in the short run – as another risk asset to de-lever.

You can see this in recent price action. The latest leg down from all-time highs above $120,000 coincided with:

- A sharp repricing of Federal Reserve rate-cut odds.

- Billions of dollars in net outflows from spot Bitcoin ETFs over several weeks.

- Incremental selling from long-term holders taking profits after the six-figure breakout.

None of that had anything to do with the halving. It had everything to do with a market that is now included in cross-asset risk models on major trading desks. Bitcoin has graduated: it is analysed alongside the dollar, gold, equities and credit spreads. That’s good news for its legitimacy and long-term adoption. It is bad news if you were relying on a simple four-year template to time every move.

5. What happens when the “warships” own most of the coins

As large institutions accumulate Bitcoin, the rules of the game shift again. Once enough ETFs, corporates, sovereigns and funds hold substantial positions, their priorities differ from those of early retail speculators. Three structural tendencies stand out.

5.1. Dampening the wild volatility

Retail traders love 30% candles; risk managers hate them. If Bitcoin is to become a core reserve or collateral asset, its biggest holders have a strong incentive to tame the worst excesses of volatility.

They don’t need Bitcoin to become as dull as short-dated Treasuries. But if you plan to use BTC in lending, repo-style arrangements, margining or structured products, you want an environment where daily swings are usually manageable, and deep derivatives markets let you hedge tail risk. That encourages:

- More active use of futures and options to smooth flows.

- Greater market-making depth from institutions whose business model depends on tight spreads rather than directional speculative positions.

- A culture among big holders of managing drawdowns and spikes rather than amplifying them.

If that sounds abstract, look at how gold trades today versus in the 1970s. It still moves, sometimes sharply. But as more balance sheets rely on it, the very biggest players use derivatives and coordinated flows to avoid chaos. A similar slow shift is likely in Bitcoin as its role as collateral grows.

5.2. Deep cold storage and structural illiquidity

The second effect of institutional dominance is more direct: many of the largest new holders are price-insensitive accumulators. Sovereign treasuries, long-only funds, strategic corporate treasuries and some ETFs are not trying to scalp every oscillation. They are treating Bitcoin as reserve, collateral or “digital property” to be held for years.

As more coins move into cold storage, multi-sig vaults and regulated custodians with tight withdrawal rules, the liquid float available to trade shrinks relative to total supply. Add in permanently lost coins and dormant early wallets, and the number of BTC that are realistically for sale at any given time is much smaller than the headline 21 million cap suggests.

In that world, Bitcoin starts to resemble a hoarded precious metal whose circulating inventory is thin. Day-to-day volatility may moderate, but when a genuine shift in demand hits – say, a new wave of sovereign buyers or a large new ETF channel – the price response can still be violent, because there simply isn’t much inventory willing to move.

5.3. The machine economy and “Bitcoin as AI salary”

The third trend is more speculative but increasingly discussed in serious circles: the idea that Bitcoin could become part of the settlement layer for autonomous AI agents and machine-to-machine payments.

As AI systems begin to control budgets, procure cloud resources and transact with each other, they need:

- Money that can move 24/7 without human intervention.

- A settlement layer that isn’t dependent on any single jurisdiction or gatekeeper.

- An asset that can be verified and transmitted programmatically.

Bitcoin, especially when paired with layers like the Lightning Network or future rollup-style solutions, fits that brief better than most alternatives. Stablecoins are easier to integrate today, but they carry issuer risk and legal dependence on specific states. Bitcoin offers a neutral, censorship-resistant base asset that machines can use to pay each other across borders without asking permission.

If that machine economy ever reaches significant scale, it will not be trading in and out of positions based on chart patterns. It will be continuously locking up and releasing small amounts of BTC as part of its operating logic. That is a fundamentally different source of demand from the discretionary human trader who “sells the news” after each halving.

6. So is the 4-year cycle really dead?

“The halving cycle is dead” is a catchy phrase, but reality is more nuanced. The halving still matters; it’s just no longer the only clock that matters.

Here’s a more precise way to frame it:

• The old retail pattern is gone. You can no longer expect a simple, monotonic bull run in the 12–18 months after every halving, powered mainly by reduction in miner sell pressure and retail FOMO. Too many other forces now dominate flows.

• The structural impact remains. Halvings will keep compressing new issuance and reinforcing the “digital hard asset” narrative. That matters for long-term valuation, especially as more institutions seek assets with predictable supply.

• Macro cycles overlay halving cycles. A halving that coincides with easing monetary policy and strong risk appetite will feel powerful; one that lands in the middle of a liquidity crunch will feel muted or even irrelevant on short timeframes.

In other words, the four-year rhythm hasn’t been “killed” so much as absorbed into a more complex score. The new soundtrack includes interest-rate paths, ETF flows, regulatory decisions, AI adoption curves and the incremental actions of big balance sheets that treat Bitcoin as infrastructure, not entertainment.

7. What this means for individual investors

If you are a smaller investor, this shift cuts both ways.

On the one hand, the days of buying any post-halving dip and watching price 20x in a straight line are probably gone. Returns are likely to be lumpier, more tied to macro cycles and, over time, lower in percentage terms as the asset base grows. The “easy mode” of simply believing in the halving meme is over.

On the other hand, a more institutionally anchored Bitcoin with deeper derivatives markets and clearer macro drivers can actually be easier to analyse. Instead of guessing when anonymous whales will move coins, you can track ETF flows, central-bank policy, long-term holder behaviour and on-chain indicators of accumulation or distribution. That’s not trivial – but it’s closer to how professional investors already think about commodities and FX.

The key is to update your mental model:

- Treat the halving as a background tailwind, not a trading system.

- Pay attention to who is accumulating – ETFs, corporates, sovereigns, AI-driven applications – and how sticky their demand is likely to be.

- Respect macro liquidity: in a tightening cycle, even scarce assets can fall; in an easing cycle, structurally scarce assets tend to outperform.

Conclusion: from firework cycles to foundation stone

Bitcoin is no longer a small experimental pond where miner supply and retail emotion set the tide. It has become part of the deep ocean of global finance, where warships like ETFs, corporate treasuries, sovereign funds and – potentially – machine economies shape the waves.

In that ocean, the 4-year halving remains an important current, but it is not the only one, nor even the strongest. The real story of the next decade will be whether Bitcoin successfully completes its transition into three roles at once:

- A global collateral asset that can back loans, derivatives and credit systems without being dependent on any single state.

- A reserve and reference asset held in deep vaults by institutions and, eventually, more nation-states, shrinking the tradable float.

- A machine-native money that AI systems and devices can use to pay each other directly across networks and jurisdictions.

If those trajectories continue, Bitcoin’s price path may indeed look less like the explosive, halving-driven fireworks of the past and more like a long, uneven climb as it is woven into the plumbing of the financial and digital world. There is no guarantee that climb will be “unstoppable” – nothing in markets ever is – but the forces at play are now far bigger than a single protocol event every four years.

Understanding that shift is the difference between trading yesterday’s Bitcoin and investing in the one that is actually being built.

This analysis is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and may be unsuitable for many investors. Always conduct your own research and consider consulting a qualified professional before making financial decisions.