The November Myth: Why Bitcoin’s “Best Month” Reputation Is More Inflated Than You Think

For years, Bitcoin commentators have repeated the same line as the calendar flips into Q4: “November is one of BTC’s strongest months.” Screenshots of seasonal charts circulate on social media, showing impressive average returns for November compared with other months. Traders talk about the “November effect” almost as if it were a law of nature.

And then a month like this one (in the scenario you describe) arrives.

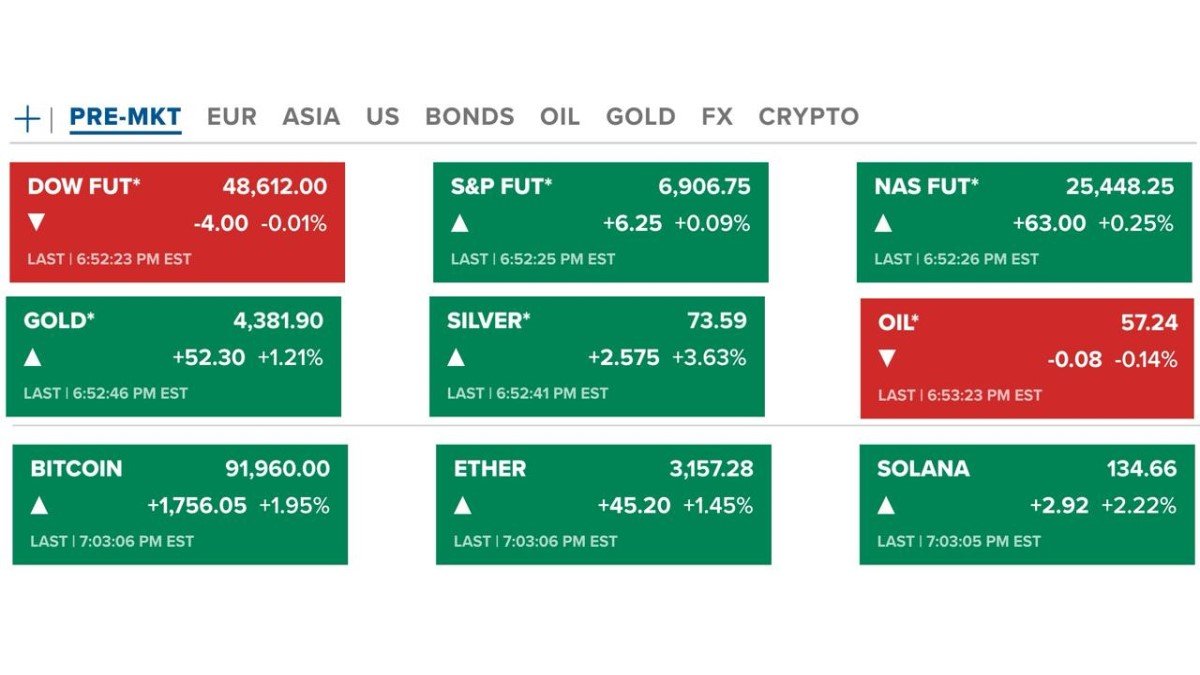

Instead of a clean grind higher, Bitcoin is on track for its worst November since 2019, down roughly 15% and having briefly traded below 89,000 USD. Just a few weeks ago, the market was still celebrating an all-time high around 125,100 USD in October. Now, the tone has shifted to anxiety: has November’s reputation as a “strong month” been oversold? Was the seasonal edge genuine, or just the by-product of a few outsized bull cycles?

Strategists in your context argue that this year is unusual: key macro data releases have been delayed, and expectations for a Federal Reserve rate cut in December have collapsed. In that backdrop, the usual seasonality template looks increasingly useless. Yet even those same strategists note that the current drawdown may be entering its late phase: price is beginning to stabilise, and the band between 97,000 and 100,000 USD is emerging as an important resistance and sentiment pivot.

This article digs into the November narrative from a professional perspective. Rather than simply repeating that “November is good” or declaring the pattern dead, we will ask three more nuanced questions:

- Where did Bitcoin’s positive November reputation actually come from?

- Why are those average returns so easy to misinterpret—and why do they become dangerous in 2025-type conditions?

- What should serious investors focus on now that the seasonal myth has been stress-tested?

Because we cannot pull live data here, any specific price levels (125,100 USD high, 89,000 USD low, the 97,000–100,000 USD zone) are treated as user-supplied scenario markers, not independently verified current quotes. The analytical framework, however, is general and does not depend on a particular day’s tick.

1. How Bitcoin became “the November coin”

Bitcoin’s November legend did not appear out of nowhere. It was built on a handful of spectacular end-of-year rallies that left a deep psychological imprint on anyone watching the market at the time.

Think back to the early and middle cycles:

- 2013: One of the earliest parabolic bull runs accelerated into Q4, with November delivering outsized gains as retail discovered Bitcoin en masse.

- 2017: In the months leading up to the famous December peak near 20,000 USD, November once again saw strong upside as speculative mania took hold.

- 2020: In the post-halving, post-COVID liquidity wave, November marked a key leg of the run that carried BTC beyond its 2017 highs and established the “institutional adoption” narrative.

When analysts later compiled monthly return tables, these episodes stood out. A few blockbuster Novembers dragged the average return for that month into impressive territory. On a simple spreadsheet, November often looked like one of the top performers in Bitcoin’s short history.

But there are three important caveats that are frequently glossed over when those tables are turned into memes:

1. Small sample size. Bitcoin has only existed for about a decade and a half. You have, at best, a low double-digit number of Novembers to work with. That is statistical dust, not a robust time series.

2. Outlier-driven averages. A few extreme bull runs heavily skew the average. If you remove one or two of the most explosive years, the “typical” November looks much less magical.

3. Regime changes. Early Novembers happened in a structurally different market—tiny market cap, minimal institutional participation, no ETFs, thin derivatives. Today’s November lives in a macro-driven, ETF-saturated environment.

In other words, the narrative that “Bitcoin always pumps in November” was always half-true at best. It described how a handful of particular cycles played out, not a reliable seasonal law.

2. Why this November feels so different

The current November (in your scenario) stands in stark contrast to that story. Instead of a euphoric ramp, Bitcoin is trading roughly 15% below the month’s starting levels and has already printed a deep intramonth low under 89,000 USD. That makes it, by your description, the weakest November since 2019.

What has changed? Part of the answer lies in macro, part in positioning, and part in expectations management.

2.1 Macro: when the calendar meets uncertainty

The market went into this quarter leaning heavily on a familiar macro script:

- Economic data would continue to show controlled disinflation.

- The Federal Reserve would feel comfortable signalling one or more rate cuts into year-end.

- Lower yields and clearer policy guidance would support a year-end rally in risk assets, including Bitcoin.

Instead, the backdrop you describe is almost the opposite. Key data releases have been delayed or muddied, leaving the market without clear signals. At the same time, expectations for a December Fed rate cut have fallen sharply. Traders who had expected monetary policy to flip from headwind to tailwind suddenly find themselves in limbo.

When macro visibility drops, seasonal patterns lose their grip. No one cares that November used to be good if they cannot confidently price the risk-free rate, fiscal trajectory or liquidity conditions. Big allocators pull back, preferring to sit in cash or short-duration instruments until the fog lifts. That alone is enough to compress Bitcoin’s November ambitions.

2.2 Positioning: priced for perfection, punished for reality

There is also a positioning story. By the time we entered November, Bitcoin had, in your scenario, already pushed to an all-time high around 125,100 USD in October. ETF flows had been strong, media coverage bullish, and retail engagement recovering.

In that context, the “November is a strong month” narrative did something subtle but important: it fed into overconfidence. Traders and even some institutions behaved as if the seasonal edge guaranteed a smooth extension higher. Leverage crept up. Derivatives curves reflected high optimism. The market was priced for perfection.

When reality turned out less cooperative—data delays, fading Fed-cut odds, choppy liquidity—the unwind hurt. A 15% drawdown against that backdrop is not only a price move; it is a psychological contrast to what traders expected. The myth of November strength magnified the disappointment.

3. The mechanics of an “overinflated” average

To understand why this November feels like a betrayal, it is helpful to look beneath the headline “average November return” and consider the shape of the distribution.

Suppose, for illustration, that over ten Novembers, Bitcoin posted monthly returns like this (purely hypothetical numbers for intuition):

+45%, +30%, +25%, +10%, +5%, +2%, -3%, -7%, -10%, -18%

The simple average is strongly positive. A seasonal chart built on that series would say: “On average, Bitcoin gains nicely in November.” But an investor living through those ten years would experience something different:

- In three or four Novembers, they would be ecstatic.

- In another two or three, they would see modest, unremarkable moves.

- In the rest, they would suffer painful drawdowns.

The experience of November is lumpy and path-dependent. The average is a statistical artefact dominated by a handful of big winners. That artefact becomes “overinflated” when people treat it as a rule rather than as a description of a noisy, outlier-driven past.

Bitcoin’s actual history is not identical to the numbers above, but the principle carries over. A few blockbuster years created a halo effect. As long as new Novembers coincided with favourable macro conditions and early-stage bull runs, that halo looked deserved. The moment a November arrived in a late-cycle, macro-uncertain environment, the halo fell apart.

4. What this November is actually telling us

Stripped of myth, what does a -15% November, the worst since 2019 in your scenario, actually signal about Bitcoin?

4.1. Late-cycle behaviour, not necessarily the end of the cycle

First, a negative November does not automatically mean the bull market is over. It may simply indicate that we are transitioning from an early, easy phase to a more complex, choppy late cycle:

- The easy trend from sub-ATH levels into price discovery is behind us.

- Valuations are rich enough that macro surprises can trigger abrupt repricings.

- Positioning is crowded enough that small shocks can produce outsized liquidations.

In that sense, this November might be better understood as a stress test of the new regime: a world in which Bitcoin is heavily owned by ETFs, macro funds and corporates, not only by early adopters and crypto natives.

4.2. The emerging importance of the 97,000–100,000 USD zone

Technically, the band between 97,000 and 100,000 USD emerges from your context as a key area. It represents:

- A psychological round-number milestone (six-figure Bitcoin).

- A region where many breakout buyers are likely concentrated.

- A pivot between euphoric “price discovery mode” and more cautious “range-trading mode.”

As long as Bitcoin remains below that zone, the market will treat rallies as potential selling opportunities for trapped longs and profit-takers. If price can reclaim and hold that band on strong volume, the narrative shifts: November becomes a shake-out in a larger uptrend, not the start of a secular top.

The early signs of “stabilisation” that strategists point to—sideways ranges instead of new lows, shallower intraday wicks, reduced liquidations—are consistent with a market trying to build a base below resistance. But until the 97,000–100,000 zone is convincingly retaken, November’s damage remains only partially repaired.

4.3. Volatility compression after the flush

Another subtle signal is volatility behaviour. Typically, deep mid-cycle corrections feature:

- Spikes in realised volatility as price accelerates downward.

- Surges in implied volatility as traders scramble for protection.

- Subsequent volatility compression as the immediate panic fades and both bulls and bears become more selective.

In your scenario, the language of “Bitcoin showing signs of stabilising” suggests we are entering the third phase. For investors, that means two things:

- The easy short trade—selling into obvious fear—may be behind us.

- The easy long trade—blindly buying November seasonality—has just been exposed as naive.

What remains is harder work: analysing flows, macro, and structure rather than relying on calendar-based heuristics.

5. Lessons for traders and allocators: beyond calendar superstition

From a professional perspective, the main value of this November is not in declaring that a specific seasonal pattern “failed”. It is in highlighting the limits of seasonality as a decision tool in a market as young and structurally evolving as Bitcoin.

5.1. Treat seasonality as background, not a market update

Seasonal statistics can be useful as context. Knowing that Bitcoin has historically done well in certain months can inform your priors. But they should rarely be used as standalone signals, especially when:

- The underlying sample is small.

- The market structure has changed dramatically (ETFs, institutional flows, macro linkages).

- Valuations are rich and the asset is already near all-time highs.

In such cases, seasonality can even be contrarian information: if everyone expects November to be strong because they’ve seen the charts, the market may front-run the move, leaving it vulnerable to disappointment.

5.2. Focus on flows, leverage and macro drivers

Instead of leaning on calendar myths, serious desks should prioritise:

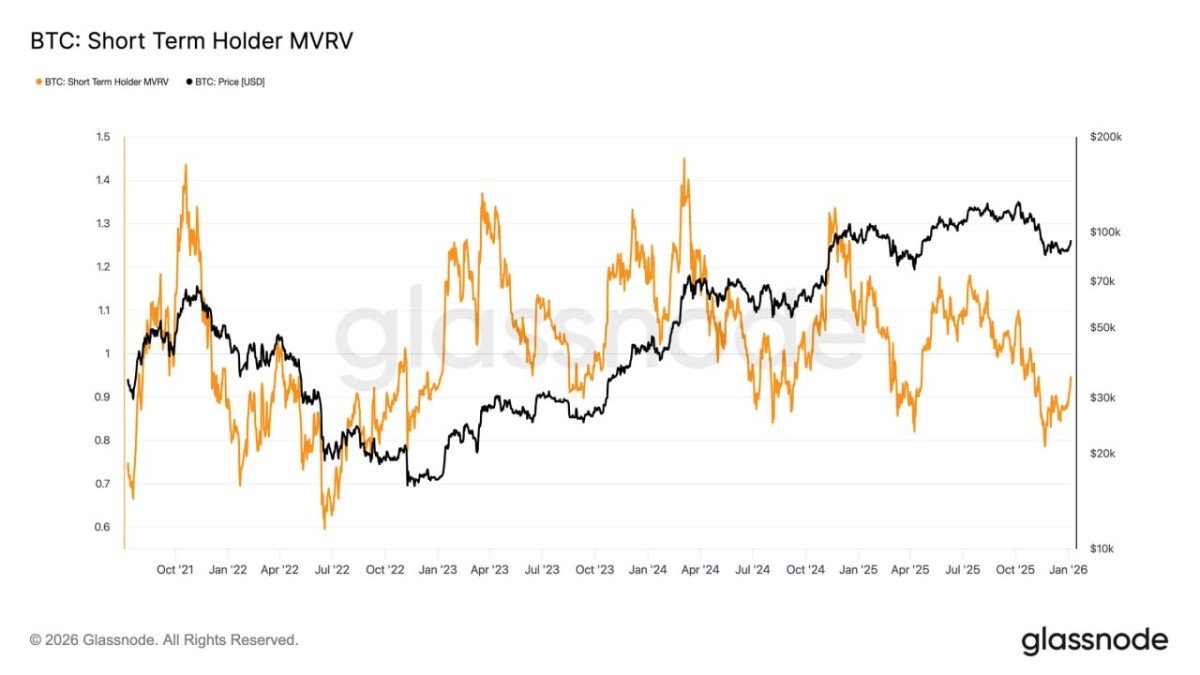

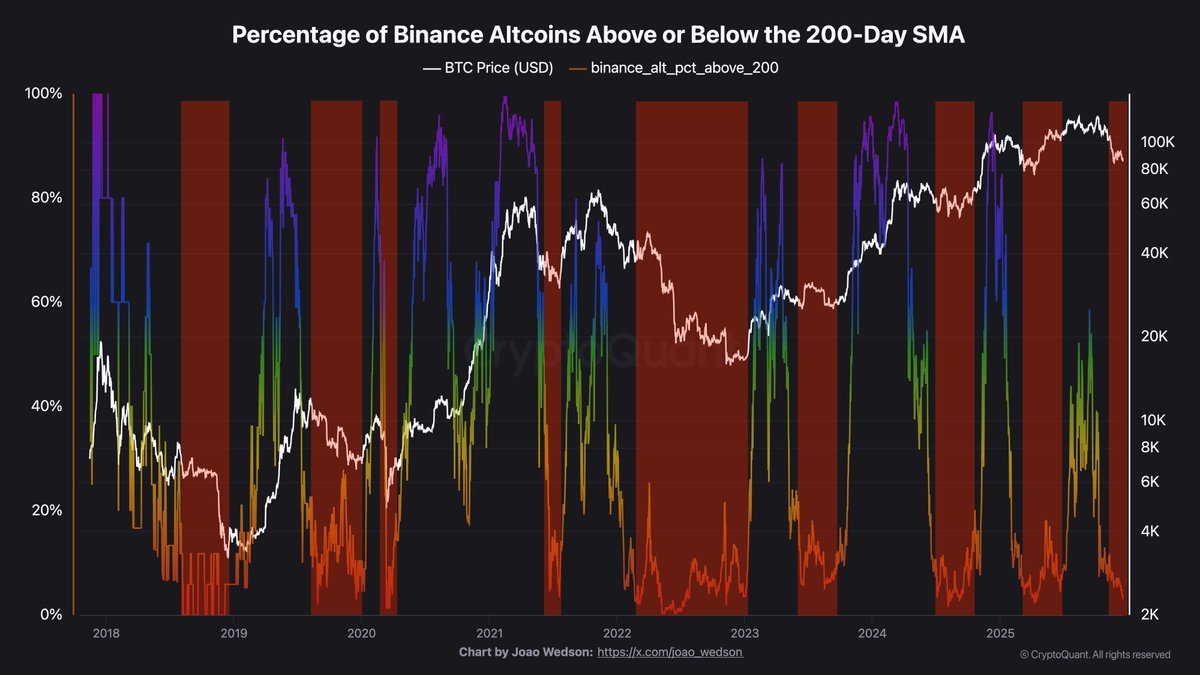

- Flows: ETF creations/redemptions, exchange net flows, on-chain movement of long-term holders versus short-term speculators.

- Leverage: Perpetual funding rates, open interest concentration, basis levels between spot and futures.

- Macro drivers: Rate expectations, dollar liquidity, cross-asset risk sentiment when large macro events (Fed decisions, fiscal deadlines, geopolitical flares) hit.

These variables do not fit into neat monthly buckets, but they drive marginal pricing far more directly than what month it happens to be.

5.3. Build scenarios, not slogans

Instead of saying “November is usually good”, it is more productive to build explicit scenarios:

- Bullish scenario: Data surprises are benign, Fed tone softens despite delays, ETF flows stabilise, and Bitcoin reclaims 100,000 USD. November’s drawdown becomes a textbook shake-out in a broader uptrend.

- Base-case scenario: Macro remains noisy, ETF flows are mixed, Bitcoin ranges between, say, 85,000 and 105,000 USD for months, compressing volatility and punishing impatient traders.

- Bearish scenario: Macro deteriorates further, liquidity tightens, ETF outflows accelerate and Bitcoin fails repeatedly at 100,000 USD, eventually breaking down to retest much lower support zones.

Seasonality may nudge the probabilities slightly (for example, you might lean a bit more bullish in historically strong months if other factors line up), but it should not be the cornerstone of these scenarios.

6. What this means for Bitcoin’s longer-term narrative

One final question remains: does a weak November in 2025 undermine Bitcoin’s broader “digital macro asset” story?

The short answer is: not really.

Seasonality is a surface-level pattern. The deeper drivers of Bitcoin’s multi-cycle behaviour are still:

- Its fixed supply schedule and halving-driven issuance cuts.

- Institutionalisation through ETFs, corporate treasuries and sovereign experiments.

- Its role as a high-beta expression of liquidity cycles and fiat skepticism.

Those forces operate on multi-year horizons. They can easily accommodate one or several “disappointing” Novembers along the way. In fact, frequent stress tests are almost a prerequisite for long-term credibility. An asset that only goes up when the calendar says it should is not a resilient macro instrument; it is a superstition on a price chart.

If anything, the current November is a reminder that Bitcoin is maturing into a real asset—one that trades like the rest of the macro complex, responding to rates, liquidity and positioning, not just to halving dates and seasonality slides. For long-term holders, that may be uncomfortable in the short run, but it is a sign that Bitcoin’s fate is no longer decided solely within the echo chamber of crypto Twitter.

Conclusion: deflating the November myth—without deflating Bitcoin

Bitcoin’s rough November, in the scenario you describe, has punctured a convenient story: that the market could rely on a historical average to deliver a year-end gift. Down about 15%, briefly under 89,000 USD and struggling below the 97,000–100,000 USD resistance band, this month looks nothing like the seasonal charts that have circulated for years.

But that does not mean Bitcoin is “broken”, nor does it prove that seasonality is useless. It proves something simpler and more important: averages built on small, outlier-heavy samples are a poor guide to the future, especially once the underlying market structure has changed.

The right response for a professional investor is not to swing from blind faith in November to blanket cynicism. It is to downgrade seasonality from “signal” to “background noise” and elevate the variables that actually move price today: macro, flows, leverage and positioning.

Bitcoin can still reclaim 100,000 USD and go on to make new highs in a later month. If that happens, November 2025 will be remembered as a cleansing shake-out. If it does not, and the market spends more time grinding lower or sideways, this month will be remembered as the moment when the community finally learned that the calendar alone is not a trading edge.

Either way, one lesson is already clear: the phrase “strong average November” should no longer comfort anyone who is deploying serious capital. It belongs where it always should have been—at the bottom of the research note, as a footnote, not as the headline.

Disclaimer: All specific price levels and performance data in this article are based on the user-supplied scenario and could not be independently verified here. This analysis is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and may be unsuitable for many investors. Always conduct your own research and consider consulting a qualified professional before making financial decisions.