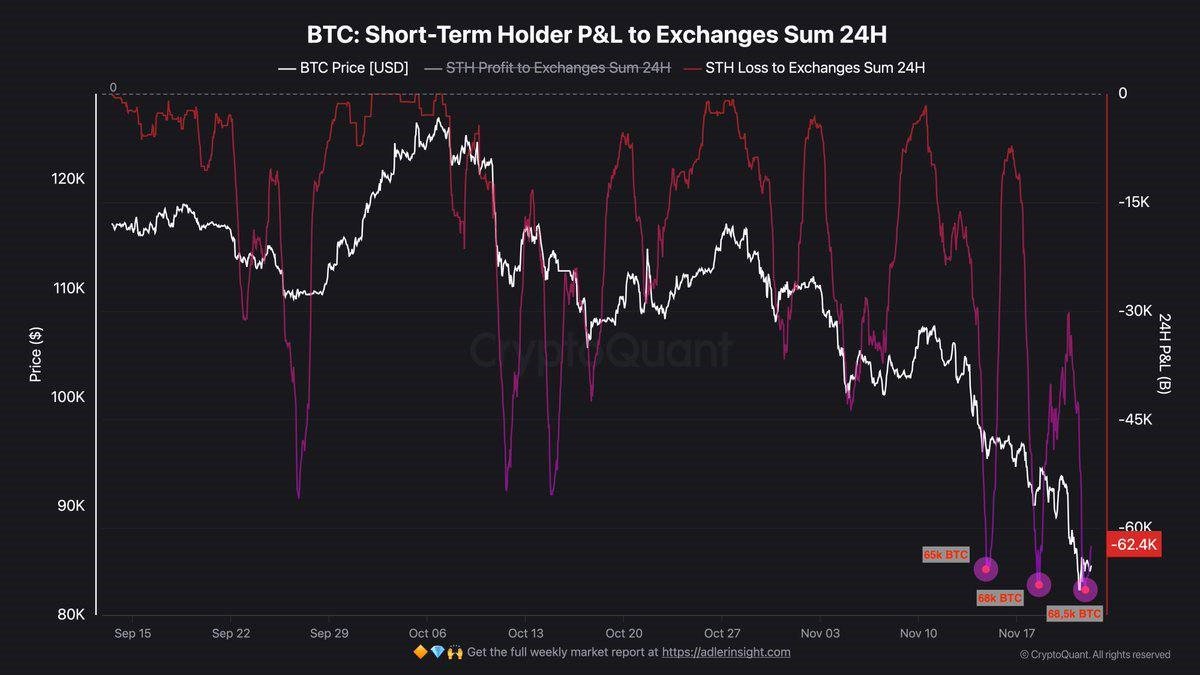

68,500 BTC Sent to Exchanges in Loss: Are Short-Term Holders Signalling the End of the Selloff?

The latest on-chain data paint a dramatic picture. In just 24 hours, short-term Bitcoin holders (STHs) have pushed roughly 68,500 BTC – around 5.7 billion USD at recent prices – onto exchanges while sitting in loss. It is not an isolated event. According to the chart you provided, this is the third time in a matter of days that loss-making STH supply sent to exchanges has spiked to extreme levels, each time as price grinds lower.

To the traders living through it, the move feels like simple panic: newcomers who bought near the highs are capitulating as the drawdown deepens. But for anyone trying to understand the structure of this market, the pattern carries deeper meaning. Large waves of loss-driven selling from short-term holders have historically appeared near the late stages of corrections, when weak hands are flushed out and ownership quietly migrates to stronger, more patient capital.

Before we dig in, one caveat is essential. The numbers we use here – 68,500 BTC, three recent spikes, approximate dollar values – are taken directly from the scenario and chart you shared. In this environment we cannot independently verify them against live CryptoQuant or exchange data. The analysis below is therefore about what such a pattern implies, not a forensic audit of exact figures. As always, none of this is investment advice, but a framework for making sense of what is happening on chain.

1. Reading the Chart: What Short-Term Holder P&L to Exchanges Actually Measures

The chart titled “BTC: Short-Term Holder P&L to Exchanges Sum 24H” combines three layers of information:

- The white line tracks Bitcoin’s price in USD over the past couple of months.

- The purple/magenta lines show the 24-hour sum of BTC sent from STH wallets to exchanges in profit and in loss.

- Highlighted markers near the current right edge of the chart show spikes where 55k, 68k and 68.5k BTC were deposited while those coins were underwater.

In plain English, this metric answers one question: “How many coins held by short-term investors are being moved to exchanges to be sold, and are they being sold at a gain or at a loss?”

When the loss curve plunges deeply (as it does in the most recent three events), it means STHs are transferring coins to trading venues in a state of heavy unrealised loss and locking those losses in. These moves typically occur when sentiment has already soured and buyers from the last few months have, emotionally, had enough.

In the context of the current downtrend – with price sliding from the mid-120,000s toward the low-80,000s – those spikes tell us two things simultaneously:

- The cohort that bought late in the rally is capitulating. They are sending coins to exchanges not to rebalance calmly, but to exit a position that has become psychologically intolerable.

- Market stress is accelerating rather than slowly fading. Each spike in loss-making deposits is as large as or larger than the last, even as price falls, signalling that the pain is now being felt by a broader and broader slice of recent buyers.

2. Who Are Short-Term Holders and Why Are They the First to Break?

On-chain analytics firms usually define short-term holders as addresses whose coins have moved within roughly the last 155 days. That window is not arbitrary. Historically, UTXOs older than ~5 months tend to behave very differently from younger ones. Coins that have rested longer are more likely to be held by long-term believers or institutional treasuries; coins that moved recently are often in the hands of traders, FOMO buyers, or funds actively rotating risk.

Short-term holders share a few key traits:

- They anchor their expectations to recent prices. If they bought near 120,000 USD, a drawdown to 100,000 USD already feels uncomfortable; 80,000 USD feels catastrophic.

- They are often more leveraged, using futures, perpetuals or margin to amplify exposure.

- They are more likely to be driven by narratives and headlines (“new ATH”, “ETFs pumping”, “institutional adoption”) than by multi-cycle conviction.

Because of that, STH behaviour is ironically both fragile and informative. Fragile, because this group is the first to hit the sell button when volatility flips against them. Informative, because their capitulation often marks the point where the market has wrung out the excess optimism that built up during the previous leg higher.

When you see three massive spikes of STH coins being sent to exchanges in loss in quick succession, you are effectively watching the late-cycle believers capitulate in real time.

3. Three Waves of Loss Selling: Anatomy of a Capitulation

The pattern visible on your chart is brutal but textbook. Over just a few weeks, price grinds lower, with rallies becoming smaller and more short-lived. Each leg down is accompanied by a sudden vertical plunge in the “STH loss to exchanges” line. The highlighted numbers – roughly 55k BTC, then 68k BTC, then 68.5k BTC – show how each new wave of selling equals or surpasses the prior one.

Here is one way to interpret these three waves:

• Wave 1 – The disbelief flush. The first 50–60k BTC loss spike often comes early in the correction. Some traders sell quickly once they realise the parabolic advance has broken. Price is still relatively high, so the narrative among many is “just a dip.”

• Wave 2 – The hope-to-fear transition. As price fails to reclaim key levels and lower highs form, a second, larger wave of STH coins hits exchanges in loss. These sellers usually held on through the first leg down hoping for a V-shaped recovery. When that fails to materialise, they capitulate.

• Wave 3 – The emotional exhaustion phase. By the third spike, sentiment on social media and derivatives markets is often extremely negative. Funding rates go deeply negative, futures trade in backwardation, and even some long-time influencers talk about “being done with crypto.” The 68.5k BTC loss transfer is a manifestation of this exhaustion: people who swore they were long-term suddenly cannot tolerate the drawdown any longer.

From a cycle perspective, the important observation is that each subsequent wave tends to happen at a lower price but with similar or higher volume. That means more and more recent buyers are being flushed out even though the marginal new downside may be shrinking. The market is spending an enormous amount of emotional and financial energy to push price down relatively smaller increments.

4. Why Heavy STH Loss Selling Often Appears Near the End of Corrections

On-chain history doesn’t repeat perfectly, but it rhymes. In previous cycles, clusters of large STH loss spikes have frequently appeared near late-stage corrections:

- During the May–July 2021 drawdown, as BTC fell from 60k to 30k, STH P&L metrics showed intense loss realisation as newcomers from the spring top capitulated.

- In the post-FTX collapse phase in late 2022, a similar pattern of chronic STH losses signalled that coins acquired near the 40k–60k range were being flushed out at 16k–20k.

Those episodes did not mark the exact tick of the bottom, but they did coincide with the capitulation zones that long-term investors later celebrated as opportunities.

The logic is straightforward:

- Short-term holders are the most likely sellers in a correction. They bought recently and lack deep conviction.

- As they sell en masse at a loss, the coins they relinquish are absorbed by buyers who are willing to step in despite negative headlines – often long-term holders (LTHs), funds with dry powder, or regional desks with a different macro view.

- Once a large enough portion of STH supply has changed hands, the market’s sell pressure from that cohort collapses. There simply aren’t many marginal STH coins left to dump.

In that sense, extreme STH loss-to-exchange spikes can be seen as a process of transferring ownership from weak hands to stronger hands. The pain is real for those selling, but the structural impact is often bullish over a multi-month horizon.

That said, there are two important caveats:

- Capitulation patterns can stretch out longer than people expect, especially if macro conditions worsen or derivatives positioning remains fragile.

- Short-term holders are not the only source of sell pressure. Miners, funds and even some long-term holders can still decide to sell if broader risk sentiment deteriorates.

5. The Bearish Case: Why This Might Not Be the Final Flush

No serious analysis should treat a single on-chain metric as a magic bottom signal. While the STH loss data are encouraging for long-term bulls, there are still plausible bearish scenarios.

First, macro uncertainty can extend the pain. If central banks signal that rates will stay high for longer, if equity markets enter a deeper correction, or if geopolitical risks escalate, Bitcoin may remain under pressure regardless of what on-chain structure looks like. Even strong-hand investors have risk budgets and may reduce exposure if their broader portfolios are stressed.

Second, ETF and fund flows could reinforce downside. If spot Bitcoin ETFs experience sustained net outflows in the coming weeks, authorised participants may need to sell more BTC into a market already reeling from STH capitulation. That can delay or dilute the impact of weak-hand flushing.

Third, derivatives positioning remains a wild card. If open interest is still high and concentrated in levered longs, another leg down could trigger additional forced selling. In such cases, STH loss spikes we currently see would be the prelude to a larger “liquidation candle,” not the endpoint.

Fourth, structural seller overhangs matter. Large entities such as bankrupt estates, was impacted by a security incident exchange treasuries or early ICO treasuries occasionally liquidate sizable tranches of BTC. If any of those overhangs happen to hit the market now, they could overwhelm the absorption capacity of current buyers.

In short: heavy STH loss realisation is necessary for a sustainable bottom, but rarely sufficient on its own. It tells us that one important cohort is close to exhaustion; it does not guarantee that other cohorts will not step in as sellers later.

6. The Constructive Case: Why Long-Term Investors Pay Attention to This Signal

Despite those risks, the constructive narrative is compelling. Consider what the market structure may look like after three such waves of capitulation:

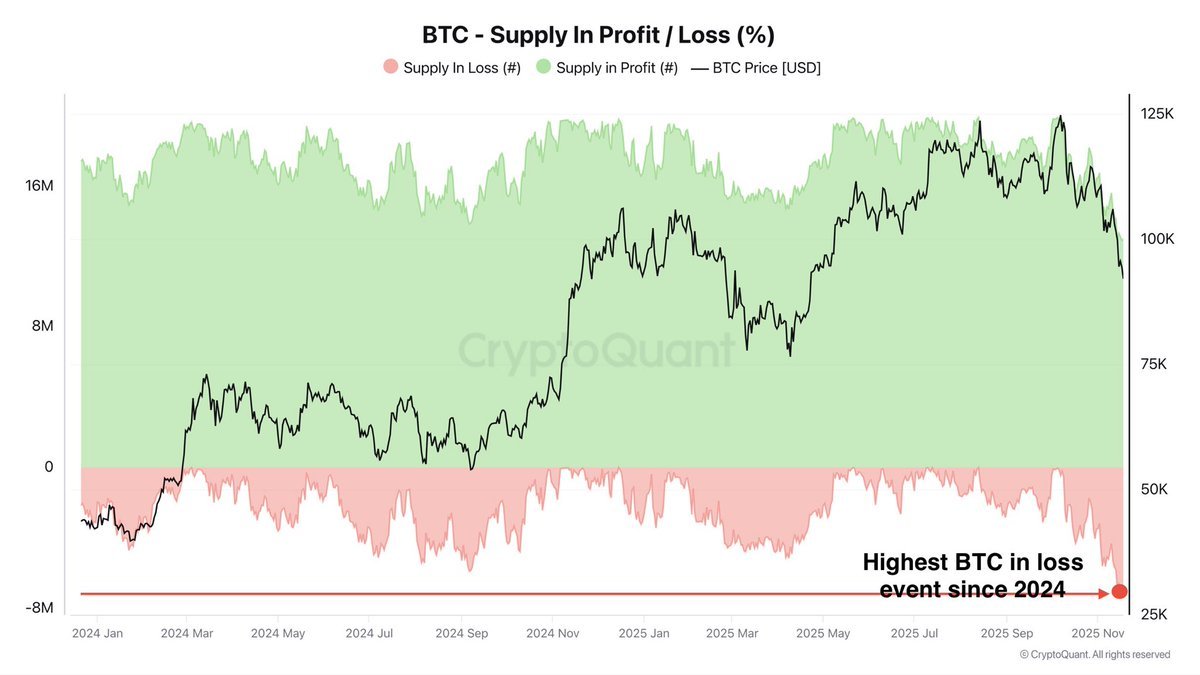

- A large fraction of coins bought in the euphoric phase near the top have been sold at a loss and redistributed.

- The remaining supply is increasingly concentrated in hands that are either unleveraged or explicitly long-term.

- Short-term holders who remain have, by definition, survived significant volatility. They may be less sensitive to incremental drawdowns, having already made the decision to hold through pain.

From a long-term perspective, that is exactly how bull markets reset. Froth and speculative leverage get purged, while committed capital quietly accumulates inventory at lower prices. When the macro backdrop improves – for instance, if rate-cut expectations firm up, ETF flows stabilise, or new jurisdictions adopt clearer crypto regulation – that re-based supply structure can support the next sustained advance.

This is why analysts such as the CryptoQuant team (again, assuming your context accurately describes their view) often argue that “corrections end when STHs have nothing left to sell in panic.” Each spike like the current 68.5k BTC event brings the market closer to that point.

7. How a Professional Desk Might Trade or Allocate Around This

For a professional trading or investment desk, the question is not "Is this the exact bottom?" but rather "How should we adjust risk when on-chain signals say late-stage capitulation is underway?" A few practical approaches emerge:

7.1 For medium-term investors

- They might begin scaling in gradually rather than trying to call the bottom tick. For example, allocating a portion of dry powder after each major STH loss spike, while reserving capital for further downside.

- They will look for confirming signals: stabilising ETF flows, funding rates moving back toward neutral, and signs that long-term holder supply is growing again.

- Risk management remains central: position sizes are kept small enough that another 10–20% drawdown does not force liquidations or emotional decision-making.

7.2 For short-term traders

- STH capitulation clusters are often used as a warning to avoid aggressive shorting at obvious lows. The asymmetry of further downside versus potential reflexive bounces becomes less attractive.

- They may still trade intraday volatility but will avoid high leverage and set tight invalidation levels.

- Some may even position for short squeezes if they see negative funding, crowded shorts and signs that selling pressure is finally subsiding.

7.3 For research and risk teams

- They treat the 68.5k BTC loss event as a data point in a larger regime-shift analysis, not as a standalone trigger. Combined with metrics like realised cap, dormancy, and long-term holder SOPR, it helps classify the market as “late correction,” “capitulation,” or “early recovery.”

- They communicate to stakeholders that drawdown risk remains, but that the structure of selling is changing – from FOMO exit to final shakeout.

8. What This Means for Individual Investors

For individual investors reading professional analysis, the key lesson of this episode is not "buy now" or "sell everything". It is the importance of understanding who is selling and why.

- If you recognise yourself in the short-term holder cohort – buying late, using leverage, reacting to headlines – this is a moment to reassess your process. Capitulating at the same time as everyone else is rarely a winning strategy.

- If you are genuinely long-term, these are the weeks where you test whether your time horizon is real or just a slogan. Can you handle volatility without checking the price every ten minutes? Have you sized your position so that further drawdowns do not put your financial stability at risk?

On-chain data like the STH loss-to-exchange metric are powerful because they reveal behaviour that social media often hides. The same people screaming "HODL" a month ago may now be part of the 68,500 BTC being flushed out in loss. Understanding that dynamic helps you decide whether you want to be part of the wave – or on the other side of it.

Conclusion: A Violent Shakeout, Not (Yet) a Verdict

The current episode of heavy short-term holder capitulation – with more than 68,500 BTC sent to exchanges in loss in a single day, the third such spike in a short span – is a clear sign that the market is in the late, emotionally exhausting phase of a correction. Newer buyers who chased price higher are now paying the painful tuition that every crypto cycle seems to demand.

From a structural standpoint, that capitulation is a necessary part of resetting the market. It transfers coins from weak hands to stronger ones, reduces future sell pressure and lays the groundwork for the next advance. But it does not immunise the market against further downside if macro conditions worsen, ETF flows deteriorate or additional large sellers emerge.

The role of a professional analysis outlet is not to shout “bottom in!” or “game over,” but to map how supply and demand are evolving under the surface. Right now, the map says this: short-term holders are running out of ammunition to sell in panic. Whether that exhaustion marks the bottom or just a bottom will be determined by what the rest of the market does next.

Important note: All numerical values and event descriptions in this article are based on the scenario and chart provided and cannot be independently confirmed from this environment. They should be treated as illustrative, not as audited live data. This article is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and can result in the loss of all capital invested. Always do your own research and consider consulting a qualified professional before making financial decisions.