Nearly $1 Billion Liquidated in 24 Hours: What 226,851 Traders Getting Wiped Out Really Tells Us

In the span of a single day, roughly 226,851 traders were liquidated across major derivatives venues, with total forced closures estimated at $955.84 million. Bybit topped the list with about $197.83 million in liquidations, followed by Hyperliquid with $182.51 million and Binance with around $174.00 million. The biggest individual hit reportedly came on HTX, where a single BTC-USDT position worth roughly $30.91 million was wiped out in one go.

Because live data cannot be checked from here, we treat these figures as they are presented by third-party trackers and by your context. Whether the exact numbers end up being revised slightly is less important than what this scale of liquidation tells us about how the crypto derivatives market is currently structured, who is taking the real risk and why events like this are both painful and, paradoxically, healthy for the long-term cycle.

1. What a $955.84 Million Liquidation Wave Actually Means

Liquidations occur when a trader’s margin no longer covers their losses. At that point, the exchange’s risk engine steps in, automatically closing the position to prevent it from going deeply negative. In a highly leveraged market, this creates a feedback loop: price moves trigger liquidations, liquidations trigger market orders, and those market orders push price further in the same direction, causing even more liquidations.

Almost $1 billion in forced closures in 24 hours tells us several things at once:

• Leverage usage was elevated. You do not erase nearly a billion dollars in margin unless the system was full of traders running thin buffers relative to their position sizes.

• The move was sharp and one-sided. Whether the underlying shift was driven by macro news, a large spot sale or derivatives positioning, price did not give traders much time to adjust.

• Volatility was being underpriced beforehand. When markets become too comfortable, funding spreads compress and traders start treating 50–100x leverage as a feature, not an emergency tool. Large liquidation clusters are often the market’s way of repricing risk back to reality.

For newcomers, the headline looks catastrophic. For seasoned desks, it looks more like a forced reset: a flush of weak leverage that clears the path for a more sustainable trend on lower open interest.

2. Why Bybit, Hyperliquid and Binance Dominate the Wipeout Statistics

That Bybit, Hyperliquid and Binance top the liquidation table is not an accident. Each platform has carved out a slightly different niche in the derivatives landscape, and that positioning shows up clearly on days like this.

2.1 Bybit: the high-leverage habitat

Bybit has long cultivated an image as a derivatives-first venue. It attracts aggressive traders with deep perpetual futures markets, competitive funding rates and a product suite that leans into high leverage. When volatility spikes, it is almost inevitable that Bybit will see an outsized volume of liquidations: its user base simply runs more risk on average.

Seeing roughly $197.83 million in liquidations here is a reminder that the exchange is a central hub for speculative leverage. That is not inherently negative—liquidity and price discovery depend on traders taking risk—but it does mean that systemic deleveraging events will always show up in its numbers first.

2.2 Hyperliquid: the new-school perp machine

Hyperliquid, despite being newer than giants like Binance, has quickly become a magnet for sophisticated perp traders. The platform offers low-latency execution, niche pairs, innovative risk parameters and a culture that appeals to degen but technically savvy participants. The reported $182.51 million in liquidations reflects the fact that much of the market’s most leveraged, high-frequency flow has migrated here.

When you have a dense cluster of hedge funds, proprietary trading firms and power users experimenting with leverage and complex strategies, liquidation cascades are not a bug—they are part of the environment. Hyperliquid’s challenge is to keep its liquidation engine robust enough to manage such episodes without triggering unnecessary auto-deleveraging that hurts healthy positions.

2.3 Binance: the liquidity ocean

Binance’s roughly $174 million in liquidations must be interpreted relative to its scale. As one of the largest venues by open interest across BTC, ETH and major altcoin perpetuals, Binance is simply where a huge proportion of derivatives exposure lives. When the market re-prices sharply, the platform will always show large liquidation counts, even if, proportionally, its risk controls are working as intended.

From a structural perspective, the key takeaway is that liquidation waves are no longer concentrated on a single exchange. Risk has been distributed across a multi-venue landscape. That reduces the danger of any one platform’s failure destabilising the entire market, but it also means traders need to pay attention to funding, liquidity and open interest across several venues, not just one.

3. The $30.91 Million Lesson: What a Single Giant Liquidation Tells Us

The largest reported wipeout during this episode—an approximately $30.91 million BTC-USDT position on HTX—is more than just a statistic. It encapsulates nearly every behavioural mistake traders can make during extended trends.

While we cannot see the private risk profile of that user, a few things are highly probable:

- Leverage was extreme. To trigger a liquidation of this size, the trader either ran very thin margin relative to their position or doubled down repeatedly as price moved against them.

- There was likely no hard invalidation point. Rather than exiting at a pre-defined stop-loss level, the trader allowed the exchange to dictate the exit via the liquidation engine.

- Position sizing ignored tail events. A multi-million dollar single position suggests concentration risk. If one trade can erase your account, you were not trading—you were high-risk speculation with advanced tools.

For the broader market, such a liquidation is simultaneously disruptive and cleansing. The forced sale adds aggressive sell pressure (if it was a long) or buy pressure (if it was a short) right at the worst moment, intensifying the move. But once the position is cleared, that particular grenade is no longer sitting in the order book waiting to explode on the next 5 percent candle.

4. Liquidation Cascades as Macro Thermometers

Large liquidation events rarely happen in a vacuum. They are usually triggered by a catalyst somewhere in the macro or crypto-specific narrative: a surprise policy signal from the Federal Reserve, a major ETF flow reversal, an on-chain shock such as an exchange security incident or a big treasury sale, or even a combination of several smaller shocks hitting a complacent market simultaneously.

The precise trigger for this $955.84 million sweep matters less than what it reveals about sentiment. When nearly a quarter-million traders are taken out in 24 hours, it tells us that the market had drifted into a regime where participants were pricing in low volatility and one-way continuation. Everyone was leaning in the same direction, and when the music stopped abruptly, there were simply not enough bids or offers on the other side to absorb the unwinds gracefully.

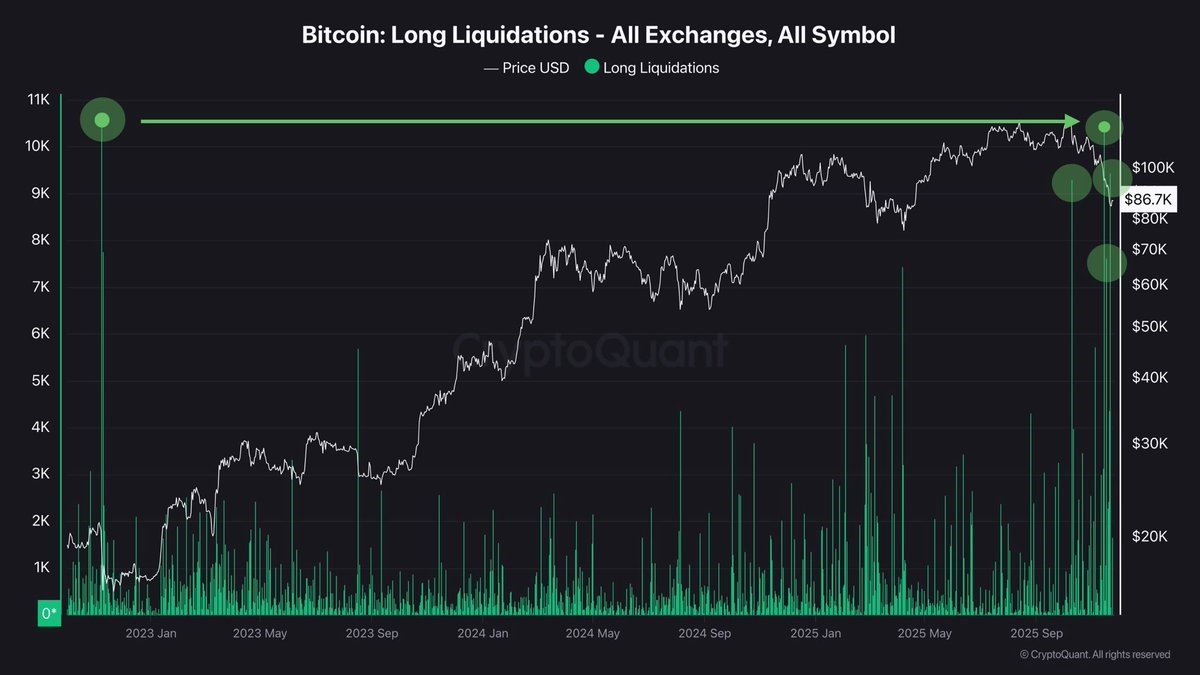

From a cycle perspective, these flushes often mark inflection points. They can signal the late stages of a local uptrend (when overconfident longs get washed out) or the exhaustion phase of a downtrend (when despair-driven shorts get squeezed). Knowing which one you are in requires more than reading liquidation charts; you need to layer those charts on top of funding rates, spot flows, ETF data and macro context.

5. Why Pain for Many Can Be Healthy for the Market

It may sound cold, but the forced liquidation of 226,851 traders is not necessarily bearish for Bitcoin or the broader crypto complex. In fact, episodes like this can reduce systemic risk in several ways.

5.1 Deleveraging resets the board

Before the wipeout, a portion of the market’s open interest was backed by fragile margin structures: thin collateral, risky cross-margin setups, and overly aggressive use of leverage. That is precisely the kind of configuration that can turn a 5 percent intraday move into a 25 percent meltdown. By flushing out weak positions, the market returns to a state where remaining leverage is more conservative, supported by stronger collateral and more patient capital.

5.2 Funding and basis come back to earth

Liquidation waves usually drag perpetual funding rates and futures basis down, sometimes from extreme positive levels into neutral or even negative territory. This shift is healthy. It encourages new capital to step in on the other side of the trade—market makers, arbitrage desks and long-term investors who are happy to earn yield when speculative froth has been removed. In other words, deleveraging events can reset the risk-reward equation for fresh entrants.

5.3 Stronger hands replace weaker hands

Forced sellers rarely represent long-term conviction capital. Their exit makes room for investors with longer time horizons and better risk management. Over the medium term, this migration of coins and positions from reactive traders to patient buyers tends to stabilise price action, even if the short-term candles look brutal.

6. Practical Lessons for Traders

A professional analysis site should not simply point at the wreckage; it should also extract lessons. Here are several risk principles that stand out from a day where nearly a billion dollars of positions evaporated.

6.1 Treat leverage as a tool, not a lifestyle

Leverage is not inherently evil. It can be used to manage capital efficiently, especially for hedging or basis trades. But when directional traders start treating 20x or 50x leverage as normal, disaster is only one volatility expansion away. A simple rule of thumb used on many professional desks: if a 10–15 percent move in the underlying wipes you out, you are overleveraged for a market that regularly sees 20–30 percent swings.

6.2 Position sizing matters more than entry precision

The trader who lost $30.91 million on HTX may have picked a reasonable entry in terms of technical levels, but position size made that largely irrelevant. Good risk managers design trades from the top down: they decide the maximum percentage of capital they are willing to risk on an idea, compute the invalidation level where the thesis is wrong, and derive position size from that. Retail traders tend to do the opposite, starting with the maximum position the UI allows and only thinking about invalidation after the fact.

6.3 Respect the liquidation price as a line you never want to cross

Allowing the exchange to liquidate you means voluntarily handing away control over execution. Liquidation engines are designed to protect the platform, not optimise your exit. Slippage is often severe, and partial fills can leave you with unwanted residual positions. A disciplined trader will cut the trade manually long before the liquidation price is in play, even if it means admitting the thesis was wrong.

6.4 Watch cross-venue signals, not just your favourite exchange

Because leverage is now spread across Bybit, Hyperliquid, Binance, HTX and others, focusing solely on funding or order flow in one place is dangerous. A liquidation cascade triggered by oversized positions on a single venue can drag global prices with it. Monitoring aggregated open interest, cross-venue funding and global liquidation maps gives a far more accurate picture of systemic stress.

7. What to Monitor After the Dust Settles

Once the immediate storm passes, the real analytical work begins. A professional perspective focuses less on the drama of 24-hour liquidation totals and more on how the structure of the market evolves in the aftermath.

Key metrics worth tracking in the coming days include:

• Open interest by exchange: Did Bybit, Hyperliquid or Binance lose a disproportionate share of open interest, suggesting a shift in where leverage is comfortable living?

• Perpetual funding rates and futures basis: Are we seeing a move from overheated premiums toward neutral or mild contango, which would indicate healthier positioning?

• Spot versus derivatives volume: Does spot volume increase as longer-term participants step in, or does the market remain derivatives-dominated and fragile?

• Volatility term structure: Are short-dated options still pricing panic, or is implied volatility normalising as traders digest the move?

If those indicators trend toward normalisation while price stabilises, the liquidation event will likely be remembered as a painful but constructive reset. If, on the other hand, leverage rebuilds rapidly and funding races back to extremes, this may simply be the first act in a longer series of washouts.

Conclusion: A Violent Reminder of Old Lessons

The wipeout of 226,851 traders and roughly $955.84 million in a single day is a dramatic headline, but it is not a new story. Crypto has always rewarded those who respect volatility and punished those who confuse bull market narratives with guaranteed outcomes. What makes this episode interesting is how clearly it highlights the modern market structure: Bybit and Hyperliquid as leverage hubs, Binance as the liquidity ocean, and secondary venues like HTX hosting whale-sized speculative positions that can still move the needle when they go wrong.

For individual traders, the message is brutally simple. Leverage is powerful; used without discipline it will eventually introduce you to the liquidation engine, regardless of your conviction. For the ecosystem, the event is both cautionary and healthy—a reminder that risk never disappears, it only migrates, and that occasional violent resets are the price of a market where anyone, anywhere in the world, can access sophisticated financial instruments with a few taps.

As always, the real edge lies not in predicting the next liquidation number to the dollar, but in understanding the incentives, structures and human behaviours that cause those numbers to appear in the first place.