BlackRock’s $3.5 Billion Bitcoin and Ethereum Outflows: Panic Signal or Professional Liquidity Reset?

The numbers are eye-catching. According to on-chain wallet tracking associated with BlackRock-linked vehicles, aggregate holdings shifted sharply during November: Bitcoin balances fell from roughly 806,000 BTC to 783,500 BTC, while Ethereum balances decreased from about 4.0 million ETH to 3.64 million ETH. Using average November prices of around 90,000 USD for BTC and 3,300 USD for ETH, that implies more than 3.5 billion USD in net value pulled out in just 30 days.

On top of that, observers report transfers of approximately 348 million USD worth of BTC and 54 million USD worth of ETH to Coinbase. In on-chain trading slang, "sending coins to the exchange" is usually interpreted as one thing: someone is preparing to sell. Social media naturally jumped to the worst-case conclusion: is the world’s largest asset manager quietly dumping the top two crypto assets at the top of the cycle.

In this analysis, we treat the figures as they are presented in your scenario and emphasise an important caveat: without live data, we cannot independently verify the exact balances or flows, and whatever is moving likely reflects client and product positions (such as ETFs and trusts) rather than BlackRock’s corporate treasury. That matters. But even with that caveat, the pattern is worth studying, because it reveals how large institutions think about risk, liquidity and psychology in a way that retail traders often don’t.

1. What “BlackRock withdrew $3.5B” really means

Before reading too much into any on-chain chart, it is crucial to clarify what is actually being measured. Addresses tagged as "BlackRock" generally correspond to custodial wallets used for products like spot ETFs, institutional mandates or other client funds. When those balances fall, it does not necessarily mean BlackRock itself "lost faith" in Bitcoin or Ethereum. It means that:

- Clients redeemed shares or units of crypto products,

- Portfolios were rebalanced after strong price appreciation,

- Or inventory was repositioned across custodians and exchanges for liquidity and hedging.

To the market, however, the nuance hardly matters. A 3.5 billion USD reduction in visible holdings is interpreted as a large, intelligent player taking chips off the table. Overlay that with transfers to Coinbase and the story becomes even more emotive: "the whale is sending coins to the battlefield." The key is to separate narrative from mechanism.

Mechanically, selling a fraction of holdings after a steep multi-month rally is textbook risk management. In traditional markets, asset managers trim winners all the time to keep risk budgets, value-at-risk (VaR) metrics and asset allocation bands in line. Crypto is no exception; the difference is that on-chain transparency allows the entire world to watch in real time and panic about flows that, in legacy markets, would be invisible.

2. The market maker lens: risk first, narrative later

From a market maker or large liquidity provider’s point of view, the November flows look less like an emotional exit and more like a professional rotation. When markets go parabolic, they do not wait for the absolute high to sell. They:

- Scale out of positions in phases as price accelerates,

- Reduce inventory risk before volatility explodes,

- And provide liquidity on both sides to keep spreads orderly.

Retail participants obsess over price forecasts. Institutional desks obsess over risk distribution. They ask: how much of our P&L is tied to one asset, one factor, one funding source. If BTC has doubled or tripled relative to other holdings, risk managers begin to worry about concentration long before retail traders see a top forming on the chart.

In that context, selling a slice of BTC and ETH holdings – even billions of dollars’ worth – is not a bearish thesis on the asset class. It is the equivalent of shaving profits off a winning trade to reduce drawdown if (or when) the inevitable correction comes. Ironically, this disciplined approach is one reason institutional players are still standing after multiple cycles while many retail traders are forced out near the bottom: the pros sell when everyone is euphoric and buy when everyone is traumatised.

3. Why controlled “dumping” can actually protect the market

The word "dump" carries a very specific emotional charge in crypto. It evokes images of huge market sells smashing illiquid order books and triggering cascade liquidations. That occasionally happens, but it is precisely what a professional market maker tries to avoid. If you manage billions in BTC and ETH, your goal is to exit size with minimal market impact, not to collapse the very assets your products depend on.

That is why outflows of the kind described are usually executed as controlled distribution rather than single-shot sales:

- Large blocks are split into smaller clips and executed algorithmically over time.

- Sales may be offset by buying interest from ETFs, options desks or OTC counterparties.

- Some of the flow is hedged via futures or options instead of pure spot selling.

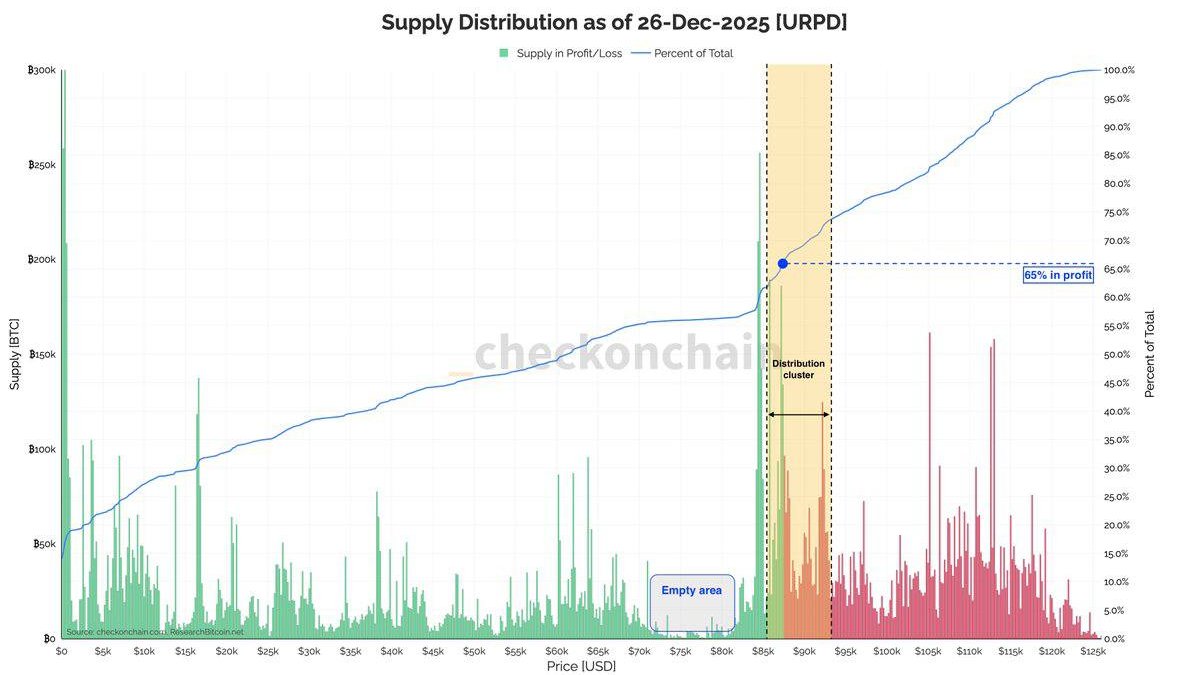

The result is often what retail observers perceive as "mysterious resistance" – price repeatedly stalls in a zone, wicks up and gets slapped back down, even though no public bad news appears. Under the surface, inventory is quietly being handed from early institutional buyers to late-arriving speculative capital. The goal is not to crash the market, but to let it breathe while risk is redistributed.

Once enough of that risk has been offloaded, it becomes safe to support the market again. This is the part many people miss: the same desks that are selling into strength are often the ones providing the floor once leverage has been flushed and panic has taken hold.

4. Sending BTC and ETH to Coinbase: more than “we’re going to dump”

On-chain watchers fixated on one specific piece of the November puzzle: several hundred million dollars’ worth of BTC and ETH being moved from cold storage to Coinbase. In crypto culture, moving coins to a centralised exchange is almost synonymous with getting ready to sell. That is one plausible explanation, but large institutions have a more nuanced set of reasons to "put coins on the shelf" at major venues.

4.1. Securing immediate liquidity

If a desk knows it may need to meet redemptions, rebalance an ETF or respond to large OTC inquiries, having inventory ready at a deep-liquidity hub is simply prudent. It cuts down settlement times, reduces operational friction and allows for more precise execution strategies. Those coins might indeed be sold. They might also be used as collateral for derivatives, as part of a basis trade, or as inventory to fill client buy orders.

4.2. Hedging and balance sheet management

Sometimes the purpose of moving assets to an exchange is not outright selling but hedging. For instance, a fund might hold long-term BTC in custody but hedge price risk via short futures on an exchange. Parking collateral on the exchange allows those positions to be adjusted quickly as volatility changes. The on-chain signal looks identical to "preparing to dump," but the economic reality is a risk-neutral or risk-reduced posture rather than a directional speculative position.

4.3. Creating working liquidity for ETF operations

ETFs and similar vehicles often require ongoing primary market activity: creations and redemptions, in-kind transfers and arbitrage. Maintaining a buffer of BTC and ETH on a liquid venue helps authorised participants and associated market makers keep spreads tight and tracking error low. Here again, the on-chain footprint resembles an impending sell-off, but the intent is to improve liquidity for end investors, not to nukes the market.

The bottom line: "coins to Coinbase" is a necessary but not sufficient signal of bearish intent. It tells you that liquidity is being prepared. It does not tell you whether that liquidity will ultimately manifest as net selling, hedged positions or market making inventory.

5. The psychological game: why $3.5B scares retail more than institutions

For retail traders, seeing a figure like 3.5 billion USD in outflows is viscerally terrifying. The human brain is not wired to think in trillions and basis points; it reacts to big round numbers and large red bars. The instinctive conclusion is, "If the smartest money is leaving, I’m doomed."

But from the institutional side, the same flows are framed very differently. They are:

- A percentage trim within a larger, still-bullish allocation,

- A way to free up dry powder for future opportunities,

- And a tool to shake out overextended traders, creating better entry points later.

Here’s the uncomfortable truth: large players need volatility and emotional responses from the crowd. Without them, they cannot accumulate size cheaply or exit without slippage. In practice, this means:

- They sell into FOMO when retail is convinced the trend will never end.

- They buy into fear when liquidations and forced selling dominate order flow.

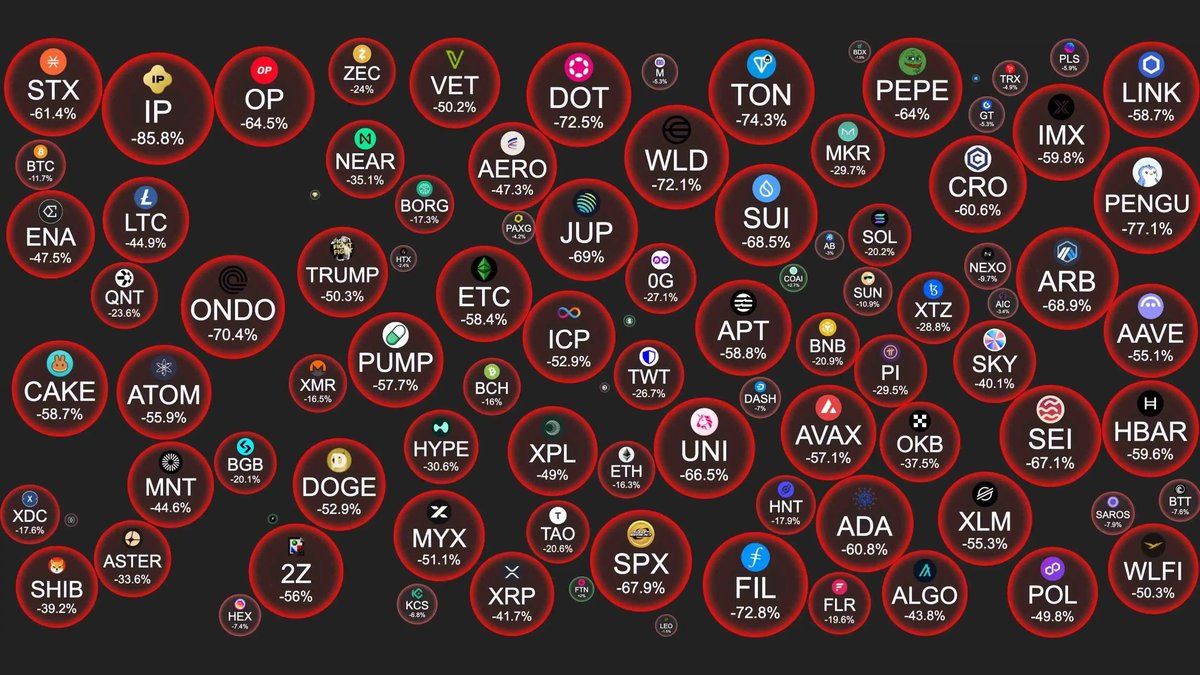

The November repositioning therefore serves a dual purpose. It reduces institutional exposure after a strong run and simultaneously increases volatility – which, in turn, triggers stop-losses, liquidations and capitulation from overleveraged retail longs. When the dust settles, many of the same entities that were selling into strength will quietly switch back into accumulation mode, this time at lower prices and with weaker hands already flushed out.

6. Short-term impact: volatility, retraces and fear

In the near term, flows of this magnitude are almost guaranteed to amplify swings. The order book absorbs billions, but not without side effects. Typical short-term consequences include:

- Elevated volatility: intraday ranges widen, spreads briefly expand, and slippage increases for late traders.

- Deep retraces: 5–15 percent pullbacks from local highs become common as supply is distributed.

- Leverage washouts: highly leveraged longs, especially on perpetual futures, are forced out as margin calls hit.

- Sentiment damage: fear and doubt spread quickly, with social media interpreting every on-chain move as confirmation of an impending collapse.

This is the stage where retail psychology often flips from euphoria to despair in a matter of days. Yet from a structural standpoint, this kind of cleansing is necessary. Markets that go up in a straight line with ever-increasing leverage are fragile. Markets that periodically reset leverage and sentiment are healthier, even if those resets hurt.

7. Medium- to long-term implications: setting the board for the next move

The key question is not whether November’s 3.5 billion USD outflow will cause a correction. It likely already has. The more interesting question is what these flows imply about the medium- to long-term trajectory of institutional crypto adoption.

Several structural points stand out:

• Trimming is not exiting. A reduction from 806,000 BTC to 783,500 BTC still leaves an enormous net exposure. The same holds for ETH. This looks like risk management inside a bullish allocation, not abandonment.

• ETF infrastructure is sticky. Once wiring, legal structures and trading desks have been built to support crypto products, they are unlikely to vanish because of one month’s volatility. The sunk cost encourages continued participation.

• Future cycles will be more institutionally driven. As ETFs, pension flows and corporate treasuries play a bigger role, we should expect more of this behaviour: staged profit taking, carefully managed liquidity, and less emotional trading.

In that sense, the flows you highlight can be interpreted as an early rehearsal of how the next decade of Bitcoin and Ethereum price action will look: less dominated by "all or nothing" retail manias and more shaped by slow, heavy reallocations of institutional capital, punctuated by liquidity squeezes when those reallocations collide with leveraged positioning.

8. What a serious investor should take away from this

For a professional or aspiring professional investor, the lesson is not "follow BlackRock blindly" or "panic whenever tagged wallets move." The lesson is to study how these entities behave and to align your strategy with the underlying logic rather than the social media narrative.

That means:

- Accepting that taking profits into strength is not betrayal of conviction; it is risk discipline.

- Understanding that large transfers to exchanges can be about liquidity and hedging, not just dumping.

- Recognising that periods of high volatility and scary headlines are exactly when long-term opportunity is highest, provided your own leverage is low and your time horizon is long.

- Using on-chain and ETF flow data as context, not as single-signal trading triggers.

Retail traders get hurt when they misread professional behaviour as either pure bullishness or pure bearishness. In reality, big players operate on a sliding scale of risk and reward. They can be structurally bullish on Bitcoin and Ethereum over five to ten years while still selling billions into a vertical rally and buying billions back during the next panic. Seeing those acts as contradictions is a sign of emotional investing. Seeing them as components of a coherent risk framework is the beginning of thinking like a pro.

Conclusion: not a farewell, but a reset

When headline trackers say that BlackRock-linked wallets have reduced BTC and ETH holdings by more than 3.5 billion USD in a month and shifted hundreds of millions to Coinbase, the easy reaction is fear. But the more accurate reading is that a large, sophisticated player is doing exactly what it is supposed to do: manage risk, lock in profits and prepare liquidity in a market that had become too one-sided.

In the short term, that process is messy. It means more volatility, deeper pullbacks and yet another round of liquidations for traders who confused leverage with conviction. In the longer term, it is a sign that crypto is maturing into an asset class where flows are driven by structured strategies rather than pure emotion. The game is still the same: strong hands sell to weak hands at the top and buy from them at the bottom. The only real question for any participant is simple: which side of that trade do you want to be on.

Note: The balances and flow figures discussed in this article are taken from the scenario you provided and from typical on-chain labelling practices. In this environment they cannot be independently verified and may reflect client or product holdings rather than BlackRock’s own balance sheet. This article is for educational and informational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and can result in the loss of all capital invested. Always perform your own research and consider consulting a qualified professional before making financial decisions.