Ethereum Under U.S. Selling Pressure: How Deep Can the Correction Go?

Ethereum is once again at the center of the crypto market narrative, but this time not because of a euphoric rally or a major network upgrade. The current story is about selling pressure – specifically, pressure coming from U.S. investors. Price has been dragged lower alongside broader risk assets, and a growing set of indicators hint that capital from the United States is stepping back at the same time that global risk appetite is fading. In that context, many traders are now watching the 2,300 USD zone as a potential next support area for ETH.

The data points behind this view are fairly consistent: spot prices on U.S. venues are no longer commanding a premium; several Ethereum related ETFs have recorded a string of net outflow sessions; derivatives leverage is shrinking; and on-chain activity on the Ethereum network has fallen to multi-month lows. At the same time, a number of technical oscillators are sliding into oversold territory, suggesting that a relief bounce is increasingly likely if macro headlines stop deteriorating.

Because live market data is not available from within this environment, we treat the figures you provided as scenario inputs rather than independently verified values. The analysis below focuses on understanding what such a pattern would mean for Ethereum and how a professional research desk would interpret it.

1. The Shape of the Current Ethereum Drawdown

The current correction in ETH is notable not only for its depth but for its character. Earlier in the year, Ethereum traded markedly higher, supported by optimism around potential ETF approvals, renewed interest in decentralised finance and the broader risk-on tone of global markets. The subsequent move lower has not been a single capitulation candle but a sequence of lower highs and lower lows, interspersed with short-lived bounces that faded quickly.

This kind of stair-step decline usually signals a grinding distribution phase rather than a sudden panic. In other words, instead of one large cohort dumping all at once, multiple groups of investors have been using each bounce to reduce exposure. That pattern fits the idea of U.S. investors slowly derisking in response to macro uncertainty and tech-sector jitters. It also explains why market participants are now focused on the 2,300 USD area: below that level there is relatively little historical traded volume until significantly lower prices, so a clean breakdown could accelerate the move.

2. U.S. Investor Footprint: Price Differentials and ETF Flows

2.1 Collapsing exchange price differentials

One of the clearest ways to detect regional demand shifts is to examine price differentials between major exchanges. When U.S. based investors are aggressively buying, ETH on venues like Coinbase or Kraken often trades at a small premium versus offshore exchanges or Asian platforms. That premium exists because demand from one region temporarily outstrips the ability of arbitrageurs to move coins across venues.

The prompt notes that the price differential has fallen sharply, even flipping into discount at times. Interpreted through a market-structure lens, this means the U.S. bid has weakened. Instead of investors in America paying up to accumulate ETH, the marginal flows are either neutral or slightly negative. Arbitrage desks can now buy more cheaply in the U.S. and ship coins elsewhere, the opposite of what occurs in a strong U.S. accumulation phase.

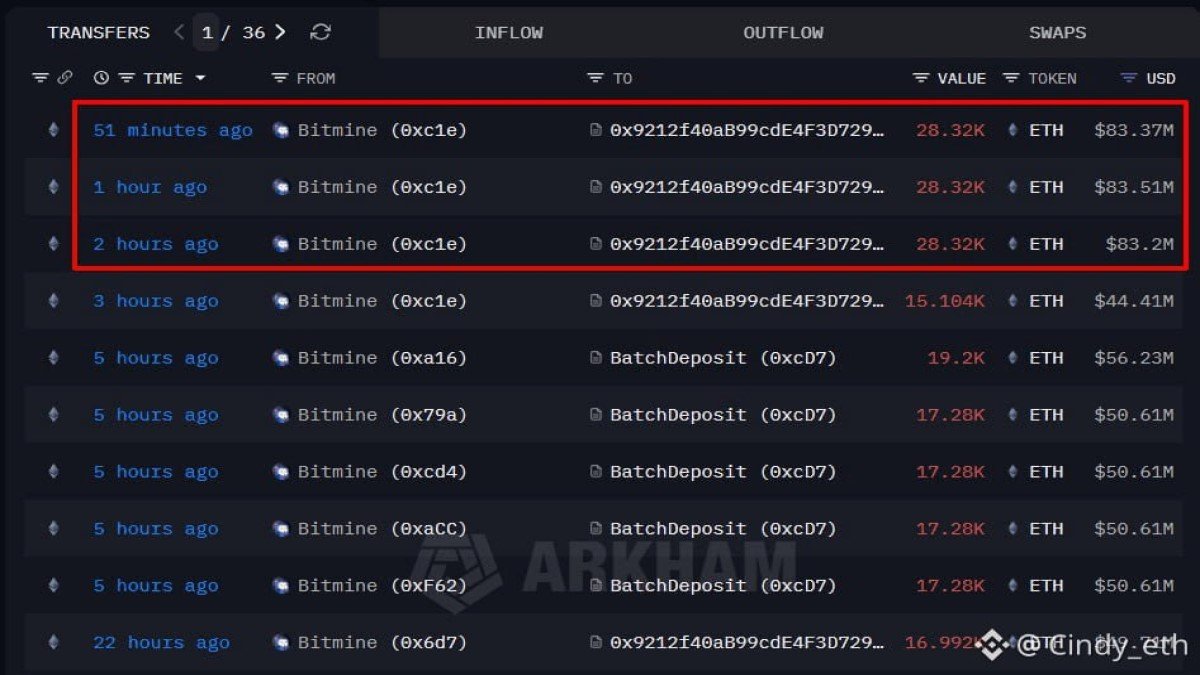

2.2 ETF outflows and risk appetite

The second pillar of the story is a stream of net outflows from Ethereum related ETFs. When exchange-traded products see redemptions day after day, they become a direct transmission channel for sell pressure into the spot market. Authorised participants redeem ETF shares for ETH and may choose to offload those coins into the open market, particularly if they are hedged via futures and simply closing a basis trade.

Importantly, outflows are not only a price effect; they are also a sentiment gauge. In general, ETF investors tend to be more conservative and slower moving than crypto native traders. When this group pulls back, it signals a broader risk-off shift in traditional portfolios. The reasons mentioned in your scenario are typical of such shifts: uncertainty around U.S. economic data, fear that high-growth technology valuations have run ahead of fundamentals, and the possibility that central banks will keep interest rates elevated for longer than previously expected.

For Ethereum, which now sits at the intersection of macro narratives and crypto innovation, ETF flows function as a barometer of institutional comfort. The recent softness suggests that, at least for now, capital allocators in the U.S. prefer to reduce exposure rather than ride out volatility.

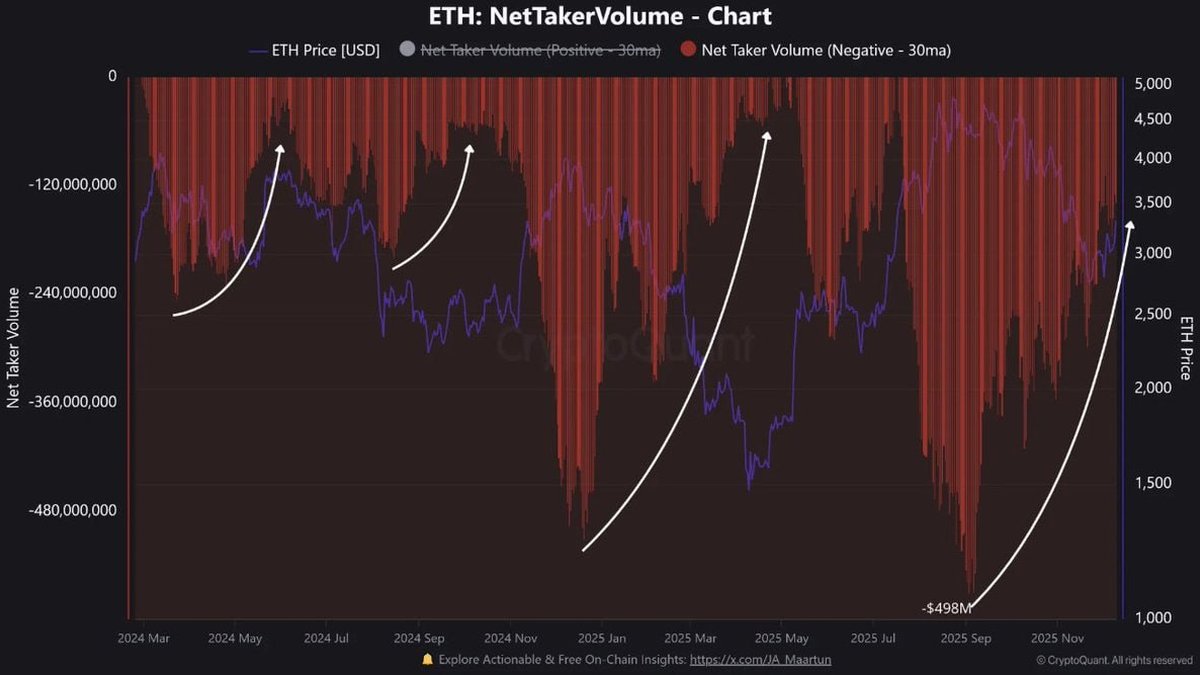

3. Derivatives: Leverage Is Bleeding Out of the System

A third piece of evidence comes from the derivatives market. According to the description you provided, both leverage and open interest are compressing. Margin requirements are effectively tightening as traders close positions, and the number of outstanding contracts declines.

When leveraged longs are dominant, futures and perpetual swaps often trade at a premium to spot, and funding rates turn persistently positive. As the market turns, forced liquidations and voluntary de-risking can flip that structure: basis premiums shrink, funding rates migrate toward neutral or even negative, and open interest falls. That is exactly the profile you describe for Ethereum.

This transition has two important implications:

- Short-term downside impulse may fade as leverage is flushed. The steepest legs lower in crypto usually happen when a heavily levered market meets an adverse catalyst. Once much of that leverage is burned off, subsequent declines often become more measured.

- Relief rallies can be sharp because there are fewer crowded longs to liquidate. If funding is flat or mildly negative and open interest is lower, a positive surprise can catch the market off balance on the other side, forcing short covering rather than long liquidation.

In other words, while shrinking derivatives activity confirms that traders are cautious, it also hints that the most violent phase of forced deleveraging may be closer to the end than the beginning.

4. On-Chain Activity: A Quiet Network, But Not a Dead One

On-chain metrics complete the picture. You highlight that active addresses on Ethereum have dropped to their lowest level in many months. Transaction counts and gas consumption in such periods often trend lower as well, reflecting less speculative trading, fewer new token launches and a general slowdown in DeFi and NFT activity.

It is easy to read this as a purely bearish signal, but a professional analysis should distinguish between three different states:

- Panic usage: activity spikes as investors scramble to move funds, unwind DeFi positions or sell into stablecoins.

- Speculative euphoria: network usage surges because users are chasing a hot narrative – memecoins, yield farms, new L2s.

- Exhaustion and disengagement: activity slumps as both bulls and bears lose interest for a time.

The current data fit the third category. That is not pleasant for those who want fast returns, but it does have a silver lining: gas prices usually fall, giving builders and long-term users cheaper blockspace. Historically Ethereum has periodically gone through such lulls before the next wave of experimentation arrives. Many of the protocol's most influential innovations were launched in periods that did not look exciting on a price chart.

For valuation, the key question is whether this drop in network activity is a cyclical pause driven by macro risk-off conditions, or evidence of a deeper secular shift in which users permanently migrate liquidity and mindshare elsewhere. At present, the scenario you describe looks more like a cyclical episode triggered by external factors than a structural collapse of Ethereum's role.

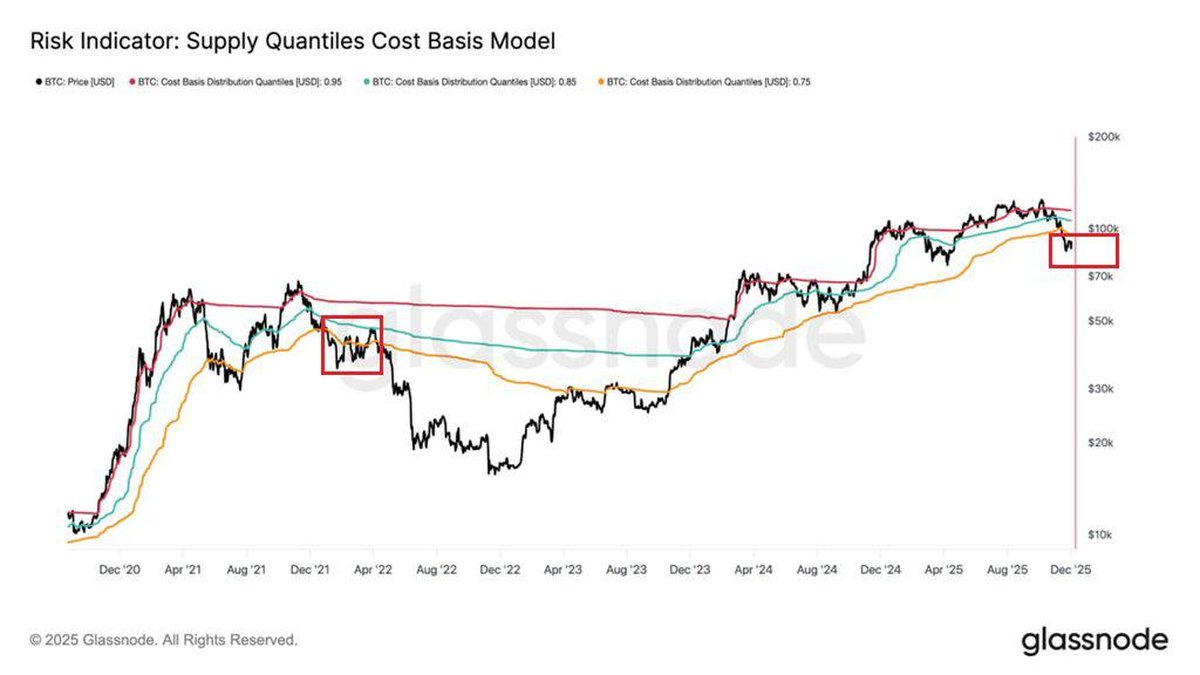

5. Technical Picture: Oversold Readings Near a Crucial Zone

Overlaying classical technical analysis onto these fundamentals, we see that multiple daily-chart indicators are slipping into oversold territory. Relative strength metrics are pushing near levels historically associated with at least temporary relief rallies. Price is trading below several widely watched moving averages, reinforcing the perception of a downtrend but also stretching distance from mean-reversion anchors.

When these technical conditions coincide with heavy U.S. selling and grim sentiment, they often mark the later stages of a move rather than its onset. That does not guarantee that 2,300 USD will hold as a perfect floor; markets can easily overshoot to the downside in illiquid conditions. But it does suggest that the reward-to-risk ratio for fresh aggressive shorts deteriorates rapidly as price approaches such zones.

From the standpoint of a professional desk, this is a classic area to shift from outright trend-following to a more nuanced stance: maintaining hedges and risk controls, but starting to look for signs of seller exhaustion and monitoring order-book behaviour around major support levels.

6. Macro Backdrop: Why U.S. Investors Are Blinking First

The sell pressure from U.S. based capital does not arise in a vacuum. Several broader forces are at play:

• Economic data uncertainty: delayed or noisy statistics on growth and inflation make it hard for traders to predict the next central bank move. In such environments, many simply reduce exposure to volatile assets like crypto.

• Higher-for-longer rate fears: if investors begin to believe that policy rates will stay elevated well into the future, the discount rate used in virtually every valuation model rises. Long-duration assets, including growth equities and Ethereum, suffer disproportionately.

• Concerns about a technology bubble: when AI stocks, high-beta tech and speculative growth all surge together, some allocators eventually decide that the risk compensation is no longer attractive. Ethereum, often grouped with tech because of its smart-contract and DeFi ecosystem, gets caught in the crossfire.

Under these conditions, it is rational for risk-sensitive U.S. investors to trim Ethereum exposure, especially if they enjoyed large gains earlier in the year. What looks like panic from the outside may simply be methodical risk rebalancing within large portfolios.

7. Scenarios From Here: Path to 2,300 and Beyond

Given this backdrop, how might the next phase of price action unfold? A professional research note would usually sketch at least three scenarios rather than a single deterministic forecast.

7.1 Bearish continuation: clean break of 2,300 USD

In the bearish case, ETF outflows persist, macro data strengthen the case for prolonged high rates, and larger funds continue to derisk. ETH grinds down toward 2,300 USD and fails to attract strong spot demand there. In this scenario, a quick extension lower driven by momentum funds and systematic strategies is plausible, especially if order books are thin over a weekend or holiday period.

Under such conditions, derivatives might briefly flip into backwardation, funding could turn sharply negative, and on-chain metrics would likely show another leg down in active addresses as retail disengages further. For long-term investors, that environment is painful but also historically where some of the best multi-year entries have emerged.

7.2 Base case: noisy range around key support

A more balanced scenario is that the 2,300 USD area broadly holds, but price action remains choppy. ETF outflows slow rather than accelerate; some days even show small net inflows as value-oriented buyers step in. Derivatives metrics stabilise, open interest stops falling, and funding hovers near flat. On chain, activity stays muted but no longer declines steadily.

In this state, Ethereum essentially digests the prior downtrend. Volatility compresses, and a multi-week base forms as market participants wait for clearer macro signals or a new fundamental catalyst, such as an upcoming protocol upgrade, new L2 adoption wave or regulatory breakthrough.

7.3 Bullish surprise: risk appetite returns quickly

The most optimistic scenario would involve a rapid improvement in the macro narrative: softer wage and inflation data, a clearer path to rate cuts, or relief that tech earnings justify valuations. Under that backdrop, sentiment toward risk assets could turn on a dime. ETF outflows might reverse, shorts could be squeezed, and sidelined liquidity might chase the market higher from depressed levels.

If such a pivot coincided with Ethereum sitting near technical support and deeply oversold readings, the resulting bounce could be vigorous. However, this scenario requires multiple stars to align and is therefore less probable than a slower, grinding normalisation.

8. What a Professional Desk Watches Now

In the middle of this uncertainty, professional analysts focus on a handful of key dashboards rather than trying to predict every candle:

• Regional price spreads between U.S. and offshore exchanges, to gauge whether U.S. selling is accelerating or abating.

• Daily ETF flow reports for Ethereum products, looking for a transition from persistent outflows to a mix of red and green days.

• Derivatives basis, funding and open interest, as an early warning system for renewed leverage buildup or complete capitulation.

• On-chain usage metrics such as active addresses, gas used, L2 settlement volumes and stablecoin transfer activity on Ethereum, to separate temporary apathy from structural decline.

• Macro calendars, since key economic releases, central bank meetings and regulatory announcements often act as catalysts for trend continuation or reversal.

None of these indicators alone will shout that the bottom is in or that a deeper crash is inevitable. But together they provide a probabilistic map that can guide risk taking, especially for funds that must justify allocation decisions to investment committees and regulators.

Conclusion: A Difficult Phase, but Not the End of the Story

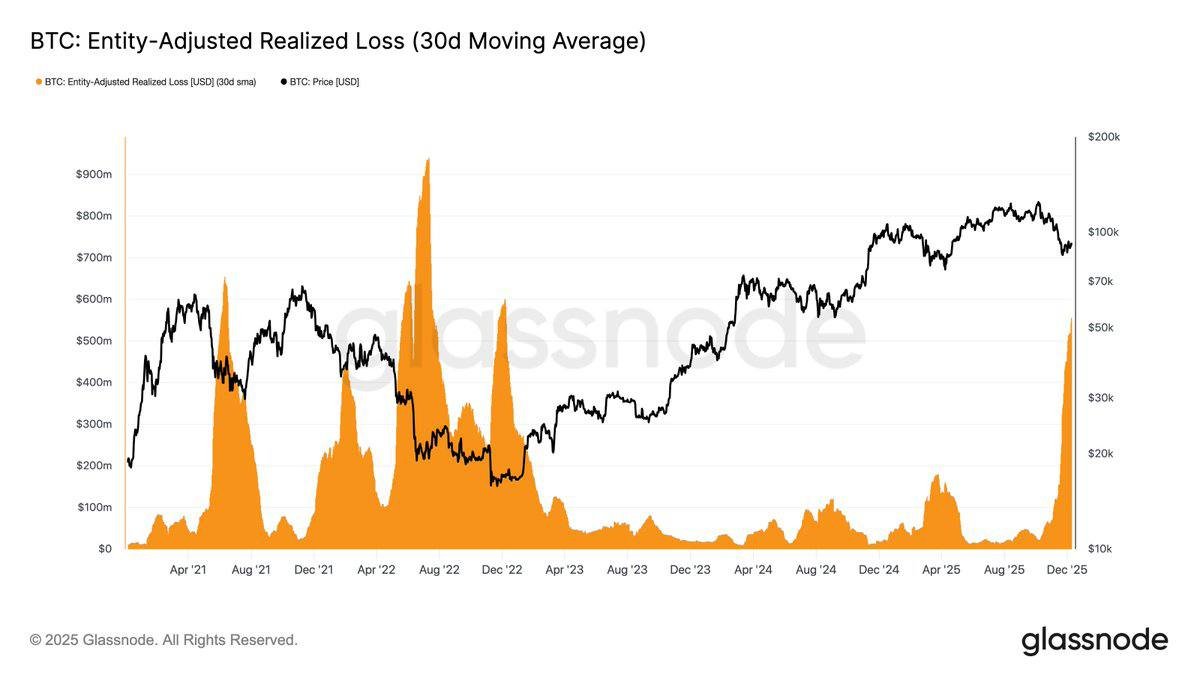

Ethereum is clearly under pressure. U.S. investors are selling through ETF redemptions and spot venues, derivatives traders are cutting leverage, and network activity has cooled. Combined, these forces make a test of the 2,300 USD region a realistic possibility, especially if macro data continue to lean against risk assets.

Yet the same data that capture this stress also hint that the market is moving into the later chapters of the current correction. Losses are increasingly being realised by recent buyers rather than long-term holders; leverage has already been drained substantially from derivatives; and valuations are approaching zones where value-driven capital historically starts to nibble, not flee.

For a professional news and analysis outlet, the objective is not to declare an exact bottom, but to translate these complex signals into a coherent narrative. Right now that narrative is one of a painful but functionally normal de-risking phase in which U.S. capital is blinking first. Whether Ethereum ultimately finds support near 2,300 USD or overshoots lower, the more important story is the slow transfer of coins from short-term, macro-sensitive hands into the portfolios of investors who are willing to look beyond the next central bank press conference.

Important note: All numbers and events mentioned in this article are based on the scenario provided and cannot be independently verified from within this environment. They should be taken as illustrative examples, not as audited live market data. This analysis is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and can result in the loss of all capital invested. Always perform your own research and consider consulting a qualified professional before making financial decisions.