Has the Memecoin Bubble Finally Burst? Data, Damage and What Comes Next After Q4 2025

Only a few months ago, the memecoin market felt unstoppable. Donald Trump’s election victory reignited the narrative that jokes could be worth billions, Fartcoin briefly pushed above a two-billion-dollar valuation, and pump.fun turned the Solana ecosystem into an assembly line for new tokens that could go from zero to cult status in hours. Telegram rooms were printing overnight millionaires (and just as many quiet losers), and for a while it seemed plausible that the cycle would end with a cartoon frog, a penguin or a parody of the S&P 500 sitting near the top of the entire crypto market.

Fast-forward to mid-November 2025 and the tone has changed. Sector trackers now put the total memecoin market cap around the high-forties to low-fifties billions of dollars, down substantially from the peak, with daily losses in the mid-single digits and volumes that have thinned out to roughly five to six billion dollars in 24 hours. The top names are no longer screaming higher every day; instead, many are quietly bleeding double-digit percentages week over week. SPX6900, one of the breakout names of 2025, has slid from above a dollar toward the mid-forty-cent range. Dogecoin is hovering around the mid-teens of a dollar, and other high-beta favourites such as Pepe, Pudgy Penguins and Bonk have given back 18–30% over the last seven days.

Against that backdrop it is natural to ask: has the memecoin fever that peaked in late 2024 and early 2025 finally broken? Or is this just a typical late-cycle shake-out before a new wave of speculative frenzy? To answer that, we need to look beyond the headlines and map how capital, liquidity and attention are actually moving across the crypto stack.

1. The data: from runaway hype to sector underperformer

Start with the hard numbers. Aggregators that track thematic baskets show that the meme sector, which once outpaced every major narrative in crypto, is now one of the weakest verticals on a relative basis. On a recent daily snapshot, the total meme-token market cap sat near $49–52 billion, with a 24-hour decline of roughly 5–7% and volumes around $5–6 billion. That might not sound catastrophic in isolation, but compared with the roaring flows of Q1–Q2 it represents a step change in participation.

The top-ten memecoins by value tell the same story. According to CoinMarketCap data compiled at the end of October and early November, Dogecoin still leads the pack with a market cap around the high-twenties of billions and daily volume in the low single-digit billions. Shiba Inu, Pepe, the TRUMP token, Pudgy Penguins, Bonk, SPX6900, FLOKI, dogwifhat and Fartcoin round out the list, with market caps ranging from several hundred million to a few billion each. Over the last week, most of these names have posted two-digit percentage drawdowns, with SPX6900 and Fartcoin among the hardest hit.

Sector-wide, this means memecoins have gone from being the performance engine of the market to being its drag. In the same window, DeFi governance tokens and real-world-asset platforms have seen relative strength, helped by rising on-chain revenues and a hunt for yield after the sharp sell-off in early October. Capital has not left crypto entirely; it has rotated away from pure meme exposure and toward tokens with clearer cash-flow or infrastructure narratives.

2. How we got here: the mechanics of the 2024–2025 meme cycle

To understand why memecoins are now under pressure, it helps to recall what made the last cycle so extreme.

First, the distribution tooling changed. Platforms like pump.fun industrialised the creation and listing of new tokens on Solana. Anyone with a half-decent joke and a few dollars of SOL could spin up a coin in minutes, with the platform taking a small fee and a cut of trading volume. Bloomberg estimates that pump.fun has generated hundreds of millions in revenue and raised more than a billion dollars via token sales, underscoring how large the meta became. The result was an explosion in token supply: thousands of coins competing every week for attention, liquidity and a slot on secondary DEXs.

Second, the macro backdrop rewarded leverage. Declining real yields, aggressive risk-taking in altcoins and a brief period of strong ETF inflows into Bitcoin created an environment in which “small cap” memes could ride the tide. Traders used cheap perpetual swaps and cross-collateralised positions to lever meme exposure on top of blue-chip holdings. As long as BTC drifted higher and funding remained manageable, meme bets felt like free lottery tickets.

Third, social media did the rest. The 2024 U.S. election cycle turned political figures into walking token brands. Trump’s own meme coin and hundreds of imitation coins piggybacked on the constant news flow. Viral X threads, Discord raids and Telegram snipes could move a token from a five-figure market cap to eight figures in a day. Liquidity was shallow, but that was a feature, not a bug: thin books made it easy for early whales to multiply their paper gains.

Put all of that together and you get a classic reflexive boom. Rising prices attracted more creators and more capital, which led to more launches, more volatility and even higher prices for the winners. At the peak, even conservative investors who usually focus on Bitcoin and Ethereum felt pressure not to miss out on the meme wave. Many entered just as the structural forces behind the boom were weakening.

3. The turn: when flows, narratives and risk management collide

Every mania ends in the same way: with more supply than genuine demand and with too much leverage sitting in the wrong places. The memecoin cycle was no exception.

Several things happened almost at once:

- Macro shocks hit high-beta assets first. The October 10th volatility spike in Bitcoin and major altcoins forced derivatives exchanges to liquidate over-levered positions. In that kind of event, memecoins are not a safe harbour; they are the first assets to be sold because they are easiest to sacrifice.

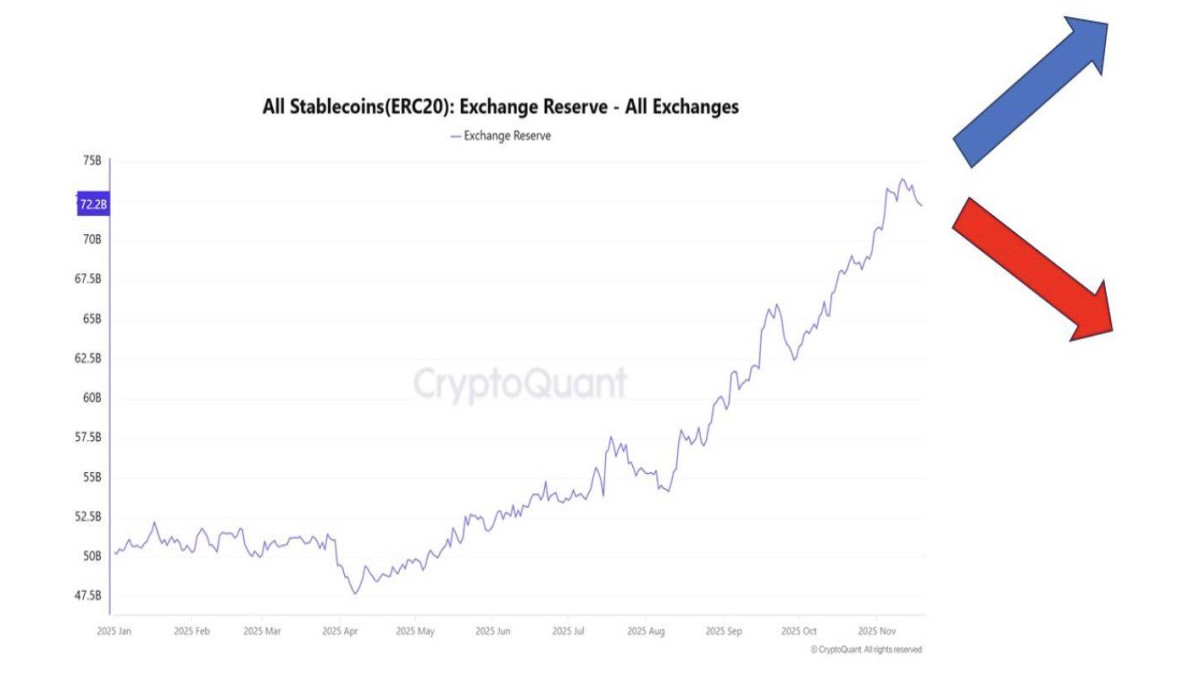

- Liquidity migrated back to BTC and stablecoins. As traders de-risked, volumes in meme pairs collapsed. Market-makers widened spreads or withdrew entirely from the most illiquid names, turning previously active tokens into ghost towns overnight.

- Regulatory and security headlines cooled retail enthusiasm. Multiple hacks of verified X accounts to promote fraudulent memecoins reminded the public how thin the line is between viral joke and organised rug pull. Newcomers who bought tops in February and March 2025 found themselves down 60–80% with no fundamental anchor to justify holding.

At the same time, sectors with clearer fundamentals began to look comparatively attractive. DeFi protocols offering real yield from trading fees or liquid-staking spread started to outperform. Infrastructure plays tied to scaling, restaking or tokenization captured attention from funds tired of being exit liquidity for anonymous meme deployers. The result was a quiet rotation: not a full-scale exit from the asset class, but a deliberate reweighting away from pure memes.

4. Under the hood: why memecoins bleed faster on the way down

The magnitude of the current drawdown is not purely about sentiment; it is baked into how memecoins work.

Concentrated ownership. Many high-profile memes have extremely skewed holder distributions. A handful of wallets, sometimes the team and early insiders, hold a large fraction of supply. When these wallets decide to rotate out, either because they are locking in life-changing returns or because they need to meet obligations elsewhere, there are often not enough natural buyers to absorb the flow.

Thin real liquidity. Headline market caps can be misleading. A token can show a billion-dollar valuation based on last traded price, while only a few million dollars of liquidity actually sits on exchanges. That works wonderfully in a bull market, where small notional buys can push the price up dramatically. In downturns it works in reverse: modest sell orders can crater price, triggering cascades of stop losses and liquidations.

Lack of fundamental anchors. Unlike DeFi protocols with measurable cash flows, or L1 tokens with staking yields and usage metrics, memecoins offer little to hang a valuation on. Their “fundamental” is attention. When narratives move on, even loyal communities eventually lose momentum. Without dividend-like mechanics or direct links to productive activity, the path from peak to irrelevance can be brutally steep.

Those structural features explain why, in the data, memecoins have underperformed almost every other major crypto category during the recent correction. When the marginal dollar of speculative appetite leaves the system, it leaves this part of the market first.

5. So, is the memecoin era over?

Despite the gloomy picture, declaring the “end” of memecoins would be naive. A better way to frame the situation is that the 2024–2025 memecoin season is in its late stages, not that the broader idea of meme-driven tokens is dead forever.

Several arguments support that view:

- Memes are a structural feature of the internet. As long as culture is produced and distributed online, there will be assets that try to monetise that attention. Every new social platform, celebrity scandal or political shock is potential fuel for the next meme wave.

- The tooling is now permanent. Platforms like pump.fun, decentralized launchpads and automated market-maker infrastructure are here to stay. They lower the cost of experimentation and guarantee that new tokens can be spun up instantly when conditions are right.

- Some memes are evolving toward utility. A small but growing subset of projects is trying to convert meme traction into actual business models: gaming ecosystems, consumer apps, merchandising, or even DeFi primitives wrapped in playful branding. Whether they succeed is an open question, but it shows that the category is not frozen in pure joke mode.

On the other hand, the easy phase of the trade is over. In 2024 and early 2025, simply buying any coin with a funny ticker during a pump.fun launch often made money in the short term. That edge has disappeared. Today’s environment looks more like a normal high-risk microcap market: a few names may still deliver outsized returns, but most will grind down or die quietly.

6. What professional investors can learn from the bust

For sophisticated investors and risk desks, the memecoin cycle is valuable not just as a trading story, but as a case study in how modern crypto markets behave.

1. Attention is a tradeable resource, but it is mean-reverting. Memecoins are essentially derivatives on attention. They teach us that social capital can be financialised extremely quickly, but that the half-life of those trades is short. Building frameworks to track attention (search data, social-media mentions, on-chain holder growth) is now part of serious fundamental analysis, not just a toy for retail traders.

2. Narrative cycles rotate faster than infra cycles. The pendulum from DeFi to NFTs to memes to restaking and back is accelerating. Memes spike hardest and fade fastest. Infrastructure and base-layer narratives build slower but can hold value through multiple rotations. Allocators who treat meme rotations as tactical trades and infra plays as strategic positions are less likely to be left holding illiquid bags.

3. Liquidity quality matters more than headline market cap. One of the clearest lessons of the SPX6900 story is how misleading simple market-cap rankings can be. SPX briefly joined the billion-dollar club, yet more recent analyses highlight a 60%+ drawdown over ninety days and warn that a break below key support could trigger further slides. For risk managers, depth metrics, slippage estimates and the distribution of liquidity across venues are at least as important as price.

4. Retail behaviour is now highly path-dependent. Many new entrants’ first experience of crypto was buying memes during the 2024–2025 frenzy. Their mental model of the market is shaped by that period. If they exit with deep losses and no plan, they may not come back for years, starving future cycles of fresh capital. That is why understanding and explaining these dynamics matters for the health of the ecosystem, not just for short-term profit.

7. Practical takeaways: how to think about memecoins from here

Given all of the above, how should an informed reader of a professional analysis outlet think about memecoins as we head into the end of 2025?

- Treat them as a clearly separated risk bucket. For most investors, memecoins belong in a “venture/casino” sleeve of the portfolio with predefined loss limits. Mixing meme exposure with core holdings like BTC and ETH without clear boundaries is a recipe for emotional decision-making.

- Focus on flow, not stories. In memes more than anywhere, narrative is cheap and liquidity is everything. Before entering any position, ask who is likely to buy after you, where that liquidity will come from, and what happens when early insiders decide to exit.

- Watch sector-level indicators. Metrics such as total meme-sector market cap, 30-day realised volatility and aggregate DEX volume can provide early warnings that the phase of easy upside is ending. The current combination — shrinking cap, declining volume, persistent double-digit weekly losses — is typical of a late-stage unwind rather than a fresh beginning.

- Do not underestimate the possibility of a sharp rebound. Precisely because of their reflexive nature, memecoins can stage violent relief rallies even inside broader downtrends. For traders, those bounces may provide opportunities to exit positions closer to break even rather than capitulating at the worst moment.

Conclusion: after the punch bowl, the reckoning

The memecoin mini-winter we are living through is not a random accident. It is the predictable aftermath of a year in which a handful of platforms made token creation effectively free, leverage was abundant, and attention was treated as a limitless resource. The data now tells a different story: sector market cap compressed, volumes down, top names losing ground quickly and capital rotating toward tokens with clearer use cases.

From the vantage point of a professional news and analysis outlet, the point is not to moralise about whether memecoins are “good” or “bad.” It is to explain what the current readings imply for risk, for liquidity and for the broader structure of the crypto market. Right now those readings say that the easy meme money has been made, that this particular wave of hype is in its late stages, and that the next big opportunity is likely to appear not from a random ticker on a launchpad, but from understanding where all that speculative energy moves next.

Will there be another memecoin supercycle? History suggests yes. But it will not look exactly like the last one, and it will not be kind to those who treat every joke token as a retirement plan. The job of serious analysis is to separate the enduring patterns from the noise. The pattern today is rotation and consolidation. Meme traders may yet enjoy another burst of upside, but the market has made one thing abundantly clear: the days when any coin with a funny name could command billions on pure narrative alone are, at least for now, behind us.

This article is provided for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets, especially memecoins, are highly volatile and speculative. Always conduct your own research and consider consulting a qualified professional before making financial decisions.