Bitcoin, $72 Billion in Stablecoins and a Silent Fed: A Market Coiled for a Macro Shock

Crypto rarely waits for anyone. Yet right now, Bitcoin looks like it is doing exactly that: marking time while it waits for the Federal Reserve.

Because key US economic reports have been delayed or distorted, the Fed is heading into its December policy meeting with less information than usual. In that kind of fog, the path of least regret is often to do nothing—hold rates where they are and ask the market to live with higher-for-longer a little while longer.

For Bitcoin, that choice would matter. A steady policy rate with no fresh cuts keeps the cost of capital elevated, sustains competition from cash and Treasuries, and discourages the kind of aggressive risk-taking that normally powers late-cycle crypto rallies. It is not a disaster scenario, but it is a lid: in the framework you suggest, it could leave BTC oscillating in a broad $60,000–$80,000 range into year-end, volatile but directionless.

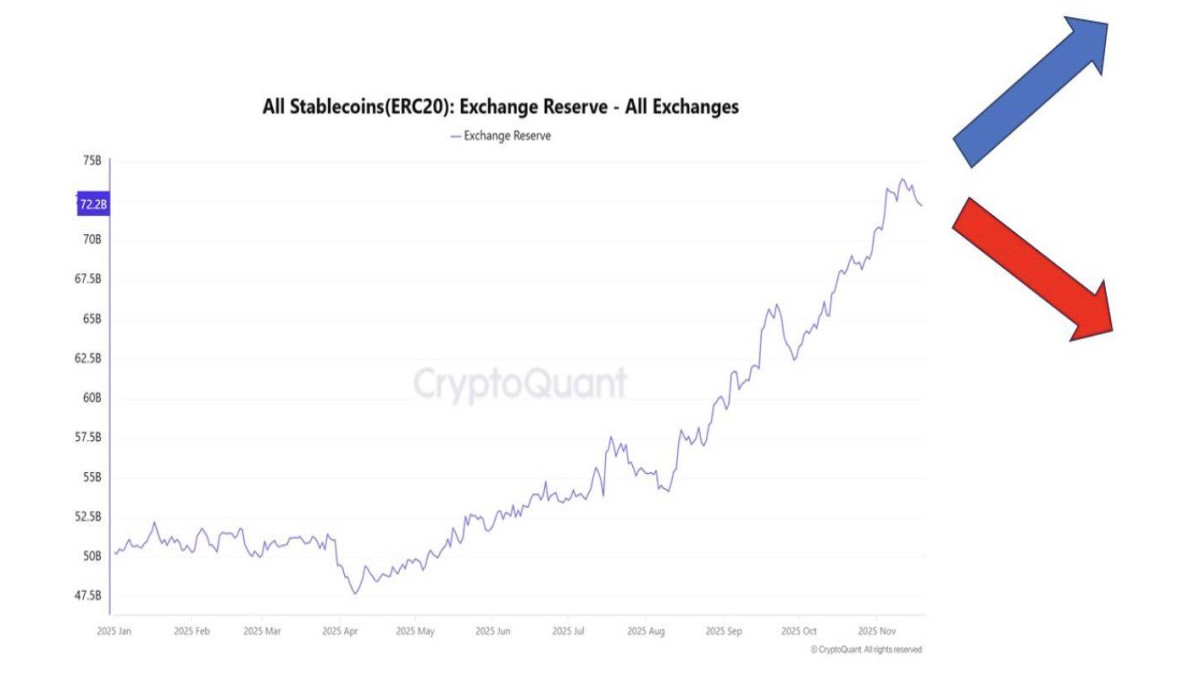

And yet the market is quietly building pressure under that lid. The CryptoQuant chart you reference, tracking all ERC-20 stablecoins held on exchanges, shows reserves climbing relentlessly through 2025—from the high-$40 billion area in January to around $72.2 billion today. The two arrows on the chart capture the fork in the road: this stockpile can either turn into a powerful buying wave or remain a parking lot for fear.

Because we cannot pull live data here, we treat these numbers and dates as part of your scenario rather than independently verified facts. The goal of this article is to unpack what such a configuration would mean: a Bitcoin market capped by macro uncertainty, and a stablecoin ocean sloshing around on exchanges waiting for a signal.

1. The missing data problem: why the Fed may stand still in December

The starting point for any serious analysis is the Fed itself. Normally, policymakers head into a meeting armed with fresh inflation prints, labour-market data, spending figures and sentiment surveys. This time, because of prior disruptions and delays, some of that information is either missing or stale.

That matters because the Fed has spent the last two years repeating the same mantra: “we are data dependent.” When the data are noisy or late, the bar for changing policy goes up. The Committee does not want to cut only to discover a month later that core inflation was re-accelerating or the labour market never cooled as much as it thought.

Against that backdrop, three constraints dominate the Fed’s December calculus:

- Inflation risk is down, not gone. Price growth has come off its post-pandemic extremes, but in the Fed’s models it is still too close for comfort to the upper end of its tolerance band.

- The economy has bent but not broken. Growth has slowed and some indicators have softened, yet nothing screams systemic stress.

- Credibility is priceless. Having been accused of being late to fight inflation once, the Fed is reluctant to be seen as declaring victory prematurely.

In such an environment, standing pat in December is the easiest choice to defend. The Fed can always cut later if incoming data in early 2026 confirm a sustained slowdown. What it cannot easily do is unwind the reputational damage from a cut that turns out to have been a mistake.

For Bitcoin and other risk assets, that default option has concrete implications: elevated real yields, a still-strong dollar and investors who are less willing to pay high valuations for volatile cash-flow-free assets.

2. What higher-for-longer means for Bitcoin in practice

Translating macro stance into market behaviour is where things get subtle. A December non-cut is not automatically bearish, but it changes the distribution of outcomes.

2.1. The $60k–$80k “compression band”

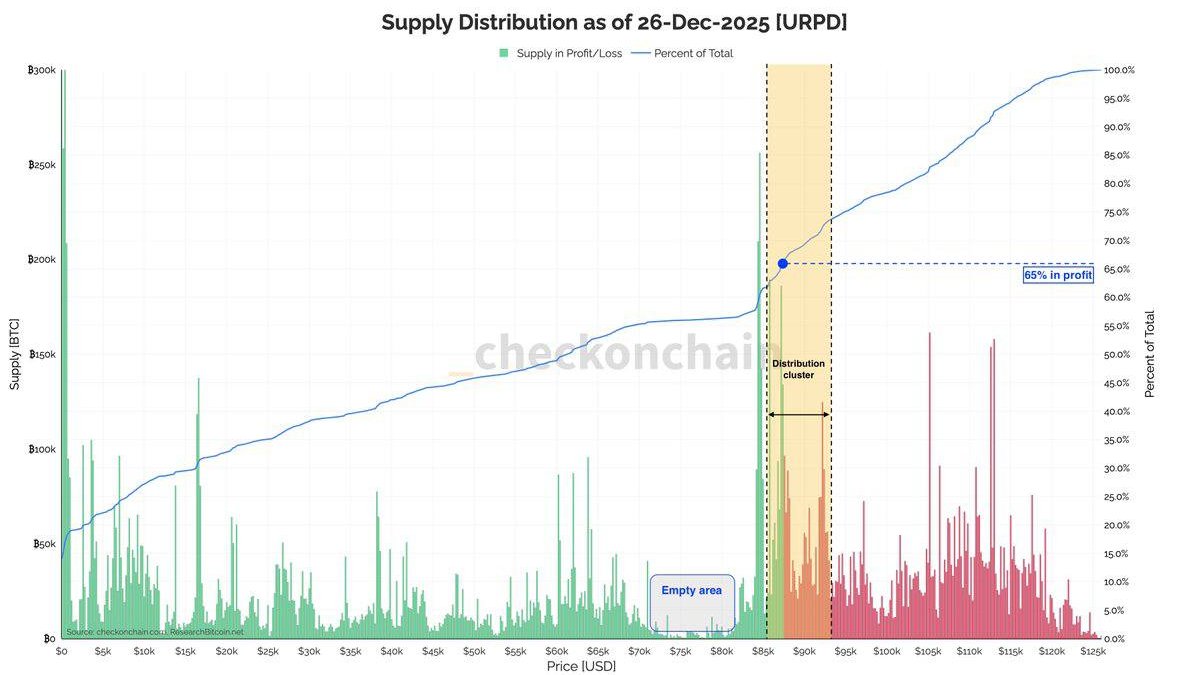

In your framework, a world without a December cut sees Bitcoin trapped in a $60,000–$80,000 band. That range is wide enough to feel violently volatile to anyone trading with leverage, yet narrow enough that long-term allocators would describe it as consolidation rather than capitulation.

At the lower end of the band, around $60,000, macro sellers and forced liquidations begin to meet value buyers who still believe in the halving story, institutional adoption and Bitcoin’s evolving role as a macro hedge. At the upper end, close to $80,000, ETF outflows and profit-taking from earlier buyers re-assert themselves, especially as traditional assets like cash and short-duration bonds offer attractive yields with far less drama.

The key point is not the exact numbers but the psychology. In a higher-for-longer regime, Bitcoin behaves less like a hyper-growth tech stock and more like a high-beta macro instrument whose upside is capped until the cost of money begins to trend back down.

2.2. Volatility migrates from price to structure

When spot price is range-bound, volatility doesn’t disappear; it migrates into the plumbing:

- Derivatives markets see sharp swings in funding rates as traders fade both ends of the range.

- ETF flows oscillate between modest inflows on dips and heavier redemptions on rallies, amplifying the range rather than breaking it.

- Altcoins fragment: some bleed out as liquidity concentrates in majors, others enjoy short-lived rotations when Bitcoin pauses.

For long-term investors, that kind of environment is frustrating but not necessarily fatal. For over-levered players, it is deadly. The market repeatedly punishes anyone who assumes that each bounce is a new bull leg or each dip is a full-blown crash, while rewarding those who treat the range as a time to de-risk, upgrade portfolio quality and watch the macro tape.

3. The stablecoin mountain: $72 billion in dry powder—or an exit queue?

This brings us to the most interesting part of the chart: the nearly vertical rise in stablecoin reserves on exchanges throughout 2025. From roughly $50 billion in January to around $72.2 billion by mid-November, the line climbs like a ski slope.

At first glance, that looks unambiguously bullish. More stablecoins on exchanges, the conventional wisdom goes, means more “dry powder” ready to rotate into Bitcoin and other assets when the macro clouds clear. But on-chain data is rarely that simple. The two arrows on your image—one pointing up, one down—capture the duality.

3.1. Bullish reading: ammunition for the next leg up

The optimistic interpretation goes like this:

- Investors—both retail and institutional—have derisked from volatile assets into stablecoins but have not left crypto altogether.

- Keeping capital in USDT, USDC, DAI and their peers on exchanges means they are ready to move quickly when conditions improve; they do not have to wire fresh fiat or navigate new onboarding.

- If and when the Fed eventually signals a more confident easing path—or at least removes the fear of surprise tightening—those stablecoins can be deployed in size, turning into a liquidity shock on the buy side.

In this view, the $72 billion stablecoin pile is the equivalent of a coiled spring. The longer it sits unused while Bitcoin grinds sideways, the bigger the eventual move once a clear macro trigger arrives.

3.2. Bearish reading: parked risk waiting for the exit

The pessimistic interpretation flips the narrative:

- Rising stablecoin balances may reflect not patience, but unease. Traders and funds have sold volatile assets and are sitting in dollars, unsure whether to rotate back in or withdraw entirely.

- Stablecoins on exchanges are just as easy to send back to banks or off-ramp through OTC desks as they are to deploy into Bitcoin. They are optionality, not a guaranteed future bid.

- If macro conditions deteriorate further—say, the Fed hints at potential future hikes, or a new geopolitical shock hits—those stablecoin balances could become fuel for a wave of outflows from the entire asset class.

In this reading, the $72 billion doesn’t guarantee a bull leg; it merely raises the stakes. A positive macro surprise could indeed amplify a rally, but a negative one could accelerate a broader de-risking as sidelined capital decides that cash in a bank account is safer than cash in a smart contract.

3.3. What the history of stablecoin cycles suggests

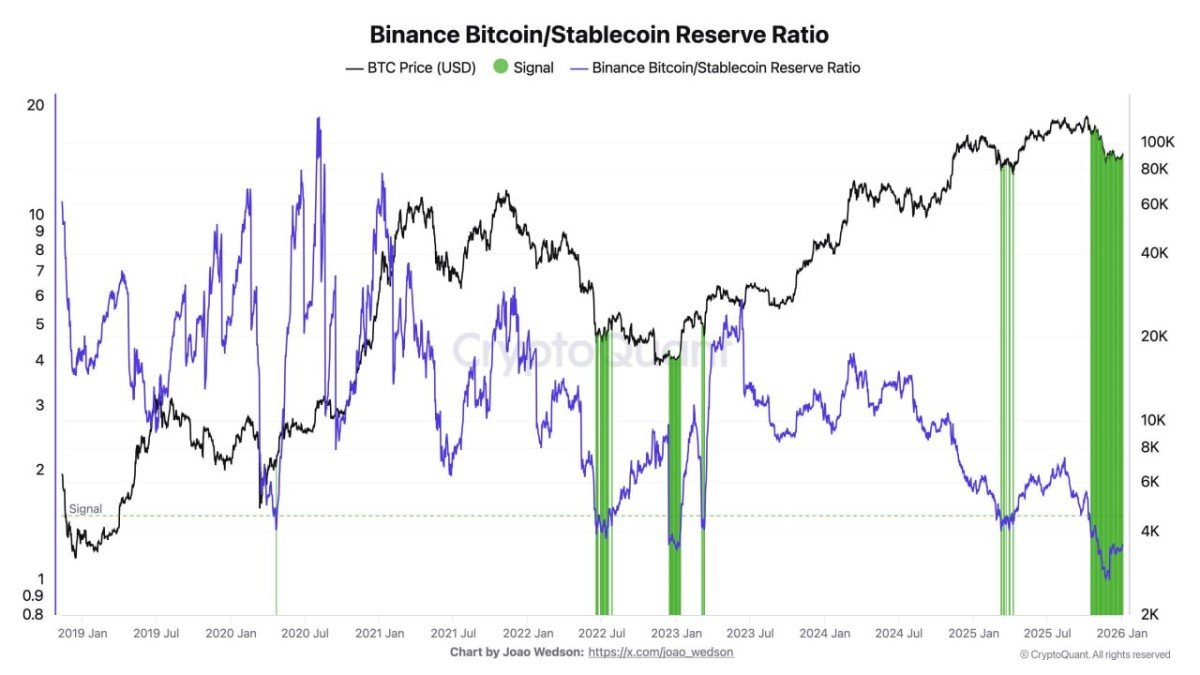

Looking back over previous cycles (up to our training cut-off in mid-2024), one pattern tends to repeat: major crypto bottoms occur when stablecoin dominance is high and rising, but price itself is still under pressure. That combination signals that most speculative leverage has been flushed out, yet capital has not fully abandoned the ecosystem.

The chart in your scenario shares elements of that pattern. Stablecoin balances are at record highs while Bitcoin is off its peak and chopping in a wide range. The missing ingredient is macro clarity. Until the Fed either confirms that the tightening cycle is over or signals a clear, data-based path to lower real rates, that capital has little reason to rush.

4. Two paths after the December meeting

With that in mind, it is helpful to map out two broad scenarios around the December Fed decision and how each could interact with the stablecoin overhang.

4.1. Scenario A: No cut, cautious language

In the first scenario, the Fed leaves rates unchanged and emphasises that, given limited data, it is "prudent" to wait for clearer evidence that inflation is on a sustainable path back to target. The statement and press conference stress flexibility but offer no strong hints of imminent easing.

Market reaction could unfold in stages:

- Short-term: Risk assets wobble. Bitcoin tests the lower half of its $60k–$80k band as traders who had quietly hoped for a surprise cut unwind positions.

- Stablecoins: Reserves dip only modestly. Most sidelined capital decides to keep optionality rather than fully exit; the story becomes "wait for Q1 data."

- Volatility: Implied volatility in options remains elevated as investors hedge both tails, aware that each subsequent data release could change the narrative.

In this world, Bitcoin does not collapse, but it remains a trading market rather than a trending one. The stablecoin mountain stays roughly intact, with only incremental deployment into high-conviction narratives (Bitcoin at deep dips, blue-chip DeFi, infrastructure plays) while the bulk waits for a cleaner macro signal.

4.2. Scenario B: Surprise cut or dovish pivot

In the second scenario, the Fed either delivers a small cut despite limited data, or more realistically, leaves rates unchanged but substantially softens its forward guidance. The statement might note that inflation is behaving as hoped, labour markets are cooling and that "if these trends continue" there could be room for "additional accommodation" in early 2026.

Here, the dynamics look very different:

• Rates and dollar: Yields at the front end of the curve fall, and the dollar weakens as markets re-price the path of policy.

• Bitcoin: BTC reacts quickly, often front-running other risk assets as traders interpret the shift as the green light they have been waiting for. The upper bound of the $60k–$80k range comes under attack, and a break could trigger systematic buying from trend-following strategies and structured products.

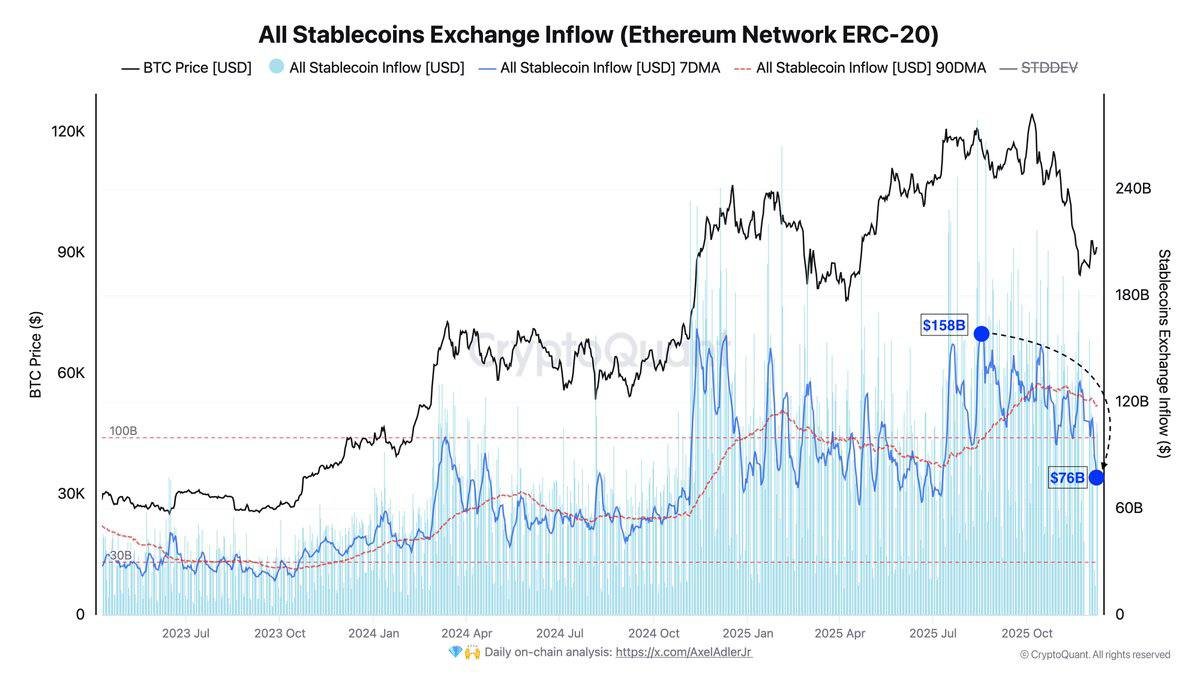

• Stablecoins: This is where the $72 billion reserve becomes a force. As price begins to break out and funding conditions improve, sidelined capital has both the motive and the means to rotate. Spot and perpetual volumes spike as stablecoins are swapped for BTC and majors, shrinking exchange reserves.

Crucially, the magnitude of the move would be shaped by how concentrated those stablecoin holders are. If a large share belongs to sophisticated funds waiting for exactly this macro trigger, the deployment could be fast and coordinated. If instead reserves are fragmented across millions of small accounts seeking safety, the rotation could be slower and more hesitant.

5. How professional investors should read the current setup

For a professional news and research platform, the job is not to predict which Fed scenario will unfold, but to frame the trade-offs.

5.1. Recognise that macro now sets the ceiling

In earlier cycles, Bitcoin often traded as if macro did not exist. Liquidity conditions obviously mattered, but they were not priced minute by minute. That era is over. With ETFs, institutional flows and global macro desks watching the same Fed, policy expectations now set a soft ceiling on Bitcoin rallies. Until that ceiling moves, it is unrealistic to expect a sustained, parabolic breakout, regardless of on-chain data.

5.2. Treat stablecoin reserves as optionality, not destiny

Charts showing $72 billion of stablecoins on exchanges are seductive. They invite simple stories: "all this money will eventually buy crypto again." The reality is murkier. Those tokens represent choice. They can buy BTC, they can buy altcoins, they can fund DeFi strategies—or they can leave the ecosystem entirely.

Serious analysis therefore tracks not only the level of stablecoin reserves, but their flow: which exchanges are gaining or losing, which chains are seeing growth, and how reserves behave around macro events. The December Fed meeting will be a crucial test of that behaviour.

5.3. Manage risk for a market that can break either way

Positioning into such a binary event is less about being a hero and more about surviving both outcomes. That means:

- Limiting leverage and being explicit about pain thresholds on both sides of the $60k–$80k range.

- Using options, where liquid, to express directional views while capping tail risk.

- Recognising that the first move after the Fed decision is often not the final one; markets frequently overshoot and then mean-revert as participants digest the details.

Conclusion: a coiled market with a macro trigger

The picture that emerges from your chart and context is of a market in suspense. Bitcoin is no longer the rogue asset that trades in its own universe. It is plugged into the same macro wiring as equities, credit and FX, and it is currently capped by a central bank that is not yet ready to declare victory over inflation.

At the same time, the crypto ecosystem has quietly built a $72 billion reservoir of stablecoins sitting on exchanges, representing either the most potent buying power the asset class has ever had—or the latent capacity for a deeper derisking if macro goes the wrong way.

Whether that reservoir turns into a tailwind or remains inert will depend less on on-chain memes and more on a handful of sentences that emerge from a wood-panelled room in Washington after the December meeting. Until then, Bitcoin is likely to keep doing what it has been doing: chopping, frustrating traders, shaking out leverage—and waiting.

Disclaimer: All numerical values, price levels and event descriptions in this article are based on the scenario provided by the user and could not be independently verified in this environment. This analysis is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and may be unsuitable for many investors. Always conduct your own research and consider consulting a qualified professional before making financial decisions.