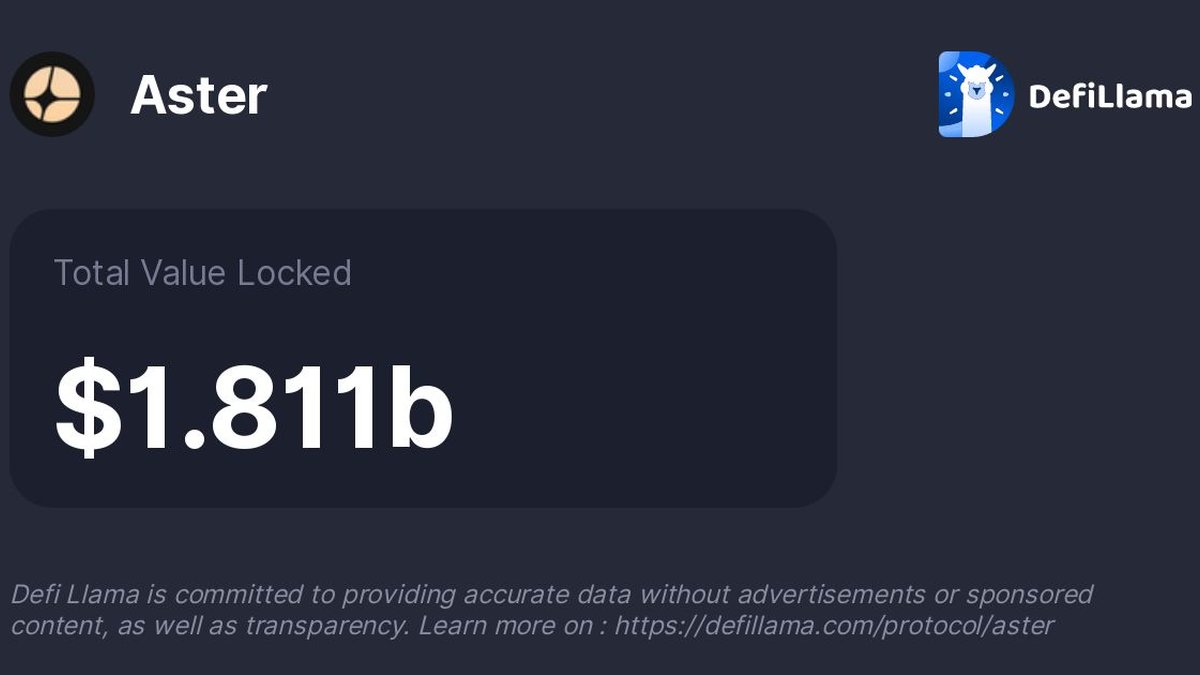

After a brief delisting over data-integrity concerns, DefiLlama has quietly reinstated Aster’s perpetuals data—with caveats. Here’s the timeline, why the dispute happened, what the relisting actually signals (and doesn’t), and a practical checklist for evaluating whether Aster’s eye-popping volumes reflect real risk transfer

DeFi’s data war took a new turn this week. After a public dispute over suspicious trading patterns, DefiLlama has relisted the perpetuals volume for decentralized derivatives exchange Aster—but not without warnings about gaps and verification limits. The saga matters beyond one venue: it’s a test of how transparent our analytics pipelines really are and whether huge reported volumes reflect price discovery or cosmetics.

The Short Timeline

- October 5–6, 2025: DefiLlama removes Aster’s perp volume citing data-integrity concerns, including claims that Aster’s activity was highly correlated with Binance perpetuals—fueling wash-trading speculation. Aster’s token and sentiment wobble in the aftermath.

- Mid–Late October 2025: Aster is quietly reinstated on DefiLlama, but coverage notes “big gaps” in historical series and caveats on verification. Some outlets frame this as a cautious relist, not an exoneration.

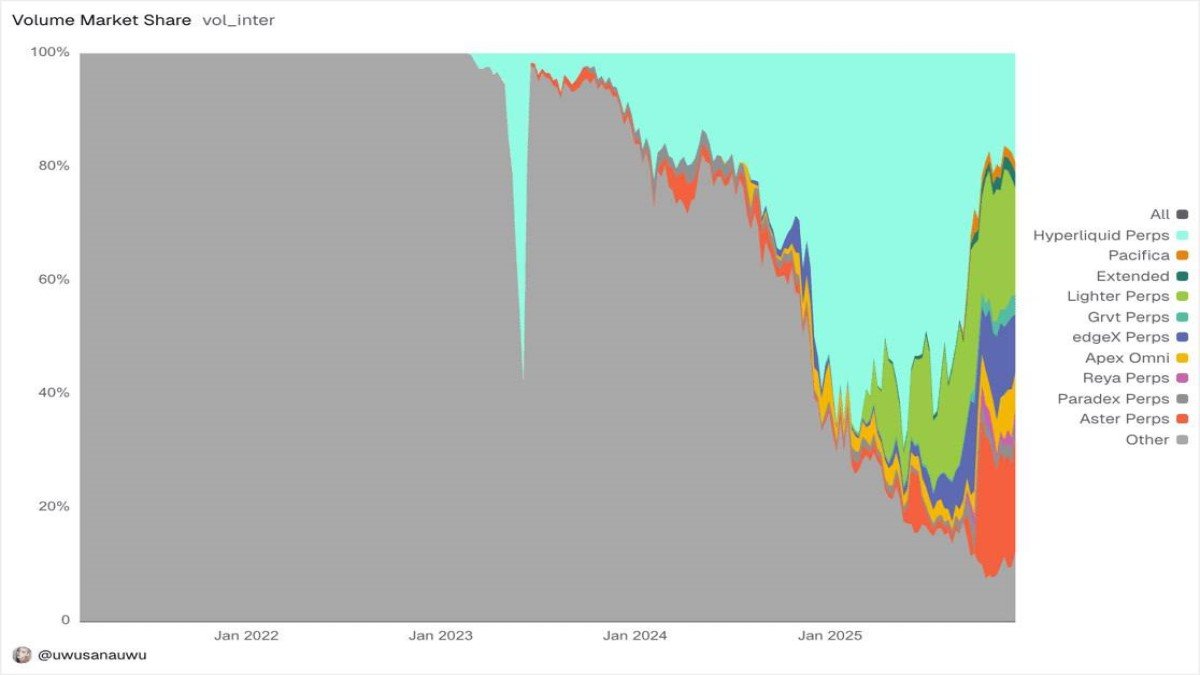

Meanwhile, Aster’s positioning as a Binance-linked (via YZi Labs) high-throughput perp DEX and its rapid market-share gains remain part of the narrative—and the controversy.

Relisting ≠ Vindication

It’s tempting to read the relist as a clean bill of health. It isn’t. Based on reports, DefiLlama’s decision returns visibility while still flagging verification gaps. That tells us two things: (1) the aggregator is willing to show the data as it is sourced, and (2) the burden to judge quality now shifts back to analysts, traders, and teams to interpret context and corroborate with independent signals.

What Sparked the Dispute?

Three issues surfaced in October:

1. Suspicious correlation patterns: Commentators highlighted that Aster’s reported perp volume moved almost in lockstep with Binance’s, beyond what simple market beta might explain. That pattern, on its own, doesn’t prove wash trading—but it does warrant scrutiny of market-microstructure.

2. Data completeness: After the relist, several outlets pointed out missing history and inconsistent series on DefiLlama, keeping the integrity debate alive.

3. Narrative/context risk: Aster’s fast ascent and associations (backing via YZi Labs / Binance ecosystem) made it both newsworthy and polarizing, shaping how the community interpreted the data.

What the Data Does Say Right Now

On the aggregator side, Aster again appears across DefiLlama’s derivatives pages and protocol listings, with conspicuously strong reported volumes and OI for a relatively new DEX. That presence restores comparability with rival venues—but the same coverage that noticed the relist also underlined that the dataset still has gaps and caveats. Translation: treat the numbers as provisional, not gospel.

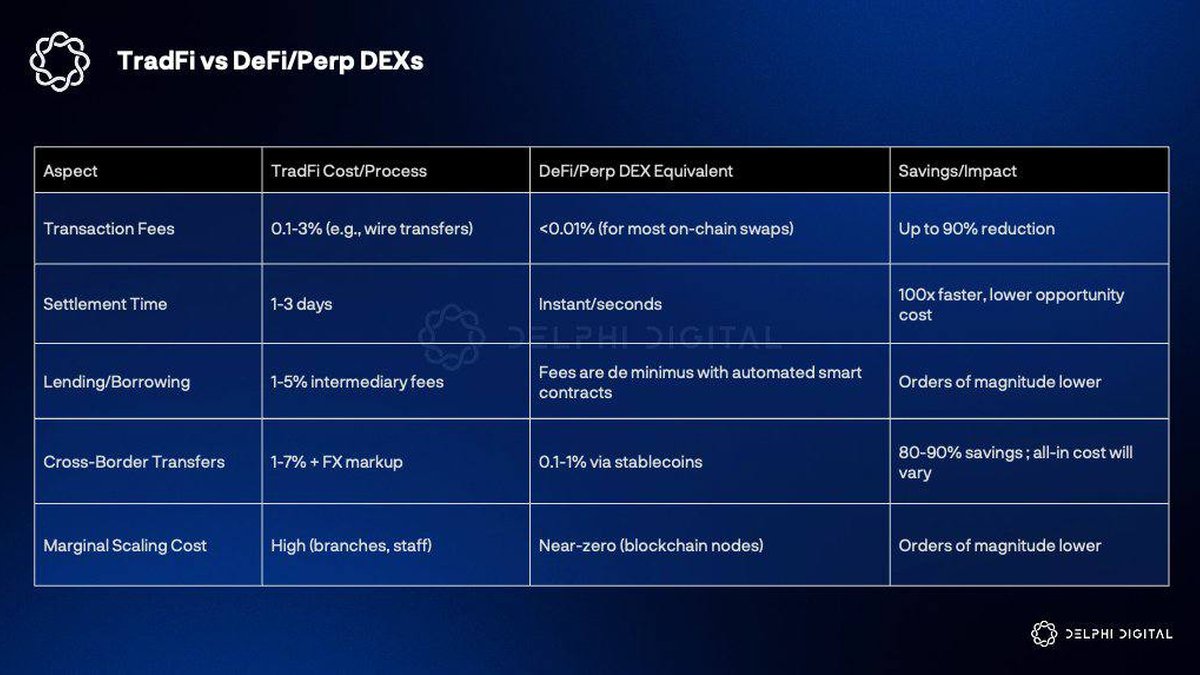

Does Massive Volume Mean Real Price Discovery?

Not necessarily. In perps markets, apparent size can be manufactured through self-matching, rebates, or off-platform coordination. The litmus test is whether volume coincides with:

- Depth and slippage: Tight top-of-book spreads and small slippage for non-captive flow across several pairs.

- Open interest quality: Sustained OI that isn’t concentrated in a handful of accounts or a single venue route; stable basis behavior across regimes.

- User breadth: Growth in unique active traders and distribution of size (not just a few whales pinging the book).

- Cross-venue lead/lag: If Aster reliably leads micro-moves that later propagate to other markets, that’s a sign of genuine discovery; if it always follows in perfect step, skepticism is warranted.

A 10-Point Checklist for Assessing Aster’s “Comeback”

1. Compare aggregates: Track Aster’s 24h/7d perp volumes vs. peers (Hyperliquid, dYdX). Note relative changes around macro moves to see if behavior is organic.

2. Depth snapshots: Record top-of-book depth at fixed intervals across majors (BTC, ETH) and leading alt pairs; audit slippage with standardized order sizes.

3. OI dispersion: Look at how open interest is distributed (if available via APIs/analytics); watch for sudden concentration or synchronized build/unwind patterns.

4. Spot linkage: Does perp activity on Aster line up with spot flows on multiple exchanges—or does it diverge without arbitrage closing gaps?

5. Funding realism: Persistently hot funding without corresponding spot pressure often signals levered churn.

6. Latency/MEV claims: Aster markets itself as MEV-minimized with one-click trading; verify by measuring quote stability and fill quality during volatile windows.

7. Listings/news sensitivity: Does volume jump on real catalysts (listings, macro prints), or at random times with no cross-venue echo?

8. API consistency: Stability of public endpoints (trades, books, stats) and alignment with third-party scrapers.

9. Accounting continuity: On DefiLlama, watch whether historical series are backfilled cleanly or keep resetting—this reveals pipeline maturity.

10. Third-party audits: Give extra weight to independent reviews from sources with a track record of catching anomalies (research firms, academics, veteran traders).

What the Relist Means for Traders and Builders

For traders, the relist lowers the visibility friction—Aster returns to standard dashboards, making it easier to compare spreads, OI, and fees across venues. But the right posture is still probationary: route size gradually, test fills, and diversify routes until depth and discovery quality are proven. A single line item in an aggregator should not be treated as due diligence.

For builders, the episode highlights that transparency is now a competitive moat. If you want the market to trust your numbers, open up data schemas, publish sampling methods, and collaborate with aggregators on validation. Aster’s next chapter will be judged as much on data operations as on incentives or liquidity mining.

Context: Who (and What) Is Aster?

Aster brands itself as a next-gen derivatives DEX with MEV-resistance, one-click trading and 1000× leverage in a simplified mode, plus a pro interface for advanced users. Coverage frequently links the project’s origins and support to YZi Labs (described by some outlets as a rebrand from Binance Labs), a connection that has fed both adoption and scrutiny. Recent ecosystem posts and education pieces also position Aster alongside Hyperliquid and dYdX in the race for DEX perp leadership.

Interpreting the Big Numbers

Headlines have touted eye-catching daily and weekly volumes since the relist. Take them as a starting point, not a conclusion. The critical question is whether those notional figures map to real, externalized risk—i.e., other venues adjust to Aster’s prints, liquidity providers quote tighter or wider because of Aster’s flow, and funding/basis track plausible inventory pressure. Without those corroborations, size can be cosmetic.

Bottom Line

DefiLlama putting Aster back on the board is significant, but it stops short of a seal of approval. Treat the data as visible but provisional, and let market-microstructure tests—depth, slippage, user breadth, cross-venue lead/lag—do the talking. If Aster’s numbers keep holding up under those lenses, the relist could mark the start of a durable chapter. If not, the debate will return quickly, and the market will price that uncertainty in. Until then, triangulate, verify, and size prudently.

Note: This article is analysis, not investment advice. Always do your own research and manage risk accordingly.