Coinbase vs Gemini: Which Offers Better Security?

Security is one of the most critical factors for crypto investors. With billions in digital assets at stake, choosing a secure exchange can mean the difference between protecting wealth and losing it overnight. In 2025, Coinbase and Gemini are two of the most trusted U.S.-regulated exchanges. But which one offers better security? Let’s break it down.

Regulatory Standing

- Coinbase: Publicly traded on NASDAQ, regulated by U.S. authorities, with transparency reports published quarterly.

- Gemini: Licensed under New York’s BitLicense and subject to one of the strictest regulatory frameworks in the world.

Custody of Assets

- Coinbase: 98% of customer assets are stored in offline cold storage, with insurance for hot wallet balances up to $250M.

- Gemini: SOC 2 certified with institutional-grade Gemini Custody, offering up to $200M in insurance coverage.

Account Security

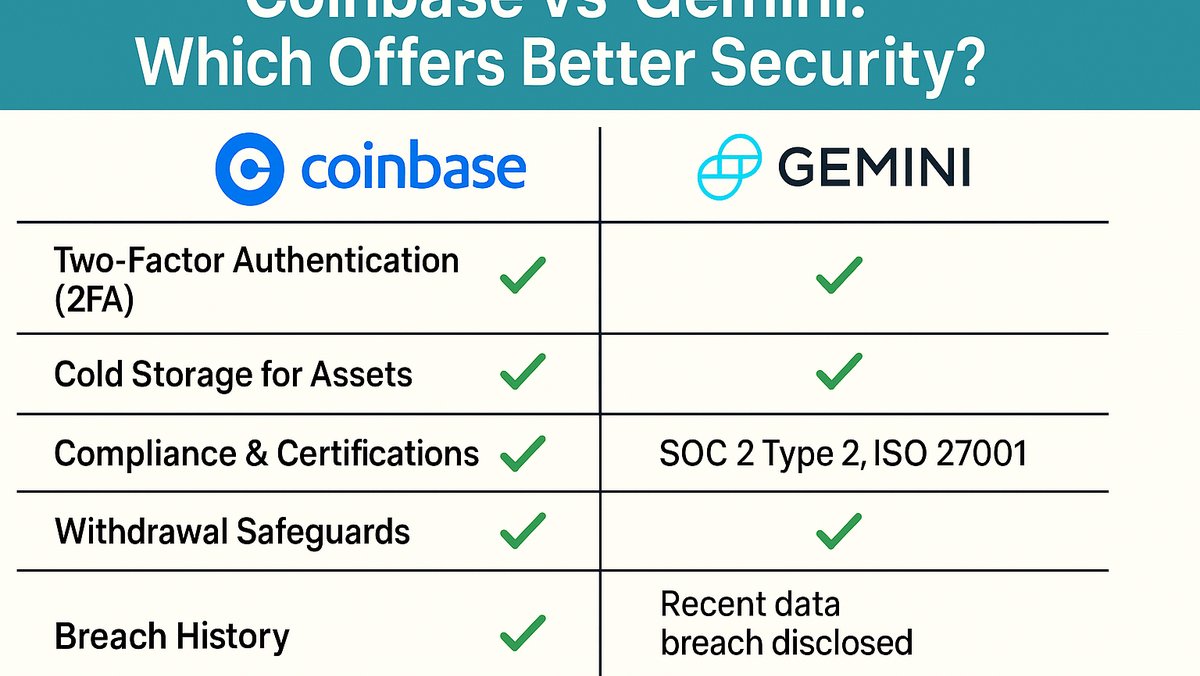

- Both exchanges enforce mandatory two-factor authentication (2FA).

- Support for hardware security keys (YubiKey).

- Biometric logins available on mobile apps.

Transparency and Audits

Gemini is known for undergoing independent SOC 1 & SOC 2 audits, demonstrating strong operational security. Coinbase provides detailed quarterly financial disclosures and has begun implementing proof-of-reserves reporting to improve user trust.

Comparing User Protections

- Coinbase: Backed by corporate balance sheet, FDIC insurance for USD balances, and insured custody.

- Gemini: Strong focus on compliance and institutional protections, particularly for high-net-worth clients.

Which Is Better for Retail Users?

Coinbase is often favored by beginners due to its ease of use, insurance policies, and wide educational resources. Gemini, while slightly more complex, appeals to users who prioritize institutional-grade security and regulatory oversight.

Risks and Considerations

- Both platforms remain custodial, meaning users don’t directly control private keys.

- Regulatory pressures could affect available assets.

- No platform is immune to insider illegal deception or cyber threats.

Investment Outlook

Both Coinbase and Gemini set the standard for security among U.S. exchanges. For beginners and retail investors, Coinbase may be the safer entry point. For institutions and compliance-driven traders, Gemini provides stronger assurances. Ultimately, investors should combine exchange use with self-custody solutions for maximum protection.

Frequently Asked Questions

Which exchange is safer in 2025? Both are highly secure, but Gemini’s regulatory framework is slightly stricter, while Coinbase offers broader insurance protections.

Do they both offer proof-of-reserves? Coinbase has begun rolling out proof-of-reserves, while Gemini continues to undergo third-party audits.

Which is better for institutions? Gemini, due to its focus on custody and compliance.

Which is better for retail? Coinbase, due to its user-friendly interface and insurance-backed hot wallets.