Bitcoin’s Apparent Demand Turns Deeply Negative: A Warning Signal—And a Test of the New Market Structure

Bitcoin’s on-chain “apparent demand” has flipped sharply negative—around -106,000 BTC on a 30-day sum—according to a chart circulated from CryptoQuant. On the surface, that reads like a simple warning: new buying power is drying up. In older cycles, those moments often preceded painful drawdowns because there were fewer natural buyers left to absorb distribution.

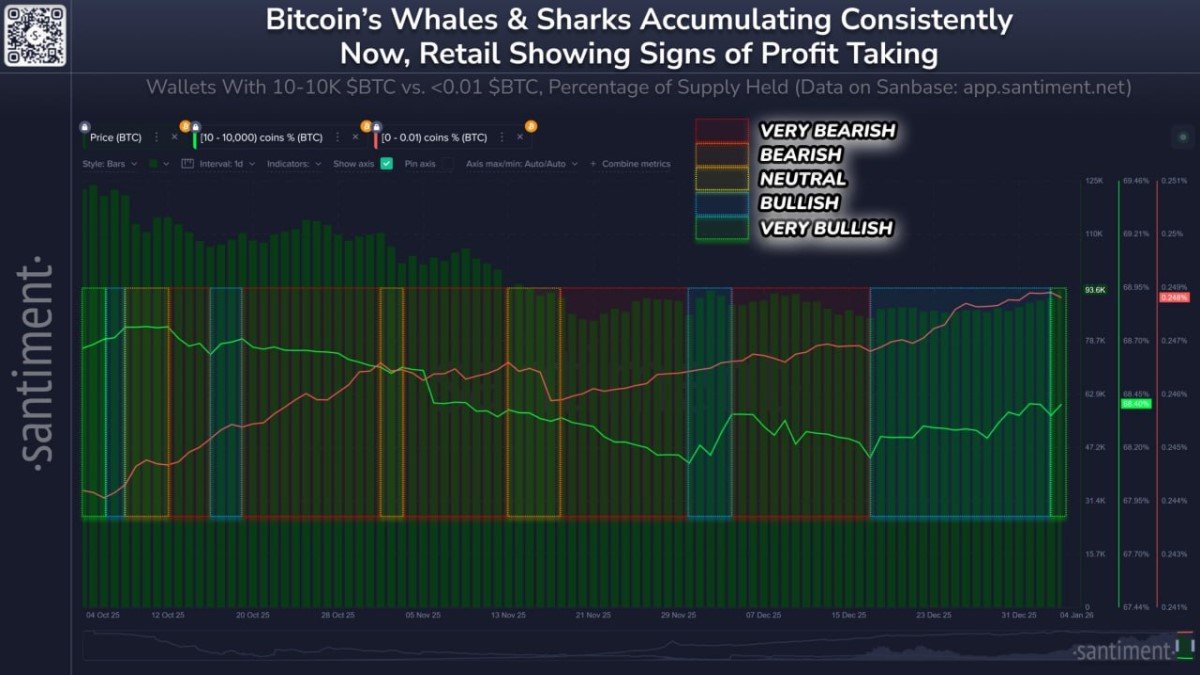

But 2026 is not 2018 or 2022. The same indicator can now describe a very different reality: demand may be less visible, not necessarily absent. ETFs, prime brokers, internalized exchange flows, and derivatives can all “move” exposure without showing up cleanly in a single on-chain gauge. So the right question isn’t “Is the bull market over?” It’s: what kind of market are we in—and what does a negative-demand regime do to price behavior, liquidity, and risk?

What “apparent demand” is actually measuring (and what it is not)

“Apparent demand” is a proxy, not a direct headcount of buyers. In many CryptoQuant-style constructions, it compares newly issued supply (block subsidy) against changes in older, previously inactive supply. When the metric turns negative, it implies that the market is seeing more net “sellable” coin pressure (fresh issuance plus reactivated dormant coins) than the on-chain activity that typically accompanies absorption.

That matters because Bitcoin’s price is ultimately a clearing price for marginal liquidity. If incremental buyers are not stepping in at the same pace, the market becomes more sensitive to shocks: a single wave of profit-taking, a macro headline, or a derivatives cascade can push price further than many participants expect. Still, two critical caveats apply:

• On-chain is not the whole market. ETF creations/redemptions, custodial rebalancing, and internal exchange matching can shift exposure without producing a clean on-chain “demand signature.”

• Negative doesn’t mean “no buyers.” It means net absorption is weaker relative to net supply pressure. Price can still rise in a negative-demand regime if sellers are exhausted and liquidity is thin on the offer.

Why demand can look “weaker” even when adoption is stronger

In early cycles, retail spot buying was the main engine: money hit exchanges, coins moved, and on-chain metrics lit up. Today, the market has multiple parallel rails. A large allocator can increase exposure through an ETF wrapper, synthetic futures positions, or an OTC desk that later nets flows internally. The economic effect is real demand, but the blockchain footprint is diluted.

At the same time, liquidity has become more fragmented. Capital rotates between Bitcoin, altcoins, stablecoins, equities, and even tokenized products faster than before. This fragmentation makes “timing the inflow” harder. What appears as a demand drought can be a period where capital is simply parked in low-volatility structures—waiting for clarity on rates, regulation, or risk events.

Negative demand is less a bearish prophecy than a “behavioral regime”

The biggest mistake traders make with on-chain indicators is treating them like a switch: green means buy, red means sell. In practice, a deeply negative reading is more like a regime label. It tells you how price tends to move: choppier, more headline-sensitive, and often punctuated by short, violent squeezes rather than smooth trends.

In a negative-demand regime, three behaviors become more common:

• Overhead supply becomes “loud.” Investors who bought higher and held through a drawdown may prefer to exit near breakeven. When price revisits those cost bases, selling can appear suddenly—even if sentiment feels calm.

• Leverage matters more than spot. If spot absorption is weak, futures positioning can dominate short-term direction. That can amplify both rallies (short squeezes) and drops (long liquidations).

• Mean reversion strengthens. Instead of long, clean trends, price often oscillates around clusters of value (areas where many coins last changed hands), grinding both bulls and bears.

So why do “apathy zones” sometimes create opportunity?

It sounds contradictory: if demand is weak, why would opportunity increase? Because markets are forward-looking and reflexive. When everyone expects a big move, the market becomes crowded and fragile. When participants grow cautious, positioning often clears out, volatility compresses, and the next directional move can start from a cleaner base.

Historically, the most durable rallies often begin after the market stops caring—when leverage is lower, profit-taking pressure fades, and sellers run out of urgency. A negative-demand reading can coincide with that “boring” phase. The opportunity, then, is not a guarantee of upside. It is the chance to build a better risk-to-time profile—where the same price level can carry less speculative froth.

What could flip the demand story from “weak” to “renewed”

If you want to treat this metric as a dashboard, don’t stare at the number alone. Watch the mechanisms that can turn “weak absorption” into “renewed absorption.” The shift usually comes from a mix of liquidity and narrative—one without the other tends to fade.

Here are the most practical “flip catalysts” to monitor conceptually (without needing a perfect forecast):

• Stablecoin liquidity returning to venues. When stablecoin balances or net inflows into major exchanges rise, it can signal deployable buying power returning—even if Bitcoin on-chain demand still looks muted.

• ETF flow persistence. Two days of strong inflows can move price; months of steady inflows can change market structure by absorbing supply mechanically.

• Falling realized profits during price recovery. If price rises while realized profit-taking stays subdued, it suggests sellers are stepping back—often a prerequisite for trend continuation.

• Short-term holders regaining profitability. When newer buyers are underwater, rallies can stall as they sell into strength. If that cohort returns to profit and doesn’t immediately distribute, the market can build momentum.

How to read the risk: downside is possible, but the “old cycle script” may not repeat

The classic bear-market script was brutal: a euphoric top, a 50%–80% drawdown, and a long winter. Today’s market has new stabilizers—regulated products, corporate treasuries, and a broader base of long-term allocators. That doesn’t eliminate drawdowns, but it can change their shape. Instead of a single deep capitulation, the market can “bleed” through chop, repeatedly punishing impatient positioning.

In that world, a negative-demand signal is best viewed as a reminder: the market will test conviction. Not with a dramatic headline every day, but with time, noise, and false starts. For long-horizon participants, the key is aligning exposure with the ability to sit through that testing without being forced to act.

A simple framework for investors who don’t want to trade every swing

None of this is a call to buy or sell. It’s an educational way to think about decision-making when the data looks “bad” but the structure is evolving. If you’re not trying to time week-to-week moves, your edge is usually in process, not prediction.

Consider three questions:

• What is your time horizon? A negative-demand regime can be miserable for short-term traders and tolerable for multi-year allocators—because the same volatility means different things at different horizons.

• What would force you out? If your position size or leverage would make you sell into stress, then the “opportunity” isn’t opportunity—it’s a trap.

• What evidence would change your mind? Define in advance what data (liquidity returning, volatility resetting, profit-taking easing) would make you more confident, and what data (persistent distribution, rising leverage-driven fragility) would make you more cautious.

Conclusion

A deeply negative “apparent demand” reading—around -106,000 BTC on a 30-day basis—should not be ignored. It is a real warning that net absorption has weakened relative to net supply pressure. But it also shouldn’t be treated as a one-line verdict on Bitcoin’s future. The market now routes demand through multiple rails, and the most important shifts often happen when the tape looks dull and the crowd is hesitant.

In 2026, the smarter interpretation is structural: negative demand increases sensitivity, makes overhead supply louder, and raises the importance of leverage dynamics. Yet the same regime can also set the stage for a healthier reset—if sellers tire and liquidity returns. The takeaway is not “bullish” or “bearish.” It’s that the market’s next move will be decided less by hype and more by who can absorb supply when nobody is excited.

Frequently Asked Questions

Does negative “apparent demand” guarantee a price crash?

No. It indicates weaker net absorption relative to net supply pressure, which can increase fragility. But price can still rise if sellers are exhausted, liquidity is thin, or demand arrives through off-chain channels like ETFs.

Why can on-chain demand look weak even when ETFs are buying?

ETF flows often involve custodial and internalized settlement paths that don’t always register as straightforward on-chain “spot demand.” The economic exposure changes, but the blockchain footprint can be muted or delayed.

What should I watch besides this one metric?

Conceptually: exchange and stablecoin liquidity conditions, persistence of regulated-product inflows, realized profit-taking intensity during rallies, and whether leverage is building faster than spot participation.

Is this a good time to take a long-term position?

This article is educational, not investment advice. In general, periods of low enthusiasm can offer better long-horizon setups—but only if risk is sized appropriately and you can tolerate volatility without forced selling.

Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or legal advice. Crypto assets are volatile. Consider your objectives and risk tolerance, and seek independent professional advice where appropriate.