X’s Built-In Price Tracking Could Turn the Timeline Into a Market Terminal—And That Changes Crypto’s Next Onboarding Wave

Social networks have always shaped markets, but usually through narrative: headlines, memes, influencer threads, and the occasional viral chart screenshot. What’s reportedly being tested inside X is different. Instead of “talking about price” and then leaving the app to check a chart, the chart comes to you—inline, contextual, and one tap away from deeper context.

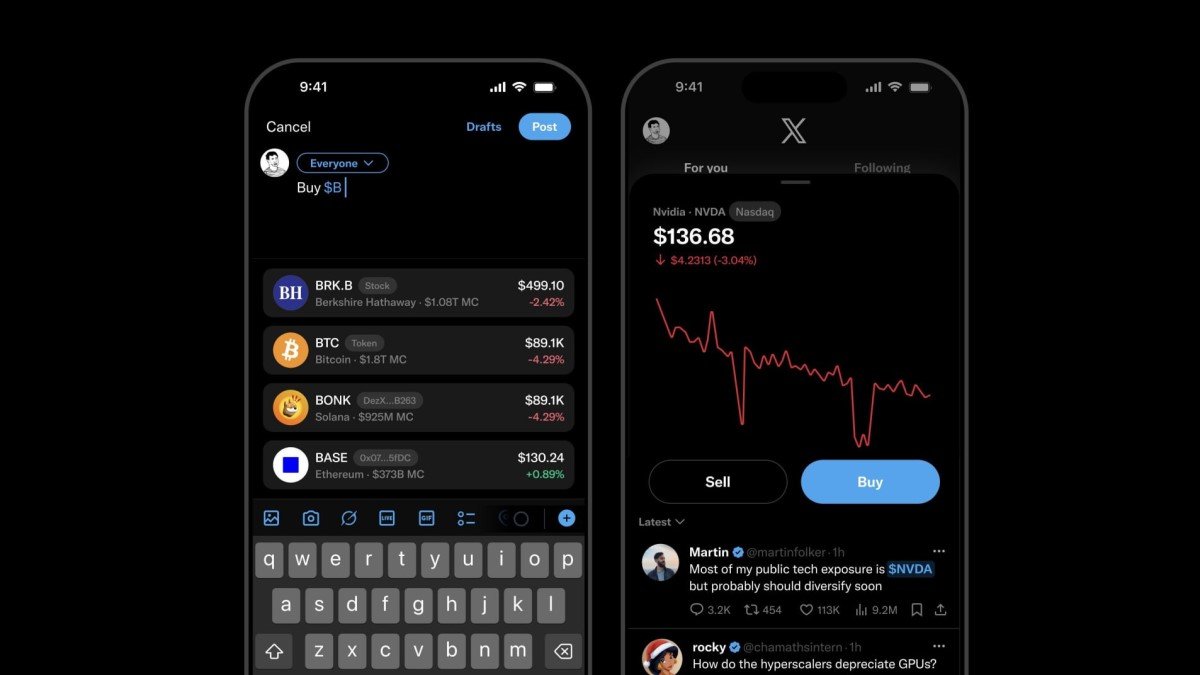

If X rolls out integrated price tracking for both crypto tokens and equities directly from the timeline (screenshots suggest a compact quote card with a chart view and quick actions), it won’t be just another convenience feature. It’s a subtle but meaningful rewiring of the user journey: from attention → curiosity → data → decision. In crypto, where distribution often matters as much as technology, that rewiring could be a bigger catalyst than many “big announcements.”

Why this matters more than a UI tweak

Markets move when friction drops. The friction we rarely talk about is not fees or block times—it’s cognitive friction: switching apps, searching a ticker, deciding which chart to trust, and figuring out whether the move you’re seeing is “real” or just noise. A timeline-native quote card compresses those steps into a single surface where social proof and market data sit side by side.

That compression changes behavior. When information becomes ambient, people don’t research less—they research differently. They react faster, but also in more social ways: copying what looks popular, anchoring to the same visible levels, and “learning” through the feed’s collective attention rather than through deliberate study. The tool doesn’t force speculation, but it can make speculative behavior feel like the default mode of browsing.

Three second-order effects are worth watching:

1) Discovery becomes passive. You won’t need to “go find” $BTC or $NVDA; the feed can nudge you into seeing them repeatedly.

2) Context gets richer (and louder). A quote card embedded under a viral post turns sentiment into an on-screen indicator—useful, but also biasing.

3) The funnel shortens. If price awareness sits where attention already lives, more people will cross the line from “observer” to “participant.”

X isn’t starting from zero: cashtags were the warm-up

Long before “everything app” became a slogan, Twitter’s cashtags ($AAPL, $TSLA, $BTC) trained users to treat the timeline as a semi-financial interface. In recent years, the platform experimented with richer cashtag experiences, including price charts and integrations that route users to external trading partners for certain assets. That history matters because it suggests two things: there is already demand for market data inside the feed, and X has operational experience with the messy edges—data sourcing, latency expectations, spammy ticker behavior, and the tricky line between “information” and “promotion” when the UI nudges users toward action.

So if the next iteration is a more deeply integrated “price tracking” module—watchlists, inline charts, and quote cards that behave like mini-widgets—then what looks like a product feature is also a strategic statement. X wants to own the first screen of financial curiosity, not just the conversation around it.

What could be new this time isn’t the existence of charts—it’s the degree of integration:

• From link-out to stay-in: fewer taps to see the data, fewer reasons to leave.

• From single ticker to habitual tracking: a timeline that learns what you follow can become a personalized market channel.

• From “information feature” to “platform primitive”: once embedded, price cards can power creators, advertisers, and eventually payments or trading flows.

The strategic bet: turning attention into a financial graph

Every “everything app” pitch eventually runs into one reality: payments and investing are not social features—they are regulated, trust-sensitive utilities. You can’t simply add a “Buy” button and expect mainstream adoption. What you can do is build the habit layer first. Price tracking is habit infrastructure. It doesn’t require users to deposit money, pass new verification steps, or even believe in crypto. It just asks them to look.

That matters because the hardest part of financial expansion is not shipping the feature—it’s changing the mental model. If checking a token’s move becomes as normal as checking replies, the platform has made markets part of daily social consumption. Over time, that habit can support multiple monetization paths: premium analytics, creator-driven market communities, affiliate brokerage flows, and eventually in-app rails that feel less like “finance” and more like “native behavior.”

Think of the timeline as a conversion machine:

Awareness (a post mentions $SOL) → Verification (an inline quote card appears) → Social interpretation (replies provide narrative) → Action intent (watch, share, subscribe, or trade elsewhere).

Crypto’s distribution problem—and why X could be a shortcut

Crypto has matured technologically, but onboarding still suffers from a distribution gap. New users often arrive through hype cycles, then bounce when they hit complexity: wallets, keys, bridges, gas, and unfamiliar risk. In parallel, the market has been moving toward clearer rules and more institutional participation in the background. That combination creates a window where consumer-facing simplicity becomes the bottleneck.

Inline price tracking doesn’t solve wallets or custody, but it does solve a more basic issue: getting ordinary users to build “price literacy” without effort. If X truly sits in the hundreds-of-millions monthly active user range (public estimates vary), even a small conversion of casual viewers into regular price-checkers could create a meaningful new layer of market participation. And because the feature covers both stocks and crypto, it can blur the line between the two—making crypto feel less like a separate subculture and more like one more asset class users can observe, compare, and learn about.

That blurring has consequences:

• Retail learns by comparison. Seeing $BTC next to $BRK.B encourages users to think in portfolios, not tribes.

• Narrative competition increases. Crypto no longer competes only with other crypto; it competes for attention against equities, rates, commodities, and macro headlines in the same feed.

• Volatility gets reframed. When both asset types share the same UI, crypto’s swings can feel either thrilling—or unusually risky—depending on what users anchor to.

Risks: when the feed becomes the chart, manipulation gets cheaper

Embedding market data inside a social feed has obvious benefits, but it also reduces the distance between influence and execution. In crypto, where thin-liquidity tokens and meme-driven runs are common, anything that amplifies viral discovery can unintentionally reward the loudest actors. The concern is not that X “causes” manipulation; it’s that a tightly coupled attention-and-data surface can make manipulation more efficient.

When the chart is one swipe away from the post, coordinated campaigns become easier: seed a narrative, create momentum, show the chart as proof, repeat. This is especially sensitive for microcaps, which can swing sharply with modest flows. A responsible rollout would likely need guardrails: clearer labeling for illiquid assets, warnings for extreme volatility, and friction on any action flows that could be interpreted as solicitation.

What good guardrails could look like (without killing the product):

• Transparency: show data source, timestamp, and whether quotes are indicative or tradable.

• Context: display liquidity or volume bands for smaller tokens to reduce false confidence.

• Safety rails: discourage “instant trade” prompts in highly volatile moments; emphasize educational context over calls-to-action.

The regulatory edge: a feature that signals “we’re ready”

Whether you love or hate regulation, markets price legal uncertainty. A platform like X cannot integrate financial surfaces at scale without thinking about licensing, marketing rules, and cross-border constraints. Even if the feature is “just data,” the line between “information” and “promotion” can blur quickly when UX suggests action—especially in crypto, where retail protections are a central policy concern.

That’s why the most interesting reading of this move isn’t “X wants to pump crypto.” It’s that X is positioning to benefit from a world where digital assets are treated as a governed part of the financial system. In such a world, the winners are not only the best protocols—they’re the best distribution channels that can responsibly intermediate attention, identity, and data. If the next few years bring clearer market-structure rules, platforms that already have compliant market surfaces will be better positioned to onboard institutions and consumers without rewiring their product under pressure.

What to watch next: product clues that reveal the real strategy

With platform moves, the strategy is often hidden in the defaults. A single screenshot can’t tell us everything, but rollout details will. If price tracking is truly going public, these are the signals that matter more than headlines.

Key clues to monitor:

• Watchlists vs. one-off cards: watchlists imply habit formation; one-off cards imply novelty.

• Data partners: who supplies quotes reveals the intended market tier (retail-grade vs. professional-grade).

• Coverage breadth: does it focus on majors (BTC/ETH, mega-cap equities) or include long-tail tokens?

• Action layer: are “Buy/Sell” buttons real trades, affiliate links, or placeholders for future rails?

• Creator tooling: can creators embed tickers, build dashboards, or monetize market content natively?

Conclusion

If X succeeds at integrating price tracking into the timeline, it won’t instantly change fundamentals. But it can change something markets often underestimate: how people arrive. The next onboarding wave may not start with a whitepaper or an exchange signup. It may start with a casual scroll, a ticker mention, an inline chart, and a habit of checking “what happened” without leaving the feed.

The upside is real: better market literacy, faster access to information, and a simpler bridge between traditional finance and crypto. The downside is also real: more efficient hype loops, greater influence concentration, and a thinner line between discussion and solicitation. The long-term impact depends on design choices—what the feature defaults to, what it discourages, and how transparently it shows users what they are actually looking at.

Frequently Asked Questions

Is this the same as Twitter/X cashtags?

Not exactly. Cashtags already help users discover tickers and, at times, see market context. The reported “price tracking” concept looks more like a deeper, widget-like integration—closer to a mini terminal embedded into the feed, potentially spanning both crypto and equities.

Does integrated price tracking mean X will offer trading?

Not necessarily. Many platforms show quotes without executing trades. If X adds an action layer, it could be affiliate routing to partners, a standalone wallet, or a future brokerage-style feature. The difference matters for regulation, user protection, and product risk.

Why include both stocks and crypto?

Because it normalizes crypto as an asset class rather than a niche. It also increases engagement: users who come for equities might discover tokens, and vice versa, without needing separate apps or communities.

Could this increase market manipulation?

It could increase the speed and reach of narratives—good and bad. The real question is how the feature is designed: data provenance, latency, liquidity context, and whether the UI encourages impulsive action or informed exploration.

What should users do with this information?

Treat it as a tool for learning, not as a signal to trade. Use integrated quotes to build context, then verify information across multiple sources, understand risks, and avoid making decisions solely based on social momentum.

Disclaimer: This article is for educational purposes only and does not constitute investment advice, financial advice, or a recommendation to buy or sell any asset. Digital assets and equities are volatile and carry risk.