Perp DEX 2026: The Quiet Flip from Exchanges to Embedded Trading

Most market narratives treat perpetual futures as “another crypto product.” That’s like calling an engine “another piece of metal.” Perps are the mechanism that turns speculation into price discovery, hedging into liquidity, and attention into revenue. When perps move, everything else in crypto tends to follow—spot volumes, stablecoin flows, even where wallets and apps decide to integrate.

That’s why 2025 mattered. It wasn’t merely a year where decentralized perpetual exchanges improved their UX. It was the year the center of gravity began shifting away from the classic exchange app and toward something more subtle: trading as a feature embedded inside wallets, stablecoin rails, and on-chain financial workflows. In 2026, Perp DEXs are no longer trying to look like CEXs. They’re trying to make the exchange disappear.

Why Perps Keep Winning the “Where the Money Is” Contest

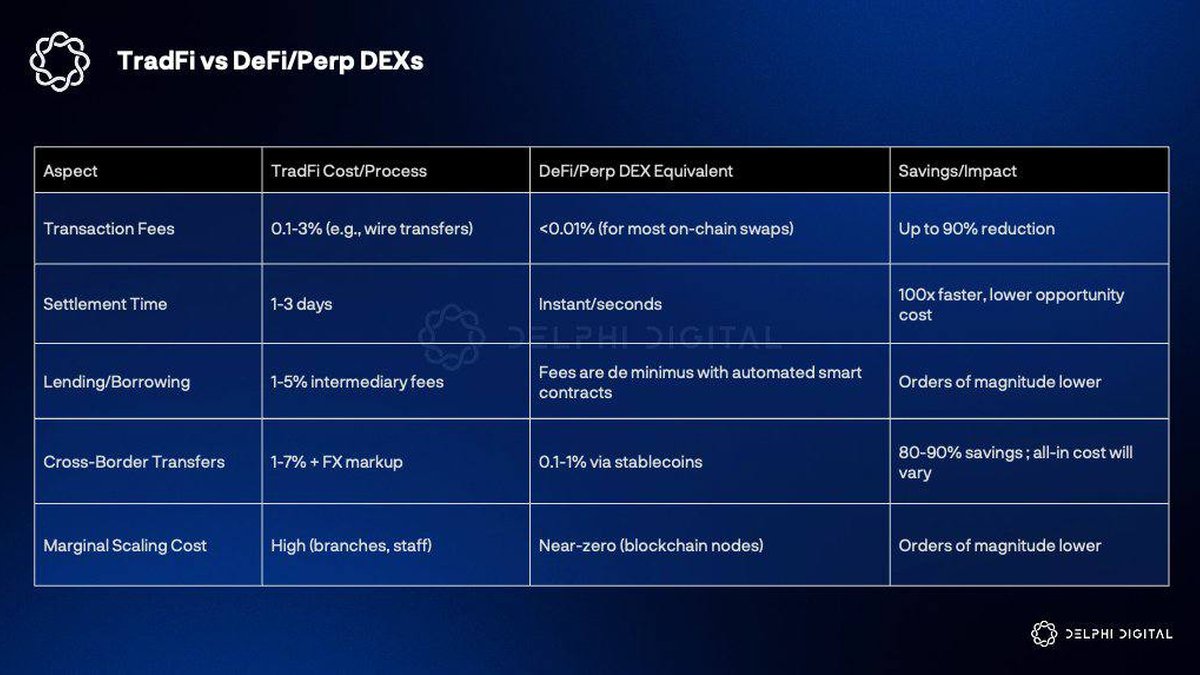

Spot markets are what newcomers see. Derivatives markets are what professionals use to express views, hedge exposure, and manage inventory. In traditional finance, derivatives often exceed spot because they’re capital-efficient: you can take a position without fully paying for the underlying asset. Crypto perps compress that logic even further—24/7, cross-margin, and with a global base of collateral that is itself programmable.

So when people ask why Perp DEXs can outgrow centralized venues on “trust” and “technology,” the deeper answer is that perps are the natural home for the two things crypto does unusually well: composable collateral and automated risk. If your collateral is stablecoins, your settlement is on-chain, and your risk engine is transparent, the exchange becomes less of a brand and more of a protocol primitive—something other products can route into like an API.

Key idea: perps are not a category inside crypto. Perps are the monetization layer for the entire on-chain risk economy.

The UX Breakthrough Wasn’t Faster Charts—It Was Disappearing Complexity

“Better UX” is often misunderstood as prettier interfaces or lower fees. The real UX leap is reducing the number of moments where a user feels they are doing “crypto things.” In 2025, a growing number of users could open a wallet, tap a trading module, and place leveraged positions with a flow that feels closer to a mainstream brokerage than a DeFi dApp from 2021.

This matters because distribution is destiny. A standalone exchange has to acquire users. A wallet is already where users live. If perpetual trading becomes native inside wallets (or even inside other financial apps), perps stop being a destination and become a background capability. The most dangerous competitor to a centralized exchange is not “another exchange,” but a wallet that owns the customer relationship and can route order flow to whichever venue offers the best execution.

In 2026, the question isn’t “Which exchange do you use?” It’s “Which interface owns your order flow?”

What the Market-Share Chart Really Suggests

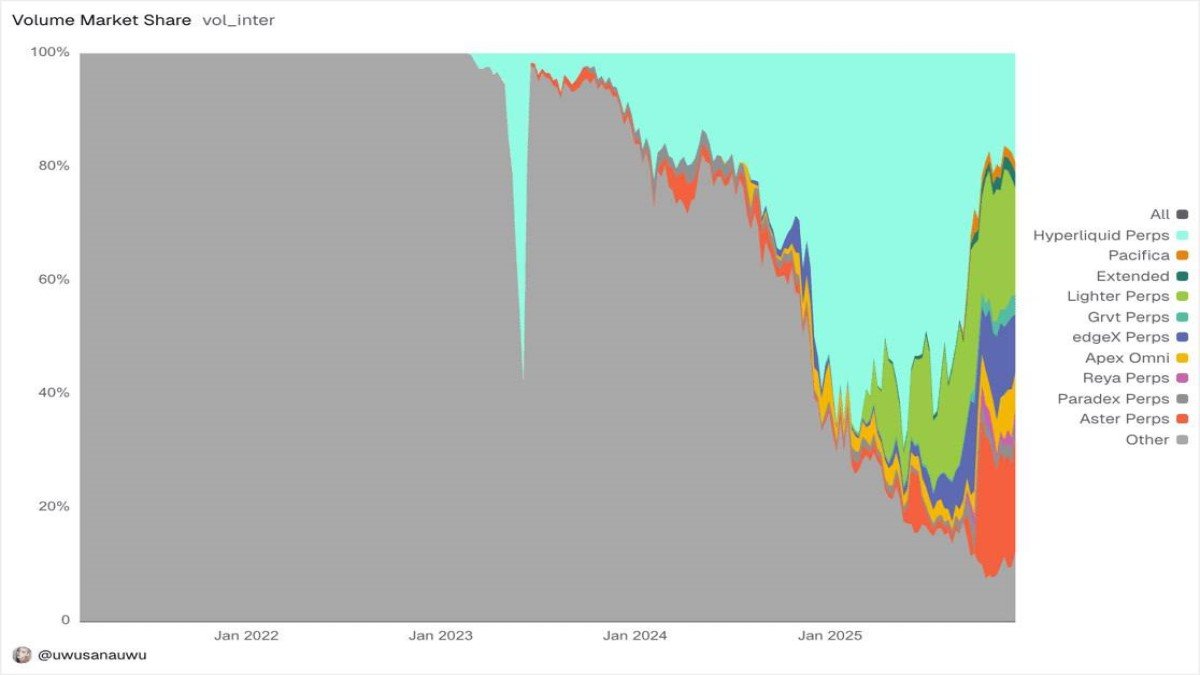

At first glance, the chart below looks like a standard market-share visualization: a large incumbent share compresses over time as multiple new entrants gain ground. But the more interesting story is the shape of the transition. Market share doesn’t shift smoothly—it breaks, fragments, re-aggregates, and then breaks again. That pattern is typical when an industry moves from a brand-led era to an infrastructure-led era.

Notice how the landscape evolves into a multi-venue ecosystem where Hyperliquid Perps becomes a dominant pillar while a long tail of competitors emerges (Lighter, edgeX, Apex Omni, Paradex, Aster, and others). This is not merely competition by marketing. It’s competition by microstructure: latency, liquidation design, margin efficiency, oracle robustness, incentive alignment, and how easily wallets can integrate a venue without inheriting operational nightmares.

Interpretation: the market is not converging on “one DEX to rule them all.” It’s converging on a few liquidity anchors plus a dynamic periphery—exactly what you’d expect when front-ends and wallets begin routing intelligently across venues.

Hyperliquid’s Moat: Liquidity Is the Product, Risk Is the Differentiator

It’s tempting to describe Hyperliquid’s rise as an outcome of “better tech.” But tech is table stakes once the basics work. The real moat is the liquidity flywheel: deep liquidity improves execution; better execution attracts more flow; more flow tightens spreads; tighter spreads attract even more flow. In perps, liquidity isn’t a feature—it’s the product users feel in every click.

The second moat is less visible: risk design. Perps are a risk engine with a trading UI attached. The venue that liquidates cleanly, handles stress well, and avoids cascading failures earns credibility that marketing cannot buy. In 2026, the gap between venues is increasingly measured by how they behave during ugly hours: sudden volatility, oracle shocks, correlated liquidations, or chain congestion. That is where “trust” becomes real and reputations are made or destroyed.

Practical takeaway for observers: when evaluating Perp DEX dominance, focus less on headline volume and more on stress performance, liquidation quality, and integration breadth.

The Challengers Aren’t Copying the Leader—They’re Specializing

New entrants don’t need to beat the market leader at everything. They need one wedge: a specific user segment, a specific chain environment, or a specific product design that becomes the preferred route for a certain kind of order flow. That’s why the “long tail” in the chart is meaningful. It implies a market where multiple business models can coexist, as long as distribution and execution are strong enough.

Some challengers will likely compete through ecosystem alignment—built into a chain’s native liquidity and incentives. Others will compete through product surface area: tokenized stocks, specialized indices, prediction-market integrations, or portfolio margining that feels closer to professional prime brokerage than retail trading. The goal isn’t to be the biggest exchange. The goal is to become the default venue for a particular kind of trade.

Watch for two forms of specialization: (1) venues that win by being “the fastest and simplest inside a wallet,” and (2) venues that win by offering markets and collateral options others cannot safely support.

2026’s Real Shift: From Exchange Wars to Stack Wars

The most underappreciated evolution is that “the exchange” is becoming modular. The stack can be separated into: the interface (wallet/app), the routing layer (best execution), the venue (order book/AMM hybrid), the risk engine (margin/liquidations), the collateral layer (stablecoins/RWAs), and settlement (on-chain finality). Once these layers are interoperable, power shifts away from the exchange brand and toward whoever controls the top of the funnel.

This is why partnerships matter so much: wallets integrating perps; stablecoin issuers enabling collateral; custodial-grade infrastructure making institutions comfortable; and on-chain analytics shaping risk policies in real time. In that world, a Perp DEX can be both a destination and a liquidity back-end. And a wallet can become both a user’s home screen and an execution router. The winners will be the teams that think like market-structure engineers, not just product designers.

Counterintuitive conclusion: the future of Perp DEX dominance may be decided by wallets and collateral rails as much as by matching engines.

The Risks People Underprice When Everything Feels “Too Smooth”

A market built on leverage is always stable—until it isn’t. Perp DEXs reduce certain trust issues (custody risk, opaque exchange practices), but they introduce other failure modes. Smart contract vulnerabilities, oracle manipulation, governance risk, and unexpected chain-level congestion can all become systemic during high volatility. Even when contracts are secure, liquidation design can amplify drawdowns if too many traders share the same positioning and collateral.

There is also behavioral risk. Seamless embedded trading lowers friction, which can encourage overtrading and excessive leverage. The more “invisible” the exchange becomes, the easier it is to forget you’re using one of the most aggressive instruments in finance. That’s why the maturation of Perp DEXs should be paired with better education, clearer risk disclosures, and guardrails that help users understand liquidation mechanics rather than treating them as mysterious penalties.

Educational note: decentralization changes who you trust, not whether risk exists.

Conclusion

The Perp DEX story in 2026 is not simply “DEXs beat CEXs.” It’s a structural shift in where trading lives and how it’s distributed. The exchange is turning into infrastructure; the wallet is turning into a terminal; and liquidity is turning into the core product. Hyperliquid’s leadership—alongside an expanding field of specialized competitors—signals that we’re entering an era where market structure, risk engineering, and distribution partnerships matter more than slogans about decentralization.

If 2025 was the year Perp DEXs proved they can compete, 2026 looks like the year they start defining the default architecture of crypto trading—quietly, through integrations, execution quality, and the relentless gravity of liquidity.

Frequently Asked Questions

What makes perpetual futures different from spot trading?

Perpetual futures (perps) let traders gain exposure with margin, often making them more capital-efficient than spot. They also enable hedging and shorting more easily, which tends to concentrate sophisticated activity in derivatives markets.

Why does wallet integration matter so much for Perp DEX growth?

Wallets already sit at the top of the user funnel. When perps are embedded inside wallets, exchanges don’t need to “win users” one by one—order flow can be routed naturally from where users already store assets and manage positions.

Does higher Perp DEX volume automatically mean lower risk than CEXs?

No. Custody risk can be reduced in DeFi, but other risks appear: smart contract exploits, oracle issues, governance decisions, and chain congestion. Risk changes shape rather than disappearing.

Why does liquidity matter more than marketing in perps?

Because perps are extremely sensitive to execution quality. Deep liquidity typically improves slippage, reduces liquidation spikes, and attracts more flow—creating a feedback loop that can be hard for smaller venues to break.

Is the market likely to converge to one dominant Perp DEX?

The chart dynamics suggest partial concentration around major liquidity anchors, alongside a long tail of specialized venues. As routing and wallet distribution improve, multi-venue ecosystems become more plausible.