Binance Sees $670M Stablecoin Net Inflow After a Weak December: Why “Dry Powder” Is Real—But Not a Buy Button

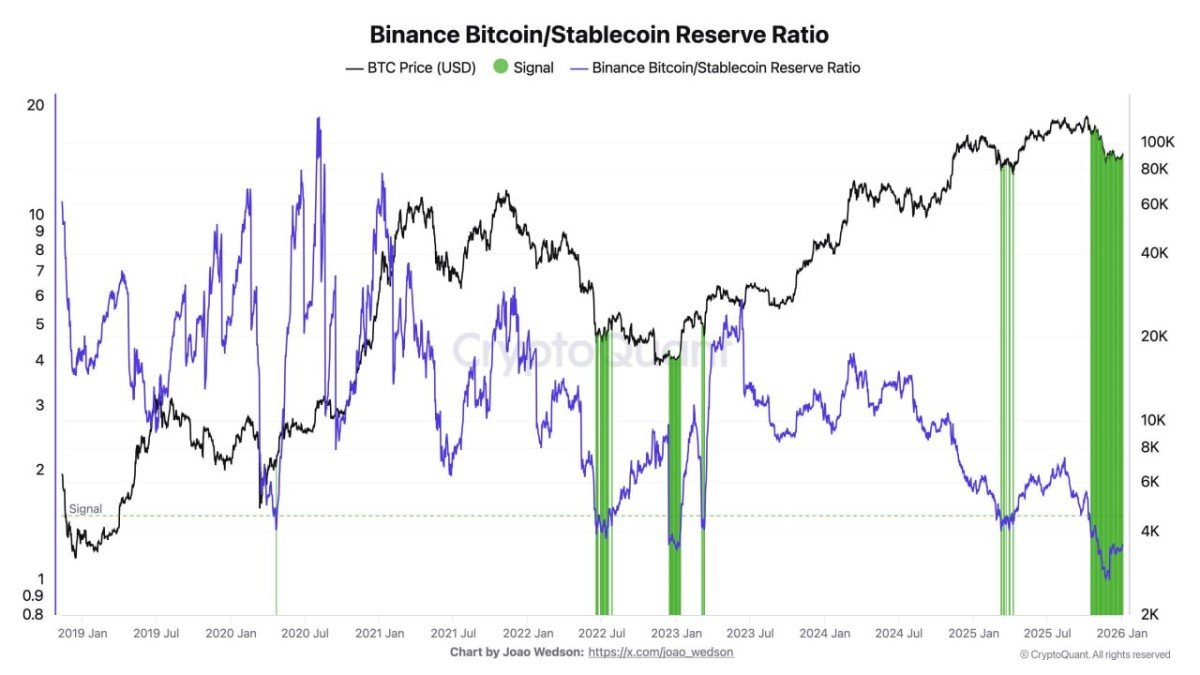

Stablecoin flows are one of the few crypto indicators that feel almost physical. Price can be narrative-driven, but stablecoins are “cash-like” units that people actually deploy, park, and recycle. So when Binance prints a clear reversal—after a gloomy December with roughly $1.8B net outflow, January opening with $670M net inflow in a week—it’s tempting to translate it into a simple sentence: buyers are back.

That sentence is directionally useful, but incomplete. The deeper truth is that stablecoins on exchanges behave less like “money arriving to buy spot” and more like optionality arriving to choose: spot buys, derivatives collateral, basis trades, OTC settlement, yield rotation, or even just operational treasury movement. If you read netflow as a single-purpose signal, you will often be right at the wrong time—correct on direction, wrong on mechanism.

The December Drain vs. the January Refill: What Changed?

From your notes, November already hinted at a slowdown: around $1.7B net inflow—positive, but not the kind of relentless liquidity surge that powers a straight-line market. Then December flipped into a noticeably defensive posture, with about $1.8B net outflow. That’s not just a number; it’s a statement about preferences: market participants chose to hold stablecoins outside Binance rather than on Binance.

January’s early rebound matters because it reverses that preference. In one week, Binance logged more than $670M net inflow. Even if that’s smaller than the big monthly swings we’ve seen historically, the timing is what stands out: it’s not a late-cycle “everything is euphoric” inflow—it’s an early-month re-risking after a cautious December. That makes it more about positioning and optionality than about FOMO.

• December outflow usually clusters around risk reduction. Traders pull stablecoins to self-custody, redeploy to other venues, or simply step back when volatility or headlines feel asymmetric.

• January inflow often reflects re-engagement. New capital comes in, but just as often, existing capital returns to the venue where it can be used most flexibly.

The key: a refill doesn’t guarantee a rally. It indicates that the market is reloading its toolkit.

Why Stablecoins Flow to Exchanges: “Buying Power” Has Multiple Jobs

Stablecoins arriving on Binance look like demand because they can become immediate spot bids. But Binance is not only a spot marketplace; it’s also a derivatives and collateral engine. The same USDT or USDC can support leveraged exposure, hedge structures, and market-making inventory. In other words, stablecoins are not only spending power; they are margin power.

Here are four common “jobs” that exchange stablecoins perform. None of them require a simple spot buy the moment funds arrive.

1) Spot buying and laddered bids. The obvious one—but sophisticated buyers often scale in. They deposit first, then wait for liquidity pockets, news catalysts, or technical confirmations before deploying.

2) Derivatives collateral and basis trades. Inflows can rise when traders want margin for perpetuals/futures, or when they run cash-and-carry strategies (long spot, short futures). That can increase volume without translating into immediate net spot demand.

3) OTC settlement and internal treasury ops. Institutions may route stablecoins through major venues for settlement efficiency, compliance processes, or counterparty access—even when their end action is not “buy crypto now.”

4) Yield rotation inside the exchange ecosystem. Depending on products available, some flows reflect stablecoin yield hunting, not directional crypto exposure. Liquidity is still “present,” but it’s not necessarily “risk-on.”

This is why stablecoin netflow is best treated as a capacity indicator: it tells you how much energy is in the system, not how that energy will be used.

Binance-Specific Netflow: The Good Signal—and the Trap

Exchange-specific data is powerful because it narrows the lens: you’re not looking at “crypto liquidity in general,” you’re looking at liquidity choosing a particular execution venue. Binance is a global liquidity hub, so stablecoins moving there often matter for price discovery.

But the trap is that exchange netflows can be distorted by “non-market” behavior: wallet reshuffling, custody upgrades, compliance-driven migrations, and ecosystem incentives. A large deposit can reflect a change in how funds are stored rather than a change in risk appetite. Similarly, a large withdrawal can be operational, not bearish.

To avoid the trap, treat Binance stablecoin netflow as a conditional signal that needs a second confirmation. The best confirmations are not narratives—they’re microstructure.

• If inflow is paired with rising derivatives open interest and stable/positive funding, it may be collateral for leveraged exposure.

• If inflow is paired with improving spot order book depth and rising spot volume, it looks more like genuine spot demand.

• If inflow is paired with flat activity and no spread tightening, it may be precautionary parking or operational movement.

In short: netflow tells you “ammo arrived.” Market microstructure tells you “ammo was fired.”

A More Useful Mental Model: Stablecoins as “Liquidity Temperature”

Most traders want a binary answer: bullish or bearish. Stablecoin netflow doesn’t reward binary thinking. A better approach is to treat it like temperature. December’s net outflow wasn’t “the market is dead.” It was “the market is cold.” Cold markets can rally—sometimes violently—because positioning is light and shorts get punished. But cold markets can also stay cold because nobody wants to take the first risk.

January’s $670M net inflow is a warming signal. Warming doesn’t guarantee summer; it just tells you the environment is becoming more conducive to risk. That matters because many rallies don’t start with euphoria—they start with permission: permission for market makers to tighten spreads, permission for traders to re-leverage, permission for sidelined capital to re-enter without feeling late.

If you’re trying to interpret the next move, the best question is not “Will this inflow pump BTC?” The best question is: What kind of market does this inflow make possible?

What Would Make This Signal Stronger (or Weaker) From Here?

To keep the analysis practical and brand-safe, here is a checklist of “follow-through” conditions you can watch conceptually—without turning the article into a trading instruction sheet.

Stronger interpretation (more constructive):

• Stablecoin inflow continues for multiple weeks rather than printing a one-off spike.

• Spot volume and order book depth improve alongside inflows (liquidity becomes usable, not just present).

• Volatility remains contained while price grinds higher (a sign that supply is being absorbed rather than chased).

Weaker interpretation (more cautious):

• Inflows rise, but BTC fails to reclaim key ranges and repeatedly rejects (liquidity may be used for hedging, not buying).

• Derivatives leverage expands too quickly (the market becomes fragile, vulnerable to liquidation cascades).

• Netflows flip back negative shortly after (suggesting opportunistic parking rather than committed positioning).

Notice what’s missing: none of this requires predicting a single candle. It’s about identifying whether liquidity is becoming structural or staying tactical.

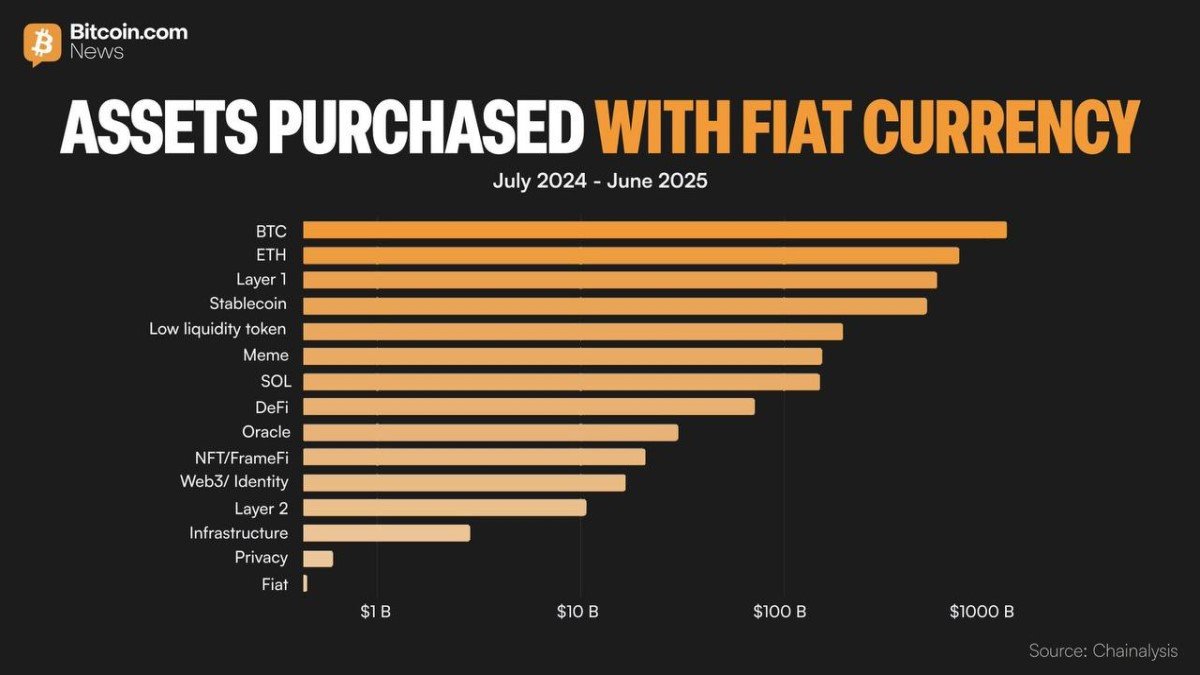

Why This Matters in 2026: The Market’s “Cash Layer” Is Getting More Strategic

One underappreciated shift is that stablecoins are no longer only a crypto convenience; they are becoming the market’s cash layer. That cash layer now serves both retail and institutions, and it travels across venues based on cost, speed, compliance comfort, and product access. In that world, stablecoin netflow is not just a speculative metric—it’s a window into how capital allocators are routing liquidity through the system.

December’s outflow and January’s inflow can be read as a small version of a larger behavior: liquidity is increasingly mobile, and it moves to where optionality is highest. Binance, for better or worse, remains one of the places where optionality concentrates—spot, derivatives, deep pairs, and global reach.

So a $670M net inflow in a week is meaningful not because it guarantees upside, but because it suggests the market is choosing to keep more of its “cash layer” close to execution. That’s how trends become possible.

Conclusion

The clean headline is simple: after a soft December with roughly $1.8B in stablecoin net outflows, Binance started January with more than $670M in net inflows within a week. The deeper takeaway is better: this is a liquidity warming signal—capital moving back toward execution and optionality.

But optionality is not direction. Stablecoins arriving on Binance can become spot bids, but they can also become collateral, hedges, or settlement balances. To read this well, pair the flow signal with microstructure: spot depth, volume quality, and derivatives leverage. The market doesn’t move because “money arrived.” It moves when money stays, and then money gets used.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment, legal, or tax advice. Nothing herein is a recommendation to buy, sell, or hold any asset. Digital assets are volatile and carry risk, including the risk of total loss.

Frequently Asked Questions

Does a stablecoin inflow to Binance mean Bitcoin will go up?

Not automatically. It indicates liquidity is available on the venue, but that liquidity can be used for spot buying, derivatives collateral, hedging, or settlement. Think “capacity increased,” not “price must rise.”

Why would stablecoins leave an exchange during a weak month?

Outflows often reflect risk reduction, self-custody preference, reallocations to other venues, or operational treasury moves. In defensive periods, participants prefer flexibility and lower exposure to exchange-specific risk.

What makes Binance stablecoin netflow important compared to other exchanges?

Binance remains a major global liquidity hub. When liquidity chooses Binance, it often signals a preference for deep execution and product breadth. Still, it should be confirmed with market activity metrics.

What’s the best “confirmation” for stablecoin inflow?

Look conceptually for improved spot order book depth, healthier spot volume, and a measured (not explosive) rise in derivatives activity. The goal is to see liquidity become usable and persistent.

Could the $670M inflow be ‘noise’?

Yes. A single week can be tactical. The signal strengthens if inflows persist and coincide with microstructure improvements rather than fading quickly or being offset by rising leverage fragility.