Bitcoin’s Profit-Taking Pressure Is Cooling—A Subtle Reset That Matters More Than the Breakout

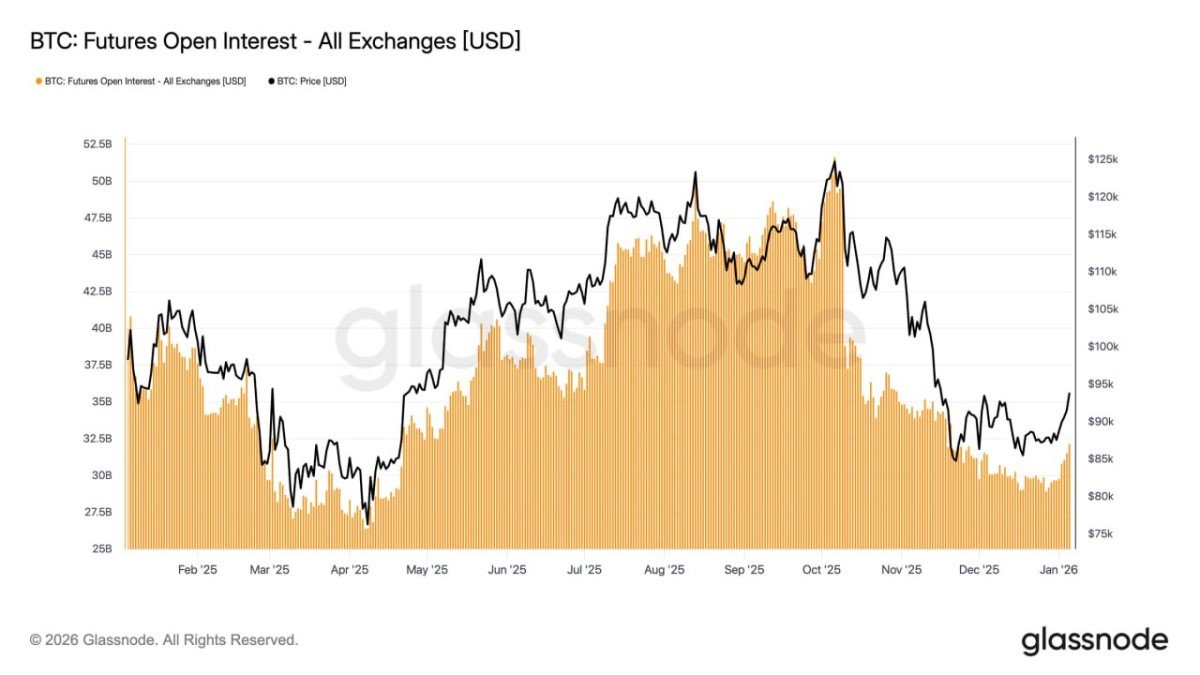

Bitcoin didn’t just move higher at the start of 2026—it moved higher with less drama than many expected. After compressing around the $87K region, price pushed above $94K, and the breakout felt unusually “clean.” In crypto, clean breakouts are rare because markets usually carry baggage: trapped sellers, late leverage, or cohorts waiting to cash out the moment price rebounds.

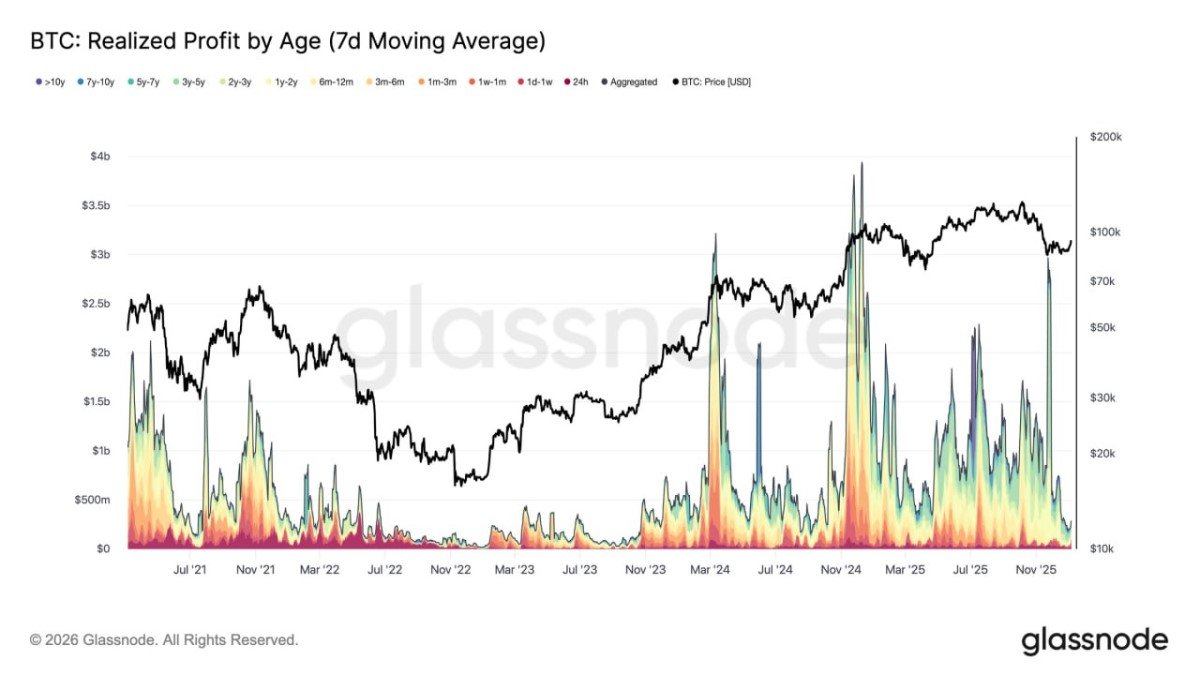

The chart shared from Glassnode’s on-chain view—Realized Profit by Age (7-day moving average)—suggests that one big piece of that baggage got lighter. Profit-taking pressure appears to have cooled materially into late December 2025, which can change how price behaves in the following weeks. Not because selling disappears, but because the market’s most persistent form of selling—steady distribution into strength—becomes less constant.

Why Realized Profit Is a Better “Sell Pressure” Lens Than Headlines

Most market commentary treats sell pressure as a vibe: “people are taking profits,” “whales are selling,” “retail is euphoric.” Realized profit is more concrete. It measures profits that were actually locked in when coins moved on-chain at a price higher than their cost basis. It’s not perfect—wrappers and custodians can blur the picture—but it’s closer to the real engine of supply than sentiment alone.

Think of realized profit like heat leaving an engine. When it’s running hot, the market is constantly converting paper gains into cash. When it cools, two things can be true at once: (1) fewer holders feel urgency to sell, and (2) the market needs less incremental demand to keep price supported. That second point is underappreciated—price can rise simply because it’s no longer fighting a daily wall of distribution.

The Late-December Reset: When “Less Selling” Starts to Matter

Based on the figures you provided alongside the chart, the 7-day SMA of realized profit fell sharply into late December 2025, reaching roughly $183.8M per day. Earlier in Q4/2025, it was often above $1B per day. Even allowing for normal data noise, that’s a meaningful cooldown: the market went from a “cash-out climate” to something closer to a “wait-and-see climate.”

This is the kind of change that doesn’t feel exciting on social media—there’s no meme for it—but it’s the kind that can quietly improve price’s ability to trend. If the market was previously spending weeks trying to climb while holders repeatedly sold into every bounce, the removal of that friction can make a breakout look surprisingly effortless. It’s not magic; it’s simply less overhead supply.

Why the Age Breakdown Matters: Who Stops Selling Changes the Outcome

The most useful detail in the Glassnode visualization isn’t just the total realized profit—it’s the segmentation by coin age. When longer-term holders reduce selling, the market’s supply dynamics can shift in a way that short-term traders can’t replicate. Short-term holders can stop selling today and start again tomorrow. Long-term cohorts, when they choose not to distribute, often do so because their time horizon or mandate is different.

Put differently: if the cohort that typically funds rallies by selling into them begins to step back, price can travel further on the same demand impulse. That doesn’t mean “only up.” It means rallies are less likely to be capped immediately by systematic distribution. In more mature cycles, that often produces a different texture: fewer sharp rejections at prior highs, more grinding continuation—until liquidity conditions change.

The Breakout Above $94K: A Symptom, Not the Main Story

It’s tempting to treat the $87K-to-$94K move as the headline and everything else as justification. But on-chain often works in reverse: the “breakout” is the visible symptom of invisible conditions improving underneath. If profit-taking genuinely reset, the market effectively reduced one of its main headwinds from Q4.

There’s also a psychological layer. When holders are realizing less profit, it often reflects a market that is less euphoric and more selective. That can be healthier than it sounds. Euphoric markets generate profits quickly, but they also distribute aggressively, and the rally becomes fragile. A market that advances while profit-taking cools can be telling you that conviction is rising faster than greed—at least for a period.

Why This Doesn’t Automatically Mean a Straight-Line Rally

Here’s the part many news-style summaries skip: less profit-taking removes friction, but it doesn’t create fuel. If the broader market remains “defensive,” as you noted, then fresh demand may still be too thin to absorb a sudden surge of selling should it reappear. This is how markets produce sharp, confusing pullbacks even in structurally improving conditions—liquidity dips, not narratives, become the trigger.

In practice, that means the downside risk shifts rather than disappears. Instead of distribution-led declines (steady selling from holders), the bigger risk becomes liquidity-led declines: leverage flushes, collateral tightening, or cross-venue deleveraging. The bullish read is “headwind removed.” The sober read is “now price depends more on liquidity quality.”

A Practical Framework: Three Ways This Setup Can Evolve

Markets rarely pick one clean path; they oscillate between regimes. If realized profit remains muted, you can think in scenarios—not predictions. This keeps the analysis educational and avoids turning a data point into a trading command.

Scenario A — Controlled continuation: realized profit stays relatively low, and price trends with shallow pullbacks. This is the “reduced friction” regime where each dip finds demand because overhead selling is limited.

Scenario B — Range with churn: realized profit remains low, but price stalls because fresh demand is insufficient. The market digests gains, and the rally becomes time-based rather than price-based.

Scenario C — Liquidity shock pullback: realized profit is low, yet price drops quickly due to leverage or macro liquidity stress. This can look bearish on the chart, but it’s a different animal than a long distribution phase—often faster, sometimes reversible, always emotionally loud.

Conclusion: The Market May Be “Resetting” More Than It’s “Rallying”

The cleanest insight from the Glassnode view is not simply that Bitcoin went up—it’s that the market appears to be doing so with reduced profit-taking intensity, especially into late December. If the reported drop in realized profit (7D SMA) from the >$1B/day zone in Q4/2025 to roughly ~$183.8M/day holds as a real signal, it implies the distribution pressure that capped price in the prior quarter has eased.

That’s constructive for the medium term, but it doesn’t eliminate risk. It changes the battlefield: less friction from sellers, more sensitivity to liquidity conditions. In 2026, the winners are rarely the loudest forecasters—they’re the ones who understand which force is currently dominant: distribution, or plumbing.

Frequently Asked Questions

Does falling realized profit mean people stopped selling?

Not necessarily. It usually means fewer coins are being sold at a profit relative to their cost basis, or that profitable spending is less intense. Selling can still occur—especially from coins near break-even—without showing the same realized-profit spike.

Why does coin age matter in realized profit charts?

Because different cohorts behave differently. Short-term holders often react to price and narrative quickly. Longer-term holders tend to distribute more selectively. When long-term cohorts reduce selling, overhead supply can shrink and rallies can become less “capped.”

Is this a guarantee Bitcoin won’t dump?

No. It’s a structural observation, not a promise. Lower profit-taking can support trend behavior, but sharp drawdowns can still happen if liquidity tightens, leverage unwinds, or broader risk markets reprice suddenly.

What’s the biggest risk if profit-taking stays low?

Paradoxically, the biggest risk becomes liquidity: thin demand and leverage-driven moves. A market can be structurally healthier yet still vulnerable to sudden shocks if the liquidity environment is fragile.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment, legal, or tax advice. Nothing herein is a recommendation to buy, sell, or hold any asset. Digital assets are volatile and carry risk, including the risk of total loss.