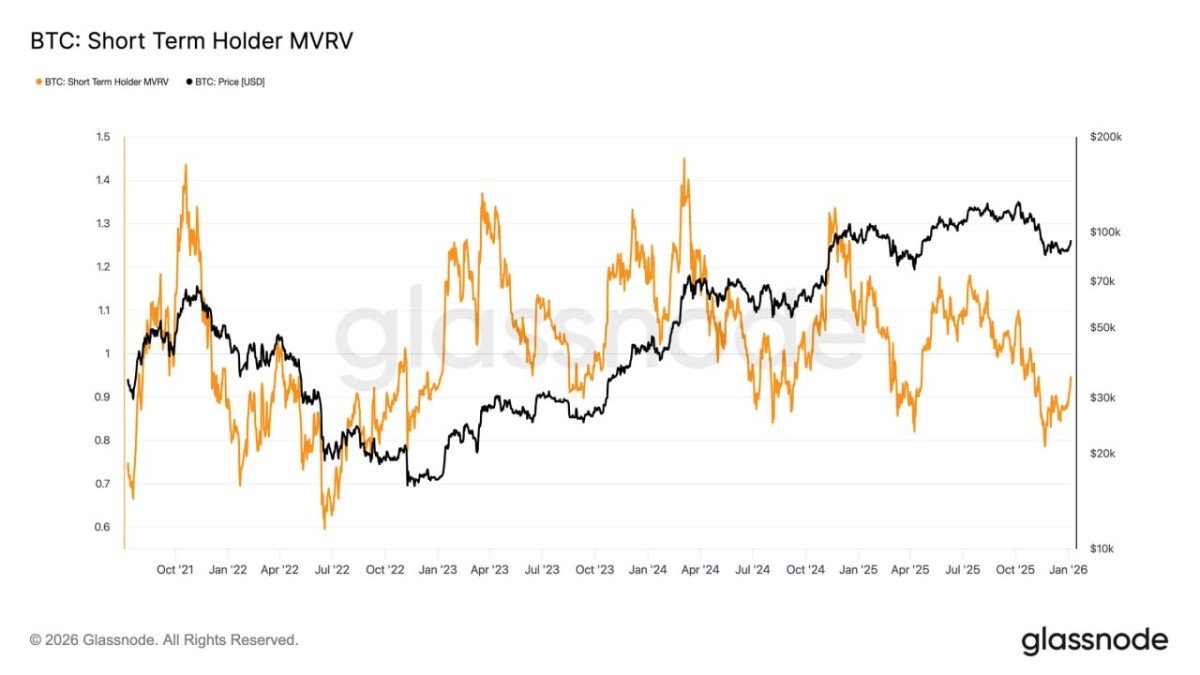

Bitcoin’s Short-Term Holders Are Still Underwater: Why STH MVRV < 1 Can Keep the Market ‘Headline-Sensitive’

Some market phases feel calm because the fundamentals are calm. Others feel calm because investors are comfortable. And then there are phases like this—where the market can look stable on the surface while remaining emotionally fragile underneath. Short-Term Holder MVRV (STH MVRV) is one of the cleanest ways to measure that fragility, because it asks a simple question: are the newest participants winning or losing?

The current read is still below 1 (roughly around ~0.8 in your note). That means the average short-term holder remains underwater. In practical terms, a large slice of the market is not thinking about “upside potential”—they’re thinking about damage control. That’s why this metric often correlates with a market that’s hypersensitive to headlines.

What STH MVRV Measures (Without the Buzzwords)

MVRV compares two values:

• Market Value (MV): the current value of coins at today’s price.

• Realized Value (RV): the value of those coins at the price they last moved (a proxy for cost basis).

STH MVRV applies this specifically to short-term holders—typically coins held for a short holding period (commonly around 155 days, depending on the standard used). This group matters because they are often the cohort that reacts first to price moves and news. They’re not “dumb money” by definition; they’re simply closer to their entry point, more exposed to regret, and more likely to have tighter risk limits.

How to interpret the threshold:

• STH MVRV > 1: short-term holders are in profit (a psychological cushion forms).

• STH MVRV < 1: short-term holders are in loss (a psychological debt accumulates).

That “debt” doesn’t show up on a balance sheet—but it shows up in behavior.

Why a Market With Underwater Short-Term Holders Feels Like It’s Always One Headline Away

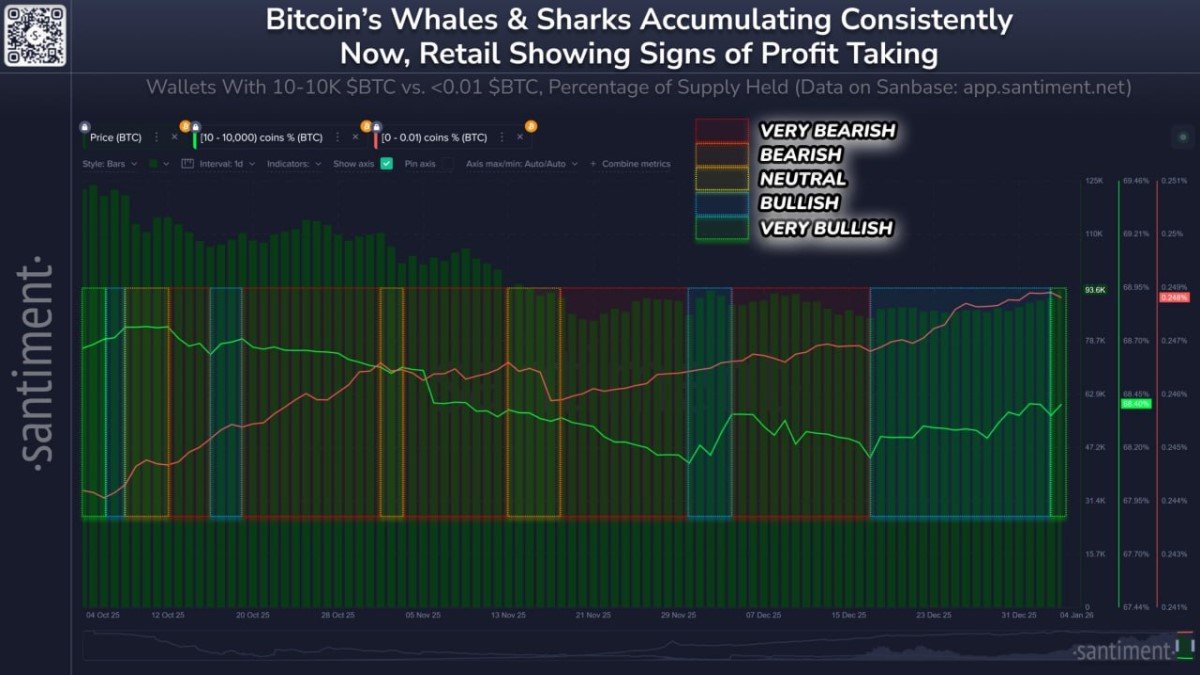

When STH MVRV is below 1, rallies often run into a very specific type of supply: relief selling. Not the euphoric profit-taking you see at peaks, but the quieter, more mechanical selling that happens when people finally get a chance to reduce risk without crystallizing a large loss.

Think of it as a hidden rule many investors follow, consciously or not: “If I can get close to breakeven, I’ll reassess.” When thousands (or millions) of participants share that rule, it becomes market structure.

This is why STH MVRV < 1 can keep sellers ‘in control’ even during rebounds:

• Rallies become exit ramps. Up-moves are used to lighten bags rather than add risk.

• Bad news hits harder. Losses reduce patience; investors cut faster to avoid deeper drawdowns.

• Good news has diminishing returns. Even positive catalysts can be sold into if the crowd wants out.

The 0.8 Reading: Not “Bullish” or “Bearish,” but a Specific Kind of Market

You noted STH MVRV has recovered toward ~0.8, but remains under 1. That nuance matters. A move from very depressed levels toward 0.8 can reflect improving conditions—price has rebounded, stress is easing, forced sellers may be fewer. But being below 1 still means the market is missing a key ingredient for sustained momentum: broad short-term profitability.

When a market climbs while many recent buyers are still losing, you often get what traders call a “climb of worry,” but on-chain it looks more like a climb of liability: the higher price goes, the more supply becomes tempted to sell simply because it hurts less than yesterday.

This is also why narratives like “it’s a bull trap” become louder in these regimes. Retail doesn’t need to be correct to be impactful—retail only needs to react similarly at the same time. And underwater positioning is the perfect soil for synchronized fear.

Why Getting Back Above 1 Changes the Game (Behaviorally, Not Magically)

Markets change character when STH MVRV crosses above 1 and stays there. Not because “the indicator says so,” but because the average short-term participant becomes psychologically less forced. Profit creates optionality. Optionality creates patience. Patience reduces reflex selling. And reduced reflex selling is, effectively, more liquidity for upside.

Common behavioral shifts when STH MVRV sustains > 1:

• Dips get bought faster. Investors are less afraid to add when they’re already winning.

• Headlines lose power. Negative news still matters, but reactions are often shorter and shallower.

• Trend becomes cleaner. Fewer sudden dumps from breakeven sellers means fewer whipsaws.

That’s why your condition—“if it doesn’t return above 1 soon”—is a useful framing. It’s not a prediction; it’s a description of what kind of fuel the market currently lacks.

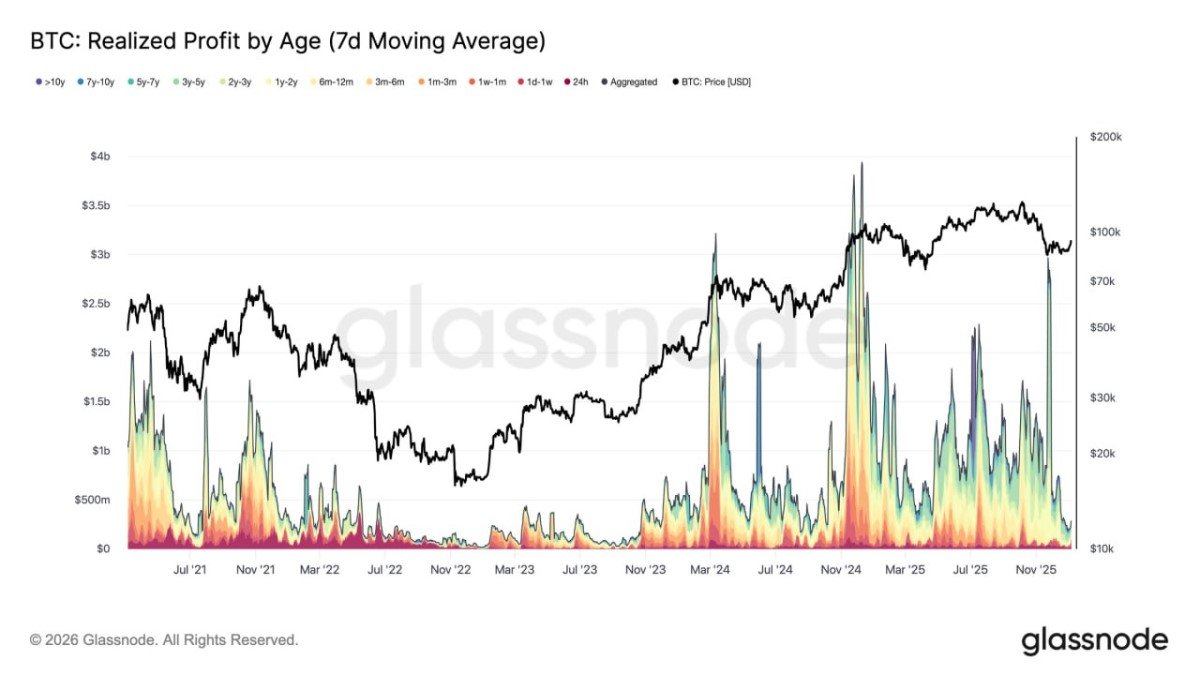

How STH MVRV Interacts With Other On-Chain Structure (The Missing Layer in Most Writeups)

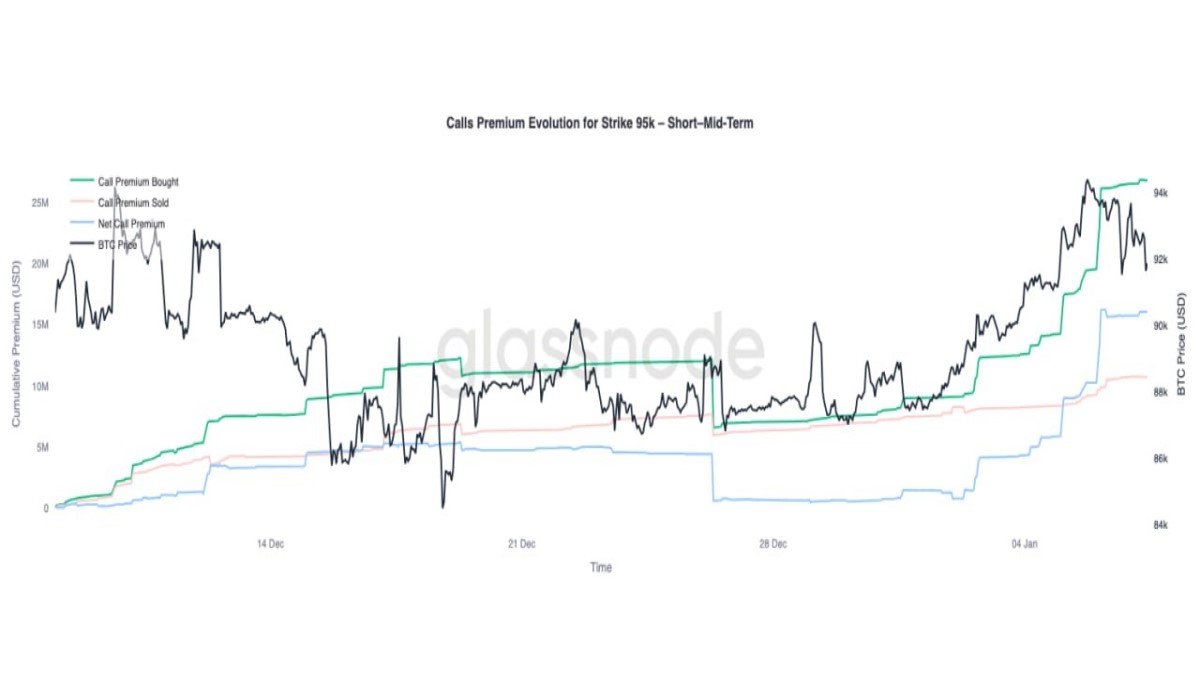

STH MVRV is powerful, but it’s not standalone. Its real value emerges when you pair it with structural maps of supply. For example, if price is moving into a dense cost-basis region (like thick URPD bands), the market may face two simultaneous pressures:

• Overhead supply from cost-basis clusters (holders selling near breakeven/profit zones).

• Underwater short-term holders who sell rallies because they need relief.

This combination is why markets can feel “heavy” even when the macro narrative sounds positive. The story might be bullish, but the positioning is not yet comfortable. And positioning usually wins short-term arguments with narratives.

What to Watch Next (Educational, Not Instructional)

The most useful question is not “will it go up?” but “what would make the market less reactive?” In STH MVRV terms, that means watching whether the short-term cohort is repriced into profit and whether that profit is held rather than immediately sold.

Practical observation checklist:

• Does STH MVRV approach 1 and reject? That often coincides with rallies that get sold hard.

• If it breaks above 1, does it hold? Sustained holds imply behavior change, not just a momentary bounce.

• How does price react to negative headlines? If dips become shallower, it’s evidence that forced selling is fading.

• Does volatility compress or expand? Underwater regimes often show sharp spikes; healthier regimes show more orderly pullbacks.

Conclusion: Below 1 Means the Market Is Still Paying Off Emotional Debt

STH MVRV below 1 is not a doomsday signal. It’s a diagnosis: the market is still carrying a burden of recent losses, and that burden changes how people behave. That’s why even constructive price action can remain choppy and headline-driven—because many participants are still trying to get back to neutral.

If the metric can reclaim and hold above 1, the market typically becomes more stable and less reactive, because short-term holders gain breathing room. If it stays below 1, sellers can keep control through a thousand small decisions—selling into strength, flinching at news, and turning every rally into a debate about whether it’s real.

In other words, the next phase is less about finding the perfect narrative and more about watching whether the newest money finally stops feeling trapped. That’s the moment a market stops being “news-driven” and starts being “trend-driven.”

Frequently Asked Questions

Who are “short-term holders” and why do they matter?

Short-term holders are typically defined as coins held for a relatively short period (often around ~155 days, depending on the methodology). They matter because they are more sensitive to price changes and headlines, and their behavior often drives short-term volatility.

Does STH MVRV < 1 guarantee more downside?

No. It indicates short-term holders are, on average, in loss—raising the probability of selling into rallies and stronger reactions to negative news. Price can still rise if demand absorbs that supply.

Why is crossing above 1 important?

Above 1, the average short-term holder is in profit, which often reduces forced selling and increases patience. That behavioral shift can make uptrends more stable.

Can this metric be “fooled” by exchange or custodian movements?

On-chain metrics can be affected by internal transfers, but entity-adjusted and filtered approaches aim to reduce noise. It’s best used as a behavioral lens rather than a precise timing tool.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment, legal, or tax advice. Nothing herein is a recommendation to buy, sell, or hold any asset. Digital assets are volatile and carry risk, including the risk of total loss.