Bitcoin’s $95K Call Premium Is Rising: What Options Markets Reveal About Conviction, Patience, and the Next Price Regime

Most market commentary treats options like a weather report: “calls are being bought, traders are bullish.” That’s true in the same way that saying “the ocean is wet” is true. The useful question is why those calls are being bought, who is paying for them, and what dealers must do as a consequence. That’s where options stop being sentiment and start being market structure.

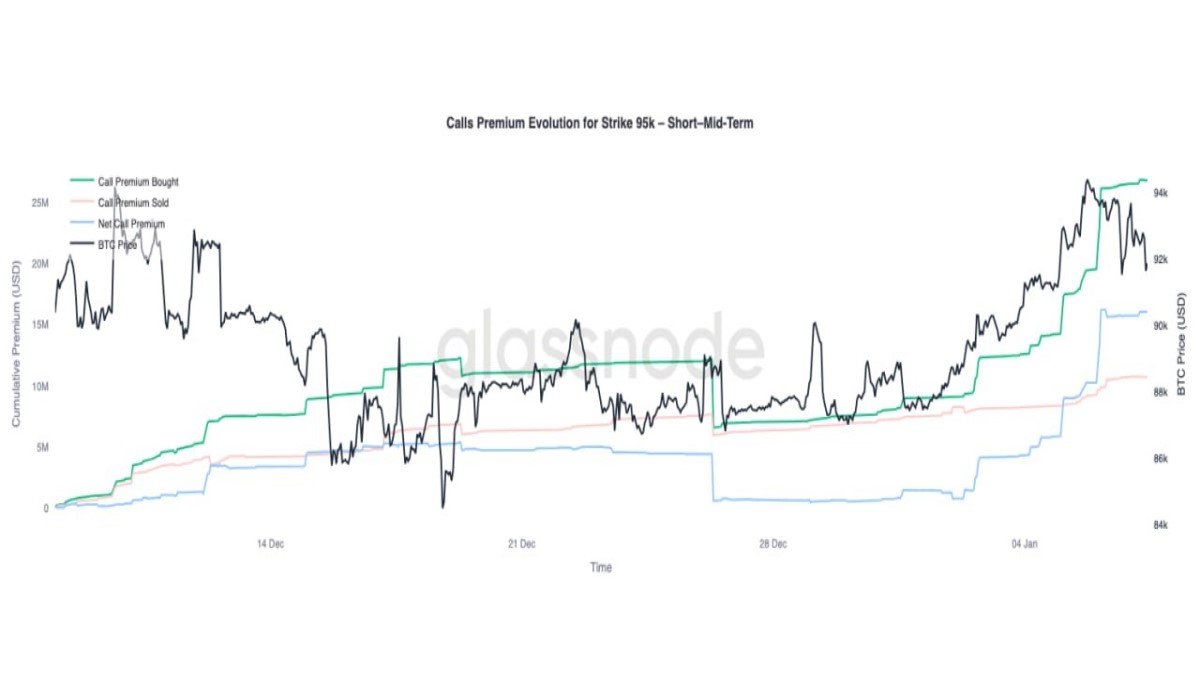

Your chart—Calls Premium Evolution for Strike $95K (Short–Mid-Term)—captures a clean narrative: as Bitcoin pushed from roughly the high-80s into the mid-90s at the start of 2026, the cumulative premium paid for $95K calls rose sharply. Then something subtle happened: the call premium curve began to flatten, while the put side also cooled. That combination is not just “bullish.” It’s a particular kind of bullish—one that often signals patience and positioning for a higher range rather than frantic chasing.

Why the $95K Strike Matters More Than It Looks

Options strikes are not just numbers; they are coordination points. Retail traders, institutions, and dealers tend to cluster around round levels and widely watched strikes. Once a strike becomes a focal point, it can influence price behavior through two channels:

• Narrative gravity: $95K becomes a “line in the sand” that anchors expectations (breakout vs. rejection).

• Mechanical gravity: options hedging flows can create buying or selling that intensifies as spot approaches the strike.

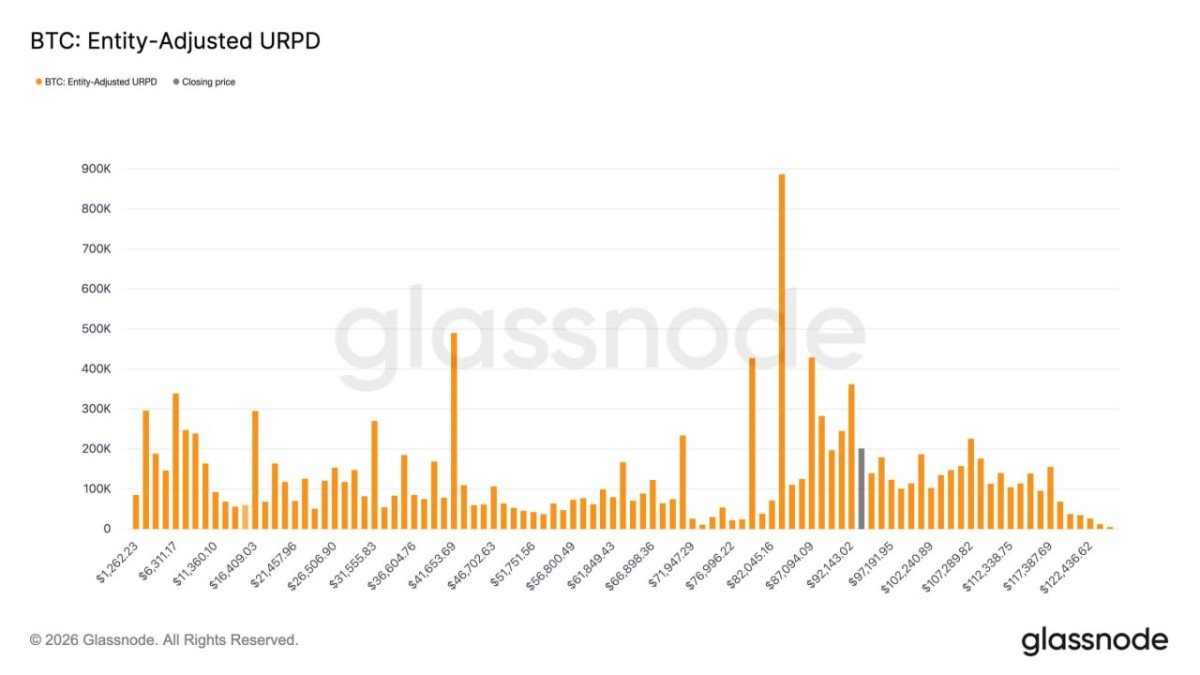

That’s why analyzing the premium at $95K is not about predicting a single direction. It’s about understanding the regime the market is trying to transition into: a world where $95K is a ceiling that rejects price—or a world where $95K becomes ordinary.

Call Premium Rising: The Obvious Read—and the Better One

Obvious interpretation: More call premium bought = traders believe BTC can rise above $95K and they’re willing to pay for that upside.

That is correct, but incomplete. The better interpretation starts with a simple truth: options are insurance for uncertainty. When people buy calls, they are not only expressing belief; they’re expressing discomfort about missing the move. In markets like crypto, that “fear of being left behind” can be as powerful as genuine conviction.

So we split call demand into two archetypes:

1) Conviction calls

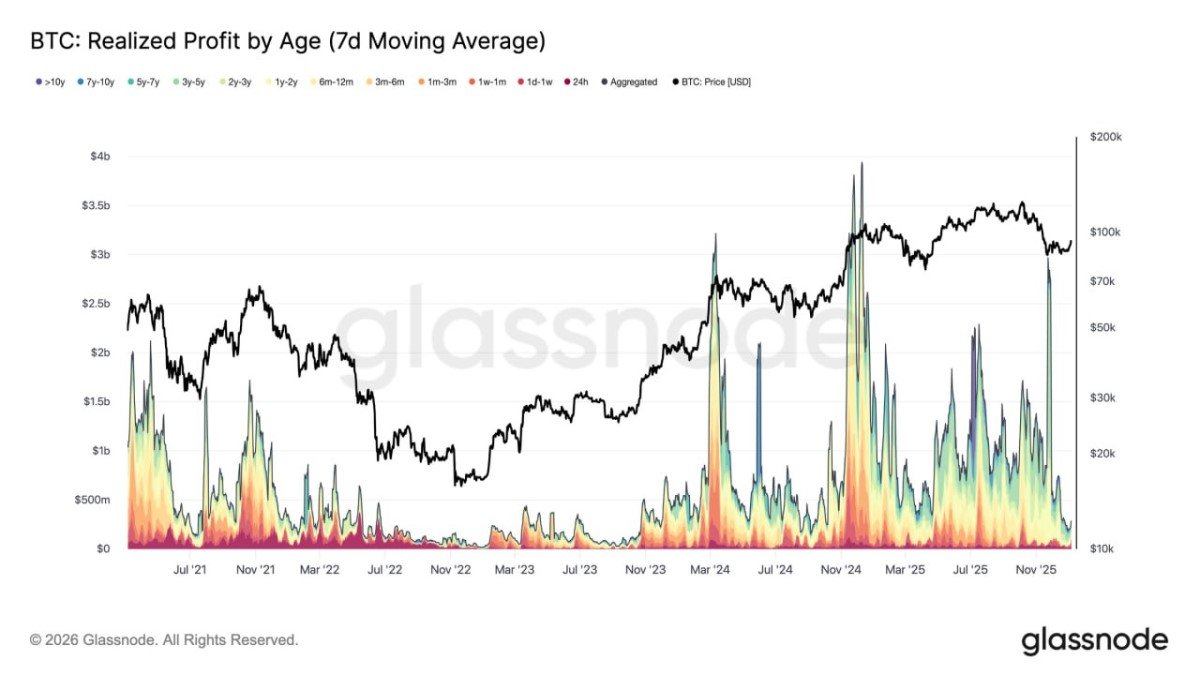

These are bought when traders expect a higher price regime and want asymmetry. They often appear when price is consolidating and volatility is not exploding—because buyers are positioning early.

2) Panic calls

These appear when price is already ripping and traders are paying up to chase. They tend to coincide with rising implied volatility and unstable price action, because the market is crowding into the same trade.

The chart suggests the rise in call premium began as BTC climbed from the high-80s toward $95K—consistent with a market that is building upside exposure as the level comes into view. But the key nuance you highlighted is that call premium then stabilized rather than accelerating endlessly. That leans closer to conviction positioning than to pure chase behavior.

The Most Important Line Is the One People Ignore: Calls Sold

Options flows are always two-sided. If call premium bought is rising, someone is collecting premium by selling calls. Dealers and professional traders often take the other side, not because they’re bearish, but because they’re running inventory and hedging risk.

When call selling rises alongside call buying, it can mean:

• yield-style strategies (covered calls, structured products),

• dealers warehousing demand and dynamically hedging,

• or a market that thinks upside is limited (if sellers are confident spot won’t break).

This is why the “net call premium” line matters. If net premium continues to rise, demand is overwhelming supply. If net premium flattens, the market is reaching a temporary equilibrium: buyers still want upside exposure, but sellers are comfortable providing it at current prices.

Why Put Premium Falling Changes the Story

Your final note is the real signal: above $95K, call premium stalls—but put premium also declines, leaving the system in a maintained, stable state. This is structurally different from a market that is topping.

In a classic “fake breakout” setup, you often see:

• call buying spikes (chasing),

• put buying also spikes (fear),

• volatility rises,

• and spot becomes wick-heavy.

But if put premium is falling while call premium is no longer accelerating, it can imply something calmer: traders are not desperately hedging downside, and they are not aggressively paying up for upside either. That often happens when the market believes it is transitioning into a new higher trading range—where dips are bought, but not with panic, and upside is expected, but not with hysteria.

The Dealer Lens: How a $95K Strike Can Pull Price

Here’s the piece that makes options analysis feel “different” from news sites: the market isn’t only about opinions; it’s about forced behavior. If calls are being bought, the sellers—often dealers—may hedge by buying spot or perpetual exposure. The closer spot gets to the strike, the more sensitive hedging can become.

That means a concentrated strike like $95K can create a feedback loop:

• Price rises toward $95K → call demand grows → dealers hedge → hedging supports price.

But the same mechanism can invert if positioning shifts and dealers are no longer in that hedging posture. This is why “OI and premiums” are not directional prophecies; they’re a map of where mechanical flows might intensify.

What the Market Is Really Saying: “We’re Patient, Not Euphoric”

Putting the pieces together, the most coherent read of your chart is:

1) Upside demand exists, and it grew as price approached $95K. That supports the idea that participants believe a higher level is plausible and are willing to pay for it.

2) The market then reached a pricing equilibrium. Call premiums stopped accelerating—suggesting less FOMO at the margin—while put premiums cooled, indicating less urgency to hedge downside.

3) This looks more like “range-building” than “blow-off.” Traders are engaged, but not frantic. They appear to be underwriting the idea that $95K is an important threshold—and they’re willing to wait.

In plain terms: confidence can show up as calm. That is the opposite of the emotional stereotype people attach to crypto.

What Could Break This Setup

A stable options equilibrium doesn’t mean the market is safe; it means the market is balanced—until it isn’t. The main risk is not that call premium stops rising, but that an external catalyst changes the distribution of outcomes overnight. When that happens, the options market reprices volatility first, and spot often follows.

Three regime-breakers to watch conceptually:

• A volatility shock that forces put demand to surge (risk-off).

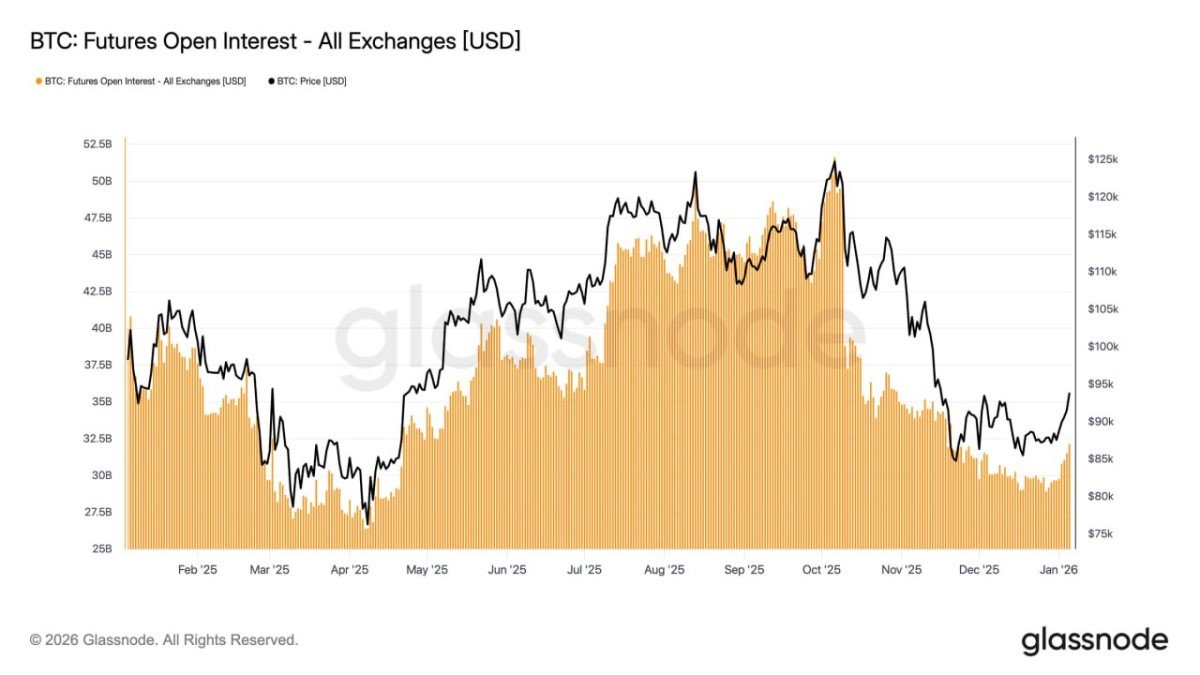

• A liquidity shock where hedgers unwind basis or leverage (forced selling).

• A narrative shock that pulls attention away from crypto and into macro hedges (rates, commodities, geopolitical risk).

The point is not to predict which one happens. The point is to recognize that the current options picture—rising call premium, then stabilization with softer puts—describes a market that is composed. And composed markets can still move violently when the composition breaks.

Conclusion: A $95K Call Market Is a Story About Patience, Not Just Bullishness

The $95K strike has become a focal point where narratives and mechanics meet. Rising call premium from early 2026’s rebound suggests genuine appetite for upside exposure. But the deeper, more distinctive signal is the stability that followed: call premium growth slowed while put premium also declined, leaving a maintained equilibrium.

That pattern often reflects a market that is not simply “bullish,” but patient. Participants appear willing to pay for upside—yet they’re not panicking. They’re not screaming that price must go up tomorrow. They’re positioning as if $95K is a level that can be lived above, not just tagged and rejected.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment, legal, or tax advice. Nothing herein is a recommendation to buy, sell, or hold any asset. Digital assets are volatile and carry risk, including the risk of total loss.

Frequently Asked Questions

Does rising call premium guarantee Bitcoin will break above $95K?

No. It indicates demand for upside exposure at that strike. Price can still reject the level if positioning becomes crowded or if catalysts shift risk sentiment.

Why does falling put premium matter?

Lower put premium can imply reduced urgency to hedge downside. Combined with stable call premium, it can signal calmer conviction and an attempt to form a higher trading range.

What’s the difference between “conviction calls” and “panic calls”?

Conviction calls tend to be bought while volatility is stable and before euphoric momentum. Panic calls often surge during fast rallies when implied volatility jumps and traders chase upside.

How can options around a strike affect spot price?

Dealers who sell options may hedge dynamically. As price approaches a heavily traded strike, hedging flows can intensify—sometimes reinforcing the move, sometimes dampening it, depending on positioning.