Bitcoin’s “Broken” 4-Year Cycle in 2025: What Actually Changed (And What Didn’t)

Every market carries a few stories that are so convenient they become superstition. In Bitcoin, the most durable one is the 4-year cycle: halving happens, supply tightens, the post-halving year explodes upward, and the year after that sobers everyone up. It’s a narrative with a calendar, a mechanism, and just enough historical rhyme to feel like a rule.

Then 2025 arrived like a quiet contradiction. Bitcoin set a fresh high above $126,000 in October, yet still finished the year down roughly 6%. That single statistic is why so many people declared the cycle “broken.” But the more useful conclusion is subtler: 2025 didn’t kill the halving cycle. It killed the assumption that the halving cycle is the only cycle that matters.

1) Why the 4-Year Cycle Became So Persuasive

The halving story worked because it offered a clean causal chain. Bitcoin issuance drops roughly every four years. If demand is stable (or growing) while new supply shrinks, price pressure can rise. Add reflexive behavior—people front-run what they believe others will do—and you get a self-reinforcing narrative: the halving isn’t just an event, it’s a coordination mechanism.

In earlier eras, that coordination mattered more because Bitcoin’s market was smaller, less liquid, and more sentiment-driven. When enough participants believe a timeline, the timeline can become a trade. That’s not mystical; it’s microstructure. But it also means the narrative is vulnerable: the more widely known a pattern becomes, the more it gets traded in advance, dampening the very effect people are trying to capture.

So the 4-year cycle was never a law of physics. It was a useful compression of complexity—until the complexity grew too large to compress.

2) 2025 Didn’t Lack a Rally—It Lacked a Clean Finish

The headline “Bitcoin was down in 2025” can trick the mind into thinking “Bitcoin didn’t rally.” But 2025 did rally—it just didn’t end where the rally began. This is a critical distinction because it changes the diagnosis.

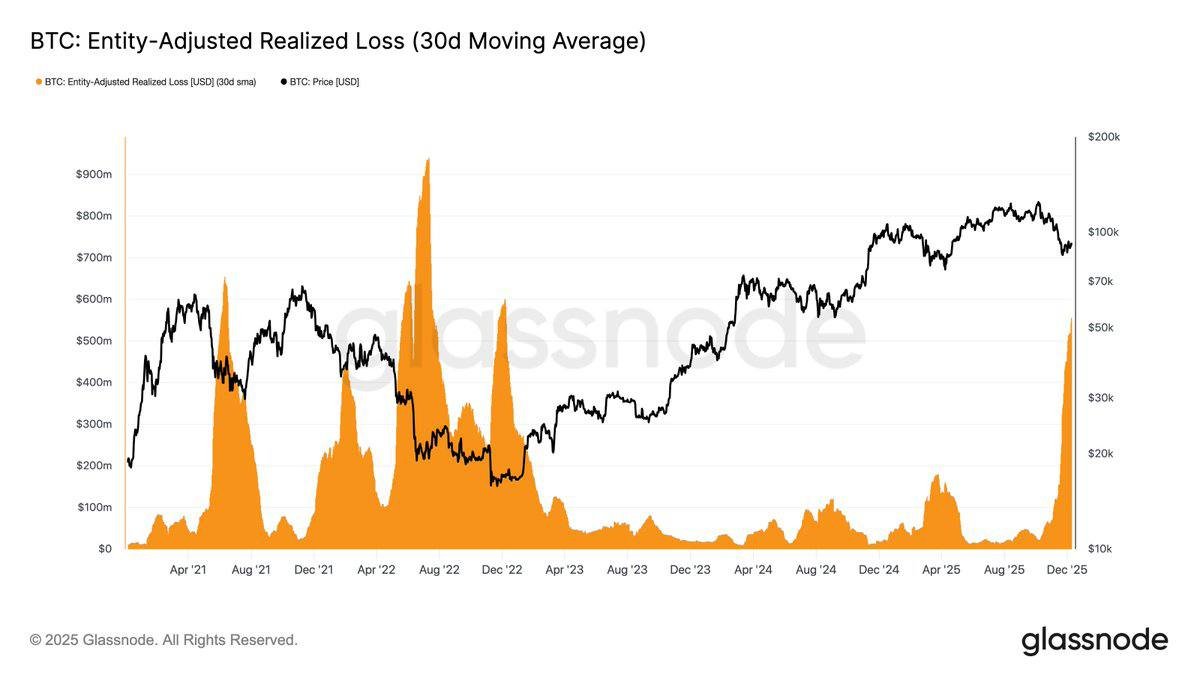

A year that prints a major high and still closes negative is not a year without demand. It’s a year where demand was not dominant enough to overpower late-year selling pressure. That pressure can come from many places: risk-off macro conditions, profit-taking from earlier inflows, hedging flows, or policy shock. In other words, the market may still have expressed the post-halving “upward impulse,” but it failed to maintain it through the full calendar year.

This is where simplistic cycle talk breaks down. The halving story explains supply. It doesn’t explain liquidity regimes, hedging behavior, or cross-asset correlation. And those forces increasingly matter.

3) The Halving Still Matters—But Its Marginal Shock Shrinks Over Time

One under-discussed reason the 4-year script gets less reliable each cycle is arithmetic. Each halving cuts issuance, but the cut becomes smaller relative to Bitcoin’s total existing supply. Early halvings were dramatic supply shocks compared to the circulating base. Later halvings are still meaningful, but they’re no longer the only engine capable of moving price.

Think of it like a city that once relied on a single highway. Expanding or restricting that highway used to determine traffic for everyone. Over time, the city built subways, side streets, bridges, and alternative routes. The highway is still important, but it’s no longer the whole system.

Bitcoin’s “alternative routes” are demand-side valves and macro liquidity conditions—especially as institutional access expands. Which brings us to the structural change that 2025 made impossible to ignore.

4) ETFs Turned Demand Into a Switch, Not a Vibe

In older cycles, the marginal buyer was often a rotating cast of retail enthusiasm, venture flows, and crypto-native leverage. In the ETF era, a meaningful share of demand (and supply) can be expressed through products that behave like modern finance: inflows, outflows, rebalancing, and risk-parity behavior. That is not “worse” or “better.” It is different.

Why does it matter? Because demand becomes more elastic and more correlated with broader portfolios. When risk appetite fades, ETF investors don’t need a new narrative to sell—they just rotate. When volatility rises, institutions don’t need to panic—they hedge. These behaviors can compress upside and accelerate drawdowns compared to a retail-only market that is slower to rebalance.

This is one plausible reason 2025 could produce both an all-time high and a negative annual return: the same access rails that enabled new demand also enabled faster, more systematic de-risking. The market didn’t lose belief. It gained plumbing.

5) Derivatives Matured the Market (By Making It Harder to Stay One-Directional)

If you want a single phrase for what derivatives do to a market, it’s this: they make price discovery less sentimental. Futures, options, and perpetual swaps allow participants to express views without buying spot, hedge spot exposure without selling, and monetize volatility itself. This reduces the likelihood that a single narrative—like “post-halving year always pumps”—can dominate uninterrupted.

In early Bitcoin history, exposure often meant spot buying, and fear often meant spot selling. In a derivatives-heavy market, exposure can be layered, and fear can be hedged. That changes the texture of cycles. It doesn’t eliminate them; it makes them look less cinematic.

There is also a less romantic point: in mature markets, the crowd’s favorite pattern becomes a source of liquidity for professionals. If too many participants lean on the same calendar trade, the market can punish that concentration—sometimes without any conspiracy, simply through positioning mechanics and liquidity needs.

6) Bitcoin’s “Maturity” May Mean It Trades Like a Macro Asset More Often

The idea that Bitcoin has become more macro-sensitive is not an insult; it’s what happens when an asset integrates into mainstream portfolios. When institutions treat Bitcoin as part of a risk allocation stack, it will respond more visibly to rates, liquidity conditions, and policy uncertainty. In that world, the halving is a tailwind—but a tailwind can be overwhelmed by a headwind.

2025’s pattern—strong highs followed by a weaker finish—fits a world where macro events can dominate late-cycle positioning. The question is not whether Bitcoin “failed.” The question is whether the market is now pricing Bitcoin with a wider set of inputs than the community’s favorite historical template.

If you’re looking for “maturity,” it often looks like this: fewer straight lines, more cross-currents, and a market that punishes certainty.

7) A More Useful Framework Than “The Cycle Is Dead”

Declaring the 4-year cycle “dead” is emotionally satisfying, but analytically lazy. A better framework is to treat the halving as a structural drift—a long-term change in issuance—while treating price outcomes as the result of multiple overlapping cycles:

• Issuance cycle: the predictable halving schedule (slow, structural).

• Liquidity cycle: global risk appetite and credit conditions (often faster, sometimes violent).

• Positioning cycle: derivatives leverage, hedging intensity, and dealer flows (can dominate short to medium windows).

• Access cycle: ETF/product flows and regulatory clarity (turns demand into a mechanism, not a mood).

Under this lens, 2025 becomes less mysterious. The issuance drift still exists. But other cycles likely overpowered the neat “post-halving year must be green” story—especially once you account for how quickly large pools of capital can move in and out when access is frictionless.

8) What 2025 Really Taught Long-Term Observers

The important lesson is not “don’t use cycles.” It’s “don’t use a cycle as a prophecy.” Bitcoin’s cycle narrative was always descriptive, not prescriptive. It described what happened in specific historical contexts. It did not guarantee what must happen under new market structure.

If 2025 is a sign of maturity, it’s not because Bitcoin became calm. It’s because Bitcoin became harder to model with a single story. Mature markets don’t hand out free patterns forever. They evolve until the only reliable edge is risk management, humility, and a willingness to update assumptions.

Conclusion

Bitcoin finishing 2025 down about 6%—despite reaching a new high above $126K—doesn’t prove that the halving cycle is irrelevant. It proves that the halving cycle is no longer sufficient as a standalone model. The market now includes ETF plumbing, deeper derivatives, and stronger macro correlation—forces that can dampen, delay, or even reverse a calendar-based expectation.

So yes, the “easy version” of the 4-year cycle broke in 2025. But that might be progress, not failure. It suggests Bitcoin is transitioning from a narrative-driven frontier asset into a financial instrument priced by multiple regimes at once. And in markets, that’s what growing up looks like: fewer fairy tales, more systems.

Frequently Asked Questions

Does a negative year after the halving mean the halving no longer matters?

No. The halving still reduces new supply issuance. But price is shaped by both supply and demand—and demand is now influenced by ETFs, derivatives hedging, and macro liquidity conditions that can overwhelm a single-factor model.

How can Bitcoin hit an all-time high and still end the year negative?

Because annual return is about the January-to-December close, not intra-year peaks. A market can rally strongly and still give back gains later due to profit-taking, risk-off conditions, or systematic de-risking.

Is this “market maturity” good or bad?

Neither by default. Maturity usually means deeper liquidity, more hedging tools, and broader participation—which can reduce some extremes but also introduce new correlations and more complex price dynamics.

Should people stop talking about the 4-year cycle entirely?

It’s still a useful historical lens, but it should be treated as context—not a forecast. A better approach is to combine it with liquidity, positioning, and product-flow analysis.

Disclaimer: This article is for educational purposes only and does not constitute financial, investment, legal, or tax advice. Cryptoassets involve risk, including volatility and potential loss. Past performance and historical patterns do not guarantee future outcomes. Always do your own research and consider consulting qualified professionals.