When the Dollar Slips but Bitcoin Still Falls

For years, market commentary has repeated một câu quen thuộc: “When the dollar goes up, risk assets go down – and vice versa.” The US Dollar Index (DXY) is often treated as a mirror image of global appetite for risk. A strong dollar usually comes with pressure on equities, commodities and digital assets. A soft dollar is supposed to provide the opposite: easier financial conditions and a friendlier backdrop for growth assets such as Bitcoin.

Yet the current environment is challenging that textbook playbook. While DXY has been drifting lower, Bitcoin has not responded with a powerful rally. Instead, price has slid from the 124,000 USD area down toward the low 90,000s, carving out a clear downtrend on the daily chart with only modest bounces. The question is no longer just about correlations; it is about what this divergence reveals regarding liquidity, positioning and the maturity of the digital asset market.

1. The classic DXY–risk asset relationship

To understand why this decoupling matters, it is useful to revisit why DXY and risk assets have historically moved in opposite directions.

• DXY as a barometer of global stress. In periods of uncertainty, investors seek safety and liquidity. The US dollar, backed by deep government bond markets and a dominant role in global trade, becomes a preferred parking place. Demand for USD rises, DXY strengthens, and risk assets typically experience outflows.

• Funding and leverage. Many global investors borrow in one currency to invest in higher-yielding instruments elsewhere. When the dollar strengthens, the cost of servicing USD liabilities rises, forcing deleveraging. That deleveraging often shows up first in high-beta assets such as growth stocks and digital assets.

• Global trade and commodities. Because many raw materials are priced in USD, a stronger dollar can tighten financial conditions for importers, weighing on growth expectations and the valuations of cyclical assets.

In previous cycles, Bitcoin typically behaved like a high-volatility tech stock within this framework: it tended to rally when DXY rolled over and suffered when the dollar surged. That pattern helped traders build macro narratives around Bitcoin as a liquidity-sensitive asset.

2. Why a weak dollar is not lifting Bitcoin this time

Today, DXY is no longer near its peak and has shown signs of fatigue. Normally, this would be seen as a green light for risk-taking. Yet Bitcoin is trading closer to recent lows than to its highs, down roughly one-third from the 124,000 USD area without a sustained recovery.

There are several reasons the old rule-of-thumb is not working as expected.

2.1. Liquidity is more than the dollar index

A softer DXY does not automatically mean global liquidity is abundant. Central banks can be slowing the pace of rate increases or even cutting modestly, while still keeping real rates positive and balance sheets relatively tight. The era of near-zero rates and large-scale asset purchases has ended for now, so the amount of excess capital available to chase high-risk exposure is more limited than in earlier cycles.

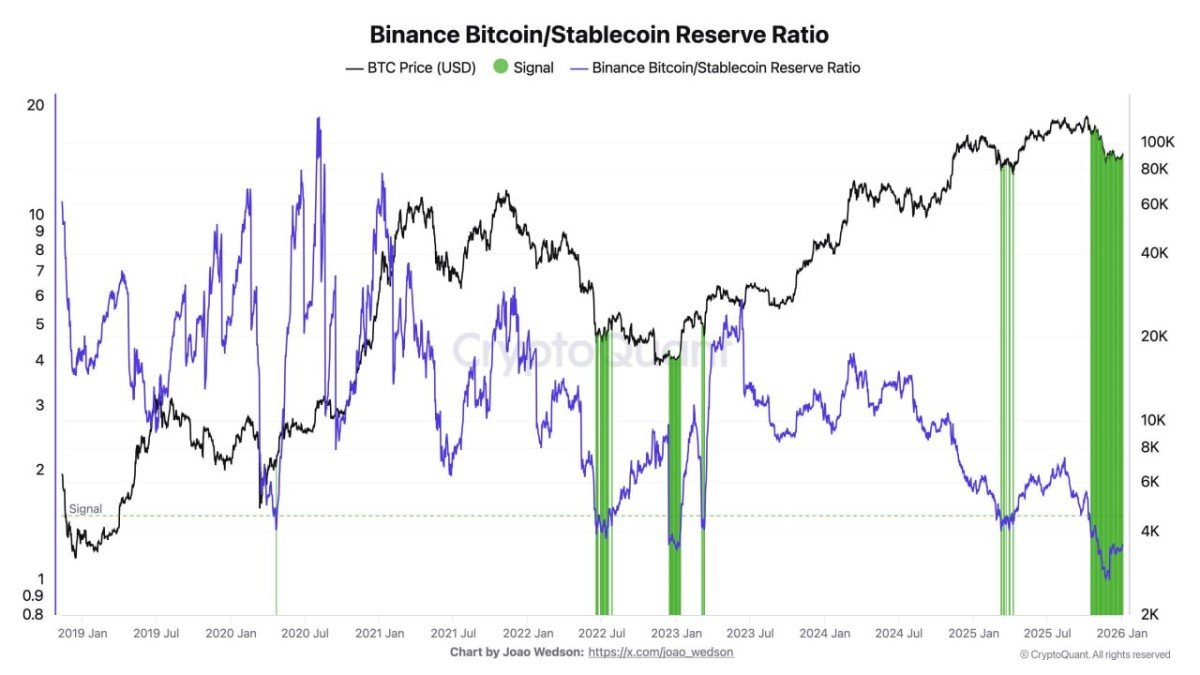

From Bitcoin’s perspective, what matters is not simply whether DXY ticks lower, but whether net new capital is flowing into the asset class. If institutions are cautious, if stablecoin supply is not expanding, and if leverage on derivatives platforms is being reduced, then a modest decline in the dollar index may not be enough to offset those headwinds.

2.2. Positioning after a parabolic run

The recent Bitcoin cycle featured a rapid ascent from the mid-60,000s to above 120,000 USD. That move pulled in significant speculative positioning, from futures to options to highly leveraged spot structures. When an asset doubles within a relatively short period, it does not need a strong dollar to correct; positioning itself becomes a source of fragility.

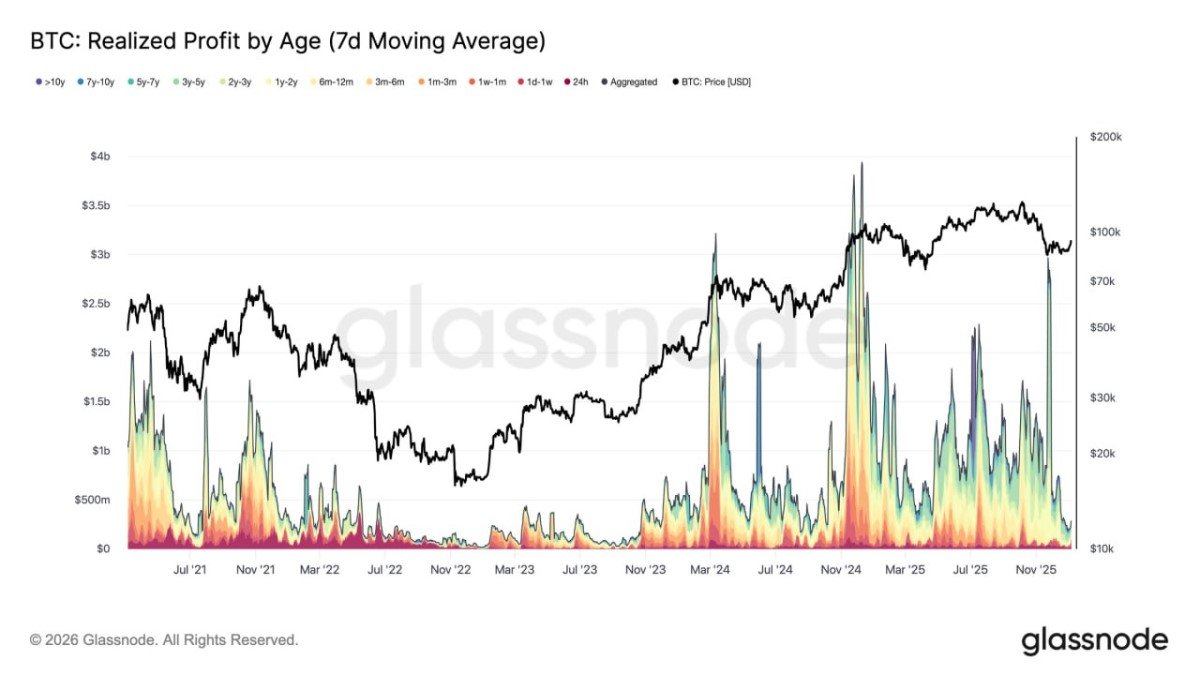

As the chart shows, once the local peak near 124,000 USD was established, Bitcoin began forming lower highs and lower lows. The selling pressure was not triggered by a surge in DXY but by profit-taking, risk management and stop-outs across the derivatives complex. In this phase, the relationship with the dollar becomes secondary to the internal mechanics of the Bitcoin market.

2.3. Rotation within the risk asset universe

Another subtle force at work is rotation. While Bitcoin has been correcting, traditional equity indices have been marching toward record highs. Investors with a fixed amount of risk capital may be reallocating from digital assets back into familiar public equities, especially when large-cap technology companies and AI-linked names are perceived as having clearer earnings visibility.

In that sense, DXY softness is helping risk assets – just not equally. The incremental dollar of risk may currently be favouring listed companies over digital assets, at least in the short term. That rotation can leave Bitcoin in an awkward middle ground: too risky for defensive investors, yet not as favoured as sectors with strong earnings momentum.

2.4. A maturing asset interacting with new products

The proliferation of listed products, from spot exchange-traded funds to structured notes, has changed how Bitcoin trades. These vehicles bring in long-horizon investors but also create new layers of hedging and rebalancing.

- ETF providers may need to rebalance holdings daily based on flows and benchmark tracking.

- Market makers use futures and options to hedge inventory, which can amplify short-term swings when volatility spikes.

- Large holders can overlay option strategies that generate income but also cap upside in the short term.

All of this means that Bitcoin is no longer driven solely by spot supply and demand from retail traders. Its price is influenced by a more complex ecosystem of hedgers, structured-product desks and institutional allocators. That ecosystem can temporarily mute the impact of macro indicators like DXY, especially when many players are de-risking after a sharp rally.

3. Reading the current Bitcoin chart: a downtrend without panic

The daily chart of BTC/USD underscores this story. After topping out in the 124,000 USD area, price has stepped down in stages toward the 90,000 USD region. The move has been persistent, but not chaotic: there are no dramatic capitulation candles, no obvious signs of forced deleveraging on the scale seen in past crises.

That combination – orderly price decline plus lack of a strong recovery – often points to an environment where:

- Short-term participants are gradually taking profits or cutting exposure rather than exiting in panic.

- Fresh demand is hesitant, either because investors are waiting for lower levels or because competing opportunities look more attractive.

- Structural long-term holders are not selling aggressively, but they are also not yet joined by a new wave of buyers.

In other words, the market is not collapsing; it is digesting. Unfortunately, digestion phases can feel worse than outright panic because they drag on. Prices grind lower, narratives become more cautious, and many participants lose patience.

4. What the DXY–BTC disconnect tells us about capital flows

If DXY is soft and Bitcoin is still struggling, the implication is straightforward: the dominant constraint today is not the price of the dollar, but the appetite for additional risk within portfolios already exposed to Bitcoin.

Several themes are likely shaping that appetite:

4.1. Risk budgets and regulatory uncertainty

Many institutional investors operate with risk budgets: internal limits on how much volatility or drawdown they are willing to tolerate from each asset class. After a powerful run-up, even a modest retracement can bring realised volatility above those thresholds, prompting risk committees to pause new allocations until the price action settles.

At the same time, the regulatory landscape for digital assets continues to evolve. Even when the overall direction is constructive, uncertainties around specific products, venues or jurisdictions can encourage a wait-and-see attitude. That can delay the next wave of inflows, leaving Bitcoin vulnerable to drift lower despite a supportive macro backdrop.

4.2. Competing narratives: AI, equities and real yields

The current cycle is also defined by powerful narratives outside crypto. Artificial intelligence, reshoring of manufacturing and large-scale infrastructure spending are drawing attention and capital into traditional markets. Some investors who might previously have looked to Bitcoin for growth exposure are now focusing on companies that build hardware, software and services around AI.

In parallel, real yields remain meaningfully positive in several major economies. For conservative allocators, the ability to earn steady returns in government or high-grade corporate bonds reduces the pressure to search for alternative sources of performance. That is another reason the correlation between DXY and Bitcoin is less reliable right now: even if the dollar is soft, attractive yields elsewhere can keep capital anchored outside digital assets.

5. Lessons for long-term participants

The key takeaway is not that the DXY–Bitcoin relationship has vanished forever, but that macro correlations are conditional. They work best when the market environment is simple and positioning is light. They can break down when new products, regulatory changes and heavy positioning enter the mix.

For long-term participants, several educational points emerge from this episode.

5.1. Avoid single-indicator decision making

Using DXY as a sole signal for Bitcoin exposure is increasingly risky. It remains a useful input, but it must be combined with other dimensions: on-chain activity, derivatives positioning, fund flows and the broader macro picture.

A declining dollar can coexist with weak Bitcoin if:

- the previous rally left many investors sitting on large unrealised gains,

- structured products and options strategies are capping upside, or

- alternative assets (such as AI-linked equities) are absorbing incremental risk capital.

Recognising this prevents oversimplified assumptions like “DXY down, BTC up” from guiding high-stakes decisions.

5.2. Price action is information, not just noise

The persistent decline from 124,000 USD toward 90,000 USD without a strong relief rally suggests that buyers are not yet willing to compete aggressively at current levels. That does not automatically imply that a deeper bear market is inevitable, but it does signal that the market is still searching for an equilibrium where long-term and short-term participants are both comfortable.

Instead of trying to guess precise turning points, many disciplined investors focus on building rules around how they respond to such environments: adjusting position sizes, diversifying across assets and time horizons, and reserving capital for periods when both macro and market structure signals align more clearly.

5.3. Decoupling cuts both ways

The current phase shows Bitcoin underperforming even as DXY softens. At some point in the future, the opposite may happen: equities and the dollar could face pressure while Bitcoin stabilises or even strengthens, especially if its role as a reserve-like asset for institutions and sovereign entities continues to grow.

That possibility is precisely why many analysts caution against treating Bitcoin purely as a high-beta extension of equity indices. Over short windows it can behave like a tech proxy; over longer horizons it may reflect deeper forces related to monetary policy, debt sustainability and digital scarcity.

6. Walking through the next phase

With price hovering near the low 90,000s and DXY not providing a clear directional cue, the market is in a reflective phase. Participants are reassessing how much of the previous rally was driven by genuine long-term adoption and how much came from leverage, enthusiasm and short-term trend following.

For those building a long-term view, several questions are worth tracking:

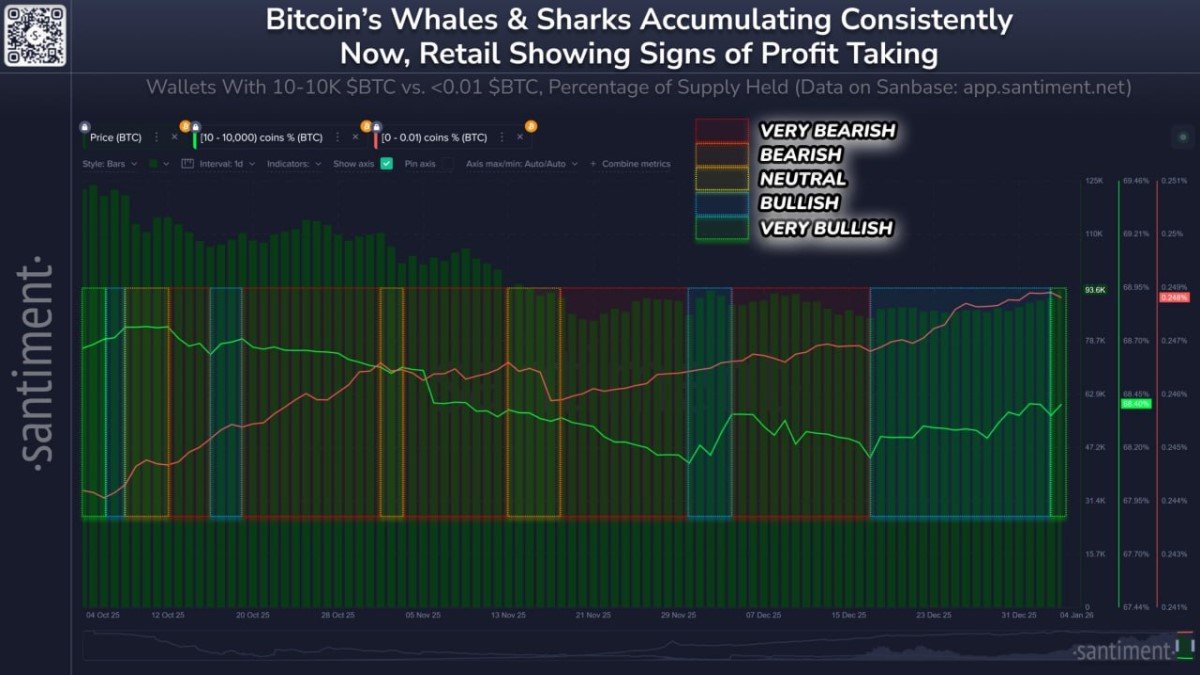

- Are spot exchange-traded funds and corporate treasuries continuing to accumulate, or have they paused?

- Is stablecoin supply expanding again, signalling fresh liquidity, or remaining flat?

- How are policy paths evolving at major central banks beyond the BoJ – especially regarding real (inflation-adjusted) rates?

- Does on-chain data show renewed network activity, or mainly rotation between short-term traders?

The answers to these questions will shape whether this DXY–Bitcoin decoupling is a temporary pause before another leg higher, or the beginning of a longer consolidation phase.

7. Conclusion: when the macro map is not the territory

DXY remains a valuable indicator of global risk sentiment, but it is no longer enough to explain Bitcoin’s behaviour on its own. The recent divergence – a weaker dollar alongside a declining Bitcoin price – highlights the importance of looking beyond simple correlations to the underlying plumbing of markets: funding costs, positioning, product design and investor psychology.

Ultimately, Bitcoin’s long-term story is still tied to broader questions about money, debt and digital infrastructure. Short-term episodes where a softer dollar fails to ignite a rally do not invalidate that story, but they do remind us that the path is rarely linear. For thoughtful participants, the goal is not to chase every correlation, but to understand why those relationships change – and to build strategies that can survive both sync and decoupling.

Disclaimer: This article is for informational and educational purposes only. It does not constitute investment, legal or tax advice. Digital assets are volatile and may not be suitable for all investors. Always conduct your own research and consult a qualified professional before making financial decisions.