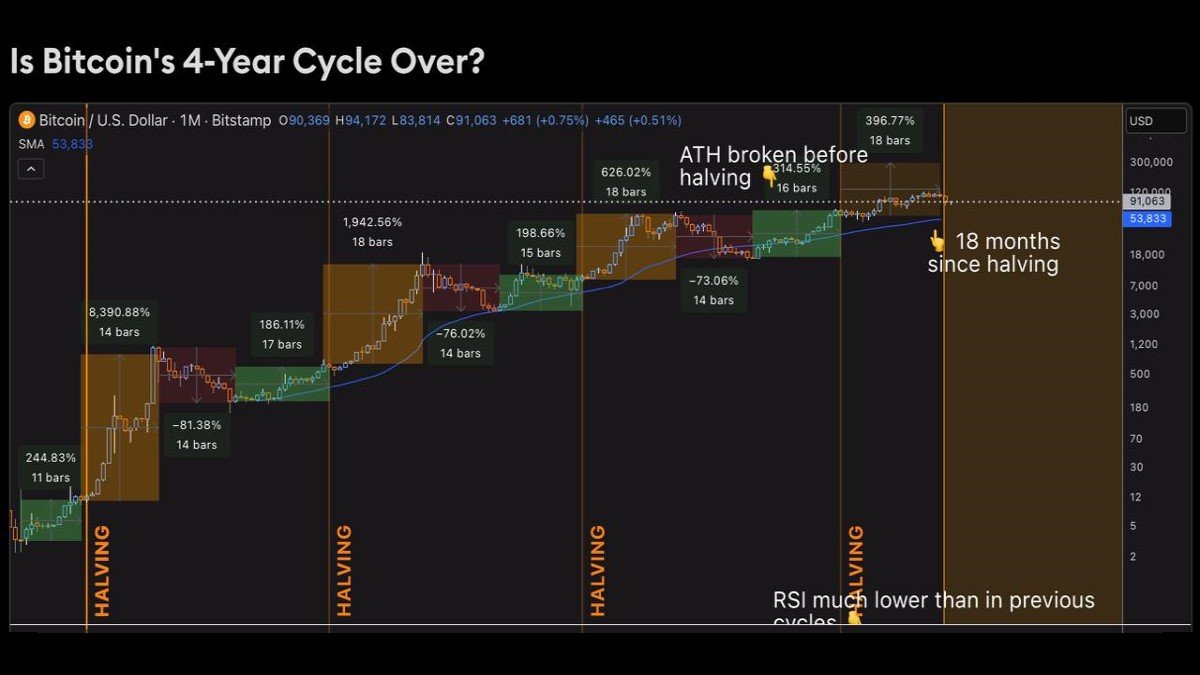

Is Bitcoin’s Four-Year Cycle Breaking? Why Macro Politics Now Matter More Than Halving

For most of its history, Bitcoin seemed to dance to a remarkably simple rhythm. Roughly every four years, the block subsidy halves. Miners receive fewer new coins, new supply slows, and—after a lag—the market eventually grinds its way into a powerful bull phase. The pattern repeated often enough that many investors internalised it as an almost mechanical law of nature: buy before the halving, be patient, and the market will eventually reward you.

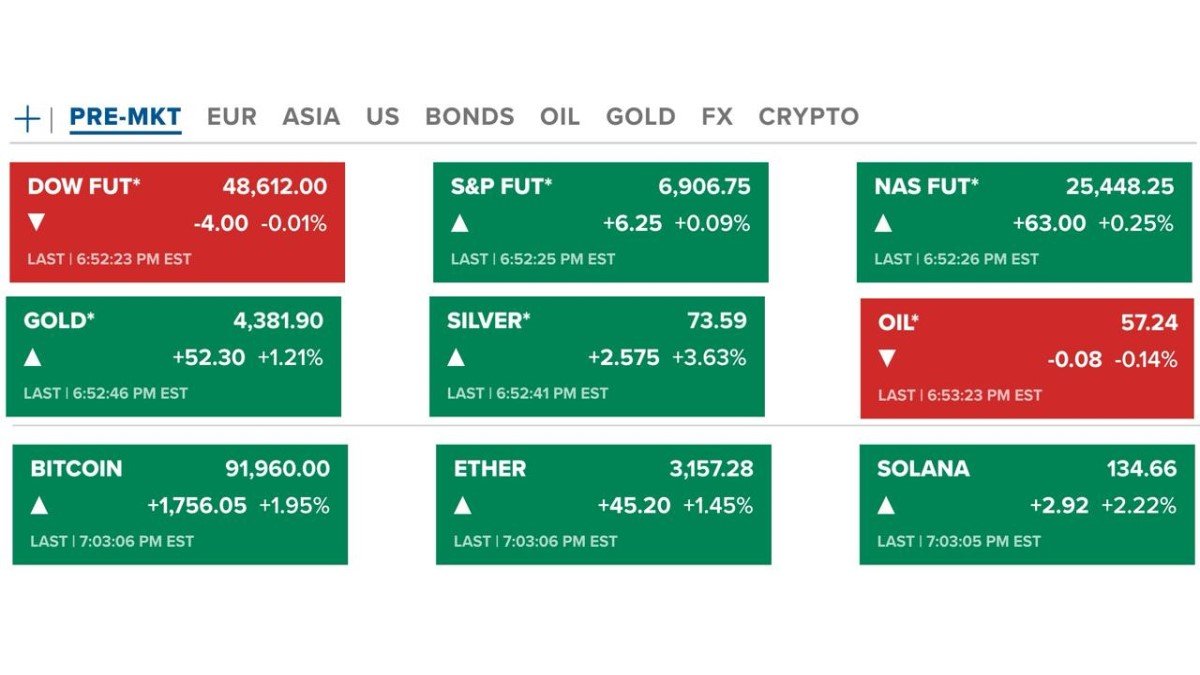

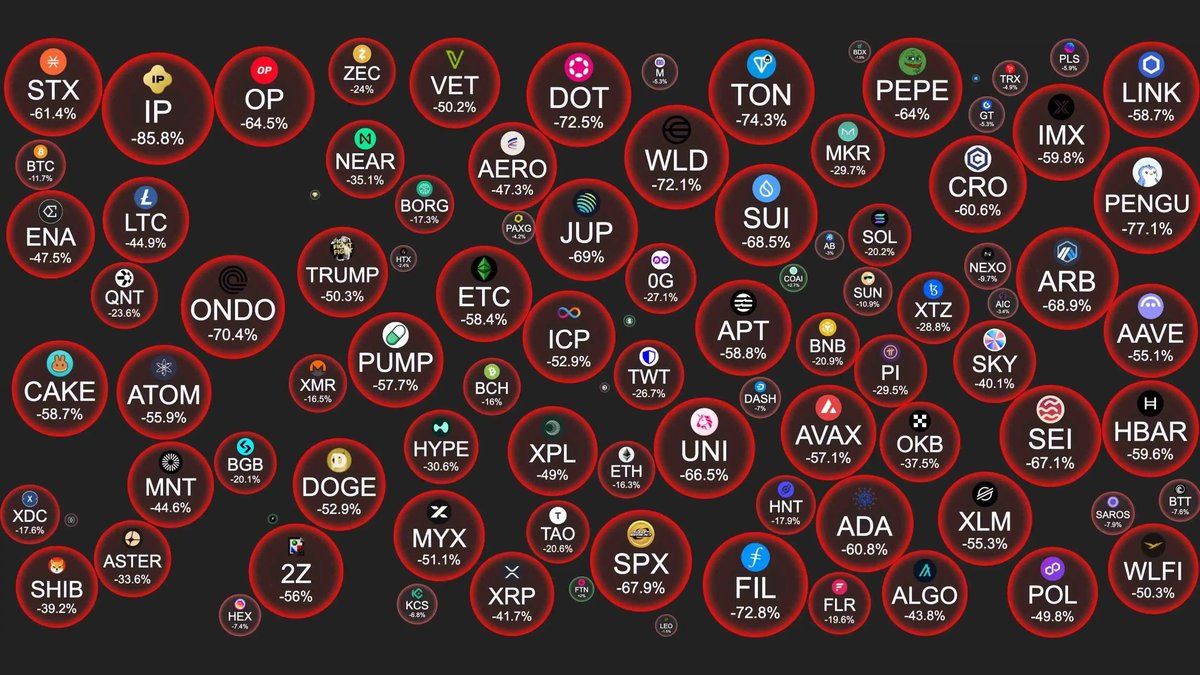

In the current cycle, that narrative is facing its toughest test so far. Instead of cleanly following the post-halving script, Bitcoin’s price has reacted violently to interest-rate expectations, political headlines and liquidity shifts. According to Markus Thielen, CEO of 10X Research, recent market peaks and corrections have lined up far more closely with macro events than with the halving timetable. The usual four-year template still exists in the background, but it is no longer the main conductor of the orchestra.

This article unpacks that shift: how the classic halving cycle emerged, why macro forces are now dominating short- and medium-term moves, and what it means when Bitcoin starts to behave less like a niche crypto asset and more like a sensitive instrument of global macro sentiment.

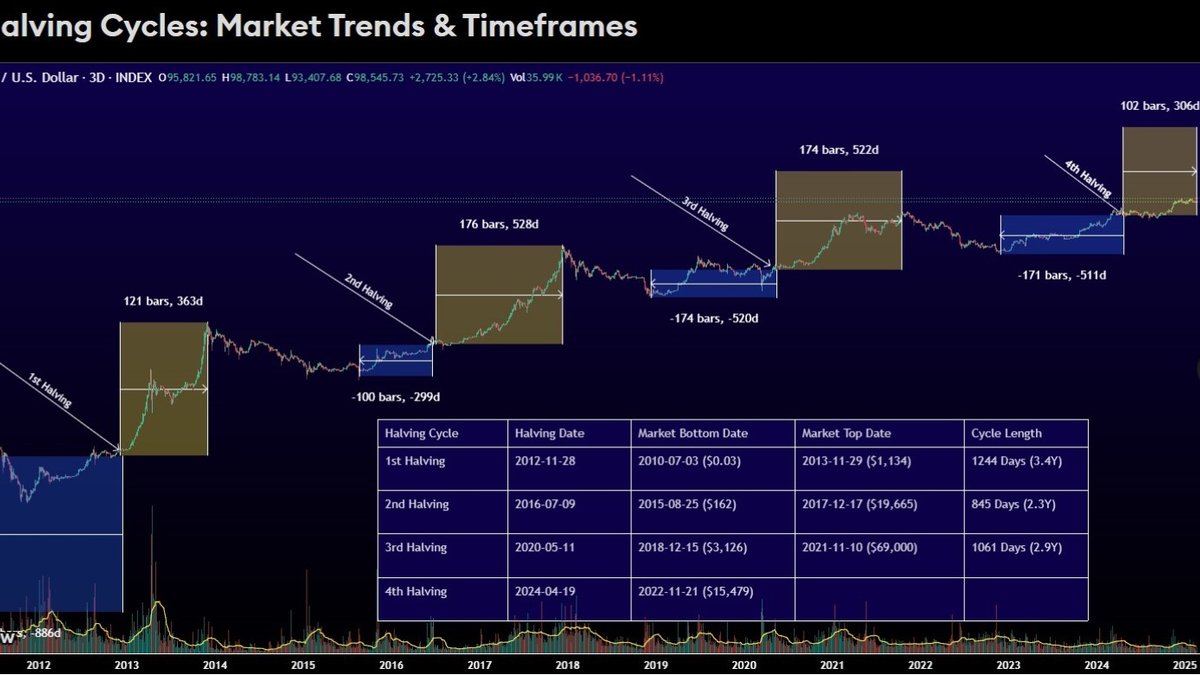

1. How the Four-Year Halving Cycle Became Market Dogma

Bitcoin’s monetary schedule is one of the few things in finance that we can describe as fully predictable. Approximately every 210,000 blocks—roughly four years—the reward for mining a new block is cut in half. This mechanism gradually slows the rate of new supply until it eventually converges towards 21 million coins.

In the early cycles, this hard-coded event appeared to line up nicely with market behaviour:

- The 2012 halving was followed by a dramatic rally into late 2013, when Bitcoin first broke through four-digit prices.

- The 2016 halving preceded the 2017 cycle top, a textbook speculative blow-off that introduced Bitcoin to a much broader public audience.

- The 2020 halving arrived just months before a new all-time high and a strong expansion phase that lasted deep into 2021.

In each of these episodes, investors could tell a simple narrative: as new supply was cut, long-term holders absorbed most of the coins, leaving fewer available for new demand. When fresh capital arrived—whether from retail traders, early funds or corporate treasuries—the price had to adjust upward to clear the market. The halving became shorthand for this entire supply story.

That simplicity made the cycle extremely attractive as a mental model. It compressed complex dynamics into one easily observable anchor date, and many strategies were built around it: from long-term accumulation schedules to on-chain indicators that mapped price progress against the halving clock.

2. The New Cycle: When the Macro Calendar Overrules the Chain Calendar

In the current cycle, the halving still happened on time—but Bitcoin’s behaviour around it has looked very different. Instead of the market clearly bottoming, then trending upwards into and after the event, we have seen sharp rallies and equally sharp reversals that align more closely with macro shocks than with the reduction in miner rewards.

One of the clearest examples is Bitcoin’s reaction to changes in interest-rate expectations. When the Federal Reserve moved towards rate cuts, Bitcoin surged alongside equities and other risk assets, reinforcing the view that it has matured into a macro-sensitive instrument. Yet when Fed Chair Jerome Powell later adopted a more cautious tone—signalling fewer cuts than markets had priced in—Bitcoin reversed quickly, shedding a large part of its gains.

This pattern is not unique to a single announcement. If we look back at recent years, the most powerful upside moves have often coincided with periods of liquidity expansion connected to political and policy events rather than the exact halving dates themselves. In 2019, for example, Bitcoin rallied during a phase when central banks were easing and global growth concerns triggered supportive measures. In the latest cycle, rallies have aligned with expectations of more accommodative policy, while corrections have followed hawkish messaging or tightening signals.

The message is clear: the market is increasingly treating Bitcoin as a macro asset that responds to real-world cash flows, interest rates and political risk, not just as a token whose destiny is locked to a four-year issuance schedule.

3. Why Bitcoin Is Becoming a Macro-Sensitive Asset

Several structural changes help explain why macro forces now have more influence than in earlier cycles.

3.1 Larger Market Capitalisation Requires Larger Liquidity Waves

When Bitcoin was a niche asset with a relatively small float, a modest inflow of fresh capital could have an outsized effect on price. Halving-driven supply reductions played a big role because even small imbalances between new issuance and demand were enough to move the market dramatically.

Today, Bitcoin operates at a market capitalisation measured in the trillions of dollars. To move an asset of that size, the market needs far larger liquidity injections than before. Those injections rarely come from isolated crypto narratives; they tend to originate from global monetary policy, fiscal stimulus, and institutional capital flows. In other words, the engine that powers Bitcoin’s big cycles has shifted from protocol-driven supply adjustments to macro-driven demand waves.

3.2 Institutional Adoption and the Policy Channel

Another major shift is the growing presence of institutional investors, public companies and regulated funds. These actors make allocation decisions in the same framework they use for other macro assets. Bitcoin now competes for capital against equities, bonds, real estate and commodities, and is evaluated based on its behaviour under different rate regimes, inflation scenarios and political risks.

As a result, policy expectations have become a direct input into Bitcoin demand. When investors expect easier policy, they are more willing to hold assets with higher volatility and longer duration—categories that often include Bitcoin. When they anticipate tighter conditions or policy uncertainty, they scale back risk, and Bitcoin can be affected alongside tech stocks and other growth-sensitive exposures.

3.3 Derivatives, ETFs and Faster Transmission of Sentiment

The growth of derivatives markets, exchange-traded funds and structured products has also changed how quickly macro sentiment translates into price action. In previous cycles, it took time for new narratives to filter through retail channels. Today, a shift in interest-rate expectations can be expressed instantly through futures, options and ETF flows. That speed amplifies the market’s responsiveness to every new speech, forecast or political headline.

4. What Happens to the Halving Now?

Does this mean the halving has become irrelevant? Not quite. The reduction in new supply still matters—especially over longer horizons—but it has moved from the role of primary driver to that of a background condition.

Think of the halving as setting the long-term slope of potential supply pressure. With less new Bitcoin entering circulation, it becomes easier for growing demand to absorb issuance. However, the timing and intensity of that demand are now dictated less by the block-reward schedule and more by external variables such as fiscal deficits, central-bank balance sheets, election calendars and geopolitical uncertainty.

In this sense, the four-year cycle has not disappeared, but its internal mechanics are evolving. Instead of a simple countdown to a protocol event, the cycle is increasingly shaped by how macro liquidity and policy expectations interact with that hard-coded supply path.

5. Bitcoin as a Barometer of Macro Confidence

The deeper implication of this shift is that Bitcoin is behaving more like a barometer of global macro confidence than like an isolated crypto experiment. Several observations support this view:

- Sharp upward moves increasingly coincide with periods of easing financial conditions—when central banks signal flexibility, governments expand spending, or credit spreads tighten.

- Corrections often follow hawkish surprises or renewed concern about inflation and deficits, which prompt investors to de-risk across multiple asset classes.

- Election cycles, policy statements and geopolitical tensions now trigger noticeable reactions in Bitcoin, reflecting the asset’s role as both a speculative vehicle and, for some participants, a partial hedge against systemic uncertainty.

Viewed through this lens, Bitcoin is no longer simply a story of digital scarcity. It is also a real-time indicator of how investors feel about future purchasing power, institutional trust and the credibility of economic management.

6. Rethinking Cycle Playbooks: From Block Timers to Liquidity Maps

If macro conditions are now central, investors who still rely on the old halving-only playbook may find themselves surprised by volatility that seems “off-schedule”. Instead, a more nuanced framework is needed—one that combines Bitcoin’s protocol features with its growing integration into global capital markets.

A macro-aware approach to Bitcoin might include:

• Tracking liquidity indicators such as central-bank balance sheets, real yields, credit spreads and major fiscal announcements. These often provide early signals about risk appetite across markets.

• Monitoring political calendars—elections, budget negotiations, and policy reviews—that can influence expectations for regulation, taxation and economic management.

• Studying on-chain behaviour in conjunction with macro events. For example, do long-term holders accumulate during periods of policy uncertainty, suggesting stronger conviction? Or do they lighten exposure when real yields rise?

• Recognising that cycles may lengthen or become less symmetric. As the asset grows and institutional allocation frameworks evolve, the clean four-year rhythm could give way to more irregular patterns connected to the timing of global liquidity waves.

This does not mean individual investors must become full-time macro strategists. But it does imply that ignoring the macro environment is no longer an option if one wants to understand why Bitcoin is moving the way it does.

7. Opportunities and Risks in a Macro-Driven Bitcoin

The transition from a halving-dominated narrative to a macro-sensitive one brings both opportunities and new types of risk.

On the opportunity side, Bitcoin’s integration with mainstream macro themes makes it easier for institutional allocators to justify exposure. They can frame it as part of a broader toolkit for dealing with currency debasement, rate cycles or geopolitical uncertainty. The asset becomes part of discussions about portfolio construction, diversification and long-term purchasing power, rather than a purely experimental technology bet.

On the risk side, Bitcoin becomes more exposed to policy mistakes and political shocks. Sudden shifts in interest-rate expectations, regulatory news, or fiscal tensions can trigger rapid re-pricing, especially given the leverage embedded in derivatives markets. Investors who previously focused solely on halving-based models may underestimate how quickly macro narratives can change.

In addition, as the market grows, each new cycle may require larger and more sustained liquidity inflows to maintain the same pace of price appreciation. Without those inflows, bullish trends can stall even when halving reduces new supply. That makes timing more uncertain and places greater weight on the quality of broader economic conditions.

8. What Remains Constant: Scarcity, Transparency and Open Access

Despite these shifts, some core aspects of Bitcoin remain unchanged. The supply schedule is still transparent and verifiable. Anyone with the right tools can run a node and independently confirm the rules being enforced. The network remains open—no central authority can decide who may or may not participate in basic transactions.

These characteristics continue to differentiate Bitcoin from most traditional assets, even as its price becomes more closely tied to macro dynamics. In practice, what is evolving is not the protocol itself, but the way global capital markets interact with that protocol. As more participants with macro-oriented frameworks enter the space, they naturally project those frameworks onto Bitcoin’s behaviour.

9. Conclusion: The Four-Year Cycle Evolves, Not Disappears

The idea that “the four-year cycle is over” is too simplistic. A more accurate statement might be: the classic halving-centric cycle is being reshaped by macro forces. Halving events still matter because they define long-term supply, but they no longer dominate price action in the way they once appeared to. Market peaks and troughs now reflect a complex mix of issuance, liquidity, institutional behaviour and political decisions.

For investors, this evolution is both a challenge and an invitation. It challenges old assumptions that timing everything around a single protocol event is enough. At the same time, it invites a richer understanding of how digital scarcity, global liquidity and political risk weave together into a new form of market cycle.

In the coming years, Bitcoin is likely to keep serving as both a technology experiment and a macro instrument—a bridge between programmable money and the messy realities of real-world economics. The halving clock will keep ticking every four years, but the music the market plays around it will increasingly be composed by central banks, governments and the collective expectations of millions of participants watching the global economy.

Disclaimer: This article is for educational and analytical purposes only. It is not investment advice, financial guidance or a recommendation to buy or sell any asset. Digital assets are volatile and involve significant risk. Always conduct your own research and consider consulting a qualified professional before making financial decisions.