Is Bitcoin’s Four-Year Cycle Over – Or Just Evolving?

For years, the idea of a strict four-year cycle has been one of Bitcoin’s most persistent narratives. The story is intuitive: every four years, the protocol halves the block subsidy that miners receive. That programmed supply cut historically coincided with a new bull market, followed by a parabolic peak and a deep bear phase. Many participants came to treat the halving almost like a calendar for the entire asset class.

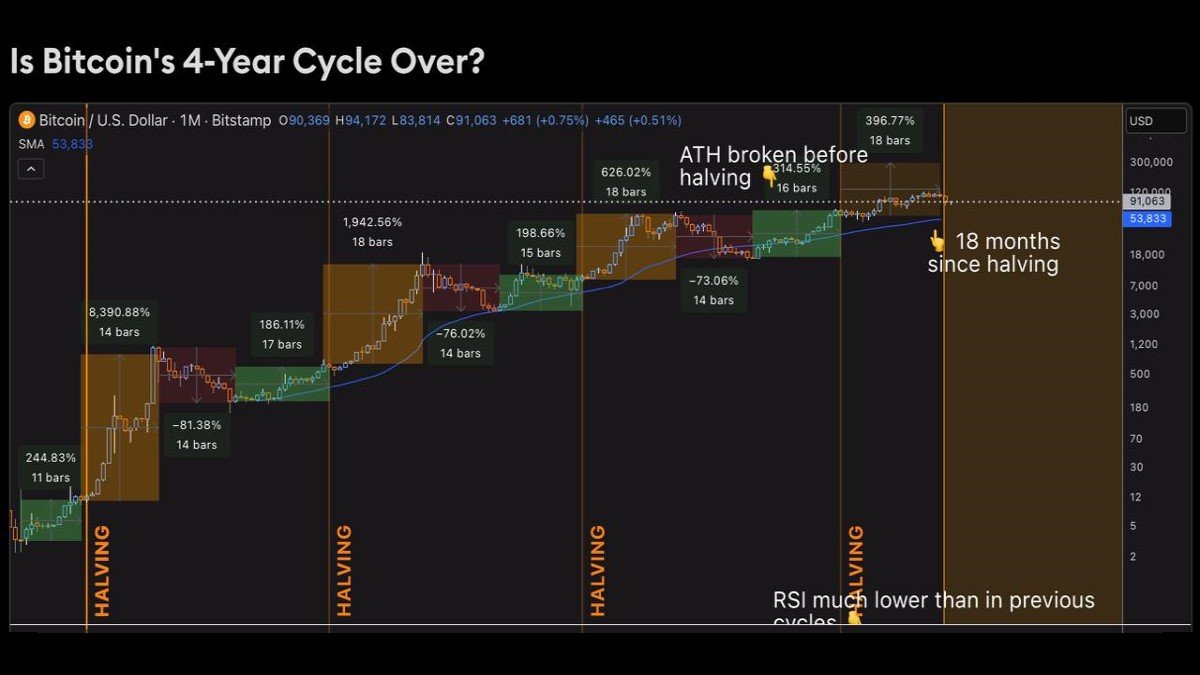

But the current cycle looks different. Bitcoin climbed from a low near 15,000 USD in late 2022 to new all-time highs before the 2024 halving even occurred, something no previous cycle had seen. Around 18 months after that halving, the market finds itself in an unusual place: Bitcoin trades near 90,000 USD, roughly flat to slightly negative for the year, with no textbook blow-off top and a broad altcoin complex that still lags far behind its 2021 valuations.

This divergence has opened a serious discussion. One group insists the four-year pattern is intact and that Bitcoin is now simply transitioning into its usual post-halving downturn. Another argues that the cycle has been fundamentally reshaped by institutional adoption, spot ETFs and macro forces. Instead of a neat four-year rhythm, they see a longer, structurally driven trend that will not fit easily into the old framework.

To understand what is at stake, we need to unpack how the four-year cycle narrative emerged, what each side of the debate is really saying, and how investors can interpret the data without falling into simplistic conclusions.

1. What People Mean When They Talk About Bitcoin’s Four-Year Cycle

The four-year cycle narrative is built around a simple mechanical fact: approximately every 210,000 blocks, the Bitcoin network halves the number of new coins created with each block. This event, known as the halving, reduces the rate of new supply issuance and, in theory, should make existing coins more scarce over time.

Historically, analysts mapped the market into four rough phases tied to each halving:

- Accumulation after a bear phase, where price trades below previous highs and long-term holders gradually increase positions.

- Halving year optimism, as participants anticipate the supply cut and begin to price in future scarcity.

- Parabolic expansion, typically 12–18 months after the halving, when new capital enters, leverage increases and price runs far above fundamental trend lines.

- Deep correction and prolonged bear market, resetting valuations and sentiment before the next cycle.

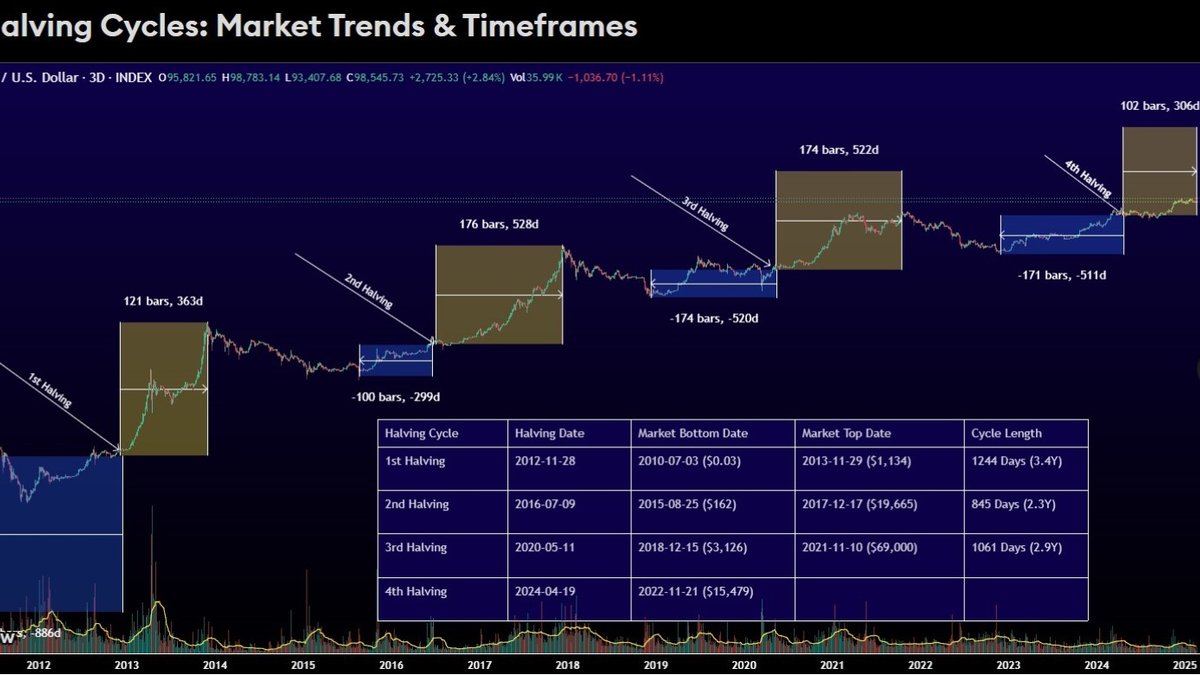

Previous epochs seemed to fit this pattern surprisingly well. After the 2012 halving, Bitcoin surged thousands of percent into the 2013 peak before collapsing. The 2016 halving was followed by the explosive 2017 run-up and subsequent bear market. The 2020 halving preceded the 2021 advance, the rise of NFT and DeFi narratives, and another sharp downturn in 2022.

Because these three cycles aligned so neatly with the four-year schedule, many participants concluded that Bitcoin’s market behaviour was effectively locked into the halving rhythm. The question now is whether that assumption still holds.

2. The Case for “The Four-Year Cycle Still Works”

Supporters of the traditional view argue that, despite some cosmetic differences, the current cycle fits the long-standing template. From the 2022 low near 15,000 USD to the highs above 120,000 USD, Bitcoin appreciated more than eightfold. That magnitude, they argue, is consistent with prior bull markets, even if the exact timing shifted.

2.1 Diminishing Returns, Familiar Structure

One key element of this argument is diminishing upside. As Bitcoin matures and its market capitalisation grows, the percentage gains from each cycle naturally compress. Early moves of several thousand percent are unlikely to repeat when the asset is already widely held and integrated into institutional portfolios. In that light, an eightfold rise from cycle low to cycle high does not look structurally different from the 20x or higher moves of the past; it is simply the next step in a pattern of gradually smaller, but still powerful, expansions.

From this perspective, the recent consolidation near 90,000 USD is the early stage of the familiar post-peak environment. Volatility cools, speculative leverage fades, and long-term holders begin another slow accumulation phase. Whether the precise calendar matches earlier cycles is less important than the broader rhythm of expansion and contraction around each halving.

2.2 Altcoin Underperformance as a Feature, Not a Bug

Another point for the “cycle still works” camp is the behaviour of altcoins. In prior peaks, alternative assets tended to rally later and more aggressively than Bitcoin, fuelled by narratives such as ICOs in 2017 or NFTs and play-to-earn experiments in 2021. This time, however, the vast majority of altcoins have underperformed. Many remain below their 2021 highs, and some trade significantly lower despite Bitcoin’s new peaks.

Proponents of the four-year cycle see this not as a sign of structural change, but as evidence that narratives did not reset. The number of alternative tokens has grown enormously, competition for attention is intense, and regulators have become more cautious about newer experiments. Without a dominant story like the ICO or NFT booms, capital has remained concentrated in Bitcoin and a small handful of large platforms. The absence of a spectacular altcoin season, in this view, is a quirk of narrative and regulation, not proof that the halving cycle has vanished.

3. The Case for “The Four-Year Cycle Is Breaking Down”

The opposing camp, which includes research firms, industry founders and macro analysts such as Lynn Alden, sees the current environment as qualitatively different. They argue that the combination of institutional demand, exchange-traded products and tighter connections to macro variables has changed the way Bitcoin trades.

3.1 A New All-Time High Before the 2024 Halving

The most visible piece of evidence is timing. For the first time in Bitcoin’s history, the market set a new all-time high before the halving rather than after it. Previous cycles saw price bottom, recover, then break the old high roughly one year after the supply cut. Hitting that milestone ahead of schedule suggests that participants may be front-running the halving narrative rather than reacting to it.

This makes sense in a world where major asset managers, sovereign institutions and corporate treasuries now plan around the halving years in advance. When everyone anticipates the supply shock, capital can arrive earlier, smoothing the pattern and weakening the old calendar-driven structure.

3.2 Bitcoin as a Macro Asset, Not a Self-Contained Cycle

Critics of the four-year model also point to Bitcoin’s growing sensitivity to macroeconomic data. Rate expectations, real yields, global liquidity and risk sentiment now appear to have a larger influence on price than in earlier years. In 2025, for example, Bitcoin’s year-to-date performance has been modest, roughly down a few percent, despite the fact that a halving-year extension rally would traditionally still be underway. Instead of moving in isolation, BTC has reacted to changes in Federal Reserve guidance, fiscal outlooks and currency dynamics.

In this view, Bitcoin is transitioning from a self-contained, programmatic cycle to a macro-linked asset embedded in the wider financial system. The halving remains a structural feature, but it is only one of many forces shaping price. As the asset becomes more widely held by institutions, its behaviour begins to resemble that of other long-duration assets: sensitive to discount rates, liquidity regimes and cross-asset flows.

3.3 ETF and Institutional Flows as New Gravity

A third argument centres on spot ETFs and institutional adoption. Since early 2024, ETFs have accumulated a large share of circulating Bitcoin, funded by retirement accounts, wealth-management platforms and professional allocators. Even when BTC experienced corrections of 30 percent or more, outflows from these vehicles remained limited, reportedly below five percent of assets in several drawdowns. That behaviour suggests a base of holders with longer time horizons and more structured mandates than the retail-dominated peaks of earlier cycles.

Research from investment firm Bernstein frames this as evidence that Bitcoin is entering a multi-year, structurally driven uptrend rather than a short, discrete halving rally. Their thesis is that institutional inflows, via ETFs and other vehicles, are absorbing coins from short-term holders and miners over an extended period. In that framework, corrections are pauses in a longer climb, not the start of a classic four-year winter. Bernstein has gone as far as modelling scenarios in which Bitcoin could approach one million dollars by 2033 if adoption and allocation trends continue.

Large banks have begun to echo parts of this structural view. JPMorgan, for example, has projected that Bitcoin could reach the 170,000 USD region within 6 to 12 months, with the current cycle peak possibly occurring around 2027 rather than in the immediate aftermath of the 2024 halving. That implies a stretched cycle, where the timeline between supply cut and ultimate peak is longer than the familiar 18-month window.

4. Are We Watching the End of the Cycle – or a Regime Change?

With credible arguments on both sides, how can observers make sense of this debate? One useful approach is to think in layers rather than in absolutes.

4.1 Layer One: The Halving Still Matters

At the most fundamental level, the halving undeniably affects Bitcoin’s supply dynamics. It reduces the flow of new coins entering the market and, over time, increases the proportion of supply held by long-term owners. Even in a world of ETFs and institutional desks, miners still need to cover operating costs, and a lower subsidy eventually constrains how much fresh supply they can sell.

So the question is not whether the halving matters—it almost certainly does—but how directly it translates into price movements when other powerful forces are at work. In immature markets, a large change in supply might drive dramatic price swings on its own. In more developed markets, that effect is mediated by derivatives markets, hedging strategies, inventory management and investor expectations. The halving becomes a background parameter rather than the sole driver.

4.2 Layer Two: Liquidity and Macro Conditions

The second layer is global liquidity and macro policy. When real interest rates are falling, credit is abundant and risk assets are in favour, scarce assets such as Bitcoin typically benefit. When rates rise and investors de-risk, even assets with strong long-term narratives can experience extended drawdowns. The current cycle has seen both forces at play: a burst of enthusiasm around ETF approvals and structural adoption, followed by periods where concerns about fiscal sustainability, inflation and growth dominated investor psychology.

In this environment, relying solely on the halving calendar is risky. A halving that arrives during a supportive liquidity regime may coincide with strong performance, while one that occurs in a tightening phase might deliver a muted response. The 2024 event took place against a backdrop of shifting expectations about central-bank policy and global growth, complicating the usual script.

4.3 Layer Three: Market Structure and Ownership

The third layer is market structure: who owns Bitcoin, through which vehicles and with what constraints. As coins move from short-term retail traders and lightly regulated venues into ETFs, corporate treasuries and potentially bank balance sheets, the characteristics of the holder base change.

Longer-horizon owners may be less sensitive to daily price volatility and more guided by asset-allocation models or strategic theses. Their transaction patterns—periodic rebalancing, systematic purchases, hedged exposure—can dampen extremes. At the same time, they can also create new forms of reflexivity: if a widely followed macro model tells allocators to de-risk all long-duration assets, Bitcoin ETFs may see outflows alongside technology stocks and credit funds.

Seen through this lens, the argument that Bitcoin is leaving behind a simple four-year cycle is less about ideology and more about acknowledging that ownership has changed. The asset is now embedded in a financial ecosystem that reacts to many variables, not just block rewards.

5. Educational Takeaways: How to Think About Cycles Without Relying on a Calendar

For individual observers and analysts, the practical question is not which camp to cheer for, but how to build a framework that remains useful even as the market evolves.

5.1 Treat the Four-Year Pattern as a Historical Guide, Not a Rule

Past cycles offer valuable context. They show how investor psychology tends to overshoot in both directions and how long it has historically taken for confidence and liquidity to rebuild after large drawdowns. However, using those patterns as strict rules—assuming, for example, that every halving automatically leads to a peak within a fixed time window—can be misleading in a more complex environment.

A healthier approach is to treat the halving as one important variable among many. It sets a long-term trajectory for supply, but it does not override macro events or structural shifts in demand. When historical averages and current macro conditions align, conviction may be higher; when they diverge, humility is warranted.

5.2 Be Careful With “This Time Is Different” – and With “Nothing Ever Changes”

Both extremes carry risk. Dismissing every new development with a shrug and insisting that the old pattern will repeat exactly can blind observers to genuine regime changes, such as the institutionalisation brought about by ETFs. On the other hand, declaring that the past is irrelevant every time the market behaves unusually can lead to overconfidence in untested narratives.

Balancing these instincts means recognising that structural changes—like a large share of supply moving into regulated funds, or major banks building digital-asset infrastructure—can bend cycles without erasing the underlying logic of supply and demand.

5.3 Focus on Quality of Demand, Not Just Price Targets

Forecasts such as Bernstein’s long-term vision of Bitcoin potentially reaching one million dollars by 2033, or JPMorgan’s shorter-term targets around 170,000 to 200,000 USD, are best read as scenarios based on particular assumptions, not as promises. What matters more than the numbers themselves is the underlying view of demand: who they expect to buy, at what scale and with what constraints.

If those underlying drivers—such as pension funds allocating small percentages of portfolios, or sovereign wealth funds treating BTC as a strategic reserve—do materialise, the market could indeed evolve into a longer, more gradual uptrend. If they do not, the asset may continue to show boom-and-bust dynamics, even if the timing of each phase shifts.

Conclusion

The question of whether Bitcoin’s four-year cycle is over has no simple yes-or-no answer. The halving still shapes supply, and elements of the old pattern—accumulation, expansion, euphoria and correction—are likely to persist as long as human psychology does. At the same time, the emergence of spot ETFs, the growing role of macro factors and the changing composition of the holder base mean that the cycle can no longer be understood by looking at the block subsidy alone.

What seems most plausible is not that the cycle has ended, but that it is evolving. The strict, almost mechanical rhythm of past decades is giving way to a more nuanced interplay between protocol rules, policy decisions and portfolio theory. In that new environment, the most useful skill is not memorising dates, but learning to read how supply dynamics, liquidity regimes and institutional participation interact over time.

Educational note: This article is for informational and analytical purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be used as the sole basis for any financial decision. Digital assets can be volatile and may not be suitable for every investor. Readers should conduct their own research, consider their financial circumstances and risk tolerance, and consult qualified professionals before making any investment or allocation choices.