Crypto’s “Netscape Moment” Meets the Memecoin Stress Test

Every technology cycle eventually hits a transition point where infrastructure fades into the background and distribution takes over. For the internet, that moment was when user-friendly browsers like Netscape Navigator turned a research network into a consumer product. For smartphones, it was when the iPhone unified hardware, software and an app store into a single experience.

According to Paradigm co-founder Matt Huang, crypto is now somewhere in that same arc: a “Netscape or iPhone moment” where the combination of onchain infrastructure and regulated investment products is pushing the industry beyond its early-adopter base. The question is whether this inflection leads to a durable financial stack—or simply a larger version of the speculative booms that came before.

1. From Experimental Rails to Investable Products

Over the last few years, most of the energy in crypto has gone into building rails: faster blockchains, better wallets, bridges, oracles, and liquidity layers. These systems are increasingly capable of doing things that traditional finance cannot: atomic settlement across assets, programmable pay-outs, permissionless market creation and 24/7 liquidity that never closes for weekends or holidays.

In parallel, a very different kind of infrastructure has been taking shape in traditional finance. Exchange-traded products (ETPs) and exchange-traded funds (ETFs) holding digital assets give investors exposure through brokerage accounts and custodians they already understand. Bloomberg ETF analysts count roughly 155 crypto ETP filings tracking 35 assets, with expectations that the number of listed products could exceed 200 over the next year as more issuers enter the race. This shift marks a migration from niche specialist vehicles to a broad menu of listed products integrated into mainstream platforms.

Put simply: the onchain world has built programmable finance; the off-chain world is now building regulated wrappers around the assets that live on those rails. The convergence of these two layers is what gives the “Netscape moment” label its weight.

2. How Onchain Infrastructure and Regulated ETPs Reinforce Each Other

It is tempting to treat ETFs and onchain finance as opponents: one centralized and regulated, the other decentralized and permissionless. In practice they solve different problems for different users, and the system is strongest when both are allowed to do what they are good at.

- Onchain infrastructure specialises in final settlement and programmability. It allows direct self-custody, transparent collateralisation, composable DeFi applications and real-time clearing between parties who may not know each other.

- ETFs and other ETPs specialise in distribution and compliance. They allow pensions, insurers, family offices and retail investors to gain price exposure without changing operational processes or custody models overnight.

In that sense, regulated products do not replace onchain activity; they sit at the edge of it. They buy the underlying assets, hold them with qualified custodians and issue claims against those holdings in the form of exchange-traded shares. The more successful they are, the more base-layer demand they create for Bitcoin, Ethereum and, increasingly, for selected altcoins.

For the underlying networks, this has two important effects. First, it anchors a portion of demand in holders with longer time horizons—asset managers that rebalance quarterly rather than intraday. Second, it forces improvements in custody, auditing and governance, because the institutions allocating capital through these products have explicit fiduciary obligations. Those improvements then spill over to benefit the broader ecosystem, including users who never touch an ETF.

3. The “Netscape Moment” Analogy—And Its Limits

Huang’s comparison to Netscape and the iPhone resonates for a reason. The original web browser reduced the friction of using the internet from command-line instructions to point-and-click navigation. The iPhone did something similar for mobile computing: instead of worrying about hardware specs and operator settings, users tapped icons on a touchscreen and downloaded apps from a curated store.

Crypto’s equivalent is the combination of user-friendly interfaces and tightly integrated investment channels. Self-custodial wallets no longer require users to manage raw private keys; they can use passkeys, social recovery and clear transaction prompts. At the same time, brokerage platforms are rolling out spot ETFs, multi-asset crypto baskets and ETPs tracking specific sectors. For many people, that is their first direct contact with digital assets—just as early internet users met the web through a browser rather than an RFC spec.

However, the analogy has limits. The internet’s “Netscape moment” coincided with a massive dot-com bubble where countless companies listed on public markets with thin business models. The browser made access easier, but it did not guarantee that early valuations were justified. The same tension is visible in crypto today: easier access via ETFs and ETPs does not automatically separate sustainable onchain products from purely speculative experiments.

4. The Complementarity of CeFi and Onchain Economy

One common fear is that as ETFs and centralized platforms expand, onchain activity will be sidelined—that users will stop caring about self-custody or DeFi and simply hold ticker symbols in brokerage accounts. That outcome is not inevitable, and several analysts argue the opposite is more likely.

Regulated entry points tend to act as funnels, not dead ends. Investors who begin with a simple Bitcoin or Ethereum ETF may eventually want to understand staking yields, new protocol launches or onchain yield opportunities. Over time, some graduate from passive exposure to more active participation, whether that means running validator nodes, using lending protocols or accessing tokenized real-world assets. The key is that without a low-friction gateway, many of these users would never reach the onchain layer in the first place.

From this perspective, centralized finance (CeFi) and onchain infrastructure are two halves of the same growth story. CeFi brings distribution, brand recognition and compliance; onchain rails offer settlement finality, programmability and global reach. Rather than fighting each other, they expand the surface area of the overall “onchain economy,” making it more likely that new capital sticks around instead of cycling in and out with each speculative wave.

5. The Memecoin Dependency Problem

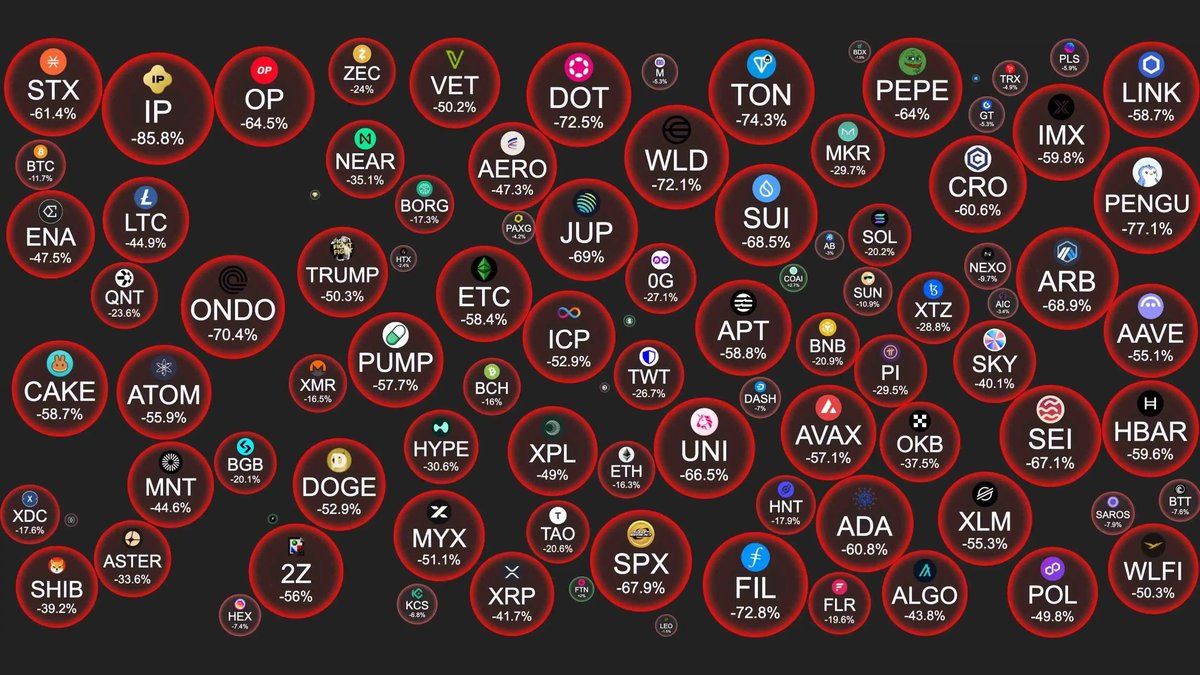

Against this backdrop of institutionalisation, there is a less comfortable reality: a significant portion of onchain revenue still comes from highly speculative memecoin activity. Solana is the clearest illustration. According to data from infrastructure providers and network reports, memecoin-related applications have accounted for roughly 62% of Solana dApp revenue in recent months and helped push total dApp revenues to around 1.6 billion USD in the first half of 2025. Much of that income is tied to rapid-fire trading and the launch of short-lived tokens, rather than long-term utility applications.

On the one hand, this shows that Solana’s technology stack is capable of handling enormous transaction volumes at low cost. Low fees and fast confirmation are precisely what make it attractive for retail-driven flows and experimental markets. On the other hand, it raises questions about the quality of the underlying economic activity. If a majority of network revenue depends on short-term trading of tokens with limited fundamental use, what happens when attention shifts elsewhere?

The dot-com era offers a useful parallel. In the late 1990s, a large chunk of market capitalization and trading volume accrued to companies whose business models were little more than “eyeballs” and ad banners. The underlying technology—browsers, TCP/IP, server infrastructure—was transformative and ultimately changed the world. Many of the early public names, however, did not survive once capital started asking hard questions about recurring revenue and margins.

6. Why Memecoin Booms Can Coexist With Structural Progress

It would be a mistake to conclude that heavy memecoin activity automatically invalidates the “Netscape moment” thesis. Speculative waves are almost a feature of early networks: they attract attention, stress-test infrastructure and, paradoxically, fund further development through transaction fees and ecosystem grants.

The important distinction is between temporary drivers and enduring foundations. Memecoin bursts may dominate fee revenue for a time, but they are unlikely to remain the primary story once the system matures. Instead, the lasting value tends to come from applications that solve concrete problems—payments, market access, credit, identity, data coordination—using onchain tools in a way that cannot be replicated easily with traditional databases.

For Solana and other high-throughput chains, the challenge is to convert the visibility and funding from memecoin cycles into infrastructure and applications that would still make sense even if speculative volume disappears. That means investing in developer tooling, stable infrastructure providers, real-world integrations and clear messaging to regulators. If that transition happens, the fact that early network revenue came from memecoins will matter less; the internet’s own early traffic was dominated by banners and chat rooms, but the technology outgrew those first use cases.

7. How Crypto Can Avoid a Dot-Com Style Hangover

To avoid repeating the worst parts of the dot-com cycle, the industry needs to learn from its history. Several concrete steps can help:

• Transparent revenue composition. Protocols and foundations should report not just total fees or revenue, but also how much comes from different categories: trading, payments, gaming, infrastructure services and so on. Clear disclosure helps investors and users distinguish between structural and cyclical income.

• Stress testing for fee sustainability. Networks can run scenario analyses that ask: “What happens to validator rewards and security if speculative volume drops 70%?” If the model only works during peak activity, it may not be robust enough for the next phase of adoption.

• Aligning incentives with long-term usage. Token designs that reward short-term trading but neglect loyalty, real-world integrations or ongoing development are vulnerable to boom-and-bust patterns. Reward structures that prioritise stability—such as incentives for long-term staking, real-world asset onboarding or mission-critical infrastructure—encourage healthier growth.

• Regulatory engagement. As ETFs and ETPs proliferate, regulators will pay closer attention to the assets underlying them. Projects that take disclosure, governance and user protection seriously are more likely to attract long-term capital than those that treat regulations as an afterthought.

The dot-com bubble did not invalidate the internet; it simply accelerated a sorting process. Something similar is likely in crypto: the underlying technology is powerful, but not every token or application built on top of it will survive the transition from enthusiasm to scrutiny.

8. What a Successful “Netscape Era” Looks Like for Crypto

If the industry navigates this moment well, the result could be a financial stack that looks very different from today’s system, but more stable than many expect. In that scenario:

• ETFs and ETPs give hundreds of millions of people low-friction exposure to digital assets through retirement accounts and brokerage platforms.

• Onchain infrastructure settles a growing share of cross-border payments, collateral management and market operations, often without end-users realising that blockchain technology is involved.

• Memecoin cycles still occur, but they represent a smaller share of total revenues as payments, credit, identity and real-world asset protocols grow.

• Regulators treat digital assets as one more category of financial instrument, subject to clear standards on disclosure, custody and risk management rather than ad-hoc responses.

In that world, the phrase “Netscape moment” becomes less about speculative excitement and more about a quiet shift in default behaviour: people and institutions simply start using crypto-enabled rails because they are faster, cheaper or more transparent than the alternatives.

Conclusion

Crypto is indeed approaching a turning point. The simultaneous rise of regulated ETFs/ETPs and high-throughput onchain infrastructure feels similar to the convergence of browsers, broadband and consumer hardware that pushed the internet into everyday life. At the same time, the dominance of memecoin activity on some networks is a reminder that usage statistics can be misleading if we do not ask what people are actually doing on these rails.

For observers and participants, the key is to hold both truths at once. Yes, this may be a “Netscape or iPhone moment” in terms of accessibility and institutional acceptance. But that makes it even more important to build applications and governance structures that can outlast the current cycle of speculative attention. The opportunity is not just to ride the next wave, but to turn crypto’s experimental sandbox into financial infrastructure that still makes sense ten or twenty years from now.

Educational notice: This article is for information and analysis only. It does not constitute financial, investment, legal or tax advice. Digital assets can be volatile and may not be suitable for every investor. Readers should conduct their own research, consider their personal circumstances and risk tolerance, and consult qualified professionals before making any financial decisions.