Solana’s 2025 DEX Surge: What the Volume Really Says (and What It Doesn’t)

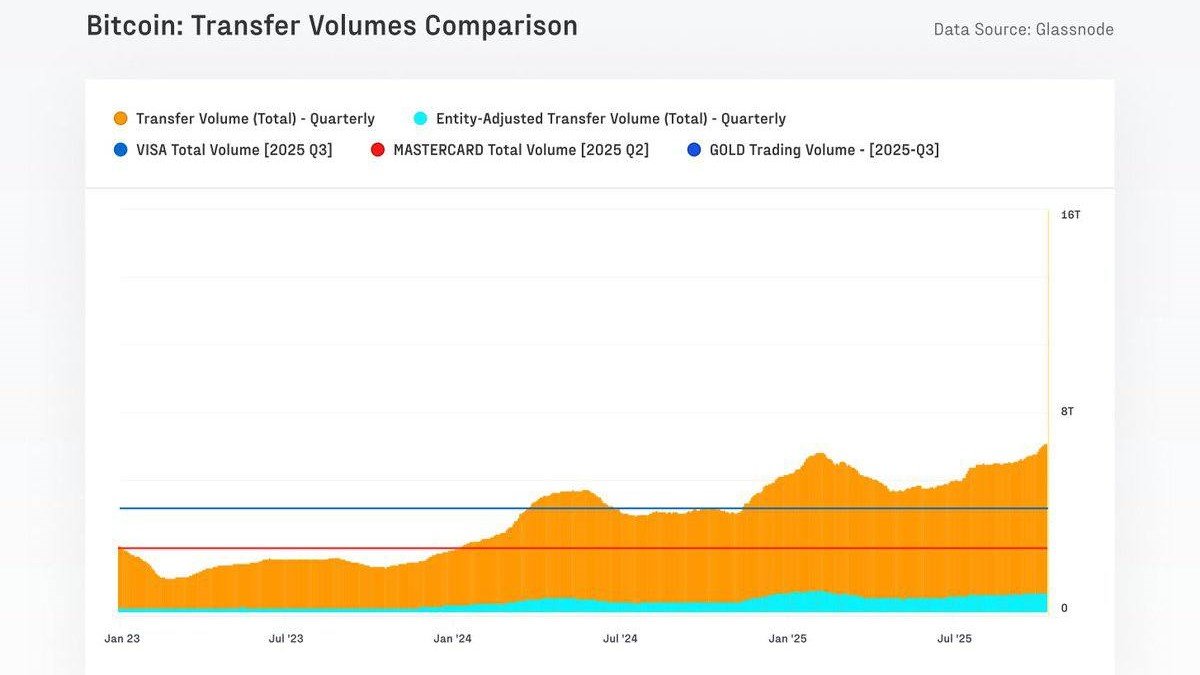

When people talk about Solana in 2025, they often reach for the biggest number they can find. Trillions in DEX volume. Months where Solana outpaced other chains. Eye-catching 24-hour spikes that make screenshots travel faster than context. But volume alone is a noisy narrator — it tells you that something happened, not why it happened or who benefited.

A more useful lens is to treat Solana’s on-chain trading like a live experiment in market structure. In 2025, Solana didn’t merely host DEXs; it increasingly behaved like an integrated trading venue where distribution (token launches), execution (routing and pricing), and settlement (stablecoins) reinforced each other. That feedback loop is the real story — and it’s also where the risks hide.

Start With the Shape of the Flow, Not the Size

Ecosystem reports show Solana’s DEX volume reached extraordinary levels in 2025, including roughly $890B in the first five months alone — already close to the prior year’s total. That’s not just “more trading.” It’s a clue that Solana became the default venue for a specific type of activity: high-frequency, low-friction swapping where speed and cost matter as much as brand names.

At the same time, dashboards and monthly snapshots repeatedly showed Solana clearing psychologically important thresholds (like $100B+ months) while maintaining a fee profile that makes iterative trading feasible. In other words, volume was not simply pulled in by higher prices — it was enabled by a system that can absorb relentless small trades without collapsing into fee spikes.

Here’s the practical takeaway: the most important question isn’t “How big was Solana’s volume?” It’s “How dependent was that volume on a narrow set of behaviors?” If the majority of flow is short-horizon trading, volume can evaporate quickly when incentives shift. If it’s driven by sticky use cases (payments, on-chain treasury ops, durable apps), the same number means something very different.

PumpSwap: When Distribution Becomes a Trading Moat

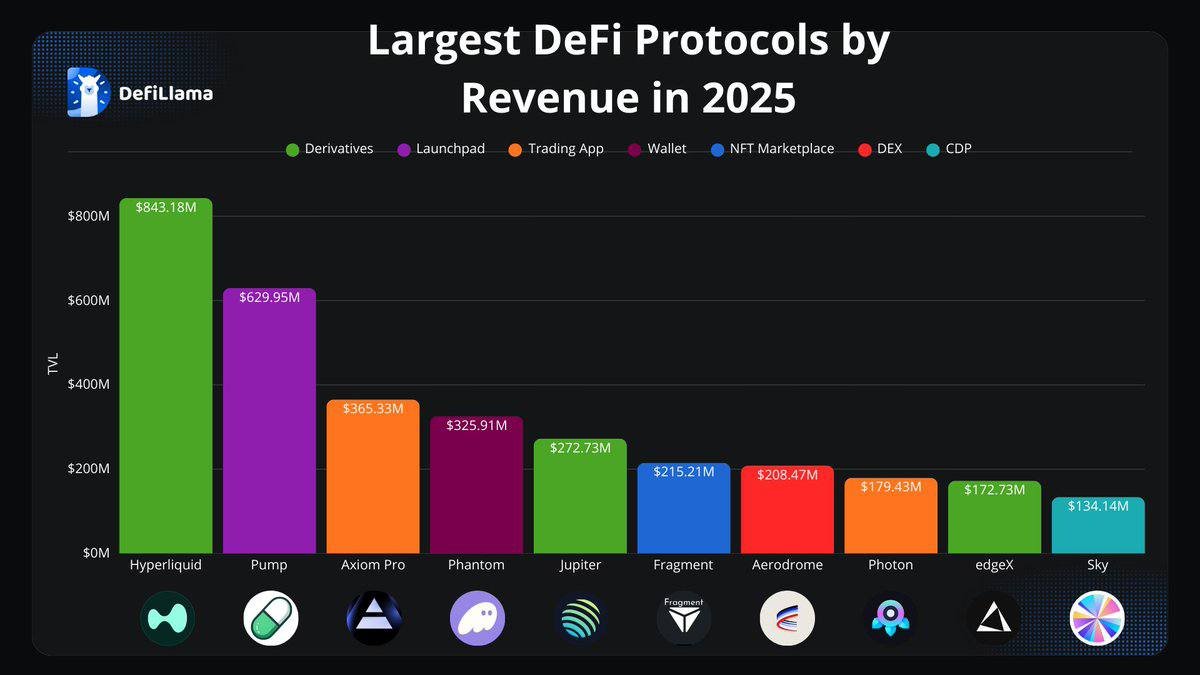

Solana’s DEX boom was not a generic “DeFi season.” A major catalyst was distribution — where new assets are born and how quickly liquidity forms around them. In 2025, token-launch dynamics tightened their grip on DEX routing. Once a launchpad becomes the default front door for new tokens, it quietly becomes the default on-ramp for swaps, too.

PumpSwap’s emergence captured attention because it compressed the distance between creation, liquidity, and secondary trading. Instead of users bouncing between venues, the launch flow and the swap flow started to live in the same neighborhood. That matters because the fastest-growing exchanges aren’t always the best-designed ones — they’re often the ones closest to the place where attention enters the system.

Within days of launch, PumpSwap’s activity was already material on a chain-wide basis, reaching a billion dollars in cumulative volume quickly and posting notable single-day bursts. Whether you view that as healthy competition or attention-driven churn, it demonstrates a structural advantage: distribution can function like liquidity — at least long enough for a venue to become habit-forming.

HumidiFi and the 2025 Shift Toward Execution-First Design

If PumpSwap represents distribution, HumidiFi represents execution. Its rise highlighted a theme that gets overlooked in “volume war” narratives: traders don’t only chase the lowest fee; they chase the lowest total cost of trading. That includes slippage, adverse selection, and the subtle ways transparent pools can be gamed by faster actors.

HumidiFi’s “dark pool / proprietary AMM” framing (whatever label you prefer) signals demand for more controlled execution. In 2025, Solana didn’t just add more DEXs — it broadened the palette of market microstructures available on-chain. That’s a big deal. Mature markets don’t converge to one design; they diversify as different participant types optimize for different constraints.

HumidiFi briefly posted attention-grabbing daily volume figures and climbed the rankings among Solana DEX venues, underscoring that experimentation isn’t theoretical anymore — it’s attracting real order flow. The deeper implication is uncomfortable but useful: a chain can “win” volume while still debating what the fairest, safest, and most sustainable execution model should be.

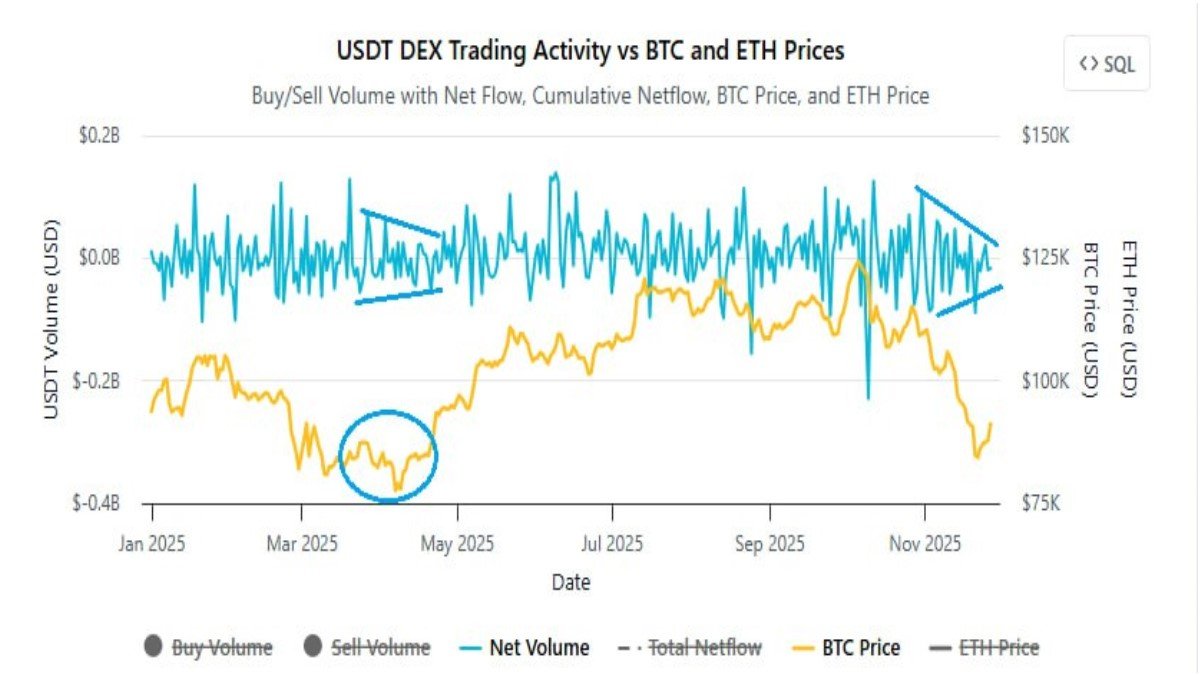

USDC Minting: The Quiet Engine Behind Loud Volume

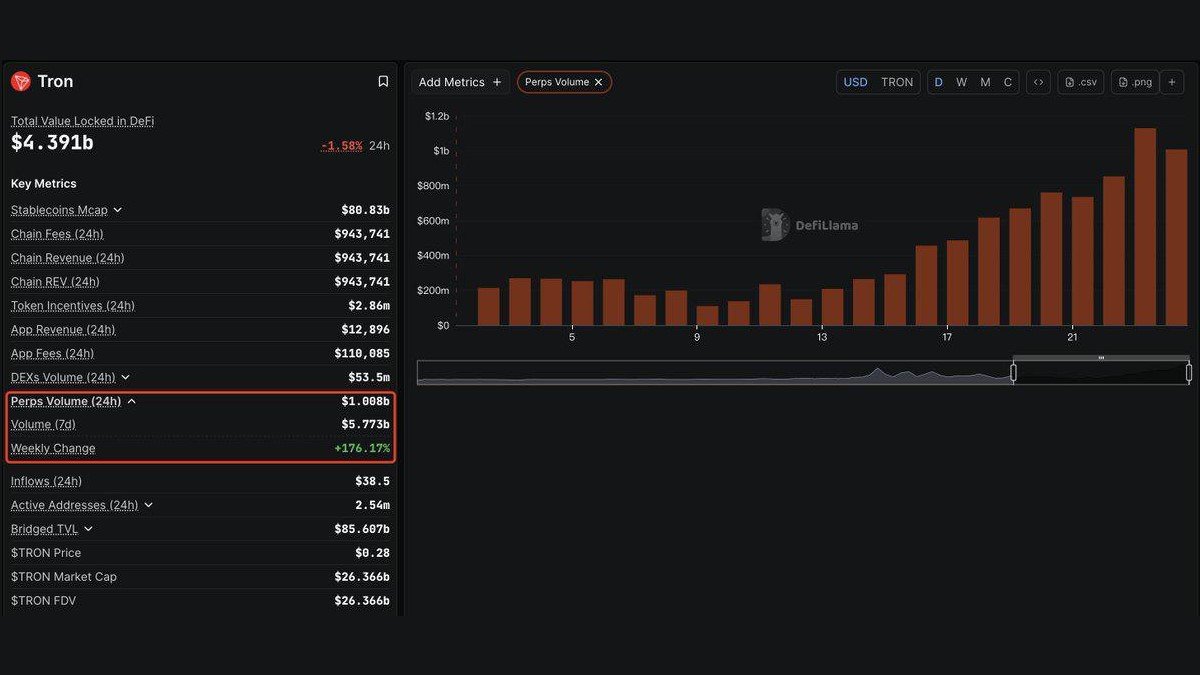

DEX volume is the headline, but stablecoin plumbing is the engine room. Most users don’t think about it because stablecoins are designed to feel boring — which is exactly why they matter. If stablecoins are scarce, spreads widen, routing worsens, and traders migrate. If stablecoins are abundant, activity can compound because settlement becomes frictionless.

In 2025, Solana’s stablecoin footprint (and USDC’s dominance inside it) helped explain why liquidity stayed resilient during intense trading periods. When a chain becomes a preferred venue for stablecoin circulation, it gains a kind of “financial gravity”: liquidity providers can operate with tighter buffers, and arbitrage becomes easier, which further tightens pricing across venues.

There’s a second-order effect here. As stablecoin liquidity deepens, DEXs stop feeling like isolated pools and start feeling like components of a single, chain-wide marketplace. That’s when volume becomes more than a metric — it becomes a behavior pattern. And behavior patterns, unlike one-off spikes, can persist.

Network Revenue: Who Actually Captures the Value?

One of the most misunderstood parts of Solana’s 2025 story is “revenue.” People often mix three different buckets: base transaction fees, priority fees, and MEV-related tips paid to validators. Some analytics packages group them under Real Economic Value (REV), while other dashboards track fees and revenue more narrowly. The result is a lot of confident commentary built on mismatched definitions.

Solana’s own data story makes the distinction unavoidable: the chain can process enormous volume while base fees stay tiny, meaning the economic footprint shifts toward priority fees and MEV infrastructure. Ecosystem research highlighted that validator tips (often associated with MEV supply chains) can represent a large share of REV, and that REV itself can spike dramatically during peak events.

So how should readers interpret the “$1.3–$1.5B in 2025 revenue” style estimates? Treat them as a directional signal: Solana’s economic throughput matured enough that multiple data providers began ranking it near the top by chain-level earnings. But don’t treat any single figure as gospel unless the definition is explicit. The healthiest way to read the number is: Solana proved it can monetize blockspace demand — but the split between apps, validators, and MEV pipelines remains the key debate.

The Solana-vs-Ethereum Flip: A Better Way to Frame It

“Solana beat Ethereum in DEX volume” is the kind of sentence that wins engagement and loses nuance. A more useful framing is: Solana optimized for a different trade. Ethereum optimized for decentralization and modular scaling through a broad ecosystem of Layer 2s; Solana optimized for high-throughput execution on the base layer with extremely low per-transaction costs.

Those architectural choices attract different flows. Solana’s 2025 DEX dominance aligns naturally with activity that benefits from fast settlement and cheap iteration: arbitrage, rapid rotation, and retail-scale experimentation. Ethereum’s strengths show up in different ways: deep liquidity across mature DeFi primitives, robust institutional tooling, and a long runway of protocol conservatism.

What 2025 actually demonstrated is that on-chain trading is not a single market — it’s a family of markets. Solana captured a growing branch of that family. The open question for 2026 isn’t whether Solana can win another month; it’s whether it can convert high-velocity trading into durable financial infrastructure.

What to Watch Next: A Sustainability Checklist for 2026

Solana’s 2025 numbers were loud. Sustainability will be quieter, and that’s the trap: the market tends to stop paying attention right when the most important signals emerge. If you want to evaluate whether Solana’s DEX economy is maturing (not just growing), focus on metrics that are hard to fake and slow to build.

Below are practical indicators that help separate “volume as weather” from “volume as climate.” None of them require price predictions — they require patience and consistent definitions.

1) Stablecoin resilience: Is stablecoin supply and usage holding steady through calm periods, or does it spike only during hype waves? Persistent stablecoin depth is one of the best predictors of durable liquidity.

2) Venue diversity: Does volume concentrate in a single mechanism, or spread across multiple DEX designs (including execution-focused models)? Market maturity typically increases diversity, not monoculture.

3) Value capture clarity: Are apps capturing meaningful revenue relative to chain-level REV, or is most value leaking into MEV pipelines? Healthy ecosystems tend to balance incentives so builders can keep building without relying on short-term subsidies.

4) User retention over raw activity: High daily active addresses can coexist with high churn. Look for repeat users across months, not just bursts of new wallets.

5) Performance under stress: The crucial test is not average-day speed — it’s whether the network maintains predictable execution during peak demand without degrading user experience.

Conclusion

Solana’s 2025 DEX surge is best understood as a market-structure event, not a popularity contest. Distribution engines (like launch-driven flows), execution experiments (like proprietary AMM models), and stablecoin plumbing (especially USDC liquidity) combined to make on-chain trading feel less like a niche and more like a mainstream venue.

The next chapter is harder than the last. Scaling volume is impressive; scaling trust, fairness, and sustainable value capture is the real milestone. If Solana can keep broadening execution choices, deepen stablecoin resilience, and clarify who earns what — without compromising reliability — then 2025 will look less like a spike and more like an inflection point.

Frequently Asked Questions

Does higher DEX volume automatically mean Solana is “better” than other chains?

Not automatically. Volume tells you where trading happened, but not whether it was sticky, evenly distributed, or economically sustainable. Different chains optimize for different trade-offs, and volume often reflects which trade-offs were rewarded in a specific period.

Why do stablecoins like USDC matter so much for DEX growth?

Stablecoins reduce friction in settlement and routing. When stablecoin liquidity is deep, swaps become cheaper in practice (less slippage), arbitrage tightens pricing, and liquidity providers can operate more efficiently — all of which can support higher volume without turning the experience into a fee-driven bottleneck.

What’s the difference between fees, revenue, and REV?

“Fees” often refers to base transaction fees. “Revenue” can be defined differently depending on the dashboard (sometimes net of incentives). “REV” typically bundles multiple value streams paid for blockspace and execution, including MEV-related tips. Always confirm definitions before comparing figures across chains.

Is Solana’s DEX activity mostly retail-driven?

A meaningful portion of the activity profile aligns with high-frequency and retail-scale behavior because low fees make iterative trading practical. But execution-focused venues and sophisticated routing also attract more advanced participants. The mix matters — and it can shift quickly as incentives evolve.