DeFi’s 2025 Revenue Leaders: The Quiet Shift From “Protocols” to Real Businesses

The most important DeFi story of 2025 isn’t a single launch or a single narrative. It’s a scoreboard—and the way that scoreboard has changed what builders optimize for. When you line up the year’s biggest revenue generators, you don’t just see “crypto apps.” You see a set of businesses that priced user attention, repeat engagement, and liquidity demand with increasing precision.

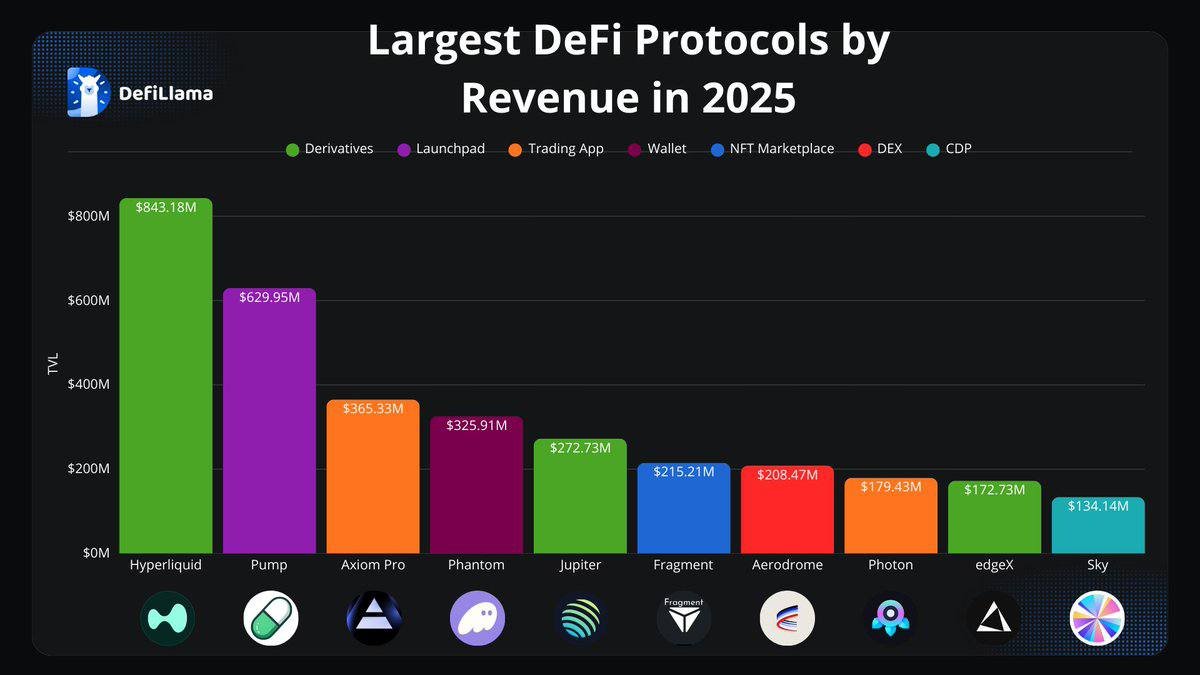

Based on the figures shown in the revenue leaderboard image, the top earners in 2025 were: Hyperliquid ($843.18M), Pump ($629.95M), Axiom Pro ($365.33M), Phantom ($325.91M), and Jupiter ($272.73M). This list matters because it cuts across categories—derivatives, launchpads, trading apps, wallets, and aggregators—and that variety reveals a broader shift: DeFi value is increasingly captured by distribution and execution, not just by base primitives.

1) Why “Revenue” Became the Metric That Changes Behavior

For years, DeFi’s default scoreboard was TVL. TVL was easy to understand, visually impressive, and—at times—misleading. It captured how much capital was parked, but not whether people were genuinely using a product or just renting yield. A protocol could look enormous and still operate like a subsidized theme park: crowded, yes, but only because entry was free.

Revenue changes the psychology. Revenue is a receipt. It suggests that a user paid for something they valued: speed, access, convenience, leverage, a smoother interface, or the ability to express a view. That doesn’t automatically mean the product is “good” in a moral sense—it means it is economically legible. And once the market starts ranking projects by economically legible demand, the incentives for builders and communities become sharper.

Two subtle consequences follow:

• Products become less obsessed with attracting one-time liquidity and more obsessed with retaining repeat behavior.

• Protocol teams begin optimizing not only for decentralization ideals, but for operational excellence: uptime, risk engines, customer support, and UX.

The result is a more mature industry—but also a more demanding one. When you’re measured by revenue, you can’t hide behind “we’re early” forever.

2) A Critical Caveat: “Revenue” Is Not One Universal Definition

Before we over-interpret any leaderboard, we need a small but crucial piece of humility: dashboards define revenue differently. Some count gross fees paid by users. Some count protocol revenue after incentives. Some separate supply-side payouts (like LP rewards) from what the protocol keeps. A chart can be accurate and still be easy to misunderstand if you assume every bar means the same thing.

So the right analytical posture is not “this protocol earned X, therefore it’s the best.” The better posture is: “What kind of money is this, who paid it, and who ultimately receives it?” In DeFi, those questions can have surprisingly different answers depending on token design, governance decisions, and how a protocol splits fees between users, liquidity providers, and treasuries.

A simple way to read DeFi revenue responsibly is to run four checks:

• Source check: is revenue mostly trading fees, listing/launch fees, routing spreads, or something else?

• Repeatability check: does revenue come from repeat usage or one-off hype cycles?

• Cost check: how much of the “revenue” is effectively rebated through incentives, points, or rewards?

• Rights check: who has a real claim on cash flows—users, LPs, a treasury, or token holders (and under what governance conditions)?

Keep those checks in mind as we walk through the top five, because the most valuable insight isn’t that the numbers are large. It’s that the business models are different.

3) Hyperliquid: When Onchain Derivatives Become a Cash Machine

Hyperliquid leading the board at roughly $843M is the clearest sign of where DeFi demand concentrated in 2025: derivatives and high-frequency trading behavior. Spot trading is important, but derivatives are where traders repeatedly express views, hedge risk, and rotate positions. That means more transactions, more fee events, and more opportunities for a protocol to monetize reliability.

Derivatives revenue is also psychologically “stickier” than many DeFi categories. A trader who finds a venue with tight execution and consistent uptime is less likely to bounce around. In that sense, derivatives protocols can behave like exchanges: once you have liquidity and trust, you can build habits. Habits are the most defensible asset in any fintech product.

What makes derivative-driven revenue impressive is also what makes it fragile: it depends on market activity and on the protocol’s ability to manage tail risk. In good times, volumes surge. In stress, a risk engine gets tested. So the sustainability story for a top-earning derivatives venue is less about marketing and more about engineering discipline:

• Can the system handle volatility without cascading liquidations that erode trust?

• Are liquidity conditions robust across regimes, not just during hype?

• Does the protocol maintain credible backstops (insurance mechanisms, margin logic, conservative parameters)?

If Hyperliquid’s 2025 number proves anything, it’s that DeFi users will pay meaningful fees for an onchain trading venue that feels “institutional” in execution quality. The long-term test is whether that execution remains dependable when markets become less forgiving.

4) Pump: The Launchpad Economy and the Price of Attention

Pump at roughly $630M is a different kind of story: not about leverage, but about distribution. Launchpad-style revenue often looks almost magical from the outside because it monetizes something markets consistently underestimate—attention. In onchain markets, attention can be transformed into fees through token launches, routing, and the “micro-monetization” of user curiosity.

This is where DeFi starts resembling the internet economy more than traditional finance. The internet monetizes attention through ads and subscriptions. Onchain launch ecosystems monetize attention through creation fees, trading activity, and the rapid churn of new assets. The lesson is not that this is “good” or “bad.” The lesson is that financialized attention is a business model—and it can be enormous when sentiment is hot.

But attention-driven revenue has a unique risk profile: it can be cyclical and socially sensitive. When the crowd is excited, revenue can surge. When the crowd becomes cautious, the same model can cool quickly. Sustainability, then, depends on whether the platform can evolve from pure novelty into a repeatable distribution layer with stronger norms.

What to watch in 2026 is whether attention-based platforms can build:

• Better quality filters and clearer disclosures (so users don’t feel exploited by noise).

• Repeat usage beyond speculative cycles (community, tooling, discovery, safer launch mechanics).

• A reputation moat (trust that the platform is more than a “one-season phenomenon”).

In a strange way, Pump’s 2025 success is a maturity signal: it shows DeFi can monetize consumer behavior at scale. The responsibility signal is whether that monetization becomes more transparent and user-respectful over time.

5) Axiom Pro: The Rise of the “Trading App” Layer

Axiom Pro at roughly $365M is important because it highlights a layer of the stack that used to be underestimated: the interface layer. In early DeFi, the protocol was the product. In maturing DeFi, the experience becomes the product—and experiences are often owned by apps, not primitives.

When a platform is categorized as a trading app on a revenue leaderboard, it typically means it is capturing value through execution: routing, tooling, premium features, embedded swaps, or user flows that reduce friction. This looks familiar to anyone who has studied fintech: the winners are not always the ones with the deepest plumbing, but the ones that make the plumbing feel invisible.

There’s a deeper structural implication here. If the app layer becomes a major revenue center, DeFi becomes more modular—and more competitive. The best app can switch liquidity sources, integrate new venues, and shape order flow. That changes bargaining power across the ecosystem. Protocols may find themselves competing not just for users, but for integration slots and distribution partnerships.

For readers, the educational takeaway is simple: in 2026, you should expect more value capture to occur at the layer where users make decisions. That layer is often not the base protocol. It’s the front-end, the wallet, the router, the discovery engine.

6) Phantom: Wallets as Toll Roads (and Trust as the Currency)

Phantom at roughly $326M makes an argument that used to sound controversial: wallets are not just utilities; they are businesses. A modern wallet is a distribution hub. It chooses which networks are highlighted, which swaps are easiest, which bridges feel safe, and which apps are one click away. In a world where attention is scarce and onboarding is hard, that placement is valuable.

Wallet revenue often comes from embedded swaps, routing economics, premium services, and sometimes partnerships. But beyond the mechanics, the moat is trust. Users tolerate complexity in crypto only when they trust the interface that is guiding them. That trust is fragile. A wallet’s “revenue” is therefore tightly tied to its security posture and its ability to avoid reputational damage.

Phantom showing up this high suggests something else: DeFi is not only about protocols extracting fees. It’s also about consumer-grade distribution. If DeFi is going to reach wider adoption, wallets and super-app interfaces will likely be the front door. And front doors are where economics tend to accumulate.

7) Jupiter: Aggregation as a Business Model, Not a Public Service

Jupiter at roughly $273M is the clearest proof that aggregation is not a background feature; it’s an economic role. Aggregators reduce search costs. They simplify routing. They compress complexity into a single click. In finance, that function often belongs to brokers or market makers. In DeFi, it belongs to routers and aggregators.

What makes aggregation powerful is that it benefits from composability: the aggregator can integrate many venues and pick the best path. Over time, that can create a flywheel. Better routing attracts more users. More users create more data and more integration leverage. More leverage improves routing again. This is how a “thin” product becomes thick.

But aggregation also carries a subtle responsibility: it sits between user intent and market execution. That means transparency matters—about routing logic, slippage handling, and any economics embedded in the path selection. The long-term winners in this category tend to be the ones that treat routing as a trust product, not just a revenue product.

8) The Unifying Pattern: DeFi Revenue Is Shifting Toward Execution and Distribution

Look at the top five again and a pattern emerges. Only one of these is “purely” a base-layer primitive in the old sense. The list is dominated by systems that either (a) facilitate trading at scale or (b) control the customer relationship. That’s not accidental. When an industry matures, value moves toward the places that reduce friction and concentrate users.

In 2025, DeFi’s economic map started to resemble mainstream fintech’s map: exchanges, brokers, routers, wallets, and launch distribution. That doesn’t mean DeFi has become TradFi. It means DeFi is discovering the same economic gravity wells that exist in any market where liquidity and convenience matter.

This shift also changes how to think about moats. In DeFi, code is forkable. Liquidity is mobile. What’s less forkable is:

• A reputation for reliability under stress.

• A distribution channel users open every day (wallets, apps).

• An execution network with deep, sticky liquidity (derivatives venues).

• A discovery system that shapes what users see first (launch ecosystems).

If you want a “deep” takeaway from the leaderboard, it is this: DeFi is starting to price the same intangible assets that the internet priced decades ago—trust, habit, and attention—just with onchain settlement.

9) How to Read DeFi Revenue in 2026 Without Getting Tricked by One Great Year

A big revenue year can mean genuine product-market fit. It can also mean “the market was hot.” The discipline is to ask which part is structural and which part is cyclical. DeFi’s challenge is that cycles can mimic fit: when prices rise, everything looks like it has users. When prices fall, only a few products still do.

So if you’re building, researching, or simply trying to understand the space, focus on three durability questions:

1) Is the revenue regime-dependent? Derivatives and launch activity can be highly sensitive to volatility and sentiment.

2) Is the revenue defended by trust? Wallets and aggregators win by being safe and reliable, not by being loud.

3) Is the revenue aligned with user outcomes? The healthiest models tend to be the ones where users feel they paid for genuine value: better execution, lower friction, clearer decisions.

If 2025 is remembered as a turning point, it won’t be because the numbers were large. It will be because the industry began proving—at scale—that users will pay for onchain products when those products behave like serious infrastructure.

Conclusion

The 2025 DeFi revenue leaderboard is a snapshot of an ecosystem becoming economically honest. Hyperliquid shows that onchain derivatives can monetize repeat behavior at scale. Pump shows that distribution and attention can be priced—sometimes explosively. Axiom Pro highlights the growing power of the app layer. Phantom reminds us wallets are not neutral; they are distribution businesses built on trust. Jupiter shows aggregation is a value-capture role, not just a convenience feature.

Read together, the list suggests DeFi is shifting from “protocol experiments” to something closer to an internet-native financial industry: modular, competitive, and increasingly shaped by execution quality and customer relationships. The next question is not whether these models can earn revenue. They already did. The question is whether they can earn it in quieter markets, under tighter standards, and with norms that are mature enough to deserve mainstream trust.

Frequently Asked Questions

Does high DeFi revenue automatically mean a protocol is “better”?

No. Revenue indicates strong paid usage, but it doesn’t capture risk management, sustainability, user outcomes, or how revenue is distributed. It’s a useful metric, not a verdict.

Why are wallets and apps showing up alongside trading protocols?

Because distribution and execution are where users make decisions. As DeFi matures, value capture often shifts toward interfaces that reduce friction and concentrate user attention.

Is revenue more important than TVL now?

They measure different things. TVL measures capital parked; revenue measures paid activity. In many cases, revenue is a stronger signal of product engagement, but it should be evaluated alongside costs and sustainability.

What’s the biggest risk when interpreting these numbers?

Assuming all “revenue” is defined the same way and assuming one strong year guarantees future stability. Definitions vary, and many models are sensitive to market regimes.

Disclaimer: This article is for educational purposes only and does not constitute financial, investment, legal, or tax advice. The revenue figures discussed are presented as shown in the referenced leaderboard image and may depend on specific dashboard definitions. Always verify methodology and consider risks before making decisions.