Why Tron’s On-Chain Perps Are Surging While the Market Cools

During a risk-off phase in crypto, the familiar pattern is that open interest shrinks, funding rates cool, and both centralized and on-chain perpetual futures (“perps”) see trading activity fade. The latest data, however, highlight a notable exception: Tron.

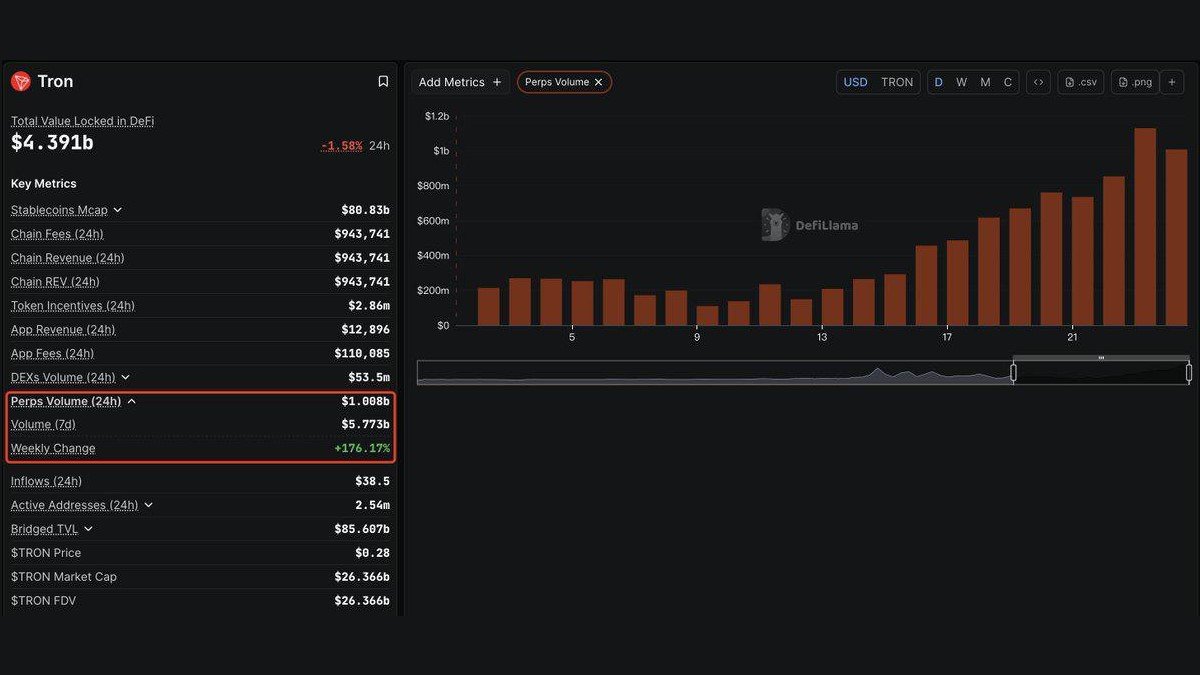

While many DeFi ecosystems are reporting softer derivatives activity, perps on Tron are accelerating. According to dashboards such as DefiLlama and Lookonchain, Tron’s daily on-chain perps volume has topped 1 billion USD for two consecutive days, and seven-day volume has reached roughly 5.77 billion USD, up about 176% week-over-week. That is a striking outlier at a time when much of the market is turning quieter.

This article is not an invitation to use high leverage. Instead, it focuses on explaining why Tron can expand so quickly while the broader market is cooling, which structural forces are behind this move, and how long-term investors should interpret the signal.

1. Context: One Billion Dollars a Day on a Cash-Flow-First Chain

To gauge the significance of a billion dollars in daily perps, it is useful to place Tron in a broader context.

• Tron is one of the largest stablecoin networks, with a substantial share of the circulating USDT supply issued as TRC-20 tokens. That has turned Tron into a dense payment and remittance rail.

• DeFi total value locked (TVL) stands at a little over 4 billion USD. This is not the highest in the industry, but it is relatively stable given recent market swings. When you compare that TVL to perps volume of 5.77 billion USD a week, it becomes clear that derivatives activity is large relative to the capital base.

• Transaction fees are low, which makes it economical to open and close positions frequently. That attribute is critical for derivatives, where active risk management often requires many small trades.

In short, Tron is a chain where stablecoin flows form a deep liquidity layer, and perps are being built directly on top of that existing cash flow.

2. Why Is Tron Accelerating While Other Perps Markets Slow Down?

The contrast between Tron and the rest of the market suggests that price direction alone cannot explain the move. There are at least four structural drivers worth highlighting.

2.1 Pull from a Massive Stablecoin Base

Most perps on Tron are margined and settled in stablecoins. On a chain that already processes huge stablecoin flows for payments and transfers, adding a derivatives layer is a natural next step. Traders do not need to leave the Tron ecosystem to hedge or take directional views; they can re-use the same liquidity that already circulates there.

This creates a virtuous loop: stablecoins arrive for payments or treasury management, and a portion of that liquidity is reused in perps for hedging or tactical positioning. As on-chain payments grow, demand for derivatives that manage price risk can grow alongside them.

2.2 Low Fees and High Throughput

Perps are extremely sensitive to transaction costs. On networks with high fees, only very large positions make sense, and traders are discouraged from adjusting risk frequently. Tron’s design – with fast confirmation times and low fees – lowers that barrier, enabling both high-frequency strategies and smaller participants to operate economically.

The result is an experience that in some respects feels similar to a centralized exchange: orders can be placed and adjusted without worrying that network fees will consume a large share of potential profit. At the same time, users retain the benefits of on-chain transparency and self-custody.

2.3 More Mature Products and Strong Incentives

Over the last couple of years, Tron’s perps protocols have moved from experimental to more mature designs. They offer broader contract lists, insurance funds, risk controls and index price feeds sourced from multiple venues. As the mechanisms become more robust, professional and semi-professional traders are more comfortable allocating activity on-chain.

In parallel, many platforms have introduced targeted incentive programs – fee rebates, revenue sharing and time-limited campaigns aimed at deepening liquidity in flagship pairs. This combination of product maturity and smart incentives helps explain how weekly volume could jump by more than 170% in a short span.

2.4 Geography and User Behaviour

Tron has a particularly strong user base in regions where access to large centralized exchanges has become more constrained. For users there, on-chain perps can be a practical alternative when combined with the familiar experience of using stablecoin wallets for everyday transactions. The psychological distance between “sending money” and “opening a hedge on perps” is smaller than it might be on chains with a primarily speculative user base.

Taken together, these factors create a different profile from some other DeFi ecosystems. Tron’s derivatives layer is attached to a payment rail that already moves significant value, which means perps can serve both speculative and risk-management functions.

3. Reading the Signal: What Does Rising Perps Volume During a Drawdown Mean?

When market prices are in a corrective phase, rising perps volume on a single chain can be interpreted in several ways, and not all of them are straightforwardly positive. At least three lenses are useful.

3.1 A Healthy Sign: Hedging and Portfolio Rebalancing

In the favourable scenario, participants use perps primarily for hedging. Funds and sophisticated traders that hold spot assets on Tron could open short perps to dampen portfolio volatility without moving their underlying holdings. Volume rises because the same units of capital are turning over more frequently in risk-management transactions.

If this is the dominant pattern, we would expect to see funding rates near neutral, limited clusters of forced liquidations, and relatively stable open interest. Under those conditions, higher volume is a sign of active risk management rather than uncontrolled leverage.

3.2 A Caution Flag: More Leverage in Both Directions

A second interpretation is that traders are using the correction to add directional leverage – for example by opening long positions in the hope of catching a reversal. In that case, higher volume may go hand in hand with rising liquidation risk if the market continues to move against those positions.

Here, volume by itself is not a quality signal. It needs to be evaluated alongside metrics such as the distribution of position sizes, the behaviour of funding rates and the frequency of sharp liquidation events. High volume with persistent one-sided positioning can be a sign of fragility rather than strength.

3.3 Incentive-Driven “Looped” Volume

Finally, part of the recent increase may be driven by incentive programs that reward raw volume. When platforms distribute rewards in proportion to trading activity, some participants naturally try to recycle positions to maximise their share of the pool. This behaviour can inflate headline numbers without corresponding growth in organic demand.

This is not necessarily problematic – incentives are a standard tool in bootstrapping liquidity – but it does mean that investors should look for persistence. If volumes remain elevated after incentives are scaled back or re-targeted, that is a stronger sign that a genuine user base has formed.

4. Implications for Tron and the On-Chain Derivatives Landscape

Whatever the exact mix of drivers, Tron is clearly emerging as one of the key hubs for on-chain perps activity. This has several implications.

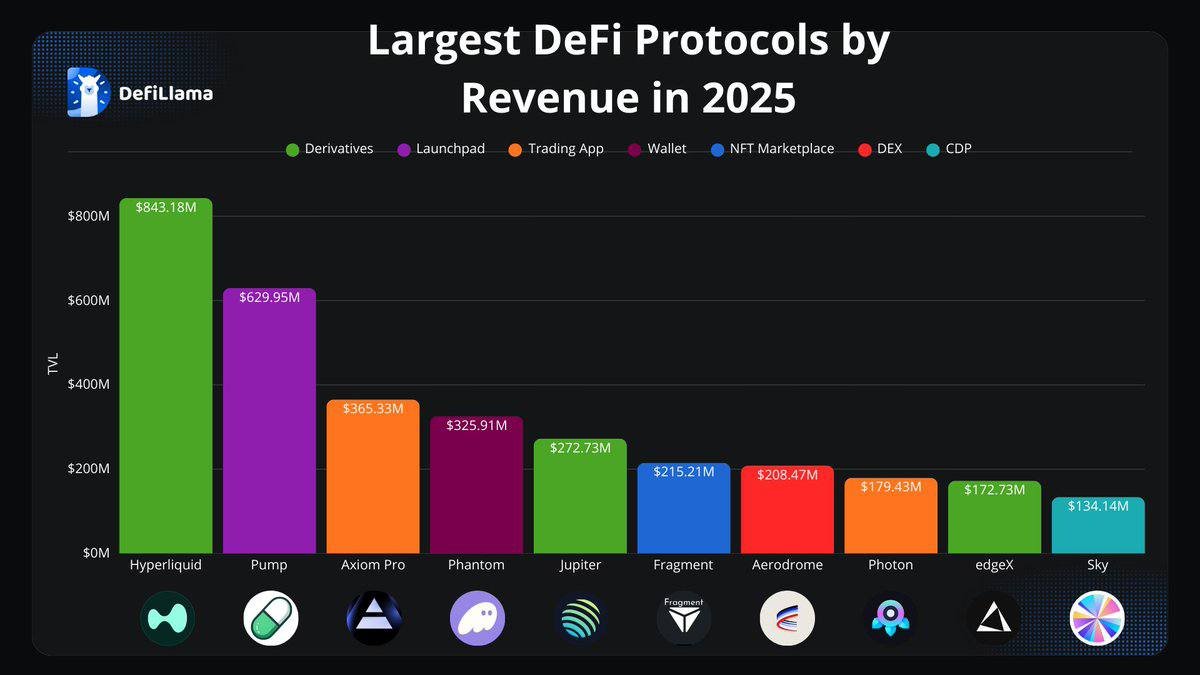

• For the Tron ecosystem: higher perps volume translates into more fee revenue for protocols and for the network itself. That provides resources to invest in security, user experience and supporting tools such as risk dashboards and analytics.

• For the broader on-chain derivatives market: the rise of multiple perps centres on different chains helps reduce concentration risk. At the same time, it makes the landscape more complex for institutions, who must monitor liquidity, counterparty risks and technical standards across several venues.

• For individual traders: increased choice comes with greater responsibility. On-chain perps require careful key management and an understanding of how liquidation and funding work; there is no customer support desk that can reverse a mistaken transaction.

At a higher level, Tron’s surge reinforces a broader lesson: chains that control stablecoin flows and offer low-cost throughput have a natural advantage in hosting derivatives. Perps are, in many ways, a by-product of efficient payment rails.

5. A Conservative Way for Investors to Use This Information

For long-term investors, perps data should be treated primarily as a signal about ecosystem health rather than as a prompt to deploy leverage. Several practical guidelines can help frame that signal:

• Focus on trends, not single spikes: sustained elevated volume over many weeks carries more weight than one promotional campaign.

• Compare derivatives activity to TVL and stablecoin supply: this helps distinguish between ecosystems where derivatives complement real economic usage and those where they are mostly self-referential.

• Assess risk-management design: insurance funds, conservative liquidation rules and transparent on-chain data can reduce the likelihood of cascading failures when volatility increases.

• Separate information from action: a vibrant derivatives market can make a chain more interesting to watch without automatically making it appropriate for every investment profile.

6. Conclusion: Tron as a Live Experiment for On-Chain Perps

Tron’s on-chain perps passing the 1-billion-dollar-per-day mark – and weekly volume rising by more than 170% – is a notable development at a time when much of the market is cooling. It suggests that:

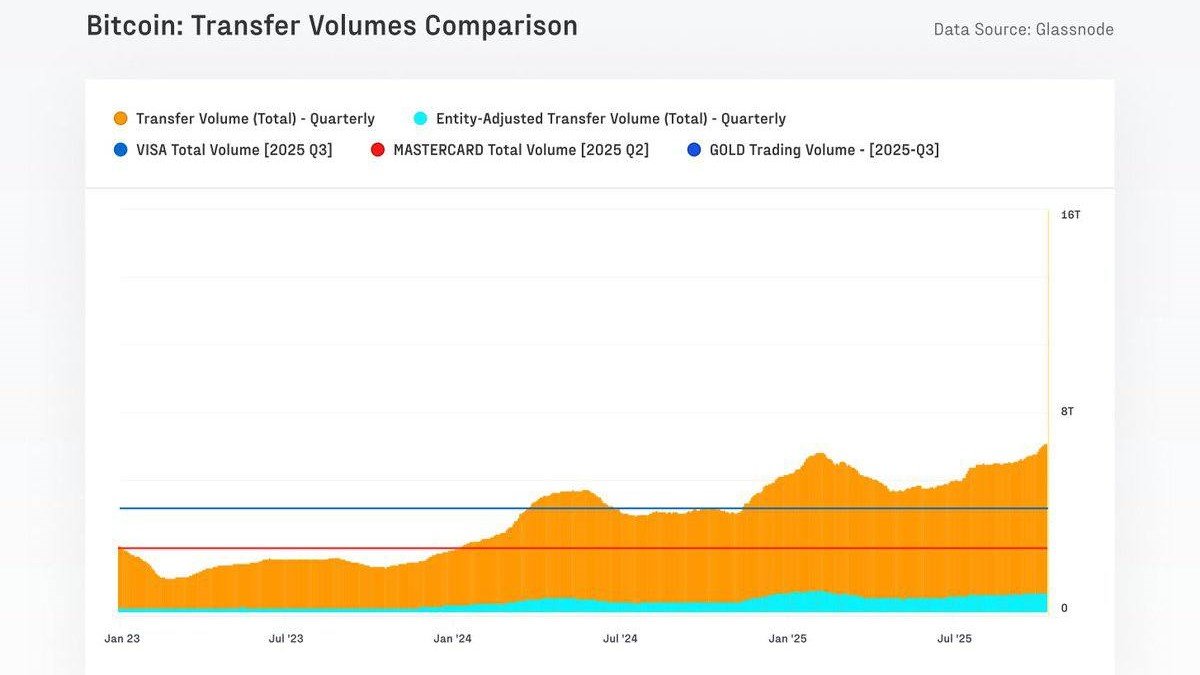

- Stablecoin rails are a powerful foundation for derivatives growth.

- Low fees and fast settlement remain key competitive advantages for any chain that wants to host active trading.

- Perps growth always has two sides: it can reflect a maturing market structure, but it can also signal rising leverage that needs to be monitored.

For now, Tron functions as a large-scale experiment in what an on-chain derivatives venue can look like when it is tightly integrated with a payment-heavy network. Whether you are optimistic or cautious about leverage, the data coming from Tron are worth tracking, because they hint at how on-chain payments, stablecoins and derivatives may converge into a new layer of digital market infrastructure.

Disclaimer: This article is for informational and educational purposes only and should not be interpreted as investment advice or a recommendation to use leverage. Digital assets are volatile and involve significant risk. Always do your own research and consider consulting an independent professional before making any financial decisions.