Bitcoin’s Settlement Engine Is Running Hot: Trillions in Payments, $1T DEX Perps and a Surge in Market Buys

Most market headlines still obsess over whether Bitcoin is a few percent higher or lower on the day. But beneath those short-term swings, the network is quietly doing something much more structural: it is moving very large sums of value.

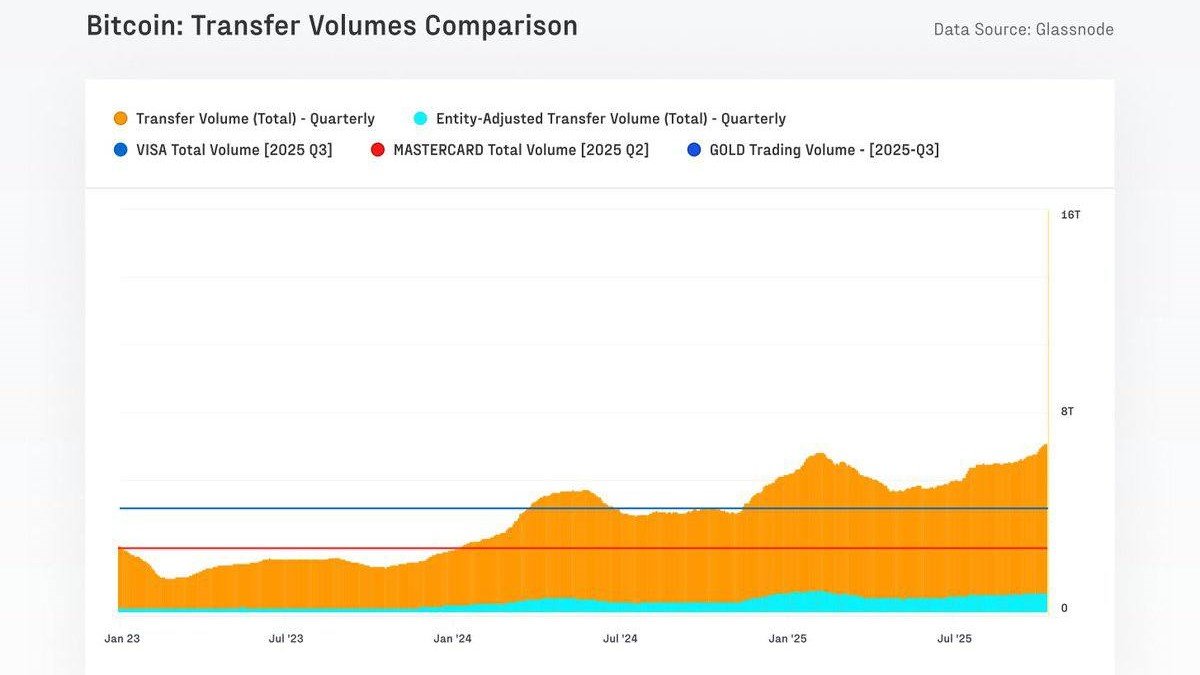

Over the last 90 days, Bitcoin has settled close to $6.9 trillion on-chain. That puts it in the same conversation as payment networks such as Visa and Mastercard on raw settlement volume, even as a growing slice of activity is now routed through exchange-traded funds (ETFs), brokers and custodians rather than directly on public blockchains.

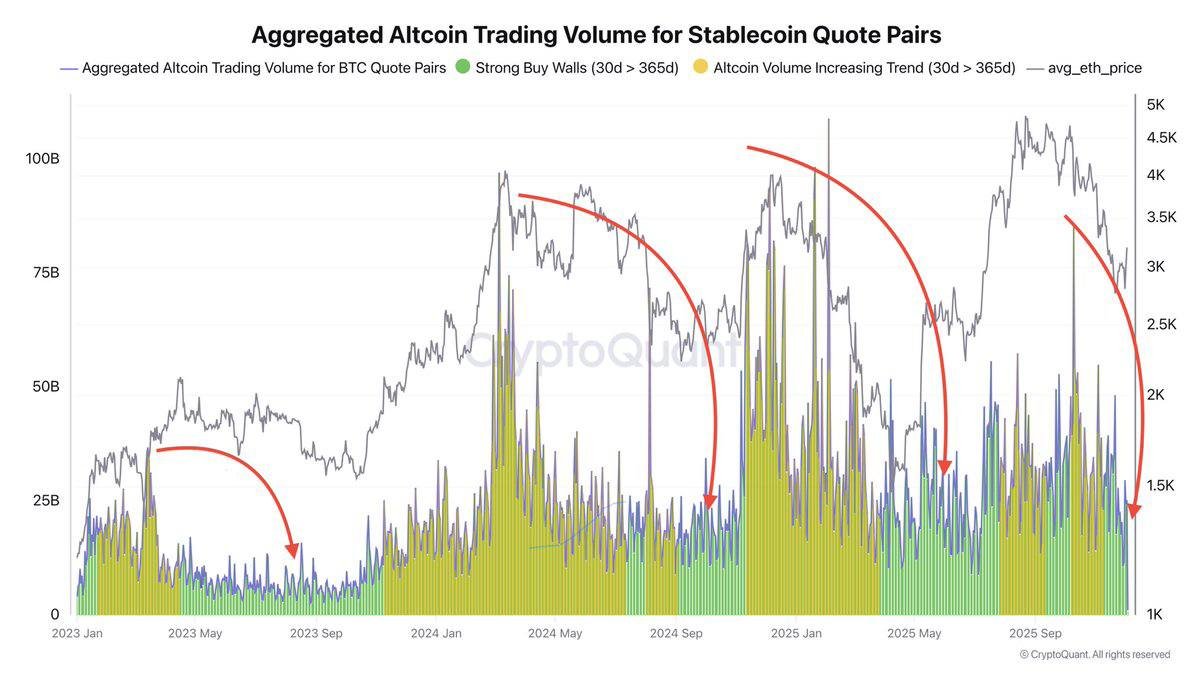

At the same time, market-structure signals are turning in an interesting direction. Data on order flow shows that market buy orders now significantly outweigh market sell orders, with the buy/sell ratio at its highest level since 2023. According to researchers at firms such as CryptoQuant, that kind of tilt in favour of aggressive buying is usually associated with the early or middle parts of expansionary phases, when capital is flowing in through more stable, structural channels.

And there is another, newer piece of the puzzle: decentralised perpetual futures. In November, cumulative volume on DEX-based perpetuals cleared $1 trillion in a single month for the second time in a row. That is roughly four times the level of a year ago and about fifteen times the volume seen two years ago, highlighting just how quickly on-chain derivatives have grown from niche experiments into meaningful markets.

This article pulls these threads together. We will look at what it means for Bitcoin to settle trillions of dollars, why market order flow is tilting decisively toward buyers, and how the boom in DEX perpetuals fits into a broader shift toward programmable, transparent financial infrastructure. Throughout, the focus is educational: these are tools for understanding market structure, not templates for short-term speculation.

1. Bitcoin as a Global Settlement Rail, Not Just a Price Chart

When people first encounter Bitcoin, they often frame it as a volatile asset or a kind of digital commodity. That description is not wrong, but it misses an important dimension: Bitcoin is also a settlement network that moves value from one address to another, finalising transfers every ten minutes on average.

Over the past three months, that settlement engine has processed roughly $6.9 trillion in value. To put that in perspective:

- On a 90-day basis, this is in the same ballpark as the reported transaction volumes of major card networks.

- Unlike card payments, where chargebacks and layered intermediaries are common, Bitcoin settlements are final once a transaction is sufficiently confirmed.

- The network operates 24/7 and is accessible globally with only an internet connection and a compatible wallet.

Not all of that $6.9 trillion is pure economic activity. Some portion reflects internal transfers between wallets, rebalancing by custodians or exchange housekeeping. But even after filtering out that kind of “noise”, research from analytics firms continues to show that Bitcoin is handling a serious volume of real settlement activity. It has moved beyond the stage of being merely an experimental payment system.

From on-chain transfers to ETF and broker rails

One reason raw on-chain volume can appear to flatten or fluctuate is that a growing share of activity now happens off-chain in products that still rely on Bitcoin under the hood. Spot ETFs, brokerage accounts and institutional custodians often batch transactions, move funds infrequently, or settle internally within their own books. An investor might adjust exposure daily on an ETF platform, while the underlying Bitcoins move only occasionally between cold storage addresses.

In that sense, part of the “real action” has migrated into ETF shares and brokerage balances. Yet the foundation remains the same: when custodians adjust their reserves, rebalance collateral or facilitate large creations and redemptions, those flows show up on Bitcoin’s base layer. The network has effectively become a wholesale settlement system for a growing retail and institutional layer that sits above it.

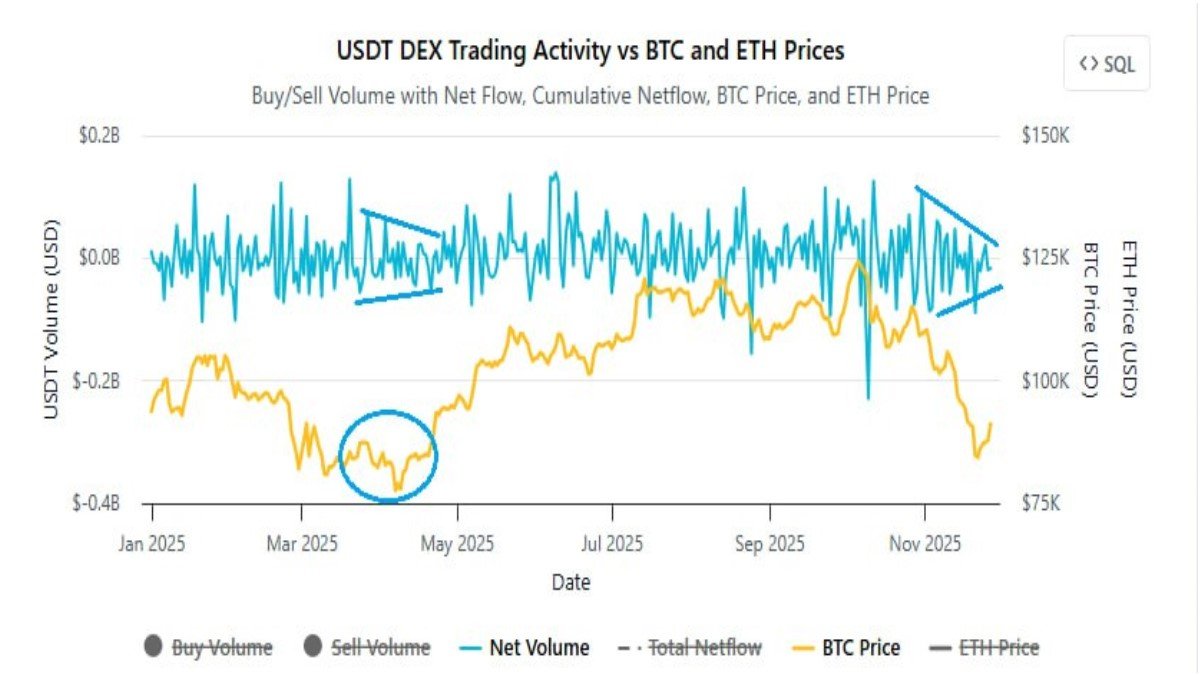

2. Stablecoins: Co-Stars in On-Chain Payments

Bitcoin does not dominate on-chain value transfer alone. Stablecoins—tokens designed to track fiat currencies such as the US dollar—have become the preferred medium for many day-to-day and business-to-business payments in the crypto economy.

Across major networks, stablecoins like USDT, USDC and others routinely process monthly volumes that rival or exceed those of some card networks. They are used for:

- Cross-border payments and remittances.

- On-chain payroll for remote teams.

- Collateral and settlement currency in DeFi and derivatives markets.

- Bridging value between exchanges and networks.

Together, Bitcoin and stablecoins form the backbone of on-chain settlement. Where Bitcoin is often used for large-ticket transfers, long-term holdings and as macro-thematic exposure, stablecoins serve as the more familiar unit of account. The fact that they both sit atop open blockchains means that, unlike legacy systems, the flows are visible and can be analysed in near real time.

3. Market Buy/Sell Ratio: What It Means When Buyers Dominate

Price tells you where the market ended up. Order-flow tells you how it got there. One of the more useful high-level gauges of behaviour is the ratio of market buy orders to market sell orders across major exchanges.

When that ratio is near 1, the market is roughly balanced: buyers and sellers are hitting each other’s quotes in similar size. When it drifts below 1, market sells dominate—participants are more eager to exit positions and are willing to hit bids. When it climbs significantly above 1, buyers are the impatient side: they are more often hitting the offer to secure exposure immediately.

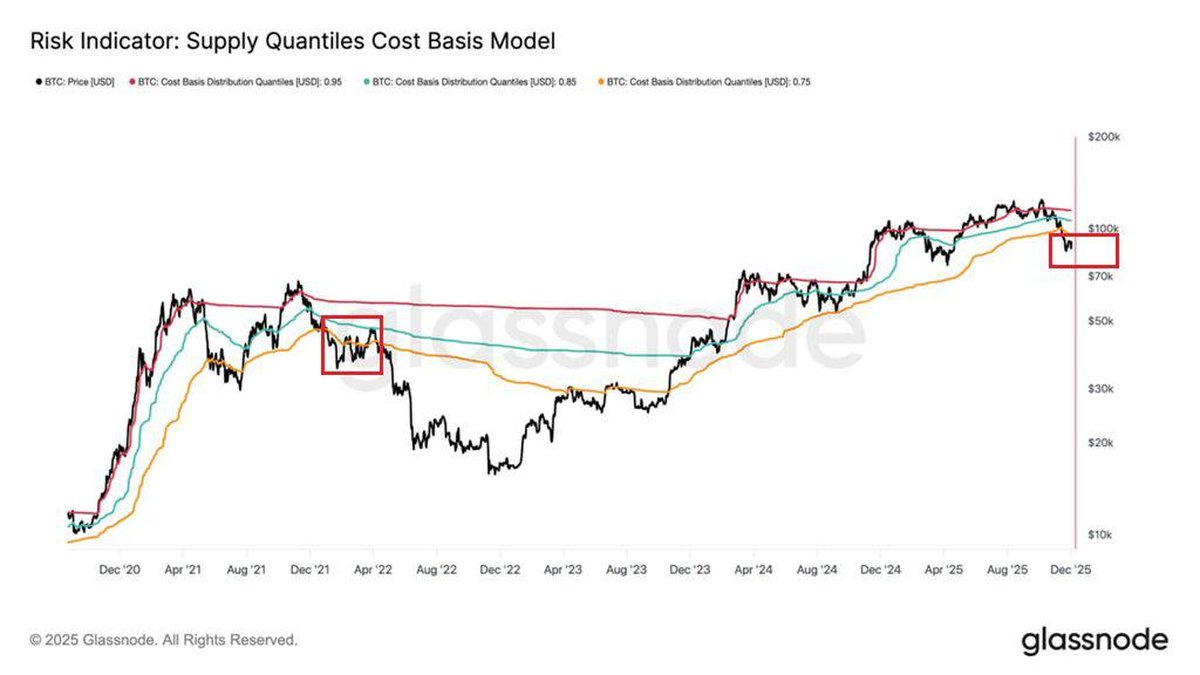

Recent data shows that this ratio has reached its highest level since 2023, meaning that, across tracked venues, there are significantly more market buys than sells. CryptoQuant and similar platforms note that this pattern—an extended tilt toward aggressive buying—tends to be characteristic of:

- Early expansion phases, when new capital starts flowing into the market after a period of caution.

- Mid-cycle accelerations, when structural buyers such as funds, treasuries and retail investment products gradually step up allocations.

Crucially, this is different from a short-lived spike. Temporary surges can happen around news events or liquidations. What is notable now is the persistence of the bias toward buying. It suggests that there is a sustained pool of participants willing to lean into Bitcoin at current levels, even as macro headlines and price volatility create uncertainty.

Why this does not guarantee a straight-line rally

It is important to treat the buy/sell ratio as context, not as a prediction engine. A period dominated by market buys can coincide with sharp pullbacks if external shocks hit (for example, an unexpected macro data point or a regulatory announcement). In addition, large, sophisticated participants may use both aggressive buys and sells as part of more complex strategies.

However, from an educational standpoint, the current reading does tell us that the market is not in a state of panic-driven distribution. In the most aggressive parts of down-cycles, the opposite pattern appears: market sells overwhelm buys as participants rush for the exit. Today, the data suggests that, at least for now, liquidity is being met with demand rather than desertion.

4. The $1 Trillion Month: DEX Perpetuals Grow Up

Perpetual futures—contracts with no expiry that track the price of an underlying asset—have long been a dominant feature of centralised crypto exchanges. Over the last two years, a large chunk of that activity has started to migrate on-chain to decentralised venues known as DEX perps.

In November, cumulative notional volume across major DEX perpetual platforms surpassed $1 trillion for the second consecutive month. Compared with the same period a year earlier, that represents roughly a 4× increase; relative to two years ago, the figure is about 15× higher.

What does that actually mean in practice?

- More traders are choosing to trade via self-custodial, smart-contract-based protocols rather than leaving collateral on centralised platforms.

- On-chain infrastructure has matured enough to handle very large volumes with acceptable latency and fee levels, especially on high-throughput, low-cost networks.

- Protocols are increasingly integrating with stablecoins and cross-margin systems, making DEX perps feel more familiar to traditional derivatives users.

For Bitcoin and the broader crypto asset class, this is more than just a volume milestone. It signals that the ecosystem is building its own capital markets stack, layer by layer: spot settlement on base chains, leverage and hedging via perpetuals, and risk transfer through options and structured products—all implemented on transparent, programmable rails.

Why rising derivatives volume cuts both ways

Higher derivatives volume is not inherently bullish or bearish. It can provide:

- Better price discovery, as more participants can express views on direction, volatility and relative value.

- Risk-management tools for long-term holders who want to hedge, rebalance or smooth returns.

But it also introduces leverage and the possibility of rapid liquidations when markets move sharply. This is true on centralised exchanges and DEXs alike. For that reason, a brand-safe interpretation focuses less on the idea of “high volume = guaranteed upside” and more on the structural reality: on-chain finance is becoming deeper, more complex and more interconnected with Bitcoin at its core.

5. How These Signals Fit Together

Viewed separately, each data point—$6.9 trillion in settlement, elevated buy/sell ratios, $1 trillion in DEX perps—tells part of the story. Taken together, they describe a market that is maturing and expanding its plumbing even as price action remains volatile.

A useful way to connect the dots is to think in terms of layers:

- Base layer: Settlement. Bitcoin and major stablecoins handle large flows of value, both directly between users and as the settlement backend for ETFs, brokers and custodians.

- Liquidity and flows: Order-book dynamics. The tilt toward market buys suggests that structural demand is now strong enough to absorb supply at current levels, at least for the time being.

- Leverage and hedging: Derivatives. DEX perps and other on-chain instruments offer more ways to manage exposure, for better or worse, depending on how they are used.

From an educational angle, the key takeaway is not that any single metric is “bullish” or “bearish” on its own, but that Bitcoin’s role is broadening. It is simultaneously:

- A macro asset with ETF wrappers and institutional adoption.

- A settlement network moving trillions of dollars for individuals and businesses.

- A reference asset at the heart of deepening derivatives and DeFi ecosystems.

6. Practical, Brand-Safe Takeaways for Readers

For analysts, builders and long-term participants, the current data environment suggests a few grounded lessons:

1. Look beyond daily candles. Settlement volume, order-flow ratios and derivatives growth provide richer context than price alone. They help explain who is using the network and how.

2. Treat on-chain and off-chain rails as complementary. The rise of ETFs and brokers does not mean Bitcoin’s base layer is obsolete; it means the settlement function is shifting toward larger, more aggregated flows.

3. Derivatives are tools, not shortcuts. The $1 trillion DEX perp milestone highlights the power of on-chain leverage and hedging. Used carefully, these instruments can support risk management; used recklessly, they can amplify drawdowns.

4. Metrics are descriptive, not prescriptive. A high buy/sell ratio, robust settlement volume or growing derivatives activity describe current conditions. They do not guarantee any particular future path for prices.

5. Align data with your time horizon. Short-term traders may track these signals on an hourly or daily basis. Long-term participants might instead focus on multi-month trends, viewing noise as part of the journey.

7. Conclusion: A Network Growing Into Its Role

Bitcoin’s last 90 days tell a story that is easy to miss if we focus only on short-term volatility. The network has settled around $6.9 trillion of value, on a scale comparable with major global payment systems. Stablecoins continue to dominate on-chain transactional usage, alongside Bitcoin, forming a digital settlement layer that operates around the clock.

Meanwhile, the market buy/sell ratio has climbed to its highest reading since 2023, hinting that the current phase looks less like a late-cycle blow-off and more like an early or mid-cycle expansion where structural buyers are willing to absorb supply. And on the derivatives front, DEX perpetuals clearing over $1 trillion in monthly volume show that crypto is building deeper capital markets infrastructure on its own rails.

None of this eliminates risk. Digital assets remain volatile, sensitive to macro conditions and subject to regulatory change. But from an educational perspective, these metrics illustrate how far the ecosystem has come: from a speculative experiment to a layered financial system with Bitcoin at its settlement core.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any digital asset or financial product. Digital asset markets are volatile and carry risks, including the possibility of total loss. Readers should conduct their own research and, where appropriate, consult qualified professionals before making decisions related to cryptocurrencies or other investments.