For most of the last two years, one of the easiest narratives in listed Bitcoin exposure was simple: if you wanted more than one-to-one performance, you could buy the equity of companies whose main strategy was to hold BTC on their balance sheet. When Bitcoin went up, these digital asset treasury (DAT) stocks tended to move even faster, supported by investor enthusiasm and generous premiums to the value of their underlying coins.

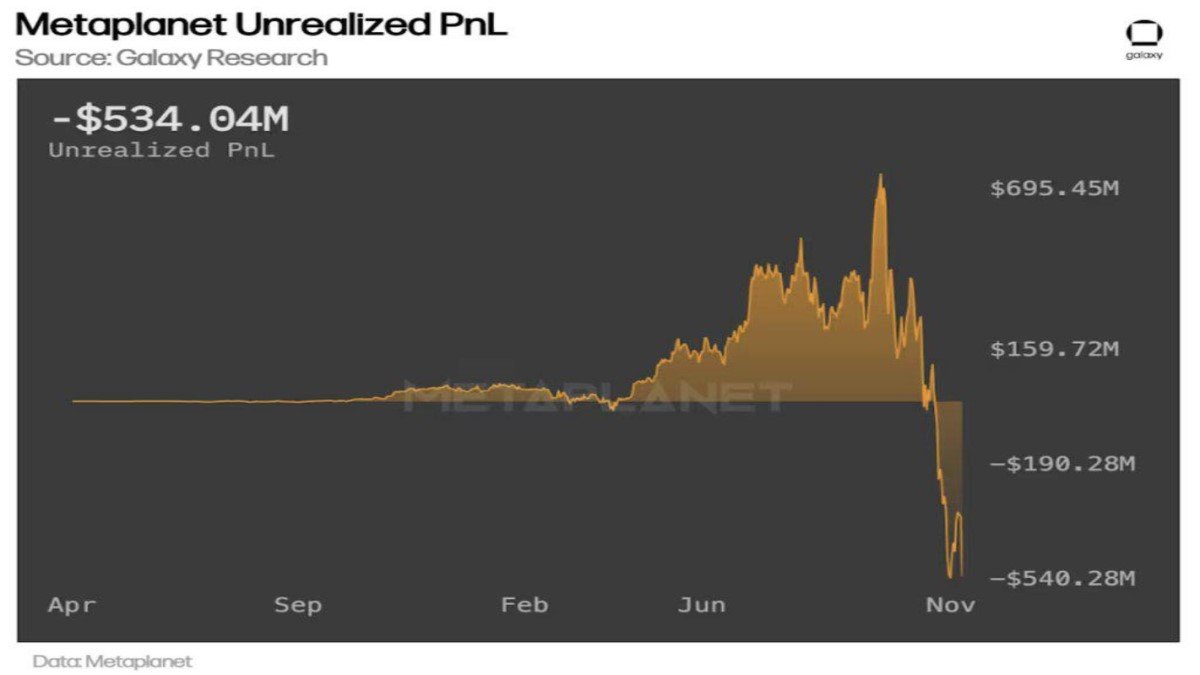

After the latest drawdown, that story has become more complicated. Bitcoin has pulled back sharply from its recent peak near six figures, and the equity market has re-rated many of these names in brutal fashion. The chart of Metaplanet's unrealized profit and loss tells the tale: what was once more than $600 million in paper gains in early October has flipped into roughly $530 million in unrealized losses as of the start of December. The market is beginning to ask hard questions about how sustainable the DAT model really is.

What Are Digital Asset Treasury (DAT) Companies?

DAT stocks are public companies that treat Bitcoin (and sometimes other digital assets) as a core part of their corporate strategy rather than a small treasury allocation. In many cases, their primary business model is to:

- Raise capital in traditional equity or debt markets.

- Use a large portion of that capital to acquire BTC.

- Offer shareholders a liquid, listed instrument that behaves like a leveraged proxy for Bitcoin.

Unlike spot exchange-traded funds, which are designed to track BTC as closely as possible, DATs are real operating companies. They may have legacy businesses, new ventures, or service revenues, but the market tends to value them largely on the basis of their BTC holdings and the optionality associated with future acquisitions.

Metaplanet in Japan is a clear example. The company has accumulated more than 30,000 BTC with an average acquisition price around the low six-figure range in US dollar terms, largely financed via bond issuance and equity sales. Other DATs include high-profile US software and data firms, as well as newer players like Nakamoto in the US and certain holding companies in Europe and Asia.

The Three Layers of Leverage in the Treasury Trade

Galaxy Research describes DAT stocks as a kind of 'triple-levered' exposure to Bitcoin, and the recent market action shows why. Investors in these names are exposed to three distinct amplification mechanisms:

1. Bitcoin price beta. At the base layer, the company owns BTC. If Bitcoin rises 50%, the value of its holdings rises 50%, all else equal.

2. Premium (or discount) to net asset value (NAV). Equity markets rarely price these companies exactly at the value of their BTC per share. In bull phases, enthusiasm can drive a premium—sometimes a very large one—over NAV, as investors pay up for perceived future purchases, strategic optionality and scarcity. In down phases, this premium can compress or even flip to a discount.

3. Balance-sheet leverage. Many DATs issue bonds or take on other forms of debt to acquire more BTC than they could by using equity alone. Leverage magnifies upside when prices rise, but it also increases sensitivity to drawdowns and refinancing risk.

When all three forces point in the same direction—BTC rising, premiums widening, and leverage available at reasonable cost—the result can be spectacular performance. During the strong leg of the last uptrend, some DAT stocks dramatically outpaced even an already powerful Bitcoin rally.

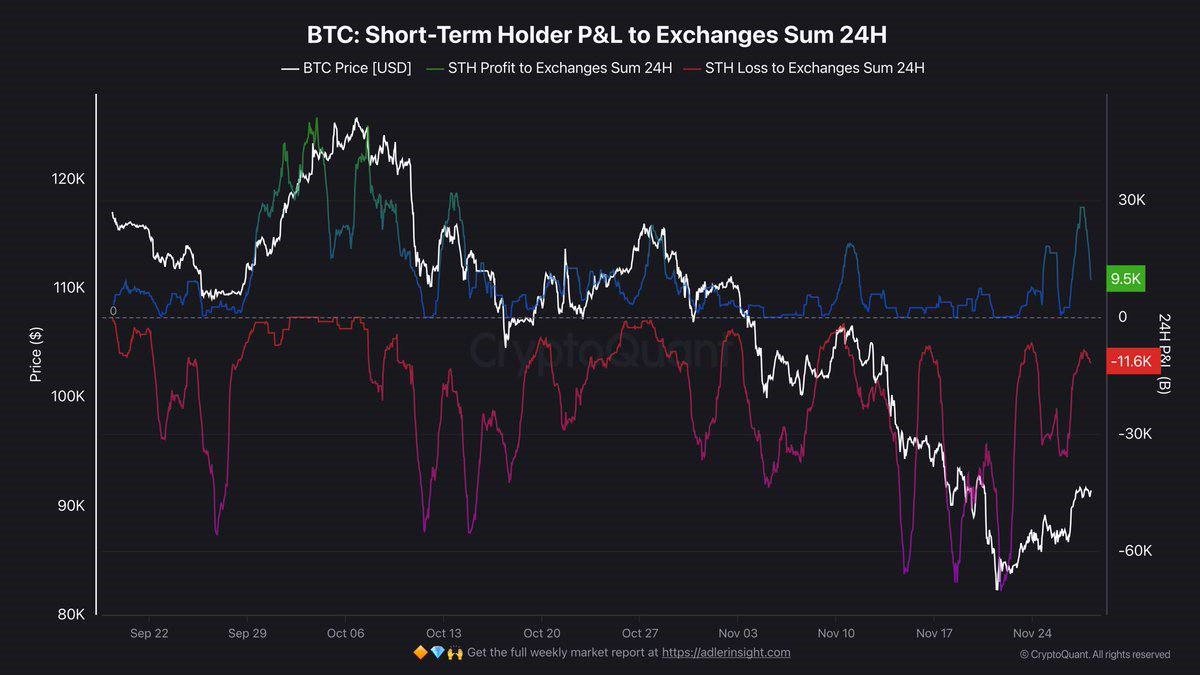

The problem is that these mechanisms are symmetric. When sentiment turns, they can unwind just as aggressively in the opposite direction.

When Premiums Vanish and Discounts Appear

In a bullish environment, the DAT flywheel works like this:

- BTC price rises, pushing up the company's NAV.

- Equity investors, enthusiastic about the story, bid the stock to an even higher premium above NAV.

- The company issues new shares at that premium, raising more capital per BTC acquired than it would otherwise.

- Management buys more BTC, increasing holdings per share and reinforcing the narrative.

This dynamic is similar to what has historically happened with certain closed-end funds or investment trusts in traditional finance during speculative phases. So long as the premium persists, the firm can keep increasing BTC holdings per share without diluting existing investors too much.

But premiums are not guaranteed. If Bitcoin experiences a sharp correction and investor appetite cools, several things can happen at once:

- The BTC price falls, reducing NAV.

- Investors demand a larger risk premium for owning a highly volatile, leveraged proxy, compressing or even erasing the premium to NAV.

- If sentiment deteriorates further, the stock may begin to trade below NAV as investors discount the possibility of further declines, capital constraints, or balance-sheet stress.

At that point, the flywheel reverses. Issuing new shares no longer makes sense when the equity trades at or below NAV, because it would dilute existing shareholders without providing enough capital to materially improve the BTC per share figure. Debt markets may also be less willing to extend favourable terms to a firm whose equity has become more volatile and whose unrealized gains have evaporated.

Galaxy Research argues that the Bitcoin treasury trade has now 'hit its natural limit' because many DAT stocks have moved from trading at large premiums to trading at or below the value of their BTC holdings. In other words, the market is no longer willing to pay extra simply for the right to own Bitcoin through a corporate wrapper.

Metaplanet: From Flagship Winner to Stress Test

Metaplanet's own dashboard illustrates the speed of the transition. The firm steadily increased its BTC position throughout 2025, often paying more than $110,000 per coin as prices surged to new highs. In early October, when Bitcoin traded near its peak, Metaplanet displayed more than $600 million in unrealized gains on its BTC holdings.

Fast forward a few weeks: Bitcoin pulled back to the $80,000–$90,000 range, and the firm's unrealized position now shows a substantial loss—around half a billion dollars on paper. The share price has tracked this swing, with the market sharply re-pricing the risks of a balance sheet heavily concentrated in BTC acquired at high levels.

To be clear, nothing about this situation is inherently catastrophic. Unrealized losses can turn back into gains if BTC recovers, and Metaplanet has been relatively proactive in raising long-dated, low-coupon funding that gives it breathing room. What the episode does highlight, however, is that DAT stocks are not simply 'BTC with a bonus'. They are distinct financial instruments with their own sensitivities to capital markets, investor sentiment and corporate decisions.

Why the Shake-Out Matters for Bitcoin and for Equities

For long-term Bitcoin holders, the struggles of certain DAT stocks do not say much about the underlying asset itself. Bitcoin's supply dynamics, network security and adoption curve are unaffected by whether a particular company is in profit or loss on its treasury strategy.

Where it does matter is in the structure of market access:

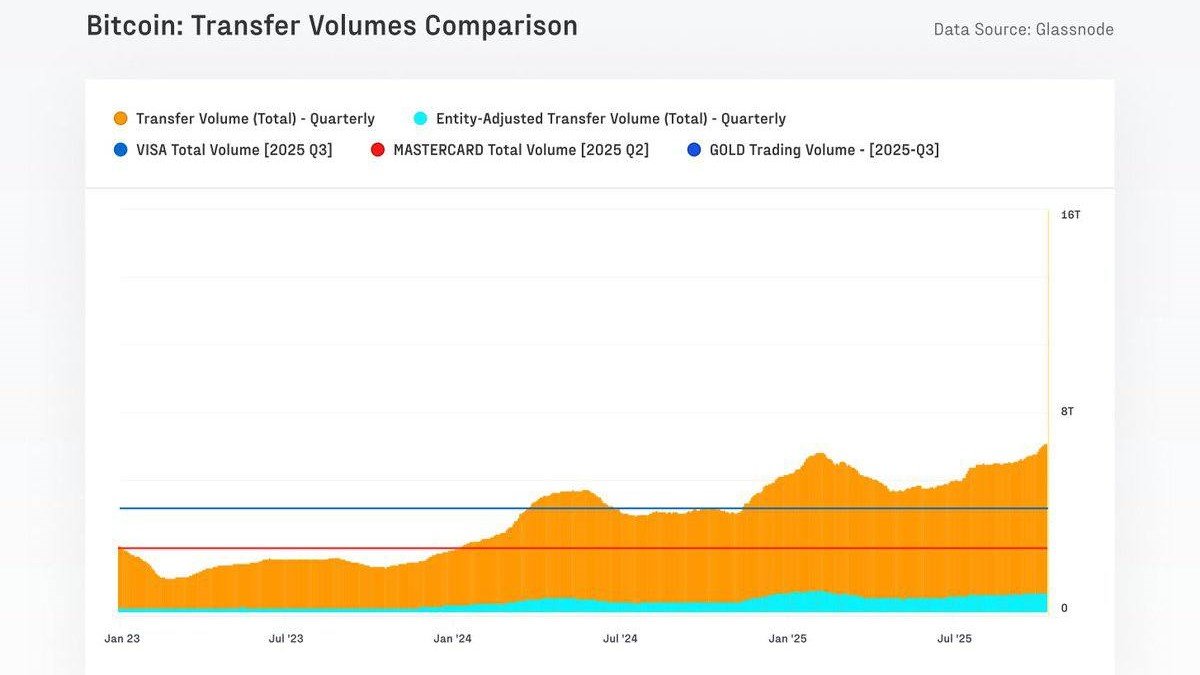

• Investor on-ramps. In regions where spot ETFs or regulated products have been slower to roll out, DAT stocks have effectively acted as one of the few ways for institutions or retail investors to gain exposure via traditional brokerage accounts. As direct products become more widespread, the structural advantage of DATs narrows.

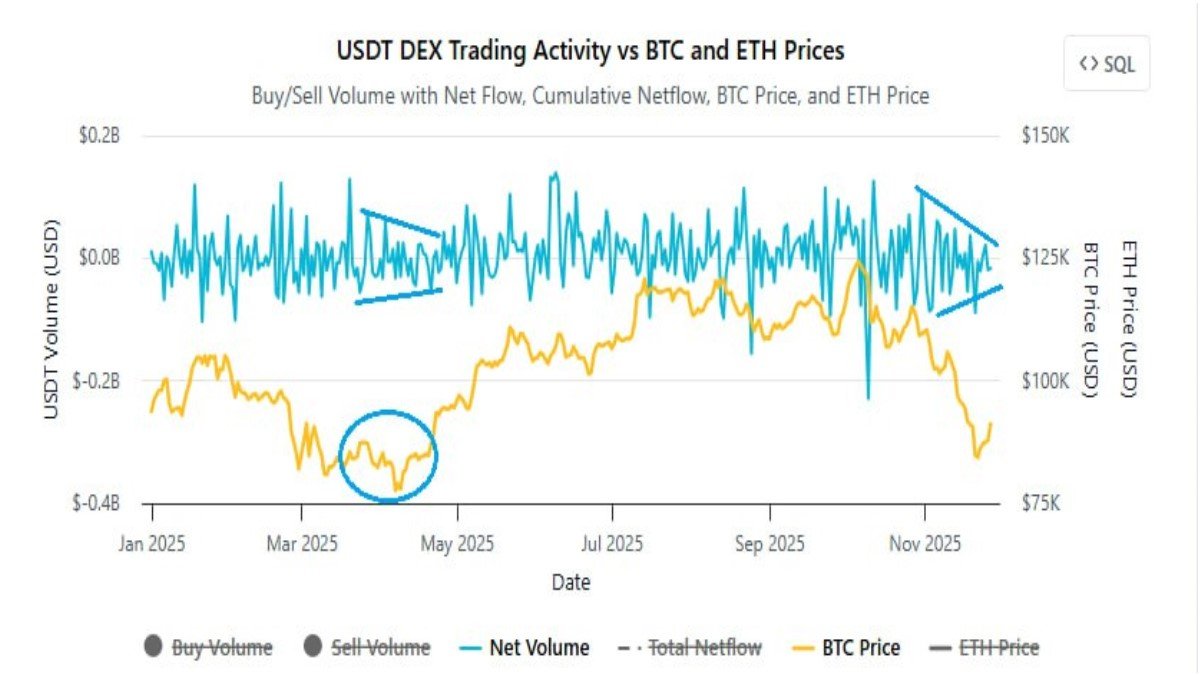

• Flow dynamics. During the uptrend, new equity issuance by DATs translated into direct BTC purchases, contributing to marginal demand. If that issuance slows or reverses, a small but non-trivial source of spot buying may disappear.

• Risk perception. Sharp drawdowns in high-profile treasury plays can feed a narrative that Bitcoin-focused corporate strategies are inherently unstable. That perception might influence how other boards and CFOs think about large balance-sheet allocations.

From the equity side, the current phase looks like a classic Darwinian filter. Many DATs launched or pivoted into the strategy during favourable conditions, when premiums were high and capital was easy to raise. Now they need to demonstrate that they can survive and create value when the environment is tougher.

What a Darwinian Phase Looks Like

So what happens next? Several scenarios are already taking shape:

1. Consolidation and Restructuring

Some DAT companies may seek mergers or strategic partnerships to stabilize their capital structures. Firms that have both operating businesses and BTC treasuries could become acquirers of more fragile, pure-treasury entities. Others might pursue asset sales, debt renegotiation, or equity injections from strategic investors who believe in the long-term thesis but demand more conservative risk management.

2. Transition to a 'Quasi–Closed-End Fund' Model

If equity markets keep pricing certain DAT stocks close to their NAV, the growth-flywheel based on repeated equity issuance becomes less attractive. In that world, some boards may decide to slow down Bitcoin purchases, focus on managing costs and treat the company more like a closed-end BTC fund with an operating wrapper. Sharper capital allocation—buybacks near heavy discounts, cautious issuance when premiums reappear—will matter more than narrative.

3. Emphasis on Real Operating Cash Flows

The most resilient DATs will likely be those that can stand on two legs: a significant BTC treasury and a business that generates recurring revenue in its own right. Software, data, infrastructure or service lines can help cover interest, buy back shares during weakness, and reduce dependence on capital markets. Investors may begin to favour companies where BTC is a powerful enhancement to a viable business, rather than the only pillar of the story.

4. Regulatory and Indexing Feedback Loops

Another important variable is index inclusion. If major index providers choose to add or remove DAT stocks from large benchmarks, it can trigger mechanical flows from exchange-traded funds and institutional portfolios. Those flows, in turn, affect liquidity and valuations, feeding back into how management teams think about risk.

A Framework for Evaluating Treasury Stocks

For individual investors and portfolio managers who still find the DAT space interesting, this phase calls for a more disciplined framework. A few questions are especially important:

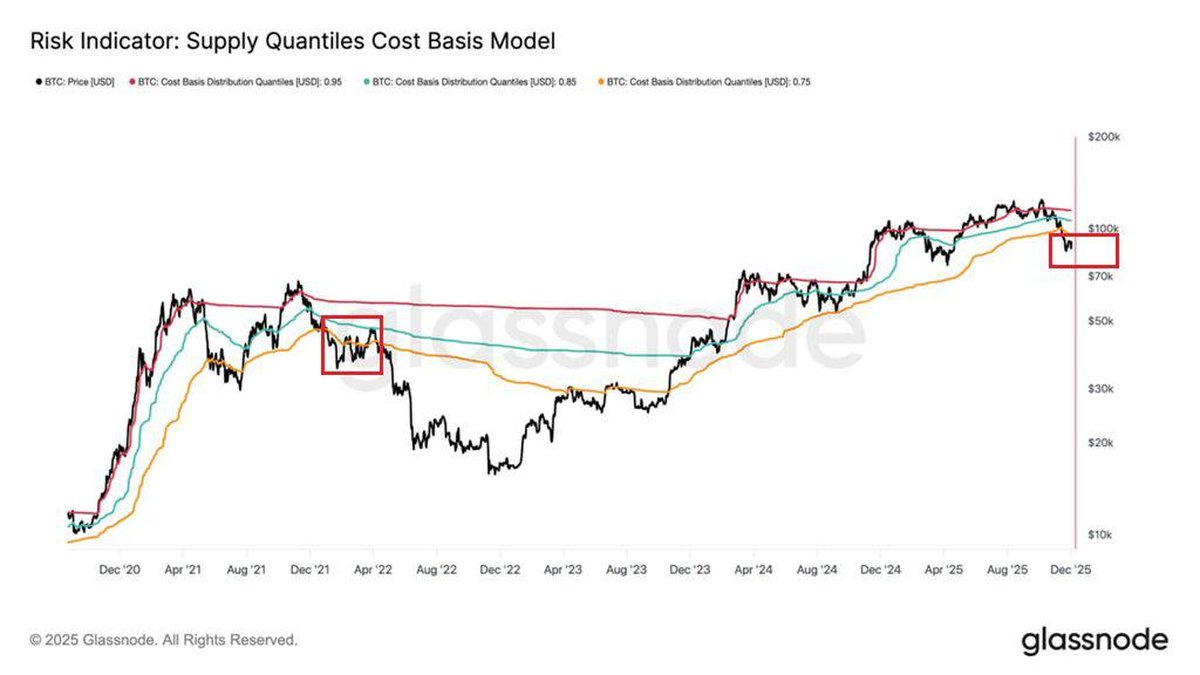

1. What is the average BTC cost basis?

Companies that accumulated most of their holdings at extremely elevated prices have less cushion in a drawdown. Public dashboards like Metaplanet's make it possible to see the blended cost of acquisitions over time.

2. How much balance-sheet leverage is in place?

Look beyond headline BTC holdings and market capitalization. Consider bond maturities, covenants, interest coverage and refinancing risk. A company that can comfortably service its obligations through operating cash flow is in a very different position from one that relies on rising equity prices to roll over short-term funding.

3. Is there a real operating business?

Some DATs have substantial revenue from software, consulting or infrastructure services; others are closer to holding companies. Evaluate how much the non-BTC operations contribute to earnings and resilience.

4. How has management behaved through the cycle?

Did the company reduce issuance when premiums were extremely high, or did it lean in aggressively at the top? Did it communicate clear risk limits and scenario plans? Past behaviour is not a perfect guide, but it offers clues about how leadership might act in future stress.

5. What is the liquidity profile of the stock?

Thinly traded names can experience outsized volatility during both rallies and sell-offs. Liquidity matters not only for entry and exit, but also for index inclusion and institutional participation.

Applying this type of checklist does not guarantee success, but it can help distinguish between firms that are merely riding the cycle and those that are building something more durable.

What This Phase Does Not Mean

It is tempting to read the pressure on DAT stocks as a verdict against the broader Bitcoin thesis. That would be a mistake. What we are really observing is an experiment in capital markets design: using corporate balance sheets and public equity as a leveraged access point to a new monetary asset.

Experiments sometimes reach their limits. There is nothing automatic about the idea that a company trading at a premium to its BTC holdings should always be able to issue shares, buy more BTC and compound that premium forever. At some point, valuations, risk appetite and alternative products—such as spot ETFs or regulated futures—constrain the trade.

In that sense, the current shake-out is healthy. It forces the market to separate genuine business models from pure momentum plays, encourages more thoughtful use of leverage and pushes investors to look beyond simple narratives like 'this stock is just Bitcoin with extra upside.'

Looking Ahead

The next phase for digital asset treasury companies will likely be more nuanced than the first. Instead of one-directional enthusiasm, we may see:

- A smaller set of stronger DATs that survive the current drawdown with manageable leverage and credible strategies.

- New entrants that learn from the missteps of early movers, constructing more balanced capital structures from the start.

- Greater integration between corporate treasuries, regulated funds and on-chain markets, with each playing a different role in how capital allocates to Bitcoin.

For investors, the key is to treat treasury stocks as what they are: hybrid instruments that sit at the boundary between traditional equity and digital asset exposure. They can still play a role in portfolios, especially for those who understand the risks and are comfortable with higher volatility. But the days when a ticker automatically deserved a rich premium simply for buying BTC may be behind us.

In other words, the Darwinian phase has begun. The companies that emerge on the other side will likely be fewer in number, but stronger in design—and better prepared for whatever the next chapter of the Bitcoin cycle brings.