When Capital Walks Away from Altcoins: Liquidity Drought, Smart Money and the Long Game

Markets rarely say “I am at an important turning point.” Instead, they whisper it through exhaustion, boredom and the quiet exit of capital.

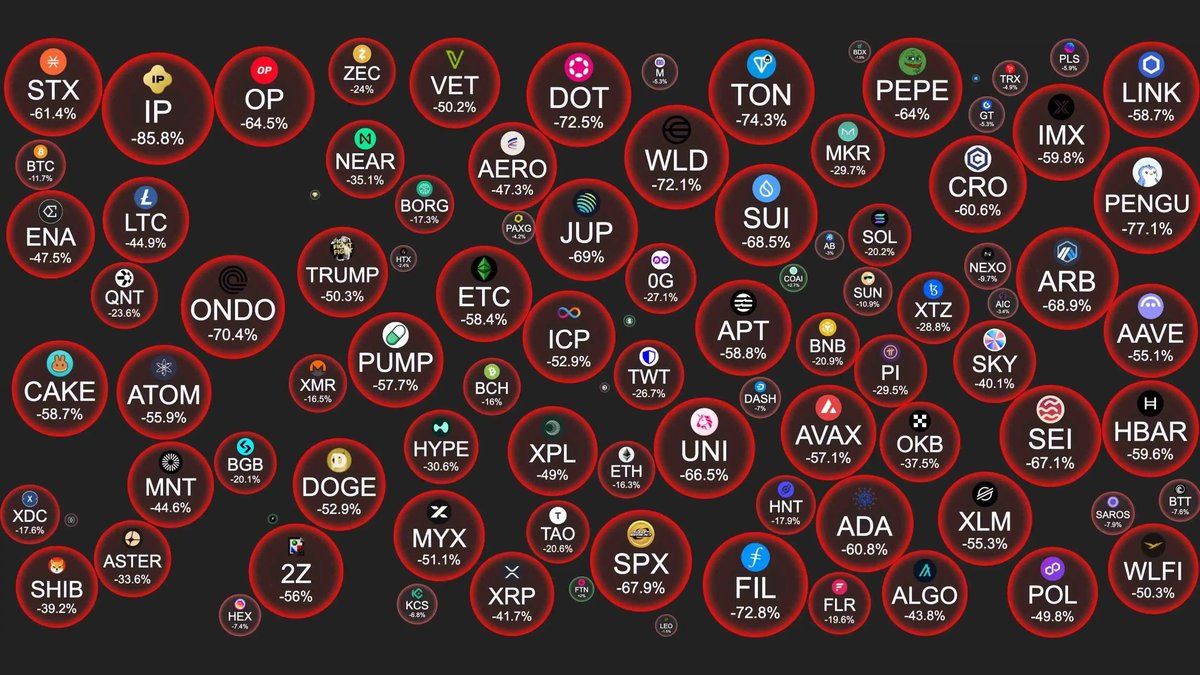

That is roughly where the altcoin market finds itself today. While gold and silver grind to fresh highs and major stock indices continue to attract inflows, much of the altcoin space looks frozen. Order books are thin, volumes are modest, and many charts drift sideways or down despite an apparently strong environment for other risk assets.

For a lot of participants, the feeling is not just frustration; it is fatigue:

- Fatigue from holding coins that no longer move while traditional assets trend steadily upward.

- Fatigue from narratives that promised a new paradigm but have not (yet) translated into sustainable price appreciation.

- Fatigue from questioning one’s own judgment: “Maybe this market simply is not for me.”

That emotional state matters, because markets are not only about numbers—they are about behavior. Once enough people reach the point of saying, “I would rather move my savings into something that feels safer and more predictable,” the cycle enters a new phase. Understanding what that phase is, and what usually follows it, is the key to making sense of altcoins in the years ahead.

1. Has the money really left crypto?

On the surface the answer looks obvious: capital is leaving. Stablecoin supplies are not growing as quickly as before, many smaller tokens trade at deep discounts from their previous peaks, and even some large-cap projects see modest demand compared to more traditional assets.

Yet if we zoom out, a more nuanced picture appears.

• Capital is rotating, not disappearing. Institutions and large investors constantly assess relative opportunities. When gold, government bonds or major equity indices appear to offer a smoother path with lower perceived uncertainty, it is rational for them to increase exposure there and trim more volatile holdings, including altcoins.

• Liquidity has “parked” in apparently safer assets. Many investors have not abandoned the idea of digital assets; they are simply choosing to wait from the sidelines, holding cash, money-market instruments or precious metals until the risk–reward in altcoins looks compelling again.

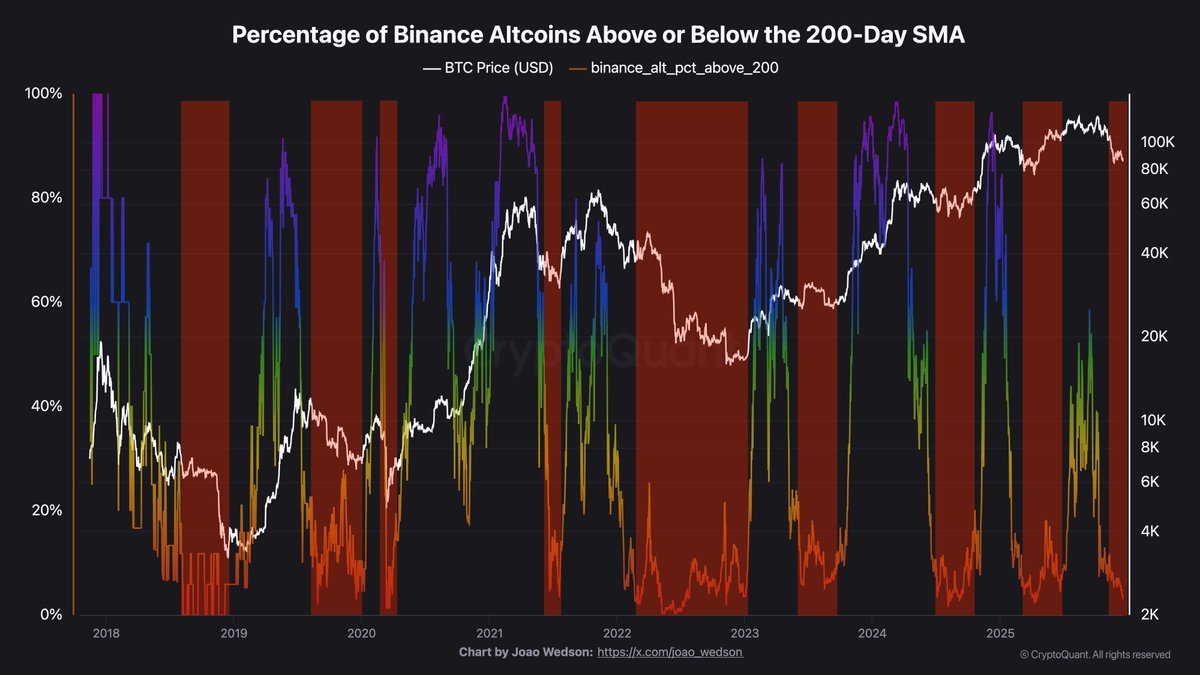

• The crypto market itself is maturing. A larger share of total value now sits in Bitcoin, Ethereum and a handful of blue chip infrastructure tokens. That concentration makes the long tail of altcoins feel especially quiet because speculative capital no longer spreads as thinly as it once did.

From the perspective of someone holding mid-cap or smaller tokens, however, the impression is clear: money is “leaving”. Prices bleed slowly, order books look shallow, and every bounce seems to be an opportunity for others to exit. This disconnect between how the cycle feels and how capital actually behaves is where smart money builds its edge.

2. How narratives pull liquidity away from altcoins

Markets are coordinated by stories. Over the past year, several powerful narratives have pulled capital toward traditional assets and away from altcoins:

• “Hard assets as protection.” Concerns about inflation, currency debasement and fiscal deficits have made gold and silver attractive again. Their steady performance reinforces the belief that they are the “proper” place to park value in uncertain times.

• “Equities as the innovation trade.” With listed technology companies pushing into artificial intelligence, cloud infrastructure and semiconductors, many investors feel that they can capture innovation without the perceived complexity of altcoins.

• “Crypto is too speculative.” After several years of rapid token issuance and mixed project outcomes, parts of the market have been labeled as excessively experimental. That label does not have to be fully accurate; it only has to be persuasive enough to redirect flows.

Over time, these narratives shape behavior. It becomes socially easier—and emotionally more comfortable—to allocate capital to large, familiar markets where performance has been visible and relatively consistent. Crypto, and especially the altcoin segment, is cast as the place where one goes after everything else, not as a core component of a diversified portfolio.

This shift in perception is exactly what long-term, opportunistic capital prefers. To accumulate at attractive valuations, it needs two conditions:

- A depressed price environment, where early optimism has faded and speculative excess has been cleared out.

- A discouraged crowd, where many participants are convinced the asset class was a mistake and voluntarily move their capital elsewhere.

The current altcoin landscape checks both boxes.

3. From retail exhaustion to smart-money preparation

When altcoins underperform for an extended period, three psychological stages tend to unfold among individual investors:

1. Denial. After the first downtrend, many holders treat it as a temporary correction. They are confident that a recovery is near and that their earlier theses remain intact.

2. Frustration. As sideways or downward price action drags on, optimism turns into impatience. Holders start comparing their positions to other assets that are performing better, such as precious metals or major stock indices.

3. Capitulation. Eventually, the emotional cost of waiting outweighs the potential upside in investors’ minds. At this point they choose stability over optionality, often rotating into assets perceived as safer, even if that means locking in losses.

For long-term, disciplined capital, this third stage is crucial. It means:

- Order books are thin. A relatively small amount of buying can move prices significantly.

- Strong hands can accumulate quietly. With sentiment low, there is less competition from fast-moving retail flows, allowing larger players to build positions without triggering obvious spikes.

- The crowd is less likely to chase early moves. After being disappointed repeatedly, many investors ignore initial rallies, assuming they are temporary. This gives smart money more time to accumulate before trends become obvious.

None of this guarantees immediate upside. Smart money does not need altcoins to bounce tomorrow; it is comfortable operating on multi-year horizons. What matters is that valuations, positioning and psychology are gradually shifting toward a configuration where the asymmetric opportunity lies with patient buyers rather than sellers.

4. What “altcoin winter” looks like under the hood

Beyond price charts, several structural signs typically accompany an altcoin liquidity drought:

• Lower issuance pressure. Projects delay token unlocks, treasury spending or incentive programs because the market cannot absorb large new supply. While this may feel negative in the short term, it can reduce long-term dilution.

• Consolidation of serious projects. Teams with real products or clear roadmaps continue building, while purely speculative ventures lose visibility. Over time, the signal-to-noise ratio improves.

• Attention shifts to infrastructure and cash flow. Rather than chasing every new narrative, both builders and investors concentrate on networks and applications that generate sustainable usage and fees.

During this phase, price action can appear brutally indifferent. Tokens of robust projects may fall alongside weaker ones simply because the marginal buyer is absent. That is why the market feels so discouraging: it does not seem to differentiate in the short run.

But beneath the surface, an important sorting process is taking place. Altcoins with transparent governance, healthy treasury management, real users and credible long-term plans tend to survive these periods and often emerge with stronger relative positions when liquidity returns.

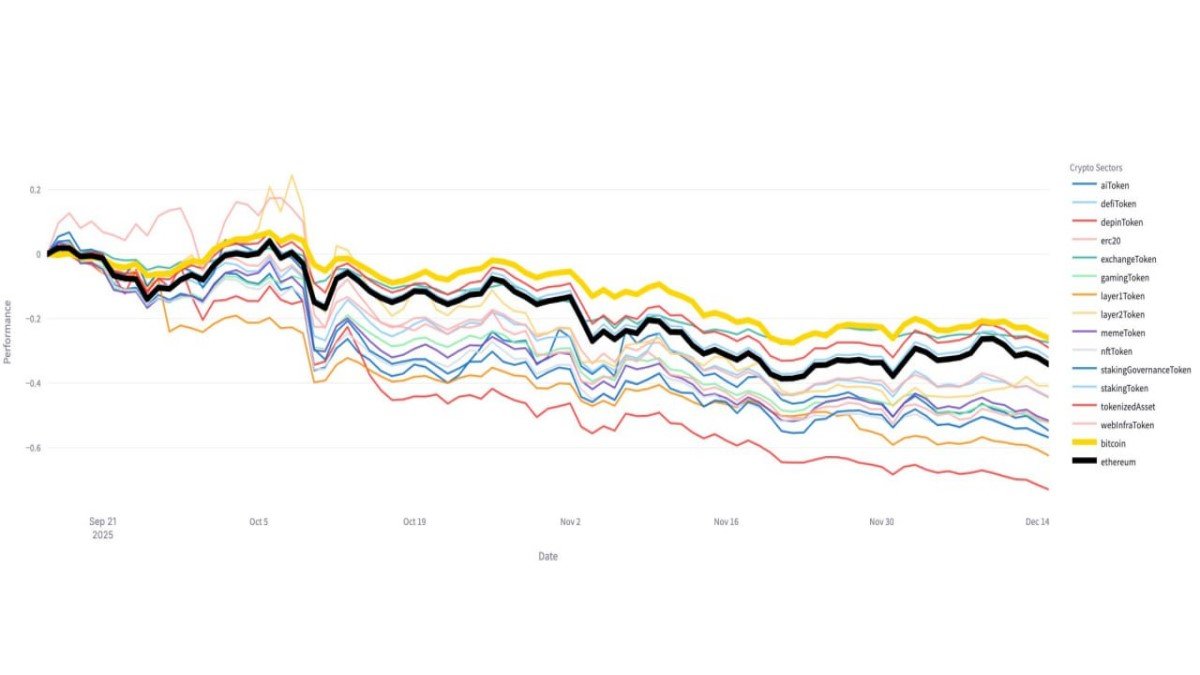

5. Choosing where to stand: blue chips vs. long tail

In an environment where capital is cautious, not all altcoins face the same prospects. A simple—but often effective—framework is to separate the universe into three broad buckets:

5.1 Foundational assets

This category includes Bitcoin, Ethereum and a small set of large-cap networks that are already deeply integrated into the broader financial system. They tend to have:

- Deep liquidity and derivatives markets.

- Established narratives (digital store of value, smart-contract base layer, settlement asset, etc.).

- Growing participation from regulated products and institutional vehicles.

For many investors, these assets form the core of any crypto allocation. When the cycle turns defensive, they are often the last to be sold and the first to attract fresh inflows once confidence returns.

5.2 High-quality large and mid caps

This group consists of platforms, infrastructure projects and application ecosystems with meaningful usage and clear differentiation. They may not be as dominant as Bitcoin or Ethereum, but they:

- Earn protocol revenue or fees.

- Have active developer communities.

- Operate with relatively transparent token economics.

In the next cycle, this is where a significant share of opportunity is likely to appear. However, selecting among these projects requires careful analysis rather than reliance on marketing or short-term social media momentum.

5.3 Long-tail tokens

The remainder of the market—small caps, experimental governance tokens and various thematic plays—can certainly experience large percentage moves in either direction. Even in difficult environments, some of them may rally sharply when specific stories capture attention.

Yet for most long-term portfolios, these tokens are best treated as speculative satellites, not foundations. The combination of limited liquidity, high dilution and narrative dependency means that they can underperform for long periods, even if occasional rallies are impressive.

In a liquidity drought, the distinction between these buckets matters. Capital that wants exposure to the asset class but wishes to reduce risk tends to concentrate in Bitcoin and Ethereum first, then in a carefully chosen list of larger altcoins. Only when sentiment warms significantly does the long tail benefit.

6. Looking toward 2026–2027: a difficult bridge to potentially better ground

If the current cycle continues along historical lines, 2026 is unlikely to be a comfortable year for passive altcoin holders. Several forces could converge:

- Macro conditions may remain uncertain, with policy decisions and economic data influencing the availability of global liquidity.

- Token unlocks and treasury spending from projects launched in previous years will continue, adding supply to already cautious markets.

- Regulatory developments—both supportive and restrictive—will keep reshaping which segments of the market attract institutional attention.

This does not mean that prices must collapse. It does mean that the path is likely to be choppy, with periods of sharp rallies followed by equally sharp reversals as participants test how much risk they are willing to take.

Paradoxically, such a challenging environment can lay the groundwork for a healthier market in the late-2026 to 2027 window. By then:

- We will know which projects managed to build real traction despite difficult conditions.

- Valuations may have reset enough to attract fresh strategic capital.

- New narratives—perhaps around tokenized real-world assets, efficient on-chain trading infrastructure or mainstream consumer applications—may provide a more fundamental basis for growth.

The goal for investors is therefore not to predict the exact date when altcoins will recover, but to avoid being forced out of the market at the most emotionally difficult moment. That usually requires two things: realistic expectations and robust risk management.

7. Practical principles for navigating an altcoin liquidity drought

Given the current backdrop, several guidelines can help maintain discipline:

• Reassess position sizes. Exposure that felt comfortable during the early bull market may now be too large relative to your total net worth and emotional tolerance. Adjusting down is not defeat; it is risk control.

• Prioritize quality over quantity. Rather than holding a long list of small tokens, consider concentrating on a handful of assets with transparent fundamentals and staying power.

• Avoid relying solely on “it will come back.” Some projects will not reclaim previous peaks, even if the broader market recovers. Historical cycles are full of examples where a new set of leaders emerged each time.

• Separate time horizons. It can be helpful to distinguish between a structural allocation (for example, to Bitcoin and Ethereum) and tactical positions in more speculative altcoins. Each bucket can have its own rules for entry, exit and sizing.

• Keep an eye on liquidity, not just price. Volume, depth of order books and the presence of long-term holders are as important as chart patterns when assessing the resilience of an asset.

These principles do not remove uncertainty, but they reduce the likelihood of being forced into decisions purely by emotion—exactly the trap that the cycle sets when it convinces market participants that they are always late or always wrong.

8. Final thoughts: when belief leaves before price

The altcoin market today is not characterized by extreme panic. It is characterized by something quieter and, in many ways, more powerful: disbelief. Investors are not rushing to exit at any cost; they are gradually drifting away toward assets that feel easier to hold. Narratives about safety and reliability have pulled liquidity toward precious metals and large-cap equities, while much of the crypto universe lies dormant.

History suggests that this sequence often unfolds in the same order:

- Confidence erodes first. People stop telling positive stories about a sector.

- Capital rotates second. Cash moves quietly into alternatives that are performing better.

- Prices respond last. Once enough liquidity has left, markets settle at levels that no longer excite the crowd but increasingly interest patient buyers.

Altcoins appear to be somewhere between the second and third step of that process. Whether the next major uptrend begins in late 2026, early 2027 or later, the underlying mechanics will be the same: liquidity will return when it is needed by new narratives—and by portfolios that once again seek diversified sources of growth.

For now, the most useful stance may be neither blind optimism nor complete abandonment, but informed patience: accepting that the current phase is uncomfortable, using it to refine portfolio quality, and keeping enough flexibility to participate when conditions eventually shift.

Note: This article is intended for educational and informational purposes only. It is not investment, tax or legal advice, nor a recommendation to buy or sell any asset or to pursue any specific strategy. Digital assets are volatile and can involve a high level of risk. Always conduct your own research and consider consulting a qualified professional before making financial decisions.