Altcoin Winter: Record Liquidity Stress and the Anatomy of a Potential Bottom

On the surface, the digital asset market still looks resilient. Bitcoin remains far above its cycle lows, exchange traded products continue to attract capital, and headline indices do not yet resemble the deep bear phases of past cycles. Underneath that surface, however, the picture for many altcoins has turned bleak.

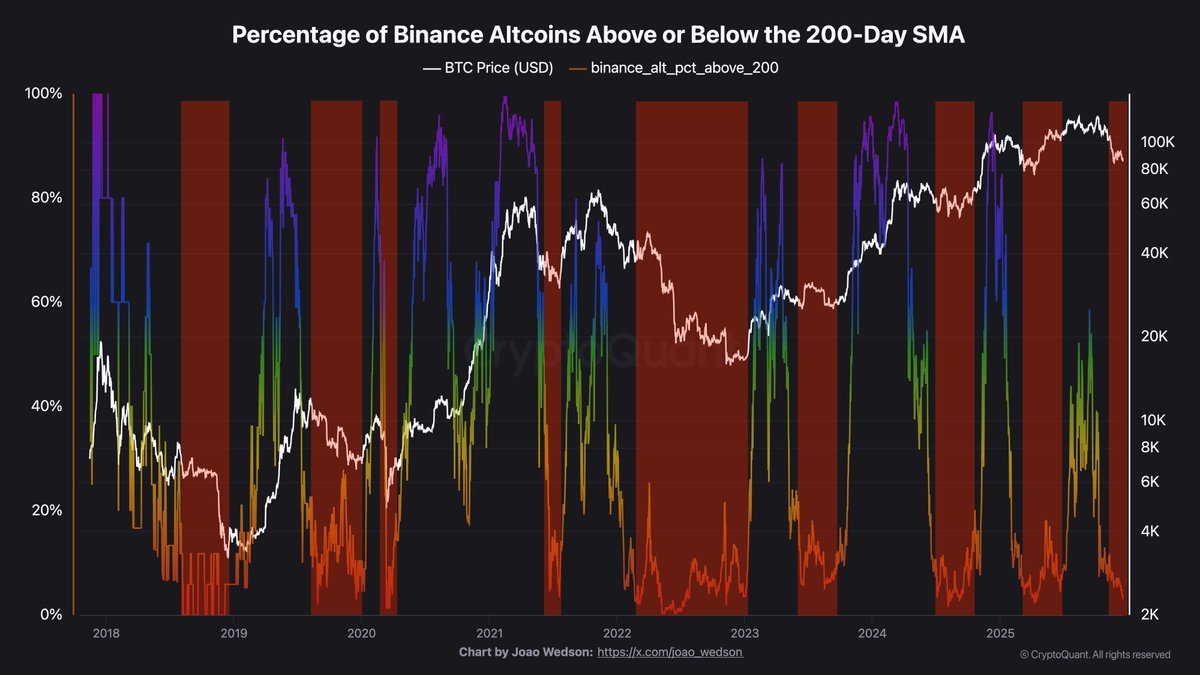

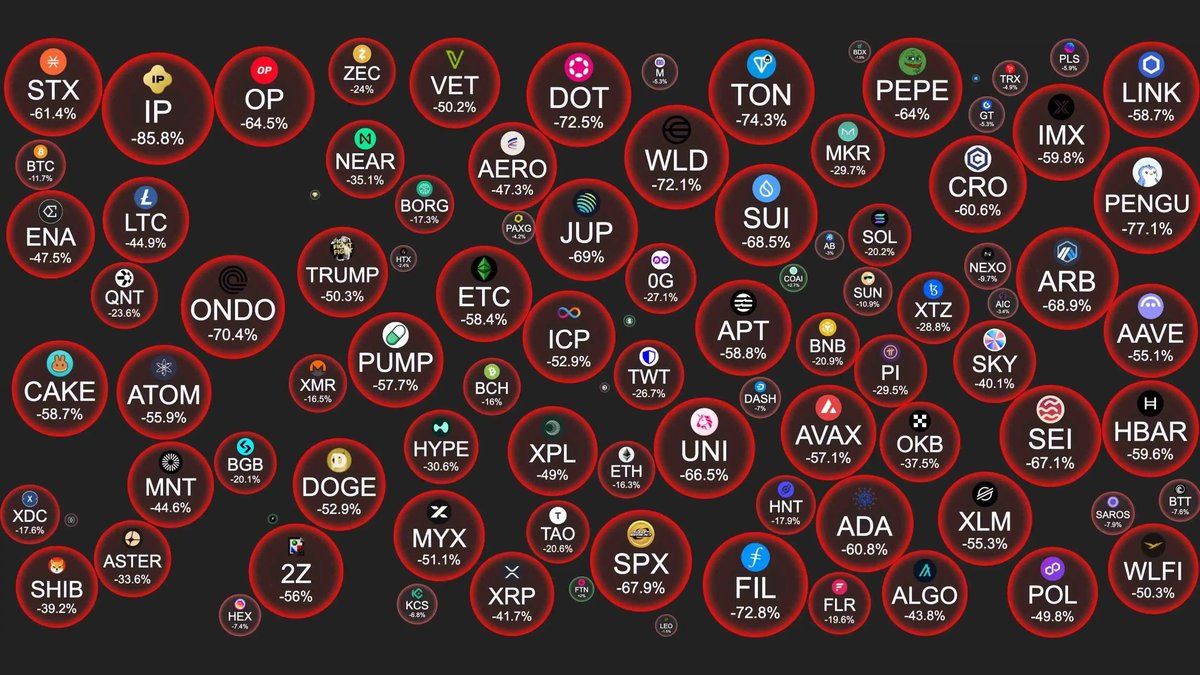

A breadth indicator that tracks the percentage of Binance listed altcoins trading above their 200 day simple moving average has dropped to roughly 3 percent. In other words, more than ninety out of every one hundred listed alternative assets are currently trading below what many investors consider a basic threshold for a positive trend. At the same time, the combined value of the altcoin market excluding the top ten names has fallen about forty six percent since October.

This is not just a price story. It is a liquidity story. Order books are thin, funding for new projects has slowed, and even coins with established communities have seen daily turnover shrink. Yet paradoxically, history shows that the most pessimistic phases of breadth and liquidity often coincide with the early stages of long term accumulation. The challenge for market participants is to distinguish between structural damage and cyclical exhaustion.

1. What the 200 Day Breadth Indicator Is Really Telling Us

The chart in focus plots two series. The first is the price of Bitcoin in white. The second, in colour, shows the percentage of Binance altcoins that are above their 200 day moving average. Extended periods near or below the ten percent zone have historically aligned with what many would describe as altcoin winters.

The 200 day moving average is not magical, but it serves as a simple proxy for the direction of an asset over a meaningful timeframe. When only three percent of a large universe are trading above that level, it tells us several things at once:

- Trend weakness is broad based. This is not a story about one sector underperforming. It is a sign that most smaller and mid sized tokens have broken down.

- Correlation is extremely high. Altcoins are moving together rather than based on project specific fundamentals. Macro forces and flows dominate.

- Risk appetite has contracted. Investors are avoiding exposure to names that require a strong belief in future growth and instead concentrating in assets seen as more robust.

The important nuance is that breadth indicators are better at describing the state of the market than predicting exact turning points. A reading near zero does not guarantee an immediate reversal. It tells us that conditions have already become extreme, and that future downside comes with increasingly compressed risk premia for those willing to adopt long horizons.

2. Why Liquidity Has Evaporated So Quickly

To understand the current altcoin winter, it helps to look at where capital has gone rather than only where it has left. Several forces have converged:

• Dominance of large cap assets. Institutional flows into listed products have concentrated buying power in Bitcoin and, to a lesser degree, a small set of large caps. This has pulled liquidity away from the long tail of tokens.

• Macroeconomic caution. Even as inflation readings moderate, many investors remain wary of growth assets and prefer instruments linked to cash flow or short duration yields. That leaves less capital available for speculative segments of the crypto market.

• Rotation into stablecoins. Rising stablecoin value shows that some participants are waiting on the sidelines rather than exiting the ecosystem entirely. For altcoins, however, this interim step still feels like a withdrawal of support.

• Regulatory uncertainty for smaller projects. While the policy backdrop is gradually becoming clearer for large assets and stablecoins, many smaller projects continue to face ambiguity, which can reduce appetite for long term commitments.

The result is a feedback loop. Lower prices lead to lower volumes, which in turn widen spreads and make large trades more disruptive. Market makers adjust inventory and reduce risk, causing liquidity to thin even further. In that environment, even modest sell orders can push prices sharply lower, reinforcing the perception that altcoins are uninvestable.

3. Historical Echoes: Previous Altcoin Winters and Their Aftermath

Breadth readings close to zero are rare but not unprecedented. Similar extremes appeared in late 2018, mid 2019, mid 2022 and, in a different form, during the deleveraging events of 2023. Each period had its own trigger, from macro tightening to specific industry shocks, yet the patterns share common features.

In each case, several observations stand out:

- Bitcoin outperformed on a relative basis. While it often experienced significant drawdowns in absolute terms, it tended to fall less and recover earlier than the broad altcoin basket.

- Many altcoins never returned to prior highs. Breadth recoveries did occur, but they were often driven by a new cohort of leaders rather than a uniform recovery of the earlier favourites.

- Liquidity crises were followed by periods of quiet accumulation. On chain data and order book analysis frequently showed large holders increasing positions while retail participation thinned.

The key implication is that altcoin winters can be both destructive and regenerative. They tend to dismantle overly crowded narratives, clear out unsustainable token models, and refocus attention on projects with durable networks or clear revenue paths. However, the process takes time and is rarely friendly to those who need quick results.

4. The Paradox of Maximum Pessimism

From a psychological perspective, the current environment is classic maximum pessimism. Commentators openly question whether altcoins still have a place in portfolios, social media interest has fallen, and search activity for many newer projects has declined. At the same time, Bitcoin continues to hold a much higher share of total crypto value, reinforcing the narrative that only a handful of assets matter.

Yet markets often move ahead of narratives. When almost every metric tells investors to avoid risk, any incremental improvement in liquidity or macro conditions can have an outsized impact. Once sellers are exhausted, the marginal trade no longer pushes prices lower. Instead, small pockets of demand can create sharp counter trend rallies.

This does not mean that every altcoin will recover, nor that a new broad based uptrend is imminent. Rather, it means that downside becomes increasingly skewed toward idiosyncratic risk. At this stage of the cycle, the main questions shift from whether altcoins as a whole will exist in the future to which specific projects will justify scarce capital.

5. Structural Shifts Inside the Altcoin Universe

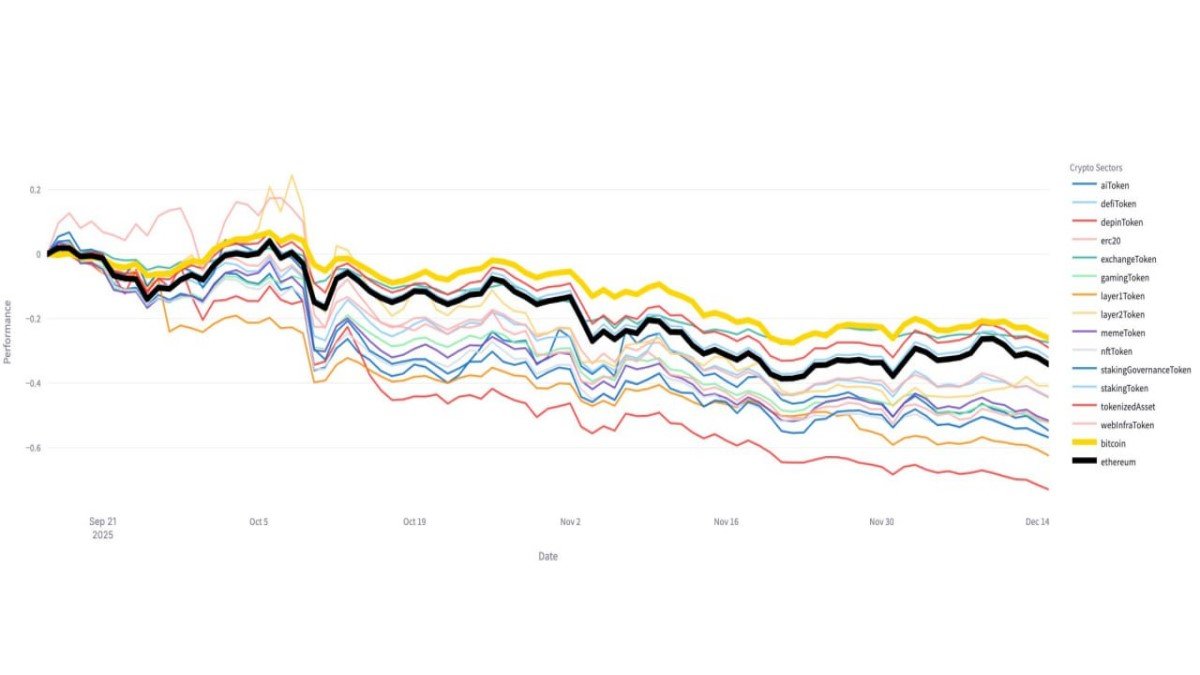

Another complexity of this cycle is that the altcoin universe itself has changed. In earlier eras, the distinction between large caps and the long tail was less pronounced. Today, the landscape can be roughly divided into several groups:

- Blue chip protocols. Networks that have established multi year track records, significant developer ecosystems and deep liquidity.

- Infrastructure and middleware. Projects that support rollups, cross chain messaging, data availability and other technical needs.

- Application tokens. Assets linked to decentralised exchanges, lending protocols, prediction markets, gaming, and similar verticals.

- Experimental and niche tokens. Highly speculative assets with limited operating history.

When breadth collapses, these categories do not move in perfect lockstep. Some blue chip names may still hold near their moving averages, while illiquid tokens can fall much faster. The current reading of only three percent above the 200 day average compresses all of these segments into a single number, but under the surface, dispersion remains significant.

For long term observers, this dispersion can be informative. A few tokens that manage to remain close to trend despite a hostile backdrop are sending a signal that demand for their utility or governance still exists. Conversely, assets that declined heavily even when the market was strong may struggle to regain attention once the cycle turns.

6. How to Think About Accumulation Without Predicting the Exact Bottom

From an educational standpoint, one of the most valuable lessons of every altcoin winter is that timing the precise bottom is extremely difficult. Breadth can remain depressed for months, and early rallies often fade. Rather than aiming for a perfect entry, many long term investors focus on process:

• Clarify time horizons. Funds intended for short term needs are usually not suitable for high volatility assets. Participants considering altcoins typically think in multi year horizons and accept that interim drawdowns can be large.

• Prioritise fundamentals over narratives. Metrics such as on chain activity, revenue, protocol usage and developer engagement provide a more grounded view than short term excitement.

• Use position sizing instead of extremes. Allocations that are small relative to overall net worth can make volatility more manageable than all in or all out decisions.

• Consider staggered entries. Gradual accumulation over time, sometimes called a dollar cost averaging style approach, reduces sensitivity to short term fluctuations. This is not a guarantee of profit but a way to smooth timing risk.

Equally important is recognising projects where capital preservation should take priority. If a token has minimal liquidity, limited transparency or no clear reason to exist beyond price appreciation, the risk of permanent loss can outweigh any benefit from potential rebounds. The fact that breadth is depressed does not turn weak business models into strong ones.

7. Scenarios for the Coming Months

Looking ahead, several broad scenarios can help frame expectations rather than precise forecasts.

Scenario A: Slow Healing

In this path, Bitcoin stabilises within a broad range while macro conditions slowly improve. Stablecoin value continues to climb, suggesting that capital is still inside the ecosystem, but participants remain selective. Over time, a handful of altcoins begin to show consistent higher lows, breadth rises from three percent toward twenty or thirty percent, and liquidity gradually returns. This process can be frustratingly slow but tends to be healthier for long term foundations.

Scenario B: Another Leg Down

An alternative is a renewed macro shock or industry specific setback that pushes Bitcoin lower and drags altcoins down another step. In this case, breadth might remain near zero for an extended period. Historically, however, additional downside from such depressed breadth levels has often been finite rather than open ended. The main risk here is psychological capitulation, where participants lose patience just before conditions begin to improve.

Scenario C: Sharp Reversion

A less common but possible outcome is a rapid shift in sentiment driven by policy clarity, new product launches or stronger than expected economic data. In this scenario, sidelined capital moves back quickly, leading to aggressive rallies in liquidity constrained names. While attractive on paper, sharp reversions are difficult to navigate in real time, as they can leave little room for considered decision making.

No single scenario is guaranteed, and the eventual path may blend elements of all three. The point of outlining them is to remind readers that today's extreme conditions are not static. Markets are adaptive systems; participants, incentives and information flow change over time.

8. Lessons From This Altcoin Winter

Altcoin winters are uncomfortable, especially for those who entered the market near prior highs. However, they also offer some of the clearest lessons about risk management and portfolio construction.

• Diversification within a single high risk asset class is not the same as true diversification. Holding many altcoins does not necessarily reduce risk if they all respond to the same macro forces.

• Liquidity matters as much as price. An asset that cannot be sold at a reasonable spread when conditions change can amplify losses. Monitoring depth and turnover is as important as watching charts.

• Quality often becomes clearer in adversity. Projects that maintain development pace, engage openly with their communities and continue to innovate even in difficult markets tend to stand out over time.

• Patience cuts both ways. It is needed both to endure drawdowns and to wait for confirmation that a real trend change is under way.

Ultimately, the current combination of record low breadth, severe drawdowns outside the largest names and rising stablecoin value paints a picture of a market that is wounded but not abandoned. For cautious participants, the safest response may be simply to observe and learn rather than to rush toward risk. For those with long horizons and robust risk controls, this environment can mark the beginning of a new research phase, identifying which networks and applications might emerge stronger when liquidity finally returns.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are volatile and can involve significant risk, including potential loss of principal. Always conduct your own research and consider consulting a qualified professional before making financial decisions.