Bitcoin Versus The Rest: What Three Months of Altcoin Underperformance Really Tells Us

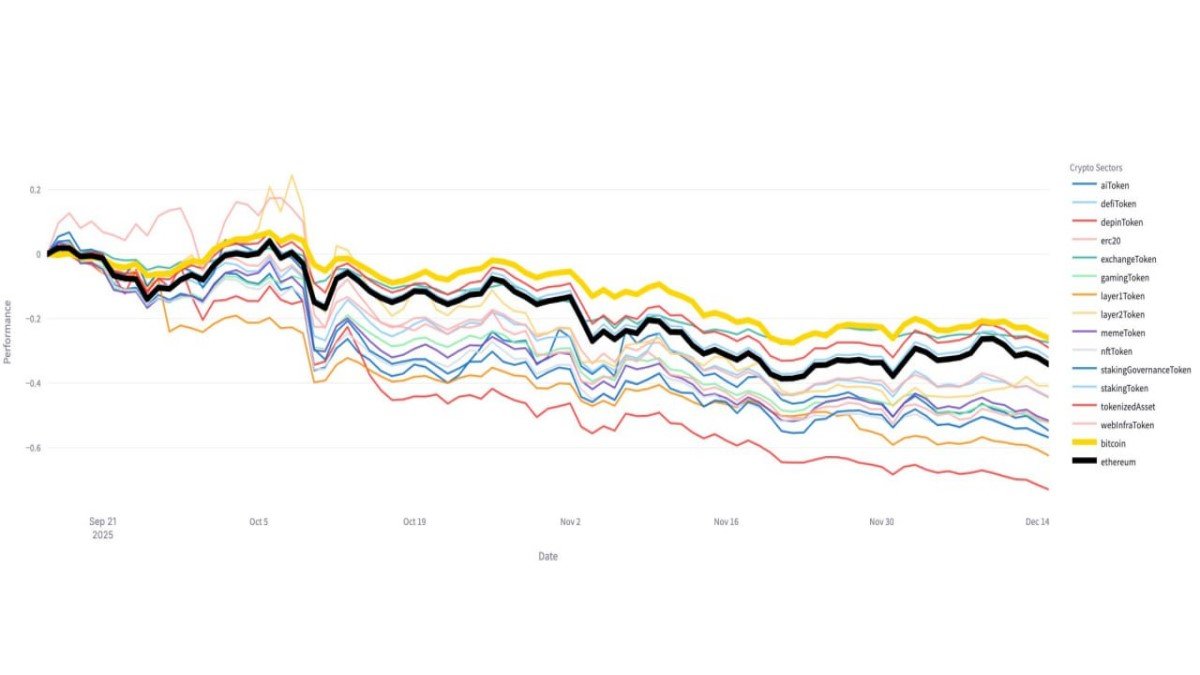

Over the past three months, Bitcoin has quietly pulled ahead of most of the crypto universe. Sector performance data from Glassnode shows that almost every major altcoin group – from DeFi and gaming to infrastructure and staking – has trailed behind Bitcoin. In the chart, the yellow and black lines representing Bitcoin and Ethereum sit above a cluster of coloured sector curves, all sloping steadily lower.

For traders who entered the market expecting a broad altcoin boom, this divergence can feel disappointing. Yet from a market structure perspective it is not unusual. Phases where Bitcoin outperforms while the rest of the market drifts lower are a recurring feature of crypto cycles. They often tell us something important about where we are in the risk spectrum, how capital is positioned and what kind of strategies are more resilient in the current environment.

This article unpacks that message in detail: why capital is concentrating in Bitcoin, what this means for altcoin holders, and how to think about portfolio construction when the market is clearly BTC led rather than a broad-based rally.

1. What the Sector Chart Is Actually Showing

The Glassnode chart plots the relative performance of multiple crypto sectors since late September. Each line represents the cumulative return of a different group of tokens – AI, DeFi, gaming, exchange tokens, layer 1 and layer 2 networks, non-fungible token infrastructure, staking assets, tokenized assets and more. Bitcoin and Ethereum are also included as reference benchmarks.

Three features stand out immediately:

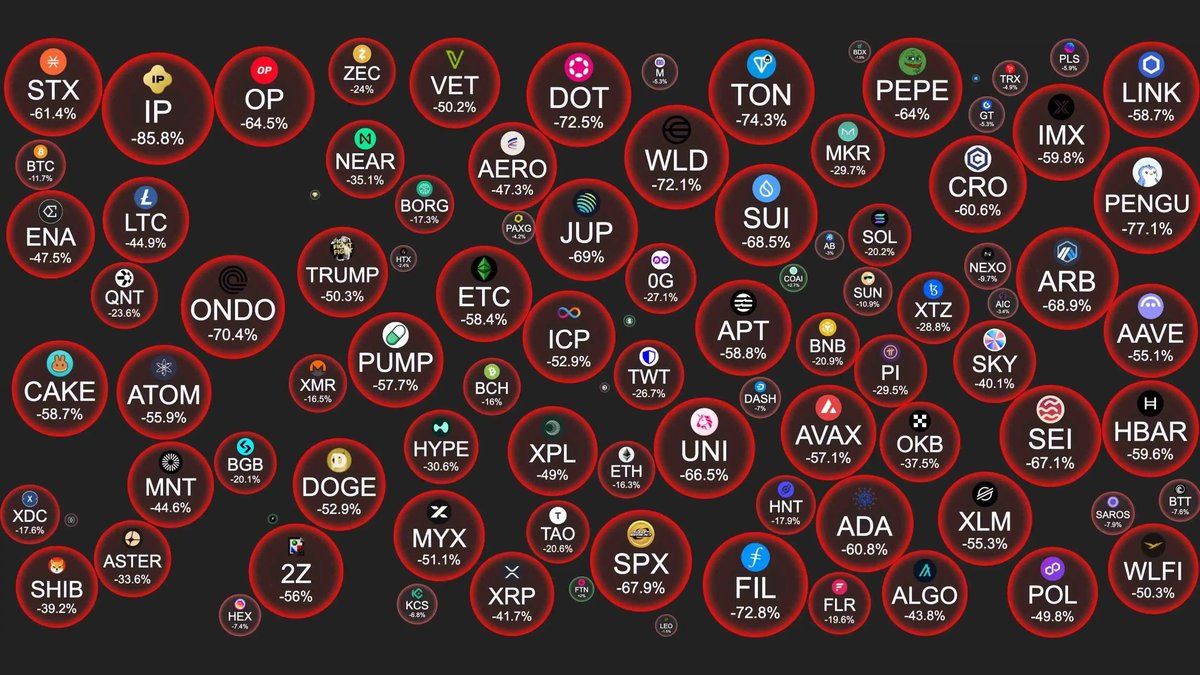

• Almost all sectors are below Bitcoin. While BTC has declined from recent highs, most altcoin groups have fallen further, resulting in negative relative performance.

• The divergence grew over time. In late September, all lines clustered tightly around zero, indicating similar returns. As weeks passed, the sector curves gradually fanned out beneath the Bitcoin line, signalling persistent underperformance rather than a one-off event.

• There is no single altcoin sector clearly leading. Some groups have fared slightly better than others, but the overall picture is broad weakness. This is very different from periods where, for example, DeFi or NFT-related assets drove a distinct narrative.

In short, this is what a Bitcoin leadership phase looks like in data: capital is not leaving crypto altogether, but it is concentrating in the asset that investors perceive as the most robust within the ecosystem.

2. Why Capital Is Clustering Around Bitcoin

There are several interconnected reasons why the market is favouring Bitcoin over altcoins at this stage of the cycle.

2.1. Macro uncertainty favours the most established asset

Global markets are still processing a complex macro backdrop: interest rates that are off their peaks but not yet low, uncertainty around future central bank policy, and lingering concerns about growth. In such an environment, investors tend to move up the quality ladder within each asset class.

Within crypto, that quality ladder is simple: Bitcoin sits at the top as the most mature, most liquid and most widely held asset. It has a transparent monetary policy, deep derivatives markets and, crucially, a growing set of institutional access points through exchange-traded products and regulated custody. When risk sentiment is cautious, rotating from smaller tokens into BTC can be seen as a way to stay in the asset class while reducing idiosyncratic risk.

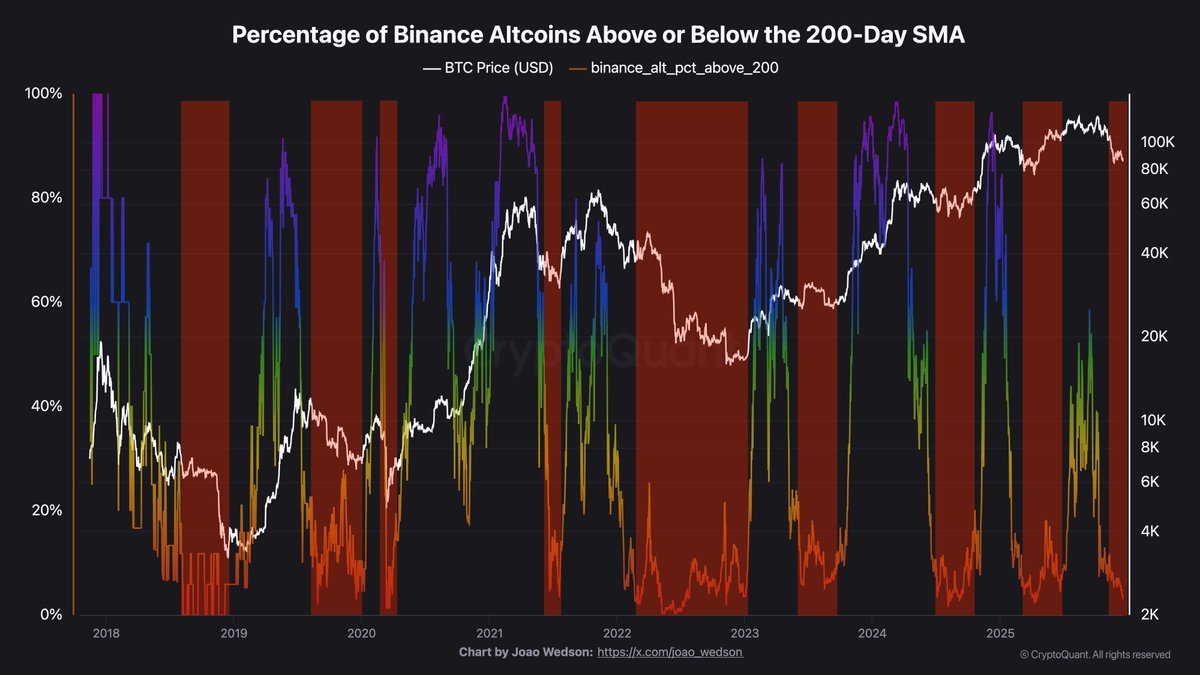

2.2. ETF flows anchor demand for BTC

Spot Bitcoin exchange-traded products have become a structural buyer in the market. Even when daily flows are not spectacular, the presence of regulated vehicles that channel retirement and wealth-management capital into BTC creates a steady baseline of demand. Altcoins, by contrast, have far fewer large-scale vehicles of this kind.

This asymmetry matters: when the overall crypto pie is not expanding dramatically, consistent demand for one asset will naturally draw relative performance away from the rest. The sector chart captures exactly that effect.

2.3. Narrative fatigue across many altcoin themes

Many of the dominant altcoin narratives of earlier cycles – initial coin offerings, yield farming, non-fungible tokens, play-to-earn games – are no longer in their explosive discovery phase. While there is still active development, price action has already priced in a portion of those stories, and some investors remain cautious after prior boom-and-bust episodes.

The result is that new capital asks tougher questions: which projects have durable users, real revenues or clear paths to sustainability? Until convincing answers emerge at scale, altcoin sectors can drift or underperform, even while Bitcoin holds up relatively better.

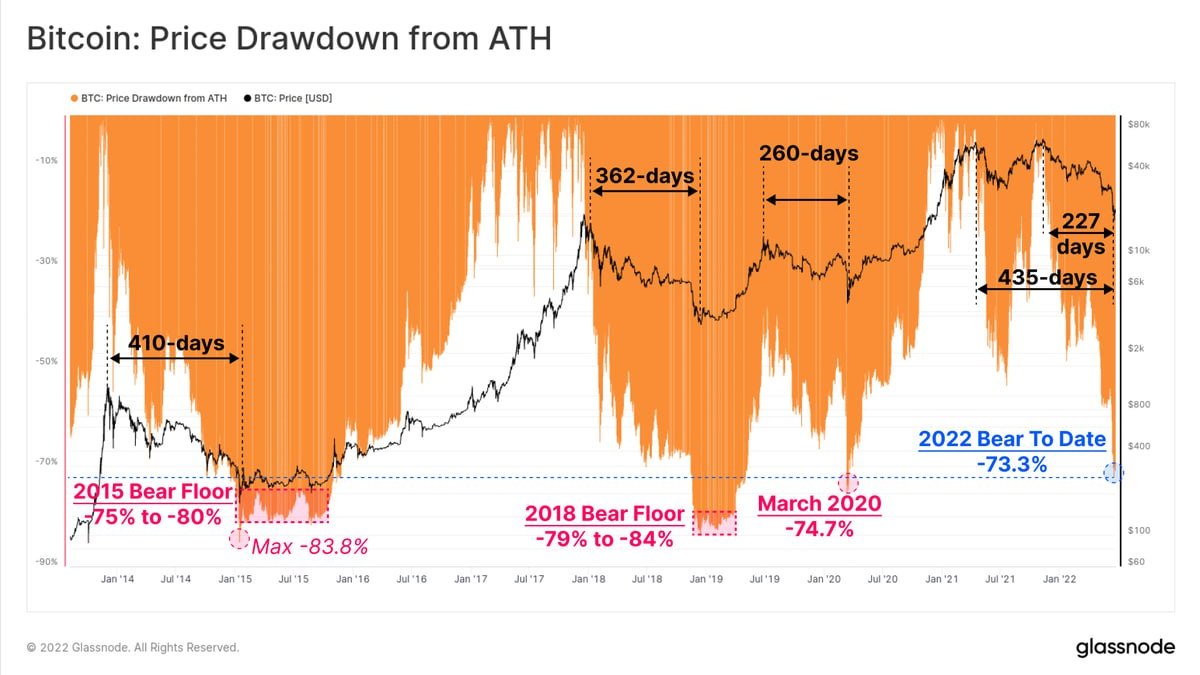

3. Bitcoin Seasons and Alt Seasons: A Recurring Rhythm

Historically, crypto cycles often rotate through different phases:

1. Bitcoin leadership. During or after major drawdowns, or when macro uncertainty is elevated, Bitcoin typically outperforms. Dominance – BTC share of total market capitalisation – tends to rise. Risk appetite within crypto remains, but it concentrates in the asset perceived as most resilient.

2. Large-cap rotation. Once confidence improves and BTC establishes a clear uptrend, attention gradually spills over into large-cap alternative assets such as Ethereum or major layer 1s. Relative performance begins to equalise.

3. Broad altcoin participation. In late-cycle phases, smaller sectors sometimes rally strongly as participants look for higher potential returns. This is when sector narratives – for example, decentralised finance or gaming – can dominate headlines.

The current data suggests we remain in the first phase, or at most the early part of the second. Bitcoin is leading, Ethereum is closer to its orbit than most, and the majority of altcoin sectors are still under pressure. That does not mean a broad altcoin phase will never arrive, but it does indicate that the market is not there yet.

4. Why Altcoin Underperformance Matters For Risk Management

For portfolio construction, the key insight is not that altcoins are inherently flawed. Rather, it is that the timing of when altcoin risk is rewarded tends to be highly cyclical. When sector data shows persistent relative weakness, strategies built on heavy diversification into smaller tokens may experience deeper drawdowns without a compensating improvement in expected return.

Several practical implications follow:

• Concentration risk cuts both ways. A portfolio heavily tilted into altcoins during a Bitcoin leadership phase may underperform even if the investor is correct about the long-term prospects of individual projects.

• Correlation rises in stress events. In strong sell-offs, many altcoins move together and often fall more than Bitcoin. The sector chart illustrates this: the lines fan out not only because BTC holds better, but also because weaker liquidity magnifies swings in smaller tokens.

• Liquidity matters as much as narrative. Deep order books and derivatives markets make it easier for large players to manage risk in BTC. That makes it a natural destination when they want to stay exposed to digital assets but reduce volatility.

From a risk-management standpoint, holding a core allocation to Bitcoin while being selective and measured with altcoin exposure is more aligned with the current data than a broad equal-weight basket of sectors.

5. How Ethereum Fits Into The Picture

The chart also highlights Ethereum as a special case. The black line representing ETH generally tracks closer to Bitcoin than most sectors, though it still underperforms at times. This is consistent with Ethereum's role as a general-purpose settlement and smart-contract platform that underpins much of the altcoin ecosystem.

In phases where risk appetite is moderate, Ethereum often behaves like an intermediate asset: less defensive than Bitcoin, but generally more resilient than smaller tokens tied to a single application niche. For investors who believe in the long-term growth of decentralised infrastructure, treating ETH as a separate bucket – neither pure altcoin beta nor a direct substitute for BTC – can provide more nuanced positioning.

6. When Might The Balance Shift Back Toward Altcoins?

If history is any guide, sustained altcoin leadership typically requires a combination of factors:

• A clear upward trend in Bitcoin. When BTC is grinding higher and volatility is moderate, some investors feel comfortable rotating a portion of gains into higher-beta assets.

• Fresh narratives with measurable traction. New use cases – such as tokenization of real-world assets, modular infrastructure, or innovative scaling solutions – need to demonstrate real user adoption, not just speculative enthusiasm.

• Improving macro conditions. Easier financial conditions and stronger growth tend to support risk-taking across asset classes, which can create room for smaller crypto projects to attract attention and capital.

Without these ingredients, attempts to call the start of an altcoin cycle may result in repeated false starts. The last three months show exactly that kind of environment: occasional short squeezes or rotation days, followed by renewed underperformance relative to Bitcoin.

7. Lessons For Long-Term Participants

For long-horizon investors and builders, the current phase carries several broader lessons:

1. Leadership changes, but cycles rhyme. It is normal for Bitcoin to reclaim leadership after periods where smaller tokens have run ahead. Treating this as a breakdown of the market rather than a cyclical pattern can lead to overreaction.

2. Quality and resilience are increasingly rewarded. As the industry matures and regulatory frameworks develop, capital tends to favour projects with transparent governance, sound economics and real users. Bitcoin fits this description in the store-of-value niche; other networks will need to prove it in their own domains.

3. Position sizing should respect volatility. Even in optimistic long-term scenarios for decentralised applications, smaller tokens are likely to remain more volatile than Bitcoin. Aligning exposure with personal risk tolerance is essential.

In other words, the takeaway from three months of sector underperformance is not that altcoins will never recover, but that the market is currently paying a premium for robustness and liquidity – qualities that Bitcoin offers more than any other digital asset today.

8. Conclusion: Recognising a Bitcoin-Led Phase Without Overreacting

The Glassnode sector data paints a clear picture: across AI, DeFi, infrastructure, gaming and other themes, most altcoin groups have delivered weaker returns than Bitcoin over the last quarter. This is a textbook example of a Bitcoin-led phase, where investors concentrate risk in the most established asset while adopting a more cautious stance toward higher-beta tokens.

For anyone participating in this market, acknowledging that pattern is more useful than denying it. It does not mean abandoning innovation or ignoring promising projects, but it does argue for building around a core of higher-quality assets, being deliberate with diversification and resisting the urge to chase every short-lived rotation.

Markets move in cycles, and the balance between Bitcoin and altcoins will eventually shift again. Until then, the recent three-month underperformance of altcoin sectors serves as a reminder that in periods of uncertainty, capital tends to migrate toward perceived strength – and right now, that strength is still concentrated in Bitcoin.

Disclaimer: This article is intended for educational and analytical purposes only. It does not constitute financial, investment, legal or tax advice. Digital assets are volatile and involve risk, and readers should conduct their own research and consult qualified professionals before making investment decisions.