Why Many Altcoins Don’t Revisit Their All-Time Highs

Every cycle creates a fresh set of stories: the token that went from near zero to life-changing returns, the narrative that felt unstoppable, the community that seemed like it would never fade. But when you step back and compare multiple cycles, a sobering pattern appears: a large share of altcoins stay below their previous all-time highs long after a major cycle ends.

This is not only anecdotal. Historical price series from major market-data aggregators show that many non-Bitcoin assets experience a single “breakout” cycle of rapid repricing, followed by extended underperformance where price drifts sideways or trends lower in real terms. Some projects adapt, sustain usage, and reclaim (or exceed) prior peaks, but they tend to be the exception rather than the baseline.

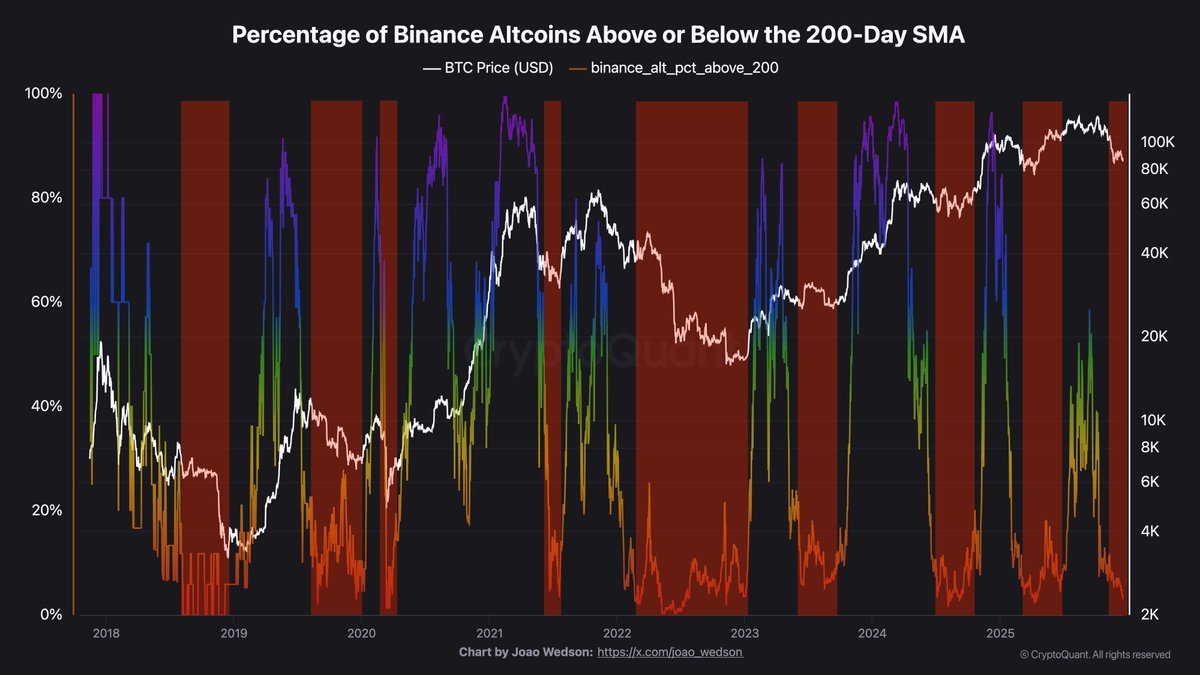

Market structure also looks different than it did in 2021. Liquidity is more selective, attention is more fragmented, and the number of listed tokens has grown dramatically. In that environment, assuming every altcoin will “come back someday” is less a plan and more a hope.

This article is not meant to spread fear. Instead, it explains why so many altcoins struggle to revisit their highs, how today’s market structure amplifies that tendency, and what a more realistic framework for approaching altcoins might look like.

1. The One-Cycle Pattern: How Many Altcoins Actually Peak

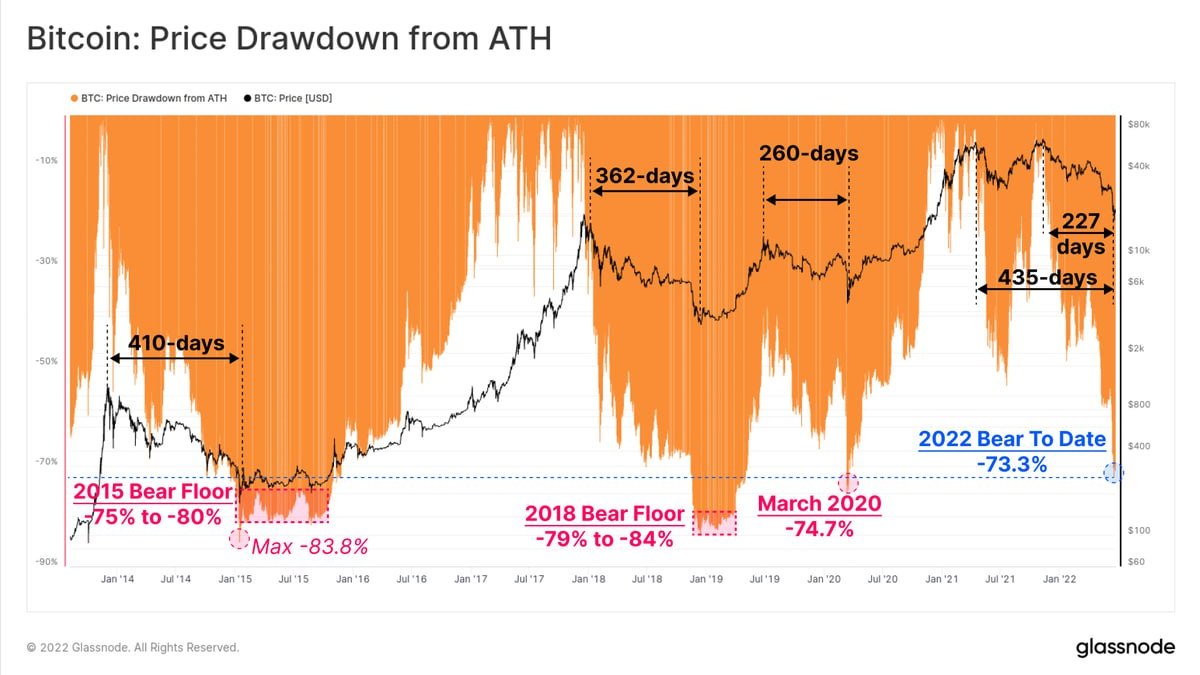

If you review prior cycles — 2013–2015, 2017–2018, 2020–2021 — a familiar rhythm appears:

- A new narrative emerges (smart contracts, DeFi, NFTs, layer-2 scaling, real-world assets, and so on).

- Capital rotates aggressively into the leading projects of that narrative.

- Hundreds of lookalike tokens launch, riding the same themes.

- Prices climb rapidly, often well ahead of fundamentals.

- As macro conditions tighten or the narrative matures, capital rotates out again.

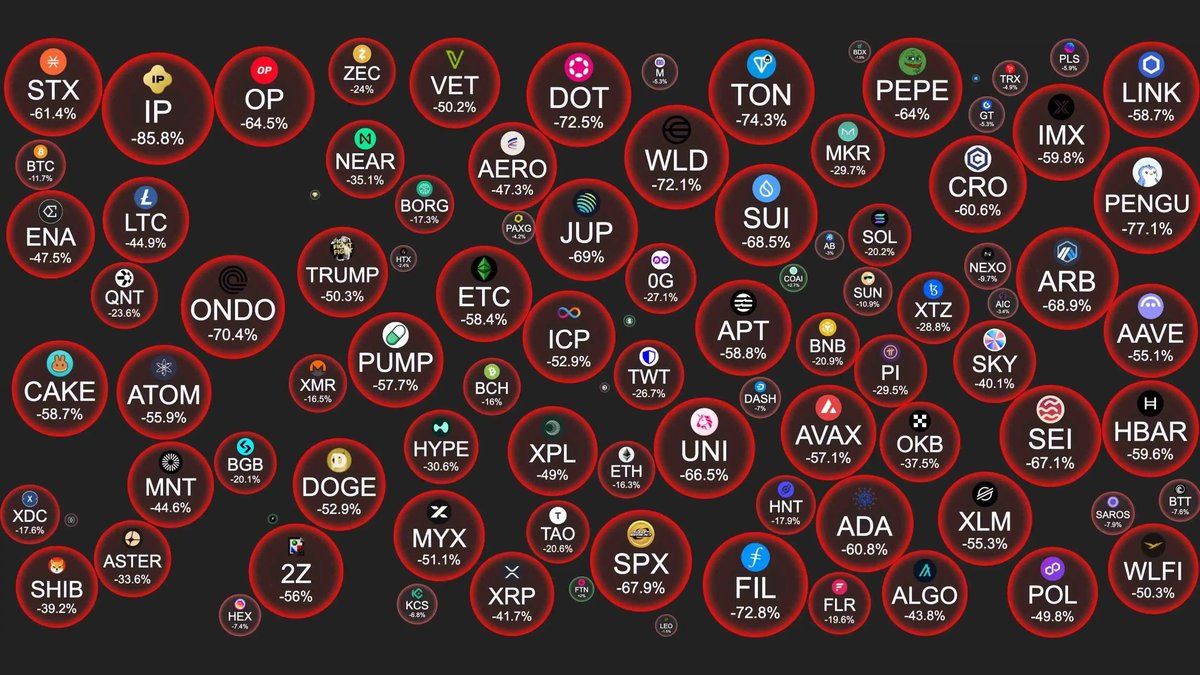

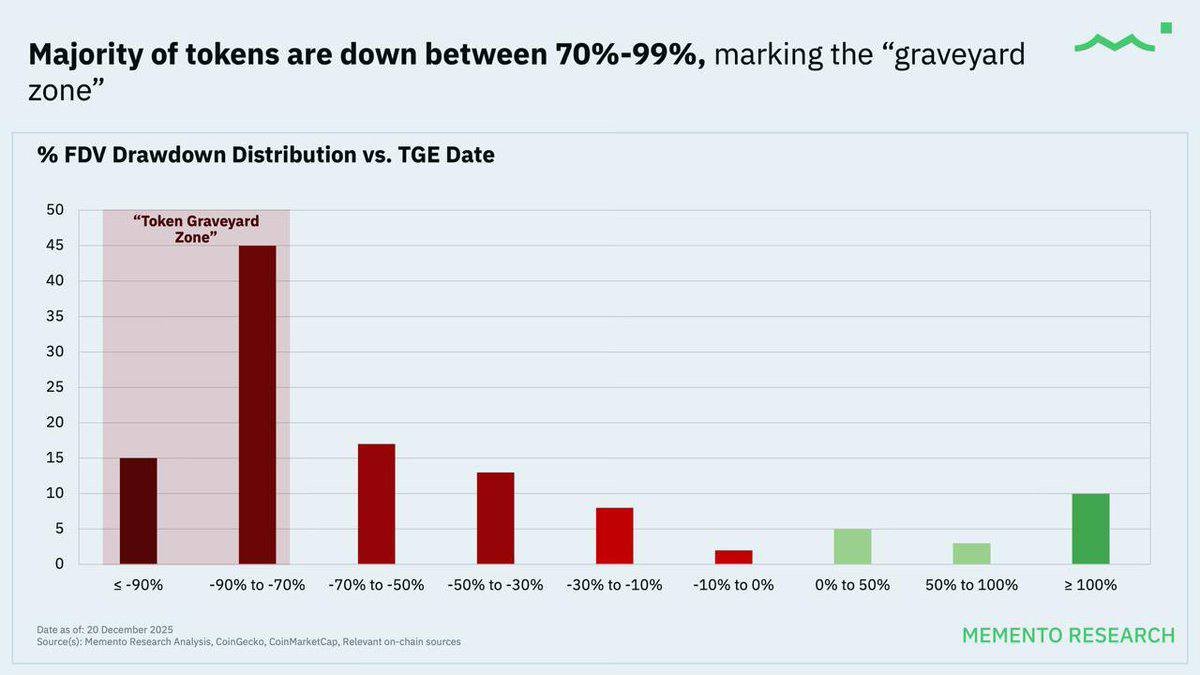

For a subset of projects, that breakout is effectively their defining moment. Prices reach a dramatic all-time high (ATH), then a combination of supply expansion, changing narratives, and fading participation leads to a long decline. Years later, even if the broader market improves, many of those tokens fail to regain their prior levels.

In practice, many altcoins can rally off the lows but still stall far below the peak set during their breakout period. In that sense, the first major cycle is often the most generous — and also the least repeatable.

2. Why Many Altcoins Struggle to Reclaim ATH

The fact that so many altcoins do not revisit their highs is not mysterious; it follows from how incentives, supply schedules, and human attention interact.

2.1 Structural selling pressure from expanding supply

Many tokens launch with a relatively small circulating supply and a much larger fully diluted supply. Early on, limited float can make prices rise sharply when demand outpaces available supply. But as vesting progresses, tokens allocated to teams, early backers, and ecosystem funds begin to unlock.

New supply does not guarantee downside, but it often creates headwinds because:

- Early investors may take profits after long lockups.

- Teams need to fund development, operations, and growth programs.

- Treasuries may diversify to reduce concentration risk.

After hype cools, this steady supply can act like a ceiling. Even if new buyers step in, they must absorb ongoing issuance that did not exist when the ATH was set.

2.2 Narratives rotate faster than most projects can adapt

Crypto markets are story-driven: “the next smart-contract platform,” “the future of gaming,” “the new scaling solution.” When a narrative is new, it captures attention and pulls in capital. But narratives rarely stay dominant for long.

As themes mature, two things often happen:

- Competition intensifies. New projects emerge with stronger positioning, sharper incentives, or improved designs.

- Expectations normalize. Adoption can be slower, revenue can be lower, and communities can become quieter.

When capital rotates to the next theme, older tokens that were tightly linked to the previous narrative can be left behind. They may rebound with broad sentiment, but rebuilding the same momentum that drove a prior ATH is difficult.

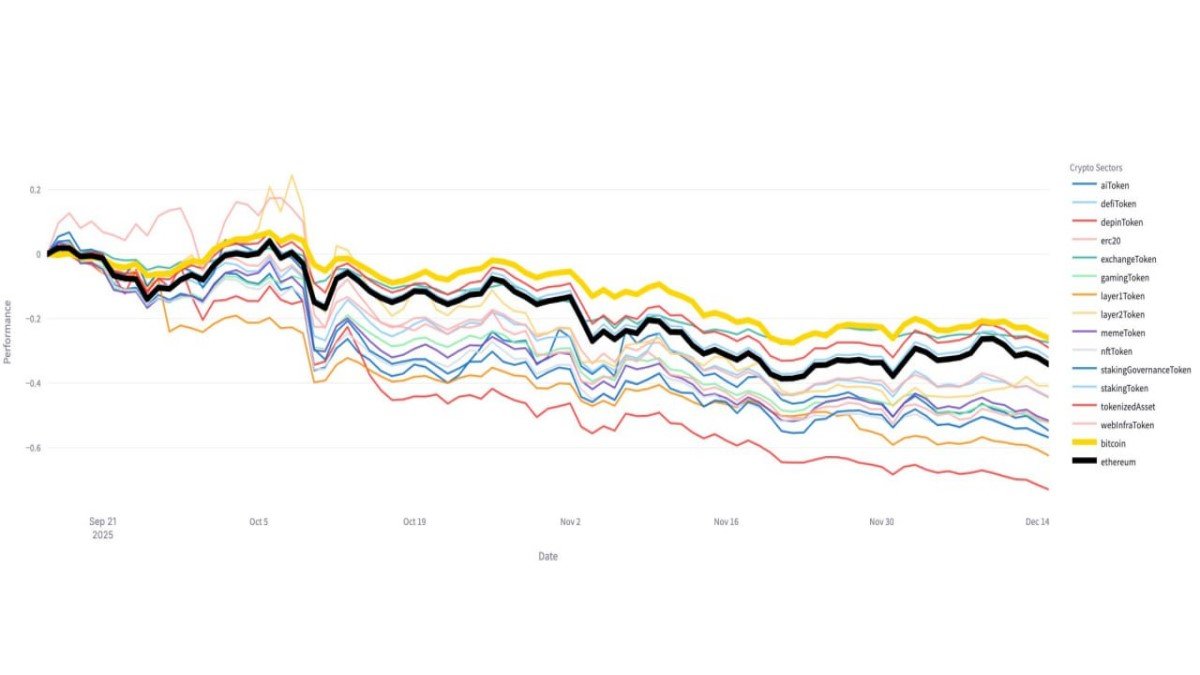

2.3 The long-tail problem: too many tokens, too little attention

Another structural issue is scale. Since 2021, the number of listed tokens has grown rapidly across the ecosystem. Many are legitimate experiments, but collectively they create an enormous long tail competing for the same pool of attention and liquidity.

Human attention does not scale as quickly as token creation. In every cycle, a small set of assets attracts most flows, while a long tail trades with thin volume and wider spreads. Once a token slips into that long tail, meaningful recoveries become harder because larger investors face higher slippage and execution risk.

2.4 Psychological anchoring and loss fatigue

Price creates anchors. If a token once traded at $10 and now sits near $1, many holders benchmark everything to the $10 level. Even after a strong rally from the bottom, some will sell early to “get back to even,” which can cap recovery.

Meanwhile, new buyers often prefer assets that feel fresh rather than those associated with painful drawdowns. That emotional baggage can slow the return of narrative energy, even if fundamentals improve.

3. The Post-2021 Environment: More Tokens, More Fragmentation

These challenges already matter in any cycle. But since 2021, market structure has shifted in ways that can make full recoveries even harder for smaller altcoins.

3.1 Liquidity is more selective

Deep liquidity tends to concentrate in the largest assets and the most actively traded venues. Many smaller altcoins have thinner order books than they did during peak risk appetite, and participation can be more intermittent.

- Moves can be sharper when flows arrive, but sustained two-sided liquidity can be limited.

- Professional traders may be cautious about slippage on long-tail tokens.

- Projects that fall out of focus can drift for long periods.

3.2 More instruments, more ways to express risk

Many sophisticated participants now allocate through a wider toolbox (derivatives, relative-value strategies, and cross-asset positioning) rather than simply holding spot altcoins for long periods. At the same time, launching new tokens has become easier, increasing competition for attention and capital.

The result is a structural mismatch: more instruments competing for attention in a market where discretionary risk capital can be more selective.

4. Rethinking Altcoin Investing: From “It Will Come Back” to “What Deserves to Survive?”

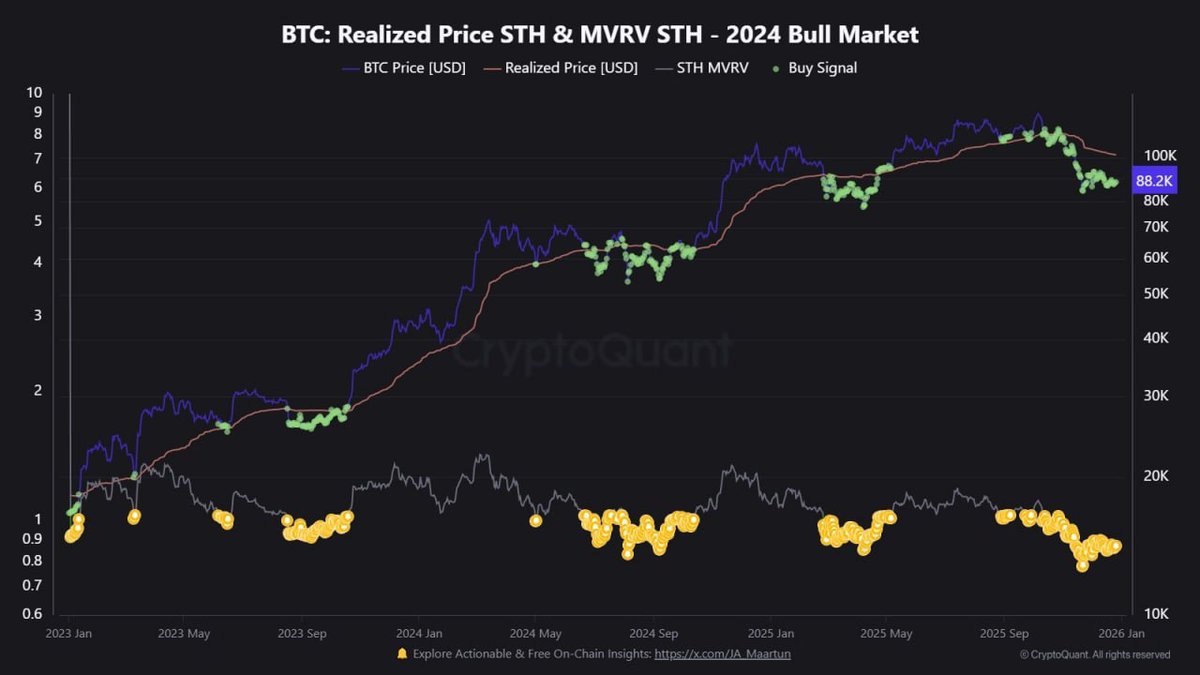

A useful mindset shift is to stop treating a prior ATH as an entitlement and start asking a more selective question: which projects have a credible path to long-term relevance?

4.1 Start with utility and value capture

- What real problem does the protocol or application solve?

- Who are the users today, and how do usage metrics evolve over time?

- Does the token capture value in a durable way (fees, discounts, utility, governance with substance)?

- Is the supply schedule transparent and sustainable?

4.2 Respect supply dynamics

Fully diluted valuation (FDV), cliff unlocks, and vesting schedules shape how much supply hits the market and when. A project can improve operationally yet still face price headwinds if large unlocks arrive into thin liquidity.

- How much supply is scheduled to unlock over the next 6–24 months?

- Who controls that supply, and what incentives do they have?

- Is there clear communication about treasury and emissions strategy?

4.3 Diversify across quality, not just quantity

If many altcoins never fully revisit prior peaks, a portfolio built on “everything will recover” can be fragile. A more resilient approach often combines a core in deeper-liquidity assets with a smaller, selective basket of higher-risk names backed by clear, testable theses.

5. What the Current Environment Is Suggesting

Put these pieces together — the tendency for many altcoins to remain below prior ATHs, the growth in token count, and the more fragmented competition for liquidity and attention — and a message emerges:

The game is more selective. The default outcome for many tokens is persistent underperformance, not automatic recovery.

That does not mean opportunity disappears. It means opportunity increasingly favors projects that keep building, attract users, and manage supply responsibly — rather than projects relying primarily on past price history.

6. Conclusion: From Hope to Discipline

The belief that “this coin will eventually return to its all-time high” can be emotionally comforting, especially after deep drawdowns. But across cycles, the combination of supply expansion, narrative rotation, and attention constraints means many altcoins face shrinking odds of a full recovery over time.

This is not pessimism; it is a framework for discipline. Instead of anchoring to an old price level set in a different environment, investors can ask harder but more useful questions: Is the protocol solving a real problem? Does the token design align incentives over time? Is there a credible plan to remain relevant as narratives evolve?

In a world with more tokens, more competition for attention, and a higher bar for sustained liquidity, those questions become the real edge. Hope can fuel rallies for a while, but over multiple cycles, discipline tends to separate long-term survivors from forgotten tickers on an old chart.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment, or legal advice. Digital assets are highly volatile and may not be suitable for every investor. Always conduct your own research and consider consulting a qualified professional before making financial decisions.