Bitcoin’s Quiet Takeover: What Rising Dominance Means for Altcoin Investors

In previous cycles, the story was simple: Bitcoin would lead the way up, attract fresh capital, and then eventually hand the baton to altcoins. Each time, its market dominance would spike during the early bull phase and then collapse when speculative enthusiasm flowed into the long tail of assets. The pattern trained an entire generation of investors to expect an inevitable “altseason” every time BTC set new highs.

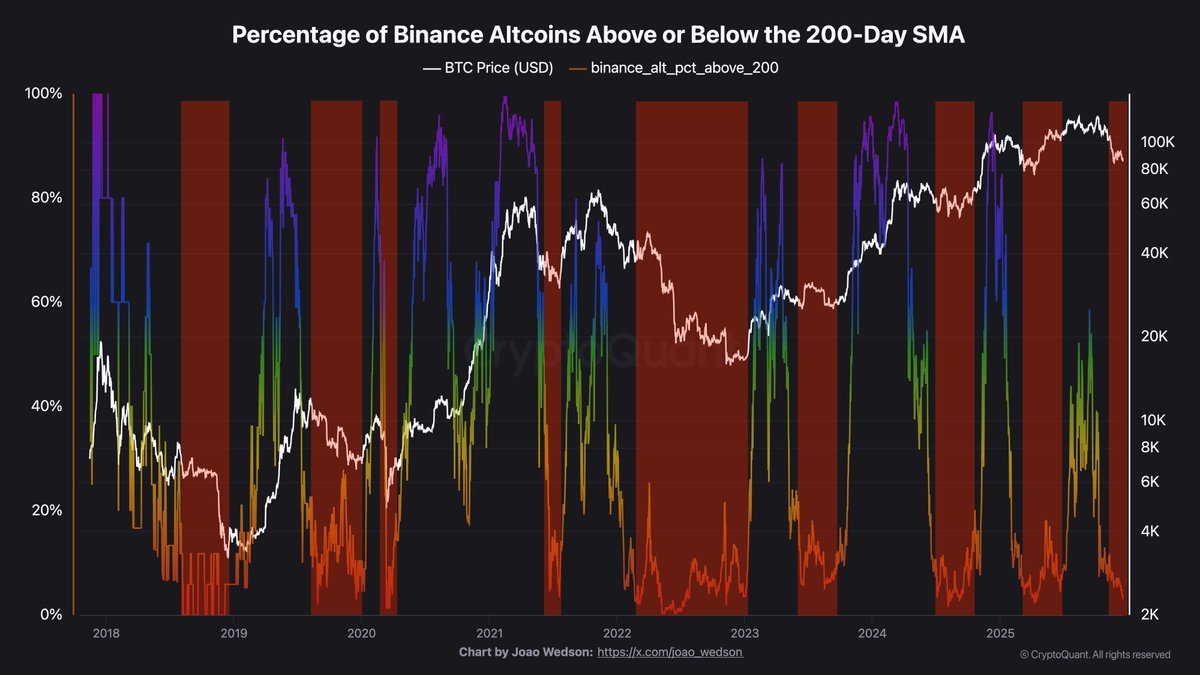

The current cycle is rewriting that script. The dominance chart now shows a very different structure: instead of a sharp rise followed by a steep decline, Bitcoin’s share of total crypto market capitalization has been climbing gradually, in a fairly steady uptrend, for roughly three years. While total market capitalization has expanded and Bitcoin’s own valuation has broken records, its dominance has not given back those gains in a meaningful way.

In other words, Bitcoin is not just rising; it is slowly taking over a larger share of the entire asset class. For anyone holding a BTC-heavy portfolio, this has been a quietly reassuring development. For many altcoin investors, however, it has meant missing a large portion of the upside or even sitting on losses despite a strong performance from the headline asset.

Reading the Dominance Chart: A Different Kind of Cycle

The chart of BTC dominance over the past decade highlights three key contrasts between earlier cycles and the present one:

• Past cycles featured violent swings. Dominance would surge above 60–70 percent during periods of fear, only to crash toward 35–40 percent when capital rotated into alternative assets.

• The current cycle shows a staircase pattern. After bottoming near cycle lows, BTC dominance has been trending upward in a series of higher lows and higher highs, rather than oscillating wildly.

• New BTC all-time highs have not triggered a lasting altcoin renaissance. There have been short bursts of altcoin outperformance, but they tended to fade quickly, leaving Bitcoin with an even larger share of the market than before.

This structural shift suggests that something deeper is changing in how capital allocates within the asset class. It is not just that Bitcoin has gone up; it is that large pools of capital increasingly treat Bitcoin as the core holding, while viewing most other assets as optional, high-risk satellites rather than core components of a diversified basket.

Why Bitcoin Dominance Is Grinding Higher

Several fundamental forces explain why BTC dominance has been rising steadily instead of peaking and collapsing as in prior cycles.

1. Institutionalisation of Bitcoin, Not of the Whole Market

The most important driver is the difference between how institutions treat Bitcoin and how they treat the rest of the crypto universe. Spot exchange-traded products, listed funds, and regulated custodial solutions have been built primarily around BTC. Pension funds, insurance companies, corporations and public investment vehicles that want exposure to this asset class are overwhelmingly choosing Bitcoin as the default entry point.

These investors often have strict mandates and a low tolerance for complex technical or operational risk. For them, Bitcoin offers:

- a long track record of uptime and settlement finality,

- relatively simple economic design,

- clearer regulatory treatment than many alternative assets, and

- the perception of a 'digital reserve' asset rather than a speculative technology bet.

As these flows arrive, they do not automatically cascade into the long tail of tokens. The dominance chart captures this concentration effect: the institutional layer is being built primarily on top of Bitcoin.

2. Altcoins as Venture Bets in a Risk-Aware Environment

At the same time, altcoins increasingly behave like early-stage venture positions. They can offer very high upside in specific cases, but they also carry product risk, governance risk and token-economic risk that Bitcoin largely avoids. In a world of higher global interest rates and enhanced regulatory scrutiny, many investors are less willing to treat the entire altcoin complex as a single high-beta play on Bitcoin.

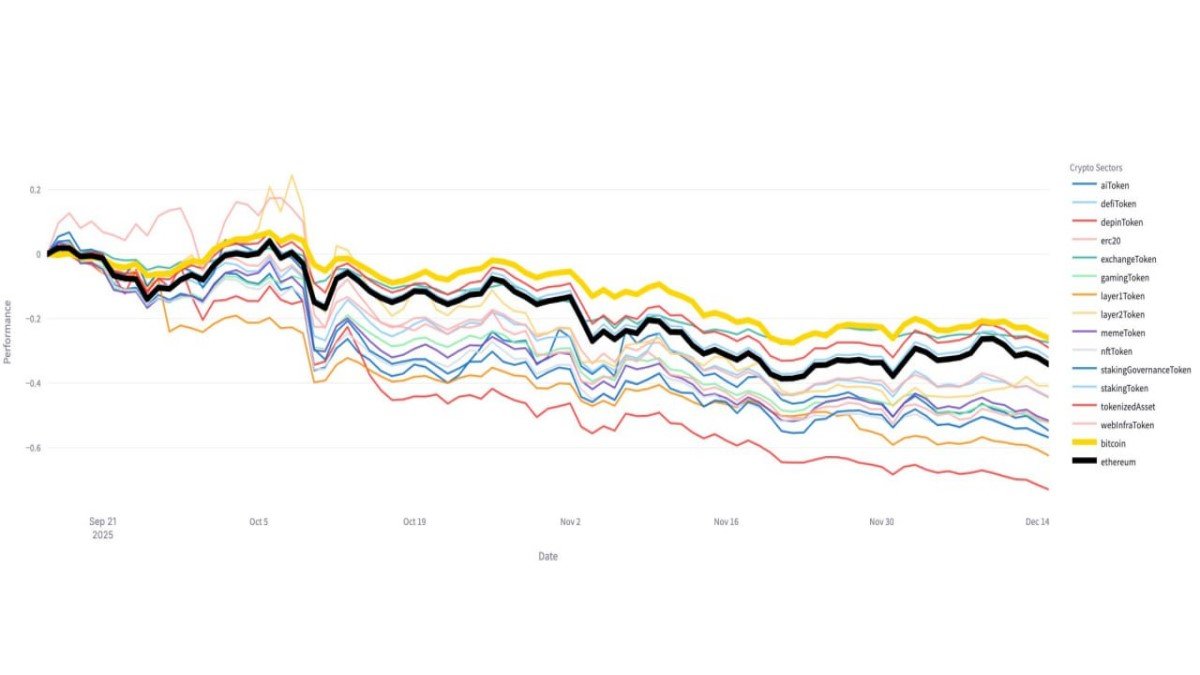

Instead, capital tends to be more selective and more rotational. A few themes attract attention — such as real-world assets, perpetual exchanges or AI-related infrastructure — while older narratives fade. When enthusiasm moves away from a sector, tokens can drift lower against BTC for long periods. On an aggregate level, this creates a slow bleed that pushes Bitcoin dominance higher even when total market capitalization is stable.

3. Supply Dynamics and Unlock Pressure

Another structural factor is the difference in supply behaviour. Bitcoin’s issuance schedule is well known, with halving events and a capped supply that the market has had years to internalise. Many altcoins, in contrast, still face sizable unlocks for teams, advisers and early investors.

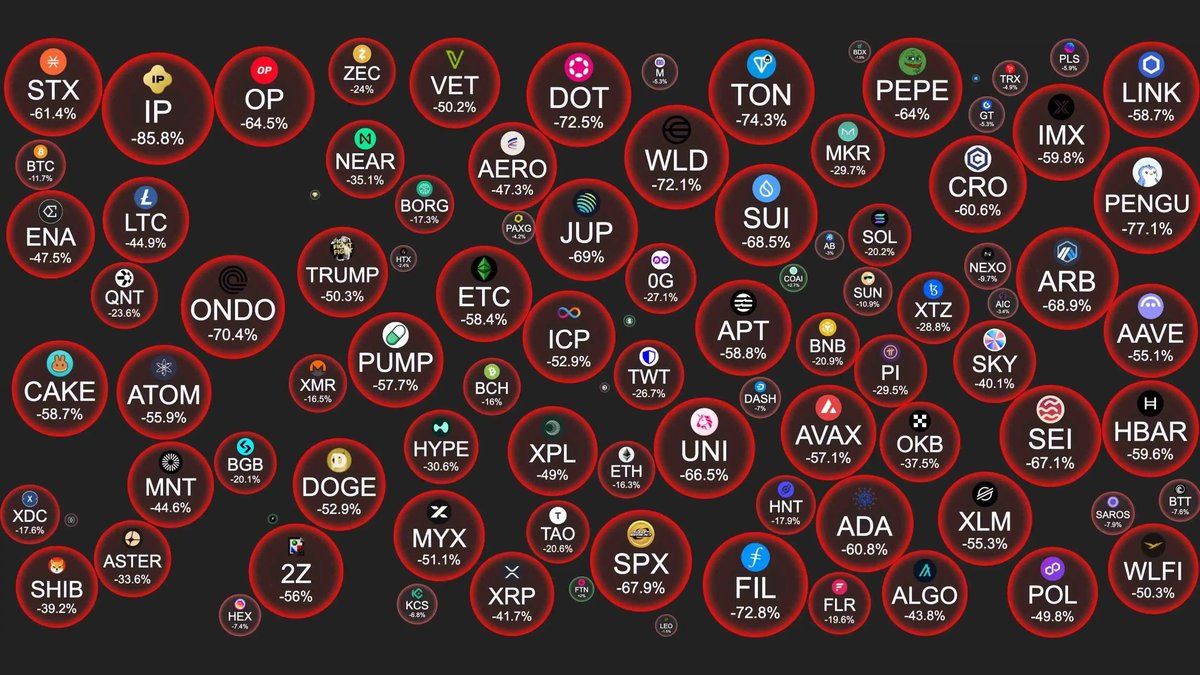

Even when projects are fundamentally sound, these unlocks add a constant drip of potential sell pressure. As we have seen in 2025, a large portion of newly listed tokens have experienced deep drawdowns from their initial valuations. Every time an altcoin sells off while Bitcoin holds its ground, another fraction of the asset class rotates toward BTC in dominance terms.

4. Regulatory Clarity Favouring Simpler Assets

Regulatory developments have also played a role. While the legal status of many tokens remains complex, Bitcoin often enjoys a clearer framework in major jurisdictions. Supervisors may not endorse it, but they increasingly understand it. This relative clarity makes it easier for banks, brokers and asset managers to offer BTC-linked products than to engage with a fragmented universe of smaller tokens.

The result is a kind of gravitational pull: each new wave of mainstream adoption tends to enter through Bitcoin first, then only selectively explore other assets. Dominance climbs as a side-effect of this cautious, stepwise adoption pattern.

What Rising Dominance Means for Portfolios

For investors who have treated Bitcoin as the foundation of their digital asset portfolio, the past three years have been comparatively comfortable. While price volatility is still significant, the combination of new inflows and rising dominance means their relative position within the asset class has strengthened.

By contrast, portfolios heavily concentrated in smaller assets have had a much more challenging journey. Even when denominated in dollars they may show periods of gain, but when measured against Bitcoin many altcoin baskets have underperformed or even lost ground. This is particularly true for tokens launched with very high fully diluted valuations and aggressive unlock schedules.

1. Bitcoin as the Core, Not the Satellite

In traditional finance, long-term portfolios often anchor around broad index funds or government bonds, with smaller allocations to higher-risk assets. A similar philosophy is starting to emerge in crypto. Rather than treating Bitcoin as just another volatile asset, more participants are treating it as the core position — the asset you own by default — with altcoins as speculative satellites added on top if the risk budget allows.

In that framework, a BTC-heavy allocation can be viewed as the digital asset equivalent of a diversified equity index: still volatile, but supported by strong network effects, deep liquidity and growing institutional ownership. Altcoins behave more like single-name growth stocks or early-stage ventures: potentially rewarding, but best sized with caution.

2. Opportunity Cost and the “Altcoin Tax”

Rising dominance also reframes the concept of opportunity cost. When Bitcoin consistently outperforms most altcoins over a multi-year period, holding the laggards becomes expensive in relative terms. Investors pay an implicit 'altcoin tax' by sitting in assets that underperform the benchmark.

This does not mean one should never allocate to alternative assets. It does suggest that the bar for doing so should be higher: clear product differentiation, evidence of real user demand, and token economics that align long-term value with actual usage. Without those elements, the probability of being outperformed by a simple BTC exposure is non-trivial, as the dominance chart quietly demonstrates.

3. Diversification vs. Dilution

One of the most persistent myths in digital asset investing is that holding many different tokens automatically creates diversification. In practice, much of the long tail tends to move together during market stress and to correlate with broader sentiment. When these assets rely on similar funding structures or narratives, buying more of them may simply increase exposure to the same underlying risk factors.

In the current cycle, we have seen the difference between diversification and dilution. A BTC-anchored portfolio with carefully chosen complementary assets behaves differently from a basket of dozens of illiquid tokens. The former can still participate in structural adoption of the space; the latter often ends up tracking the downside of the altcoin complex without benefiting fully from Bitcoin’s strength.

Does This Mean Altseason Is Cancelled?

It is tempting to look at rising dominance and declare that the era of broad altcoin rallies is over. That might be too strong. Markets are cyclical, and history suggests that there will always be periods when specific sectors or individual projects dramatically outperform, especially when new technological breakthroughs or user behaviours appear.

However, the character of those rallies may change:

- They may be narrower, driven by a smaller set of high-conviction names rather than by the entire long tail.

- They may be shorter in duration, as more sophisticated participants take profits and rotate back to core holdings sooner.

- They may be more sensitive to unlock schedules, regulatory signals and macro conditions, reducing the likelihood of indiscriminate risk-on behaviour.

In that environment, it can be dangerous to assume that a dramatic decline in BTC dominance is inevitable. The chart tells us that, so far, dominance has been remarkably resilient even after strong rallies, which means the traditional script of “Bitcoin up, then altseason, then cycle top” is no longer guaranteed.

Strategic Takeaways for Long-Term Participants

Putting everything together, the gradual rise of Bitcoin’s market share over the past three years carries several practical lessons.

1. Make Bitcoin the reference point

When evaluating any new asset, it is helpful to ask not only “Can this go up in dollar terms?” but also “Is this likely to outperform simply holding Bitcoin over a multi-year period?” If the answer is uncertain, then position size and holding period should reflect that uncertainty.

2. Respect liquidity and depth

Bitcoin benefits from the deepest spot and derivatives markets in the ecosystem. That depth provides more stable price discovery and reduces the impact of large trades relative to smaller assets. Many altcoins, by contrast, can be pushed around by relatively modest flows. In times of stress, the ability to enter or exit positions without large slippage becomes especially valuable.

3. Use altcoins as targeted, not default, exposure

Instead of spreading capital thinly across many names, some investors now prefer a barbell approach: a solid core in BTC, complemented by a few carefully researched projects that express specific theses (for example, infrastructure needed for tokenized real-world assets, or protocols directly benefiting from increased stablecoin usage). This approach treats altcoins as targeted expressions of conviction rather than as a generic way to increase volatility.

4. Accept that missing some rallies is the price of safety

A BTC-heavy portfolio will almost certainly underperform during brief phases when a particular sector rallies aggressively. That is the trade-off for greater robustness across the full cycle. The dominance chart shows that, so far, the cumulative effect of these trade-offs has favoured patience in BTC more than chasing every new trend.

Conclusion: Safety in the Foundation

The slow, persistent rise in Bitcoin dominance over the past three years is more than a curiosity on a chart. It reflects a deeper transition in how the digital asset ecosystem is structured. As institutional adoption grows, regulatory frameworks evolve and investors become more experienced, Bitcoin is increasingly treated as the foundation of the asset class rather than just its first experiment.

For those who have made BTC the backbone of their portfolio, this shift has offered a degree of safety: even with volatility and periodic corrections, they have participated in the core of the market’s value creation. For many altcoin-heavy portfolios, the same period has been far more challenging, with drawdowns against Bitcoin eroding gains and testing conviction.

This does not mean that innovation outside Bitcoin is irrelevant, nor that no alternative assets will succeed. It does suggest that in the current cycle, assuming a broad altcoin resurgence is not a risk-free strategy. Until the dominance trend tells a different story, treating Bitcoin as the default and altcoins as carefully sized satellite positions may be the more resilient approach.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment or tax advice. Digital assets carry significant risk and may not be suitable for every investor. Always perform your own research and consider consulting a qualified professional before making financial decisions.