When the Bank of Japan Raises Rates, Bitcoin Feels It: Inside the Carry-Trade Shock

For most of the last three decades, Japan was the world's supplier of ultra-cheap money. While other central banks pushed rates up and down in response to inflation cycles, the Bank of Japan (BoJ) kept policy near or below zero. That era is ending, and digital-asset markets are learning the hard way that changes in Tokyo can send shockwaves through Bitcoin and altcoins.

We have now seen three key steps in this new phase:

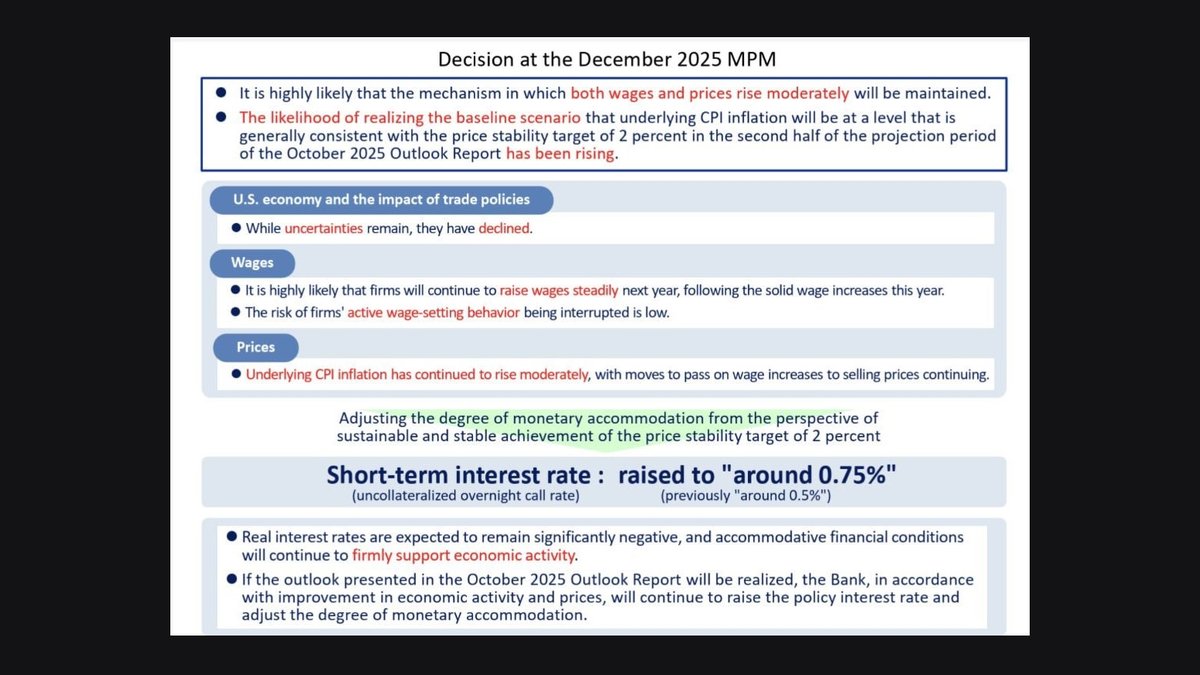

- July 2024: BoJ raises its policy rate to 0.25%. In the following weeks, Bitcoin drops more than 20% from local highs.

- January 2025: Rate moves again, up to 0.50%. Bitcoin eventually trades around 30% lower from pre-announcement levels.

- 19 December 2025: BoJ lifts rates by another 25 basis points to 0.75%, the highest level since 1995. Bitcoin initially bounces toward 87,000 USD, but the broader context is a market still wrestling with weak liquidity and heavy positioning.

At first glance, it is tempting to connect the dots in a straight line: BoJ hikes, Bitcoin falls. Reality is more nuanced, yet the pattern is not an accident. To understand why, we need to unpack how Japanese interest rates interact with global risk-taking, and why that interaction is so important for an asset that lives at the far edge of the risk spectrum.

1. Why Japan Still Matters for Global Liquidity

Japan is not just another large economy. It is a country with:

- Very high public debt levels.

- A large domestic savings pool held by households and institutions.

- A long history of near-zero or even negative interest rates.

When local yields are extremely low, global investors have a strong incentive to borrow in yen at modest cost and invest the proceeds abroad in higher-yielding assets. This practice is known as the yen carry trade. For many years, it quietly supplied funding to a wide range of markets: US equities, emerging-market bonds, corporate credit and, more recently, digital assets.

As long as Japanese interest rates stay anchored near zero and the yen is relatively stable, the trade feels almost like free money: investors collect the yield difference between foreign assets and yen funding costs. But when the BoJ changes course and allows rates to climb, the gears turn in reverse.

2. From Rate Hike to Bitcoin Selling: How the Shock Propagates

The mechanism that links a 25 basis point move in Tokyo to selling pressure on Bitcoin and altcoins can be broken into several steps:

1. Funding costs rise for yen borrowers. Every BoJ hike increases the cost of borrowing in yen and raises the risk that borrowing again in the future will be even more expensive.

2. The yen tends to strengthen. Higher yields make Japan's currency more attractive relative to the US dollar and other majors. Even the expectation of future hikes can trigger currency moves.

3. Carry traders face potential losses. If the yen appreciates, the foreign assets they bought with borrowed yen must perform extremely well just to keep the trade profitable. Otherwise, currency moves can wipe out returns.

4. Investors unwind risk positions. To control risk, many investors start closing positions funded through these structures: selling stocks, high-yield bonds and, importantly, crypto assets.

5. Leverage amplifies the move. In digital-asset markets, where derivatives and margin are common, price declines can trigger liquidations of leveraged positions. That adds mechanical selling on top of discretionary selling.

This chain reaction is why a BoJ announcement can influence Bitcoin price even though most BTC trading does not happen in yen. The central bank is adjusting the cost of one of the world's preferred funding currencies, and that adjustment ripples through every asset that depends on abundant, low-cost liquidity.

3. Looking Back at the Recent Hikes

With that mechanism in mind, the behaviour of Bitcoin around the last three BoJ moves becomes easier to interpret.

3.1 July 2024: The end of negative rates

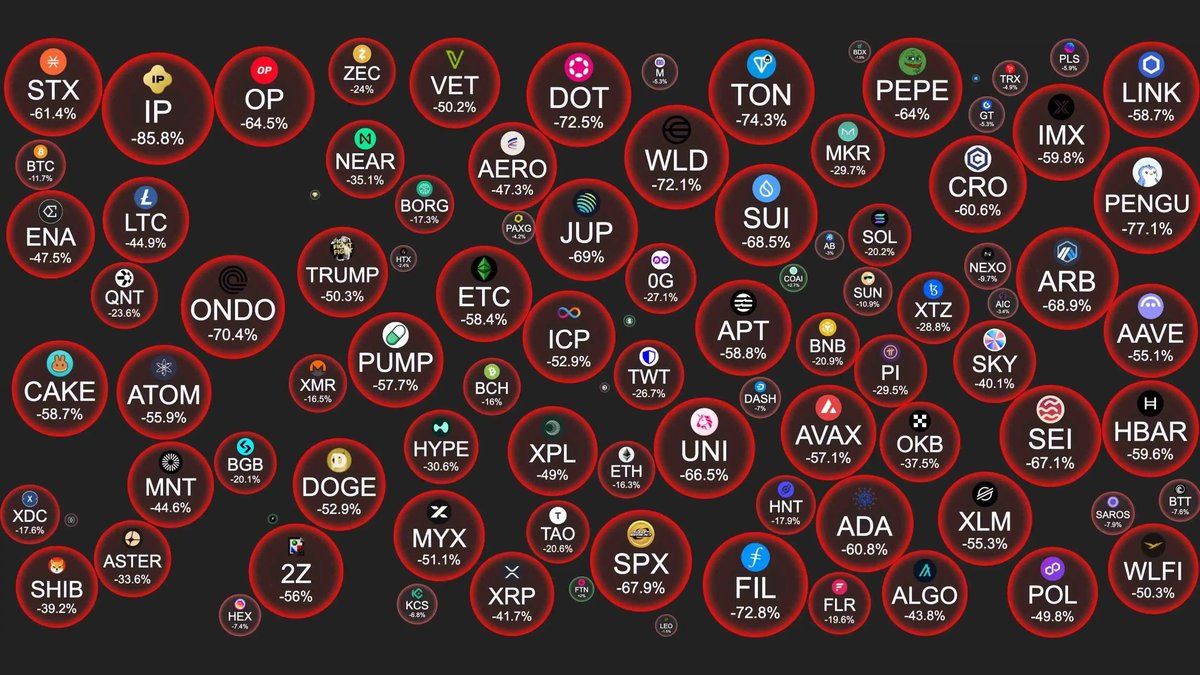

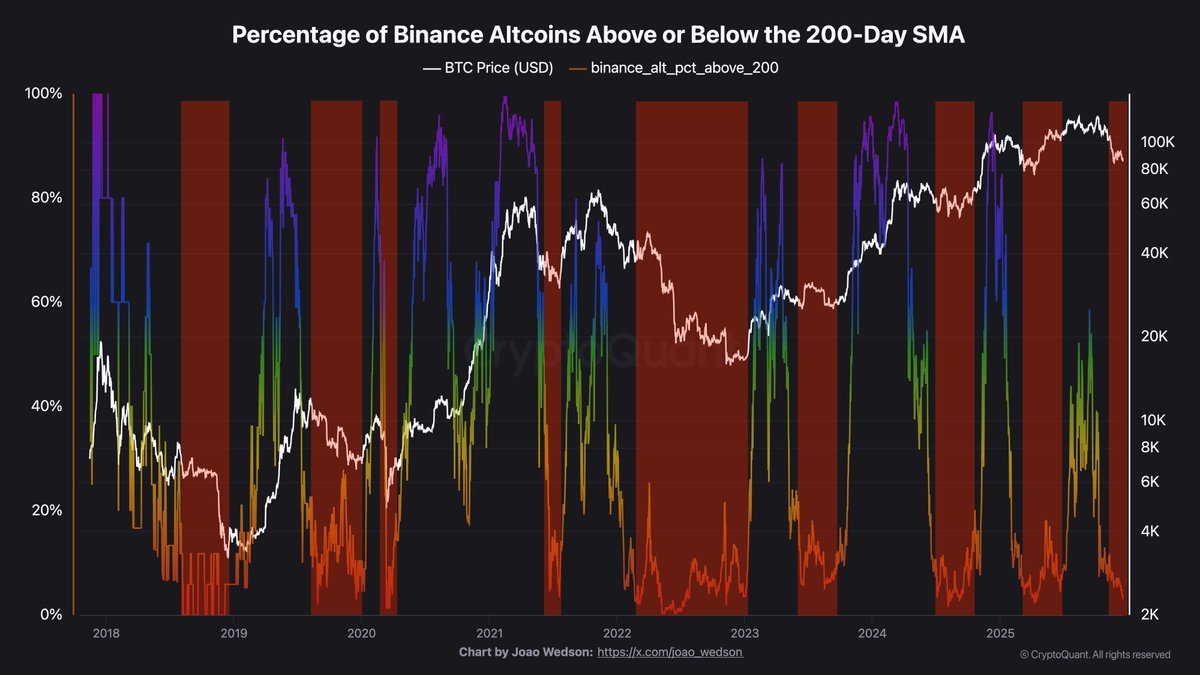

When the BoJ first nudged its policy rate up to 0.25% in July 2024, markets had been debating the possibility for months. Yet the act of crossing from effectively zero into clearly positive territory still jolted global risk sentiment. Bitcoin, which had been trading near local highs, sold off by more than 20% over the following weeks. Altcoins, as usual, experienced even sharper declines because they sit further out on the risk curve and rely on thinner liquidity.

3.2 January 2025: Confirmation of a new regime

The move to 0.50% in January 2025 confirmed that the earlier hike was not a one-off experiment but the beginning of a broader policy shift. By that point, carry trades had grown larger again as many investors assumed the first move was sufficient. The second hike forced a deeper rethink. Bitcoin's drawdown of around 30% from prior levels reflected both forced de-risking and a change in narrative: the period of 'super-cheap yen forever' was clearly over.

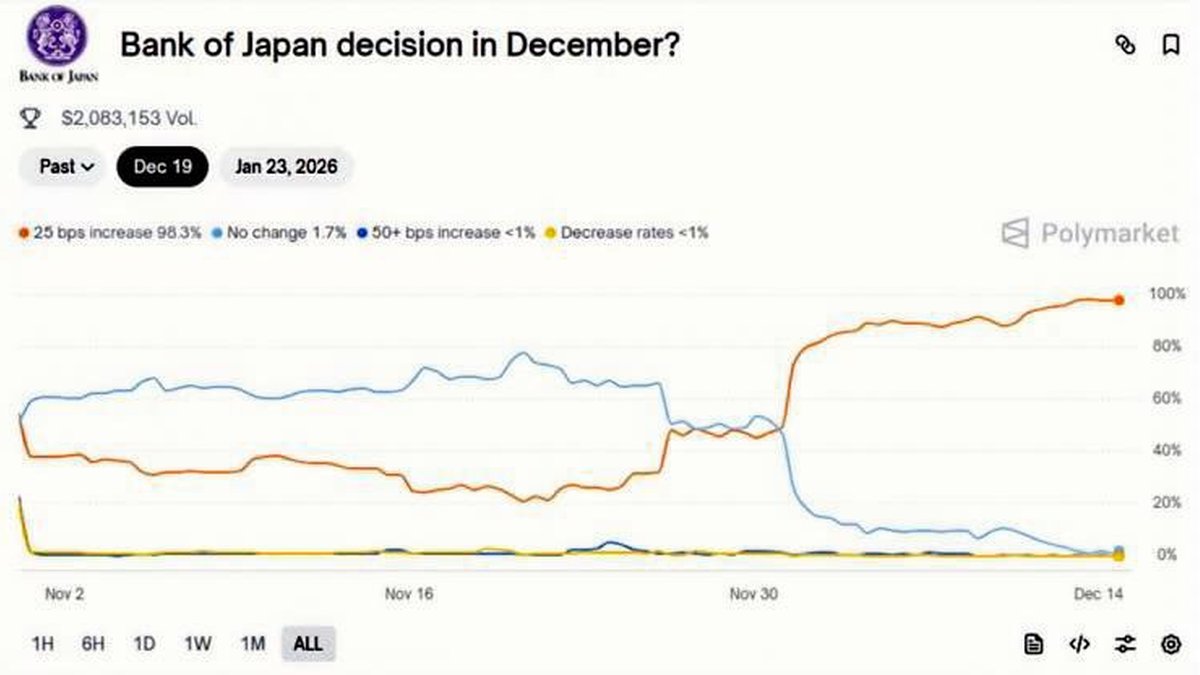

3.3 December 2025: A hike that was 'expected'

The December 2025 decision to lift rates to 0.75% has been widely signalled, so the immediate reaction in Bitcoin has been more muted. Price is attempting to stabilise near 87,000 USD after an earlier decline, even as derivatives data show that a 3,000 USD move in either direction could still trigger sizable liquidations of leveraged positions.

This illustrates an important point: the sensitivity of Bitcoin to BoJ moves is not just about the surprise element of the announcement. It also depends on where positioning and liquidity stand at the moment the decision arrives. When the market is already nervous and highly leveraged, even a well-telegraphed move can have outsized effects.

4. Why Altcoins Often Suffer More Than Bitcoin

While the conversation often focuses on Bitcoin, altcoins are usually hit harder when Japanese rates rise. There are several reasons:

- Lower liquidity: Many altcoins trade in thinner order books, so a given amount of selling pressure causes larger price swings.

- Higher perceived risk: In times of stress, investors tend to retreat toward assets viewed as more established. Within the crypto universe, that means flows often rotate from smaller tokens into BTC or stablecoins.

- Derivatives concentration: A large share of speculative leverage is concentrated in altcoin perpetuals. When funding costs rise or volatility spikes, these contracts can see rapid liquidations.

In short, when the carry trade unwinds, altcoins behave like high-beta versions of Bitcoin. They can rebound strongly in calmer conditions, but during a funding shock they are usually not the place where risk is first reintroduced.

5. The End of Super-Cheap Yen: What Changes and What Does Not

The phrase 'end of super-cheap money' captures the mood, but it is worth being precise about what has changed and what remains true.

What has changed:

- The yen is no longer a near-zero-cost funding currency. Every hike raises the hurdle rate for global investors considering leveraged strategies.

- BoJ is signalling that it cares more about price stability and financial-sector resilience than before. That reduces the likelihood of a quick return to ultra-loose policy.

- Global portfolios must now budget for the possibility that both US and Japanese rates remain meaningfully positive at the same time, compressing the relative appeal of carrying risk assets on borrowed funds.

What has not changed:

- Japan still has a large domestic savings pool looking for returns.

- Demographic trends and moderate growth mean that domestic demand for credit remains limited, so some capital will still flow abroad.

- Bitcoin continues to trade globally, 24/7, with a fixed supply schedule and an investor base that spans retail, institutions and corporates.

In other words, the BoJ's shift increases volatility and changes the shape of risk-taking, but it does not remove the structural drivers that brought digital assets into portfolios in the first place.

6. Yen Strength, Dollar Dynamics and Bitcoin's Medium-Term Role

A subtle but important angle is the interaction between the yen and the US dollar. When Japanese rates rise from very low levels, the yen often strengthens. Over time, that can chip away at the perception that the dollar is the only strong currency anchor.

If US policy moves in a more accommodative direction while Japan tightens, the dollar could soften relative to a basket of major currencies. Historically, Bitcoin has tended to perform better in periods when the dollar is not aggressively strengthening. A landscape where both the yen and the dollar are adjusting to new realities could create opportunities for BTC to reassert itself as an independent macro asset rather than simply a high-beta expression of US liquidity.

However, this kind of re-rating usually plays out over quarters and years, not days. In the short run, the funding shock from BoJ tightening tends to dominate price behaviour, especially when market sentiment is fragile.

7. Short-Term Liquidity Versus Long-Term Thesis

To make sense of the current environment, it helps to separate two clocks:

- The short-term liquidity clock: driven by carry trades, leverage, derivatives positioning and forced liquidations.

- The long-term thesis clock: driven by adoption trends, regulatory clarity, institutional participation and Bitcoin's fixed-supply design.

BoJ hikes primarily affect the first clock. They change the cost of funding and reset risk appetite. That is why we see rapid, sometimes violent, moves in Bitcoin and altcoins around announcement dates. But the second clock keeps ticking in the background. Long-term holders, corporate treasuries and infrastructure builders generally do not reverse multi-year strategies because a single central-bank decision added 25 basis points to a foreign policy rate.

For investors, the challenge is to respect the power of the short-term liquidity clock without losing sight of the long-term thesis. That means paying attention to positioning, avoiding excessive leverage during policy weeks and acknowledging that even a strong structural story can experience deep drawdowns when funding conditions tighten.

8. What the Current Setup Implies for Risk Management

Given the present mix of weak liquidity, elevated macro uncertainty and still-significant derivatives open interest, a few practical lessons stand out:

• Avoid overusing leverage around central-bank announcements. Policy days can generate rapid price swings that trigger liquidations far beyond what the underlying news might justify.

• Recognise that altcoins are higher on the risk ladder. When funding costs rise and global investors de-risk, capital usually migrates toward assets seen as more resilient. Concentrated exposure to small tokens can therefore be particularly volatile.

• Watch the interaction between FX and crypto. Sharp moves in the yen and the dollar can signal that funding trades are being unwound, even before digital-asset prices fully adjust.

• Use on-chain and derivatives data as context, not as a crystal ball. Metrics on liquidations, futures positioning and exchange flows help explain why markets move; they are not guarantees about what comes next.

None of these points offer easy answers, but they help frame a disciplined approach: treat BoJ decisions as important macro events that can reshape the playing field for a time, rather than as isolated headlines.

9. Could Bitcoin Eventually Benefit from Japan's Shift?

Paradoxically, the same policy changes that create short-term headwinds may strengthen Bitcoin's long-term story. As the cost of traditional funding rises and global debt levels remain elevated, investors are searching for assets that are not bound to a single central bank's decisions. A world where both US and Japanese policymakers must juggle inflation control, debt sustainability and growth could increase interest in assets with transparent supply schedules and global liquidity.

That does not mean Bitcoin is immune to macro shocks. It simply means that the reasons some participants hold it—as a diversifier, a treasury asset or a long-term store of value—remain intact even when the price reacts sharply to changes in short-term funding conditions.

10. Conclusion: Reading the BoJ-Bitcoin Link Without Panic

The latest hike from the Bank of Japan, lifting policy rates to 0.75%, is another step in a multi-year process of normalising one of the world's most important funding currencies. For Bitcoin and altcoins, each step has so far been associated with turbulence: lower prices, forced de-risking and a reset of speculative positioning.

Understanding the mechanics behind this link—yen-funded carry trades, shifts in FX, leveraged structures—is essential for any investor who wants to participate in digital assets through a full macro cycle. At the same time, it is important to remember that these are episodes within a much longer story about the evolution of money, markets and technology.

In the near term, cautious position sizing, limited leverage and respect for policy calendars are simple but effective defences. Over longer horizons, the key questions remain structural: How will savings move in a world of higher global rates? Which networks will institutions choose as settlement layers? And what role will Bitcoin play as both a high-beta macro asset and a long-lived digital bearer instrument?

Those are the questions worth revisiting long after the immediate reaction to the latest BoJ press conference has faded from the charts.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and involve risk. Always conduct your own research and consult a qualified professional before making financial decisions.