BoJ Hikes to 0.75%, but Real Rates Stay Negative: Why Bitcoin Could Benefit in the Short Term

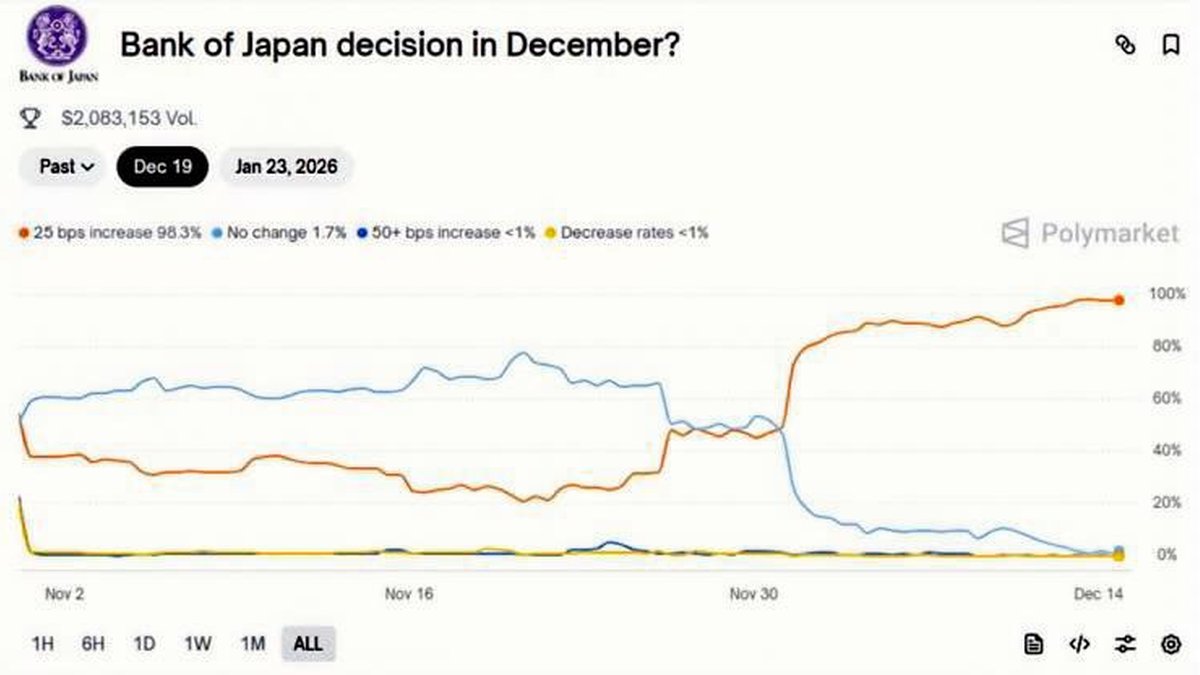

Most market commentaries treat interest-rate increases as automatic bad news for Bitcoin and other risk assets. Higher yields are supposed to pull capital back toward government bonds and cash, while speculative positions are unwound. At first sight, the latest move from the Bank of Japan (BoJ) appears to fit that script: the policy rate has just been lifted to around 0.75%, the highest level Japan has seen since the mid-1990s.

Yet a closer look at the BoJ's own materials tells a more subtle story. The central bank explicitly notes that real interest rates are expected to remain significantly negative, and that accommodative financial conditions will continue to “firmly support economic activity.” Underlying inflation is projected to run around the 2% target in the second half of the outlook period, while both wages and prices are expected to keep rising moderately.

If nominal rates are 0.75% and inflation is near 2%, the implied real rate is roughly -1.25%. That is not a tight stance. It is still a world where borrowing remains attractive, cash is slowly eroded by inflation, and savers are encouraged to look for higher-yielding opportunities. In that environment, the story for Bitcoin is more complex—and in the short term, it can even be constructive.

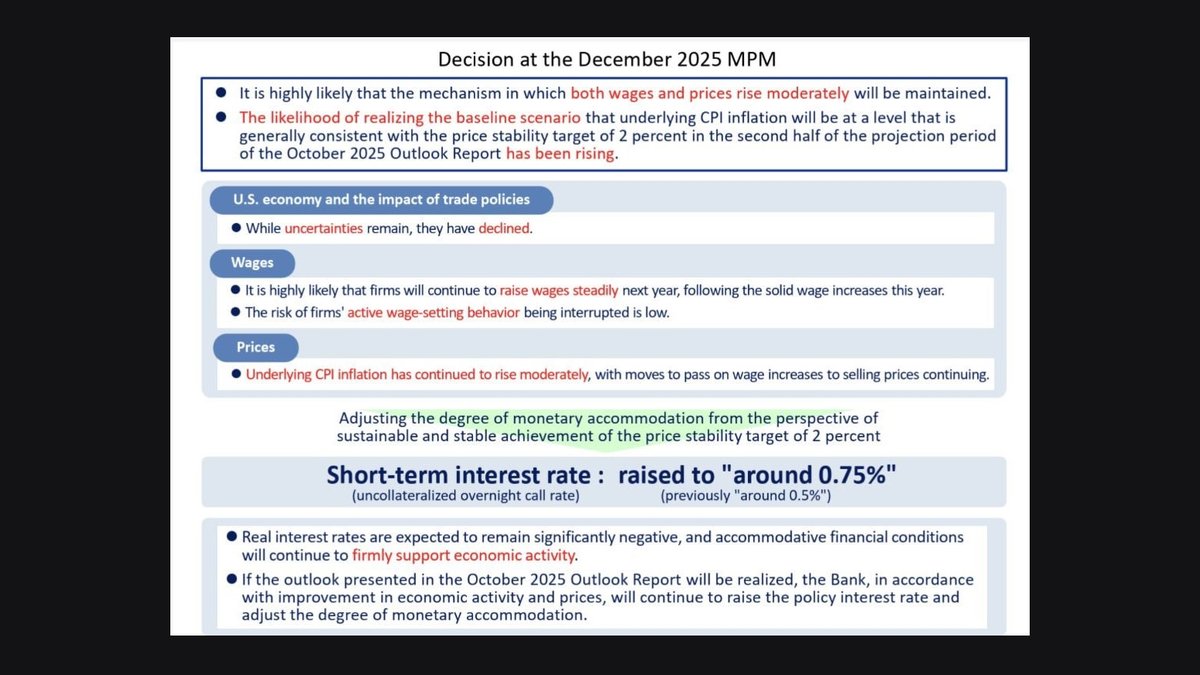

1. What the BoJ Actually Decided in December 2025

The slide deck from the BoJ's December 2025 Monetary Policy Meeting highlights three core messages:

- Wages: Firms are expected to continue raising wages steadily next year, following solid increases this year. The risk that this wage-setting momentum is interrupted is assessed as low.

- Prices: Underlying CPI inflation is judged to be rising moderately, with companies still passing some of the wage increases through to selling prices.

- Economic backdrop: Uncertainties around the global economy and trade policy remain, but they have declined relative to previous assessments.

Against this backdrop, the BoJ describes its move as an adjustment in the degree of monetary accommodation rather than a shift into restrictive territory. Short-term rates are raised from “around 0.5%” to “around 0.75%,” but the Bank emphasises that real rates will stay negative and that financial conditions will continue to support growth.

In other words, Japan is not slamming on the brakes. It is gently easing off the accelerator while still driving with supportive policy.

2. Real Rates, Not Just Headlines, Drive Risk Appetite

Markets often react to the headline “rate hike” without distinguishing between nominal and real interest rates. But for risk-taking, the real rate—the policy rate minus inflation—is what really matters. If prices are rising faster than the coupon earned on safe assets, holding cash-like instruments becomes less attractive over time.

With inflation near 2% and the short-term policy rate at 0.75%, Japan remains a country where savers are paying a subtle “inflation tax” on deposits. Their purchasing power erodes unless they move further out on the risk curve. That does not mean everyone runs directly into Bitcoin, but it does mean the search for yield is still alive within and beyond Japan.

From a global perspective, the rate differential between the United States and Japan also remains wide. Even if the Federal Reserve starts cutting rates in the coming years, US short-term yields are still expected to sit notably above Japanese ones for some time. That gap incentivises capital to move out of yen and into higher-yielding currencies and assets.

3. Yen, Dollar and Bitcoin: A Short-Term Positive Mix

There is a widely held rule of thumb in crypto trading: “Stronger dollar, weaker Bitcoin.” While this relationship is far from perfect, extended periods of dollar strength have often coincided with pressure on risk assets. The yen, meanwhile, has historically played a different role: for many years it was the funding currency of choice for global investors.

When observers see the BoJ increase rates, they often assume the yen will strengthen significantly and that this will trigger the unwinding of yen-funded carry trades. In the short run, that can indeed happen. However, the Bank's own guidance at this meeting hints at a different medium-term dynamic:

- Real rates remain negative, so capital is still encouraged to seek higher returns abroad.

- The yield gap versus the US is still substantial, maintaining an incentive to hold foreign assets.

- The BoJ signals that further moves will be gradual and data-dependent, avoiding any impression of an aggressive tightening cycle.

Put together, this suggests that the yen's path may not be a straightforward march higher. If investors conclude that policy is still accommodative in real terms, the currency could continue to face structural weakening pressures over time. A softer dollar and a yen that does not surge can both create room for Bitcoin to stabilise or recover after earlier drawdowns, especially if other central banks are moving toward easier policy.

4. Why a “Not-So-Tight” BoJ Can Support Bitcoin

From Bitcoin's perspective, the latest BoJ decision combines several features that are quietly supportive in the short term:

1. Negative real yields encourage borrowing and risk-taking. When the real cost of capital is below zero, it becomes rational for firms and investors to consider using moderate leverage to pursue higher-return opportunities. Some portion of that activity eventually finds its way into digital assets.

2. Japan remains a source of global capital. With domestic yields still low in real terms, Japanese households, pension funds and institutions continue to look abroad for returns. Even if their primary destinations are bonds and equities, the broader flow supports the risk-taking environment in which Bitcoin participates.

3. Policy is predictable rather than disruptive. The BoJ is signaling continuity: a gradual path, close attention to wages and inflation, and a strong desire to maintain stability. That reduces the odds of sudden policy shocks that could severely dislocate markets.

Combine these factors with thin liquidity in parts of the crypto market, and it does not take enormous flows to move prices. When sentiment shifts even slightly in favour of “real yields stay low, the global search for return continues,” Bitcoin can respond quickly.

5. The Role of Regulation and “Legitimisation”

Macro conditions rarely act alone. For Bitcoin to benefit from Japan's still-negative real rates, investors also need a sense that the asset class is gaining firmer footing in terms of rules and infrastructure. Over the past year, several developments have pointed in that direction:

- New leadership at key US agencies has been more open to building comprehensive market-structure frameworks for digital assets.

- Large custodians, exchanges and financial institutions have invested heavily in compliance, transparency and risk controls.

- Tokenisation pilots and on-chain settlement experiments have become mainstream for bonds, money-market funds and, increasingly, tokenised securities.

In such an environment, a world of negative real rates in major economies does not just push investors into speculative trades; it also encourages them to consider digital assets as part of a broader portfolio of regulated instruments. If macro conditions are supportive and regulatory clarity continues to improve, demand for Bitcoin and other large-cap assets can rise from both retail and institutional channels.

6. Why the Market Still Feels Fragile

All that said, the current market is far from invulnerable. Liquidity in many trading venues remains modest, especially during off-peak hours. Derivatives open interest is concentrated in a few major platforms, and a relatively small amount of directional activity can trigger chains of liquidations when funding rates swing or prices cross key thresholds.

This means that even when underlying macro conditions are moderately supportive, Bitcoin's price path can be noisy. Short squeezes and rapid pullbacks are both possible as traders react to headlines, adjust positions and respond to changes in funding costs. The same thin liquidity that allows positive flows to lift prices can also magnify downside moves when sentiment turns cautious.

For long-term participants, the lesson is not to ignore these dynamics but to contextualise them. A sudden candle on the chart may reflect trading mechanics rather than a deep shift in the macro environment. Understanding that distinction helps investors avoid overreacting to each short-term move.

7. Short-Term Takeaways for Bitcoin and Altcoins

How should market participants interpret this specific BoJ decision?

• Headline “rate hike” does not equal restrictive policy. With inflation near 2% and rates at 0.75%, Japan's real yield remains comfortably below zero. Monetary policy is still accommodative in real terms.

• The yen's long-term trajectory is uncertain. A modest rate increase does not automatically reverse years of structural pressures on the currency. If investors continue to seek returns abroad, the yen may stay soft rather than decisively strong.

• Bitcoin can benefit when real funding costs stay low. As long as the global environment encourages risk-taking and the dollar is not aggressively strengthening, there is room for BTC to stabilise or recover after earlier corrections.

• Altcoins remain more sensitive. While the macro picture can support risk-taking, smaller tokens with lower liquidity will still experience amplified volatility in both directions.

In other words, the December 2025 BoJ move may be less of a threat to crypto than the headline suggests. By confirming that policy remains supportive in real terms, it signals that the era of extremely cheap capital is evolving rather than ending outright.

8. Longer-Term Perspective: Negative Real Rates and Digital Scarcity

Beyond the next few weeks, the deeper connection between negative real rates and Bitcoin is about how societies respond to prolonged periods where cash and government bonds yield less than inflation. In such environments, investors look for ways to preserve purchasing power, diversify away from single-currency exposure and access assets with transparent rules.

Bitcoin, with its fixed supply schedule and global trading infrastructure, is one candidate within that search. It is not a guaranteed hedge, nor is it immune to cycles, but it represents a different monetary design from the discretionary policies of central banks. When large economies like Japan signal that real rates will remain negative for an extended period, some investors interpret that as an invitation to explore alternatives.

Whether those flows are large enough to drive new all-time highs is an open question. What seems clearer is that as long as major central banks maintain accommodative stances in real terms, the structural case for scarce digital assets remains on the table.

9. Conclusion: Reading BoJ Through a Crypto Lens

The Bank of Japan's decision to raise its policy rate to around 0.75% might sound like an unequivocal tightening move. But once inflation is taken into account, the picture looks different: real rates are still firmly negative, and the BoJ itself stresses that financial conditions will continue to support growth.

For Bitcoin and other digital assets, that mix can be quietly supportive in the short term, especially if regulatory clarity improves and liquidity remains manageable. A stronger yen and weaker dollar could create additional tailwinds if the global environment shifts toward easier policy elsewhere.

None of this removes the need for caution. Crypto remains volatile, and markets can react sharply to both macro headlines and internal dynamics. But by looking beyond the headline “rate hike” and focusing on real yields, cross-currency forces and policy guidance, investors can form a more balanced view of how Japan's evolving stance might shape the next chapter of the digital-asset cycle.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and involve risk. Always conduct your own research and consult a qualified professional before making financial decisions.