Ethereum Leaves the Exchanges: What a Nine-Year Low in ETH Supply Really Means

One of the most striking on-chain charts for Ethereum right now is not about price at all. It is about where ETH lives.

Data tracking the total ETH held by major centralised exchanges shows a clear, persistent downtrend. From more than 23 million ETH on exchanges in early 2023, reserves have slid to roughly 16 million today – the lowest level since 2016. The white line on the chart (ETH price in USD) swings up and down through the cycle, but the blue line (exchange reserves) moves almost one way: down.

At first glance, the narrative practically writes itself: fewer coins on exchanges, lower immediate selling pressure, therefore a constructive signal for long-term holders. There is truth in that story, but it is only half of the picture. A shrinking tradable float also carries implications for liquidity, volatility and market structure that deserve just as much attention.

This article looks beyond the headline to explore three core questions:

- Why is ETH leaving exchanges in such size?

- How does a lower exchange balance change the way the market behaves?

- What does this mean for different types of participants – from long-term allocators to short-term traders and builders inside the ecosystem?

1. Reading the Chart: A Structural Drain, Not a Short-Term Blip

The first thing to notice is the timeframe. The decline in exchange reserves is not a reaction to a single event; it has been unfolding for years across multiple price regimes.

- During 2023, as ETH traded from the low 1,000s toward 2,000 USD, exchange balances drifted lower.

- In 2024, even as ETH rallied above 3,000 and then 4,000 USD, reserves did not rebuild in a sustained way. Temporary upticks around volatility events were quickly absorbed by renewed outflows.

- Through 2025, the pattern continued. Price carved out new cycle highs and sharp corrections, but the blue line on the chart marched steadily downward to a nine-year low.

This behaviour suggests that structural forces are moving ETH off exchanges. Short-term sentiment can explain bursts of deposits or withdrawals, but it rarely sustains a multi-year trend of this magnitude. To understand the deeper drivers, we need to look at how Ethereum itself has changed.

2. Why ETH Is Leaving Exchanges

2.1. Staking turns ETH into a yield-bearing asset

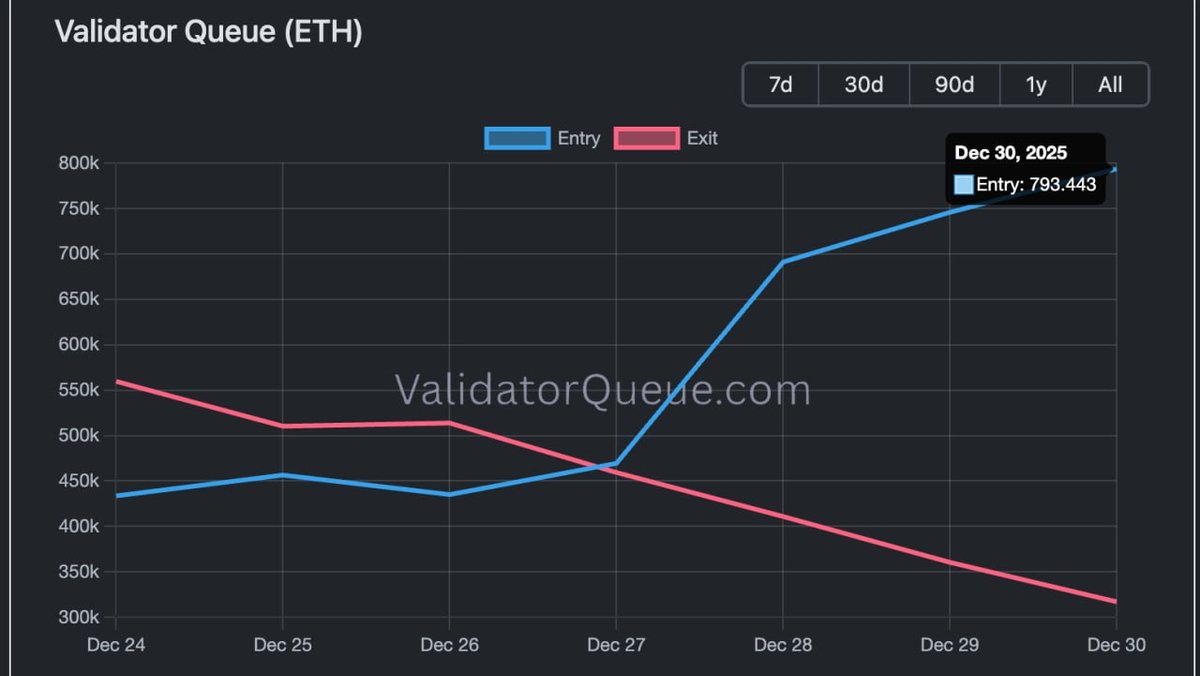

The most obvious catalyst is staking. Since Ethereum's transition to proof-of-stake and the subsequent enabling of withdrawals, staking has become a mainstream activity. Holding ETH now offers a base yield in exchange for helping to secure the network.

From the perspective of an ETH holder, this changes the default choice:

- Before proof-of-stake, idle ETH on an exchange and idle ETH in a self-custody wallet were economically similar.

- Now, idle ETH can be converted into staked ETH, either directly or through liquid staking tokens, earning a yield while retaining varying degrees of liquidity.

As staking platforms have matured, many long-term holders have simply decided that keeping large balances on trading venues is no longer attractive. The opportunity cost of not staking is visible and measurable.

2.2. DeFi and layer-two ecosystems absorb working capital

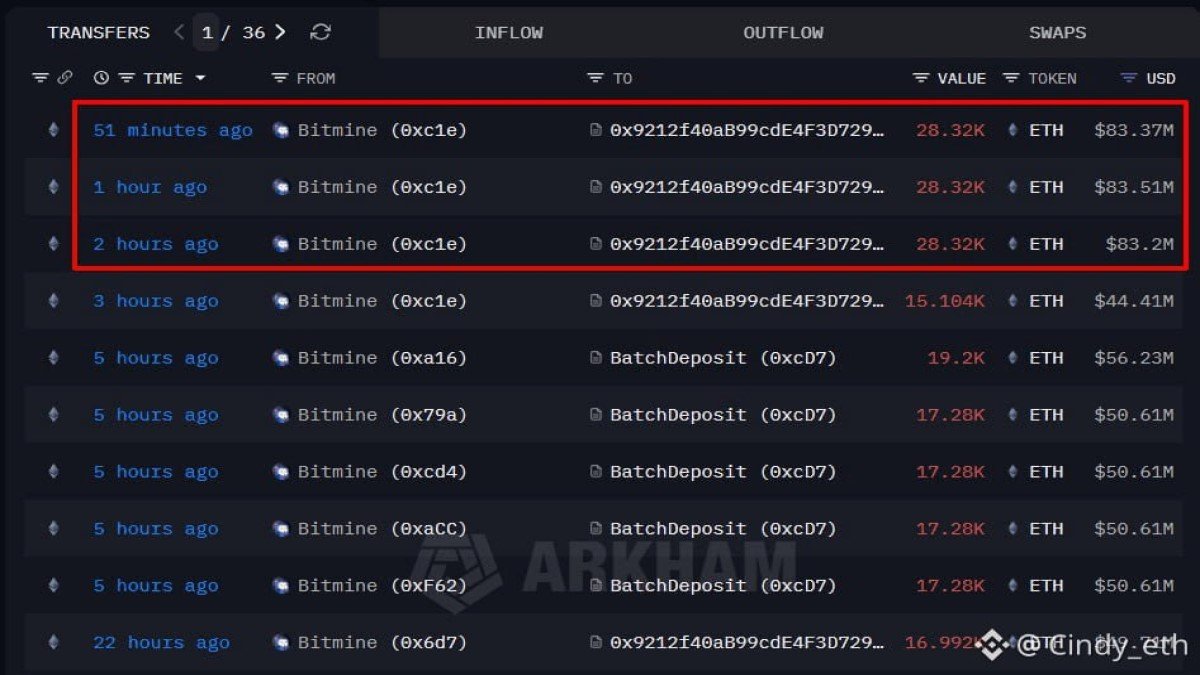

Beyond staking, ETH is increasingly the base asset for applications across decentralised finance and layer-two networks. Bridges, rollups and restaking protocols all rely on ETH as collateral or gas. When users deploy capital into these systems, coins literally leave exchange wallets for smart contracts and L2 addresses.

This reflects a subtle but important shift in Ethereum's role. ETH is not only a trading instrument; it is also a productive asset that powers lending markets, decentralised exchanges, restaking layers and more. As use cases multiply, it is natural that a larger share of the total supply lives on chain rather than in centralised order books.

2.3. Self-custody and institutional custody

The last few years have also seen an educational push around self-custody and the use of regulated custodians for large allocations. Many individuals are more comfortable using hardware wallets or multi-signature solutions, while institutions often work with specialised custody providers that are not counted as trading venues in exchange reserve metrics.

In other words, not all coins leaving exchanges are immediately deployed into staking or DeFi. Some are simply moving to storage arrangements that better match the risk tolerance and compliance requirements of their owners.

3. Lower Exchange Balances: Bullish Supply Story, With Nuance

From a classical market-structure perspective, a lower supply of ETH available on exchanges reduces the inventory that can be sold quickly. If demand remains steady or increases, this should, all else equal, support price.

There are several reasons analysts often interpret falling exchange reserves as a constructive signal:

- Indication of long-term conviction. Moving coins to staking, DeFi or cold storage typically requires more effort than leaving them on an exchange. It signals that the owner does not plan to trade them frequently.

- Lower immediate sell pressure. Coins in self-custody or time-locked contracts are less likely to be market-sold in response to short-term volatility.

- Supply squeeze potential. If a major positive catalyst appears while the tradable float is thin, price can adjust rapidly as buyers compete for a limited set of coins.

However, relying on the supply story alone can be misleading. Price is always a function of both supply and demand. A shrinking exchange balance is supportive if there is sustainable demand on the other side. If demand weakens sharply, lower supply does not guarantee resilience; it only changes how adjustments play out.

4. Liquidity Paradox: Less to Sell, But Also Less to Cushion Shocks

One of the under-discussed consequences of reduced exchange balances is the liquidity paradox. When inventory on centralised venues is low, each individual order can have a larger impact on price.

Consider two stylised scenarios:

- In a deep market with abundant resting orders, a 10 million USD buy or sell order may move the price only slightly because there is ample liquidity on both sides.

- In a thin market with fewer resting orders, the same 10 million USD order may push price much further as it sweeps through the order book.

Falling exchange reserves do not automatically mean that order books are thin, but they make it more likely, especially during stress periods. This leaves ETH more sensitive to large flows, whether those flows come from institutional rebalancing, derivatives hedging or sudden shifts in sentiment.

The result is a market that can experience sharp moves in both directions:

- Rallies can accelerate quickly when new demand appears, because there is less floating supply offered at each step higher.

- Corrections can also be abrupt if a concentrated holder decides to reduce exposure, or if leverage unwinds into a shallow order book.

For observers, this dual nature is important. A thin market is not inherently positive or negative; it is simply more responsive. That responsiveness rewards patience and risk management over attempts to predict every short-term move.

5. Staking and DeFi: Sinks or Springs?

Another nuance is that much of the ETH that leaves exchanges does not disappear; it sits in smart contracts that can, in principle, release liquidity quickly.

- Liquid staking tokens allow holders to retain trading flexibility while their underlying ETH remains bonded.

- Lending markets make it possible to borrow against staked positions, turning long-term holdings into working capital.

- Layer-two networks can shuttle liquidity back to mainnet or to centralised venues when incentives change.

This means that staking and DeFi are both sinks of supply and potential springs of future liquidity. If yields compress or risk preferences shift, some of that ETH can ultimately find its way back to exchanges.

From a risk-management standpoint, the key question is not only how much ETH is off exchanges, but also how quickly it could return under different market conditions. A highly liquid staking token with deep secondary markets has a very different profile from ETH locked in a niche protocol with long exit times.

6. What This Means for Different Types of Participants

6.1. Long-term allocators

For long-horizon investors, the decline in exchange reserves generally aligns with a constructive thesis. It suggests that a growing share of ETH supply is held by participants who view the asset as strategic infrastructure rather than a short-term trade.

However, this does not remove price risk. A market with lower float can still deliver deep corrections if macro conditions tighten or if risk appetite fades. The main takeaway is that periods of weakness in such a structure may be sharper but shorter, as there is less marginal supply available to sustain extended downtrends.

6.2. Short-term traders

For traders, a thin exchange float is more of a double-edged sword. On the positive side, volatility can create opportunity. Strong impulses – both up and down – may offer larger price swings around technical levels.

On the other hand, thinner order books increase the importance of:

- Position sizing. Large positions relative to market depth can be difficult to exit gracefully.

- Slippage awareness. Executions may deviate more from quoted prices, especially during fast markets.

- Risk controls. Stop levels and margin management become critical when price can gap through levels that previously acted as support.

In short, the same conditions that may reward nimble trading can amplify the cost of mistakes.

6.3. Builders and the Ethereum ecosystem

For builders, lower exchange balances underscore Ethereum's evolution from a purely speculative asset into infrastructure capital. ETH is increasingly locked in contracts that power rollups, staking systems, restaking layers and application protocols. That supports the narrative that Ethereum is not merely a token but a base layer for a broad digital economy.

At the same time, developers need to be conscious of liquidity when designing token models and incentive schemes. Sustainable ecosystems benefit from healthy secondary markets; over-concentrating ETH in locked contracts without regard for market depth can unintentionally increase fragility.

7. How to Use Exchange Supply as a Signal – Without Over-Fitting

Exchange reserve metrics are powerful, but like any single indicator, they can be misleading if interpreted in isolation. A balanced framework might consider:

- Usage metrics. Are transaction fees, active addresses and application-level activity growing or stagnating?

- Macro conditions. How do interest rates, liquidity conditions and risk sentiment look across broader markets?

- Derivatives positioning. Are futures and options markets heavily skewed in one direction, signalling crowded trades?

- Stablecoin flows. Are participants bringing fresh capital into the ecosystem, or simply rotating existing value?

When falling exchange reserves line up with healthy network usage and constructive macro signals, the bullish interpretation is stronger. When they coincide with weakening fundamentals or tight global liquidity, caution is still warranted.

8. The Bigger Picture: Ethereum as a Scarce Productive Asset

Stepping back, the nine-year low in ETH on exchanges is part of a broader story: Ethereum is increasingly treated as a scarce productive asset rather than just a medium for trading.

Staking turns ETH into yield-bearing collateral. DeFi and layer-two networks use it as the native fuel for a growing set of financial and non-financial applications. Institutions are beginning to hold ETH through professional custody arrangements, sometimes as a strategic exposure alongside more traditional assets.

In this context, shrinking exchange balances are a symptom of maturation. They show that more of the supply is spoken for – either by long-term holders, by network infrastructure, or by applications that require ETH to function. That does not eliminate volatility, but it does support the view that Ethereum's role in the broader digital asset landscape is deepening rather than fading.

9. Final Thoughts

The fact that ETH supply on exchanges has dropped to levels last seen in 2016 is remarkable. It reflects years of technological progress, from the proof-of-stake transition to the rise of staking, restaking and rollup ecosystems. It also reflects behavioural change: more users are comfortable holding their own keys or using dedicated custodians instead of leaving everything on trading venues.

For investors, the key is to recognise both sides of the coin. Lower exchange balances can ease some forms of selling pressure and increase the potential for strong moves when new demand appears. At the same time, they can make markets more sensitive to large flows and heighten the importance of liquidity management.

As always, no single chart should dictate strategy. But as a window into how Ethereum is held and used, the current exchange reserve trend is one of the clearest signals that the network has entered a new phase – one where ETH is less a trading token and more a core piece of digital financial infrastructure.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are volatile and can involve significant risk, including the potential loss of principal. Always conduct your own research and consider consulting a qualified professional before making financial decisions.