Ethereum’s Validator Queue Explodes: What a 800k Entry Backlog Really Means for ETH

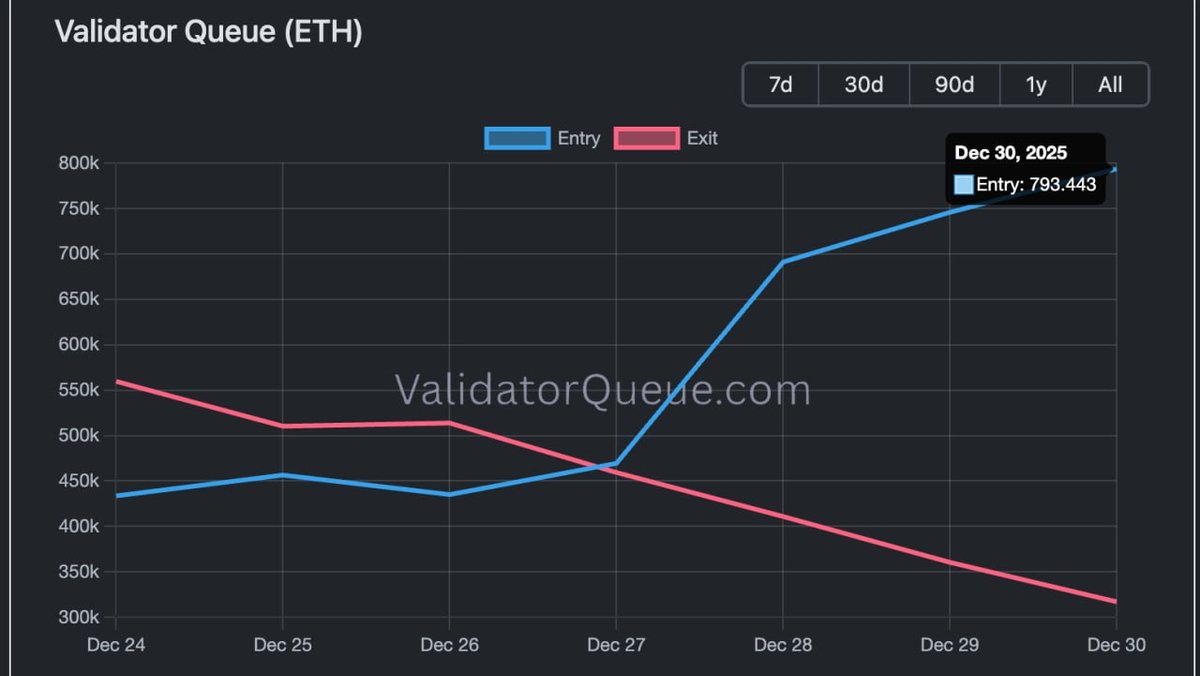

At first glance, a chart of Ethereum’s validator queue looks like a niche piece of infrastructure data only protocol engineers would care about. Yet the latest readings from ValidatorQueue.com tell a story that reaches far beyond node operators. Over just a few days, the entry queue for Ethereum validators has surged toward roughly 800,000 ETH, while the exit queue has fallen sharply toward around 320,000 ETH.

This is a decisive reversal from conditions earlier in the year, when headlines were dominated by concerns about withdrawals after major upgrades. Today the picture is the opposite: more ether is lining up to be locked into staking than to be withdrawn, and the gap between the two queues is widening.

On the surface, this simply means that more participants want to become validators than to stop validating. But underneath, it speaks to deeper forces: how investors view Ethereum’s risk-reward profile, how they think about yield in a world of higher interest rates, and how the circulating supply of ETH is quietly changing.

1. What the Validator Queue Actually Measures

To understand why this move matters, it helps to start with the mechanics. Since the transition to proof-of-stake, Ethereum’s security is provided by validators that lock up ETH as collateral. Each validator requires a 32 ETH deposit. Because the network wants to avoid sudden swings in the validator set, there are limits on how many validators can enter or exit per epoch. When more participants want to join or leave than the protocol can process immediately, a queue forms.

The chart you are looking at does not show the number of individual validators but the amount of ETH represented by those validators. Two lines stand out:

- Entry queue (blue): ETH that has been signaled for staking but has not yet been activated as validators.

- Exit queue (pink): ETH belonging to validators that have signaled their intention to stop validating and eventually withdraw.

When the entry line rises and the exit line falls, it means more ether is scheduled to be locked into staking than to become liquid. The recent spike is particularly striking: over roughly a week, the entry queue has climbed from the low 400,000s to nearly 800,000 ETH, while the exit queue has dropped from more than 550,000 ETH to near 320,000 ETH.

At current market prices, that swing represents billions of dollars of ETH moving toward a staked state instead of circulating freely on the market.

2. Reading the Signal: From Withdrawal Anxiety to Staking FOMO

Queues tell us about intentions. A large entry queue means many participants are willing to accept illiquidity—locking up capital in return for staking rewards and potential long-term appreciation. A shrinking exit queue means fewer participants are rushing to reclaim their ether for other uses, whether that is trading, spending, or simply holding in liquid form.

When you put the two together, today’s configuration implies:

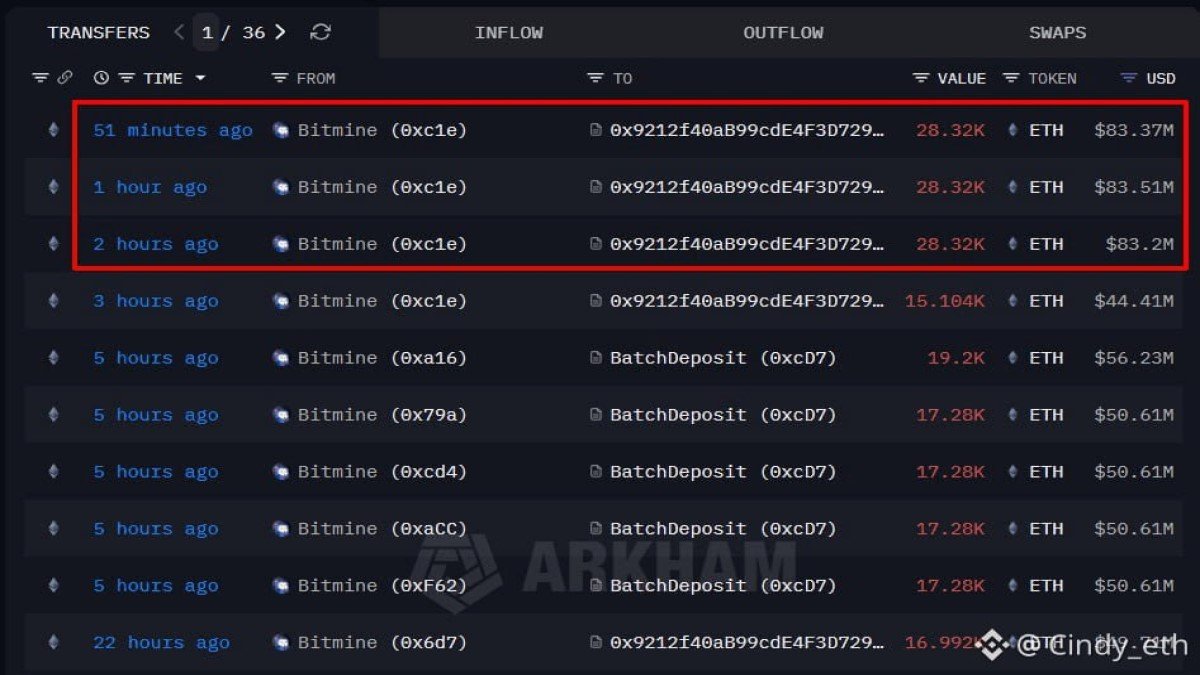

- Staking demand is surging. New validators, institutional operators and staking providers are all queueing to bring additional ETH into the consensus layer.

- Withdrawal pressure is fading. The wave of exits that some feared might follow earlier upgrades has not only slowed; it has reversed.

This is important because it shows how sentiment around Ethereum has evolved. In the first months after withdrawals were enabled, it was reasonable to ask whether a large share of staked ETH might leave the system. Many early stakers had been locked in for years and could finally access their funds. Today, however, the narrative is different: staking is being treated as an attractive, relatively conservative strategy for ETH holders who believe in the network’s long-term trajectory.

3. Supply Dynamics: More ETH Locked, Less Available to Sell

An expanding entry queue and falling exit queue have a direct impact on Ethereum’s supply dynamics. Every additional validator that enters represents ETH that is, in effect, removed from liquid circulation for an extended period. Withdrawals are possible, but they are subject to queue limits and operational decisions by validators or staking services.

When more ETH is being locked than unlocked, three things happen:

1. Circulating supply shrinks at the margin. Even if the total supply of ETH remains the same, the fraction that is freely tradable on exchanges or in day-to-day transactions declines.

2. Immediate sell pressure is reduced. Staked ETH typically belongs to holders with a longer time horizon; they are seeking yield and are, by definition, willing to accept delayed liquidity. That does not mean they will never sell, but their horizon tends to be measured in months or years rather than days.

3. Price moves can become more sensitive to demand shocks. When fewer coins are available on the market, sudden increases in demand—whether from spot buyers or new products—can have a larger impact on price. The same is true in the other direction: sharp de-risking events can still cause fast repricing, especially if some stakers use liquid staking derivatives that are tradable even while the underlying ETH remains locked.

From a purely mechanical perspective, a net increase of hundreds of thousands of ETH scheduled to stake is similar to a large buy-and-hold program: coins are being removed from the active float. For investors, this is a reminder that Ethereum is increasingly behaving like a yield-bearing, semi-illiquid collateral asset, not just a trading vehicle.

4. Why Are Investors Rushing to Stake Now?

The obvious question is: why has staking demand suddenly accelerated? There is rarely a single cause, but several forces likely intersect here.

4.1 Yield that competes with traditional finance

Staked ETH earns rewards from a combination of consensus issuance and a share of transaction fees. While yields fluctuate, they remain meaningful, especially when combined with the possibility of long-term price appreciation. In a world where traditional interest rates may eventually trend lower again, ETH staking offers a blend of on-chain yield and growth exposure that some investors find compelling.

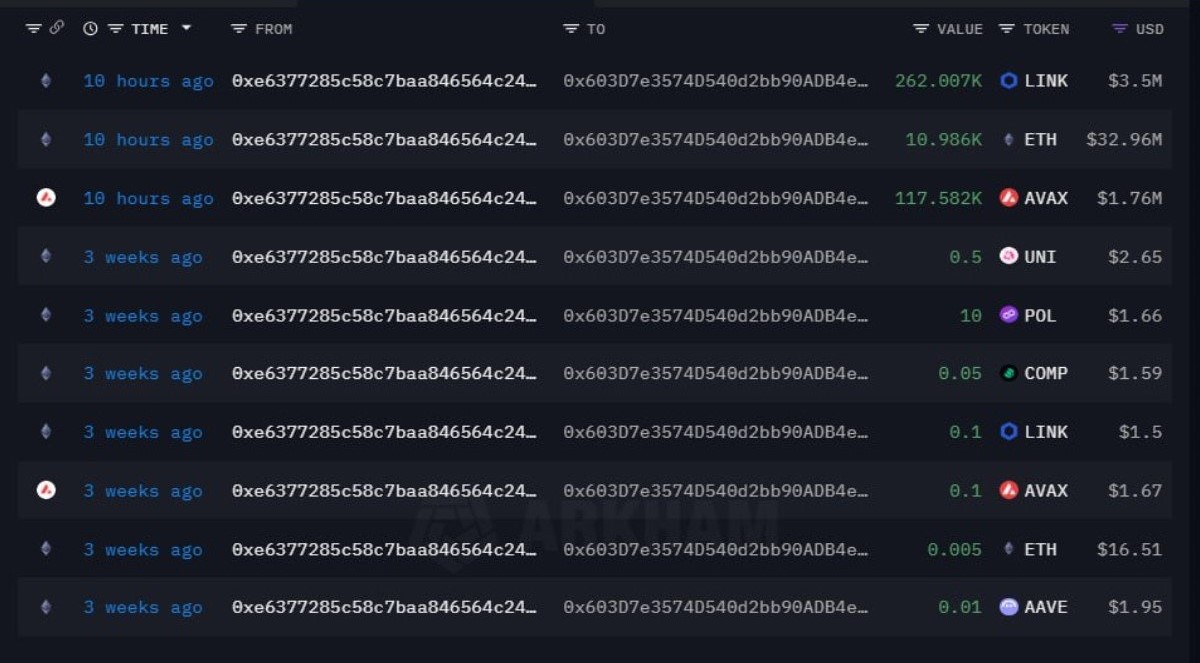

For institutions, staking is increasingly being viewed as a core part of an Ethereum allocation: rather than simply holding ETH passively, they can delegate or operate validators to earn additional return, provided that operational and regulatory requirements are met.

4.2 Greater comfort with staking infrastructure

Over time, the ecosystem of staking providers, custodians and technological tools has matured. Large holders now have more options: they can operate their own validators, use non-custodial delegation services, or work with regulated custodians who handle validator operations on their behalf.

This improved infrastructure reduces the perceived operational risk and makes staking a more straightforward decision. The shift from an exit-dominated queue to an entry-dominated one suggests that many participants now view staking as part of a standard ETH strategy, rather than a niche activity reserved for early adopters.

4.3 Strategic positioning around Ethereum’s roadmap

Ethereum’s long-term vision includes continued scaling through rollups, enhancements to the execution layer, and improvements to the staking and validator experience. Investors who believe this roadmap will continue to attract applications and user activity have an incentive to lock in exposure now. By staking, they align themselves with the network’s growth path and earn yield while they wait.

In addition, as more institutional capital experiments with Ethereum-based products—whether tokenized assets, settlement rails or decentralized finance—there is a growing perception that ETH is evolving into core infrastructure for digital value transfer. Staking provides exposure to that role in a way that is both economic (through rewards) and structural (via participation in consensus).

5. Historical Context: What Past Queue Reversals Have Signaled

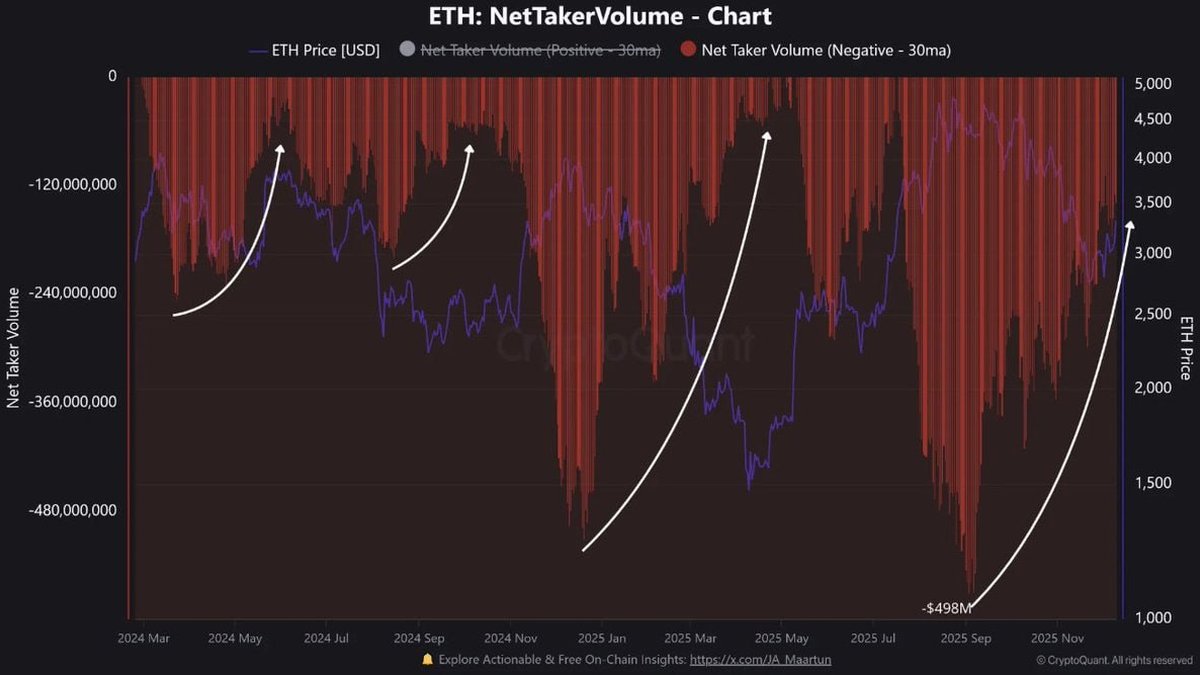

This is not the first time Ethereum’s validator queues have shifted dramatically. After withdrawals were introduced, there were periods when the exit queue swelled as early stakers took the opportunity to rebalance. Yet in several cases, once those waves of withdrawals were processed, staking demand returned and the entry queue rebuilt.

Looking back, these phases often coincided with moments when the market was reassessing Ethereum’s role in the wider digital-asset ecosystem. After initial uncertainty was resolved—either around protocol upgrades, regulatory headlines or macro conditions—long-term holders tended to use lower-volatility periods to increase their staked positions.

It is important to emphasize that correlation does not guarantee causation. A strong entry queue does not automatically translate into immediate price appreciation. However, it is a solid indicator of underlying conviction: market participants who control large amounts of ETH are choosing to lock it up for yield instead of keeping it fully liquid.

6. Nuances and Risks: Higher Staking Is Not a Free Lunch

While the recent data is encouraging for those who are optimistic about Ethereum, a balanced view also considers potential drawbacks.

6.1 Concentration of validators

One key question is who is filling the entry queue. If a significant share of new validators is controlled by a small number of entities—large staking providers, institutional operators or intermediaries—then high staking participation might also increase concentration risk. The protocol includes mechanisms to limit the influence of any single validator, but diversity of operators remains an important consideration for long-term resilience.

6.2 Liquidity risk through derivative tokens

Many participants do not stake directly; they use liquid staking tokens that represent a claim on underlying ETH. These tokens aim to combine staking yield with the ability to trade or use the position in decentralized finance. While they can be efficient tools, they also introduce additional layers of smart-contract and market risk. If confidence in a specific derivative product were to weaken, it could create short-term volatility even if the underlying validator queues remain healthy.

6.3 The possibility of a sharp macro reversal

Finally, Ethereum does not operate in isolation. A strong entry queue today reflects current expectations about interest rates, regulation and technology adoption. A major macro shock or a shift in global risk appetite could still prompt some stakers to reconsider their exposure. The queue limits make it impossible for everyone to exit at once, but they also mean that market participants should plan around the time needed to regain liquidity if their thesis changes.

7. What This Means for ETH Holders and the Broader Ecosystem

For individual ETH holders, the message is twofold:

- The network is becoming more yield-centric. Staking is increasingly viewed as the default rather than the exception. Holders who choose not to stake are implicitly deciding to forgo the yield that many of their peers are collecting.

- Circulating supply is tightening. With hundreds of thousands of additional ETH preparing to enter staking, the pool of liquid ether available on exchanges is getting smaller at the margin.

For the broader ecosystem—developers, decentralized finance platforms, and off-chain institutions—the staking boom reinforces the idea that Ethereum is maturing into a foundational yield-bearing asset. Protocols can design around staked ETH as a building block, whether for collateral, liquidity provision or settlement. At the same time, they must respect the constraints of validator queues and withdrawal times when designing risk frameworks.

8. Conclusion: A Vote of Confidence Written in 32-ETH Increments

The surge in Ethereum’s validator entry queue, coupled with the sharp decline in the exit queue, is more than a technical curiosity. It is a visible expression of how market participants currently view ETH: not just as a speculative instrument, but as a long-term, yield-bearing asset at the heart of a large digital economy.

Nearly 800,000 ETH lining up to join staking while only about 320,000 ETH waits to exit is a powerful signal. It tells us that, at least for now, capital is more interested in locking in participation and yield than in rushing for the exit. That shift reduces immediate sell pressure, tightens circulating supply and provides a supportive backdrop for builders and investors who are planning beyond the daily price chart.

None of this removes risk. Market cycles can still be sharp, and Ethereum faces both technical and regulatory challenges as it grows. But when you look at the validator queue, you are seeing thousands of individual decisions all pointing in the same direction: confidence in the network’s medium- to long-term future.

For anyone following Ethereum closely, that is a metric worth watching.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment or legal advice. Digital assets, including ETH and staking derivatives, can be highly volatile and may not be suitable for every investor. Always conduct your own research and consider consulting a qualified professional before making financial decisions.