Bitmine Stakes ETH for the First Time: Signal or Just a Treasury Rebalancing?

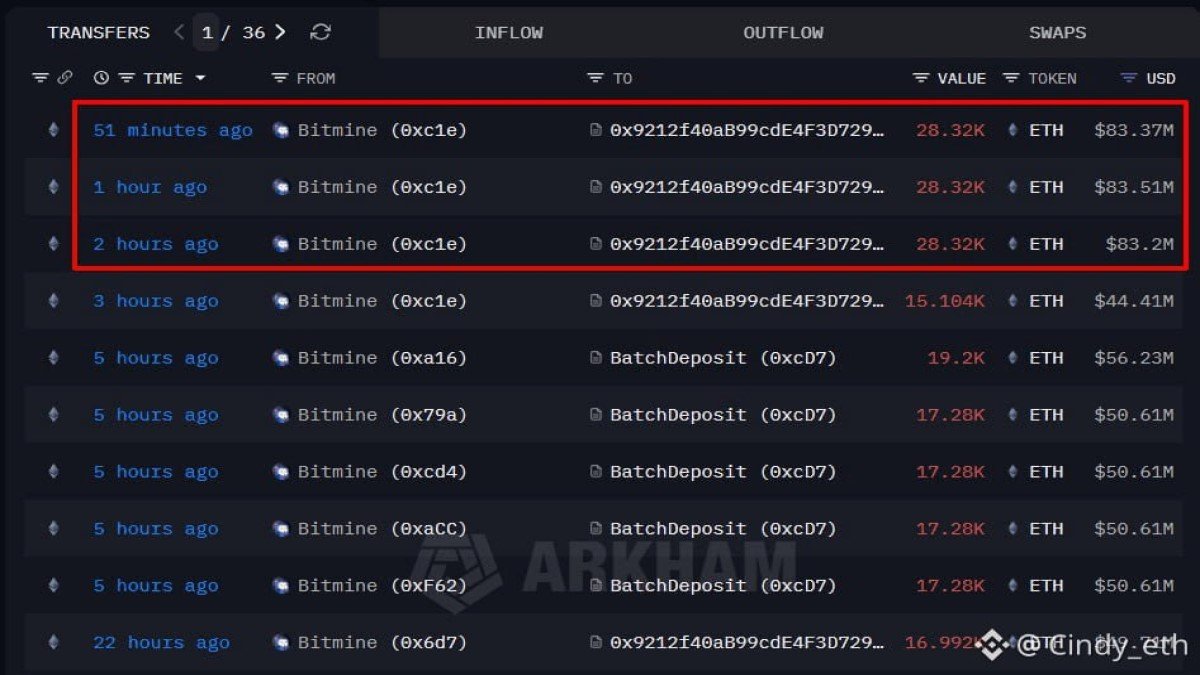

On-chain data has just recorded a notable milestone for Ethereum. Bitmine, currently the largest known non-contract holder of ETH, has staked 74,880 ETH (roughly 219.2 million USD at recent prices) in a series of batch deposits. For a company that has spent months simply accumulating and holding, this is the first visible step toward putting a portion of its balance sheet to work through staking.

On its own, 74,880 ETH is not enough to transform the dynamics of Ethereum’s staking ecosystem. But in context, it matters. Bitmine now holds around 3.743 million ETH – approximately 10.95 billion USD in value – a position said to be more than three times its original accumulation plan. When an entity of that scale slightly adjusts its strategy, market participants understandably pay attention.

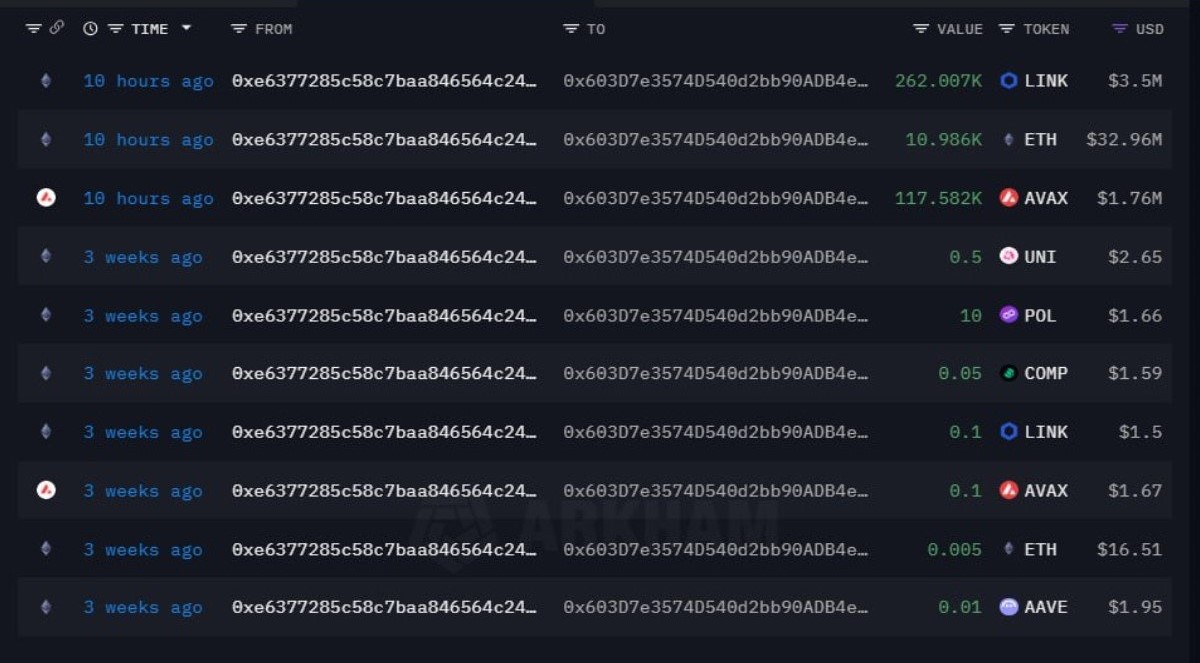

In parallel, another large entity, Sharplink, has begun to move in the opposite direction, unstaking 35,627 ETH after roughly two months in the validator set. Put together, these moves suggest that large holders are actively refining how they use Ethereum’s yield-bearing infrastructure, rather than passively sitting on reserves.

This article explores what Bitmine’s first staking transaction could mean, why the size of the stake matters, how Sharplink’s decision fits into the picture, and what all of this tells us about the next phase of institutional participation in Ethereum.

1. Why this stake is symbolically important

The first thing to underline is that Bitmine has been, until now, known primarily as a pure accumulator. On-chain dashboards have tracked a consistent pattern: ETH flowing in from major exchanges and institutional platforms into Bitmine-linked wallets, with very little being moved back out.

By choosing to stake for the first time, Bitmine is sending at least three signals:

• Time horizon: Staking is, by design, a medium- to long-term activity. Validators earn yield over time in exchange for locking up capital and helping secure the network. Even though withdrawals are possible, the decision to stake hundreds of millions of dollars’ worth of ETH implies that Bitmine is not planning for a quick exit.

• Participation in the protocol: Up to now, Bitmine’s relationship with Ethereum was essentially that of a holder. By staking, the company becomes more directly intertwined with the protocol’s security and consensus, aligning its incentives more tightly with the network’s health.

• Shift from “store-only” to “store-and-yield”: As long as ETH is sitting idle in a cold wallet, the main thesis is price appreciation. Once a portion moves into validators, the thesis expands: holders seek both potential price performance and a predictable stream of protocol rewards, denominated in ETH.

From a narrative perspective, this is meaningful. Many observers have treated Bitmine as a kind of “Ethereum reserve company”, echoing earlier cycles where listed firms turned Bitcoin into a strategic treasury asset. The move into staking suggests a maturation of that role: from simply holding a scarce asset to actively participating in the infrastructure that underpins it.

2. Why the size of the stake matters just as much as the decision itself

The second important detail is that, relative to Bitmine’s total position, 74,880 ETH is small. With 3.743 million ETH in reserve, the newly staked portion represents only around 2% of the company’s reported holdings.

That proportion carries several implications:

• Limited impact on liquid supply (for now): Moving 2% of holdings into validators locks up some liquidity, but leaves a vast majority of Bitmine’s ETH technically available for future decisions. Anyone hoping this event alone would dramatically reduce circulating supply is likely to be disappointed.

• Exploration, not full commitment: The modest size suggests that Bitmine may be conducting a structured experiment: testing operational processes, validator performance, risk controls and regulatory treatment before deciding whether to scale up.

• No clear message on near-term selling: Because such a large share of Bitmine’s ETH remains unstaked, the on-chain data does not support a strong conclusion about its short-term selling intentions. Staking 2% of holdings neither proves that the company refuses to sell nor that it is preparing for major distribution. It simply indicates that a small slice of its balance sheet is now attached to validators.

In other words, the direction of the change is important, but it would be a stretch to extrapolate too much from the magnitude at this stage. The real story may be what happens over the next six to twelve months: does Bitmine gradually increase its staked portion, or does it treat this as a capped pilot program?

3. Sharplink moves the other way: what does an unstake tell us?

While Bitmine was stepping into staking, Sharplink was taking a different path, unstaking 35,627 ETH that had been participating in consensus for around two months. On the surface, these moves may look like opposites, but they likely reflect different positions on the same learning curve.

For an institution, the decision to unstake can have several possible explanations:

• Treasury rebalancing: After a period of earning yield, the entity may wish to increase flexibility, raise cash, or diversify into other assets. In that case, unstaking is a routine part of balance sheet management.

• Risk-adjusted return assessment: If the realised yield from staking is viewed as insufficient compared with other opportunities – or if the volatility of ETH has shifted the risk profile – management might choose to pause or resize exposure.

• Operational review: Early staking experiments can surface gaps in custody, reporting or compliance. Some institutions temporarily step back to refine their processes before returning with a more robust setup.

The key point is that staking and unstaking are not simply bullish or bearish switches. They are also tools for treasury operations. Seen in this light, Bitmine’s first stake and Sharplink’s first major unstake belong to the same story: institutions are actively exploring where Ethereum fits in their internal frameworks, rather than passively holding or avoiding it.

4. What this means for Ethereum’s institutional narrative

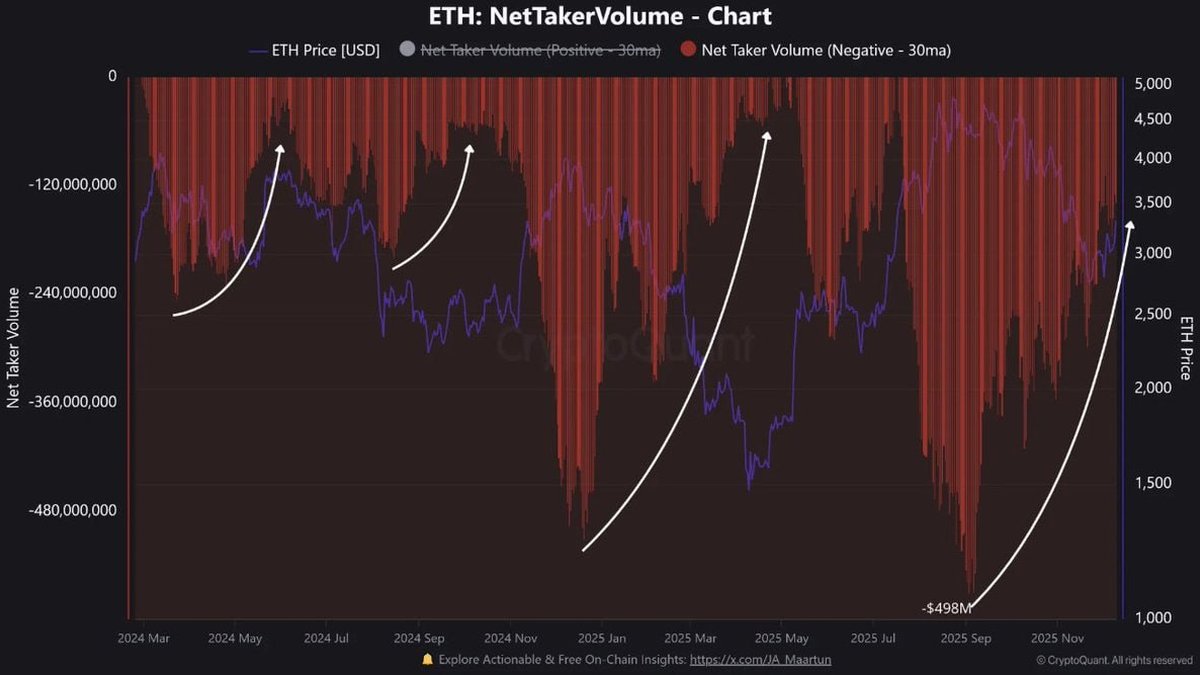

When retail participants see a headline about a large entity staking ETH, the instinctive reaction is often to translate it directly into a price view. But for Ethereum’s long-term development, the more important angle is how institutional behaviour is evolving around three themes: participation, diversification and governance.

4.1 From spectators to protocol participants

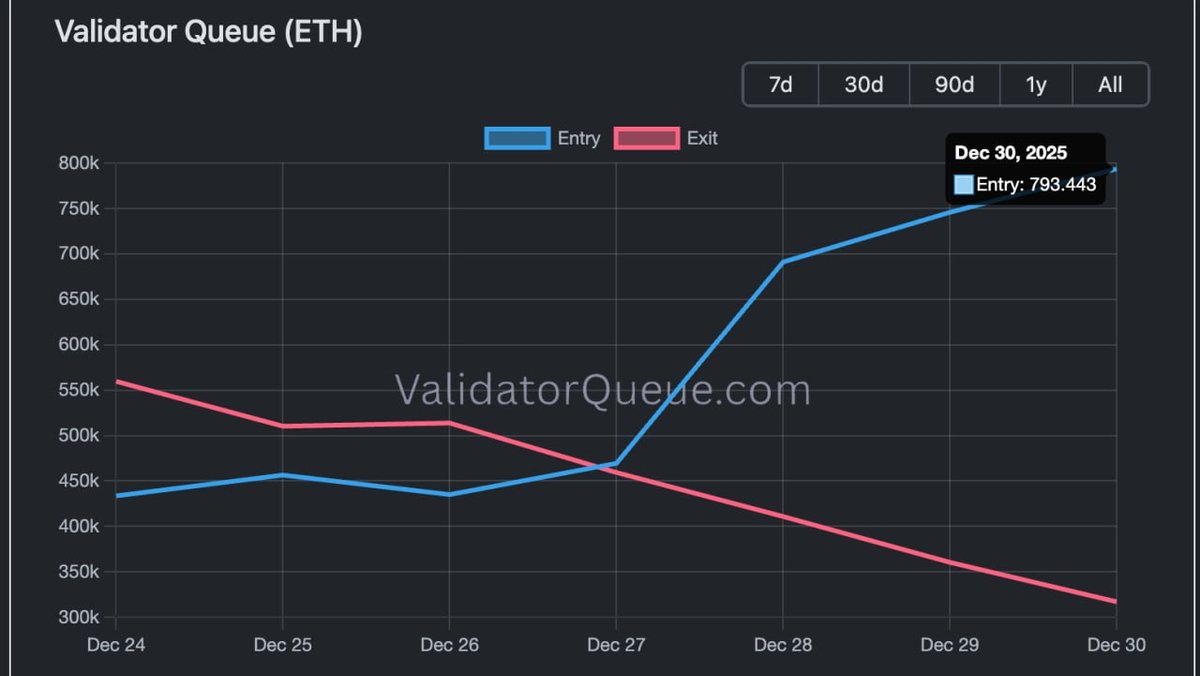

Ethereum’s shift to proof-of-stake made it possible for large holders to directly contribute to network security without running energy-intensive hardware. When top holders like Bitmine begin to stake, Ethereum gains more aligned validators with substantial economic interest in the network’s safety and stability. This can strengthen the protocol’s resilience, provided that client diversity and decentralisation are maintained.

4.2 Staked ETH as a new class of yield-bearing asset

For treasury teams, ETH today is not just a volatile asset; it is also a yield-generating instrument when staked. That puts it conceptually closer to a floating-rate instrument than to a non-yielding commodity. The Bitmine stake, even if modest in size, reinforces the idea that institutional ETH positions can follow a “barbell” structure: some portion liquid, some portion staked for longer horizons.

Sharplink’s unstake, meanwhile, shows the other side of that coin: because withdrawals are possible, staking is not an irreversible decision. Institutions can learn, adjust and re-enter when conditions fit their mandates.

4.3 On-chain transparency as a feedback loop

Unlike traditional finance, where many treasury decisions remain opaque, Ethereum’s ledger makes large moves visible almost in real time. Dashboards that track entities like Bitmine and Sharplink give the public a view into how big holders behave. This transparency can create a feedback loop between institutional strategy and market expectations – sometimes helpful, sometimes noisy.

For researchers and long-term investors, these flows are valuable because they offer direct evidence of how different types of institutions respond to changing yield curves, regulatory guidance and macro narratives.

5. How should individual investors read these signals?

It is tempting to treat Bitmine’s first stake as a simple “green light” or Sharplink’s unstake as a “red light”. A more realistic approach is to see them as data points in an evolving landscape. A few principles can help frame them correctly:

• A single entity rarely defines the cycle. Even a top holder with billions of dollars in ETH is only one participant in a global market. Their actions matter, but they sit alongside the decisions of millions of other users, protocols and enterprises.

• Institutional strategies are multi-layered. Treasury teams care about more than price charts. They must balance liquidity needs, regulatory requirements, accounting treatment and risk limits. Staking and unstaking decisions often reflect a mix of these factors, not just market direction.

• Direction of travel is more important than a single transaction. If Bitmine gradually increases its staked portion over the coming quarters while other institutions join in, that would be a stronger sign that staking has become a core building block of corporate ETH strategy. If, instead, this remains a one-off, it may simply have been an operational experiment.

6. Looking ahead: a more active corporate layer on Ethereum

Bitmine’s first staking move and Sharplink’s concurrent unstake highlight an important transition. The corporate layer on Ethereum is moving from a simple binary – either holding or not holding ETH – to a richer spectrum of behaviours: accumulating, staking, unstaking, rebalancing and integrating ETH into treasury and infrastructure planning.

If this trend continues, the network may see several longer-term effects:

- More professional validator operations backed by robust custody, monitoring and risk controls.

- Greater demand for staking-related services such as institutional-grade pools, insurance solutions and governance tooling.

- Deeper discussion around centralisation risks as large holders decide what share of their balances to stake directly versus through intermediaries.

For now, Bitmine’s 74,880 ETH stake is best understood as a meaningful, but measured, step. It does not rewrite Ethereum’s supply dynamics overnight, nor does it reveal a precise roadmap for the company’s future decisions. What it does show is that one of the largest ETH holders on record is prepared to engage more deeply with the protocol, even as others like Sharplink refine their own approach.

In a market often driven by short-term headlines, this kind of gradual, exploratory behaviour from large entities may be one of the more important signals of all: evidence that Ethereum is evolving from a speculative instrument into a piece of financial infrastructure that serious institutions are willing to learn, test and eventually incorporate into their long-term plans.

Disclaimer: This article is for educational and analytical purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and may not be suitable for all investors. Always conduct your own research and consider consulting qualified professionals before making financial decisions.