Ethereum Taker Flow on Binance Is Recovering: How Much Does It Really Matter?

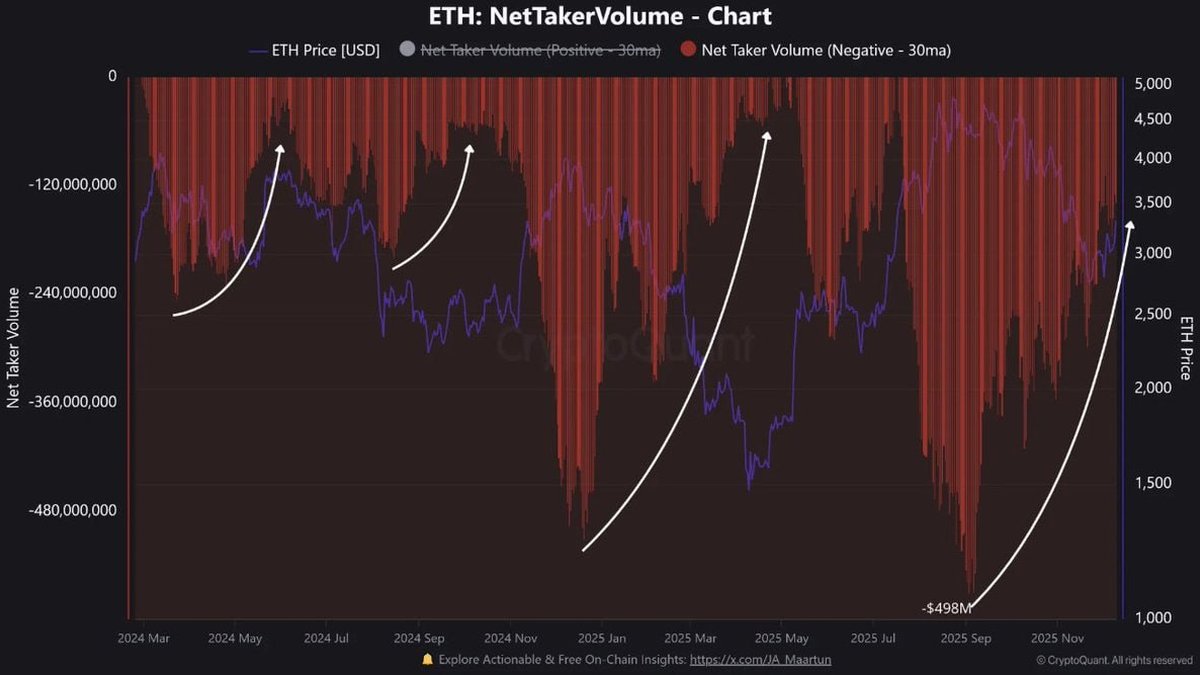

On-chain data from CryptoQuant shows that net taker volume for Ether (ETH) on Binance has started to recover. The metric is still negative at approximately –138 million USD, but that is a dramatic improvement from the deep trough near –500 million USD recorded at the end of October – a period marked by intense selling pressure and a visibly stressed market.

In simple terms, the chart is telling us that aggressive sellers are no longer in full control, and that a growing share of market orders is now coming from buyers rather than sellers. That does not automatically guarantee a new bull phase, but it does change the texture of order flow in a way that deserves careful analysis.

This article dives into what net taker volume actually measures, why the latest recovery is noteworthy, how it has behaved around previous turning points, and what other signals long-term investors should combine it with before drawing conclusions about Ethereum's next move.

1. What is “net taker volume” and why do we care?

To understand the current reading, we first need to unpack the language. Every trade on an orderbook exchange like Binance has two sides:

- Makers place limit orders and wait for someone to trade against them. They provide liquidity.

- Takers submit market or marketable limit orders that execute immediately against existing orders. They consume liquidity.

Because takers are willing to accept the current price and higher fees in order to be filled instantly, their orders are often interpreted as the more “urgent” side of the market. They tend to reflect traders who feel a stronger need to act right now – whether due to conviction, risk management or short-term positioning.

Net taker volume is a way of aggregating this activity over time. Conceptually, it can be expressed as:

Net Taker Volume = (Taker Buy Volume) – (Taker Sell Volume)

On CryptoQuant's charts, values are shown in USD terms and smoothed by a 30-day moving average to filter out day-to-day noise. The interpretation is straightforward:

- Positive net taker volume means aggressive buyers (market buyers) dominate. More volume is hitting the ask than the bid.

- Negative net taker volume means aggressive sellers dominate. More volume is hitting the bid than the ask.

When the metric becomes extremely negative, it usually reflects a phase of capitulation or forced deleveraging, where participants rush to exit positions and are willing to cross the spread to do so. When it begins to recover from those extremes, it can signal that this forced selling phase is easing and that more participants are again willing to buy at market.

2. From –500M to –138M: what has changed?

According to the on-chain data, net taker volume for ETH on Binance reached roughly –498 million USD at the end of October on a 30-day basis. That was one of the most negative readings in the last two years, aligning with a period where the Ether price was under sustained pressure and many leveraged positions were being unwound.

Since then, the indicator has climbed to approximately –138 million USD. Two points are important here:

- It is still negative. Sellers remain marginally more aggressive than buyers. This is not yet a full reversal where buyers completely dominate.

- The direction of change has flipped. The market has moved from extremely one-sided selling to a more balanced dynamic, with taker buy volume closing the gap.

In other words, the data suggests that the worst of the forced selling phase may be behind us on Binance, at least for now. The price of ETH remains below earlier local highs, but the behaviour of market participants – those willing to pay the spread to act immediately – is no longer dominated by one-way exit flows.

This is exactly the type of shift that often occurs near medium-term turning points. The question, of course, is whether the pattern will repeat this time.

3. Historical context: how has net taker volume behaved around lows?

Looking back over the chart for the past 18–24 months, several episodes stand out where deeply negative net taker volume coincided with or slightly preceded major local lows in the ETH price on Binance:

- After sharp drawdowns, net taker volume would plunge as capitulation set in. Values near or below the recent –498M reading typically lined up with stressed conditions where sentiment was extremely cautious.

- As these extremes faded and net taker volume moved back toward zero, the ETH price tended to stabilise and then begin a recovery phase.

The current pattern – a deep negative spike followed by a steady recovery in net taker volume while price consolidates at lower levels – looks visually similar to those previous regimes. It does not guarantee a repeat, but it tells us that order-flow pressure is now less one-sided than it was at the October low.

Why does this matter? Because markets rarely reverse sustainably while forced sellers are still in control. When net taker volume is extremely negative, any rally attempt is often met by an overhang of supply from participants who are still in the process of exiting. When that overhang is gradually absorbed, the market becomes more sensitive to positive catalysts.

4. Reading between the lines: what the metric can – and cannot – tell us

It is tempting to treat a recovering net taker volume line as a straightforward “buy” signal, but that would be an oversimplification. The indicator has genuine information content, yet it has limitations that long-term investors should respect.

4.1. What the signal does tell us

• Short-term balance between urgency to sell and urgency to buy. An improvement from –500M to –138M means that fewer participants are rushing to get out at any price, and more are willing to cross the spread in the opposite direction.

• A likely moderation in panic or forced liquidations. Extreme negative taker volume often aligns with liquidations, risk-management sales and systematic de-risking. A reduction signals that these mechanical flows may be slowing.

• Growing confidence among active participants on a major venue. Binance is still one of the largest trading hubs for ETH. A shift in its order flow tells us something about behaviour across a sizable portion of the active market.

4.2. What the signal does not guarantee

• It does not forecast exact price targets. Net taker volume can tell us that conditions are improving beneath the surface, but it does not tell us whether ETH will rally to any specific level or on what timetable.

• It does not cover the whole market. The chart focuses on Binance taker flow. Other venues and derivatives platforms may show different patterns, especially where institutional activity is concentrated.

• It does not override macro conditions. If global risk appetite deteriorates or liquidity tightens meaningfully, even an improved taker balance may not be enough to support a sustainable rally.

The right way to use this metric is therefore as a component of a broader mosaic, not as a standalone indicator.

5. Why taker flow is turning: three plausible drivers

What could explain the recent improvement in net taker volume on Binance? On-chain data tells us what is happening, but not necessarily why. Still, we can outline several plausible drivers that fit with the broader market environment.

5.1. Capitulation and re-entry by short-term traders

The extreme negative reading in late October suggests that many short-term participants had already realized losses or closed positions. Once that process is largely complete, there are simply fewer marginal sellers left who are willing to hit the bid aggressively.

At the same time, some of those who reduced risk earlier may be cautiously returning, using market orders to rebuild exposure at lower price levels. That alone can push net taker volume toward zero even if overall trading activity remains moderate.

5.2. Gradual improvement in sentiment around Ethereum

Beyond pure positioning, there has been a quiet improvement in the narrative around Ethereum itself: discussions about scaling upgrades, progress in rollup ecosystems and renewed interest in staking yields have all contributed to a perception that the network continues to evolve. None of these factors instantly lift price, but they can make buyers more willing to express conviction through market orders rather than waiting passively with low-ball bids.

5.3. Rotation within the digital-asset complex

A third possibility is that some investors have begun to rotate from other assets back into ETH, seeing it as a relative value play when compared with more speculative tokens that outperformed earlier in the cycle. When rotation flows are executed quickly or in size, they tend to show up as taker flow, especially on major venues.

6. How investors can integrate this signal into their framework

For investors who want to incorporate net taker volume into their decision-making in a thoughtful way, several practical guidelines can help.

6.1. Treat it as confirmation, not as a trigger

One sensible approach is to use improvements in net taker volume as confirmation for ideas generated elsewhere.

- If you already believe that ETH is near a fundamental or technical support area, a recovery in taker flow can strengthen that view by showing that aggressive selling is fading.

- If you are cautious because of macro risks or weak activity in DeFi and NFTs, a single on-chain metric should not override that caution.

This avoids the trap of chasing every short-term fluctuation in order flow, while still benefiting from the information embedded in it.

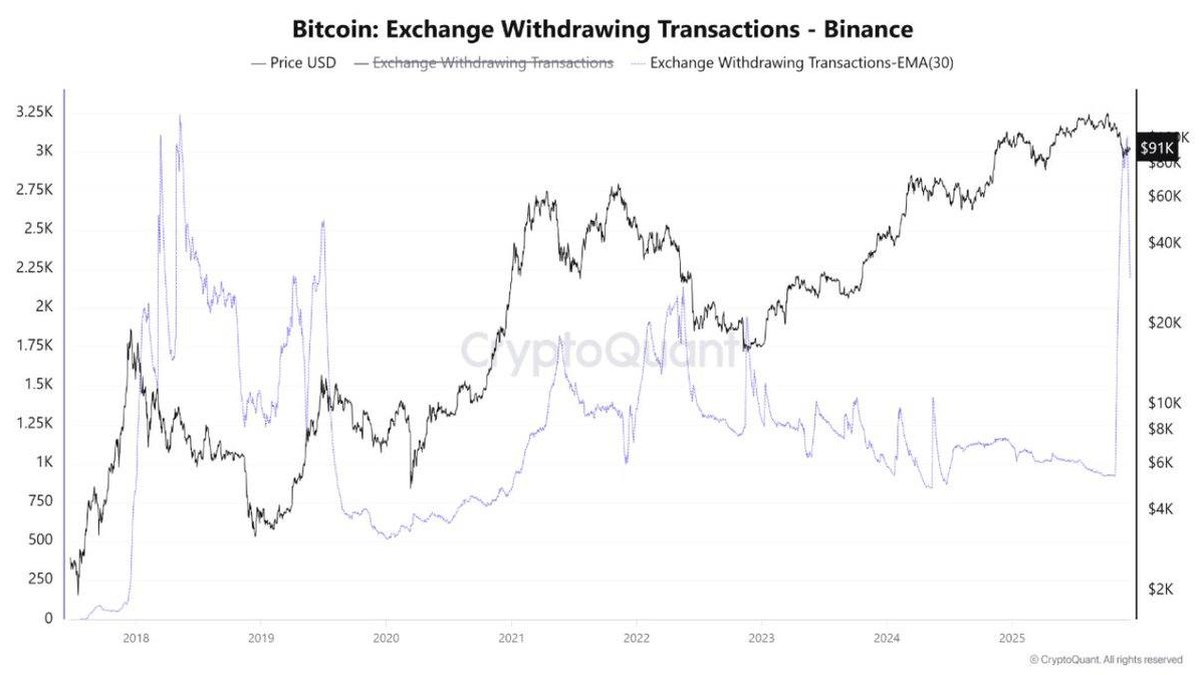

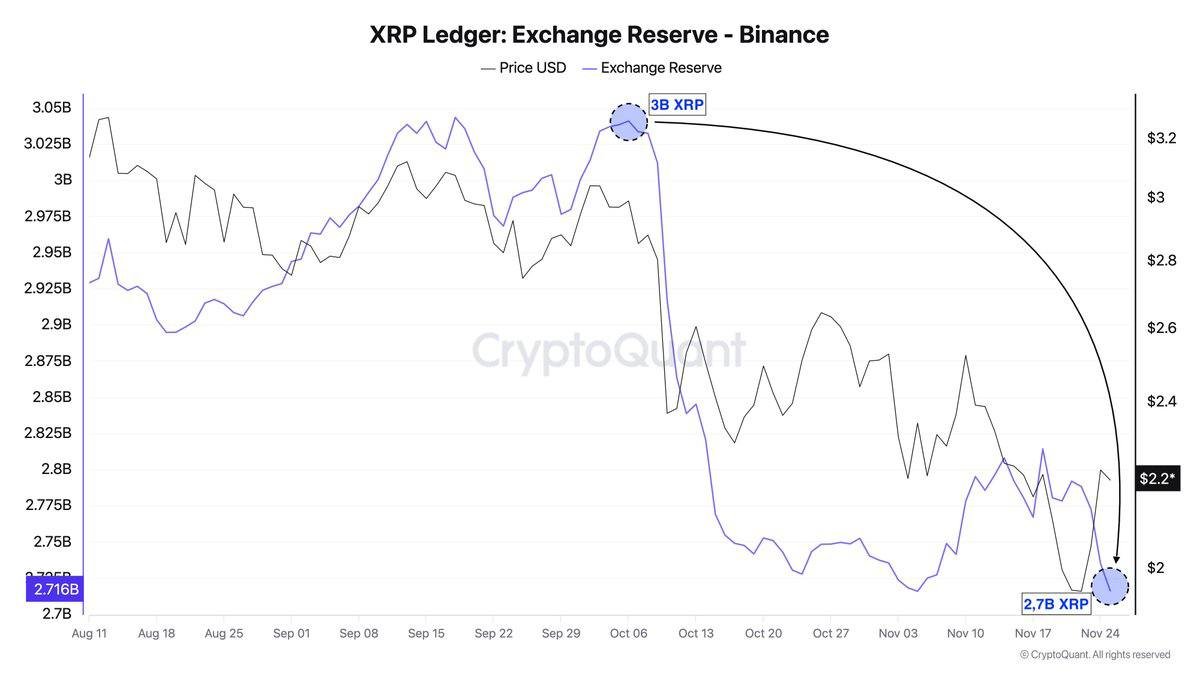

6.2. Combine it with other on-chain and market-structure indicators

Net taker volume tends to be more informative when viewed alongside other data points, for example:

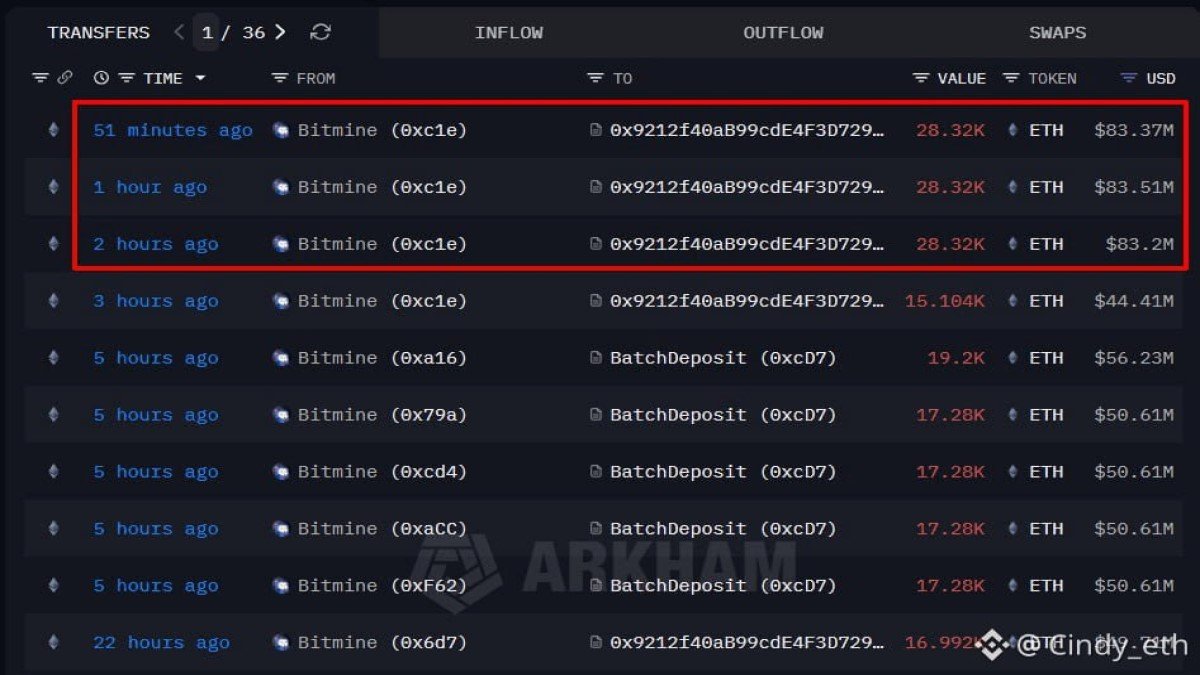

- Exchange reserves: Are net flows of ETH moving away from exchanges (often interpreted as long-term accumulation) or toward them (potential selling supply)?

- Derivatives positioning: Is open interest in futures and options rising with balanced funding, or is there evidence of crowded directional trades?

- Stablecoin flows: Are more stablecoins moving from the sidelines onto trading venues, indicating fresh liquidity?

- Activity on Ethereum itself: Are transaction counts, gas usage and fees suggesting increased network demand, or is on-chain usage subdued?

When multiple indicators align – for example, improving net taker volume, falling exchange reserves and rising on-chain activity – the overall signal becomes stronger than any single metric on its own.

6.3. Respect time horizons

The net taker volume chart uses a 30-day moving average, which makes it inherently a medium-term indicator. It is not designed to predict intraday swings or even day-to-day volatility. Investors should therefore anchor expectations to the right horizon:

- It may help frame expectations over the next several weeks to a few months.

- It is less useful for deciding whether ETH will be higher or lower by the end of today or tomorrow.

7. What could invalidate the positive read?

It is also worth thinking through scenarios in which the current improvement in net taker volume could prove to be temporary.

• Renewed macro stress: If global risk sentiment weakens sharply – for example, due to growth concerns, policy surprises or financial-sector stress – investors might again rush to reduce exposure. That could drive net taker volume back into deeply negative territory, even after a period of improvement.

• Idiosyncratic shocks to Ethereum: Major setbacks in network upgrades, governance disputes, or a prolonged decline in ecosystem activity could tilt the balance back toward aggressive selling.

• Rotation away from ETH into other narratives: If attention and capital move decisively toward a different sector – such as new layer-1s, restaking platforms or tokenized real-world assets – ETH could lag even in a constructive digital-asset environment.

In each of these cases, we would expect the net taker volume metric to reflect the change in mood by sliding back toward more negative values. Monitoring the indicator over time is therefore just as important as noting a single reading.

8. Bottom line: a healthier market, not yet a euphoric one

The recovery of Ethereum's net taker volume on Binance from around –500 million USD to roughly –138 million USD is an encouraging sign. It suggests that the most intense phase of forced selling has likely passed, that aggressive buyers are slowly regaining confidence, and that the orderbook is no longer dominated by one-way exit flows.

At the same time, the metric remains below zero, reminding us that the market is still in a healing phase rather than in full expansion mode. The signal is best interpreted as “conditions are improving beneath the surface” rather than “the uptrend is guaranteed.”

For long-term participants, the key takeaway is not a precise price forecast but a structural one: when aggressive selling eases and on-chain data begins to stabilise, the probability of sustainable recoveries increases, especially if broader liquidity conditions and network fundamentals cooperate.

In that sense, the chart is less a call to action and more a reminder that markets often turn quietly. By the time price charts look obvious, on-chain order flow has usually been whispering the story for weeks.