Historic Bitcoin Withdrawals on Binance: What a 91K Accumulation Wave Really Means

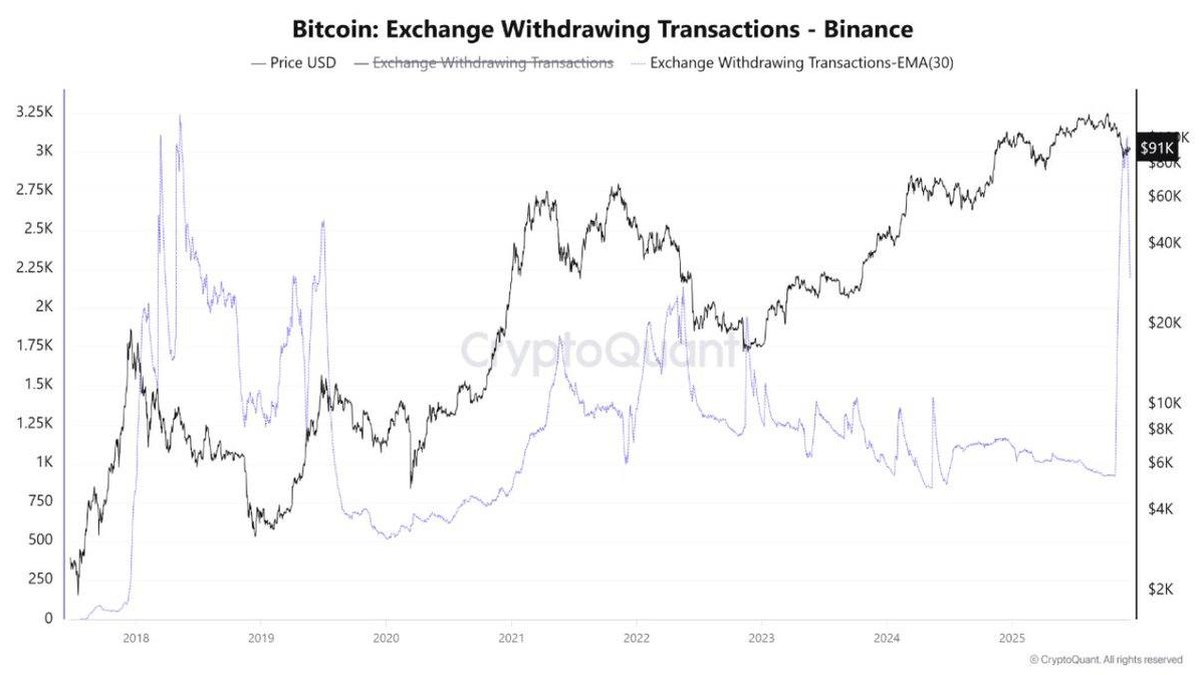

On-chain data from CryptoQuant shows an unusual picture: while Bitcoin trades in the 91,000 USD region, the number of withdrawal transactions leaving Binance has spiked to one of the highest levels ever recorded. The exchange withdrawing transactions metric, smoothed by a 30-day moving average, is surging at a time when many short-term participants are cautious or sitting on losses.

In simple terms, coins are being pulled off the order book at a rapid pace even though price has already corrected from its peak. As one analyst put it, the current phase looks like a period where supply is being quietly removed from circulation and fresh selling pressure is limited. That pattern is often interpreted as a sign of strong conviction among investors who prefer to hold their coins outside exchanges rather than keep them ready for immediate sale.

This article unpacks what that signal may mean, why it matters for the next chapters of the Bitcoin cycle, and where the risks still lie despite the optimistic narrative.

1. What exactly is the Binance withdrawal spike showing?

The chart tracks two key elements: the Bitcoin price in USD and the number of withdrawal transactions leaving Binance, aggregated and then smoothed over 30 days. Each withdrawal does not necessarily represent a huge amount of BTC, but collectively they reveal how many separate decisions are being made to move coins away from the trading venue.

Historically, spikes in withdrawal activity have tended to cluster around two types of environments:

- Periods of fear, when users migrate balances to self-custody for safety.

- Phases of conviction, when long-term holders choose to lock in their positions off-exchange, signalling they are not planning to trade quickly.

The current spike is notable because it appears in a context where price is still relatively elevated compared with past cycles. Bitcoin is not at a deep bear-market low; it is in a broad consolidation range after a prior rally. Yet withdrawal transactions are climbing toward multi-year highs. That combination hints that the dominant motivation today is accumulation and cold storage, rather than panic.

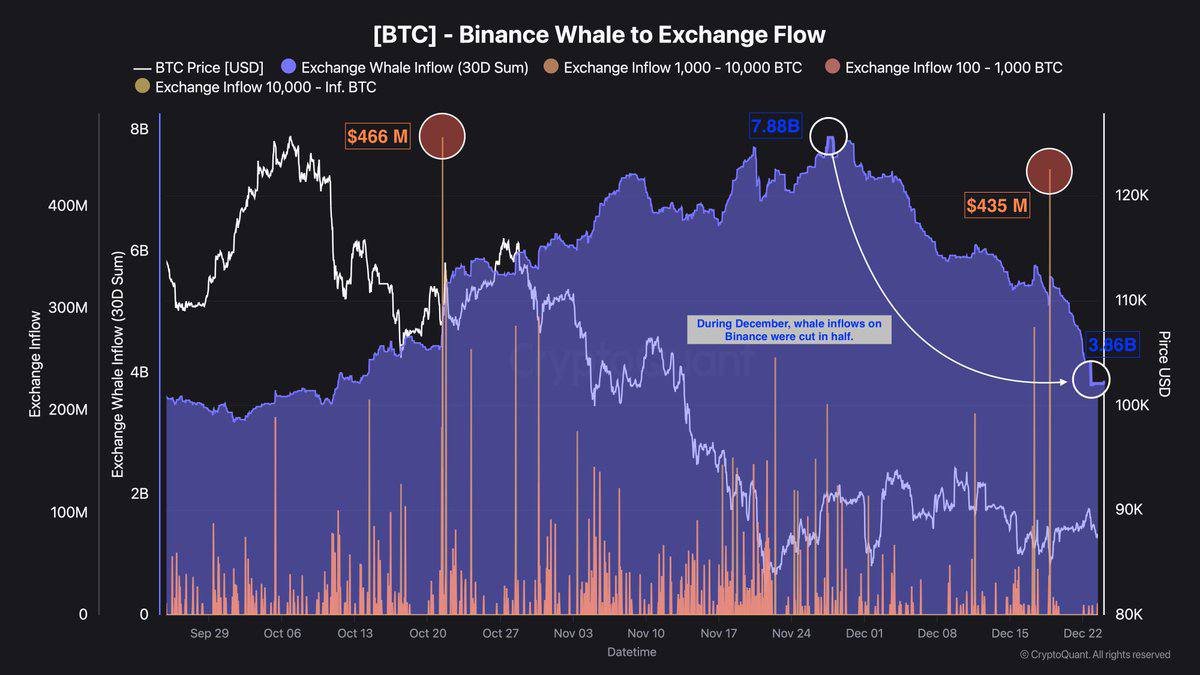

2. Supply is quietly leaving the order book

When coins flow from personal wallets to exchanges, they move closer to the sell side: they are immediately available to be placed in ask orders or used as margin. The reverse is also true. When coins are withdrawn, they step away from the trading book and usually become less likely to be sold in the near term.

The recent surge in withdrawals from Binance therefore has a mechanical implication for market structure:

- The visible spot supply available for immediate sale shrinks.

- Short-term speculators dominate a smaller share of the float, because a larger slice of circulating BTC is sitting in long-term storage, multi-signature custody, or institutional vaults.

- The price impact of a given amount of new buy or sell demand can become larger, because the resting liquidity in the book is thinner than it appears from headline market capitalization figures.

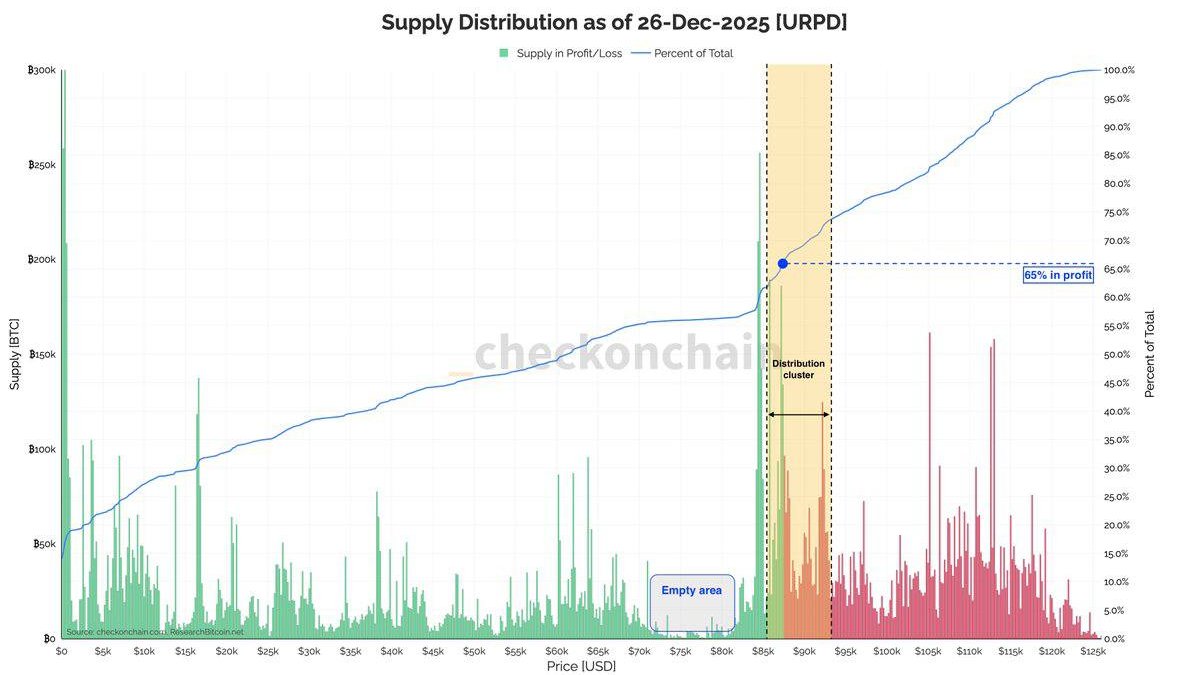

This is why on-chain analysts often speak of a 'liquidity squeeze' or 'structural tightness' when persistent outflows from exchanges coincide with steady or rising demand. It is not that the overall supply of Bitcoin changes – the protocol schedule is fixed – but that the effective supply available at each price level becomes constrained.

3. Why are investors withdrawing at 91K instead of taking profit?

At first glance, it may seem puzzling that withdrawal activity is intense while price has already fallen from its peak. Why are investors not using this liquidity window to reduce risk? Several factors likely contribute:

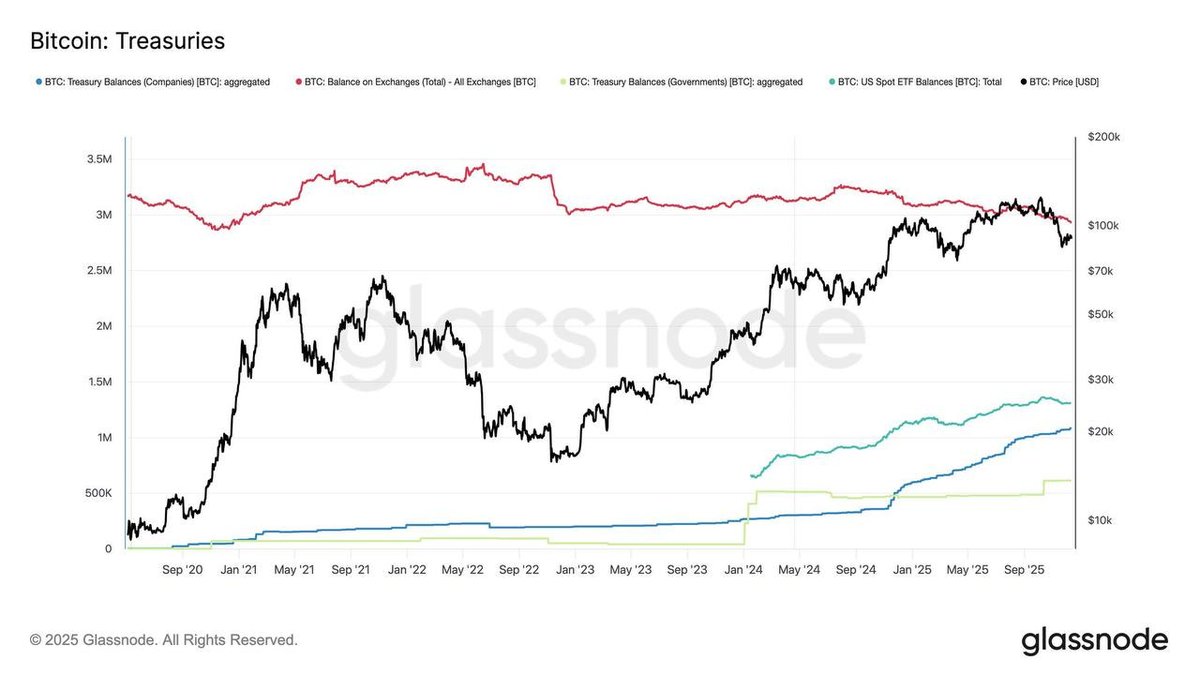

1. A shift toward long-term portfolio thinking. Many of the entities now accumulating are not trading desks chasing intraday swings; they are treasury-style holders, funds, and high-conviction individuals who treat Bitcoin as a multi-year allocation. For them, the difference between 80,000 and 91,000 USD is less important than the long-term thesis about digital scarcity and macro hedging. Moving coins off Binance into long-term custody aligns with that mindset.

2. Growing comfort with self-custody and institutional custody. Over the last few years, wallet technology, hardware devices, institutional custodians, and regulated products have matured. That makes it easier for investors to hold BTC away from exchanges while still having reliable audit trails and operational processes. Each improvement reduces the need to park coins on a trading venue for convenience.

3. A desire to step out of the short-term noise. Volatility, liquidations in derivatives markets, and rapid sentiment shifts can be stressful. Some holders respond by simply moving their BTC away from the environment where they might be tempted to make impulsive decisions. Withdrawing coins is, in a sense, a behavioral choice: it raises the friction of panic-selling and encourages a longer viewpoint.

4. Historical context: this is not a typical capitulation bottom

It is important to distinguish the current pattern from prior points in the Bitcoin timeline. In earlier cycles, extreme withdrawal spikes often aligned with deep price lows or confidence shocks. Users would move coins off exchanges out of caution, fearing counterparty risk or further adverse events. Price at those moments tended to be depressed, and the flow pattern resembled a classic capitulation-and-rebuild narrative.

The present situation is different. Bitcoin has certainly pulled back from its highs, but it remains far above prior cycle peaks. At around 91,000 USD, the asset is still valued richly relative to historical averages. The withdrawal spike is therefore less about escaping a crisis and more about aggressive accumulation at what some participants view as strategically attractive levels.

That distinction matters. A capitulation bottom often comes with exhausted sellers, thin demand, and extreme pessimism. The current environment, by contrast, shows solid structural demand coexisting with short-term uncertainty. Investors are not fleeing the ecosystem; they are repositioning within it, moving from exchange balances to longer-horizon holdings.

5. What structural accumulation can and cannot tell us

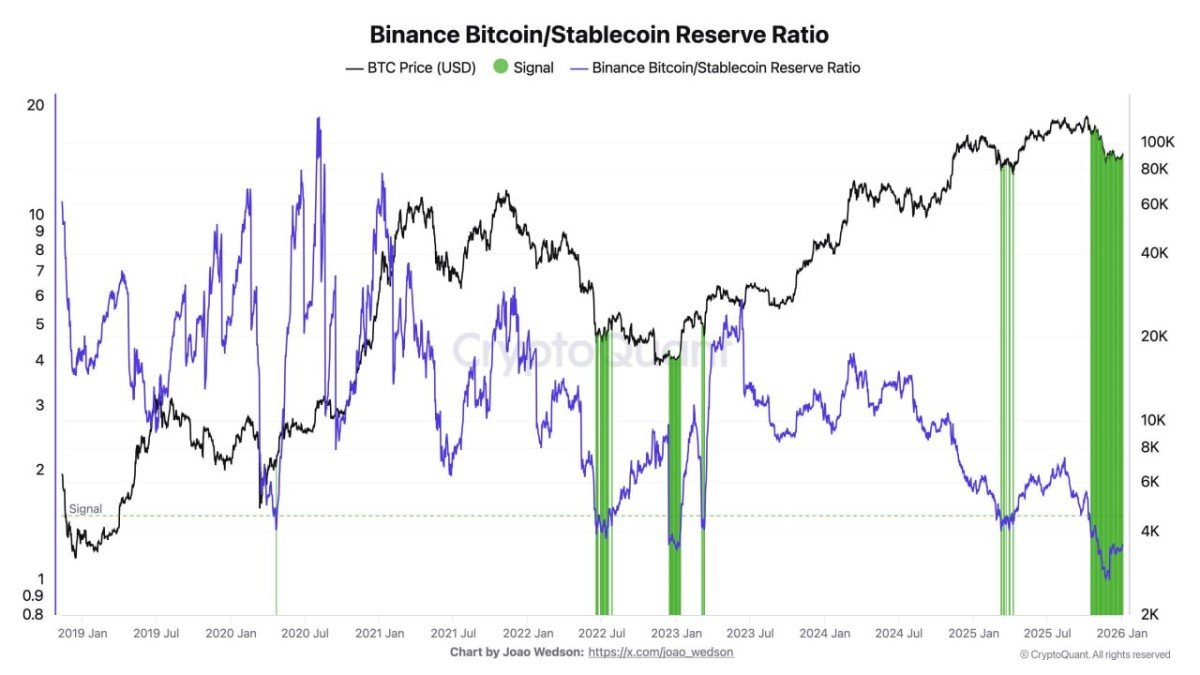

The temptation is to read a chart like this and jump directly to a bullish conclusion: 'supply is leaving Binance, therefore price must rise.' Reality is more nuanced. Structural accumulation changes the conditions under which a future rally could unfold, but it does not guarantee that rally on its own.

On the positive side:

- The more coins are locked in long-term storage, the less inventory is immediately available to meet future demand.

- If investor interest returns strongly – for example through new products, macro catalysts, or renewed enthusiasm – the reduced liquid supply can result in faster price appreciation.

- Persistent outflows also signal that many market participants are not trying to time every fluctuation; they are willing to hold through volatility, which can stabilize the long-run trajectory.

On the other hand, there are important caveats:

- Demand still matters. If new buyers do not step in, a tight float alone cannot generate sustained upside. Price could simply drift sideways while supply quietly changes hands between patient holders.

- Derivatives markets can create short-term headwinds. Even if spot coins are being withdrawn, futures and options can amplify downside moves when positioning becomes one-sided.

- Large holders who withdrew coins can still choose to redeposit them quickly if macro conditions or sentiment change. Outflows are a snapshot of current intentions, not an irreversible decision.

The correct reading, therefore, is that the market is building a foundation where a future advance could be stronger once demand returns, but there is no fixed timetable for when that may happen.

6. Why the Binance lens matters – and its limitations

The chart specifically tracks activity on Binance, one of the largest global trading venues for Bitcoin. Movements on such a platform are significant because they often reflect behavior from a wide mix of regions and participant types, from individual traders to professional desks.

However, there are reasons to be careful when drawing system-wide conclusions from a single venue:

• Internal wallet reshuffling: Sometimes exchanges move coins between hot and cold wallets for operational reasons. On-chain data providers do their best to filter these flows, but no heuristic is perfect.

• Competition among venues: A drop in balances on one exchange could be offset by inflows elsewhere if users are rotating between platforms. Net outflows from the entire exchange cluster would provide a stronger confirmation of the accumulation thesis.

• Emerging off-exchange infrastructure: Over-the-counter desks, institutional custodians, and exchange-traded products also hold significant amounts of BTC. Activity in those channels is not always visible on a single exchange chart.

As a result, Binance withdrawal data should be treated as a valuable signal within a broader mosaic, not as a standalone verdict on the entire market.

7. Behavioral message: conviction is high, patience is being tested

Despite these caveats, the behavioral message of the chart is hard to ignore. At current prices, a large number of users are choosing to remove their coins from a venue designed for rapid trading and place them into environments where selling is less convenient. That is a form of revealed preference: they are voting with their transactions that holding is more attractive than short-term speculation.

This is consistent with surveys and on-chain cohort studies showing that the average holding period for many coins is lengthening. Early in Bitcoin's history, rapid cycles of inflow and outflow between exchanges and personal wallets were common. Over time, a growing share of the supply has migrated into dormant wallets, multi-signature schemes, and long-term strategic reserves.

Paradoxically, this high conviction often coincides with psychological discomfort. While long-term participants are accumulating, price can remain range-bound or even drift lower. For new entrants, it can feel as if the market is 'ignoring' good structural news. That is a normal feature of accumulation phases: the groundwork is being laid out of sight, while the visible price action looks unremarkable.

8. Implications for different types of market participants

The current pattern of aggressive withdrawals at 91K has different meanings depending on who you are:

• Long-term allocators may see this as confirmation that they are not alone in treating Bitcoin as a strategic asset rather than a short-term trade. The message is that a sizable cohort is willing to lock coins away and accept volatility in exchange for potential long-run appreciation.

• Short-term traders should respect the fact that spot supply on major venues is becoming more concentrated. This can increase the impact of sudden bursts of demand or fear, making risk management and position sizing more important.

• Newcomers can use the data as an educational tool rather than a signal to act immediately. Learning how exchange flows, on-chain metrics, and macro conditions interact is a healthier starting point than trying to predict the next daily candle.

9. Conclusion: a strong hand transfer beneath a quiet surface

The surge in Bitcoin withdrawal transactions from Binance while price hovers around 91,000 USD paints a picture of a market undergoing a subtle but important transformation. Supply is moving away from the order book into long-term storage, indicating that many participants are looking beyond the current consolidation and positioning for potential scenarios several years out.

That does not guarantee an immediate breakout. Price is still driven by the balance between buyers and sellers in the short run, and it is entirely possible for Bitcoin to continue trading sideways or even experience further corrections while this structural tightness builds. Yet, each coin that migrates to long-term custody reduces the float available for future rallies and raises the potential impact of renewed demand.

In other words, today's withdrawals are less about abandoning the market and more about choosing a different way to be in it. For a maturing asset class, that shift from speculative churn to deliberate holding may be one of the most important, if least dramatic, signals of all.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Digital assets are volatile and may involve a high degree of risk, including the possible loss of principal. Always conduct your own research and consider consulting a qualified financial professional before making investment decisions.