Who Holds the Keys Now? How Nearly One-Third of Bitcoin Has Moved Into Institutional Treasuries

For most of Bitcoin's history, the dominant story was simple: a grassroots network held mostly by early adopters, mining pools and retail traders. The latest on-chain data from Glassnode paints a very different picture. Bitcoin is still open and permissionless, but its ownership map has shifted decisively toward large balance sheets and professional custodians.

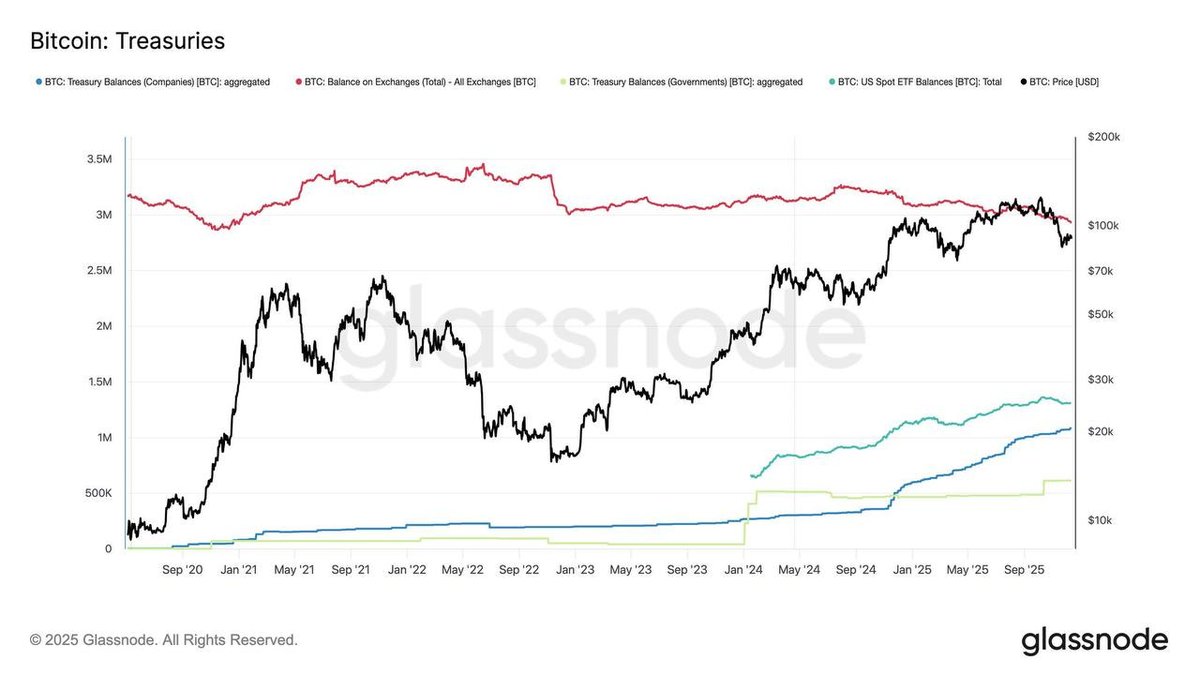

According to the dataset you shared, four groups now hold a striking share of the circulating supply:

- Public companies: roughly 1.07 million BTC

- Governments: roughly 0.62 million BTC

- US spot ETFs: roughly 1.31 million BTC

- Centralised exchanges: roughly 2.94 million BTC

In total, that comes to about 5.94 million BTC, or close to 29.8% of the circulating supply. It is a powerful snapshot of how far Bitcoin has travelled from its cypherpunk origins into the centre of the global financial system.

This article looks beyond the headline numbers. What does it actually mean when a growing slice of Bitcoin is held in treasuries and custodial pools rather than in self-hosted wallets? Is this a structural tailwind for price, a concentration risk for liquidity, or both at the same time? And how should investors interpret this shift as they think about the next cycle?

1. Reading the Glassnode Chart: From Retail Float to Institutional Balance Sheet

The Glassnode chart makes two trends visible at a glance. First, holdings by public companies, governments and US spot ETFs have been steadily rising, especially since 2024. Second, the total balance of Bitcoin on exchanges has been trending flat to slightly lower around the 3 million BTC mark, despite large price swings.

In other words, more Bitcoin is leaving the liquid trading pool and entering what looks like long-horizon storage:

- Corporate treasuries that report holdings quarterly to shareholders.

- Government balances, often accumulated through seizures or strategic purchases.

- ETF vehicles where coins are custodied on behalf of a broad base of investors.

- Exchange reserves that back order books and customer balances.

The first three categories are inherently less fluid than hot exchange wallets. They still represent potential sell pressure, but decisions are filtered through boards, regulators, compliance teams and risk committees. That creates a different market structure than in earlier cycles, when a larger share of coins sat with individuals who could react instantly to volatility.

2. Public Companies: Bitcoin as Corporate Reserve Asset

The 1.07 million BTC held by public companies confirms how mainstream the idea of Bitcoin as a strategic reserve has become. A few years ago this category was dominated by a single name; now it includes a long list of entities such as listed miners, digital asset firms, payment companies and diversified corporates.

The motivations are diverse:

- Balance-sheet diversification. Some management teams view Bitcoin as a long-term store of value that complements cash, short-term bonds and other liquid assets.

- Brand and signalling. For companies that operate in technology, payments or Web3-adjacent industries, visible Bitcoin holdings can signal alignment with digital innovation.

- Yield and collateral. Large holdings can be used in lending structures, over-the-counter financing or as collateral for other corporate activities, subject to risk controls.

From a market-structure angle, corporate treasuries tend to behave differently from speculative traders. They normally build positions in discrete steps, disclose purchases after the fact, and evaluate performance over years rather than weeks. That often translates into sticky supply: coins that are unlikely to be sold aggressively during routine drawdowns.

The flip side is that when these entities do change their stance, the impact can be meaningful. A major rebalancing, an index removal or a large capital-raising event could push a non-trivial quantity of coins back into circulation. However, those decisions are usually announced and debated in advance, giving the market time to absorb the information rather than being surprised by sudden selling pressure.

3. Governments: From Confiscated Coins to Strategic Reserves

The figure of 0.62 million BTC held by governments is equally striking. A large proportion of these coins originate from law-enforcement seizures, but over time some states have also begun to purchase or retain Bitcoin for strategic reasons.

Compared with private actors, government holdings introduce two specific dynamics:

- Policy over profit. Decisions to sell or retain coins can be influenced by legal, political or diplomatic factors, not just market price.

- Irregular supply events. When seized coins are auctioned, they can temporarily increase available supply, but these events are usually telegraphed in advance.

From the perspective of liquidity, government balances are something like a delayed faucet. They are not part of daily trading flow, but periodic disposals can add bursts of supply. At the same time, the very existence of these holdings contributes to Bitcoin's legitimacy: it is hard to label an asset purely speculative when multiple sovereigns hold measurable quantities on official balance sheets.

4. US Spot ETFs: The New Gatekeepers of Retail and Advisory Capital

Perhaps the most transformational line on the chart is the 1.31 million BTC now custodied by US spot ETFs. In less than two years, these products have become one of the largest single channels for Bitcoin exposure.

ETFs change the game in several ways:

- Access. They allow financial advisers, retirement accounts and institutions with strict mandates to gain exposure without dealing with private keys or specialised platforms.

- Operational simplicity. Rebalancing, reporting and compliance fit neatly into existing portfolio workflows.

- Transparent flows. Daily creations and redemptions provide a visible gauge of investor appetite.

On the other hand, ETFs centralise large coin balances with a small number of custodians. While these custodians are heavily regulated and audited, the arrangement does create single points of operational and regulatory dependence. If sentiment turns sharply, ETF outflows could translate into meaningful redemption-driven selling, though so far redemptions have generally been modest relative to total assets.

In terms of market behaviour, ETF demand has tended to be trend-reinforcing. Strong macro narratives and positive momentum often bring in new inflows, which require additional spot purchases. During quieter phases, flows stabilise rather than reversing completely, reflecting the longer-horizon mindset of many advisory clients.

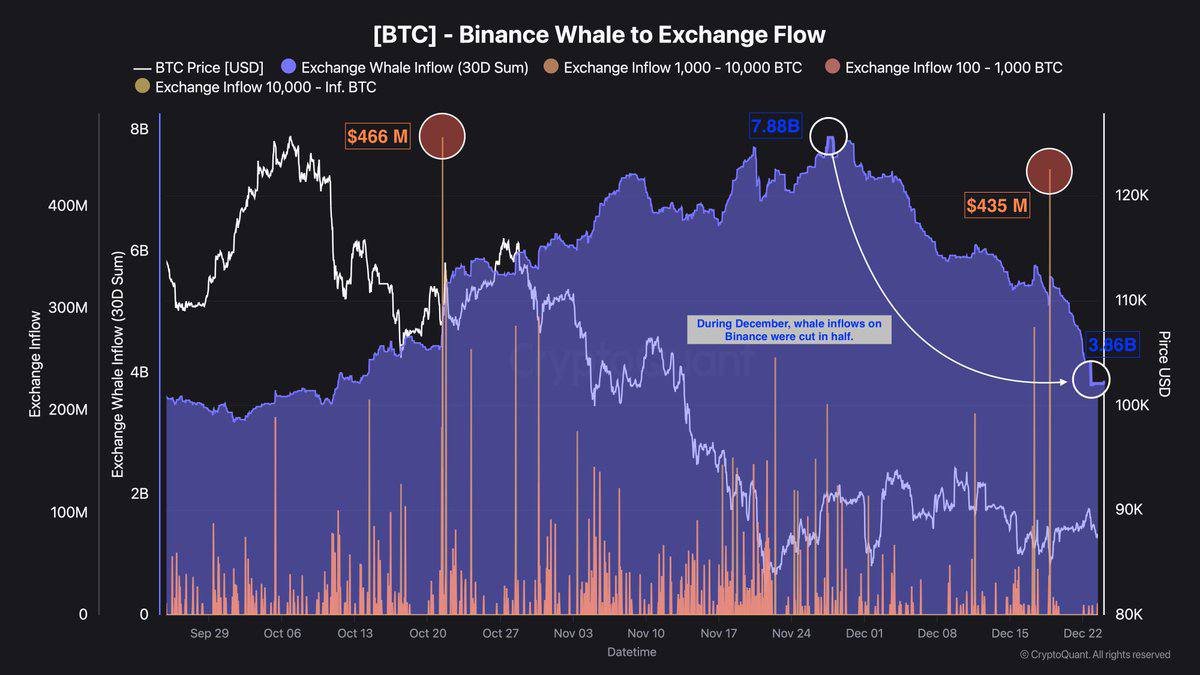

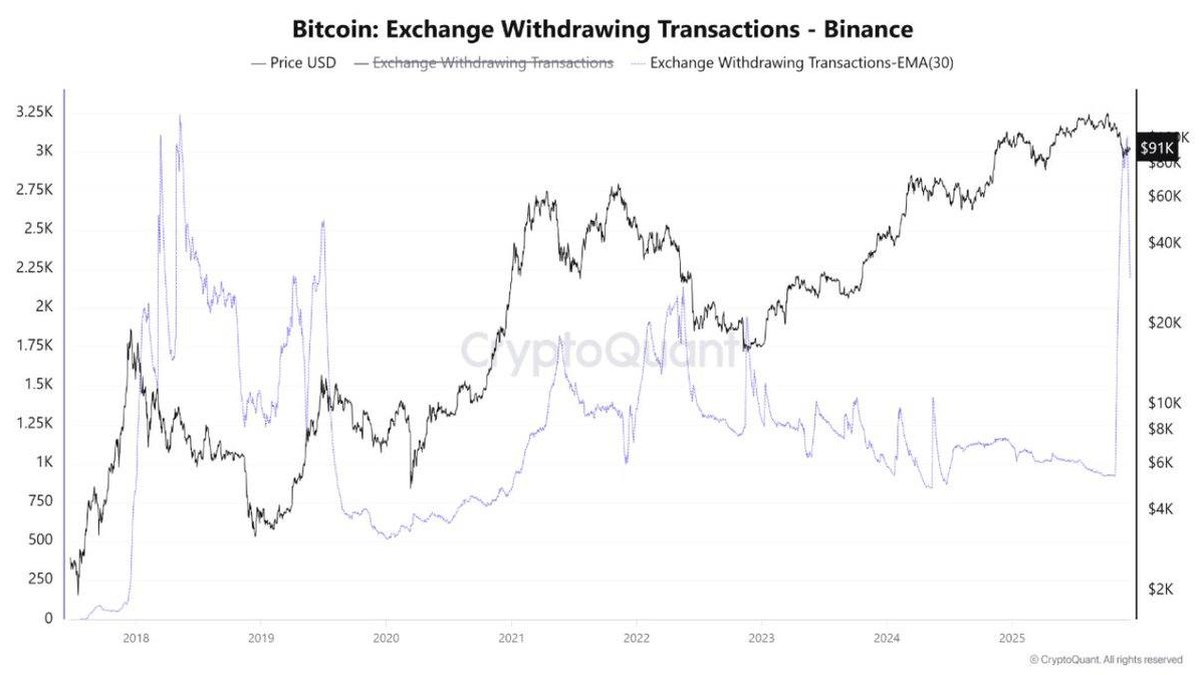

5. Exchanges: The Shrinking Pool of Immediately Tradable Coins

The final category, 2.94 million BTC on exchanges, represents the immediate trading float. These are the coins that underpin order books, serve as collateral in derivatives markets and support day-to-day withdrawals.

Historically, exchange balances were much larger. Over the last several years, however, two forces have steadily reduced them:

- Growth of long-term holding culture. More participants are opting for cold storage and multi-signature arrangements rather than keeping large balances on centralised platforms.

- Rise of institutional custody. Corporates, funds and high-net-worth investors increasingly use specialist custodians or ETF wrappers instead of exchange accounts for strategic holdings.

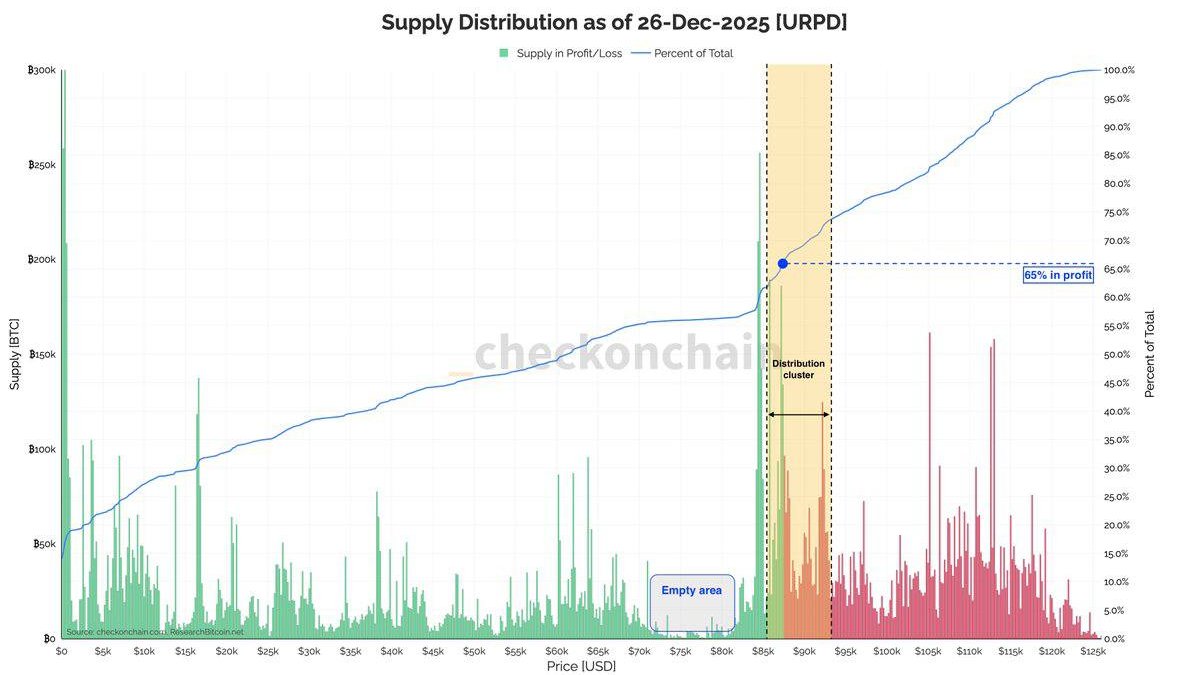

A lower exchange balance can be a double-edged sword. On the positive side, it means fewer coins are available for immediate sale, which can amplify upside moves when fresh demand arrives. On the negative side, it can reduce market depth during stressed periods, leading to faster price swings in both directions.

6. Almost 30% in Treasuries: Structural Tailwind or Concentration Risk?

Putting the pieces together, institutional and custodial entities now control roughly 5.94 million BTC, just under one-third of the circulating supply. That has several implications.

6.1 Structural support for long-term valuation

First, a significant share of Bitcoin has effectively been locked into vehicles with slower decision cycles. Boards, risk committees and regulatory frameworks all create frictions that discourage rapid selling based on short-term sentiment. This contributes to a form of structural illiquidity: fewer coins are truly for sale at any given moment.

In a system with a fixed maximum supply, structural illiquidity can support higher long-term valuations. When new demand appears – whether from an additional ETF approval, a large corporate treasury allocation or retail inflows – it has to compete for a relatively small free float.

6.2 Concentration and counterparty risk

The other side of the coin is concentration. Instead of millions of small holders, a growing portion of Bitcoin is represented by a few hundred institutional balance sheets and a handful of large custodians. That introduces several layers of risk:

- Policy risk. Regulatory changes that affect ETFs, custodians or bank-level trust entities can influence large coin pools simultaneously.

- Operational risk. While providers invest heavily in security and controls, the sheer size of the balances makes resilience a constant priority.

- Market-structure risk. If several large entities decide to rebalance at the same time – for example, due to a macro shock – the resulting order flow could be substantial relative to daily volume.

In practice, these risks are mitigated by diversification across service providers and jurisdictions, as well as strict oversight. But they are not zero, and long-term observers of the market need to factor them into their understanding of Bitcoin's evolving architecture.

7. What Happens if These Holders Turn into Net Sellers?

A natural question follows: if institutions collectively hold almost one-third of the supply, what would happen if they were to become net sellers for an extended period?

There are several scenarios to consider:

• Gradual rotation. A slow shift in asset-allocation models could see some ETFs and corporates reduce their target weights while new adopters enter, leading to a rotation rather than a sudden exit. In this case, the impact on price might be manageable.

• Macro stress. In a severe risk-off environment, some entities might sell Bitcoin to raise cash. However, historical episodes show that other investors often view sharp corrections as entry points, partially offsetting sell pressure.

• Regime change. A dramatic regulatory or technological shock could cause a deeper reassessment. This is the lowest-probability but highest-impact case, and it is precisely why diversification and risk management remain essential.

The key takeaway is that institutional ownership does not guarantee a one-way path higher, but it does change the rhythm of the market. Decisions are more likely to be announced, debated and implemented over weeks and months rather than minutes.

8. What It Means for Different Types of Participants

8.1 For long-term individual holders

For individuals who manage their own wallets, the rise of treasuries and ETFs has two implications. On the one hand, it supports the narrative that Bitcoin is maturing into an accepted macro asset, which can strengthen conviction in a long-term thesis. On the other, it underscores the importance of self-custody for those who value independence from institutional gatekeepers.

The phrase often repeated in the community – that control of private keys equals direct ownership – becomes even more relevant when a large share of supply sits in pooled vehicles. Self-custody is not practical or necessary for everyone, but understanding the trade-offs is crucial.

8.2 For traders and liquidity providers

Those who provide liquidity, whether on centralised platforms or on-chain venues, need to recognise that the available float is smaller than headline supply suggests. Thin order books can amplify both upside breakouts and downside corrections. Risk frameworks that were calibrated on earlier cycles with more exchange balances may need revisiting.

8.3 For institutions still on the sidelines

For institutions considering their first allocation, the Glassnode data offers reassurance and a challenge. Reassurance, because it shows that many peers have already taken positions and that the infrastructure for custody, reporting and compliance is now well established. Challenge, because entering a market where a significant fraction of supply is already spoken for may require a more deliberate strategy and a longer time horizon.

9. A Market Growing Up

Bitcoin's journey from a niche experiment to an asset with almost 30% of its supply tied up in treasuries, ETFs and institutional custodians marks a clear phase shift. The network has not changed its core rules – the maximum supply is still capped, blocks still arrive roughly every ten minutes – but the identity of its marginal holders has evolved dramatically.

Whether this is ultimately seen as a positive or a negative will depend on one's perspective. Advocates of broad adoption see it as evidence that Bitcoin has graduated into the same conversation as sovereign bonds, gold and major equity indices. Purists worry about concentration and prefer a world where ownership is more evenly distributed across individual wallets.

Both views can be true at the same time. What is clear is that on-chain data has become an essential tool for understanding how the market is structured under the surface of daily price moves. Charts like the one from Glassnode do not just provide trivia; they map who actually holds the scarce asset that so many narratives revolve around.

For now, the message is simple: a growing coalition of companies, governments and investment vehicles is treating Bitcoin as a multi-decade strategic asset rather than a short-term trade. That concentration creates new responsibilities and new risks, but it also anchors Bitcoin more deeply into the global financial system. As the next cycle unfolds, watching how these treasury lines move may be just as important as watching the price itself.