Bitmine Stakes Over $1 Billion in ETH: Signal, Commitment or Just Treasury Math?

Few things move crypto narratives as quickly as the actions of very large holders. Over the last 24 hours, on-chain trackers recorded a series of deposits from Bitmine into Ethereum staking contracts that add up to roughly 342,560 ETH – around $1 billion at recent market prices. Taken together with earlier deposits, Bitmine has now staked around one tenth of its reported ETH position.

For many observers this looks like a clean, bullish headline: the largest known corporate holder of ETH is committing a significant portion of its stack to staking, reinforcing the idea that it intends to be around for the long haul. But large institutional moves are rarely one-dimensional. They affect not only on-chain metrics and supply dynamics, but also sentiment, liquidity and the way other market participants think about Ethereum as an asset.

This article unpacks what Bitmine's billion-dollar staking wave really means: how it changes the balance between liquid and bonded ETH, what it reveals about institutional incentives, and how individual investors can interpret the signal without falling into either uncritical enthusiasm or unnecessary fear.

1. What actually happened on-chain?

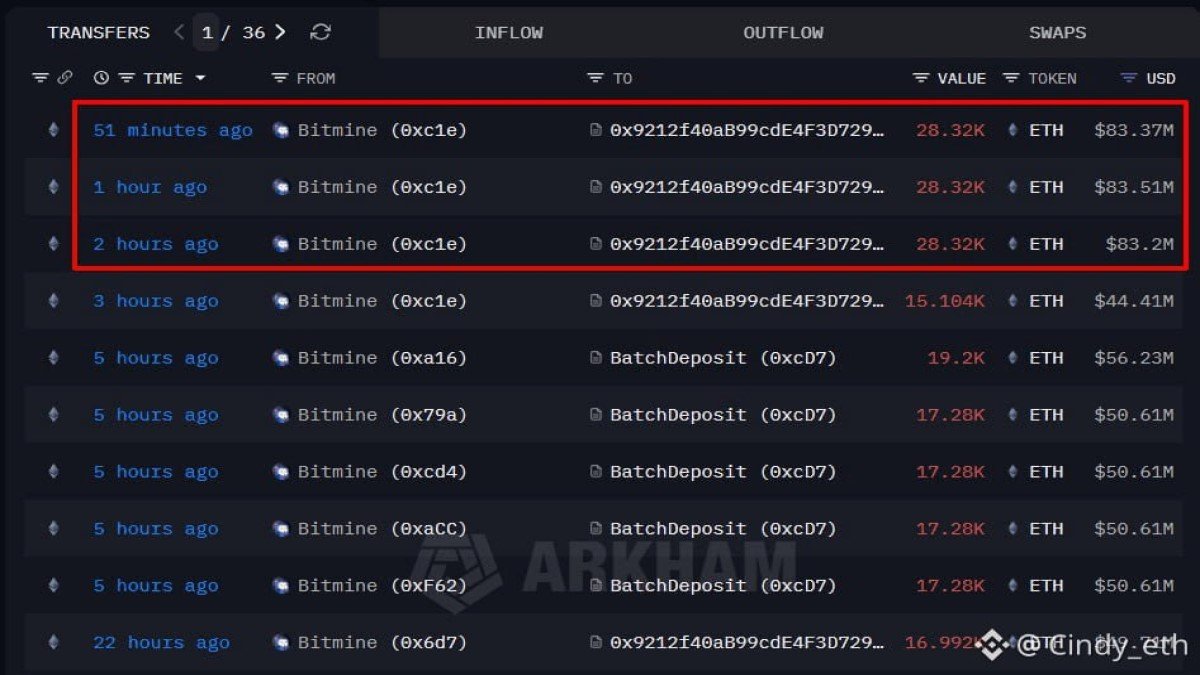

According to public transaction records, Bitmine has sent a series of large deposits from its labeled wallets into staking addresses. The most recent batch, executed within the last few hours, includes several transfers of roughly 28,320 ETH each, totalling about 84,960 ETH in the latest wave alone. Over a 24-hour window, these deposits add up to around 342,560 ETH, a little over 10% of Bitmine's current holdings.

From a mechanical standpoint, these deposits do three things:

- Lock the ETH into validator duties (either directly or via a staking service), meaning it is no longer immediately tradable on the open market.

- Redirect a portion of Bitmine's position from pure price exposure to yield-bearing exposure, as staked ETH earns protocol rewards and priority fees.

- Send a visible message to the market, because large staking flows from well-known entities are easy to track and tend to be widely discussed.

It is important to stress that staked ETH is not gone. With Ethereum's current design, validators can eventually exit and withdraw to a regular address. But staking does change the friction profile: moving from a cold wallet to an exchange becomes a slower, more deliberate process. That extra friction both reduces near-term selling capacity and tells the market something about the holder's time horizon.

2. Why large-scale staking by institutions matters

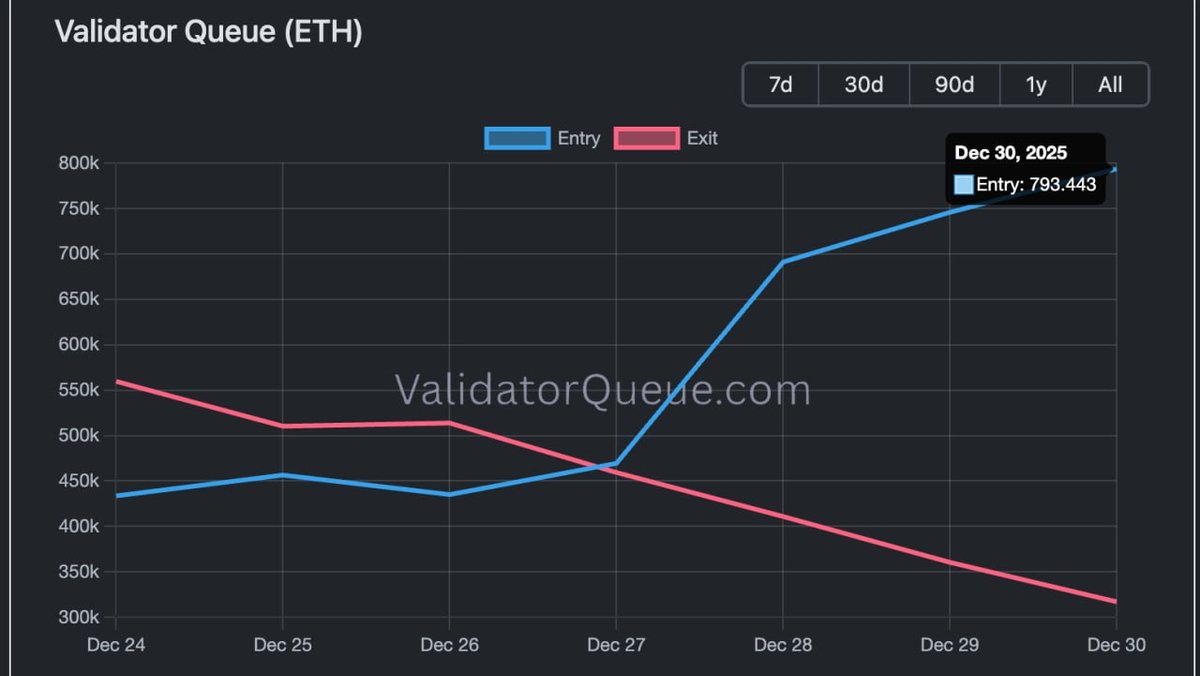

Staking by itself is not a new story. What makes Bitmine's move noteworthy is its size and the fact that it comes from an entity widely monitored by traders and analysts. When a player with tens of billions of dollars in ETH chooses to stake over a billion in a single day, several layers of impact emerge.

2.1 Liquidity and supply dynamics

Short term, the most obvious effect is on liquid supply. ETH in a staking contract is not sitting on an order book. While it can still be used as collateral in some structures or represented by liquid staking tokens, the raw probability of that ETH being sold in the next hour or day decreases.

However, this is not the same as a permanent burn. The right way to think about it is as a change in time preference:

- Before staking, Bitmine could sell any portion of its holdings on relatively short notice.

- After staking, exiting requires a validator withdrawal process and, depending on the setup, additional operational steps.

This longer path from position to market sale acts as a buffer. It does not eliminate risk, but it makes sudden large liquidations less likely and more predictable. For smaller investors worried about abrupt institutional exits, this buffer can be psychologically important even if, in absolute terms, 10% of holdings is still a minority share.

2.2 Security and network health

Every new validator adds to Ethereum's economic security. When a large, relatively sophisticated institution stakes, it strengthens the validator set in several ways:

- Increased stake weight makes attacks based on acquiring a large portion of staked ETH more expensive.

- Professional infrastructure tends to have better uptime and fewer unforced errors, which can improve overall network performance.

- Long-term alignment emerges if the institution views validator operations as a strategic business line rather than a short-lived trade.

Of course, concentration is a counterpoint: if too much stake is controlled by a few entities, governance and censorship risks can rise. We'll return to that tension later. For now, the key point is that Bitmine is moving from a passive holding role towards an active one in protocol-level security.

2.3 Sentiment and the narrative layer

Markets are narrative machines. A single event can support very different stories. With Bitmine's staking spree, two narratives are already visible:

- Supportive narrative: the largest holder is not rushing to exit; instead it is choosing to bond capital for yield, signaling belief in Ethereum's long-term prospects.

- Skeptical narrative: staking a fraction of holdings does not preclude eventual sales; it may even be a way to earn additional yield while waiting for better prices.

Which narrative dominates will shape how other investors respond. In that sense, Bitmine's move is as much about communication as it is about treasury management. A billion dollars is a powerful way of saying: "we are comfortable being locked into this ecosystem for a while."

3. What is in it for Bitmine?

Large institutions rarely act purely out of goodwill. To understand the implications for the broader market, it helps to walk through Bitmine's incentives.

3.1 Yield on a large base

Consider the arithmetic. If staking yields, for example, 3–5% annually (numbers vary with network conditions), then on a base of $1 billion that implies potential gross rewards in the tens of millions of dollars per year. For a firm already deeply exposed to ETH, not staking such a position means leaving a significant stream of income on the table.

From a treasury perspective, Bitmine faces a straightforward trade-off:

- Keep ETH fully liquid but idle, earning nothing except potential price appreciation.

- Stake a portion, accepting some operational complexity and exit friction in exchange for a steady native yield.

In a world where yields on traditional safe assets have been volatile, a protocol-level yield denominated in the base asset can be attractive, especially if the entity already plans to hold for multiple years.

3.2 Signaling and market perception

Bitmine knows that its wallets are heavily watched. Large deposits or withdrawals instantly become public information. By choosing to stake, it can shape how counterparties, regulators and partners see its strategy:

- Long-term alignment: staking aligns Bitmine with Ethereum's success. Rewards depend on the chain functioning smoothly, fees being paid and the asset retaining value.

- Operational maturity: running validators or working with reputable staking providers shows that the company is building infrastructure, not just passively holding coins.

- Risk framing: staking can be presented as a way to reduce idle exposure and earn yield, which may be more acceptable to boards and auditors than pure speculative holding.

In other words, staking at scale lets Bitmine reframe its role: from a large speculative holder to a participant in network security and infrastructure.

3.3 Optionality preserved

It is also worth noting what Bitmine has not done. By staking around 10% of its ETH, the company still keeps a very large liquid reserve. That reserve can serve multiple purposes:

- Supporting future acquisitions or strategic partnerships within the crypto ecosystem.

- Providing collateral in financial arrangements.

- Leaving room to stake more later if conditions remain attractive.

This balance between staked and liquid assets suggests a deliberate approach: commit enough to send a clear signal and earn meaningful yield, but retain flexibility to respond if market conditions change dramatically.

4. Implications for other ETH holders

For everyday investors, the most immediate reaction to Bitmine's move is emotional: relief that a large holder is not selling, and curiosity about whether this marks the beginning of a broader institutional staking wave.

4.1 Short-term comfort, long-term questions

The comfort is understandable. When a top holder appears to be locking in a sizable share of its position, fears of sudden large sell orders diminish. At the same time, it would be a mistake to treat staking as an ironclad promise never to sell. Staked ETH can eventually be withdrawn. An institution can also hedge its exposure in other ways.

Therefore, Bitmine's action should be seen as probabilistic, not absolute:

- It reduces the immediate likelihood of large spot sales.

- It increases the chance that Bitmine views ETH as a strategic, long-term asset rather than a short-term trade.

- It does not eliminate the possibility of distribution over time.

For individual investors, the key is to integrate this into a broader mosaic of information – on-chain flows, macro conditions, technical developments on Ethereum and overall market structure.

4.2 Centralization vs. stability

Another angle is decentralization. When very large entities stake at scale, they inevitably come to control a noticeable share of validator power. This can create concerns over censorship or coordination, especially if multiple big players follow the same path.

The impact depends heavily on how the staking is implemented:

- If Bitmine distributes validators across multiple independent providers and geographies, the risk is mitigated.

- If stake concentrates in a small number of tightly linked operators, governance discussions about decentralization are likely to intensify.

In practice, the Ethereum ecosystem has been actively working on tools and incentives that encourage stake distribution: from client diversity to liquid staking designs that involve different node operators. Bitmine's involvement will likely renew and sharpen those debates, which is ultimately healthy for the ecosystem.

5. Reading the signal without overreacting

So how should market participants interpret this billion-dollar staking event?

5.1 A strong but not decisive vote of confidence

Bitmine's move is best seen as a strong vote of confidence rather than a definitive verdict on Ethereum's future price path. It tells us that a large, well-informed actor believes:

- Staking yields justify the operational effort.

- The risk of needing to sell quickly is low enough to lock in a meaningful portion of holdings.

- Being visibly aligned with Ethereum's protocol-level economics is strategically useful.

It does not tell us that the market cannot correct further, or that ETH is destined to move in a straight line. Even committed, long-term institutions experience drawdowns.

5.2 A reminder of Ethereum's evolving role

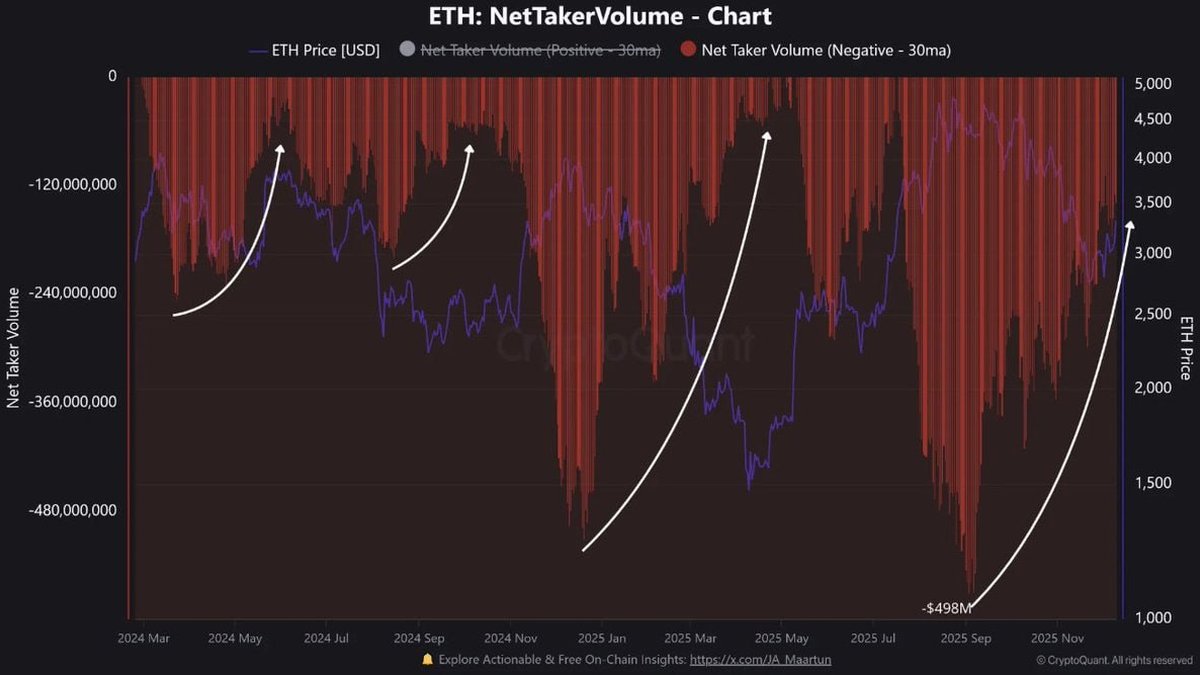

At a higher level, this event illustrates Ethereum's gradual migration from a purely speculative asset to an income-generating, yield-bearing digital infrastructure. For treasuries that think in multi-year horizons, staking rewards can be treated similarly to dividends or bond coupons, albeit with a very different risk profile.

As more entities adopt this mindset, the composition of Ethereum's holder base changes. The share of supply owned by fast-moving traders may decrease relative to the share held by funds, companies and protocols that integrate staking into their long-term plans.

5.3 A call for individual discipline

For individual investors, perhaps the most practical takeaway is not to mirror Bitmine's actions directly, but to mirror its process:

- Define a clear time horizon and risk tolerance.

- Decide what portion of a portfolio can be bonded in yield-bearing positions versus kept liquid.

- Assess validator or staking provider risk, not just reward rates.

Institutional moves can inform these decisions, but they should not replace personal research and planning. A company with billions in capital, diversified revenue streams and professional infrastructure operates under very different constraints than an individual investor.

6. Conclusion: a quiet but meaningful step in Ethereum's institutional story

Bitmine's decision to stake more than $1 billion worth of ETH within 24 hours is not a trivial development. It strengthens Ethereum's validator set, reduces the immediately tradable supply from a major holder and sends a clear message that at least one large institution views ETH as a long-term, yield-bearing asset rather than a short-term speculation.

At the same time, it is not a magic shield against volatility. Staked coins can eventually return to the market; macro conditions, regulatory changes and technological developments will continue to shape Ethereum's trajectory. The right way to read this event is as one important datapoint in a much larger picture: a sign that institutional adoption of staking is advancing, and that the line between traditional treasury management and on-chain participation is steadily blurring.

For everyday participants, the challenge is to avoid swinging between extremes of euphoria and pessimism. A billion-dollar stake from a leading holder is a positive signal, but sustainable success still depends on fundamentals: real usage, resilient infrastructure and responsible risk management at every level of the ecosystem.

Disclaimer: This article is for educational and informational purposes only. It does not constitute financial, investment or legal advice. Digital assets can be highly volatile and may not be suitable for every investor. Always conduct your own research and consider consulting a qualified professional before making financial decisions.