The First Print After the Headline: Reading a Calm S&P, a Green Nasdaq, and a Bid in Bitcoin

When U.S. futures reopen after a headline-heavy geopolitical event, many people expect a simple script: equities down, oil up, “risk-off” everywhere. The market rarely follows scripts. The first real clue is often not the size of the move, but the distribution of moves across assets. And today’s early snapshot is a textbook example of that quiet complexity.

Here’s the initial tape after the U.S.–Venezuela developments, using the numbers on the screen at the open (around the early evening ET futures session). U.S. equity futures were basically steady, with tech a touch stronger. Meanwhile, gold and crypto rose together, and oil dipped slightly. It looks calm on the surface. Underneath, it’s a story about how markets prefer to price uncertainty: not always by selling everything, but by re-weighting where protection and optionality live.

The Snapshot: What the Market Chose to Move

Before interpreting anything, anchor on the facts. The equity complex did not gap violently, which matters because it tells you what the market is not pricing: an immediate broad hit to corporate cash flows or a sudden funding shock. The more interesting moves were in stores of value and high-liquidity alternatives.

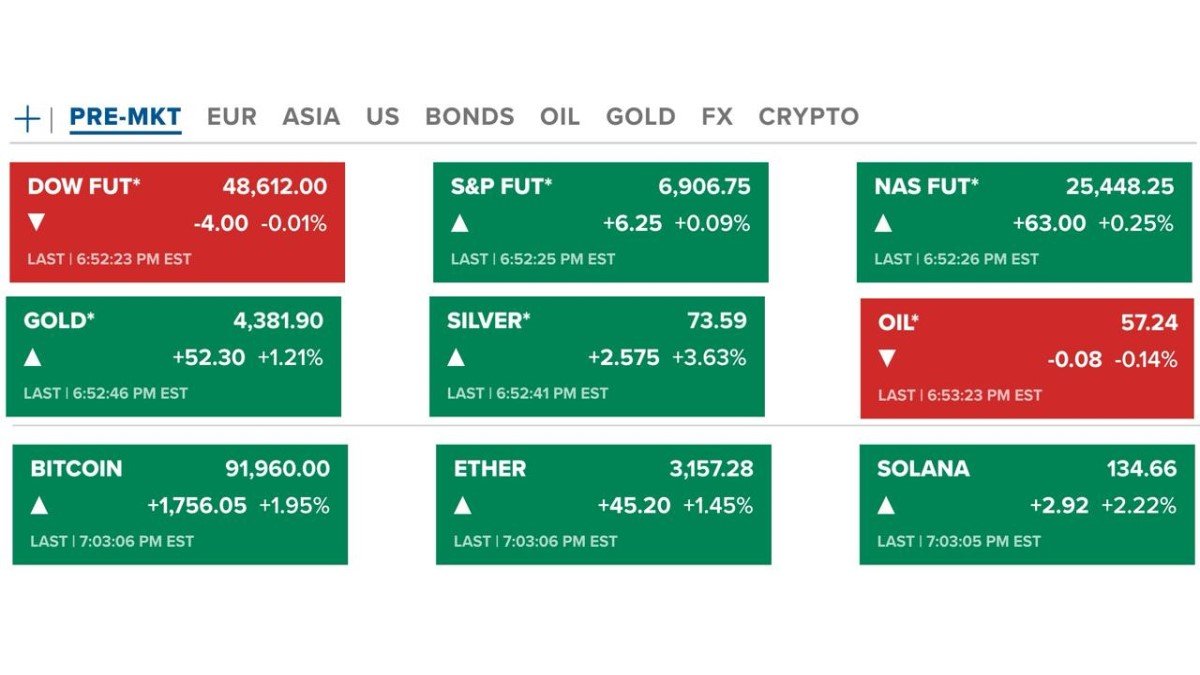

Early levels and changes:

• Dow futures: 48,612 (−4, −0.01%)

• S&P futures: 6,906.75 (+6.25, +0.09%)

• Nasdaq futures: 25,448.25 (+63, +0.25%)

• Gold: 4,381.90 (+52.30, +1.21%)

• Silver: 73.59 (+2.575, +3.63%)

• Oil: 57.24 (−0.08, −0.14%)

• Bitcoin: 91,960 (+1,756.05, +1.95%)

• Ether: 3,157.28 (+45.20, +1.45%)

• Solana: 134.66 (+2.92, +2.22%)

That combination is not random. It is a specific posture: “equities are okay for now, but I want some insurance—and I want it in assets that don’t rely on the same set of assumptions.”

Why Equities Look So Unbothered (and Why That Can Be the Point)

A flat Dow and slightly green S&P is the market’s way of saying: the event may be important, but it is not yet being translated into lower aggregate earnings or a near-term recession probability. That does not mean the market thinks risks disappeared. It means the market is still treating the shock as “digestible” rather than “systemic.”

The Nasdaq being the relative winner adds a second layer. Tech-heavy indices are often more sensitive to rates and liquidity conditions than to single-region geopolitical headlines—unless those headlines threaten a macro variable that tech cares about (like a sharp inflation impulse or a spike in long-term yields). A +0.25% Nasdaq futures print suggests the market’s first guess is that the discount-rate story hasn’t changed dramatically. It’s a small move, but the direction matters.

In plain language: investors didn’t stampede out of risk. They stayed in risk and bought selective hedges elsewhere. That is a very different emotional regime than panic.

Gold Up, Silver Even More: Insurance With a Personality

Gold rising +1.21% while equities remain steady is a classic “uncertainty bid.” It’s what you see when investors want protection against tail risks without committing to a full risk-off liquidation. Gold often performs best when people feel they’re entering a foggy zone—where outcomes are wide, narratives are loud, and the cost of being unhedged feels higher than the cost of holding insurance.

Silver jumping +3.63% alongside gold is especially telling, because silver has a dual identity: it trades as a precious metal but also carries an industrial sensitivity. When silver outpaces gold, the market is sometimes expressing a blend of “store of value” and “real economy” thinking—an inflation hedge flavor mixed with cyclical curiosity. It can also be a liquidity-driven move, because silver can swing harder when traders rotate into metals as a theme.

The deeper point is not “metals will do X next.” It’s that the market chose metals as the cleanest first expression of uncertainty—rather than expressing it by dumping broad equities.

Bitcoin Near 92K: Not Just Risk-On, Not Just Digital Gold—Something More Tactical

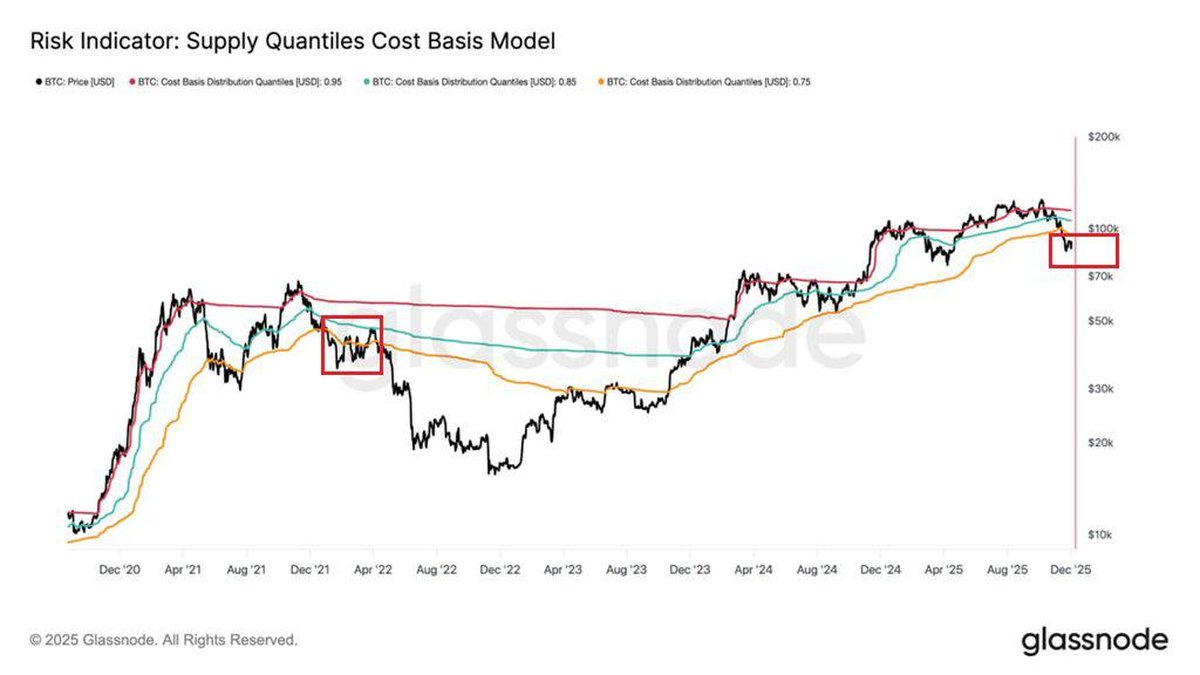

Bitcoin up nearly +2% to 91,960 while the S&P barely moves is one of those patterns that triggers pointless debates: “Is Bitcoin risk-on or risk-off?” The better question is: what function is Bitcoin serving in this moment?

In this snapshot, Bitcoin is behaving like a liquid, globally tradable alternative that can absorb flows when investors want optionality outside traditional market hours and traditional institutional channels. It’s not replacing gold; it’s joining gold in the same portfolio behavior: adding a hedge-like allocation without forcing a full exit from equities. Ether and Solana rising in tandem (+1.45% and +2.22%) suggests the move is not idiosyncratic—it’s a broad crypto bid.

There’s also a market-structure angle. Crypto trades continuously. Equities don’t. When an event lands in the gap between sessions, crypto is one of the first places capital can express a view—especially from global participants who aren’t waiting for the cash equity open. That doesn’t make crypto “smarter.” It makes crypto available. Availability matters when sentiment wants an outlet.

So the more precise interpretation is: crypto is acting as a liquidity barometer and a portable hedge at the same time. That’s why the move can coexist with calm index futures.

Oil Slightly Down: The Market Isn’t Ignoring Energy—It’s Pricing the Shape of the Story

If there’s one number people expect to jump on a Venezuela headline, it’s oil. Yet oil is down a modest −0.14% to 57.24. That’s not the market being clueless; it’s the market choosing among competing oil narratives—and, at least initially, leaning away from the “immediate disruption” narrative.

There are three clean, non-dramatic explanations for why oil can dip even as geopolitical tension rises:

• The ‘unlock’ narrative beats the ‘disruption’ narrative. If traders believe the path forward could increase accessible supply over time (through infrastructure repair, policy change, or shifting constraints), the medium-term supply expectation can nudge prices lower even as uncertainty rises.

• Demand is still the shadow on every oil move. Oil is not just geopolitics; it’s global growth. If markets are looking ahead to U.S. labor data and broader macro cooling, traders may be cautious about bidding crude aggressively without demand confirmation.

• Positioning matters at the reopen. If oil had already been bought as an event hedge, the first print can be a de-crowding move: a small sell not because the story is over, but because the trade was crowded.

The key detail is that the move is small. Oil isn’t collapsing. It’s simply not validating the most sensational version of the headline. In cross-asset terms, that supports the broader read: the market is pricing uncertainty, not catastrophe.

The Pattern Behind the Numbers: A Barbell, Not a Stampede

Put all the moves together and you see a portfolio behavior that’s more sophisticated than “risk-on/risk-off.” It looks like a barbell: keep core exposure (equities steady), add convexity (gold and crypto up), and avoid the one asset most likely to be whipsawed by narrative shifts (oil slightly lower, at least for now).

This is what markets do when they believe outcomes have widened but the base case remains intact. Instead of selling everything, they buy things that do well if uncertainty persists—without paying the opportunity cost of abandoning the rally. It’s a posture of cautious participation.

And it’s worth emphasizing: this posture can change quickly. A calm reopen is not a guarantee of calm ahead. It’s simply the market’s first draft.

What Would Prove This First Draft Wrong?

If you want to track whether the market’s interpretation holds, don’t look for louder headlines. Look for the variables that force repricing across asset classes. The next phase usually depends on whether uncertainty stays “contained” or becomes “macro-relevant.”

• Volatility and credit spreads: If volatility rises while equities stay flat, it often means hedging demand is increasing under the surface. If credit spreads widen, that’s a more serious signal than a red candle in futures.

• Rates reaction to labor data: With employment reports coming, a surprise in jobs can move yields—and yields can move Nasdaq more than geopolitics does. Watch whether rate expectations start driving the tape.

• Oil’s second move: The first print is often positioning. The second move—after policy details and supply expectations become clearer—is usually more informative.

• Crypto correlation shift: If crypto continues to rise while equities stay steady, it reinforces the “alternative allocation” read. If equities sell off sharply and crypto drops with them, it becomes a high-beta risk expression again. Correlation is the clue.

Conclusion

The market’s first reaction after the U.S.–Venezuela headline is not a scream; it’s a controlled exhale. Dow futures are flat, the S&P is modestly green, Nasdaq is slightly stronger. Meanwhile, gold is up over 1%, silver is even hotter, and crypto is broadly higher with Bitcoin near 92K. Oil is fractionally lower.

That mix suggests a market that is hedging uncertainty without abandoning risk—pricing the event as significant but not instantly destabilizing. The most important takeaway isn’t that any one asset “called it.” It’s that investors expressed caution through where they added protection rather than through what they sold. In markets, that distinction often separates a headline shock from a structural repricing.

Frequently Asked Questions

Does a calm S&P futures open mean the geopolitical event doesn’t matter?

No. It means the market is not yet pricing an immediate broad earnings shock or systemic funding stress. Second-order effects can still emerge as policy details and macro data arrive.

Why would gold and Bitcoin rise together?

They can both attract flows when investors want liquid alternatives and hedges without fully exiting equities. The overlap is behavioral—insurance and optionality—even though their volatility profiles differ.

Why is oil down if the story involves an oil-rich country?

Because oil prices reflect expected supply and demand, plus positioning. A small dip can occur if traders lean toward a supply-unlock narrative, remain cautious on demand, or unwind crowded hedges.

Is crypto’s move here “risk-on” or “digital gold”?

In this snapshot, it’s best viewed as a continuous, liquid outlet for risk expression that can behave like a hedge-like alternative when equities are stable and uncertainty rises.

Disclaimer: This article is for educational purposes only and does not constitute financial, investment, or legal advice. Market data can change rapidly, and short-term moves may reflect positioning as much as fundamentals. Always consider multiple sources and your own risk tolerance before making decisions.