Red Alert For the US Economy: What a Weak Labour Market Could Mean for Bitcoin

The latest US labour market report landed like a shockwave. Unemployment has risen to 4.6%, above expectations of 4.5% and up from 4.4% previously. Nonfarm payrolls added only 64,000 jobs in November, after a loss of 105,000 positions in October once the impact of government cuts and data disruptions is taken into account. Hourly earnings grew just 0.1% month-on-month and 3.5% year-on-year, slower than earlier in the year.

On the surface, the numbers are not catastrophic. The US economy is still generating jobs, and wage growth remains positive. But the direction of travel is clear: the labour market is cooling, unemployment is rising, and the gap between this reality and the soft-landing narrative is widening. Many analysts now describe the situation as a shift from a hoped-for 'soft landing' toward something much closer to a 'hard landing' scenario.

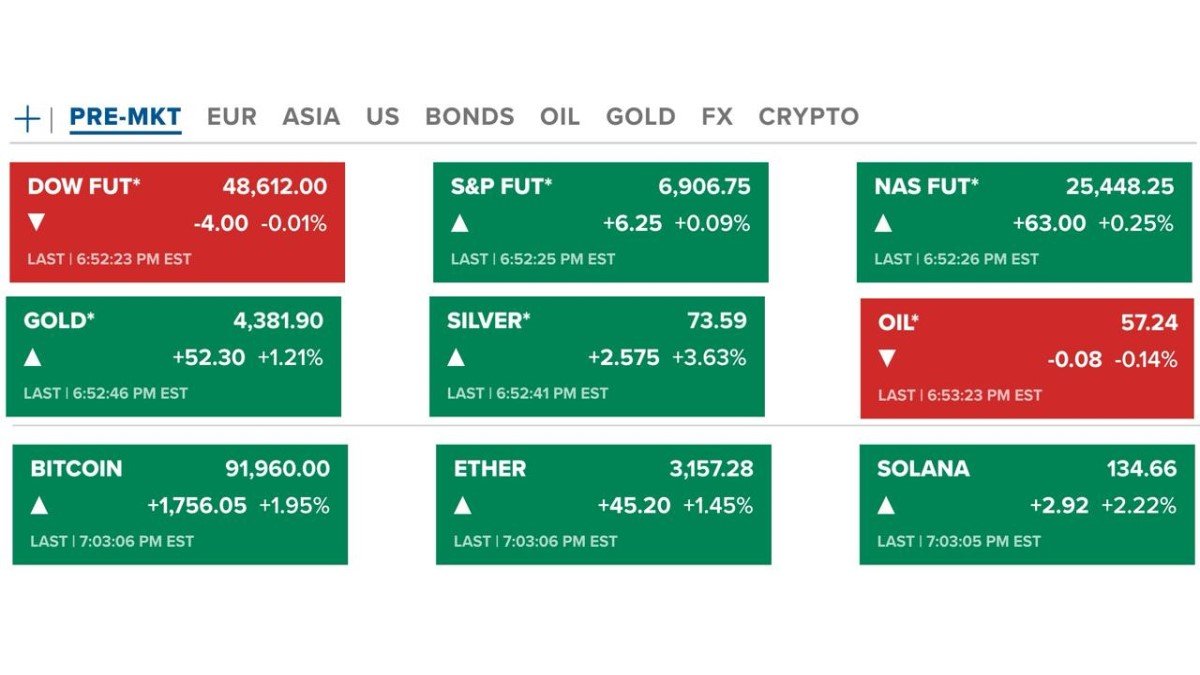

Markets reacted immediately:

- The US dollar index (DXY) dropped sharply as traders priced in a higher probability that the Federal Reserve will have to cut rates more quickly.

- Equity indices turned lower on fears that weakening growth will pressure earnings.

- Gold climbed as investors sought a traditional store of value.

- Bitcoin sold off alongside stocks, caught in a wave of short-term de-risking despite its long-term scarcity narrative.

With BTC already under pressure in recent weeks, the obvious question is: what does a deteriorating US labour market actually mean for Bitcoin from here? Is this the beginning of a deeper slide toward the 77,000–74,000 USD area that traders are watching, or the uncomfortable phase before a new macro tailwind emerges?

1. What the Labour Data Really Tells Us

To understand the implications for Bitcoin, it is worth unpacking the report itself instead of just reacting to the headlines.

1.1 A labour market that is losing altitude

For most of the post-pandemic period, the US labour market has been extremely resilient. Unemployment hovered near multi-decade lows, job creation was strong, and wage growth ran ahead of pre-2020 norms. That strength allowed the Federal Reserve to raise interest rates aggressively without immediately pushing the economy into contraction.

The latest data show that this cushion is thinning:

- Unemployment at 4.6% may still sound moderate, but it is the highest level since 2021 and clearly up from the lows around 3.5%.

- Job gains of 64,000 are barely enough to keep up with population growth, especially after the prior month’s decline.

- Most of the hiring came from sectors such as healthcare and construction, while areas like transportation and tourism continued to shed jobs.

In other words, the engine is still running, but it is sputtering. From a macro perspective, that combination – slower hiring, rising unemployment, and moderating wages – is exactly what a central bank sees when the economy drifts from cooling toward outright weakness.

1.2 Why the dollar fell even as the data looked weak

The knee-jerk drop in the dollar index reflects a simple logic: if growth slows and unemployment rises, the Fed will eventually need to lower rates to stabilise the economy. Lower US yields reduce the appeal of dollar assets versus their global peers, pulling the currency down.

Historically, a weaker dollar has often been supportive for alternative assets such as gold and, increasingly, Bitcoin. But that relationship is not mechanical. In the very early stages of a downturn, when investors first realise that growth is at risk, there is often a rush to reduce exposure across all volatile assets – including BTC.

That is where we are today: the early stage of a potential downturn, when fear and forced position adjustments dominate the tape.

2. Why Bitcoin Is Being Dragged Down in the Short Term

Many long-term Bitcoin supporters see it as a potential hedge against monetary expansion and fiscal stress. If a weaker economy ultimately pushes policymakers back toward lower rates and more aggressive support, the long-term case for a scarce digital asset should, in theory, strengthen.

So why is BTC falling now instead of rising?

2.1 Liquidity shocks do not discriminate

When recession risk becomes more visible, the first reaction of many institutional investors is to cut gross exposure. That means scaling back holdings across equities, high-yield credit, and liquid alternatives. Bitcoin, which trades twenty-four hours a day and can be sold quickly, often becomes part of this adjustment even for funds that see its long-term potential.

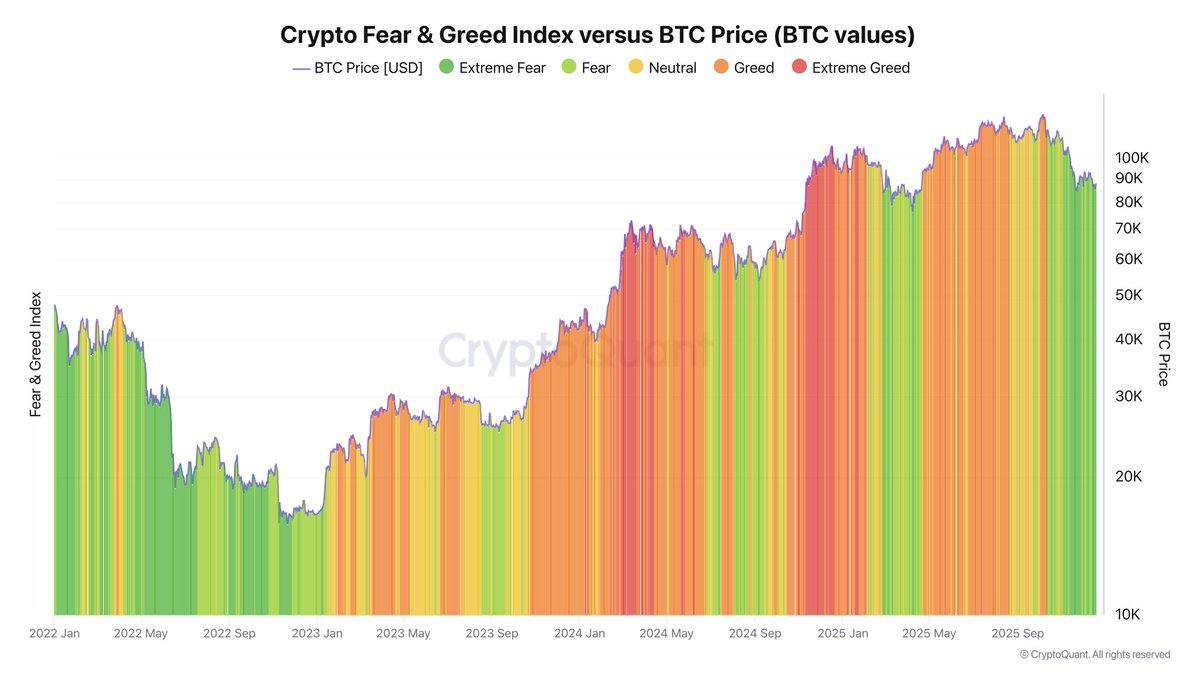

We saw a clear version of this dynamic in March 2020, when BTC dropped sharply during the initial pandemic panic before later recovering and moving to new highs once policy support arrived. The pattern does not have to repeat perfectly, but it illustrates an important principle: in the first phase of a shock, liquidity considerations override long-term narratives.

2.2 Positioning and leverage still matter

In addition to macro flows, Bitcoin is influenced by the internal structure of its own market. Over the previous months, large inflows into exchange-traded products and derivatives had encouraged leveraged positioning. As prices started to drift lower from the 120,000 USD region, liquidations and de-risking by short-term traders amplified the move.

When weak labour data hit during a period of already fragile sentiment, it did not create the downtrend; it added another wave of selling pressure on top of existing vulnerability. That is why technical levels such as the 80,000 USD zone have become important reference points. If this area fails to hold, many short-term traders expect to see price explore the 77,000–74,000 USD range in search of a new equilibrium where buyers are willing to step in.

None of this is about fundamentals in the sense of network security, long-term adoption, or fixed supply. It is about who is holding BTC right now, at what entry level, and with what degree of patience.

3. Three Macro Scenarios and How They Could Affect BTC

Instead of focusing only on the next few days, it is more helpful to think in scenarios. The same labour data can lead to very different paths depending on how policy makers and markets respond.

3.1 Scenario A: Controlled slowdown, gradual rate cuts

In this relatively benign outcome, unemployment drifts higher but stops rising sharply. Growth slows but does not collapse. The Fed responds with measured, gradual rate cuts over 2026, aiming to support demand without reigniting strong inflation.

In such an environment:

- Bond yields trend lower, making cash and short-term instruments less attractive over time.

- Equity markets may experience volatility but eventually stabilise as investors look through the slowdown.

- Bitcoin could benefit from a combination of easier financial conditions and ongoing structural adoption – think of new exchange-traded products, corporate treasuries and tokenisation projects building on public blockchains.

In this scenario, the current pullback would look like a painful but temporary re-pricing before the next up-leg in a broader cycle.

3.2 Scenario B: Harder landing and risk-off shock

A more challenging path would involve the labour market weakening more quickly than expected. Job losses could broaden from government-related cuts and specific sectors into a wider retrenchment. Business investment might slow, consumer confidence could fade, and earnings forecasts might be revised significantly lower.

In that case, even if the Fed cuts rates aggressively, there could be a period when investors prioritise capital preservation above all else. Credit spreads might widen, equity valuations could compress, and many alternative assets could face outflows.

For Bitcoin, this phase would likely mean:

- Continued volatility and the possibility of deeper dips below the 80,000 USD region.

- Ongoing rotation from shorter-term holders, who may need liquidity, to longer-term participants with stronger conviction and more flexible balance sheets.

- Elevated correlation with equities in the early part of the downturn, as de-risking remains broad-based.

Over a longer horizon, however, an extended period of very low real rates and larger fiscal deficits – often the policy response to a hard landing – could reinforce the case for scarce, non-sovereign assets. The difficulty is that markets have to endure the turbulence before they get to that point.

3.3 Scenario C: Data noise and a return to muddle-through

It is also possible that part of the weakness in the latest report reflects temporary distortions: previous government shutdown risks, survey issues, or seasonal adjustments. If subsequent data show a rebound in job creation and unemployment stabilises, markets might reassess the probability of a hard landing.

In this more neutral scenario, Bitcoin would remain influenced by its own internal drivers – ETF flows, on-chain activity, and the behaviour of long-term holders – rather than by dramatic changes in macro expectations. Price might continue to oscillate in a wide range instead of committing to a clear trend.

4. How Long-Term Bitcoin Holders Can Think About This Phase

For participants with a multi-year horizon, the goal is not to forecast every data point but to understand the forces that genuinely matter. The current environment offers several important lessons.

4.1 Separate price volatility from structural progress

Short-term charts look uncomfortable: BTC has fallen significantly from its peak, correlations with equities have increased at exactly the wrong moment, and macro headlines are dominated by the word 'recession.' Yet, beneath the surface, structural developments continue:

- Large financial institutions are building tokenised money-market funds and exploring ways to bring traditional assets on-chain.

- More listed companies are incorporating Bitcoin into their treasuries, even during periods of price weakness.

- Wallets and payment platforms are integrating BTC more deeply into their services, making it easier for users to hold and transact.

These trends do not cancel out macro risk, but they are a reminder that the long-term story is about the gradual integration of Bitcoin into the broader financial system, not just about the next support level on a chart.

4.2 Liquidity and time horizon matter more than catching the exact bottom

The temptation in times like this is to obsess over whether 80,000 USD will hold, or whether better entries lie at 77,000 or 74,000. While these levels are relevant for short-term traders, long-term investors face a different set of questions:

- Is my position size appropriate relative to my income, savings and risk tolerance?

- Do I have enough liquidity outside of Bitcoin to handle unexpected expenses without being forced to sell during a downturn?

- Have I defined a time horizon – for example, three to five years – over which I am willing to tolerate volatility?

If the answer to these questions is yes, then short-term swings, even large ones, become less threatening. Price may move through several ranges on its way to discovering fair value under new macro conditions.

4.3 Diversification still has a role

Although Bitcoin has attractive long-term properties, it remains a volatile asset. A balanced approach that includes cash, high-quality bonds, equities and, for some investors, a modest allocation to gold can reduce the impact of any one asset’s drawdown.

The recent rally in gold alongside the drop in BTC is a textbook example of why diversification across different types of stores of value and growth assets can help smooth the ride. The key is to design a portfolio that can survive multiple macro paths, not just the one that is most favourable for any single asset.

5. Conclusion: Between Red Alerts and Long-Term Signals

The latest US labour market report certainly qualifies as a warning sign. Rising unemployment, weak job creation and slower wage growth all point towards a more fragile economy. Markets have responded by pushing the dollar lower, marking down equities and, at least for now, selling Bitcoin alongside other risk assets.

In the near term, this environment can produce sharp moves. If the 80,000 USD area fails to hold convincingly, it would not be surprising to see Bitcoin test the 77,000–74,000 USD zone that many traders are monitoring. Such levels would reflect a combination of macro fear, position reduction and technical flows.

Yet, underneath the volatility, the larger story is more nuanced. A softer economy increases the likelihood of easier monetary policy in the future. Fiscal pressures remain elevated, and the long-term questions about the sustainability of public debt and the value of fiat currencies have not disappeared. At the same time, the infrastructure for holding and using Bitcoin continues to develop, from corporate treasuries to tokenised capital markets.

For thoughtful participants, the challenge is to look beyond the short-term 'red alert' headlines and ask: what does this environment mean for my time horizon, my liquidity, and my understanding of Bitcoin’s role in a changing financial system? The answer will differ for each person, but the process of asking the question calmly is what separates reaction from strategy.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and involve risk. Always conduct your own research and consult a qualified professional before making financial decisions.